Gold World News Flash |

- Dollar on the Brink of Disaster-John Williams

- Of Gold & Geopolitics

- A Couple Of "Out There" Headlines To Start The Week

- Sweet (Earnings Expectations) Dreams Are Made Of This

- Of Gold & Geopolitics

- Quantitative Easing and its effect on the U.S. economy - The Miller Report - May 19, 2014

- Gold Investors Weekly Review – May 16th

- The Seeds For A Much Bigger Crisis Have Now Been Sown

- How Long Can Phase II of the Gold Pool Be Sustained

- Gold Price Triangle Pattern Near Completion

| Dollar on the Brink of Disaster-John Williams Posted: 18 May 2014 09:15 PM PDT Dear CIGAs, By Greg Hunter's USAWatchdog.com (Early Sunday Release) Economist John Williams has a dire prediction for the U.S. dollar. Williams says, "I don't see what will save it at this point. . . . Now we are to the point that the dollar has been ignored for years. The federal deficit has been ignored... Read more » The post Dollar on the Brink of Disaster-John Williams appeared first on Jim Sinclair's Mineset. |

| Posted: 18 May 2014 07:52 PM PDT from ZeroHedge:

|

| A Couple Of "Out There" Headlines To Start The Week Posted: 18 May 2014 06:48 PM PDT First, here is one for the Magic Money Tree growers who contend the US dollar will never, ever, with absolute certainty, lose its reserve currency status:

Of course, the US is confident that all those aircraft carriers stationed around the world will make sure this never happens. But the US was also sure Russia would fold like a cheap lawn chair on the Ukraine crisis, when in reality it is Putin who has so far been the biggest beneficiary. And the other headline:

Some more from Yomiuri, as cited by BBG:

Perhaps this brilliant plan to provoke China just a little more as Vietnamese protesters are torching Chinese factories and infuriating the Beijing politburo, is precisely the catalyst China needs to test just how easy it would be to become the next reserve currency (with or without Russia's assistance, even as Putin and the top political and oligarch brass is in China right now finalizing Gazprom's "holy grail" deal with China). As for the market, so far it violently unchanged especially after the USDJPY almost moved more than 2 pips on the ridiculous Japanese data released earlier. Almost. |

| Sweet (Earnings Expectations) Dreams Are Made Of This Posted: 18 May 2014 06:23 PM PDT ConvergEx's monthly review of analysts' revenue expectations for the 30 companies in the Dow finds a ray of sunshine (let's call them 'sweet dreams') to counter the current humdrum market action. First, the 'good' news: analysts expect the current quarter to post some of the best top line growth in over 2 years. The 'meh' news: that’s still only a 2.5% comp to last year, and 2.9% excluding financials. Still, that is better than the 0.3-0.5% growth of Q1 2014. That acceleration, such as it is, continues into Q3 2014, where analysts have revenue growth pegged at 3.9%. The 'bad' news: brokerage analysts have been spectacularly wrong in forecasting revenues of late. In Q1 2014 the Street expected 4-5% growth in May of last year, only to whittle those numbers down month after month and still prove too optimistic on earnings day. Still, things might work out this time and Q2 will actually see a rebound. At current valuation levels, the bulls better hope they do. Via ConvergEx's Nick Colas, There is an old joke on Wall Street: “What’s the difference between a bond and a bond trader?” The answer: “Bonds mature.” Yes, the fixed income group in a given brokerage firm or money manager may house more bon vivants than Soho House during NY Fashion Week, but scratch a bond guy/gal and you’ll quickly find the pessimist lurking within. That’s because this group knows that over the long run the best they can do is get their money back from a bond, plus interest. Their upside is the issuer just keeps their promise. Your downside is they don’t. The chance for a surprise windfall is zero. The real optimists of Wall Street sit on the equity desk. They may play the bear from time to time, just to show they can. But stock investing is ultimately about how things can go right in pleasant and unexpected ways. The core argument for owning equities always ends with “And they lived happily ever after.” Even the turmoil of the last 20 years hasn’t shifted that foundation. Over the very long term, equities beat other asset classes because you are long human innovation when you own a portfolio of stocks. And there’s no more optimistic perspective than believing in your fellow man and woman to deliver the goods and generate positive returns on society’s capital. Silver screen vixen Mae West was famous for saying “Too much of a good thing can be wonderful”, but she probably never ran across a bulled up Wall Street stock analyst. And if she did, they probably didn’t talk stocks. Over the last few years we’ve been tracking this group’s expectations for revenue growth at the 30 companies of the Dow Jones Industrial Average. The original idea here was to follow the nascent global economic recovery as it filtered through corporate financial results in the period after the Financial Crisis. That story played out pretty well in 2009 and 2010, as revenue growth ran a healthy 10-15% year over year. It was a happy, sunny, simple time. Since then, however, the storyline has shifted to a darker tone where optimism is a great travelling companion but it can’t read a map or figure out the rental car radio. We can summarize this transition by looking at the recently completed and reported Q1 2014:

In short, optimism certainly has a place in equities, as I have described. But since the end of the snap-back in corporate revenues in 2010, we have seen nothing but the same pattern noted in the points about Q1. Analysts start out with high numbers and slowly reduce them to something more realistic as the day of reckoning arrives. Another old Wall Street aphorism: “Never hire analysts. In a bull market you don’t need them, and in a bear market they’ll kill you.” Which brings us to the current day. U.S. equities are still up on the year (at least large cap stocks, anyway). First quarter GDP was just as dismal as first quarter Dow stock revenue gains. And the map light of optimism over future quarters still shines reasonably bright on domestic equities. We can see this in the analysts’ revenue expectations for Q2 and Q3 2014 (see associated tables and charts immediately after this note):

Make no mistake – this is the single most important factor to consider when pondering the fundamental direction of U.S. stocks over the remainder of the year. That’s because revenue growth fulfills the reason equities are worth owning. Better sales drive better earnings and better returns on capital. Should you own stocks here because analysts are optimistic about the balance of the year? No. The track record here is spotty at best. The logic, however, that guides analysts to forecast a better Q2 and second half of 2014 is very much the same as that which defines the future direction of stock prices. Without sales growth, equities just keep earning the same basic returns as they have in recent years. What do you call a security where the cash flows are fixed? Yes, a bond. Only it is a bond that never matures. And you probably don’t want that. |

| Posted: 18 May 2014 05:28 PM PDT Submitted by Dan Popescu via GoldBroker.com,

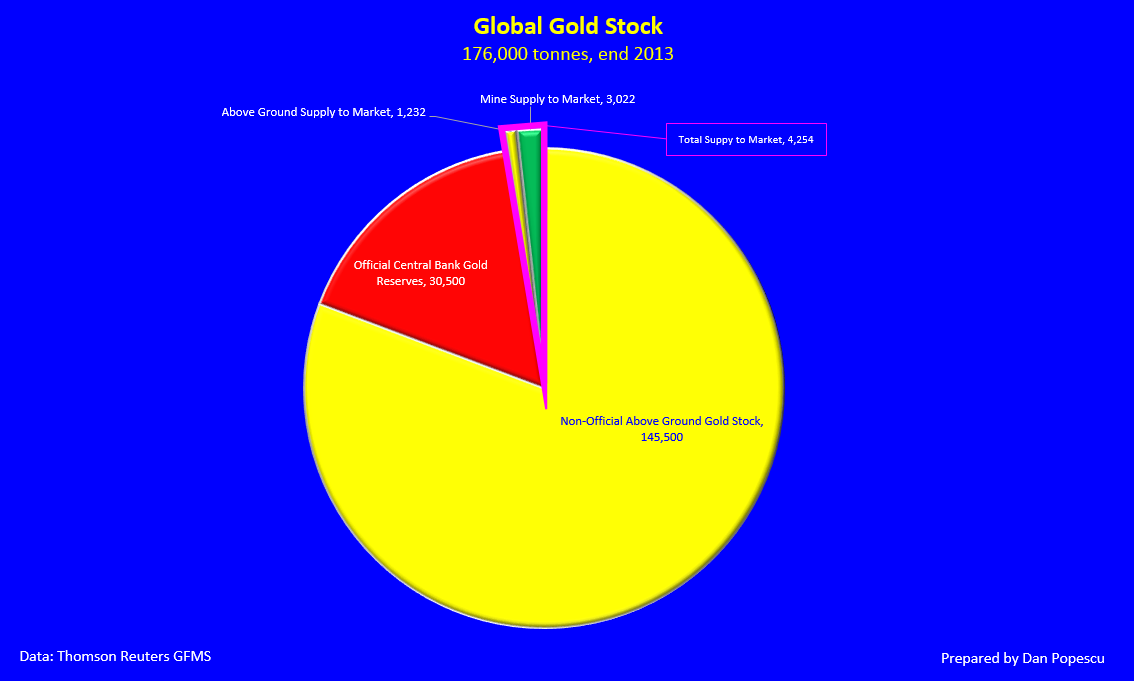

They say that gold is a geopolitical metal. Gold is real money with no counterparty risk and, furthermore, an excellent wealth preserver in time and space. Like fiat currencies (dollar, euro, yen, Yuan etc.), gold’s price is also influenced by political events, especially those having an international impact. Alan Greenspan, ex-chairman of the Federal Reserve, said that gold is money “in extremis”. This is why gold is part of most central banks’ reserves. It is the only reserve that is not debt and that cannot be devalued by inflation, contrary to fiat currencies. Observe in chart #1 that central banks own 30,500 tonnes of gold, or 19% of above ground gold. However, this number is an underestimation, because several countries (e.g. China, Saudi Arabia) report only a portion or none at all of their gold holdings. In addition, if they do, they do not do it in a timely manner.

Global Gold Stock

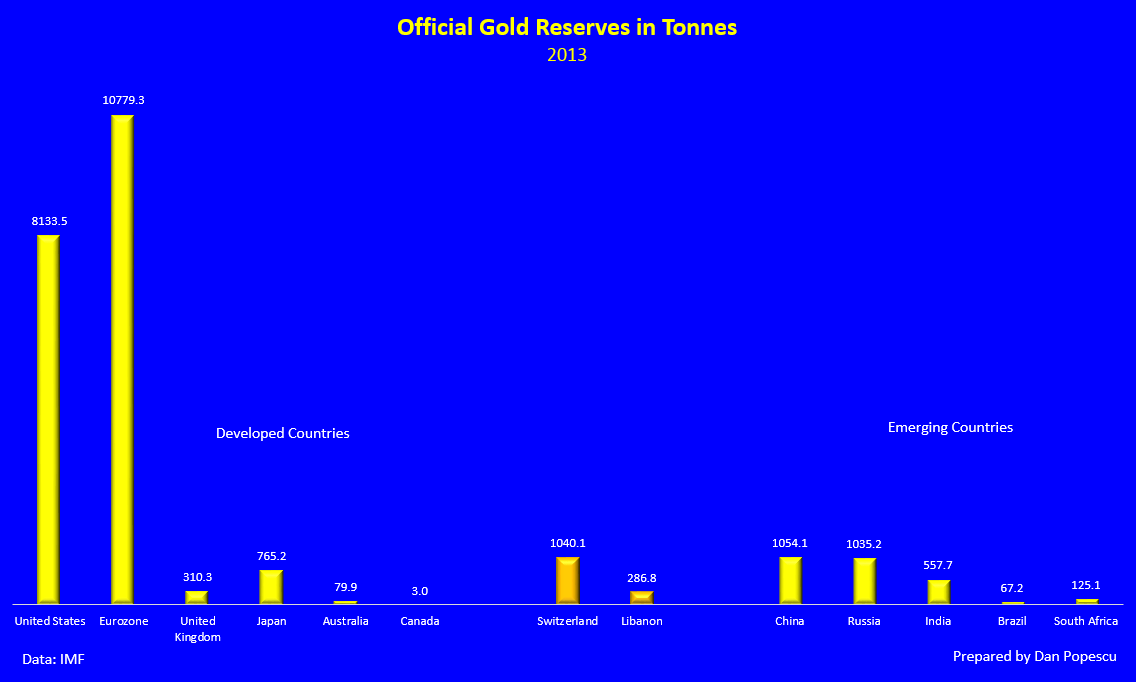

I think that the official amount of gold held by some countries (through different institutions) is rather close to 40,000 tonnes. Even if this gold represents only 20% to 25% of the total gold stock, it can be quickly brought to market and in sufficient quantities to have an impact on the market price. The annual gold market is only 4,477 tonnes per year; it is thus easy for United States or the European Union to influence gold’s price, since they own respectively 8,333 and 10,779 tonnes of gold. Currencies mirror the health of the countries issuing them. When a country manages its economy well and offers a good social and political environment, demand for its currency increases and, thus, it appreciates, whereas the opposite happens when the economy and politics of the country are poorly managed. The fiat currency is the image of the country and its value only depends on the trust people have in its economy. When the international monetary system is on the brink of collapse because of an exorbitant global debt, there is a flux taking place toward real assets (land, buildings, jewelry, gold, silver etc.). Gold is real money, contrary to the different countries’ currencies, which are fiat money and can be devalued by monetisation of the debt. Since the beginning of history, gold has taken center stage in geopolitics. History tells us that the Roman Empire invaded Dacia (Romania today) at the start of the 2nd century B.C. to take control of the rich gold mines of the Carpathians. The Empire had depleted all of its gold mines and its expenses were growing rapidly. The roman economy was based on war and those wars were costing more and more gold while they would bring in less and less. By that time, the Romans had taken a liking for luxury items that they did not produce themselves, like fine silk from China, pearls from the Persian Gulf, perfumes from India, ivory from Africa, etc. Roman gold was being used for those purchases and a lot of it was needed. Later, in the 1500s, the quest for gold became the objective of the conquest of the Americas after the return of Christopher Columbus who had discovered the Aztec and Inca gold. During the Second World War, Hitler put together a team with the mission of getting hold of the gold and other treasures of the conquered nations. Nazi Germany used all of its available resources to win the war, and gold was an important weapon in Hitler’s economic arsenal (gold stolen from occupied countries’ central banks between 1939 and 1942). It is interesting to note that private ownership of gold was forbidden, by left or right leaders, totalitarian or democrats, from Lenin in Russia, Hitler in Germany, Mussolini in Italy, Mao in China to Roosevelt in the United States. In 1944, at the Bretton Woods Conference, the United States took advantage of the great weakness of world after the Second War and imposed a monetary system based on the dollar, but backed by gold. Following a crisis opposing the United States and Europe, but mainly France, gold backing of the dollar was abandoned in 1971. Deficits and debts brought about by less productivity and some costly wars (Korea, Vietnam) started to weigh heavily on the dollar. The US dollar has become, since 1971, the international monetary standard, without any gold backing. However, gold has remained the “de facto” standard lurking in the shadows, should a major monetary crisis occur, watching for the first mistake to regain its center role. Many countries, like Canada, sold all their gold in the 90’s but, in general, the official holdings, as can be seen in chart #1, have barely diminished. A new era started in the 90’s with the end of the Cold War and, thus, the beginning of a world disarmament. An era of peace and prosperity seemed to have started under the almost absolute dominance of the United States. During this optimistic period, gold fell from $850 to $250 an ounce. This period was short lived, because the September 11 terrorist attack in New York, the war in Afghanistan, the invasion of Iraq, the 2008 financial crisis and, recently, the annexation of Crimea by Russia have changed all that. During the 2008 crisis - that almost succeeded in bringing down the current international monetary system - gold made a stunning comeback into the system. During the crisis, gold became the only accepted guarantee in order to get liquidity. What was significant was that after having been ignored for decades, gold was coming back into the international monetary system via settlements of the Bank for International Settlements (BIS). These transactions themselves confirm that gold was coming back into the system. They revealed the poor state of the financial system before the crisis and showed how gold has indirectly been mobilized to support the commercial banks. Gold’s old emergency usefulness has resurfaced, albeit behind closed doors at BIS in Basel, Switzerland. Starting in 2008, we can also observe that western central banks stopped selling gold and that emerging countries’ central banks accelerated their gold buying. The extreme indebtedness of Western countries coupled with a rebirth of the emerging markets economies have destabilized even more an international monetary system based on an already much weakened US dollar.

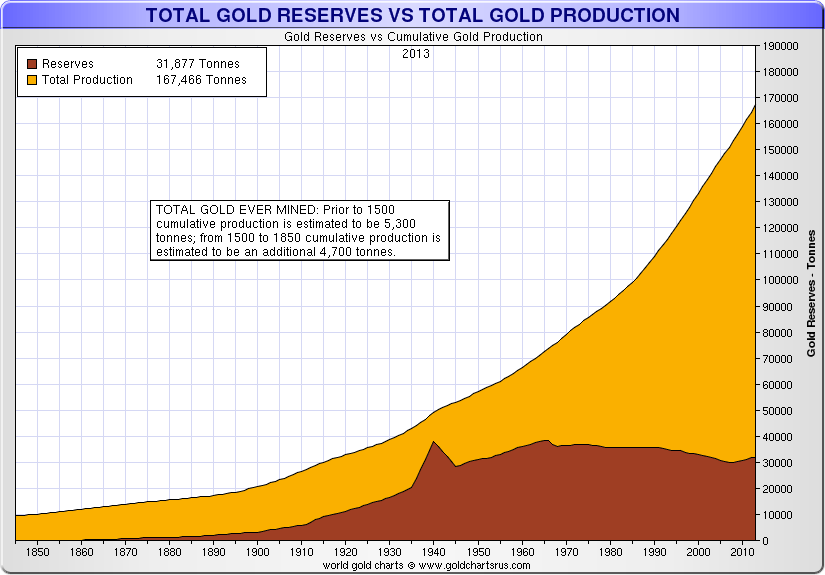

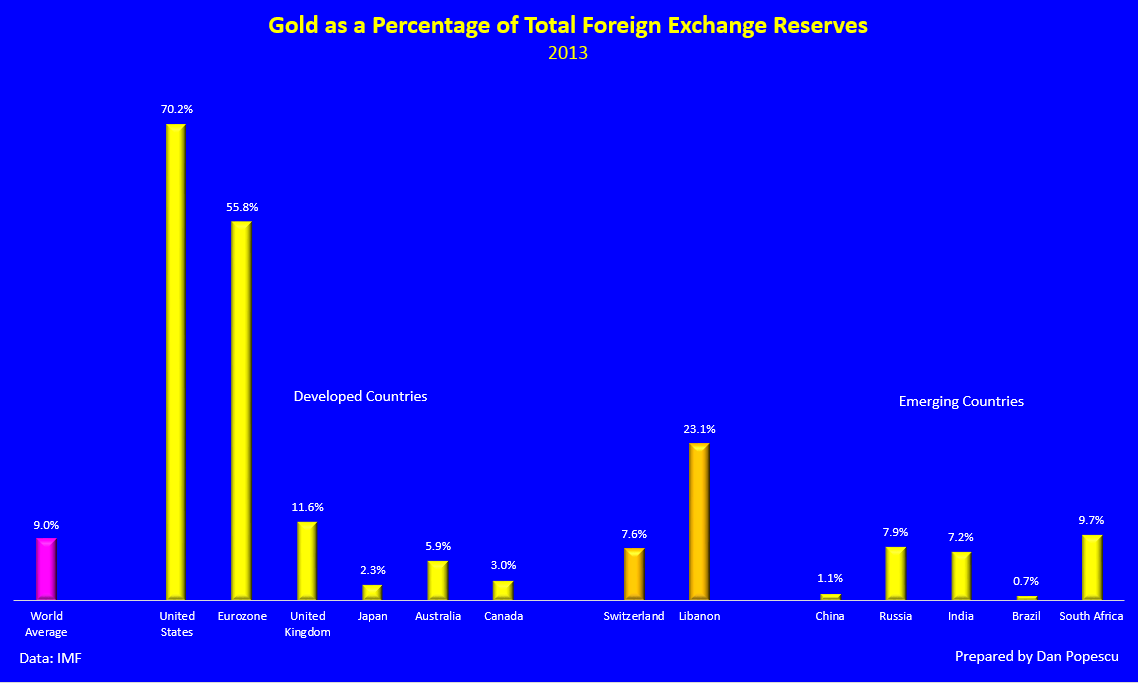

Global Gold Reserves vs Global Gold Production

A confidence crisis has also reappeared between countries, especially between emerging countries and the United States. We are in a transition period in geopolitics and we are witnessing an economic shift and transfer of wealth from West to East. The new wealth owners are also asking for accrued political power internationally, in all the institutions where the European Union and the United States have a dominant position. In order to protect the actual monetary system based on the dollar and that gives it exorbitant privileges, the United States manipulates the gold price, the only possible alternative if the dollar were to be replaced (or a SDR baked by gold). The United States is also trying to discourage countries and individuals to sell the dollar by way of negative public statements, but also by selling short on futures’ markets. Let us not forget that 40% to 60% of the US dollars circulate outside the United States. For the same reason, emerging countries are worried, and rightly so, that their reserves, mainly in dollars, will be confiscated by way of devaluation of the dollar. It is also possible that their gold reserves stored in the U.S. will be confiscated for so-called “force majeure” political reasons, in the interest of the “nation”. Gold is money “in extremis”, and this is why it should not be stored out of the country. Only exception being an exceptional situation like a war, and only for a short time. I think that the only motivation countries had to store their gold in New York was greed through the possibility to speculate on gold at the risk of losing this “in extremis” reserve. Actually, this is what happened to Portugal; during the 2008 crisis and the Lehman Brothers’ default, the country lost its gold it had lent out. In times of crises or wars, it is very important not only to have legal ownership but also physical possession of the gold. Geopolitical alliances may change at any time and access to this “in extremis” money could be restrained or even refused. In the current geopolitical framework that Ian Bremmer has so well called G0 (no country dominates; each one has advantage but also disadvantages), an international power struggle is occurring between the United States, the European Union, Russia and China. In this new Cold War, albeit in a G0 environment rather than in a G2 (United States and Soviet Union), where the European Union is not really allied with the United States and where China is not really allied with Russia, uncertainty prevails. In addition, other actors may influence this new Cold War that just got started since the annexation of Crimea by Russia. In a previous article on the gold wars, I mentioned the role of accelerator, agitator or troublemaker that third parties like Russia or Saudi Arabia could play. That is what happened with Russia, in Crimea, one month later. There is a war on the price of gold led by western countries, but there is also a war for gold ownership between all the countries; eastern countries being the ones that wish to exchange their dollar reserves for gold and as fast as possible. In this new Cold War, which also includes a currency war, the role of gold has become central in the international political strategies of all countries involved. During this period of major risks and uncertainty, and until the return of a new geopolitical, economic and monetary order, gold will shine. Gold is money “in extremis” and is the only real money without any counterparty risk. This is why gold is considered, and rightly so, a geopolitical metal.

Official Gold Reserves in Tonnes – Developed Countries vs Emerging Countries

Official Gold Reserves as a Percentage of Total Foreign Currency Reserves

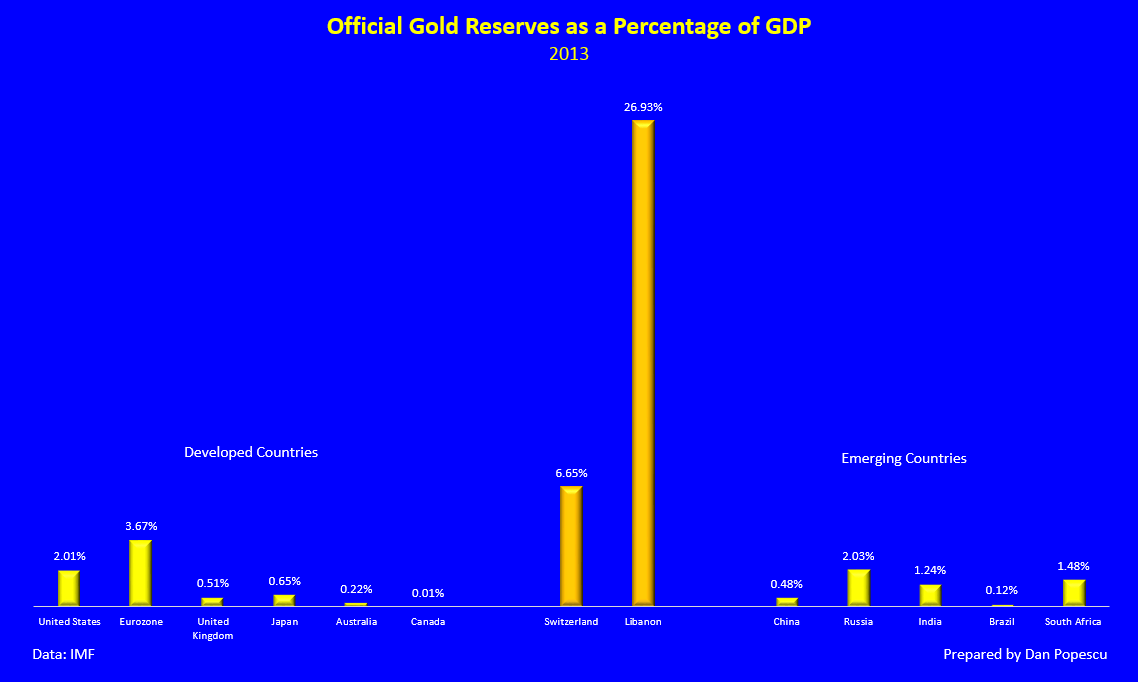

Official Gold Reserves as a Percentage of GDP – Developed Countries vs Emerging Countries

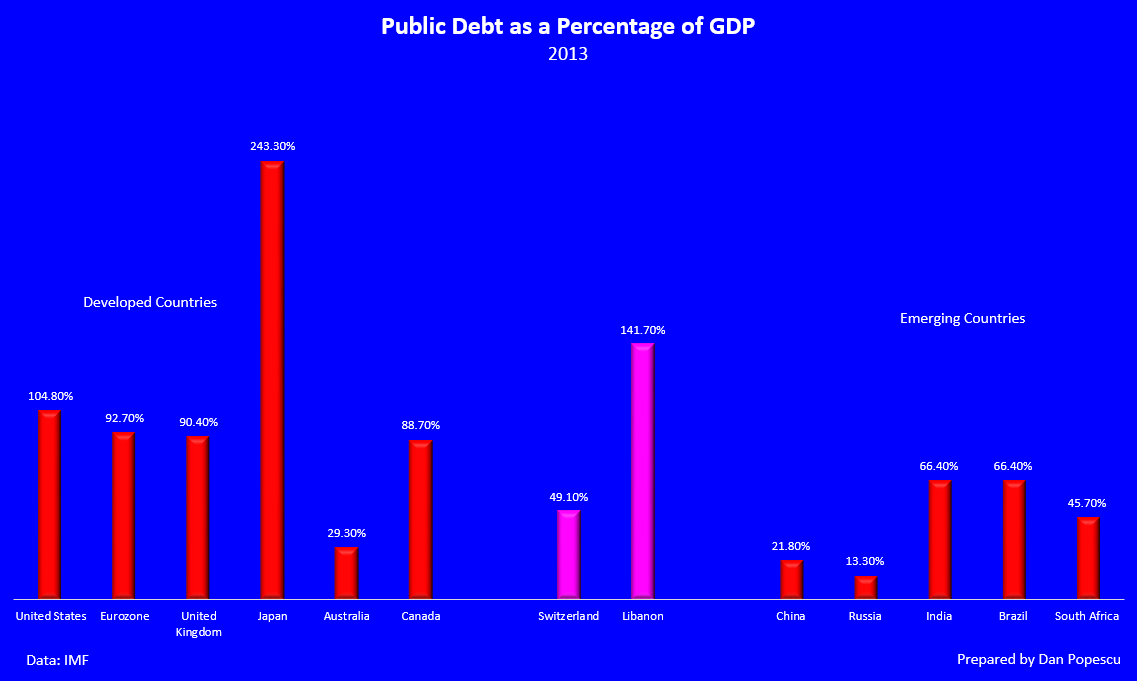

Public Debt as a Percentage of GDP – Developed Countries vs Emerging Countries |

| Quantitative Easing and its effect on the U.S. economy - The Miller Report - May 19, 2014 Posted: 18 May 2014 03:48 PM PDT With the Federal Reserve continuing to flood the economy with more and more money, clients of Birch Gold Group are often asking us for details on the stimulus program. So what exactly is Quantitative Easing? Does it work? What effect is it having on U.S. economy and markets? Is it creating... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Investors Weekly Review – May 16th Posted: 18 May 2014 02:58 PM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. Gold closed the week at $1,293.46, up $4.67 per ounce (0.36%). This was the gold investors review of past week. Gold Market StrengthsU.S. inflation has undoubtedly picked up, and is likely to rise toward the Federal Reserve's target. A number of important inflation readings outpaced the official U.S. Consumer Price Index (CPI) this week: (1) services inflation rose 2.5 percent; (2) food prices have risen more than 10 percent year to date; and (3) core import prices are rising, thus abating the deflationary impact they had over the past two years. In addition, Treasury Inflation-Protected Securities (TIPS) have been rising since the beginning of the year, and really spiked this month, in anticipation of higher inflation. This recent move lower in real yields has not yet been transmitted into higher gold prices. Palladium climbed to the highest price since August 2011, and 15 percent year to date, as concerns mounts over supply restrictions in South Africa. Meanwhile, the Russian government has moved to purchase palladium from local producers, with markets speculating the country's Gokhran palladium stockpiles are near exhaustion. On a similar note, platinum demand is expected to increase 35 percent this year in India alone as local jewelers seek to replace the volumes lost when gold import curbs took effect. Gold Market WeaknessesChinese gold and silver jewelry sales fell 30 percent in April, according to the National Bureau of Statistics. However, as Macquarie analysts pointed out, the year-over-year comparison is misleading due to the fact that April 2013 was an exceptional month for gold jewelry sales as gold prices dropped over $100 per ounce. Gold Market OpportunitiesA Bloomberg report shows China is on pace to import two-thirds of non-Chinese mined gold production as demand rises 31 percent. China is expected to import more than 1.45 million kilograms this year, while gold supply is not expected to change materially in 2014 from 2.3 million kilograms in 2013. Going forward, China's dependence on foreign gold is likely to increase given that gold reserves in China are made up of small- to medium-sized deposits of low-grade ore. Barclays' North America precious metals analysts are optimistic on the gold space following the earnings' wrap-up this week. According to Barclays, the large number of earnings' beats, together with reiterated or raised guidance, show that the pendulum "swung too far." In general terms, there was broad outperformance industry-wide in the first quarter, possibly marking the beginning of a new cycle of rising expectations. Companies like Agnico Eagle Mines, Mandalay Resources, and OceanaGold showed the investing community that there is plenty of value in gold stocks, even after the drop in gold prices. Gold Market ThreatsISI's Weekly Economic Report suggests that its Diffusion Index of company surveys, which has been used as a leading indicator, has peaked in a way that resembles the "Sell in May' peaks of the previous three years. As such, the Fed minutes for the April Federal Open Market Committee (FOMC) meeting to be released next Wednesday are likely to be the next catalyst for stocks and gold. Further to that, Friday's new home sales report is of special importance given the sharp decline seen in March, which analysts are forecasting to be corrected by the April reading. BofAML is of the opinion that the Chinese government's focus on quality over quantity of growth is likely to result in short- and medium-term weakness by allowing selective defaults. Next week's China HSBC Flash Manufacturing PMI will be an important indicator for gold. The PMI's three-month average is sitting at 48.2, while analysts' expectations call for a 48.3 reading. Any reading above this is likely to be perceived as contributing to the stabilization of the Chinese economy and should be bullish for gold as it indicates expectations of rising future incomes. India has announced it raised its benchmark import price for a number of commodities in an effort to stave off the appreciation of the Indian Rupee following the primary elections. The price benchmarks for gold and silver will be raised, which will result in small hikes to import tax bills. |

| The Seeds For A Much Bigger Crisis Have Now Been Sown Posted: 18 May 2014 11:52 AM PDT This posting includes an audio/video/photo media file: Download Now |

| How Long Can Phase II of the Gold Pool Be Sustained Posted: 18 May 2014 06:34 AM PDT "The London Gold Pool was the pooling of gold reserves by a group of eight central banks in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce by interventions in the London gold market. The central banks coordinated concerted methods of gold sales to balance spikes in the market price of gold as determined by the London morning gold fixing while buying gold on price weaknesses. The United States provided 50% of the required gold supply for sale. The price controls were successful for six years until the system became no longer workable. The pegged price of gold was too low and runs on gold, the British pound, and the US dollar occurred and France decided to withdraw from the pool. The London Gold Pool collapsed in March 1968. |

| Gold Price Triangle Pattern Near Completion Posted: 18 May 2014 06:18 AM PDT Gold is moving sideways in 1268-1331 range for more than a month between two contracting trend-lines that make a shape of a triangle. We are looking at a running triangle in wave (b) that can be near completion as rise from 1276 is already in three legs that represents wave e), final leg in the pattern. With that in mind, traders should be aware of a bearish reversal down in wave (c) towards 1220/40 especially once 1277 and pattern support will give way. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment