saveyourassetsfirst3 |

- A Stock Market And Bitcoin Surge With Miners In Tow, Gold Technical Action Solid

- Jordan Roy Byrne: The worse the bear market, the better for gold

- Gold Certainly Matters: Falling Markets, Rising Debt & Inflation, And Invisible Wealth

- Bill Blain: Be warned, a full-blooded European sovereign debt crisis is coming

- The “Washed Out” Silver CoT

- Real Estate Carnage, World Currency Crisis On Our Doorstep, And A Surge In Gold & Silver Prices

- Topping Dollar is Gold-Bullish

- The Worse the Bear Market, the Better for Gold

- Raging Inflation, A Collapsing Economy/Stock Market, The Uganda Gold Claim, And A Big Move In Precious Metals

- Adrian Day's Top Four Gold Buys

- Co. Building One of the World's Highest Grade Gold Mines

- Junior's Drills Turning in Golden Triangle

| A Stock Market And Bitcoin Surge With Miners In Tow, Gold Technical Action Solid Posted: 22 Jun 2022 05:00 PM PDT Leery investors should take note of the gold chart and the… by Stewart Thomson of Graceland Updates 1. Globally, the big theme in play is the 2021-2025 war cycle and I […] |

| Jordan Roy Byrne: The worse the bear market, the better for gold Posted: 22 Jun 2022 04:45 PM PDT Nothing is better for gold than a good bear hug. Yes, bear hugs feel a bit crushing at first, but in the broader scope they are catalysts for big golden gains. One more big bear squeeze would be more than enough to get Gold to breakout and hit my $4000 target by the end of […] The post Jordan Roy Byrne: The worse the bear market, the better for gold appeared first on DollarCollapse.com. |

| Gold Certainly Matters: Falling Markets, Rising Debt & Inflation, And Invisible Wealth Posted: 22 Jun 2022 01:00 PM PDT Those who understand gold's role can certainly prepare and protect themselves, but as always… by Matthew Piepenburg and Egon von Greyerz of Gold Switzerland In this June 2022 MAMChat, Matterhorn […] |

| Bill Blain: Be warned, a full-blooded European sovereign debt crisis is coming Posted: 22 Jun 2022 10:14 AM PDT European corporations will flood the courts in a zombi apocalypse, and nation will rise against nation within the eurozone as the streets of Paris repopulate with yellow vests, but the US dollar will continue to hobble along as the best horse at the Glue Factory Sweepstakes…. by Bill Blain on CAPX: Welcome to the age […] The post Bill Blain: Be warned, a full-blooded European sovereign debt crisis is coming appeared first on DollarCollapse.com. |

| Posted: 22 Jun 2022 07:00 AM PDT “…it’s quite likely that further dips will be shallow and that the ratio of risk to reward is now heavily skewed toward reward.”… by Craig Hemke via Sprott Money News […] |

| Real Estate Carnage, World Currency Crisis On Our Doorstep, And A Surge In Gold & Silver Prices Posted: 22 Jun 2022 05:00 AM PDT Now more than ever before, Gold is the go-to and must-have asset! by David Morgan of The Morgan Report Real Estate Carnage and World Currency Crisis On Our Doorstep | https://www.themorganreport.com […] |

| Topping Dollar is Gold-Bullish Posted: 21 Jun 2022 05:00 PM PDT This lofty extraordinarily-overbought US dollar is super-bullish for gold… by Adam Hamilton of Zeal LLC The US dollar has skyrocketed in a monster rally this year, fueled by the Fed's […] |

| The Worse the Bear Market, the Better for Gold Posted: 21 Jun 2022 02:06 PM PDT

Many of us in the gold community fear bear markets because they can inflict some damage to gold and silver stocks. That is a fair concern even though some go overboard.

That aside, it's vital to understand that these bear markets are the catalyst for big moves and bull markets in Gold.

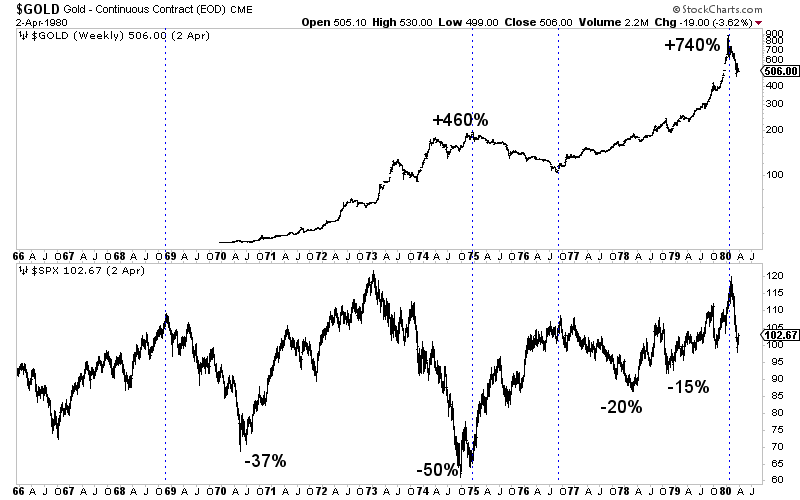

Let's take a trip down memory lane.

From 1969 through 1974 the S&P 500 had declines of 37% and 50%. During this period Gold gained 460%. (The gold stocks bottomed in 1969 five months before the stock market).

Before Gold went parabolic, the S&P corrected another 20% and 15%. Gold rebounded 140% during this period. Then it went parabolic.

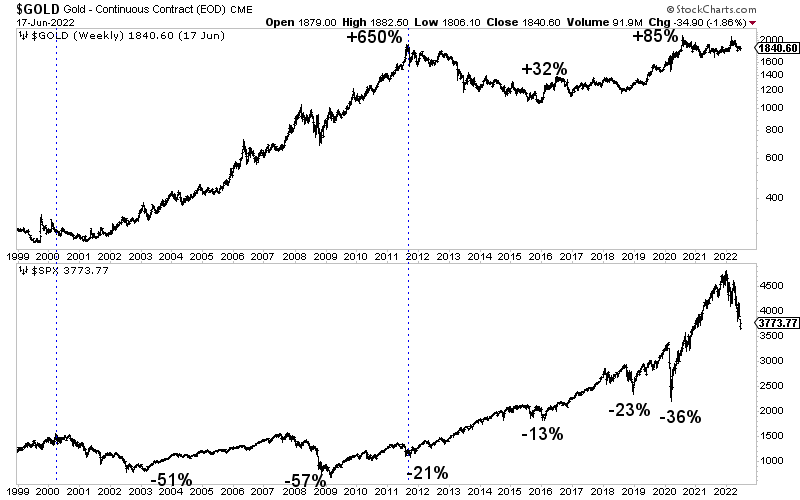

The 2000s were a similar story to the 1969 to 1974 period. The S&P 500 had twin declines of 51% and 57%, along with another decline of 21%. Gold gained 650%.

From 2011 to late 2018, the S&P had a smooth run with only a 13% decline in between. Gold performed poorly.

However, from August 2018 to August 2020, Gold rebounded by 85%. That was fueled by S&P 500 declines of 23% and then a 36% crash during Covid.

As 2022 began, Gold had corrected for 17 months and the stock market remained at all time highs. For months I had written and said that Gold would not perform or break resistance until a significant correction or bear market in the stock market.

Gold is now so much closer to a big move than it was in 2021 or late 2020.

The stock market, which declined 24%, may have made an interim bottom on Monday. It is extremely oversold and tested the 40-month moving average, an incredibly important support level.

Given that the worst isn't remotely close to being over for the economy, odds favor another leg lower in the stock market and therefore a 35% to 40% bear market.

That by itself would be more than enough to get Gold to breakout and hit my $4000 target by the end of 2024.

Now is the time to find the quality companies that can best leverage that outcome. I continue to focus on finding high-quality juniors with at least 5 to 7 bagger potential over the next few years. Periodically I will publish and update a list for subscribers of my favorite stocks with at least 10-bagger potential. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service. |

| Posted: 21 Jun 2022 09:00 AM PDT With all the factors in place to support a big move higher, the… by Dave Kranzler of Investment Research Dynamics The idea that Vladimir Putin is responsible for the raging […] |

| Adrian Day's Top Four Gold Buys Posted: 21 Jun 2022 01:00 AM PDT |

| Co. Building One of the World's Highest Grade Gold Mines Posted: 21 Jun 2022 01:00 AM PDT |

| Junior's Drills Turning in Golden Triangle Posted: 21 Jun 2022 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment