saveyourassetsfirst3 |

- Bill Fleckenstein: Gold To Catch A Bid Soon

- Stock Market Nearing Low as Gold Tests Resistance

- Is The Fed Actually TRYING To Cause A Stock Market Crash?

- Here's Where Things Get Interesting For Gold

- “Everything Is Going Down.” Why You Need To Own Gold Bullion Right Now

- Elliott Wave Technical Analyst: $1266 Gold Is Just A Short Rest Stop Before $1300

- Harvard Trained Economist: It’s More Of A Stock Market Correction Than A Stock Market Crash

- Michael Ballanger: I Continue To Look For Upside Resolution Of The Current Battle For Gold

- Time Is Running Out: Govt Shutdown Will Last “A Very Long Time” If Dems Vote ‘No’ On The Wall

- Trump Is At War Against The International Banking Cartel – We Must Win If Humanity Is To Survive

- Will Gold Rally In January After The Fed Rate Hike?

- Paul Craig Roberts: Trump To Withdrawal US Military From Syria?

- Breaking News/Best Of The Web

- Thursday Conversation - Grant Williams

- Markets Reject the Fed?

- Forget the Noise, Follow the Dollar

- Why Gold Should Be Accumulated At These Levels

- Silver Price Points To A Depressed Economy And A Silver Boom

| Bill Fleckenstein: Gold To Catch A Bid Soon Posted: 21 Dec 2018 01:30 PM PST Money manager and legendary short seller Bill Fleckenstein discusses why he thinks gold is soon to catch a bid… Bill Fleckenstein interviewed on Quoth the Raven Fleck joins me to […] The post Bill Fleckenstein: Gold To Catch A Bid Soon appeared first on Silver Doctors. |

| Stock Market Nearing Low as Gold Tests Resistance Posted: 21 Dec 2018 12:45 PM PST

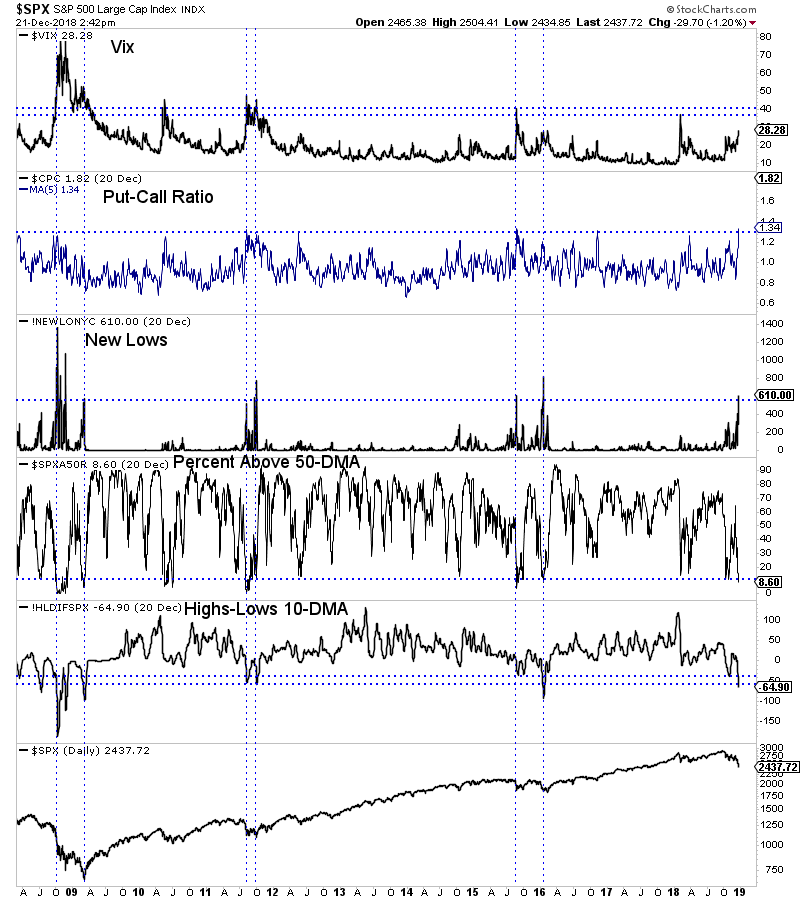

As we've been saying, the stock market will have great influence on Gold. It has been easy to see in recent months. The S&P 500 has cracked, losing both its 200-day and 400-day moving averages. Gold and gold stocks have benefitted and gained in recent months even with a stable to rising US Dollar. The past 65 years of history shows us that in almost any context (but not all) the time between the Fed's last rate hike and first rate cut is exactly when you want to buy gold stocks. We don't know if December is the last rate hike. No one does. What we do know is the stock market is approaching an extreme oversold condition and is likely to begin a counter trend rally very soon. In the chart below we plot five indicators that can help define an extreme oversold condition. These include the Vix, the put-call ratio and several breadth indicators. All but the Vix are in extreme oversold territory.

As we pen this article, the S&P 500 is trading at 2436. The 40-month moving average, which has provided key support and resistance over the past 20 years (including the 2016 and 2011 lows) is at 2395 while the 50% retracement of the 2016 to 2018 advance is at 2380. The setup for a bullish reversal is in place. Meanwhile, despite the recent carnage in stocks, precious metals have been unable to surpass resistance. Gold is set to close the week right below a confluence of resistance at $1260-$1270. Perhaps it will close right on its 200-day moving average at $1258. The gold stocks (GDX, GDXJ) have been strong since Thanksgiving but appear to have been turned back at their 200-day moving averages.

So in recent days the selloff in the S&P 500 accelerated but precious metals (at least to this point) failed to capitalize in a bullish fashion. If the S&P 500 is within one or two days of a rally then we should not expect much more upside in Gold and GDX in particular. Those were the markets that benefited most from weakness in the S&P 500. As we noted last week, the weakness in the stock market (and the economy) has not done enough to change Fed policy yet. Over the past 65 years, the start of bull markets and big rallies in gold stocks coincided with the start of rate cuts. When the market sniffs the first rate cut, we will know precious metals are beginning a sustained advance and not another false start. Until Gold proves its in a bull market (and the market begins pricing in a rate cut) it would not be wise to chase strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| Is The Fed Actually TRYING To Cause A Stock Market Crash? Posted: 21 Dec 2018 12:00 PM PST “…it was a unanimous vote to raise rates. They clearly have an agenda, and that agenda is definitely not about helping the American people…” by Michael Snyder of The Economic […] The post Is The Fed Actually TRYING To Cause A Stock Market Crash? appeared first on Silver Doctors. |

| Here's Where Things Get Interesting For Gold Posted: 21 Dec 2018 11:48 AM PST |

| “Everything Is Going Down.” Why You Need To Own Gold Bullion Right Now Posted: 21 Dec 2018 10:30 AM PST Eric Sprott breaks down all the gold & silver news you need heading into 2019, including signs that THE BIG RUN for gold has already started… Eric Sprott interviewed by Craig […] The post “Everything Is Going Down.” Why You Need To Own Gold Bullion Right Now appeared first on Silver Doctors. |

| Elliott Wave Technical Analyst: $1266 Gold Is Just A Short Rest Stop Before $1300 Posted: 21 Dec 2018 09:30 AM PST We traded above the technical price of $1,256.30, and we hit $1,266. Here’s what this technician says comes next for gold, including gold’s next pullback… by Captain Ewave of CaptainEwave […] The post Elliott Wave Technical Analyst: $1266 Gold Is Just A Short Rest Stop Before $1300 appeared first on Silver Doctors. |

| Harvard Trained Economist: It’s More Of A Stock Market Correction Than A Stock Market Crash Posted: 21 Dec 2018 09:05 AM PST Harry Dent has dived deep into the charts to compare the current stock market turmoil to the crashes from 1929 and 2000. Here is what Harry has found… by Harry […] The post Harvard Trained Economist: It’s More Of A Stock Market Correction Than A Stock Market Crash appeared first on Silver Doctors. |

| Michael Ballanger: I Continue To Look For Upside Resolution Of The Current Battle For Gold Posted: 21 Dec 2018 07:30 AM PST Michael is looking for gold & silver to make a move to the upside. Here are the specific price levels he’s watching, and why he’s watching them… by Michael Ballanger […] The post Michael Ballanger: I Continue To Look For Upside Resolution Of The Current Battle For Gold appeared first on Silver Doctors. |

| Time Is Running Out: Govt Shutdown Will Last “A Very Long Time” If Dems Vote ‘No’ On The Wall Posted: 21 Dec 2018 05:59 AM PST The House passed a spending bill with funding for the Wall. The ball is in the Senate’s court now, and the clock is ticking down. Here’s an update… from Zero […] The post Time Is Running Out: Govt Shutdown Will Last “A Very Long Time” If Dems Vote ‘No’ On The Wall appeared first on Silver Doctors. |

| Trump Is At War Against The International Banking Cartel – We Must Win If Humanity Is To Survive Posted: 21 Dec 2018 04:00 AM PST In one of the most powerful, informative interviews Sean at SGTreport has ever done, come on in and get up to speed on the fight against pure evil… Wayne Jett […] The post Trump Is At War Against The International Banking Cartel – We Must Win If Humanity Is To Survive appeared first on Silver Doctors. |

| Will Gold Rally In January After The Fed Rate Hike? Posted: 20 Dec 2018 08:00 PM PST It is December as usual, and another Fed interest rate hike is behind us. Will we now see a rally in gold in January? Here’s some insight… by Arkadiusz Sieron […] The post Will Gold Rally In January After The Fed Rate Hike? appeared first on Silver Doctors. |

| Paul Craig Roberts: Trump To Withdrawal US Military From Syria? Posted: 20 Dec 2018 06:00 PM PST Paul says Trump has been reduced to this kind of two-bit puppet, and it is unlikely Trump will be permitted to withdrawal from Syria. Here’s why… by Paul Craig Roberts […] The post Paul Craig Roberts: Trump To Withdrawal US Military From Syria? appeared first on Silver Doctors. |

| Posted: 20 Dec 2018 04:20 PM PST New York Times: Investors are in retreat, and the poorest countries are paying for it … A “major technical breakdown” just occurred in stocks … Trump may veto interim spending bill, raising odds of government shutdown … Peter Schiff: bitcoin and all other alt-coins will ‘go to zero’ … Gold and silver up, Cramer says […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Thursday Conversation - Grant Williams Posted: 20 Dec 2018 01:19 PM PST With TF With all sorts of uncertainty ahead in 2019, what a great time to check in with Grant Williams, sound money advocate and co-founder of Real Vision. Grant and I recorded this on Wednesday, just after the release of the FOMC Fedlines. And what a great time to visit! Over the course of this call, we discuss three main topics: The immediate reaction to the Fedlines and what we might expect in 2019. The likelihood of an eventual re-imposition of a gold standard monetary system. And in the end, what do you do with all of your physical gold and silver?As mentioned in this... |

| Posted: 20 Dec 2018 12:00 AM PST |

| Forget the Noise, Follow the Dollar Posted: 20 Dec 2018 12:00 AM PST |

| Why Gold Should Be Accumulated At These Levels Posted: 16 Aug 2018 07:50 AM PDT Here are a few reasons why gold should be accumulated at these levels: 1. Rising Interest Rates Although gold rose significantly from 2001 to 2011, it was not really the ideal conditions. There were many reasons for conditions not being ideal, such as: rising stock markets and major commodities like oil (more markets rising means… |

| Silver Price Points To A Depressed Economy And A Silver Boom Posted: 14 Aug 2018 05:32 AM PDT Let's take a look at silver priced in oil (WTI Crude), the Dow and US dollars: |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment