saveyourassetsfirst3 |

- Officially A Recession! Global Economic Collapse Imminent! Great Reset Playing Out!

- James Rickards: Welcome to 1984!

- Breaking News

- Where Is Your Gold? Derivative Market Exposed

- Egon von Greyerz: This implosion will be fast – hold onto your seats

- US Dollar Trending Higher As Primary Global Reserve Currency

- The World In Monetary Chaos, Gold & Bitcoin (Non-State Money Alternatives) To The Moon

- Gold & Gold Stocks Weeks From Historic Bottom

- End of Empires, End Of Western Hegemony: 5000 Years Of Gold & Silver History Not Going To Change

- Today’s Bear Market Lowers the Risk on New Gold Discoveries

| Officially A Recession! Global Economic Collapse Imminent! Great Reset Playing Out! Posted: 10 Jul 2022 05:00 PM PDT The agenda is being readied for us to morph into a new world reserve currency system and order, a technocratic cashless society based likely on… by Josh Sigurdson via World […] |

| James Rickards: Welcome to 1984! Posted: 10 Jul 2022 09:57 AM PDT Central bank digital currencies (CBDCs) are coming even faster than many anticipated. The digital yuan is already here. Fed Chair Jay Powell said, "A U.S. CBDC could… potentially help maintain the dollar's international standing." A digital dollar, however, is still a dollar. A digital euro is still a euro. They are not crypto. They are not […] The post James Rickards: Welcome to 1984! appeared first on DollarCollapse.com. |

| Posted: 10 Jul 2022 08:03 AM PDT Dollar slams gold … Payrolls smash expectations … Gold loses shine … Yosemite burns … US lubes China … Oil goes bear … The Economy and Markets 7/10 The green ammonia boom is coming – Oil Price 7/10 Possible hot inflation report, Q2 earnings may be difficult week ahead – CNBC 7/08 Commodities crushed & bonds battered as […] The post Breaking News appeared first on DollarCollapse.com. |

| Where Is Your Gold? Derivative Market Exposed Posted: 10 Jul 2022 05:00 AM PDT The derivative market’s insidious practices to control the physical gold and silver price… by Natalie Laz via Kinesis In this week's Live from the Vault, the President of the Gold Silver […] |

| Egon von Greyerz: This implosion will be fast – hold onto your seats Posted: 09 Jul 2022 06:20 PM PDT The massive money creation in the 2000s has led to a debt and asset bubble, which is about to burst. Investors will be shocked by the speed of the decline and won't react before it is too late… by Egon von Greyerz on Gold Switzerland: The massive money creation by central and commercial banks in […] The post Egon von Greyerz: This implosion will be fast – hold onto your seats appeared first on DollarCollapse.com. |

| US Dollar Trending Higher As Primary Global Reserve Currency Posted: 09 Jul 2022 01:00 PM PDT Cash is King as traders are now placing a value on… by Chris Vermeulen of The Technical Traders The U.S. Dollar is one market that continues to stand out as […] |

| The World In Monetary Chaos, Gold & Bitcoin (Non-State Money Alternatives) To The Moon Posted: 09 Jul 2022 09:00 AM PDT When the Fed realizes the economy is crumbling, they will pivot, and the only question is… Lawrence Lepard on Palisades Gold Radio Tom welcomes Lawrence Lepard back once again to […] |

| Gold & Gold Stocks Weeks From Historic Bottom Posted: 08 Jul 2022 01:55 PM PDT

Gold and Gold stocks have fallen to levels from which we should see excellent returns over the next 12 months and potentially spectacular over the long term. However, that does not mean a bottom and reversal are imminent.

Concerning the gold stocks, the indicators are extremely oversold and have reached levels similar to the 2020 and 2018 bottoms.

You will rarely hear a technician say this, but whether markets make an oversold bounce or the actual bottom depends on fundamentals. Concerning precious metals, Fed policy changes have been quite significant.

In late 2018, Gold and gold stocks rebounded and sustained gains around the time of the Fed's last interest rate hike. The Gold breakout in 2019 occurred when the Fed cut interest rates for the first time in over a decade.

The Covid crash low occurred as the Fed cut rates to 0 and the market sensed massive fiscal stimulus and transfer payments. In 2008, the Fed cut rates to 0 a month before the October bottom.

I could go on but you get the point.

Gold and gold stocks are struggling because the market continues to anticipate rate hikes through the end of the year. When the market and economic outlook force the Fed to stop, Gold and gold stocks will rebound violently, if they remain extremely oversold as they are now.

Before we get to the breadth indicators, let us focus on price.

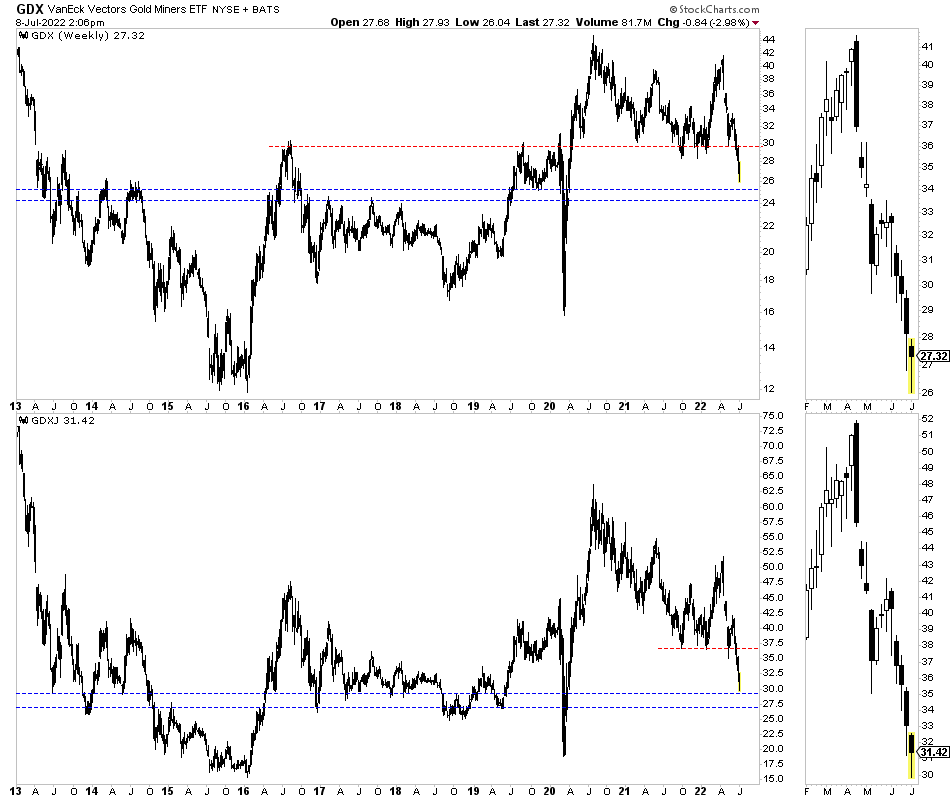

The weekly candle charts for GDX and GDXJ are below.

After a nasty 12 weeks of decline, the miners are sporting bullish hammers. They could rally for at least a few weeks.

The red lines show initial resistance targets, while the blue lines show strong support targets if this week’s lows did not mark the bottom.

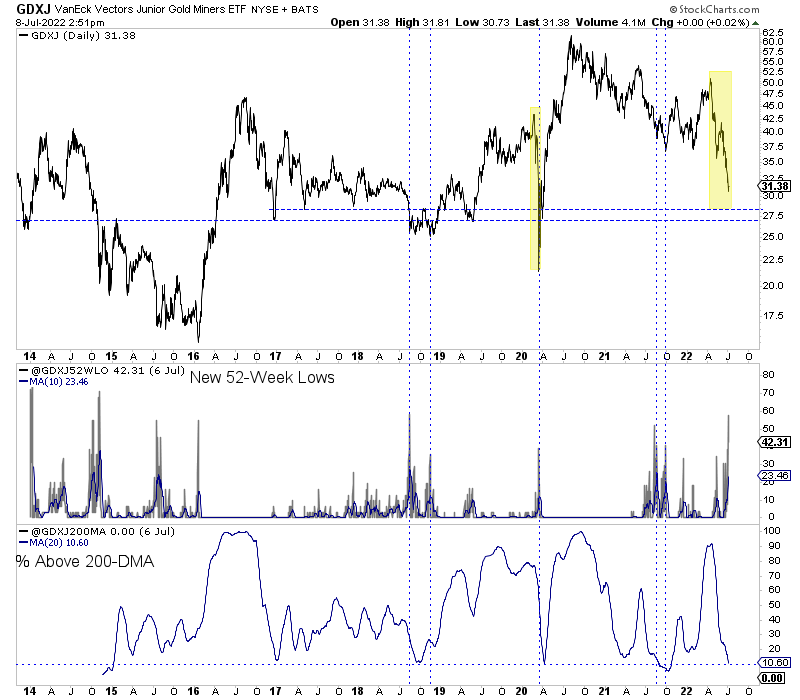

A few days ago, 58% of GDXJ stocks made a new 52-week low. That is tied with the highest single-day mark of the past seven years.

Also, the percentage of GDXJ stocks trading above the 200-day moving average (smoothed by a 20-day average) is at the second-lowest level of the past seven years.

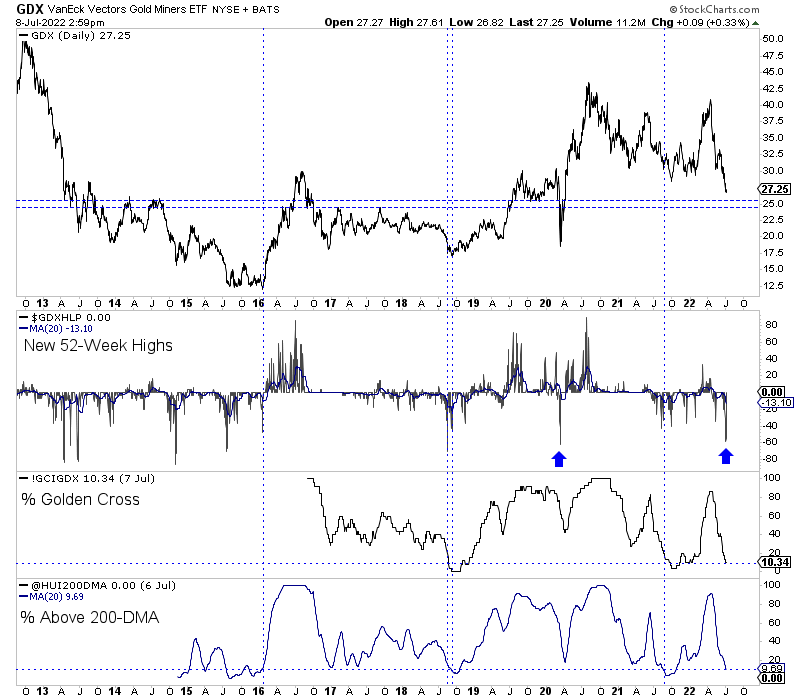

Also, 59% of GDX stocks made a new 52-week low a few days ago. That was in line with the August 2018 and March 2020 lows data.

Meanwhile, Gold has broken below support at $1780 and $1750.

It has key support at the 40-month moving average ($1720) and a confluence of support around the 2021 lows at $1675.

Technicals and sentiment indicators (which are not yet extreme) suggest Gold could easily fall and test those support levels. Perhaps that would coincide with a final selloff in the gold stocks.

The turning point for precious metals will align with or begin as the market senses a shift in Fed policy. Whether July or September is the last rate hike, I expect the turn to be in August or September.

I continue to focus on finding high-quality juniors with at least 5 to 7 bagger potential over the next few years. Periodically I will publish and update a list for subscribers of my favorite stocks with at least 10-bagger potential. To learn the stocks, we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service. |

| End of Empires, End Of Western Hegemony: 5000 Years Of Gold & Silver History Not Going To Change Posted: 08 Jul 2022 01:00 PM PDT “…all paper assets are going to be destroyed…” Bill Holter with Patrick V. on Silver Bullion TV SBTV spoke with Bill Holter about why we are at a crossroads witnessing […] |

| Today’s Bear Market Lowers the Risk on New Gold Discoveries Posted: 08 Jul 2022 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment