saveyourassetsfirst3 |

- Our Easy Money Economy Is Not Sustainable

- Stronger Dollar is Bullish Catalyst for Gold

- Ex-ScotiaBank Director Remains Outspoken on Gold

- Tech Crash 2.0? – DotCom Deja Vu – Jesse Felder

- Coming Out Of Hibernation: 14 Of BOA’s 19 Bear Market Signals Have Now Been Triggered

- David Morgan: IT IS A GRAVE MISTAKE Not To Have Silver As Bear Market Is Finally At Its End

- Peter Schiff’s Warning Becomes Reality As Global Markets In Meltdown

- Breaking News/Best Of The Web

- WARNING: China Is Already Blowing Up…Europe And The USA Are Next!

- Interview: Uranium Breakout Fails, Dollar Impact & Gold Targets

- Mannarino: Systematic Destruction Of The Middle Class Will Turn Us Back Into A 2-Tier Society

- Schemes For Foreign Currency Manipulation Spread Worldwide

- TFMR Podcast - Wednesday, October 24

- Exploring for High-Grade Silver in the Brownfields of the Yukon

| Our Easy Money Economy Is Not Sustainable Posted: 25 Oct 2018 11:00 AM PDT Not only is our easy money economy not sustainable, but trying to avoid a financial meltdown from occurring in the first place is of no use. Here’s why… by Carmen […] The post Our Easy Money Economy Is Not Sustainable appeared first on Silver Doctors. |

| Stronger Dollar is Bullish Catalyst for Gold Posted: 25 Oct 2018 10:59 AM PDT

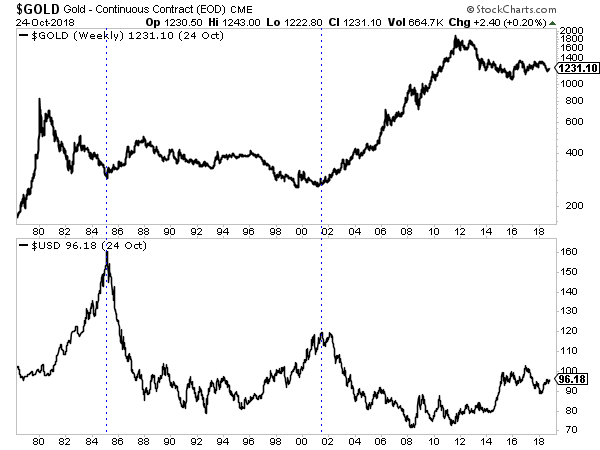

The US$ index is breaking higher. Its trading at 96.41 as we pen this. A daily close above 96.61 marks a new 52-week high and puts the dollar in position to eventually retest its bull market high at 104. If this strength continues then the relief rally in precious metals could be over. So why is that a bullish catalyst for Gold? First, we know that a real bull market is not going to begin until the Fed ends its rate hikes. A stronger US dollar can act as a form of rate hikes. Foreign markets are already in bear territory and the global economy (ex US) could be dangerously close to a recession. A rising US dollar can exacerbate the issues with foreign US-denominated debt. Ultimately these problems can also hit the US, where in 2017, 44% of sales (from S&P 500 companies) came from outside the US. Is the Fed going to continue hiking if the US dollar continues to surge? The more obvious answer is that major peaks in the US dollar tend to coincide with important bottoms in Gold and precious metals investments. This occurred in 1985 and 2001.

Note that January 2017 did not mark a major peak for the US dollar. Precious metals actually peaked in 2016. And following the 1985 and 2001 peaks, precious metals trended higher and made higher highs in steady fashion. Ultimately, precious metals are not going to begin a sustained, multi-year bull market until the Fed stops hiking. That will likely be followed by a major peak in the US dollar. The stronger the US dollar gets and the higher it goes, the closer the Fed will be to ending its hikes and the closer the US dollar will be to a major peak. It's important to note that Gold often bottoms several months before the US dollar peaks. There are some who believe the two could rise together for a while. The precursor to such a scenario would not change. It requires a rising US dollar and the Fed ending its hikes. The real question is at what point during the US dollar’s rise, do conditions turn bullish for precious metals? We’ll get to that in the future. From here, a rising US dollar will be negative for precious metals initially as the Fed will be able to hike in December and perhaps at least once more. But from a bird's eye view, it will accelerate the time between now and the start of a bull market. To prepare for an epic buying opportunity in junior gold and silver stocks in 2019, consider learning more about our premium service.

|

| Ex-ScotiaBank Director Remains Outspoken on Gold Posted: 25 Oct 2018 09:34 AM PDT A rather outspoken investment portfolio manager, Jaime Carrasco, has been making recent media rounds suggesting listeners consider prudent bullion allocations today. A former ScotiaBank Director, Jaime continues to say things […] The post Ex-ScotiaBank Director Remains Outspoken on Gold appeared first on Silver Doctors. |

| Tech Crash 2.0? – DotCom Deja Vu – Jesse Felder Posted: 25 Oct 2018 07:28 AM PDT The world now lives under threatening stagflation. With rising US interest rates, higher priced crude oil, and a relatively stronger US dollar vs other major fiat currencies. Multi decade money […] The post Tech Crash 2.0? – DotCom Deja Vu – Jesse Felder appeared first on Silver Doctors. |

| Coming Out Of Hibernation: 14 Of BOA’s 19 Bear Market Signals Have Now Been Triggered Posted: 25 Oct 2018 07:00 AM PDT October 2018 is turning out to be a lot like October 2008, and not all of the 19 signals need to be triggered to enter a bear market. Here’s more… […] The post Coming Out Of Hibernation: 14 Of BOA’s 19 Bear Market Signals Have Now Been Triggered appeared first on Silver Doctors. |

| David Morgan: IT IS A GRAVE MISTAKE Not To Have Silver As Bear Market Is Finally At Its End Posted: 25 Oct 2018 03:00 AM PDT David says there could be another $1 decline in the silver price from here, but silver is more likely to go to $140 than down a buck. Here’s more… David […] The post David Morgan: IT IS A GRAVE MISTAKE Not To Have Silver As Bear Market Is Finally At Its End appeared first on Silver Doctors. |

| Peter Schiff’s Warning Becomes Reality As Global Markets In Meltdown Posted: 24 Oct 2018 08:00 PM PDT Peter has warned of a potential economic catastrophe for some time, but now the signs of economic distress are finally showing up. Here are the details… by Mac Slavo of […] The post Peter Schiff’s Warning Becomes Reality As Global Markets In Meltdown appeared first on Silver Doctors. |

| Posted: 24 Oct 2018 07:20 PM PDT US stocks now down for the year … New home sales plunge — again … The stock market faces 'unlimited downside risk,' warns veteran trader … Trump again lashes out at Fed for raising rates … Gold and silver rising amid stock/bond turmoil, “paper gold short squeeze” … Best Of The Web Strapping in for […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| WARNING: China Is Already Blowing Up…Europe And The USA Are Next! Posted: 24 Oct 2018 06:00 PM PDT The markets are now facing the perfect storm, China is entering a recession, and financial crisis is about to strike Europe and the US. Here are the details… by Graham […] The post WARNING: China Is Already Blowing Up…Europe And The USA Are Next! appeared first on Silver Doctors. |

| Interview: Uranium Breakout Fails, Dollar Impact & Gold Targets Posted: 24 Oct 2018 04:45 PM PDT Jordan Roy-Byrne, Founder of The Daily Gold joins me to discuss a couple topics related to resource investing. First up is uranium and the failed breakout over the past couple of months. We then move to the bullish USD and what dominoes could fall if the dollar continues this strength. In the longer term sense it could lead to the move in metals all the bulls are waiting for but it is a process. Click Here to Learn More About TheDailyGold Premium

|

| Mannarino: Systematic Destruction Of The Middle Class Will Turn Us Back Into A 2-Tier Society Posted: 24 Oct 2018 04:30 PM PDT Gregory Mannarino says get out of paper and own real things such as gold, silver, and a car, as real stuff is the only way to protect against what’s coming… […] The post Mannarino: Systematic Destruction Of The Middle Class Will Turn Us Back Into A 2-Tier Society appeared first on Silver Doctors. |

| Schemes For Foreign Currency Manipulation Spread Worldwide Posted: 24 Oct 2018 03:00 PM PDT The Treasury Department’s recent report on foreign exchange manipulation is so flawed in its analysis that the report is a farce. Here’s why… by Brendan Brown via Mises Wire The […] The post Schemes For Foreign Currency Manipulation Spread Worldwide appeared first on Silver Doctors. |

| TFMR Podcast - Wednesday, October 24 Posted: 24 Oct 2018 02:06 PM PDT With TF It was a wild, wild day across all markets. However, the wildest action came in the US "stock market", which went out on its lows and finished at the lowest level since early May, completely wiping out all of the gains made earlier in 2018. Sound familiar? So, tomorrow sets up as a VERY interesting day. Will the "stock market" collapse in a manner that the chart suggests it will OR will it magically reverse? Stay tuned... For today, a discussion of these nine charts in order:... |

| Exploring for High-Grade Silver in the Brownfields of the Yukon Posted: 24 Oct 2018 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment