saveyourassetsfirst3 |

- Perseus Mining: On Track To Produce 500,000 Ounces Of Gold In 2022

- CFOs Predict A Recession In 2019 And A Market Crash In 2020

- Growing US Debts & Liabilities Lead to a Bad State of Affairs | Professor Steve Hanke

- Breaking News/Best Of The Web

- Gold & Silver Looking Good In 2019? Matt from Silver Fortune Finds Out In His Latest Interview

- Dave Janda: Famed NSA Whistleblowers Let Loose On The Importance Of The Declassification

- Jim Rickards: A New Cold War With China Is Possible

- Greg Hunter: It All Comes Back To The Clinton Foundation And The Treasonous Bribes

- Gold & Silver Give Up Some Ground To Dig In, Harden Defenses, & Prepare For Next Week’s Battle

- This Market Will Drive Gold in 2019…

| Perseus Mining: On Track To Produce 500,000 Ounces Of Gold In 2022 Posted: 15 Dec 2018 08:10 AM PST |

| CFOs Predict A Recession In 2019 And A Market Crash In 2020 Posted: 15 Dec 2018 08:00 AM PST The outlook for the economy and the markets among the vast majority of CFOs is getting increasingly pessimistic. Here are the details… by Mac Slavo of SHTFplan A vast majority […] The post CFOs Predict A Recession In 2019 And A Market Crash In 2020 appeared first on Silver Doctors. |

| Growing US Debts & Liabilities Lead to a Bad State of Affairs | Professor Steve Hanke Posted: 15 Dec 2018 05:00 AM PST We welcome Professor Steve Hanke to the show. Hanke has first hand experience both in intervening and quelling currency crisis throughout his career… Professor Steve Hanke (@steve_hanke) interviewed by James […] The post Growing US Debts & Liabilities Lead to a Bad State of Affairs | Professor Steve Hanke appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Posted: 15 Dec 2018 04:20 AM PST Zero Hedge: Bank bulls battered as financials enter bear market … Moolman: We’re “closer to a significant monetary event” … Mises: Did baby boomers ruin America? … ECB ends asset purchases, warns of slowing economy … Gold and silver down on rising dollar, but “back as a hedge against inflation” … Best Of The Web […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Gold & Silver Looking Good In 2019? Matt from Silver Fortune Finds Out In His Latest Interview Posted: 14 Dec 2018 08:00 PM PST Gold & silver are looking good in 2019. Matt from Silver Fortune interviews Peter Hug for the details…Peter Hug interviewed by Matt from Silver Fortune on Silver Fortune Interview with […] The post Gold & Silver Looking Good In 2019? Matt from Silver Fortune Finds Out In His Latest Interview appeared first on Silver Doctors. |

| Dave Janda: Famed NSA Whistleblowers Let Loose On The Importance Of The Declassification Posted: 14 Dec 2018 07:00 PM PST Dave has some EPIC insight about the declassification. Where do we stand months after Trump said release it, and unredacted? Here’s Dave & his sources… by Dave Janda of Operation […] The post Dave Janda: Famed NSA Whistleblowers Let Loose On The Importance Of The Declassification appeared first on Silver Doctors. |

| Jim Rickards: A New Cold War With China Is Possible Posted: 14 Dec 2018 06:00 PM PST Sure, there is a 90-day ‘truce’, but after recent developments, Jim explains how we could be entering a new cold war. Here are the details… by Jim Rickards of Daily […] The post Jim Rickards: A New Cold War With China Is Possible appeared first on Silver Doctors. |

| Greg Hunter: It All Comes Back To The Clinton Foundation And The Treasonous Bribes Posted: 14 Dec 2018 04:30 PM PST Greg says details uncovered in yesterday’s ‘whistleblower’ testimony are huge, exposing the corrupt Clinton Foundation and its evil, treasonous deeds… Greg Hunter gives the Weekly News Wrap-Up for Friday, December […] The post Greg Hunter: It All Comes Back To The Clinton Foundation And The Treasonous Bribes appeared first on Silver Doctors. |

| Gold & Silver Give Up Some Ground To Dig In, Harden Defenses, & Prepare For Next Week’s Battle Posted: 14 Dec 2018 03:00 PM PST SD Friday Wrap: Enjoy the weekend, and be merry! For next week gold & silver go to battle with the cartel… Too bad I don’t watch movies anymore. It is […] The post Gold & Silver Give Up Some Ground To Dig In, Harden Defenses, & Prepare For Next Week’s Battle appeared first on Silver Doctors. |

| This Market Will Drive Gold in 2019… Posted: 14 Dec 2018 02:06 PM PST

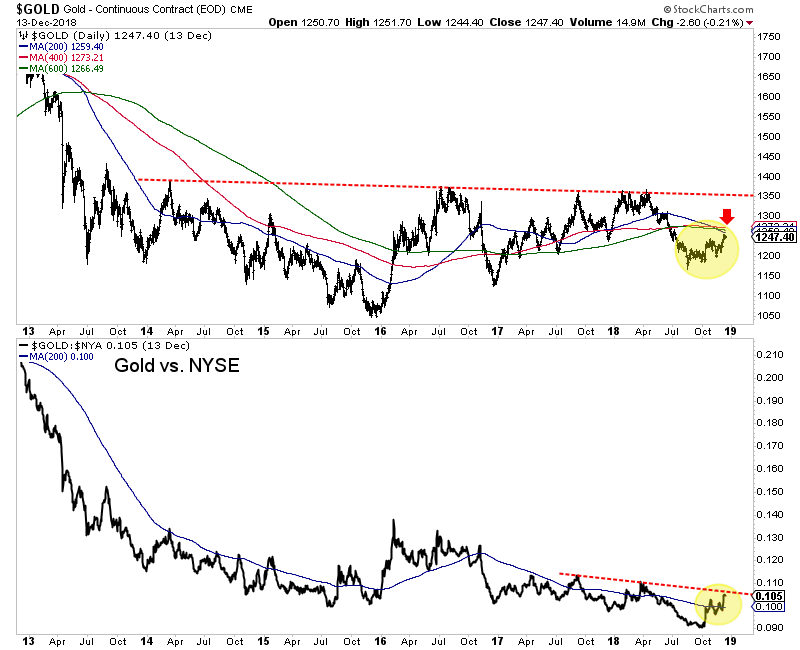

If we want to know where Gold is going we should follow Gold. Right? How about following gold stocks? At times, they lead Gold. What about the US Dollar? Wrong! In 2019, one market more than any other will impact Gold. That is the stock market. History argues (within the current context) that when the Federal Reserve ends its rate hikes, Gold's downtrend will be over and when the Fed cuts rates, the bull market shall begin. Fed policy is dictated by economic data and financial conditions which of course can be reflected by the stock market, which is also a reflection of corporate profits. Extended weakness in the stock market should bring the Fed that much closer to rate cuts. However, if the stock market is able to mount a decent counter trend rally in 2019, it could raise the possibility of another hike. Right now, the market expects no hikes in 2019 and even half of a quarter point cut in 2020. Other than the cyclical bull market of 1985 through 1987, Gold has never enjoyed a real bull market without outperforming the stock market. Below we plot Gold and Gold against the broad stock market (NYSE). Gold is still trading below a confluence of resistance ($1260-$1270) and the Gold to stock market ratio, while trading above its 200-day moving average has not broken out of its downtrend yet.

As we pen this, the stock market is breaking lower but Gold is also down and remains below a confluence of resistance at $1260-$1270/oz. Is our thesis wrong? The current weakness in equities has not completely changed Fed policy yet. Sure, the weakness in the equity market definitely could cause the Fed to pause its rate hikes and the market has already discounted that for 2019. However, for the bull market in Gold to be ignited the Fed needs to move from a pause to the start of rate cuts. The current talk is about a pause, not rate cuts. Hence, Gold is catching a bid and starting to perform better in real terms but has not reached bull market status yet. Until Gold proves its in a bull market (and the market begins pricing in a rate cut) it would not be wise to chase strength. There will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment