saveyourassetsfirst3 |

- Jordan Roy-Byrne: Gold’s fate hinges on the stock market

- The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point

- The Most Bullish Precious Metals Setup In 38-Year Career

- Gold Up In Dollars, Down In Roubles

- Gold Price Breakout Starts In Next 6-9 Months? $4k/oz Gold in 3 Years?

- Gold’s Fate Hinges on the Stock Market

- The Gold Bull Knocked Dumb Money & Emotional Traders Off At The Bottom Again

- Missguided on brink of collapse

- Gold & Silver Stocks (Miners, Explorers, Etc) Versus “Welfare” Investing, And A FAN-FAVORITE MANIPULATION DENIER Returns For A Lame Encore

- Gold $1800: The Buy Zone For Champions

- Interview: Gold Can Fully Decouple Into Bull Market This Fall

- Robert Wright: Preparing for payment system fragility

- Is Pampa Paciencia the Next El Peñón?

- Gold Pullback Creates an 'Opportunity to Buy'

| Jordan Roy-Byrne: Gold’s fate hinges on the stock market Posted: 27 May 2022 06:30 PM PDT For gold to perform well, it has to outperform the stock market. In recent years, that has happened but only occasionally and not consistently. Gold's best moves and real bull markets occur when equities are in a secular bear market … Jordan Roy-Byrne on The Daily Gold: I have been writing about this for over […] The post Jordan Roy-Byrne: Gold's fate hinges on the stock market appeared first on DollarCollapse.com. |

| The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point Posted: 27 May 2022 01:00 PM PDT Somehow, the world still believes in the magical central bank theory of solving a debt crisis with… by Matthew Piepenburg via Gold Switzerland Below we consider the classic (and oh-so […] |

| The Most Bullish Precious Metals Setup In 38-Year Career Posted: 27 May 2022 09:00 AM PDT Gold will always act as a safe haven, except when investors are trying to… Peter Grandich on Palisades Gold Radio Tom welcomes returning guest Peter Grandich to the show. Peter […] |

| Gold Up In Dollars, Down In Roubles Posted: 27 May 2022 05:00 AM PDT Europe wants to criminalize Europeans to try and avoid sanctions on… by Harvey Organ of Harvey Organ Blog GOLD TRADED UP $2.10 TODAY TO $1849.00//SILVER TRADED UP 8 CENTS TO […] |

| Gold Price Breakout Starts In Next 6-9 Months? $4k/oz Gold in 3 Years? Posted: 26 May 2022 09:08 PM PDT Jason Burack of Wall St for Main St interviewed returning guest, the editor and publisher of TheDailyGold.com and The Daily Gold Premium paid newsletter for junior mining stocks, Jordan Roy-Byrne.

Click Here to Learn About TheDailyGold Premium

|

| Gold’s Fate Hinges on the Stock Market Posted: 26 May 2022 04:59 PM PDT

I have been writing about this for over five years.

For Gold to perform well, it has to outperform the stock market. In recent years, that has happened but only occasionally and not consistently.

In a much broader sense, Gold's best moves and real bull markets occur when equities are in a secular bear market. One only needs to consider the 1970s and 2000s.

Stocks have been in a secular bull market since 2009, but there is a real risk that a new secular bear market has begun.

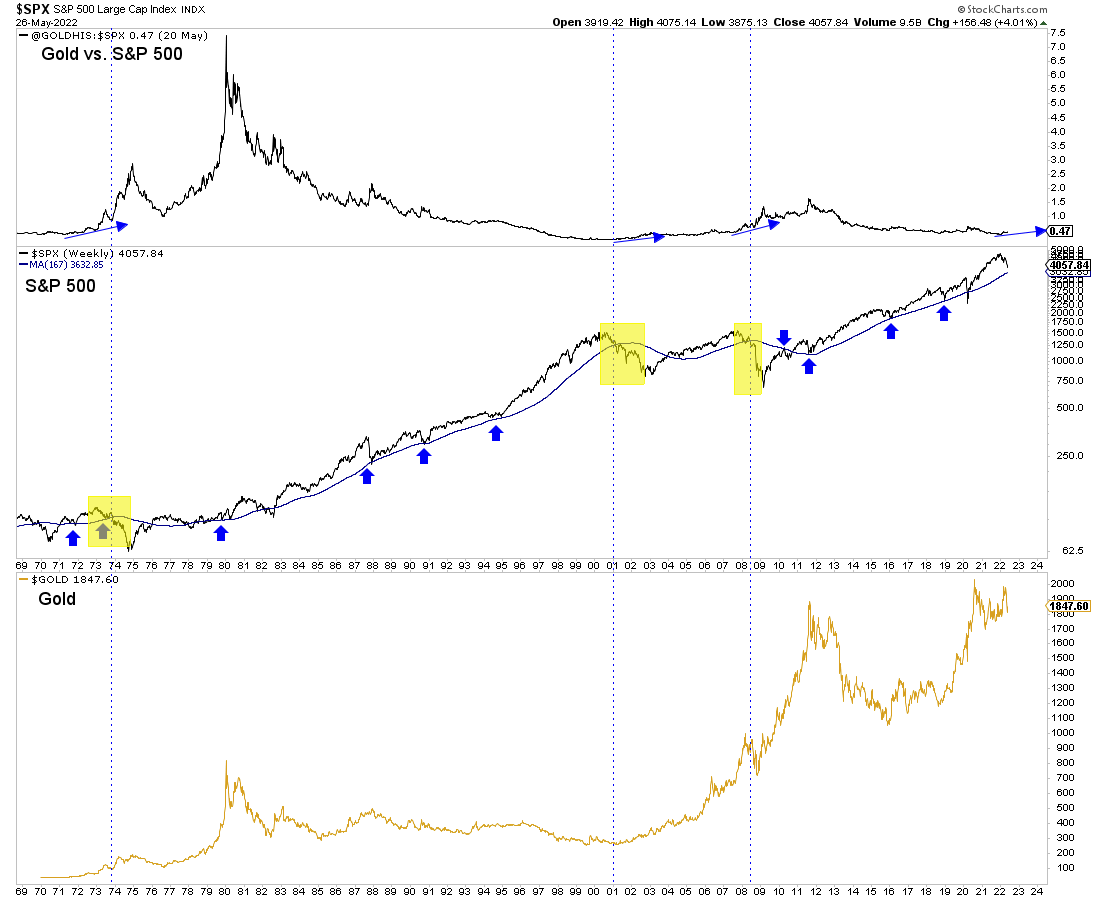

The chart below shows the importance of the 40-month moving average (equivalent) for the S&P 500. In secular bull markets, it acts as support.

If the S&P 500 loses the 40-month moving average over the months ahead, it will signal a new secular bear market as it did in 1969/1973 and 2001. Note how well Gold performs after that happens (yellow).

Should the S&P 500 lose its 40-month moving average later this year, then, it would be in its worst bear market in 14 years, and the Fed would likely be talking about easing. Gold would be in a position to break out.

At present, the S&P 500 looks to have begun a bear market rally, which fits the historical template of bear markets in a secular bear market.

There are six of these bear markets.

After the initial decline, each of the six rallied for a few months while holding above the 40-month moving average. They all broke below the 40-month moving average and the average and median time of the break was roughly nine months into the bear market.

The current bear market rally will allow the Fed to hike in June and July. The real question is how soon the Fed will have to shift policy and whether the economy is headed for a mild recession or a more severe one.

In any case, Gold is in a position to rebound when the market senses an end to tighter policy.

Further weakness in the stock market and the economy will inevitably lead to a Gold breakout and the start of a real bull market. I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. Periodically I will publish and update a list for subscribers of my favorite stocks with at least 10-bagger potential. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service. |

| The Gold Bull Knocked Dumb Money & Emotional Traders Off At The Bottom Again Posted: 26 May 2022 01:00 PM PDT “…they were a great contrarian signal…” by Gary Savage of Smart Money Tracker “…they were a great contrarian signal…” FULL SHOW NOTES AND LINKS HERE |

| Missguided on brink of collapse Posted: 26 May 2022 12:57 PM PDT This posting includes an audio/video/photo media file: Download Now |

| Posted: 26 May 2022 05:38 AM PDT Awkward… ***** HALF DOLLAR’S UPDATE, THURSDAY, MAY 26, 2022: It seems like there is a two-pronged approach in the silver market right now, which is but one standard operating procedure, […] |

| Gold $1800: The Buy Zone For Champions Posted: 26 May 2022 05:00 AM PDT There are a lot of technical green shoots in play at $1800 gold, and three key drivers could send gold to $3,000… by Stewart Thomson of Graceland Updates 1. As another […] |

| Interview: Gold Can Fully Decouple Into Bull Market This Fall Posted: 25 May 2022 06:27 PM PDT Jordan Roy-Byrne, Founder and Editor of The Daily Gold, joins us to discuss technical levels in the precious metals sector, as well as the macroeconomic factors that have his attention. Jordan highlights a few support levels he'll be watching for in gold, silver, and the mining stocks, but emphasizes he's more interested in the macro drivers of the markets and interest rates in response to the continued Fed rake hiking cycle, and at what point they'll be forced to reverse course.

Click Here to Learn About TheDailyGold Premium

|

| Robert Wright: Preparing for payment system fragility Posted: 25 May 2022 04:35 PM PDT How did people in the Great Depression make payments when money, itself, went broke and gold was confiscated? What will we do today if power outages or cyberattacks take down credit-card/debit systems? Ways to be prepared … by Robert E. Wright on American Institute for Economic Research: In previous posts, I suggested ways to cope […] The post Robert Wright: Preparing for payment system fragility appeared first on DollarCollapse.com. |

| Is Pampa Paciencia the Next El Peñón? Posted: 25 May 2022 01:00 AM PDT |

| Gold Pullback Creates an 'Opportunity to Buy' Posted: 24 May 2022 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment