Gold World News Flash |

- Breaking News/Best Of The Web

- Zero Hedge: Yuan's correlation with gold price suddenly snaps

- EU Cracking, May Drag Down The Dollar

- Gold price steadies and rises as BIS intervention diminishes

- 5 Ways China Is Subverting the United States

- Ex-Deutsche Bank traders guilty in U.S. Libor-rigging trial

- European Globalists Cower In Fear After Historic Trump-Quake Leaves Germany In Ruins

- Gold 7-Year Bear Market Phase Is Over

- Gold - A Golden Escape

- Wall Street’s Lucrative “Tombstone” Strategy… Resurrected!

- A £300k bust of Kate Moss and 24-carat bed sheets: Sotheby's all-gold collection goes up for auction

- Three Junior Miners on Brien Lundin's Top Pick List

| Posted: 17 Oct 2018 07:20 PM PDT Guggenheim: "Expect risk-off everywhere with a 40% crash" … Casey: Income exodus just wiped out $1 trillion from investors … New York Times: The Saudi cover-up crumbles … Gold and silver up as “safety play” amid stock/bond turmoil; “silver's time is coming” … Best Of The Web Yes, something just broke – Lance Roberts, Real […] The post Breaking News/Best Of The Web appeared first on DollarCollapse.com. |

| Zero Hedge: Yuan's correlation with gold price suddenly snaps Posted: 17 Oct 2018 06:36 PM PDT 9:38p ET Wednesday, October 17, 2018 Dear Friend of GATA and Gold: Zero Hedge reports tonight that the tight correlation of the valuation of the Chinese yuan and the price of gold, which appears to have begun in February, has suddenly snapped, with the yuan sinking without also taking gold down with it. ... Dispatch continues below ... ADVERTISEMENT Buy, Sell, or Store Precious Metals with Money Metals Money Metals Exchange, a national bullion dealer recently voted "Best in the USA" by a worldwide ratings group -- https://www.moneymetals.com/news/2015/02/03/worldwide-ratings-organizati... -- is a great low-cost source for precious metals coins, rounds, and bars. Money Metals also pays handsomely when you wish to sell your precious metals. Shop online with Money Metals Exchange here -- https://www.moneymetals.com/buy -- or by calling 1-800-800-1865. Meanwhile, the Money Metals Depository -- https://www.moneymetals.com/depository Of course such a tight correlation is unlikely to be maintained by ordinary market forces. It almost certainly could not happen except as the result of steady intervention by an entity with access to huge amounts of money, legal authorization to rig markets, and the motive to do so. The only entities fitting those requirements are governments and central banks. Zero Hedge's analysis is headlined "Did the People's Bank of China Just Lose Control? One Chart Says 'Yes'" and it's posted here: https://www.zerohedge.com/news/2018-10-17/did-pboc-just-lose-control-one... CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| EU Cracking, May Drag Down The Dollar Posted: 17 Oct 2018 04:08 PM PDT Somebody has promised China with world government they will be in charge. Lie. When this nation figures this out will start bad things. They oppress Christians and moslem. What regime can survive doing this. No communist regime has ever lasted more than 100 yrs. China on world stage no longer... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold price steadies and rises as BIS intervention diminishes Posted: 17 Oct 2018 01:01 PM PDT By Robert Lambourne The Bank for International Settlements has just published its September statement of account, giving summary information on its use of gold swaps and other gold-related derivatives in that month: https://www.bis.org/banking/balsheet/statofacc180930.pdf The information provided in BIS monthly statements is not sufficient to calculate a precise amount of gold-related derivatives, including swaps, but the bank's total estimated exposure as of September 30, 2018, was about 238 tonnes of gold, compared with about 370 tonnes at August 31, 2018, and about 485 tonnes as of July 31, 2018. Thus there have been two straight months of substantial declines in the BIS' largely surreptitious intervention in the gold market -- a reduction of about 115 tonnes in August and another 132 tonnes in September. ... Dispatch continues below ... ADVERTISEMENT Fisher Precious Metals is preparing and equipping Fisher Precious Metals, voted North America's bullion dealer of the year for 2018 and known for personal service and great pricing, has been helping Americans and Canadians protect their wealth with precious metals for more than a decade. Enjoying a five-star client rating across the internet with no complaints at the Better Business Bureau, the team at Fisher Precious Metals works hard to serve you. We have helped thousands of clients in buying and selling bullion, arranging segregated and offshore storage, establishing precious metals IRAs, and obtaining certified precious metals appraisals. We provide security to our clients with our Bullion Authenticity Guarantee. We recommend that you read our article "How to Avoid Bullion Counterfeits": https://fisherpreciousmetals.com/precious-metals/bullion-authentication/ As a family-owned business, we strive to help you assess your wealth-protection goals and overall investment objectives. From the new precious metals buyer to the seasoned bullion investor, we are here to help you with a no-pressure, confidential consultation. Rest assured that everyone in our firm owns physical precious metals and no one is compensated via commission -- period. Fisher Precious Metals is your full-service precious metals investment partner for life. Please call us at 1-800-390-8576 or visit us here: https://fisherpreciousmetals.com As the BIS' intervention in the gold market has diminished steadily since July 31, the gold price has ended a multi-year decline, leveled out at $1,200, and has begun to rise: https://www.kitco.com/charts/popup/au0182nyb.html The BIS refuses to answer questions about what it is doing, why, and for whom in the gold market: http://www.gata.org/node/17793 But it is evident that the bank, acting as broker for its member central banks, continues to trade actively in gold swaps. The BIS' declining involvement in gold swaps contrasts sharply not only with the steadying and rising gold price but also with the approximately 193-tonne increase in central bank gold holdings reported in the first half of 2018 and with the recent increase of 28.4 tonnes in gold reserves reported by the Hungarian central bank: http://www.gata.org/node/18557 Robert Lambourne is a retired business executive in the United Kingdom who consults with GATA about the involvement of the Bank for International Settlements in the gold market. Join GATA here: New Orleans Investment Conference * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| 5 Ways China Is Subverting the United States Posted: 17 Oct 2018 01:00 PM PDT Chris and DECLASSIFIED host Gina Shakespeare to count down the worst cases of Chinese subversion in America. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Ex-Deutsche Bank traders guilty in U.S. Libor-rigging trial Posted: 17 Oct 2018 12:38 PM PDT By Chris Dolmetsch Two former traders at Deutsche Bank AG were convicted today by a New York jury of conspiring to rig Libor, a key interest-rate benchmark, handing a victory to U.S. prosecutors targeting behavior by individuals at financial institutions that have paid billions of dollars to settle government claims. Matthew Connolly and Gavin Black were found guilty of trying to manipulate the London interbank offered rate, which is used to value trillions of dollars of financial products, from 2004 to 2011. ... Dispatch continues below ... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Since regulators began a global crackdown on how the Libor benchmark is set, banks including Deutsche Bank and Barclays Bank have agreed to pay more than $9 billion in fines. Dozens of traders have been fined, barred from the financial industry, or criminally charged in different countries. But only four, including Connolly and Black, have been found guilty at a U.S. trial, and the other two convictions were reversed. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2018-10-17/ex-deutsche-bank-trad...

Join GATA here: New Orleans Investment Conference * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| European Globalists Cower In Fear After Historic Trump-Quake Leaves Germany In Ruins Posted: 17 Oct 2018 12:22 PM PDT The whole EU will collapse in next few years . Agenda 21 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold 7-Year Bear Market Phase Is Over Posted: 17 Oct 2018 06:09 AM PDT Article posted at The Market Oracle http://www.marketoracle.co.uk/Article63354.html |

| Posted: 17 Oct 2018 05:47 AM PDT Article posted at The Market Oracle http://www.marketoracle.co.uk/Article63353.html |

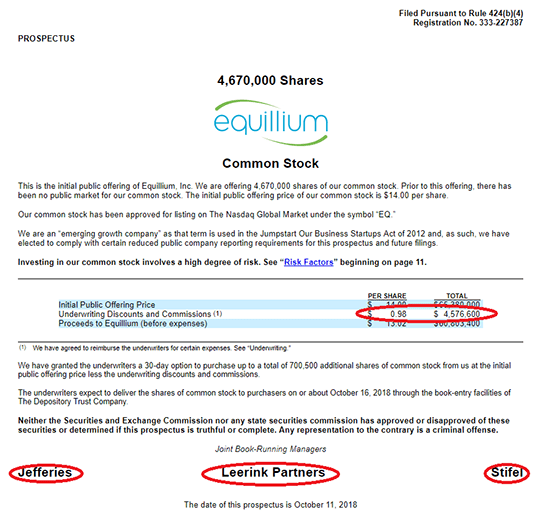

| Wall Street’s Lucrative “Tombstone” Strategy… Resurrected! Posted: 17 Oct 2018 05:30 AM PDT This post Wall Street’s Lucrative “Tombstone” Strategy… Resurrected! appeared first on Daily Reckoning. As the end of October approaches, I’m noticing tombstones popping up in a number of my neighbor’s yards. Of course, my kids are getting excited about Halloween and binging on as much sugar as possible over the next few weeks. But while the fake tombstones in my neighborhood have my kids excited about candy, I’m seeing a number of Wall Street tombstones popping up in my daily research. And these tombstones are directly related to some great investment gains you can lock in this week. If you’re not familiar with Wall Street’s tombstones — or how to make money from them — now is a great time to get up to speed. Because as earnings season kicks off and the market rebounds from last week’s pullback, this strategy is set to put thousands (if not tens of thousands — or even hundreds of thousands) of extra profits in your account. Let’s take a look… The Most Lucrative Strategy on Wall StreetWhen I took my first investment job at a hedge fund in Atlanta, my boss walked into my room and dropped a thick stack of research on my desk. I didn’t know it at the time, but the binder on top was known as a “tombstone.” A tombstone is simply a document prepared for a new stock or bond offering, which lists all the specific details for the deal. The nickname comes from the fact that the cover of each set of documents has a resemblance to the way the names and dates are laid out on a typical tombstone. As I spent time on the research desk, I began to realize that these tombstones offered some very important information for investors. And the information wasn’t just about the companies that were covered in the document. If you knew where to look, these tombstones could tell you exactly what type of profits the big Wall Street firms were going to book. Take a look at the tombstone below to see just what I’m talking about.

The picture above is the tombstone of a new IPO (or initial public offering) stock that was sold to the public this month. Every time a new stock is listed, the company is required to file a document like this with the SEC. In this case, the stock was Equillium Inc. (EQ). And I want to be clear here, I am NOT recommending shares of EQ. Instead, I want to point your attention to the specific areas circled in red. For this particular deal, EQ was sold to new investors at a price of $14 per share. But instead of all of this money going to the company, a material portion — $0.98 per share in this case — went to the underwriters. The underwriters are the Wall Street companies who helped Equillium find new investors. And these underwriters booked a total of $4.60 million in fees from this particular deal. As I’m sure you can see, these deals can be extremely lucrative for Wall Street firms. Because nearly all of these fees represent pure profit for the “underwriters.” All the Wall Street companies have to do is find investors who want to buy a hot stock, and then put the shares in the investors’ accounts! Wall Street Deals Pick Up — And Bank Profits SoarThis week, earnings season moved into high gear with some big Wall Street firms reporting strong profits. You may have seen that both Goldman Sachs (GS) and Morgan Stanley (MS) announced earnings that beat expectations and sent their stock prices higher. A large part of the earnings beat came from profitable deals that show up on thee tombstone filings. More importantly, we’re now entering a period where these deals are going to become more prevalent and more profitable. The summer months can be slow when it comes to pricing new stocks. That’s because institutional investors are often on vacation and no one wants to issue a high-profile IPO when the most important decision makers are off the desk. But now that institutional investors are back in the office, these deals are picking back up. Case in point: this week, news wires reported that Uber Technologies is reviewing proposals from big Wall Street firms who are offering to help with the company’s IPO. At this point, it looks like this new stock offering will value Uber at $120 billion. That puts Uber’s size on par with International Business Machines (IBM) — a blue chip company that has been around for decades! I can tell you that the big Wall Street firms like Goldman and Morgan Stanley are salivating over the profits that this type of offering will bring! And Uber isn’t the only big company considering an IPO transaction. Just over the next few weeks, I see a minimum of 10 new stocks set to launch.1 So today, as earnings season heats up and new deals hit the market, I expect big underwriters like GS and MS to continue to move higher. After all, investors are going to see these deals coming to market and they will connect the dots with higher Wall Street earnings. At this point, most blue chip Wall Street stocks are trading at reasonable price points. But heading into the end of the year, I expect these stocks to move sharply higher. Now is a great time to take advantage of last week’s pullback by adding shares of these investment banks to your investment account. Here’s to growing and protecting your wealth!

Zach Scheidt 1 Silver Weaton, August 2016 Presentation The post Wall Street’s Lucrative “Tombstone” Strategy… Resurrected! appeared first on Daily Reckoning. |

| A £300k bust of Kate Moss and 24-carat bed sheets: Sotheby's all-gold collection goes up for auction Posted: 17 Oct 2018 02:46 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Three Junior Miners on Brien Lundin's Top Pick List Posted: 15 Oct 2018 01:00 AM PDT Brien Lundin, publisher of Gold Newsletter, discusses recent moves in the precious metals markets, several mining companies he has his eyes on, and plans for the upcoming New Orleans Investment Conference. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment