saveyourassetsfirst3 |

- Inflation Exceeds 9%, But It’s Still Not Enough for Gold

- Breaking News

- Make Big Money in Top Tier Gold & Silver Mining Companies

- Rally Time in the Gold Stocks

- Junior 'Swings for Fences' in Golden Triangle

| Inflation Exceeds 9%, But It’s Still Not Enough for Gold Posted: 16 Jul 2022 09:00 AM PDT The inflation rate implies a more hawkish Fed, which is bad for gold in the short-run and good for gold in… by Arkadiusz Sieron of Sunshine Profits The inflation rate […] |

| Posted: 16 Jul 2022 06:40 AM PDT Real wage growth goes deeply negative … US industrial production unexpectedly tumbles in June … Can 9.1% inflation be tamed? … Bearish sentiment points to gold price falling below $1,700 next week … Germany faces coal supply crisis as Rhine River waters dwindle … The Economy and Markets 7/16 Real wage growth deeply negative – The […] The post Breaking News appeared first on DollarCollapse.com. |

| Make Big Money in Top Tier Gold & Silver Mining Companies Posted: 16 Jul 2022 05:00 AM PDT Speculative equity markets are becoming annihilated while investments in natural resources like gold and silver have been massively… by David Morgan of The Morgan Report Make Big Money in Top […] |

| Posted: 15 Jul 2022 11:31 PM PDT

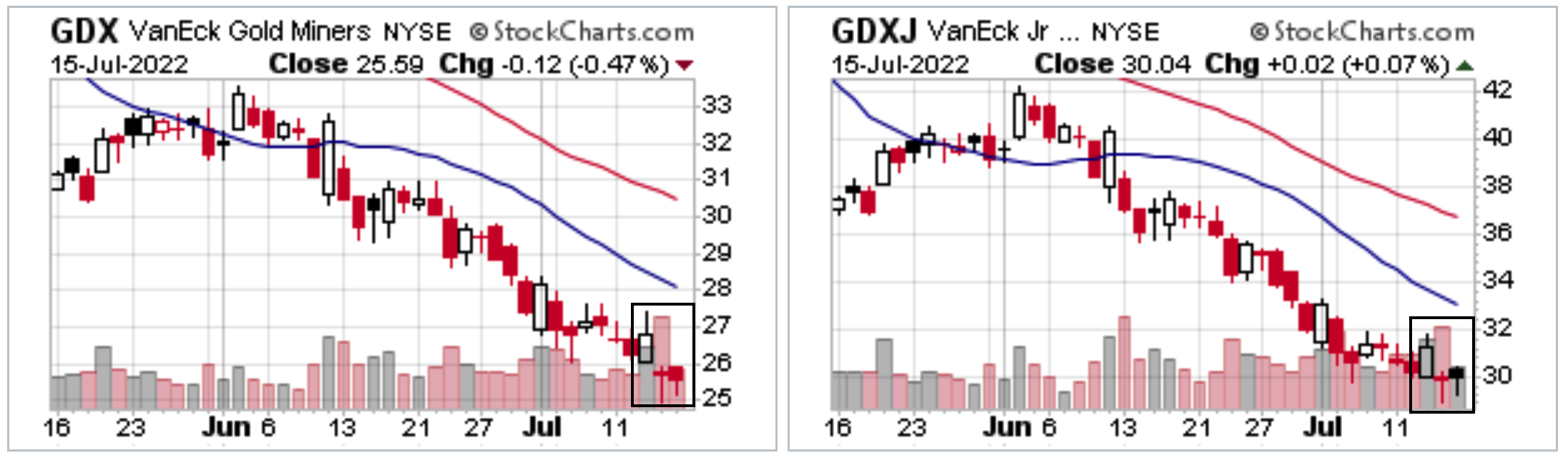

The gold stocks are extremely oversold. That's obvious.

However, selling pressure has waned since the end of June. The daily candles have been mild, suggesting less and less distribution.

The last three days mark three consecutive days of accumulation candles for the first time in months.

These candles come amidst an extreme oversold condition.

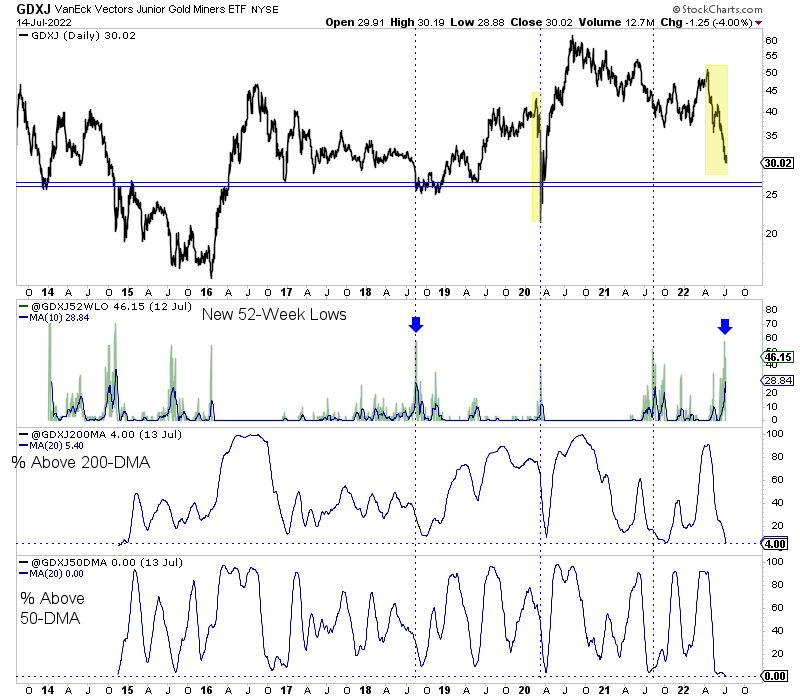

We plot GDXJ below along with our custom indicators. Each of the three indicators has hit the most extreme level in over seven years. GDXJ is the most oversold it has been since the end of 2014.

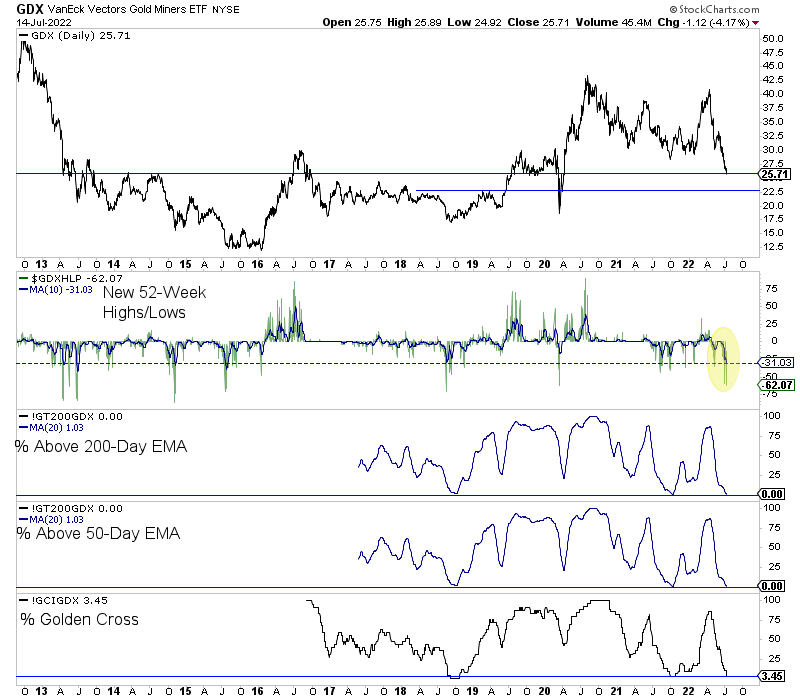

The large-cap miners are not quite as oversold as GDXJ, but they are close.

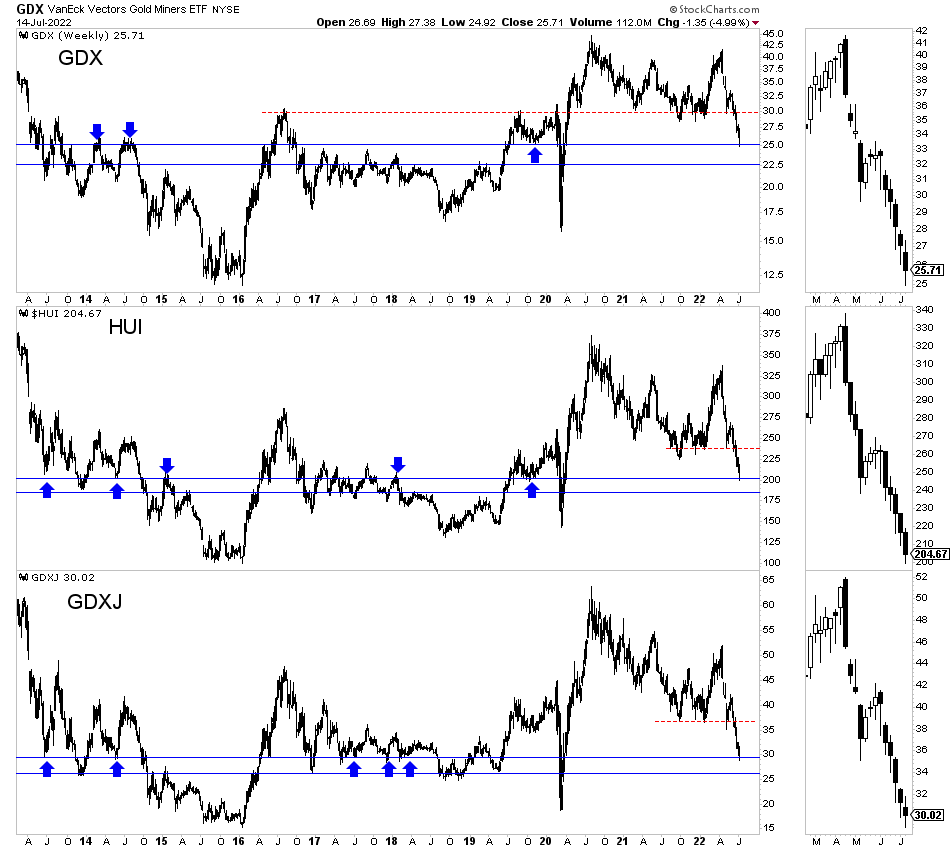

In re-assessing support levels in the gold stocks (after last week), I came up with the following (in the image below).

GDX, GDXJ, and the HUI all have begun to stabilize at their respective first support levels.

The path of least resistance for the gold stocks in the short-term is higher. Even when they were extremely oversold in 2008, 2013, and 2014, they enjoyed a relief rally before more selling.

Whether this rebound will be sustainable will depend on the market’s view of Fed policy. If the market anticipates the Fed hiking past September several weeks from now, then this rally will be sold. However, if there is a growing belief that July or September is the last hike, this rally could be the start of something big. I continue to focus on finding high-quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service. |

| Junior 'Swings for Fences' in Golden Triangle Posted: 15 Jul 2022 01:00 AM PDT StrikePoint Gold Inc. is "laser-focused" on its Porter Idaho and Willoughby properties in British Columbia's Golden Triangle. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment