saveyourassetsfirst3 |

- Alasdair Macleod Explains Why Interest Rates Are Inevitably Heading Higher

- Jim Rickards: The Makings Of A Global Debt Crisis Are In Place

- Is an Inverted Yield Curve Bullish for Gold?

- TraderStef: Goldilocks Recession Is Right Around The Curve

- “A Date Which Will Live In Infamy” – But Will Dec 7th Be Good For Gold?

- Clinton Foundation CFO Spills Beans To Investigators: ‘I Know Where The Bodies Are Buried’

- The Battle of $1250

- Gold Jumps Above $1250 For First Time Since Mid-July After November 2018 Jobs Report Release

- Unpaid Credit Card Bills, Involuntary Account Closings And Rejected Credit Applications All Rising

- Trump Says He Won’t Be Here When The Coming US Debt Crisis Goes Nuclear

- Breaking News/Best Of The Web

- Charles Hugh Smith: Preventing The Final Fall Of Our Democratic Republic

- Fund Manager: Trump’s Trade War Dilemma And Gold

- Thursday Conversation - Steve St. Angelo

- Test Mining Reveals 'Higher Grade, More Ounces and a New Proximal High-Grade Zone'

- Gold Explorer Announces First Assay from 2018 Yukon Zone Drilling

- Large Silver and Zinc Resource Found South of the Border

| Alasdair Macleod Explains Why Interest Rates Are Inevitably Heading Higher Posted: 07 Dec 2018 01:00 PM PST Alasdair Macleod explains why the recent complacency over higher rates is likely to be wrong… Alasdair Macleod interviewed by Jay Taylor on Turning Hard Times Into Good Times Alasdair Macleod, […] The post Alasdair Macleod Explains Why Interest Rates Are Inevitably Heading Higher appeared first on Silver Doctors. |

| Jim Rickards: The Makings Of A Global Debt Crisis Are In Place Posted: 07 Dec 2018 12:00 PM PST Jim says it’s important to pay attention to where we’re going, and where we’re going, globally, is to the inevitable crack-up. Here’s why… by Jim Rickards via Daily Reckoning In […] The post Jim Rickards: The Makings Of A Global Debt Crisis Are In Place appeared first on Silver Doctors. |

| Is an Inverted Yield Curve Bullish for Gold? Posted: 07 Dec 2018 10:26 AM PST

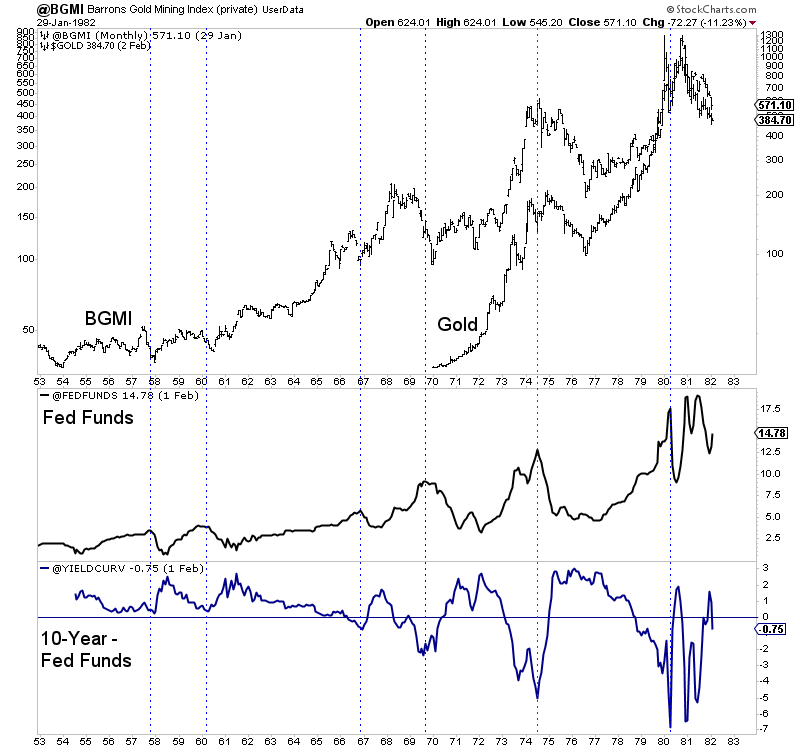

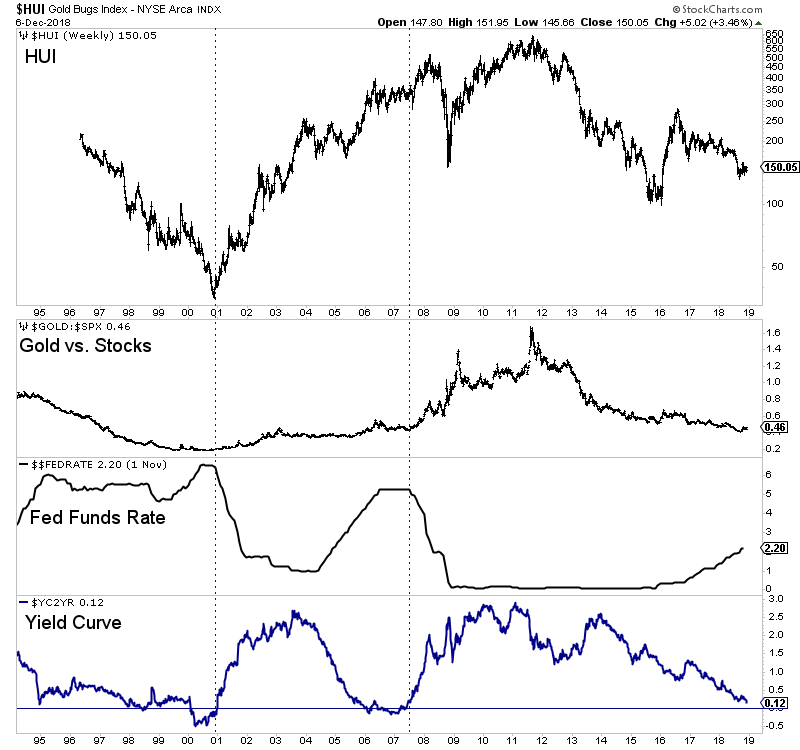

In recent days we've seen the beginnings of an inversion in the yield curve. The 2-year yield and the 5-year yield have inverted but not yet the the 2-year yield and the 10-year yield, the curve that is watched most. However, "2s and 10s" as bond traders would say appear headed for an inversion very soon. We know that an inversion of the yield curve precedes a recession and bear market. That is good for Gold. But timing is important and the key word is precedes. In order to analyze the consequences for Gold we should consult history. First let's take a look at the 1950-1980 period. In the chart below we plot the Barron's Gold Mining Index (BGMI), Gold, the Fed funds rate (FFR) and the difference between the 10-year yield and the FFR (as a proxy for the yield curve). The six vertical lines highlight peaks in the FFR and troughs in the yield curve (YC), which begins to steepen when the market discounts the start of rate cuts. A steepening YC is and has been bullish for Gold except when it's preceded by inflation or a big run in Gold.

Note that five of the six lines also mark a recession except in 1966-1967. At present, the yield curve is on the cusp of inverting for only the third time since 1990. The previous two inversions in 2000 and 2007 were soon followed by a steepening curve as the market sensed a shift in Fed policy. The initial rate cut in 2000 marked an epic low in the gold stocks and the start of Gold strongly outperforming the stock market. In summer of 2007 the rate cuts began and precious metals embarked on another impulsive advance.

The historical inversions carry a different context but the takeaways are not so different. Aside from the mid 1970s to the early 1980s, we find that a steepening of the curve (which accelerates from the start of Fed rate cuts) is bullish for precious metals. (This also includes a steepening in late 1984 that preceded the bull market in the mid 1980s). With that said, the inversion itself is not bullish for precious metals because there can be a lag from then to the first rate cut and steepening of the curve. I took a careful look at four of the previous inversions and counted the time from that point to the next significant low in gold stocks. The average and median time of those four is 10 months. That appears to be inline with my thinking that the Federal Reserve's final rate hike will be sometime in 2019. In the meantime, precious metals are rallying but the inversion of the yield curve and Fed policy argue it would not be wise to chase this strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| TraderStef: Goldilocks Recession Is Right Around The Curve Posted: 07 Dec 2018 10:00 AM PST Many signs point to a recession that is right around the curve. From plummeting hotel reservations to yield curve inversion, here’s TraderStef to explain… by TraderStef via CrushTheStreet (connect with TraderStef via Twitter or at TraderStef's website) […] The post TraderStef: Goldilocks Recession Is Right Around The Curve appeared first on Silver Doctors. |

| “A Date Which Will Live In Infamy” – But Will Dec 7th Be Good For Gold? Posted: 07 Dec 2018 09:02 AM PST Eric Sprott says it’s been a good week for gold & silver, and there are lots of things shaping-up in the markets that would take people to gold. Here’s more… […] The post “A Date Which Will Live In Infamy” – But Will Dec 7th Be Good For Gold? appeared first on Silver Doctors. |

| Clinton Foundation CFO Spills Beans To Investigators: ‘I Know Where The Bodies Are Buried’ Posted: 07 Dec 2018 08:00 AM PST Thinking he was “meeting an old professional acquaintance,” admitted to investigators that the charity had widespread problems. Here are the details… from Zero Hedge The CFO of the Clinton Foundation, […] The post Clinton Foundation CFO Spills Beans To Investigators: ‘I Know Where The Bodies Are Buried’ appeared first on Silver Doctors. |

| Posted: 07 Dec 2018 07:55 AM PST By TF Despite a weak BLSBS and surging commodity prices, the price of Comex Feb19 "gold" is being tightly contained at/near $1250 again today. And why is this level so important? All you have to do is look at the daily chart below: So, even with 2-4% gains across the board, gold struggles to move forward:... |

| Gold Jumps Above $1250 For First Time Since Mid-July After November 2018 Jobs Report Release Posted: 07 Dec 2018 06:08 AM PST The knee-jerk was a pop in gold above $1250. Silver jumped to $14.64, and the dollar dropped. Here’s a look at the report and market’s reaction… The Employment Situation Report, […] The post Gold Jumps Above $1250 For First Time Since Mid-July After November 2018 Jobs Report Release appeared first on Silver Doctors. |

| Unpaid Credit Card Bills, Involuntary Account Closings And Rejected Credit Applications All Rising Posted: 07 Dec 2018 04:00 AM PST More evidence keeps coming in that the economic downturn is here, like these developments in the world of consumer credit. Here are the details… by Mac Slavo of SHTFplan A […] The post Unpaid Credit Card Bills, Involuntary Account Closings And Rejected Credit Applications All Rising appeared first on Silver Doctors. |

| Trump Says He Won’t Be Here When The Coming US Debt Crisis Goes Nuclear Posted: 06 Dec 2018 08:00 PM PST Trump has also never once talked about debt, and he also thinks we can just grow our way out of the debt problem? Did he really say those things? from […] The post Trump Says He Won’t Be Here When The Coming US Debt Crisis Goes Nuclear appeared first on Silver Doctors. |

| Posted: 06 Dec 2018 06:20 PM PST Get ready for “a global dearth of liquidity” … Caitlin Johnstone: “MSM is getting weirder, more frantic, and more desperate by the day” … France bracing for massive protests, will close Eiffel Tower … “The market doesn't care how "fantastic" your stocks are” … Gold and silver rise on dovish Fed news. “Can gold beat […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Charles Hugh Smith: Preventing The Final Fall Of Our Democratic Republic Posted: 06 Dec 2018 06:00 PM PST There’s mounting evidence that the Age of American Exceptionalism is grinding to an end. Charles and Chris Martenson discuss the evidence… Charles Hugh Smith interviewed by Chris Martenson of Peak […] The post Charles Hugh Smith: Preventing The Final Fall Of Our Democratic Republic appeared first on Silver Doctors. |

| Fund Manager: Trump’s Trade War Dilemma And Gold Posted: 06 Dec 2018 04:00 PM PST Dave Kranzler says Trump must weaken the dollar and push it much lower to win the trade war. Here’s why, and what it means for gold… by Dave Kranzler of […] The post Fund Manager: Trump’s Trade War Dilemma And Gold appeared first on Silver Doctors. |

| Thursday Conversation - Steve St. Angelo Posted: 06 Dec 2018 01:28 PM PST With TF Longtime friend of TFMR, Steve St. Angelo of the SRSrocco Report, joins us today for an insightful and informative Thursday Conversation. As is the usual format, I primarily asked Steve to address three specific concerns: The crude oil market and how this current price plunge may impact not only inflation expectations but the entire US economy. The input costs of the average gold and silver miner and how falling energy prices can impact production costs and quarterly earnings. Global retail precious metal demand trends and how prices impact physical demand.I think you'... |

| Test Mining Reveals 'Higher Grade, More Ounces and a New Proximal High-Grade Zone' Posted: 06 Dec 2018 12:00 AM PST |

| Gold Explorer Announces First Assay from 2018 Yukon Zone Drilling Posted: 06 Dec 2018 12:00 AM PST |

| Large Silver and Zinc Resource Found South of the Border Posted: 06 Dec 2018 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment