saveyourassetsfirst3 |

- The Year In Review: Anything & Everything That Mattered In 2018

- Technical Musings About The Euro And Dollar Anchored By Macro

- Newell Brands: Never Hold Out For Top Dollar In A Bear Market

- How Many Of Your Local Taxes And Fees Are Rocketing Higher?

- Steven Mnuchin… WTF?! | Quoth the Raven, Chris Irons

- Germany’s Chancellor Says Nation States Must ‘Give Up Sovereignty’ To New World Order

- Gold’s Leading Indicators Looking Better

- TraderStef: Silver’s Hi-Ho Day Needs A Few More Dollars – Technical Analysis

- Breaking News/Best Of The Web

- Silver Quietly Climbs Higher As Cries Of ‘Mass Arrests’, ‘Sealed Indictments’ & ‘Military Tribunals’ Go Silent

- Fund Manager: The Fed’s Frankenstein

| The Year In Review: Anything & Everything That Mattered In 2018 Posted: 29 Dec 2018 11:00 AM PST This market drop was the big one? Nope. ‘Twas just a vibrating puddle in Jurassic Park, so strap in, grab some eggnog, and tune-in to the 2018 review…David Collum interviewed […] The post The Year In Review: Anything & Everything That Mattered In 2018 appeared first on Silver Doctors. |

| Technical Musings About The Euro And Dollar Anchored By Macro Posted: 29 Dec 2018 10:52 AM PST |

| Newell Brands: Never Hold Out For Top Dollar In A Bear Market Posted: 29 Dec 2018 09:51 AM PST |

| How Many Of Your Local Taxes And Fees Are Rocketing Higher? Posted: 29 Dec 2018 08:00 AM PST While wages have supposedly gone up 3.4% in 2018, taxes and fees are rising at much higher rates… by Charles Hugh Smith via Of Two Minds While wages have supposedly […] The post How Many Of Your Local Taxes And Fees Are Rocketing Higher? appeared first on Silver Doctors. |

| Steven Mnuchin… WTF?! | Quoth the Raven, Chris Irons Posted: 29 Dec 2018 05:21 AM PST First-time guest Chris Irons joins James Anderson for the show this week to discuss the markets, Mnuchin, and a whole lot more… Editor’s Note: This post will be updated at […] The post Steven Mnuchin… WTF?! | Quoth the Raven, Chris Irons appeared first on Silver Doctors. |

| Germany’s Chancellor Says Nation States Must ‘Give Up Sovereignty’ To New World Order Posted: 28 Dec 2018 08:00 PM PST Merkel is clearly attempting to push the globalist agenda to its disturbing end game BEFORE she steps down in 2021. Here’s more… by Tapainfo via Zero Hedge "Nation states must […] The post Germany’s Chancellor Says Nation States Must ‘Give Up Sovereignty’ To New World Order appeared first on Silver Doctors. |

| Gold’s Leading Indicators Looking Better Posted: 28 Dec 2018 06:35 PM PST

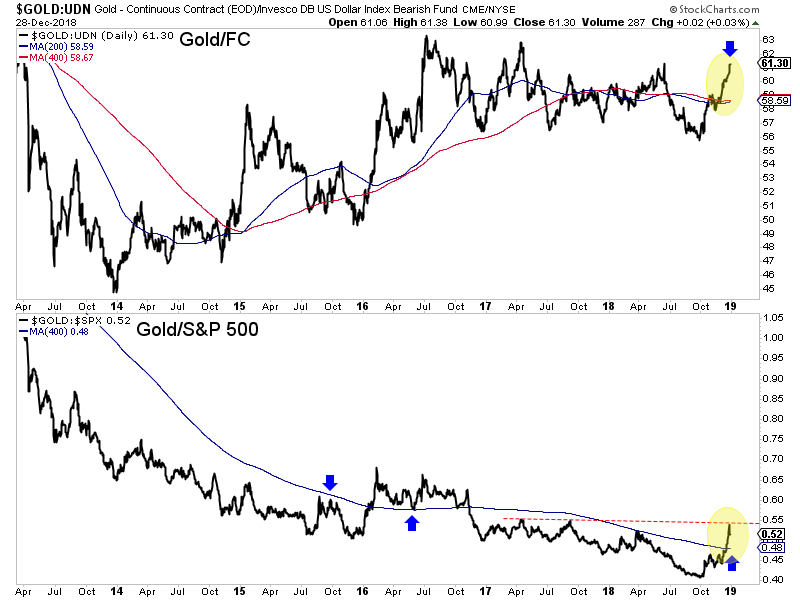

Although yours truly has yet to completely jump on the bull bandwagon (which has revved up recently), I cannot ignore the positive fundamental and technical developments for precious metals. On the fundamental side, the market is essentially pricing in no hikes for 2019 and the start of rate cuts in 2020. For Gold, that is a huge improvement from just a few months ago. In regards to the technicals, there are positives and negatives. (But there were no real positives several months ago). Let me start with the positives. Before Gold begins a bull market, it usually strengthens against foreign currencies and the stock market. Check the charts from 1999-2001 and 2008-2009. At present, Gold against foreign currencies (FC) closed within a cent of a 20-month high. It is at a 20-month high in weekly and monthly terms. Meanwhile, Gold against the S&P 500 has surged above key resistance for the first time since 2016.

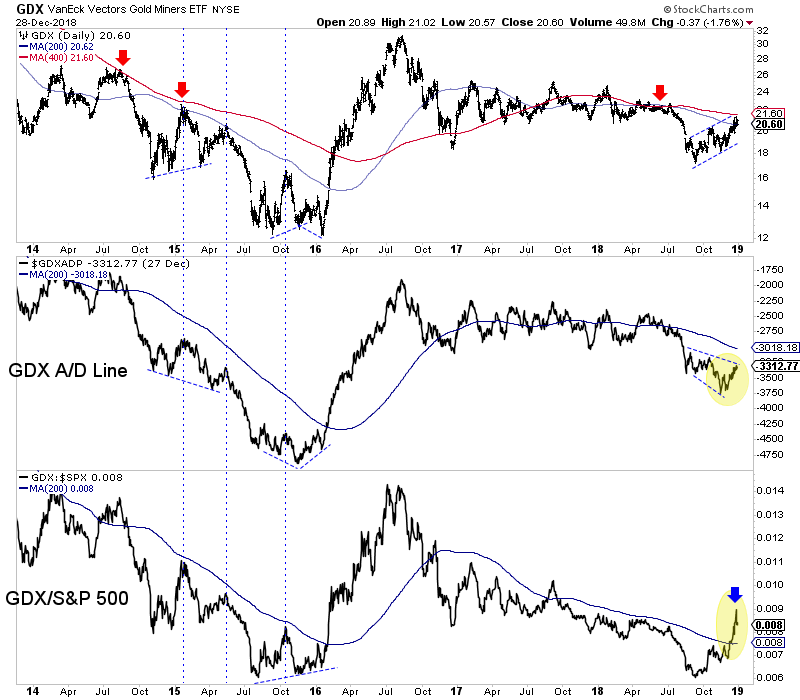

If Gold/FC can test and surpass its 2016 high and Gold/S&P 500 can surpass its 2017 peaks, then we'll definitely be in bull market mode. Turning to the gold stocks, we see a definite positive but also a negative. Note how unlike in 2015, GDX relative to the stock market has broken out above its 200-day moving average. However, the advance decline continues to show a negative divergence. In 2015 GDX rallied up to its 200-day moving average three times but each time a negative divergence with the advance decline line was in place. That line began to strengthen in November 2016 and the sector exploded two months later.

As 2019 beckons, Gold is trading within an area of strong resistance ($1260-$1300) and gold stocks (GDX, GDXJ) are battling moving average resistance while the oversold stock market is ripe for a positive first quarter. Two things that could confirm a bull market in precious metals is fast approaching would be strong improvement in GDX' advance decline line and the market pricing in no chance of a rate hike in 2019 and instead anticipating the potential for a rate cut in 2019. In addition, even if the stock market performs well in the first quarter, it would be a bullish sign if Gold and gold stocks can hold above moving average support on those ratio charts. That would indicate the recent shift from stocks to Gold has traction and is not a flash in the pan. It would not be wise to chase strength until there is more evidence that a bull market has started. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. Note that many juniors began huge moves months after the January 2016 and October 2008 lows. To prepare yourself for some epic buying opportunities in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| TraderStef: Silver’s Hi-Ho Day Needs A Few More Dollars – Technical Analysis Posted: 28 Dec 2018 05:00 PM PST She hasn’t analyzed silver for a while as the charts have been lifeless. But silver is now making progress, so let’s dive into the charts with TraderStef… by TraderStef via […] The post TraderStef: Silver’s Hi-Ho Day Needs A Few More Dollars – Technical Analysis appeared first on Silver Doctors. |

| Posted: 28 Dec 2018 04:20 PM PST Goldmoney on “The arrival of the credit crisis” … MarketWatch: Why stock-market investors fear a 'wicked bear trap' … Zero Hedge: Credit spreads blow out amid accelerating liquidations … Gerald Celente: worldwide riots, recessions – 2019 will be nuts … Gold and silver at multi-month highs, as “market turmoil shows why you should own gold” […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Posted: 28 Dec 2018 03:00 PM PST SD Friday Wrap: We’re quietly climbing as silver catches a whiff that ‘mass arrests’, ‘military tribunals’, and ‘locking her up’ just aren’t going to happen… Q-Anon has gone silent since […] The post Silver Quietly Climbs Higher As Cries Of ‘Mass Arrests’, ‘Sealed Indictments’ & ‘Military Tribunals’ Go Silent appeared first on Silver Doctors. |

| Fund Manager: The Fed’s Frankenstein Posted: 28 Dec 2018 12:00 PM PST The Fed has created its own Frankenstein in the stock market, and Dave Kranzler explains why this story won’t end will for the Fed’s hideous creation… by Dave Kranzler of […] The post Fund Manager: The Fed’s Frankenstein appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment