saveyourassetsfirst3 |

- “It Was Anarchy” As Mag 7 Earthquake Rocks Anchorage, Alaska – Tsunami Warning Issued

- Why Right Now Is The Best Time To Add Gold And Silver Bullion To Your Portfolio | Eric Sprott

- Now Even Paul Krugman Of The NYT Admits The Next Crisis Will Likely Be Worse Than 2008

- It's The Perfect Moment To Have Gold As A Hedge For Your Portfolio

- Lynette Zang: We’re Entering The Minefield – Is Your Armor Ready?

- There Is No Case Against Julian Assange So Lies Take The Place Of Evidence

- Captain Ewave NAILED HIS CALL And Now Gold Is Working On Its First Impulsive Sequence

- Day 2: Deutsche Bank Compliance Chief, 5 Board Member Offices Raided – Stock Hits All Time Low

- The Price For Insurance Is About To Jump Higher

- President Trump Cancels G-20 Meeting With President Putin

- Gold Fundamentals Improving but Not Bullish Yet

- Breaking News/Best Of The Web

- US Spends $1.5 Billion Every Day Just To Make The Interest Payments On The National Debt

- Top Ten Videos — November 30

- TFMR Podcast - Thursday, November 29

- Gold-laden Russian cruiser discovered

| “It Was Anarchy” As Mag 7 Earthquake Rocks Anchorage, Alaska – Tsunami Warning Issued Posted: 30 Nov 2018 11:55 AM PST A magnitude 7.0 earthquake has struck Anchorage, Alaska. Here are the latest details… from Zero Hedge Update: White House Press Secretary Sarah Huckabee Sanders said President Trump has been briefed on […] The post “It Was Anarchy” As Mag 7 Earthquake Rocks Anchorage, Alaska – Tsunami Warning Issued appeared first on Silver Doctors. |

| Why Right Now Is The Best Time To Add Gold And Silver Bullion To Your Portfolio | Eric Sprott Posted: 30 Nov 2018 11:25 AM PST “Typically, the guys who run the COMEX…always end up that the price is at what we call 'Max Pain.'. Max Pain is where the…” Eric Sprott interviewed by Craig Hemke on […] The post Why Right Now Is The Best Time To Add Gold And Silver Bullion To Your Portfolio | Eric Sprott appeared first on Silver Doctors. |

| Now Even Paul Krugman Of The NYT Admits The Next Crisis Will Likely Be Worse Than 2008 Posted: 30 Nov 2018 10:30 AM PST There’s growing consensus the next economic crash will be significantly worse than the financial crisis of 2008. Mainstream even admits it. Here’s more… by Michael Snyder of The Economic Collapse […] The post Now Even Paul Krugman Of The NYT Admits The Next Crisis Will Likely Be Worse Than 2008 appeared first on Silver Doctors. |

| It's The Perfect Moment To Have Gold As A Hedge For Your Portfolio Posted: 30 Nov 2018 10:18 AM PST |

| Lynette Zang: We’re Entering The Minefield – Is Your Armor Ready? Posted: 30 Nov 2018 09:00 AM PST Have your golden armor ready, because as Lynette explains, big changes are coming with new interest rate benchmarks. Here are the details… by Lynette Zang of ITM Trading As the […] The post Lynette Zang: We’re Entering The Minefield – Is Your Armor Ready? appeared first on Silver Doctors. |

| There Is No Case Against Julian Assange So Lies Take The Place Of Evidence Posted: 30 Nov 2018 07:30 AM PST Assange has done more to bring the crimes of governments to light than the MSM ever will, but he’s about to be extradited and charged for espionage… by Paul Craig […] The post There Is No Case Against Julian Assange So Lies Take The Place Of Evidence appeared first on Silver Doctors. |

| Captain Ewave NAILED HIS CALL And Now Gold Is Working On Its First Impulsive Sequence Posted: 30 Nov 2018 06:00 AM PST What a day! Captain Ewave called it with his wave counts, and now it’s really happening as the Fed may have just blinked. Here’s an update… by Captain Ewave of […] The post Captain Ewave NAILED HIS CALL And Now Gold Is Working On Its First Impulsive Sequence appeared first on Silver Doctors. |

| Day 2: Deutsche Bank Compliance Chief, 5 Board Member Offices Raided – Stock Hits All Time Low Posted: 30 Nov 2018 05:47 AM PST Another day, another raid at its Frankfurt headquarters. Here are the details on the continuing problems facing Detusche Bank… From Zero Hedge Reeling from a Morgan Stanley downgrade of European […] The post Day 2: Deutsche Bank Compliance Chief, 5 Board Member Offices Raided – Stock Hits All Time Low appeared first on Silver Doctors. |

| The Price For Insurance Is About To Jump Higher Posted: 30 Nov 2018 04:00 AM PST This is the kind of inflation that the people sharply feel in their wallets, and the cost to insure property is about to soar. Here’s why… by John Rubino of […] The post The Price For Insurance Is About To Jump Higher appeared first on Silver Doctors. |

| President Trump Cancels G-20 Meeting With President Putin Posted: 29 Nov 2018 08:00 PM PST Maybe Mueller’s noise is rising, and President Trump has come under pressure, so he has cancelled his meeting with Putin? Here are the details… from Zero Hedge Just minutes after […] The post President Trump Cancels G-20 Meeting With President Putin appeared first on Silver Doctors. |

| Gold Fundamentals Improving but Not Bullish Yet Posted: 29 Nov 2018 07:08 PM PST

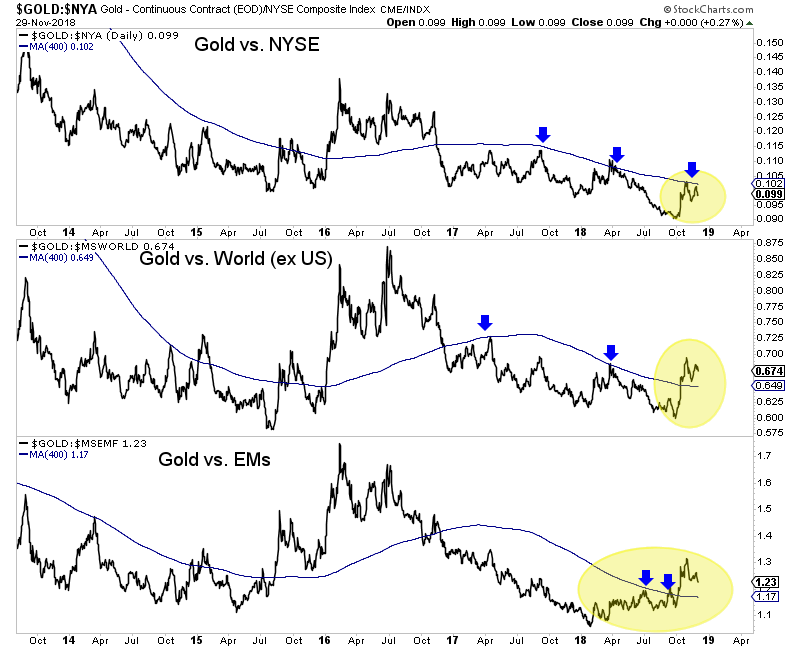

Recent market and economic developments are positive for Gold and precious metals but conditions are not bullish yet. Bullish conditions and bullish fundamentals would be highlighted by a shift in Fed policy. They aren't shifting yet. They are slowing, which precedes a shift. From a market standpoint, we need to see strength in Gold in real terms (against stocks and foreign currencies) and a steepening of the yield curve. These developments along with shifting Fed policy will tell us a new bull market is soon to begin. In regards to Gold against equities, the chart below shows both progress but the need for more strength. Gold remains below its long-term moving average against US Stocks (NYSE). The trend has not turned bullish yet. Gold relative to the rest of the world (US excluded) and Emerging Markets has turned the corner but now must prove it can hold above the long-term moving average.

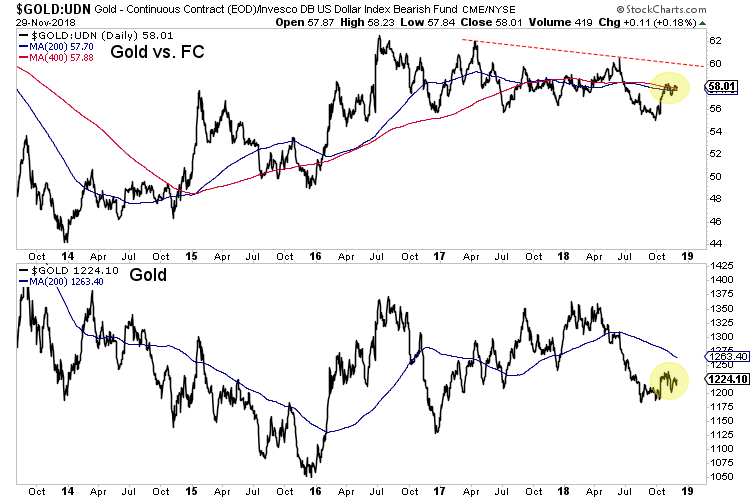

Gold relative to foreign currencies is at an interesting juncture as the chart below shows. Over the past month it has been battling with a confluence of resistance right at its 200 and 400 day moving averages.

From a market standpoint, the stock market is key as it will front-run Fed policy. It’s a reflection of the economy and health of corporations. A stronger stock market means tighter Fed policy. That could go out the window if and when the S&P 500 loses its recent lows at the 400-day moving average. But these lows could hold for several months.

The yield curve continues to flatten, which is not bullish for Gold. Steepening is. Although the Fed said something about rate hikes coming to an end and the market now expects only two more hikes, the conditions are not there for Gold. On the fundamental side, history argues that conditions turn most bullish after the last hike and when the market begins to discount a new rate cutting cycle. It appears we are still months away from the last hike. On the technical side, there is improvement in the leading indicators but nothing definite yet. Gold has not broken out of its downtrend relative to US stocks nor has it broken out against foreign currencies. These things should happen before a bull market begins. In the meantime, don't try to catch falling knives or chase weakness as there will be plenty of time to get into cheap juniors that can triple and quadruple once things really get going. Moreover, the start of the next bull looks to be more than a few months away. Consider our premium service which can help you ride out the remaining downside and profit ahead of a major bottom in the sector. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| Posted: 29 Nov 2018 06:20 PM PST Graham Summers: The Fed’s latest decision was VERY bad … ECB’s Draghi: QE will end in December “despite data” … New York Times” The “insect apocalypse” is here … Consumer spending up, industrial metals down … Gold and silver jump on Fed news. Get ready for “a replay of the 2009 precious metals bull market” […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| US Spends $1.5 Billion Every Day Just To Make The Interest Payments On The National Debt Posted: 29 Nov 2018 06:00 PM PST This is just the start, because to fund the fiscal stimulus that has already been enacted, US deficit spending is set to soar. Here are the details… from Zero Hedge […] The post US Spends $1.5 Billion Every Day Just To Make The Interest Payments On The National Debt appeared first on Silver Doctors. |

| Posted: 29 Nov 2018 04:15 PM PST Peter Schiff: "We'll have to finance this debt the old fashioned way, though inflation – just like any other banana republic" … Catherine Austin Fitts: "Always have enough gold to bribe the border guards" … Chris Hedges: "We're crucifying Julian Assange" … Jeff Berwick: “The biggest crash in human history is coming” … […] The post Top Ten Videos — November 30 appeared first on DollarCollapse.com. |

| TFMR Podcast - Thursday, November 29 Posted: 29 Nov 2018 02:33 PM PST With TF As we move into month end, let's take stock of where we stand at present and then look ahead. We begin with a general discussion of CGP/Fed, the yield plane, Comex gold open interest and the pending CoT report. We also ask you to note that there will likely be over 10,000 Dec18 gold "deliveries" even though there is only enough gold marked as registered to cover 1,286 contracts.... |

| Gold-laden Russian cruiser discovered Posted: 18 Jul 2018 08:17 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment