saveyourassetsfirst3 |

- Alamos Gold, Inc. (AGI) CEO John McCluskey on Q3 2018 Results - Earnings Call Transcript

- Puma Biotechnology: Dismal Growth, Some Silver Linings

- First US Troops Arrive At US-Mexico Border For ‘Operation Faithful Patriot’

- Silver’s Bottom Almost Complete As The US Dollar Makes Its Last Attempts To Run Higher

- TraderStef: The Big Boo On Gold This Week – Tricked Or Treated

- Jim Willie: NASTY WARNING SIGNAL In The Bank Stock Index Is Signaling Near-Term Bank Failures

- #JobsJobsJobs! Gold & Silver’s Knee-Jerk To The Jobs Report Was A Drop (Which May Be A Good Thing)

- Harvard Trained Economist: A Trail Of Bubbles 90 Years In The Making

- It’s ‘Make-It Or Break-It’ Time For The Stock Market

- ALARM BELLS RING: Gold Rises In October As Stocks And Real Estate Fall Globally

- Breaking News/Best Of The Web

- Gold Has Moved Off Of Wednesday’s $1213 Bottom, But Will The Rally Grow Legs?

- John Bolton Says The National Debt Is An ‘Economic Threat’ To The United States

- Gold Stocks are Not Close to Bottom

- Gold-laden Russian cruiser discovered

| Alamos Gold, Inc. (AGI) CEO John McCluskey on Q3 2018 Results - Earnings Call Transcript Posted: 02 Nov 2018 01:20 PM PDT |

| Puma Biotechnology: Dismal Growth, Some Silver Linings Posted: 02 Nov 2018 01:00 PM PDT |

| First US Troops Arrive At US-Mexico Border For ‘Operation Faithful Patriot’ Posted: 02 Nov 2018 10:08 AM PDT The first 100 active-duty US military service members have arrived at the US-Mexico border as part of Operation Faithful Patriot. Here are the details… from Zero Hedge The first 100 […] The post First US Troops Arrive At US-Mexico Border For ‘Operation Faithful Patriot’ appeared first on Silver Doctors. |

| Silver’s Bottom Almost Complete As The US Dollar Makes Its Last Attempts To Run Higher Posted: 02 Nov 2018 09:00 AM PDT Silver’s bottoming process looks a lot like that of 2001 to 2003, and once the dollar begins to decline, here’s what will happen to the price of silver… by Hubert Moolman of HubertMoolman.wordpress.com […] The post Silver’s Bottom Almost Complete As The US Dollar Makes Its Last Attempts To Run Higher appeared first on Silver Doctors. |

| TraderStef: The Big Boo On Gold This Week – Tricked Or Treated Posted: 02 Nov 2018 08:00 AM PDT TraderStef has an timely update on the week’s action in gold. What’s going on with gold, what’s the outlook, and what would TraderStef do? Find out here… by TraderStef of […] The post TraderStef: The Big Boo On Gold This Week – Tricked Or Treated appeared first on Silver Doctors. |

| Jim Willie: NASTY WARNING SIGNAL In The Bank Stock Index Is Signaling Near-Term Bank Failures Posted: 02 Nov 2018 07:00 AM PDT Jim has a dire near-term warning that includes a third world style US dollar crisis, a debt crisis, a major financial crisis, and the implications for gold… by Jim Willie […] The post Jim Willie: NASTY WARNING SIGNAL In The Bank Stock Index Is Signaling Near-Term Bank Failures appeared first on Silver Doctors. |

| #JobsJobsJobs! Gold & Silver’s Knee-Jerk To The Jobs Report Was A Drop (Which May Be A Good Thing) Posted: 02 Nov 2018 06:13 AM PDT The October jobs report just blew-out the estimates, and gold & silver have initially dropped, which may be a good thing for gold & silver. Here’s why… Moments ago, the […] The post #JobsJobsJobs! Gold & Silver’s Knee-Jerk To The Jobs Report Was A Drop (Which May Be A Good Thing) appeared first on Silver Doctors. |

| Harvard Trained Economist: A Trail Of Bubbles 90 Years In The Making Posted: 02 Nov 2018 04:30 AM PDT Harry Dent has dived into the 45 and 90 year cycles, and he’s calculated when the next major reset and depression bottom will be. Here are the details… by Harry […] The post Harvard Trained Economist: A Trail Of Bubbles 90 Years In The Making appeared first on Silver Doctors. |

| It’s ‘Make-It Or Break-It’ Time For The Stock Market Posted: 02 Nov 2018 03:00 AM PDT There is light at the end of the tunnel, but if stocks don’t recover because of this, you might want to run the other way, and fast. Here are the […] The post It’s ‘Make-It Or Break-It’ Time For The Stock Market appeared first on Silver Doctors. |

| ALARM BELLS RING: Gold Rises In October As Stocks And Real Estate Fall Globally Posted: 01 Nov 2018 08:00 PM PDT Very few are connecting the dots of the convergence of the many risk factors that will likely create another global financial crisis. Let’s connect them… by Mark O'Byrne of GoldCore In our latest […] The post ALARM BELLS RING: Gold Rises In October As Stocks And Real Estate Fall Globally appeared first on Silver Doctors. |

| Posted: 01 Nov 2018 07:20 PM PDT Epoch Times: “On the cusp of a historic yuan devaluation” … Jesse Colombo: “Only 28% of Americans are ‘financially healthy’ during the largest wealth bubble” … Jim Rickards: “The debt bomb is ready to explode” … Gold and silver up; “China may peg renminbi to gold” … Best Of The Web Debt alarm ringing – […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Gold Has Moved Off Of Wednesday’s $1213 Bottom, But Will The Rally Grow Legs? Posted: 01 Nov 2018 06:00 PM PDT Gold’s endless thrashing of mostly downward price action is discouraging, but the chart is still quite bullish, giving the gold bulls the edge. Here’s why… by Rick Ackerman of Rick’s […] The post Gold Has Moved Off Of Wednesday’s $1213 Bottom, But Will The Rally Grow Legs? appeared first on Silver Doctors. |

| John Bolton Says The National Debt Is An ‘Economic Threat’ To The United States Posted: 01 Nov 2018 04:30 PM PDT National Security Advisor John Bolton has declared the high level of national debt an "economic threat" to the United States. Here are the details… by Mac Slavo of SHTFplan In an […] The post John Bolton Says The National Debt Is An ‘Economic Threat’ To The United States appeared first on Silver Doctors. |

| Gold Stocks are Not Close to Bottom Posted: 01 Nov 2018 02:23 PM PDT

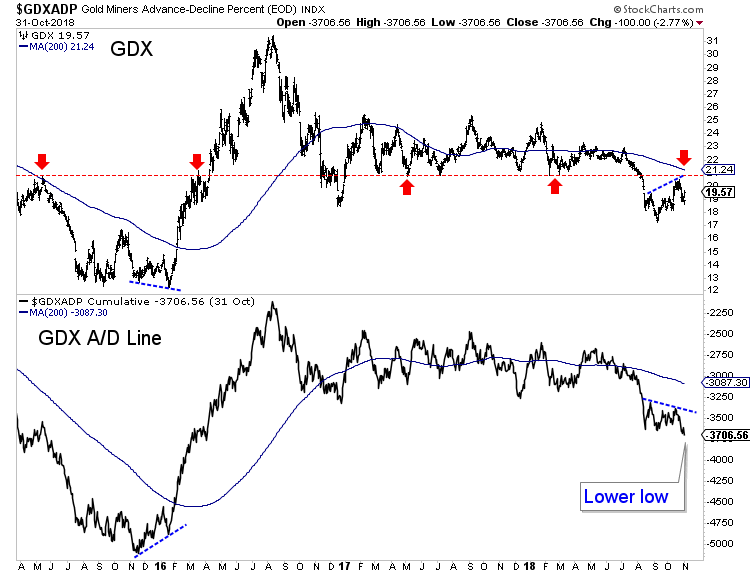

It has been a rough year for gold stock investors. Since Gold failed to break to the upside and the US Dollar bottomed, gold stocks have been in a strong downtrend. In September they hit two and a half year lows. The oversold condition since then has been corrected but that rebound has been quite weak. Evidence of that can be seen in the GDX advance decline (A/D) line (an important breadth indicator) which is showing a negative divergence and hit a new low on Wednesday. Rebounds from major market lows are accompanied by strong participation. Note the strength in the A/D line during the rebounds which began especially in December 2015 and less so in December 2016. Just a week after GDX retested major resistance at $21, its A/D line closed at a lower low.

The gold stocks enjoyed a strong Thursday but from a bird's eye view, we should not get excited. Given the weak nature of the rally and strong overhead resistance nearby, we should be on guard for the primary downtrend to reassert itself. Evidence of that taking place would be a break in the trendline connecting the September and October lows (in yellow).

A continued decline into an epic bottom would not be atypical. In fact, one should recall how the gold stocks performed prior to the epic bottoms in Q4 of 2000 and 2008. The rate of change for 6 months for the HUI Gold Bugs Index hit -50% in Q4 of 2000 and -70% in Q4 of 2008. This does not mean that gold stocks have to crash into their bottom. More so, it reminds us it would not be abnormal if it were to happen. On the fundamental side nothing has changed. As we have noted several times in recent months, precious metals will not bottom until the Federal Reserve is done with its rate hikes. Over the past 60 years, the majority of bottoms in gold stocks (but not all) have coincided with the end of Fed rate hike cycles. When the economy and stock market weaken, the Fed will end its hikes and Gold will begin to outperform stocks. If the Fed shifts to rate cuts, then we'll see miners making triple digit gains in a matter of months. But for now investors and speculators alike should be very cautious and patient. They should raise cash and if skilled enough use hedges when appropriate. That's what we are doing. To prepare yourself for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| Gold-laden Russian cruiser discovered Posted: 18 Jul 2018 08:17 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment