saveyourassetsfirst3 |

- “Political Chaos Is Rising Quickly” – Eric Sprott On The Mid-Term Elections

- 5 Things That Precede Major Bottoms in Gold

- Scorched Earth: Malibu Evacuated As ‘Apocalyptic’ Fire Rages – 75,000 Told To Flee Ventura County

- No Bed Of Roses

- Beware November 11th…Will Sunday Be The Start Of The Purge Of The Patriots?

- Victory? Reserve Bank Of Australia Forced To Address Gold Scandal

- ‘Trump Prophecies’ Mark Taylor To Greg Hunter: Tons Of Job Openings In DC After MASS ARRESTS

- Wall Street Seems To Think That Endless Gridlock And Political Turmoil Will Be Good For America

- Fund Manager: The Housing Market Collapse Happens Gradually Then Suddenly

- Dave Janda: Trump & Pelosi Are The Big Winners In The Mid-Term Elections

- Peter Schiff: The Truth Is We Don’t Have A Booming Economy

- Breaking News/Best Of The Web

- Bix Weir: Trump Will Confiscate JP Morgan’s Silver And Store It In West Point For The US Treasury

| “Political Chaos Is Rising Quickly” – Eric Sprott On The Mid-Term Elections Posted: 09 Nov 2018 11:00 AM PST "You don't want anyone to think anything's bad, you know? You don't want them to think gridlock's bad. So you run the market up…” Eric Sprott interviewed by Craig Hemke […] The post “Political Chaos Is Rising Quickly” – Eric Sprott On The Mid-Term Elections appeared first on Silver Doctors. |

| 5 Things That Precede Major Bottoms in Gold Posted: 09 Nov 2018 10:35 AM PST

The recent weakness in Gold and gold mining stocks is not over. In fact, we are worried about another leg down getting underway. If that comes to pass, we are positioned to profit from it. But I digress. Long-term oriented investors and speculators should be aware of the near term trends but they should also be aware of the conditions that will lead to a shift from a bear market to a bull market. Here, we focus on five factors that precede major bottoms in precious metals.

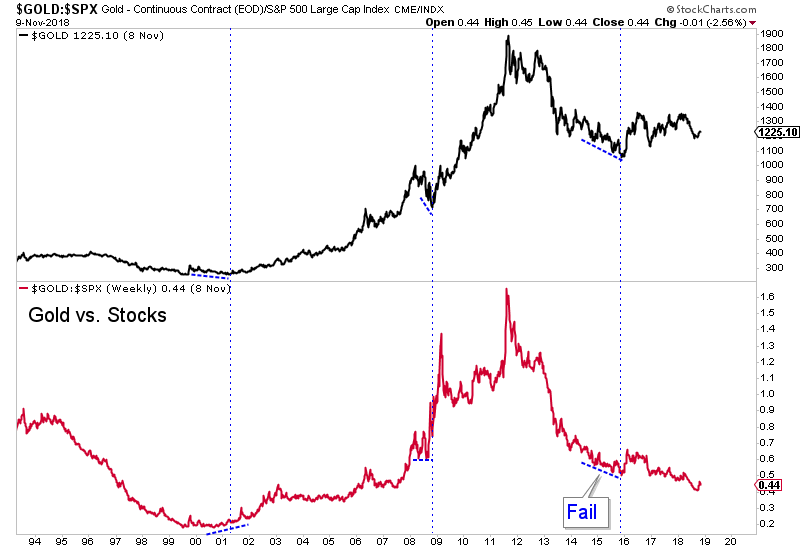

Gold Outperforms the Stock Market Other than in 1985 through 1987 there has never been a real bull market in Gold without it outperforming the stock market. A weak stock market usually coincides with conditions that are favorable for precious metals. That's either high inflation or economic weakness that induces policy that is usually bullish for precious metals. The 2016-2017 period failed to be a bull market because the equity market continued to outperform Gold. Note that the Gold to Stocks ratio bottomed prior to the 2001 and 2008 bottoms.

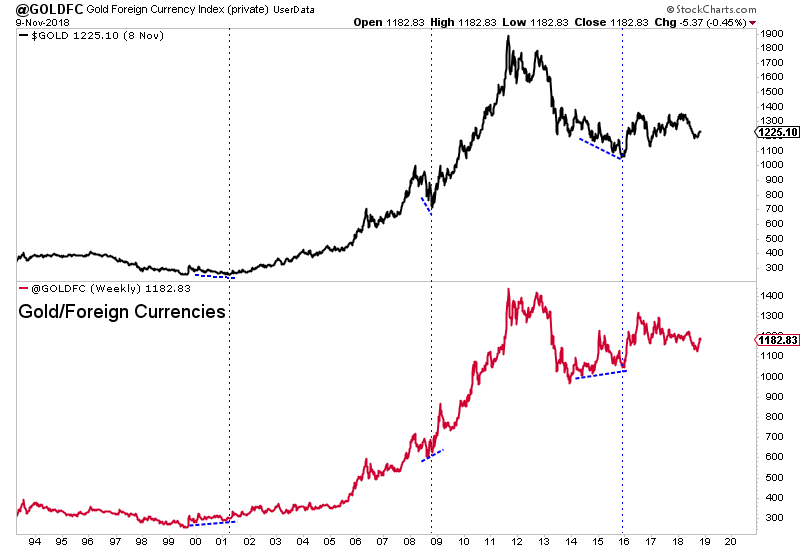

Gold Outperforms Foreign Currencies Gold outperforming foreign currencies is important because this usually happens while the US Dollar remains in an uptrend. It signals relative strength in Gold and shows that Gold is not being held hostage by the strong dollar. It also can signal a coming peak in the dollar. Gold was outperforming foreign currencies prior to the 2001, 2008 and late 2015 bottoms. There are currently no positive divergences in place.

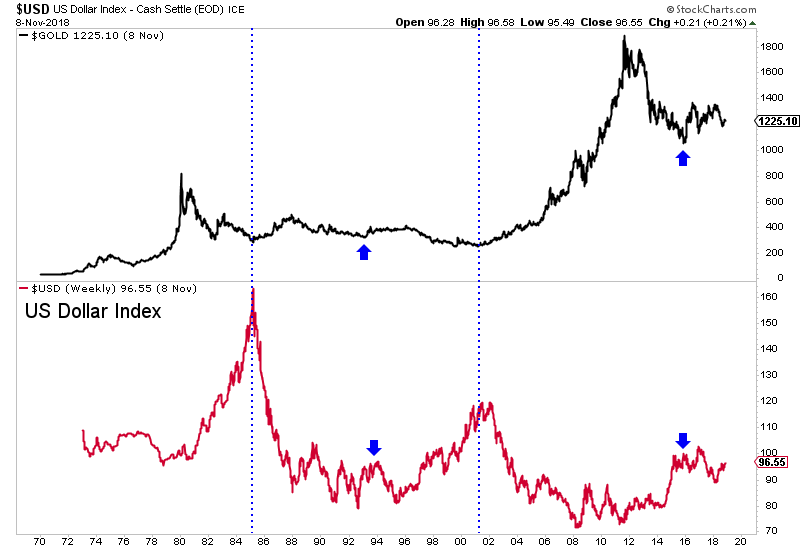

Major Peak in the US Dollar This does not precede bottoms in Gold as it typically is a lagging indicator. But a list of "4" things does not carry the same weight as five. Anyway, Gold is not going to embark on a major, long-lasting bull market without a corresponding peak in the US Dollar. Sure, they can rise at the same time and for months on end. However, it's difficult to imagine a multi-year bull market in Gold without a corresponding peak in the dollar. Peaks in 1993 and 2016 led to brief runs in Gold but those were nothing like the 1985 and 2001 peaks.

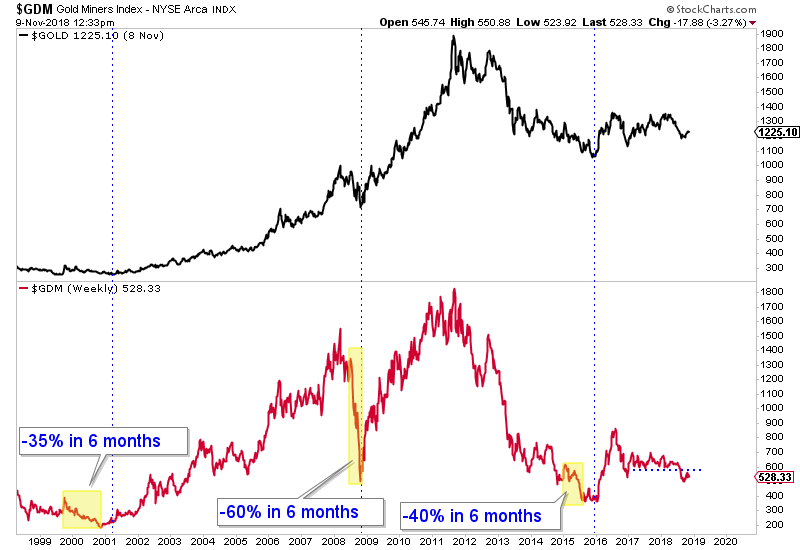

Gold Mining Stocks Crash This is not a mandatory component of major bottoms but definitely is something that can occur before a major bottom. Below we plot GDM, which is the forerunner to GDX. Note that gold stocks essentially crashed into their late 2000 and late 2008 lows. They also crashed into their summer 2015 low which wasn't the final low for the sector but was for the senior miners. The main point is that if gold mining stocks fall apart again it could very well be a sign that a bottom is almost imminent.

Fed Policy Change Over the past 60 years, gold stocks have often bottomed almost immediately after the peak in the Fed Funds rate (FFR). In 10 of 12 rate cut cycles, gold stocks bottomed a median of one month and an average of two months after the peak in the FFR. The average gain of gold stocks following that low was 185%. There are also points where the gold stocks declined during a period of rate cuts or no Fed activity. Bottoms then were sometimes followed by the start of Fed hikes. However, given the current conditions, we are quite confident that gold stocks will bottom immediately after the Fed's final rate hike.

Now you know what to look for to signal that a major bottom is imminent. Better yet, consider our premium service which can help you ride out the downside and profit ahead of a major bottom in the sector. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premiums service. |

| Scorched Earth: Malibu Evacuated As ‘Apocalyptic’ Fire Rages – 75,000 Told To Flee Ventura County Posted: 09 Nov 2018 09:02 AM PST The upscale California town of Malibu has been ordered to evacuate after a raging wildfire jumped the 101 freeway. Here’s the latest… from Zero Hedge The upscale California town of Malibu has been ordered […] The post Scorched Earth: Malibu Evacuated As ‘Apocalyptic’ Fire Rages – 75,000 Told To Flee Ventura County appeared first on Silver Doctors. |

| Posted: 09 Nov 2018 07:51 AM PST By TF But we ARE the champions. And we WILL keep on fighting 'til the end. And though that end seems so far off this morning, this is nothing more than another patience-trying exhibition of bullion bank price manipulation. Once price was only allowed to rise $50 on the Managed Money short squeeze of three weeks ago...and once price was capped at $1240...it became possible/likely that The Banks would soon move to rig prices back below the 50-day MA in an attempt to draw those same Managed Money spec back into the short side. Last week's spike of $20 gave us hope that perhaps... |

| Beware November 11th…Will Sunday Be The Start Of The Purge Of The Patriots? Posted: 09 Nov 2018 07:49 AM PST John says the ‘sealed indictments’ are against the Patriots. Will the ‘Reign of Terror’ in the US begin on November 11th? Here’s Wenkman’s final warning… Editor's Note: Quick links to […] The post Beware November 11th…Will Sunday Be The Start Of The Purge Of The Patriots? appeared first on Silver Doctors. |

| Victory? Reserve Bank Of Australia Forced To Address Gold Scandal Posted: 09 Nov 2018 06:00 AM PST Amazing developments on the gold front in Australia! The RBA has responded to pressure regarding its gold holdings. Here are the details… by John Adams from Adams Economics Amazing developments on the gold […] The post Victory? Reserve Bank Of Australia Forced To Address Gold Scandal appeared first on Silver Doctors. |

| ‘Trump Prophecies’ Mark Taylor To Greg Hunter: Tons Of Job Openings In DC After MASS ARRESTS Posted: 09 Nov 2018 05:58 AM PST Greg and Mark have a critical update on the Red Wave that was the mid-term elections, and the coming Red Tsunami of mass arrests and military tribunals… Mark Taylor interviewed […] The post ‘Trump Prophecies’ Mark Taylor To Greg Hunter: Tons Of Job Openings In DC After MASS ARRESTS appeared first on Silver Doctors. |

| Wall Street Seems To Think That Endless Gridlock And Political Turmoil Will Be Good For America Posted: 09 Nov 2018 04:30 AM PST This will be nothing like the "gridlock" that we witnessed during the Reagan, Clinton or Obama administrations. Here’s why it matters… by Michael Snyder of The Economic Collapse Blog It […] The post Wall Street Seems To Think That Endless Gridlock And Political Turmoil Will Be Good For America appeared first on Silver Doctors. |

| Fund Manager: The Housing Market Collapse Happens Gradually Then Suddenly Posted: 09 Nov 2018 03:00 AM PST A stock that’s basically a “derivative” of the housing market is suddenly plunging. Dave Kranzler breaks-down what it means for the housing market… by Dave Kranzler of Investment Research Dynamics […] The post Fund Manager: The Housing Market Collapse Happens Gradually Then Suddenly appeared first on Silver Doctors. |

| Dave Janda: Trump & Pelosi Are The Big Winners In The Mid-Term Elections Posted: 08 Nov 2018 08:30 PM PST Dave discusses the election winners & losers, the implications of the election, the Sessions resignation, and a whole lot more in this important update… by Dave Janda from Operation Freedom […] The post Dave Janda: Trump & Pelosi Are The Big Winners In The Mid-Term Elections appeared first on Silver Doctors. |

| Peter Schiff: The Truth Is We Don’t Have A Booming Economy Posted: 08 Nov 2018 07:30 PM PST Peter doesn't mince words when he declared the precarious state the United States economy has found itself in. Here is what he said and why it matters… by Mac Slavo of […] The post Peter Schiff: The Truth Is We Don’t Have A Booming Economy appeared first on Silver Doctors. |

| Posted: 08 Nov 2018 06:20 PM PST Forbes: A worldwide debt default is a real possibility … Mike Maloney: “One hell of a crisis coming” … Fed leaves rates unchanged, points to increase in December … “The economy does not care who won the midterm elections” … CNN: “Donald Trump just seized control of the Russia probe” … Gold and silver flat, […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Bix Weir: Trump Will Confiscate JP Morgan’s Silver And Store It In West Point For The US Treasury Posted: 08 Nov 2018 06:00 PM PST Bix says we’re easing in to freely traded markets, and silver will very soon move to a 1 to 1 ratio with gold. Here’s more… by Bix Weir from Road […] The post Bix Weir: Trump Will Confiscate JP Morgan’s Silver And Store It In West Point For The US Treasury appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment