saveyourassetsfirst3 |

- Keith Weiner: The Ultimate Stablecoin

- White House Authorizes Use Of Lethal Force By US Military At The Border

- Bank of America Warns The Selling Will Continue – The “Big Low” For Stocks Is Yet To Come

- Shots Fired: MSM Attacks John Adams, Egon von Greyerz, & RBA’s Missing Gold ‘Conspiracy Theory’

- Former CIA Officer: Trump Has Successfully Defeated The Deep State…Currency Reset & Gold-Backed Dollar To Follow

- Gold & Silver Steady, But Serious Problems In The US Economy Require Another Bold-Faced Lie

- CGP Rides To The Rescue

- All FANG Stocks Now In Bear Market – Facebook Investor’s Alone Lost 39% In Paper Wealth

- Translating The Mindset Of Peak Oil To Peak Gold

- Mining Stock Daily – Western Gold & Copper Is Undervalued

- Breaking News/Best Of The Web

- Chris Vermeulen: Metals Moving In Unison For A Massive Price Advance

- TFMR Podcast - Tuesday, November 20

- How to Catch Bottoms in Gold Stocks

- New Assay Grades at Nevada Project Exceed Current Resource Grades

| Keith Weiner: The Ultimate Stablecoin Posted: 21 Nov 2018 12:00 PM PST Keith brings some cold hard truth as to what is money and what is not. Is money the irredeemable paper dollar? Bitcoin? Gold? Here’s Keith to explain… by Keith Weiner […] The post Keith Weiner: The Ultimate Stablecoin appeared first on Silver Doctors. |

| White House Authorizes Use Of Lethal Force By US Military At The Border Posted: 21 Nov 2018 10:57 AM PST Evidence and intelligence indicates the migrants may prompt incidents of violence and disorder. Here’s more on the updated military authorities… from Zero Hedge President Trump’s chief of staff John Kelly signed a […] The post White House Authorizes Use Of Lethal Force By US Military At The Border appeared first on Silver Doctors. |

| Bank of America Warns The Selling Will Continue – The “Big Low” For Stocks Is Yet To Come Posted: 21 Nov 2018 10:30 AM PST Analysts, experts & pundits have been saying it for some time, and now Bank of America is saying it: Stocks are headed lower. Here are the details… by Mac Slavo […] The post Bank of America Warns The Selling Will Continue – The “Big Low” For Stocks Is Yet To Come appeared first on Silver Doctors. |

| Shots Fired: MSM Attacks John Adams, Egon von Greyerz, & RBA’s Missing Gold ‘Conspiracy Theory’ Posted: 21 Nov 2018 09:40 AM PST Typical. The MSM just can’t resist an “attack one, attack three for free” deal. Here’s the latest bashing on gold, John, Egon, and “conspiracy theories”… I’m feeling kind of festive. […] The post Shots Fired: MSM Attacks John Adams, Egon von Greyerz, & RBA’s Missing Gold ‘Conspiracy Theory’ appeared first on Silver Doctors. |

| Posted: 21 Nov 2018 07:30 AM PST Robert David Steele and Sean from SGTreport get everybody up to speed on politics, the economy, and all the latest in this crucial, hard hitting interview… Robert David Steele interviewed […] The post Former CIA Officer: Trump Has Successfully Defeated The Deep State…Currency Reset & Gold-Backed Dollar To Follow appeared first on Silver Doctors. |

| Gold & Silver Steady, But Serious Problems In The US Economy Require Another Bold-Faced Lie Posted: 21 Nov 2018 06:30 AM PST SD Midweek Update: Gold & silver are holding steady as expected, but wait until you read what has just been uncovered about the US economy… There must be a problem […] The post Gold & Silver Steady, But Serious Problems In The US Economy Require Another Bold-Faced Lie appeared first on Silver Doctors. |

| Posted: 21 Nov 2018 06:19 AM PST By TF In a stunning development, there are reports today that CGP and his Fed will reverse course and pause all fed funds hikes as soon as Q1 of next year. NO! YA DON'T SAY! Who could have seen that coming? Here's the link from ZH. You should be sure to look it over: https://www.zerohedge.com/news/2018-11-21/futures-jump-dollar-slides-aft... Now whether or not this is just a "trial ballon" designed to reverse and lift the "stock market" is not important. What... |

| All FANG Stocks Now In Bear Market – Facebook Investor’s Alone Lost 39% In Paper Wealth Posted: 21 Nov 2018 04:30 AM PST Large stock market declines are starting to become a regular thing, and tech stocks are getting hit particularly hard. Here’s an update on the market turmoil… by Michael Snyder of […] The post All FANG Stocks Now In Bear Market – Facebook Investor’s Alone Lost 39% In Paper Wealth appeared first on Silver Doctors. |

| Translating The Mindset Of Peak Oil To Peak Gold Posted: 21 Nov 2018 03:00 AM PST Many speculators in the natural resource sector are having concerns over “peak gold”, but what are we to make of it? Here’s some insight… by Maurice Jackson via Streetwise Reports […] The post Translating The Mindset Of Peak Oil To Peak Gold appeared first on Silver Doctors. |

| Mining Stock Daily – Western Gold & Copper Is Undervalued Posted: 20 Nov 2018 08:00 PM PST Dave Kranzler shares a recent interview that Mining Stock Daily did with Western Copper & Gold’s CEP Paul West-Sells…. by Dave Kranzler of Investment Research Dynamics The Mining Stock Daily, […] The post Mining Stock Daily – Western Gold & Copper Is Undervalued appeared first on Silver Doctors. |

| Posted: 20 Nov 2018 06:20 PM PST The market is incurring a "revision of belief" … Retailers hammered by profit concerns: Target down 10%, Kohl's 8% … Oil, stocks and cryptos all plunge, in classic recession signal … Morgan Stanley calls it: "We are in a bear market" … Gold and silver rise from recent lows, setting up to “go ballistic” … […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Chris Vermeulen: Metals Moving In Unison For A Massive Price Advance Posted: 20 Nov 2018 06:00 PM PST Chris shares some critical new data that can shed some light into what he believes will be a massive upside price rally in the metals… by Chris Vermeulen of The […] The post Chris Vermeulen: Metals Moving In Unison For A Massive Price Advance appeared first on Silver Doctors. |

| TFMR Podcast - Tuesday, November 20 Posted: 20 Nov 2018 02:43 PM PST With TF Tuesday lived up to its billing as a volatile day...at least for the "stock market". And now we wait to see what the rest of this holiday week has in store for us. To begin with today, we ask you to review these two links: https://smaulgld.com/russia-adds-record-amount-of-gold-to-reserves-in-2018/ https://www.sprottmoney.com/Blog/another-great-oxymoron-lbma-transparenc...And then we... |

| How to Catch Bottoms in Gold Stocks Posted: 20 Nov 2018 02:39 PM PST

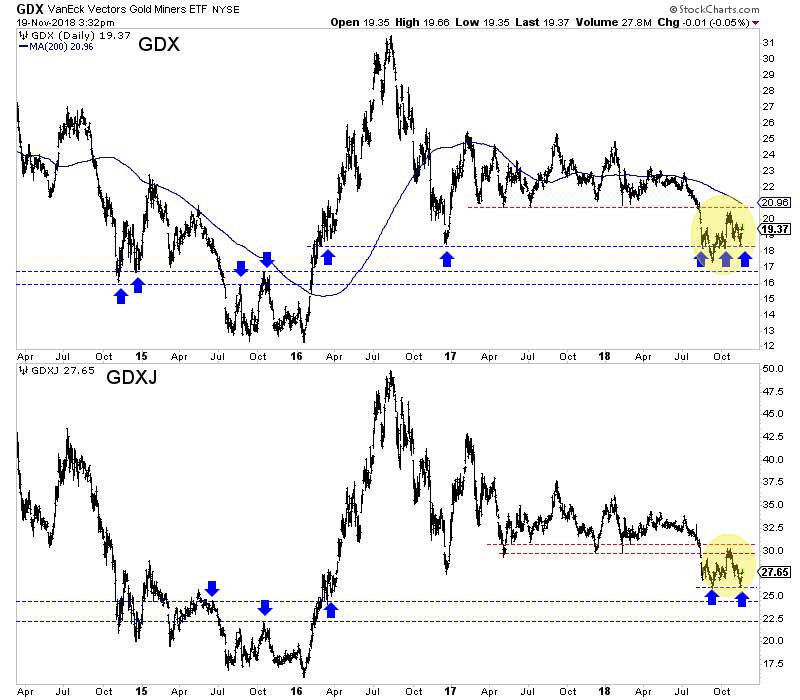

It is very difficult to pick exact bottoms but there are many tools we can use to help us pinpoint potential bottoms. You don't hear technical analysts talk about fundamentals but we do for a reason. Major shifts in the primary trend are supported by fundamental shifts, though they can be very hard to spot until after the fact. Because of our extensive study of history, we are convinced that precious metals will not begin a real bull market until the Fed stops hiking rates. The data shows that many times (though not every time) the gold stocks bottomed soon after the Fed's final rate hike. Yes, we've beaten this to death but the point is fundamentals matter. Moving on, we are going to introduce you to a number of tools and indicators which you can use to spot potential bottoms and turning points on a shorter term basis. The first and foremost focus should be the price action and the various support and resistance lines that are nearby. In the chart below, we highlight the support and resistance areas. For example, GDX last week bounced from support at $18. It faces strong resistance above $20. A loss of $18 would likely lead to a test of support in the $16s. GDXJ meanwhile, bounced from its September low at $26. It faces strong resistance near $30 and if it loses the recent low could test support in the $22-$24 range.

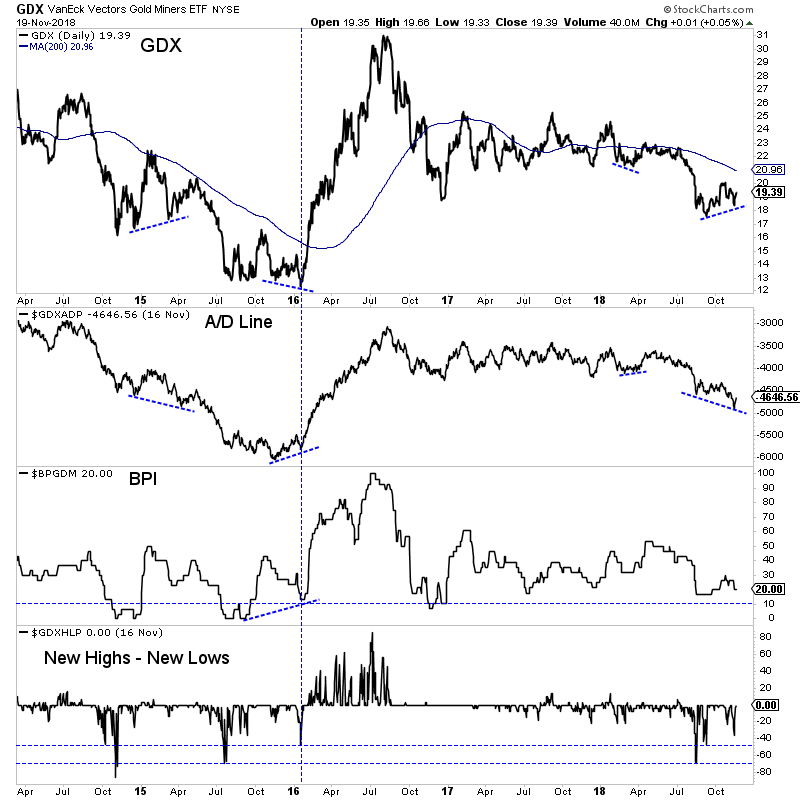

After considering the price action and important support and resistance levels, we turn to the breadth indicators which provide us information in regards to participation and sector divergences. We plot GDX below along with its advance decline (A/D) line, the bullish percentage index (BPI) and new highs minus new lows.

The A/D line, which is one of the most trusted leading indicators is flashing a negative divergence. It looks similar to the one in early 2015. Note that it flashed a major positive divergence in early 2016. Smaller positive divergences were seen in March 2018 and September 2018. The BPI currently is not telling us much. It needs to fall to 10% for the sector to be considered very oversold. Days ago the new highs minus new lows indicator hit nearly -40%, which is fairly oversold. In my opinion over -50% or even -70% tends to signal a sustained low as it did in late 2014, summer 2015 and late summer 2018. Another breadth indicator (and one we custom made for GDXJ) is the percentage of stocks that closed above various moving averages. Below we plot GDXJ along with the percentage of a basket of 55 junior stocks (mostly in GDXJ) that closed above the 20-day moving average, 50-day moving average and 200-day moving average.

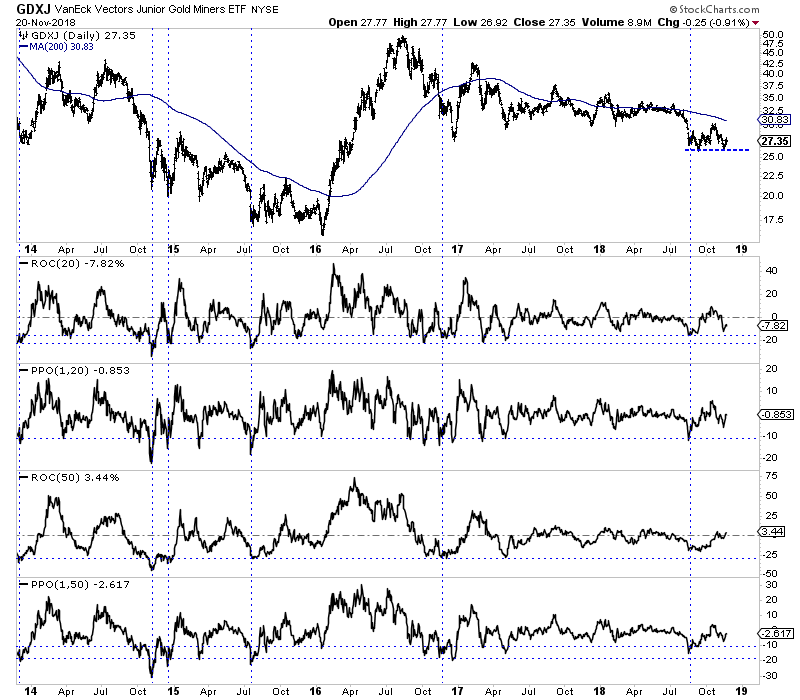

This data showed a strong positive divergence in early 2016 as well in late 2017 and to a lesser degree in late 2016. Last week it showed an oversold condition in GDXJ but no positive divergences. In addition to breadth indicators, we can also study how the stocks are performing versus the metals and we can track various momentum oscillators. My two favorite oscillators to study are the rate of change indicator and the distance from the moving average indicator. We plot these in the GDXJ chart below on a 20-day and 50-day basis.

Note that the most oversold points usually occur on the first leg down or the first break of support. Subsequent tests of the same support will show a less oversold condition. That's good if that low can hold. If not, it's worse as the market will break to new lows in a less oversold state. So what can we conclude from the current price action and these various indicators? The gold stocks hit an oversold condition last week as evidenced by the very weak breadth in GDXJ and the new highs minus new lows indicator for GDX touching nearly -40%. They also hit some technical support. However, there are no positive divergences in any of the breadth indicators and the GDX (A/D) line is flashing a serious negative divergence. Unless December is the final rate hike for the Fed, there is little reason to expect much from the current rally. While risk may not be imminent, a break below recent lows could lead to an accelerated selloff. Consider our premium service which can help you ride out the remaining downside and profit ahead of a major bottom in the sector. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| New Assay Grades at Nevada Project Exceed Current Resource Grades Posted: 20 Nov 2018 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment