saveyourassetsfirst3 |

- James Rickards: The real reason why gold has stumbled

- Gold To New All-Time High When Fed QT Fails

- Gold: First A Swoon, Next The Moon?

- RED BUTTON TIME! The Silver & Cryptocurrency Riggers End Game Is Here!

- Interview: Gold Forecast for Balance of 2022

- A Sign That Gold Stocks Have Finally Put In Their Long Overdue Bottom?

- Fed Reloads Gold Stocks

- Updated Gold Bull Analogs

- TFMR Podcast - Monday, June 6

- Do, Do That Voodoo

- Mid-Tier Silver Miner Posts 67% Gain in Q1 Revenue

- Expert Says the Fed Will Fortify the Bear Market in Cash

- Analyst Says Collective Mining Is an 'Immediate Buy'

- Vancouver Junior Publishes Impressive Copper-Silver Resource

- Junior Raising CA$3M; Strategic Investment By Crescat Capital

- Silver Junior Hits More High-Grade Veins

- Copper Find Makes Silver Explorer a 'Buy'

- Gold Is Doing It Again

- Get The Big Prize for Silver

- Webinar for Beginners to Gold

- Gold Makes Record High and Targets $6,000 in New Bull Cycle

- Gold Mining Stocks Flip from Losses to 5x Leveraged Gains!

- Dr. Stephen Leeb - March 27th, 2020. "We're All in on Gold!"

| James Rickards: The real reason why gold has stumbled Posted: 08 Jun 2022 04:15 PM PDT The world has changed radically in recent years. We've had the worst pandemic since 1918, and the third worst in world history. We've had a global supply chain breakdown. Inflation is the worst since the early 1980s. Europe is experiencing its worst war since the end of World War II. So, why isn’t gold soaring? […] The post James Rickards: The real reason why gold has stumbled appeared first on DollarCollapse.com. |

| Gold To New All-Time High When Fed QT Fails Posted: 08 Jun 2022 01:00 PM PDT One of the best years for gold & silver will be 2023, but for the time being, it’s going to be a brutal… Don Durrett with Dave Russell on GoldCore […] |

| Gold: First A Swoon, Next The Moon? Posted: 08 Jun 2022 09:00 AM PDT Clearly, a “buy and hold” approach is superb for gold, and for silver, a more tactical… by Stewart Thomson of Graceland Updates June 7, 2022 1. It's been a frustrating couple […] |

| RED BUTTON TIME! The Silver & Cryptocurrency Riggers End Game Is Here! Posted: 08 Jun 2022 05:00 AM PDT Everything is happening NOW! by Bix Weir of Road to Roota Everything is happening NOW in the process of destroying the old system and implementing something NEW!! You should be […] |

| Interview: Gold Forecast for Balance of 2022 Posted: 07 Jun 2022 05:58 PM PDT In this video update I spoke with Jordan Roy-Byrne of thedailygold.com to get his take on what has been happening with the price of gold this year and where he sees it going for the rest of 2022.

|

| A Sign That Gold Stocks Have Finally Put In Their Long Overdue Bottom? Posted: 07 Jun 2022 09:00 AM PDT Encouraging action in gold stocks… by Peter Schiff of Peter Schiff Podcast Jobs Are a Lagging Indicator · Encouraging action in gold stocks.· America has never been in a weaker […] |

| Posted: 07 Jun 2022 07:00 AM PDT The gold miners' fundamentals remain strong, and gold's own outlook remains incredibly bullish… by Adam Hamilton of Zeal LLC The gold miners' stocks collapsed into mid-May, exasperating contrarian traders. Plunging […] |

| Posted: 06 Jun 2022 11:04 PM PDT

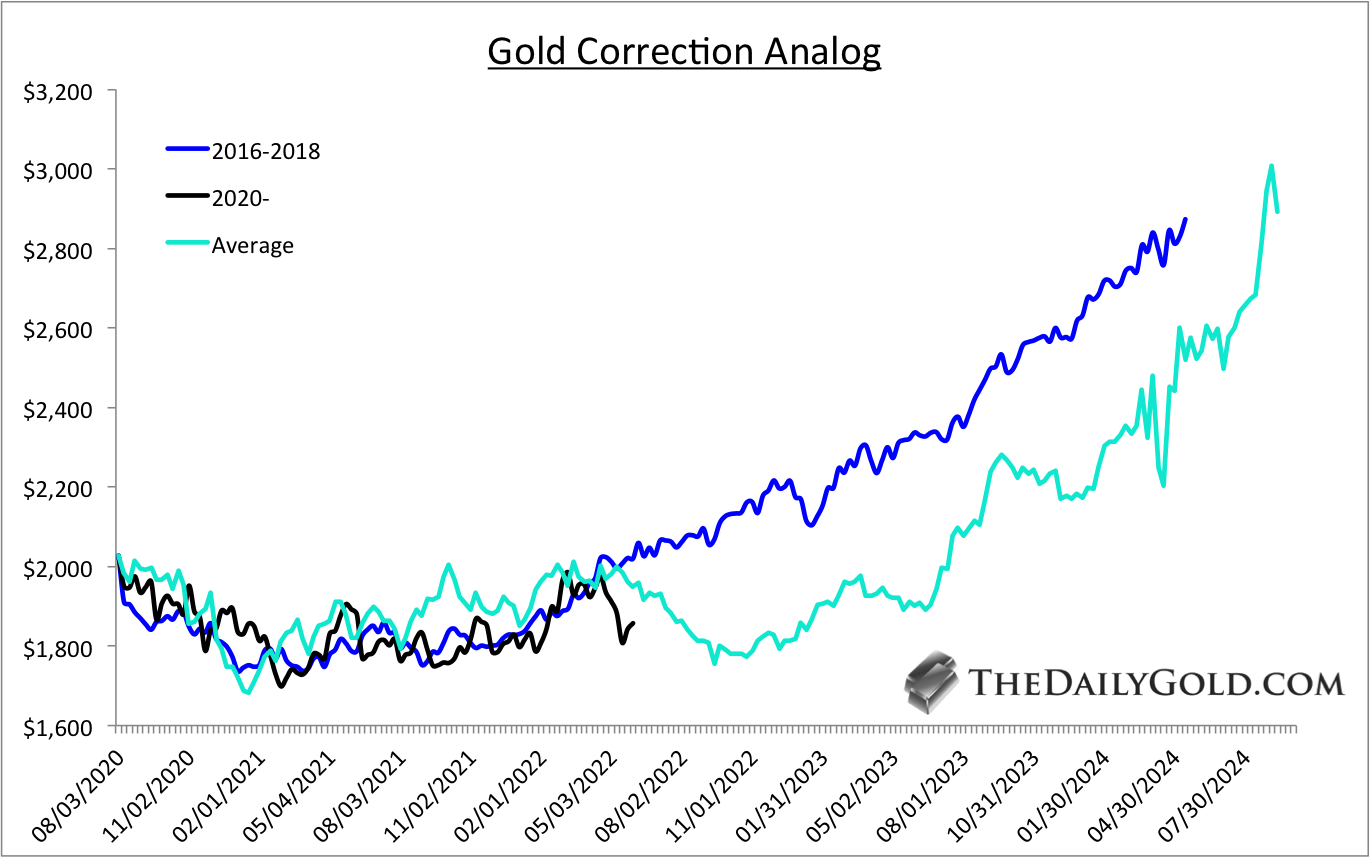

If you follow my work, you know I love studying market history and employing analogs. Market moves of the past can inform the future.

It has been a while since I've updated the analogs for Gold.

Gold was tracking the average of all bull market corrections and the ensuing rebounds until the recent decline below $1900.

As a result, the best historical comparison is the 2016 to 2018 correction. That correction ended a few months before the Fed’s last rate hike in that cycle, and later Gold broke above 6-year resistance when the Fed cut interest rates.

The average and the 2016-2018 analog put Gold around $3000 in two years.

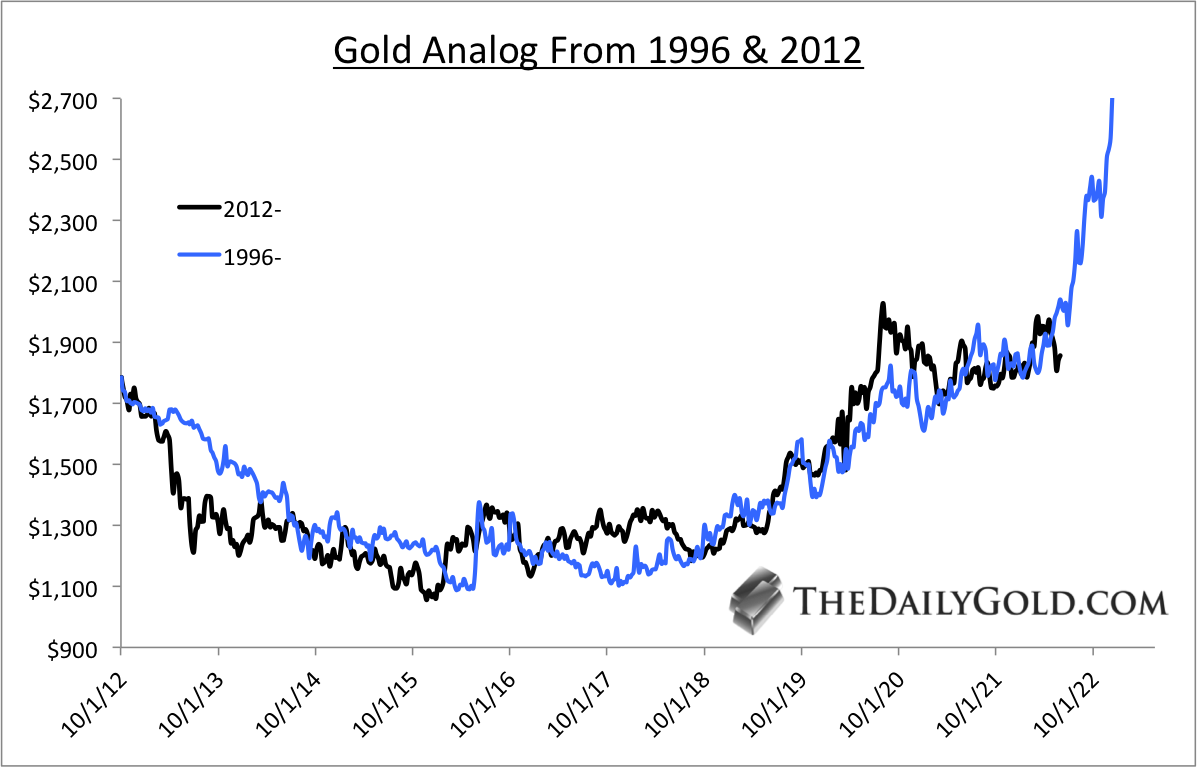

The best comparison from a bird’s eye view perspective continues to be the 1996 to 2005 period as it applies to the last nine years.

Gold exploded in late 2005 after an 18-month-long consolidation that was part of an irregular cup and handle pattern.

The current cup and handle pattern is larger, fits the textbook parameters, and is more bullish. However, it could take more time to complete.

The outcome is likely to be similar as a breakout past $2100 would lead to a vertical move.

Gold appears to be trading in a very bullish consolidation pattern. It could test even the low $1700s and remain in a very bullish consolidation.

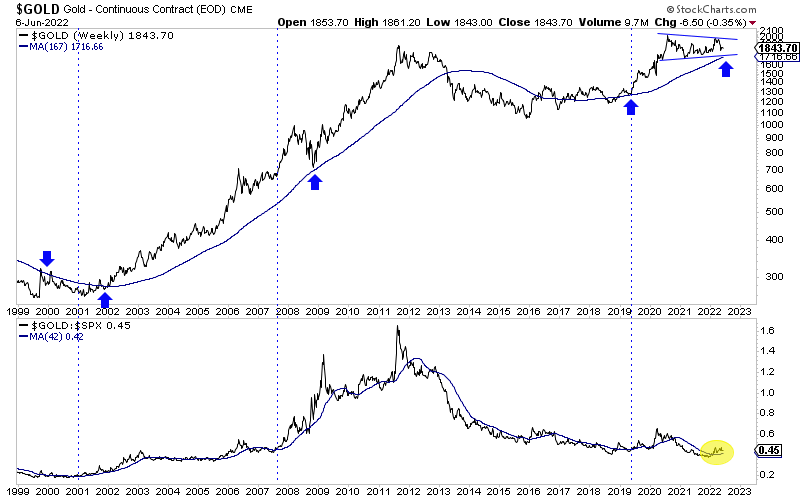

The Gold to S&P 500 ratio is trending higher and above an upward sloping 200-day moving average. See the yellow.

The blue vertical lines show the start of Fed rate cut cycles. The Fed shifting its policy later this year could be the trigger for the significant breakout in Gold.

Investors may have a few more months to accumulate high-quality juniors at very good values.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. Periodically I will publish and update a list for subscribers of my favorite stocks with at least 10-bagger potential. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service. |

| Posted: 06 Jun 2022 02:01 PM PDT With TF The new begins in much the same manner as the old week ended....bonds selling off, the POSX rallying and Comex gold under pressure. And tomorrow may bring more of the same as there's not much scheduled news until the ECB rate decision on Thursday. So for today, just a recap and general discussion that includes these three screenshots: And then these charts: More... |

| Posted: 01 Jun 2022 07:59 AM PDT By TF Things are so FUBAR again today that it's almost laughable. In fact, laughter is about the only way we can make it through the day as liquidity dries up, markets collapse, inflation soars and The Fed jawbones. So where do we even start? Well, let's start with this...since it's on my mind. Earlier today, I recorded a "special podcast" with a small natural gas producer that Kerry Lutz... |

| Mid-Tier Silver Miner Posts 67% Gain in Q1 Revenue Posted: 11 May 2022 01:00 AM PDT Endeavour Silver Corp.'s shares traded 9% higher after the Vancouver-based precious metals company reported Q1/22 financial results highlighting a 25% YoY increase in silver production. |

| Expert Says the Fed Will Fortify the Bear Market in Cash Posted: 11 May 2022 01:00 AM PDT Michael Ballanger digs deep to uncover the connection between secular bear markets and gold in a credit-tightening cycle, mining out what he believes the Fed will do in this current bear market. |

| Analyst Says Collective Mining Is an 'Immediate Buy' Posted: 11 May 2022 01:00 AM PDT Can Collective Mining follow in the footsteps of its larger predecessor Continental Gold? Clive Maund examines the latest data from its one-year chart to see if it's rising to the challenge. |

| Vancouver Junior Publishes Impressive Copper-Silver Resource Posted: 09 May 2022 01:00 AM PDT One Vancouver-based junior exploration company just went from one to two flagship projects with the release of the maiden resource estimate on a copper-silver project in Colorado. Could this be a game-changer for shareholders? |

| Junior Raising CA$3M; Strategic Investment By Crescat Capital Posted: 01 May 2022 01:00 AM PDT The Critical Investor catches up with the CEO of this gold explorer and discusses its latest financing and plans. |

| Silver Junior Hits More High-Grade Veins Posted: 27 Apr 2022 01:00 AM PDT Peru is home to some of the world's most prolific silver mines. One small-scale silver producer in a past-producing district is cleaning up its balance sheet and drilling off further resources—all while looking at M&A opportunities. It's all part of the plan to achieve long-term growth. |

| Copper Find Makes Silver Explorer a 'Buy' Posted: 27 Apr 2022 01:00 AM PDT In this article Clive Maund takes a long view of this Canadian silver explorer, flashing back to three years ago to review its trajectory. |

| Posted: 02 Oct 2020 04:02 AM PDT The US dollar cycle has turned and is likely to be under severe pressure over the coming months. This will significantly support USD gold prices. |

| Posted: 10 Sep 2020 05:00 AM PDT We are still early in this rally, so we could see a huge move |

| Posted: 27 Aug 2020 12:24 AM PDT If you are new to gold the webinar below I recorded yesterday will be useful. The main presentation goes for about 50 minutes and covers

Then there was 1 hour of Q&A that cover a lot of questions beginners have. https://www.zadelpropertyeducation.com.au/webinar-live-gold-silver-replay/ This blog has been silent for a few years as I have been writing weekly for ABC Bullion at https://www.abcbullion.com.au/investor-centre/pdf I have some topics to write about but trying to find the time in a booming gold market like we have now is proving difficult. A good problem to have. |

| Gold Makes Record High and Targets $6,000 in New Bull Cycle Posted: 27 Jul 2020 09:48 AM PDT  The gold price made a new all-time nominal high today at $1,945 per ounce. This move should not come as a surprise to anyone paying attention to the current financial landscape. The FED has injected an unprecedented amount of new money/debt into the economy since March in efforts to avoid a collapse from the impact [...] The gold price made a new all-time nominal high today at $1,945 per ounce. This move should not come as a surprise to anyone paying attention to the current financial landscape. The FED has injected an unprecedented amount of new money/debt into the economy since March in efforts to avoid a collapse from the impact [...] |

| Gold Mining Stocks Flip from Losses to 5x Leveraged Gains! Posted: 28 May 2020 10:16 PM PDT  The gold price made a new 2020 high today and looks poised to take out the nominal all-time high around $1,920 and then challenge $2,000 in the months ahead. Some are even estimating that gold could climb to $3,000 by year-end on account of the nearly $10 trillion in new money/debt/stimulus that is being created [...] The gold price made a new 2020 high today and looks poised to take out the nominal all-time high around $1,920 and then challenge $2,000 in the months ahead. Some are even estimating that gold could climb to $3,000 by year-end on account of the nearly $10 trillion in new money/debt/stimulus that is being created [...] |

| Dr. Stephen Leeb - March 27th, 2020. "We're All in on Gold!" Posted: 29 Mar 2020 08:19 AM PDT Interview Nuggets with Financial Industry Pros Contact Us 24/7: gsradio@frontier.com Subscription Monthly $24.89 USD ... GREATEST INVESTMENT INFO ON THE WEB!!! This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment