Gold World News Flash |

- X ANON ...CHILD RITUALS - BOHEMIAN GROVE

- A RED WAVE OF JUSTICE IS COMING

- EU, Russia, and China agree to special payments system for Iran

- Craig Hemke at Sprott Money: Ahead of Wednesday's FOMC

- Trump Planning Mass Arrests Of VIP ‘Deep State’ Traitors

- President Donald Trump URGENT Speech to the United Nations General Assembly

- Verizon Experiencing Massive Nationwide Outages

- One Category of Mutual Fund to Avoid

- The Fed’s In A Box And People Are Starting To Notice

- Gold – “Make Me Feel Good…Tell Me Anythingâ€

- TECH ALERT: Big Bucks From “Blood Valley”

- Free-Riding Investors Set up Markets for a Major Collapse

- The Tripwire on the Next “Black Monday”

- Exploration and Development Plans Expand on Carlin Trend Project

- Site Visit to Quebec Project Leaves 'Positive' Impressions

| X ANON ...CHILD RITUALS - BOHEMIAN GROVE Posted: 25 Sep 2018 09:00 PM PDT Alex Jones ran a video of this place years ago.Most wouldn't believe it at the time. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| A RED WAVE OF JUSTICE IS COMING Posted: 25 Sep 2018 08:00 PM PDT Bix Weir returns to SGT Report to discuss military tribunals for the bad guys and the big red wave of justice that's coming for the deep state criminals. We also discuss JP Morgan's silver position, Bitcoin, Litecoin and much more. Thanks for tuning in. The Financial Armageddon... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| EU, Russia, and China agree to special payments system for Iran Posted: 25 Sep 2018 07:09 PM PDT By Mehreen Khan and Henry Foy The European Union's three biggest member states have agreed to a deal with Russia and China to set up a special payments system to facilitate trade with Iran as global powers step up measures to protect a nuclear deal with Tehran after the United States reimposed sanctions. In a joint statement today, the foreign ministers of China, Russia, Germany, the UK, and France agreed to "assist and reassure economic operators pursuing legitimate business with Iran," including its oil exports. The five countries remain signatories to a 2015 Iran nuclear deal which Donald Trump withdrew from earlier this year after calling it the "worst deal ever." ... For the remainder of the report: https://www.ft.com/content/4aa03678-c0a7-11e8-8d55-54197280d3f7 ADVERTISEMENT Goldco Is America's No. 1 Gold IRA Provider Goldco Precious Metals was founded by Trevor Gerszt in 2006 with a mission to help Americans protect their retirement accounts from market volatility and inflation by adding precious metals like gold and silver. Experts predict that we are headed toward another economic crash like the one in 2008. If you aren't prepared, your retirement savings could vanish. At Goldco we take the time to understand our customers' investment goals and objectives and give them the resources to feel confident that their money will be there for them when they need it. To learn more about adding gold and silver precious metals to your retirement accounts, please visit Goldco here: Join GATA here: New Orleans Investment Conference * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Craig Hemke at Sprott Money: Ahead of Wednesday's FOMC Posted: 25 Sep 2018 06:41 PM PDT 9:45p ET Tuesday, September 25, 2018 Dear Friend of GATA and Gold: On Wednesday, the TF Metals Report's Craig Hemke writes today at Sprott Money, the Federal Reserve chairman is likely to present a lovely evaluation of the U.S. economy. Don't believe it, Hemke says. Hemke writes: "By the second quarter of 2019, the Fed could be talking about rate cuts. A contracting U.S. economy will lead to falling tax receipts, thus requiring additional fiat creation and even talks of a resumption of quantitative easing.' Under this scenario, do you think that the prices of Comex gold and silver will remain at present levels?" Hemke's commentary is headlined "Ahead of Wednesday's FOMC" and it's posted at Sprott Money here: https://www.sprottmoney.com/Blog/ahead-of-wednesdays-fomc-craig-hemke-25... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Trump Planning Mass Arrests Of VIP ‘Deep State’ Traitors Posted: 25 Sep 2018 06:00 PM PDT According to a number of government documents from the U.S. Federal Register, Trump will declare temporary martial law in order to fulfil his promise of draining the D.C. swamp. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| President Donald Trump URGENT Speech to the United Nations General Assembly Posted: 25 Sep 2018 02:00 PM PDT President Donald Trump will give his second speech at the United Nations General Assembly MUST WATCH: President Donald Trump URGENT Speech to the United Nations General Assembly The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Verizon Experiencing Massive Nationwide Outages Posted: 25 Sep 2018 01:00 PM PDT This is the second day in a row that Verizon has seen connection issues across the country. You can track the current reports at the downdetector link below. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://lindseywilliams101.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| One Category of Mutual Fund to Avoid Posted: 25 Sep 2018 12:11 PM PDT This post One Category of Mutual Fund to Avoid appeared first on Daily Reckoning. The basics of personal finance are pretty simple: You spend less than you make. You use credit wisely. And you establish some type of emergency fund that can be easily accessed at any time. Then, going forward, you put your new savings into investments that can grow your wealth more rapidly over time. The harder part is figuring out the specific how's, what's, when's and where's. Now as far as most investors are concerned, there are really only three basic investment categories — stocks, bonds, and cash. Of course, there are also precious metals like gold and silver … as well as other so-called alternative assets like real estate and foreign currencies. And with the ever-expanding universe of mutual funds and ETFs, accessing all corners of the investment world has never been easier. So, the first and most important decision you face as an investor is not which specific investments to buy, it's your asset allocation – i.e. what specific categories of investments you should buy and in what proportions. As I'll explain in a moment, Wall Street has a relatively new answer to this problem – one that I generally dislike. But first, just to refresh your memory on asset allocation… A traditional rule of thumb says to subtract your age from 100. The resulting answer determines the percentage of stocks that should be in your portfolio. For example, a 40-year-old investor would allocate 60% of his or her portfolio to equities. The obvious idea here is that the longer you have until retirement, the more aggressive you should be. Since stocks are historically more volatile — but also better able to outpace inflation over long periods — they deserve the lion's share of a younger investor's nest egg. In contrast, bonds are considered better able to weather storms and kick off income, so they should comprise a higher percentage of an older investor's portfolio. Or at least that's the traditional thinking. Unfortunately, the one-size-fits-all approach isn't perfect. As you probably know, I don't think bonds trump stocks either as income investments or as safe havens – especially not now. So in my opinion older investors can dedicate larger portions of their portfolios to equities. And again, these aren't your only two choices. So how much gold should you have? Or how much real estate? To further complicate matters, how much of an annual investment return do you need to meet your future goals? Someone who has to make up for lost time will need to invest more aggressively than someone who has already achieved independence financially. Last but not least, there's your overall tolerance for risk. Some folks — even 20-year-olds — just aren't able to sleep at night when they're sitting on a paper loss of 20% or 30%. That's fine. But those people might be better off in ultra-conservative investments even if the standard rule of thumb suggests otherwise. Sure, math and history might argue otherwise, but no amount of investment return is worth more than the ability to relax and enjoy life! This is why so-called lifecycle funds can't really solve the asset allocation question… A whole new batch of mutual funds have come on the scene over the last few years and they are rapidly gaining prominence in employer-sponsored retirement plans. These "lifecycle" mutual funds — which also go by names like "targeted funds" or "age-based" funds — promise to solve the issue of asset allocation in one fell swoop. How? Well, lifecycle funds are "fund of funds." In other words, you buy one fund, but really own multiple mutual funds under that single banner. So you simply decide when you plan on retiring, and let the lifecycle fund do the rest. The fund's manager will automatically determine what kind of asset allocation is appropriate for you and then spread your money into other funds that cover those areas. Example: A 33-year-old investor might buy a lifecycle fund with a 2040 target date. And right now, that fund might put 70% into a couple of different stock mutual funds and the other 30% into some bond mutual funds. Then, as the years go by, the manager will gradually make the portfolio more conservative, by shifting money from the stock funds into the bond funds. So by the time 2040 rolls around, the lifecycle fund will be primarily invested in bond funds and our now-60-year-old investor is ready to enjoy retirement. But as I pointed out, there's no way to lump an entire generation – or even two people of similar age – into one single asset allocation! Moreover, even lifecycle funds with similar target dates can vary wildly in terms of their holdings. Some managers are very conservative, even for far-off dates. Others might go hog wild on stocks. There's really no way to know without doing some due diligence. And at that point, you might as well just assemble a list of funds or individual investments that suit your needs! By the way, perhaps the biggest design feature of lifecycle funds is that they lead to nice fees and commissions for the companies that run them. In fact, the beauty of this approach — from a fund company's perspective — is that it virtually guarantees all of your assets stay "in house." It doesn't matter if the fees are high or the individual fund performances are poor. The concept encourages you to mindlessly pour your money into the same firm … and keep it there as long as you live! Am I saying all lifecycle funds are bad? Of course not. You can find low-fee choices that might work well for you, especially if you don't like picking individual investments or worrying about monitoring your asset allocation. And I'd much rather see someone invest in an imperfect vehicle than not plan for retirement at all! But in my opinion, you can do much better on your own. All it takes is a little self-examination using the big-picture questions I've already raised. And even if you just tweak the basic rule of thumb method and use low-cost index funds, you'll save yourself a lot of wasted money on mutual fund fees. Bottom line: If you don't currently have an overarching plan for your portfolio, please take an hour or two and figure out what your current asset allocation is … and whether it's really appropriate for your needs. Doing this simple exercise is truly worth the minimal effort involved. To a richer life,

Nilus Mattive The post One Category of Mutual Fund to Avoid appeared first on Daily Reckoning. |

| The Fed’s In A Box And People Are Starting To Notice Posted: 25 Sep 2018 10:28 AM PDT It's long been an article of faith in the sound money community that the Fed, by bailing out every dysfunctional financial entity in sight, would eventually be forced to choose between the deflationary collapse of a mountain of bad debt and the inflationary chaos of a plunging currency. That generation-defining crossroad is finally in sight. […] The post The Fed's In A Box And People Are Starting To Notice appeared first on DollarCollapse.com. |

| Gold – “Make Me Feel Good…Tell Me Anything†Posted: 25 Sep 2018 09:50 AM PDT Article posted at The Market Oracle http://www.marketoracle.co.uk/Article63204.html |

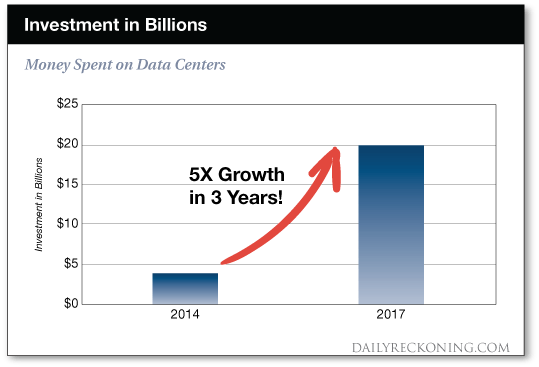

| TECH ALERT: Big Bucks From “Blood Valley” Posted: 25 Sep 2018 05:30 AM PDT This post TECH ALERT: Big Bucks From "Blood Valley" appeared first on Daily Reckoning. The Montreux Casino was going up in flames. And along with it went the recording studio which a famous rock band had booked for a free session the next day. The members of the band watched in horror as the flames leapt into the night sky. It was 1971 and the fire in the sky and the smoke that hung over the waters of a nearby lake would soon inspire the band’s most famous song. As some of you might have already guessed, the band was Deep Purple and the song was Smoke on the Water. That song’s iconic bass riff motivated me into picking up the guitar, and even made me harbor thoughts of a career on stage… My rock star aspirations were short-lived. However, thanks to scientists from the University of Washington, Microsoft and Twist Bioscience, that song could soon live on forever… Literally. That’s because recently, scientists from these three research facilities conducted a unique experiment that involved storing the song Smoke on the Water on a DNA sequence. I’m sure you’ve heard of DNA. “Deoxyribonucleic acid” is one of the smallest molecules in all living organisms. Its sole purpose is storing information. Today, I want to give YOU a front row seat to the rapidly growing DNA data storage industry. All signs point to this technology becoming the future of data storage, which will mint millionaires in the process… A Billion Dollar Industry: Hidden In Our Human “Code”Because of its unique information storing property, scientists have always viewed DNA as the ultimate medium for data storage. In 2012, scientists at Harvard managed to store the text of a book on DNA. Since then, researchers have successfully stored data, equivalent to 900bn pages of plain text, in one gram of DNA and read it back accurately. In fact, the Defense Advanced Research Projects Agency’s (DARPA), was so impressed with DNA data storage technology that it recently funded further research into DNA storage. If successful, it could be the answer to the problems of archiving the increasing amounts of information the world is creating. And boy was it successful. In the space of the last 12 months, they have progressed from storing print to storing music that could be decoded and played back without any loss of quality. Big Data = Big Bucks $$$$DNA is infinitely small, stores a ton of data, is cheap and has a very long shelf life. It’s not going to be obsolete even in 10,000 years. Compare that to the current silicon based magnetic tape decks that degrade and have to be copied every 10 years. But the biggest factor in favor of DNA is that it’s abundant. This is very important as there is a looming need for new data storage! Data is exploding so fast that new words are being invented to keep pace. Gone are the glory days of Gigabytes and Terabytes and even Petabytes. The world has now moved on to Exabytes, Zettabytes and Yottabytes. We’re moving so fast you probably think I’m making those names up! But they’re real. And this data trend is important for investors. Just so you know, 1 yottabyte equals 931,322,574,615,480 gigabytes. That’s equivalent to the storage capacity of a hundred billion top-end laptops. And even as you’re trying to get your head around that, they are already discussing brontobytes (the next level) in hushed whispers. But let’s talk in words and numbers you and I understand… The Human Processor Is Coming…By 2020, every human being will generate approximately 1.7 MB of data per second. That’s 146,880 MB per day. Per person! As data grows bigger, there is a growing need for space to store it. You’ve undoubtedly heard of “the cloud.” But let’s not forget that the cloud needs a home. And server farms and processors are not cheap…

And rising costs are not the only factor. The bigger problem is that at the rate data is exploding, the earth is expected to run out of memory-grade silicon soon. Data storing companies are frantically trying to find a solution for a problem they know is going to engulf, nay, submerge them. The Answer Lies In Your DNAWhether you are a bug, a potato, or President Trump, your DNA stores your most important information. And now that scientists have figured out how to store data on DNA, the world’s data storage problems are as good as solved. When perfected, all of today’s data (I’m talking of all the data stored in the thousands of data centers around the globe) can be stored in DNA that can fit into a semi-trailer. This is why the biggest data storage companies are putting big bucks into this technology. Over the past five years, more than $45 billion of investment capital has flowed into the data center sector. This is where the smart money is. And it’s continuing to grow. A lot of startups are looking at DNA just as people looked at Silicon in the late 80s early 90s. Think Intel, AMD, Qualcomm… Your Billion Dollar Blood… (Bye Bye, Silicon. Hello DNA!)While DNA undoubtedly offers immense data storage capabilities, it offers an even bigger investment opportunity. Companies like IBM, Google, Facebook, Apple and Microsoft are investigating the use of DNA to store vast quantities of digitized data. But you might do well to look at the little-known players that are focused entirely on DNA data storage. Here’s a few of the best names in the space: Evonetix: Founded in 2015, this U.K. startup has taken in $14 million in funding to develop technology that allows them to create long DNA threads accurately and at scale, a prerequisite to using DNA for data storage. Catalog: This Massachusetts startup company has taken in $9.3 million in funding from a diverse set of 25 investors so far since its launch in 2016. You might be interested to know that Chinese internet giant Baidu is one of these investors. Twist BioScience: This San Francisco startup is leading the pack. It has over $253 million in funding from 24 different investors including Illumina and asset manager Fidelity. Having recently closed a massive Series D funding, Twist may have enough capital to start thinking in IPO terms. Unfortunately, none of these small companies are publically traded. Yet! But, there’s big money in the new “blood valley” and I want to make sure you see this huge trend coming down the road. Here’s to a stable retirement,

Patrick Stout The post TECH ALERT: Big Bucks From "Blood Valley" appeared first on Daily Reckoning. |

| Free-Riding Investors Set up Markets for a Major Collapse Posted: 24 Sep 2018 06:57 AM PDT This post Free-Riding Investors Set up Markets for a Major Collapse appeared first on Daily Reckoning. Free riding is one of the oldest problems in economics and in society in general. Simply put, free riding describes a situation where one party takes the benefits of an economic condition without contributing anything to sustain that condition. The best example is a parasite on an elephant. The parasite sucks the elephant's blood to survive but contributes nothing to the elephant's well-being. A few parasites on an elephant are a harmless annoyance. But sooner or later the word spreads and more parasites arrive. After a while, the parasites begin to weaken the host elephant's stamina, but the elephant carries on. Eventually a tipping point arrives when there are so many parasites that the elephant dies. At that point, the parasites die too. It's a question of short-run benefit versus long-run sustainability. Parasites only think about the short run. A driver who uses a highway without paying tolls or taxes is a free rider. An investor who snaps up brokerage research without opening an account or paying advisory fees is another example. Actually, free-riding problems appear in almost every form of human endeavor. The trick is to keep the free riders to a minimum so they do not overwhelm the service being provided and ruin that service for those paying their fair share. The biggest free riders in the financial system are bank executives such as Jamie Dimon, the CEO of J.P. Morgan. Bank liabilities are guaranteed by the FDIC up to $250,000 per account. Liabilities in excess of that are implicitly guaranteed by the "too big to fail" policy of the Federal Reserve. The big banks can engage in swap and other derivative contracts "off the books" without providing adequate capital for the market risk involved. Interest rates were held near zero for years by the Fed to help the banks earn profits by not passing the benefits of low rates along to their borrowers. Put all of this (and more) together and it's a recipe for billions of dollars in bank profits and huge paychecks and bonuses for the top executives like Dimon. What is the executives' contribution to the system? Nothing. They just sit there like parasites and collect the benefits while offering nothing in return. Given all of these federal subsidies to the banks, a trained pet could be CEO of J.P. Morgan and the profits would be the same. This is the essence of parasitic behavior. Yet there's another parasite problem affecting markets that is harder to see and may be even more dangerous that the bank CEO free riders. This is the problem of "active" versus "passive" investors. An active investor is one who does original research and due diligence on her investments or who relies on an investment adviser or mutual fund that does its own research. The active investor makes bets, takes risks and is the lifeblood of price discovery in securities markets. The active investor may make money or lose money (usually it's a bit of both) but in all cases earns her money by thoughtful investment. The active investor contributes to markets while trying to make money in them. A passive investor is a parasite. The passive investor simply buys an index fund, sits back and enjoys the show. Since markets mostly go up, the passive investor mostly makes money but contributes nothing to price discovery. The benefits of passive investing have been trumpeted by Jack Bogle of the Vanguard Group. Bogle insists that passive investing is superior to active investing because of lower fees and because active managers can't "beat the market." Bogle urges investors to buy and hold passive funds and ignore market ups and downs. The problem with Bogle's advice is that it's a parasitic strategy. It works until it doesn't. In a world in which most mutual funds and wealth managers are active investors, the passive investor can do just fine. Passive investors pay lower fees while they get to enjoy the price discovery, liquidity and directional impetus provided by the active investors. Passive investors are free riding on the hard work of active investors the same way a parasite lives off the strength of the elephant. What happens when the passive investors outnumber the active investors? The elephant starts to die. The following chart shows that this is exactly what is happening. Since 2009, over $2.5 trillion of equity investment has been added to passive-strategy funds, while $2.0 trillion has been withdrawn from active-strategy funds. The active investors who do their homework and add to market liquidity and price discovery are shrinking in number. The passive investors who free ride on the system and add nothing to price discovery are expanding rapidly. The parasites are starting to overwhelm the elephant.

This chart reveals the most dangerous trend in investing today. Since the last financial crisis, $2.5 trillion has been added to "passive" equity strategies and $2.0 trillion has been withdrawn from "active" investment strategies. This means more investors are free riding on the research of fewer investors. When sentiment turns, the passive crowd will find there are few buyers left in the market. There's much more to this analysis than mere opinion or observation. The danger of this situation lies in the fact that active investors are the ones who prop up the market when it's under stress. If markets are declining rapidly, the active investors see value and may step up to buy. If markets are soaring in a bubble fashion, active investors may take profits and step to the sidelines. Either way, it's the active investors who act as a brake on runaway behavior to the upside or downside. Active investors perform a role akin to the old New York Stock Exchange specialist who was expected to sell when the crowd wanted to buy and to buy when the crowd wanted to sell in order to maintain a balanced order book and keep markets on an even keel. Passive investors may be enjoying the free ride for now but they're in for a shock the next time the market breaks, as it did in 2008, 2000, 1998, 1994 and 1987. When the market goes down, passive fund managers will be forced to sell stocks in order to track the index. This selling will force the market down further and force more selling by the passive managers. This dynamic will feed on itself and accelerate the market crash. Passive investors will be looking for active investors to "step up" and buy. The problem is there won't be any active investors left or at least not enough to make a difference. The market crash will be like a runaway train with no brakes. The elephant will die. Regards, Jim Rickards The post Free-Riding Investors Set up Markets for a Major Collapse appeared first on Daily Reckoning. |

| The Tripwire on the Next “Black Monday” Posted: 24 Sep 2018 06:55 AM PDT This post The Tripwire on the Next "Black Monday" appeared first on Daily Reckoning. "Black Monday" — Oct. 19, 1987 — remains the bloodiest one-day carnage in market history. 508 points the Dow Jones plunged that hell-sent day — an impossible 22%. A similar stock market event today would translate to a 5,843-point cataclysm. We compare that October day to the ancient Battle of Cannae, when invincible Rome lost as many as 70,000 legionnaires to Hannibal's armies — in a single day. Or to the first day of the Battle of the Somme, July 1, 1916, when nearly 20,000 British soldiers fell flat under the German guns… and never got up. What could lead today's market to its own Cannae, its own Somme — its own Black Monday? Today we consider one harrowing possibility… Harley Bassman is a world-class expert in derivatives — what Warren Buffett has termed "weapons of mass destruction." Not long ago Bassman set out with one question in mind:

That is, what could turn a bad day on Wall Street into another Black Monday? And is there a specific percentage decline that could start the dominoes going over? Bassman's researches indicate there is. But what? Before revealing that (black) magic number, let us identify the villain of this tale, a possible trigger for the next horror picture: Passive investing. After the 2008 near-collapse, the emergency responders at the Federal Reserve inundated markets with oceans of liquidity. The biblical-level flooding knocked down existing financial signposts… and "fundamentals" no longer seemed to matter. The tide was rising, and all boats with it. "Active" asset managers on the hunt for market inefficiencies could no longer separate winner from loser. Some 86% of all actively managed stock funds have underperformed their index during the last 10 years. Explains Larry Swedroe, director of research at Buckingham Strategic Wealth: "While it is possible to win that game, the odds of doing so are so poor that it's simply not a prudent choice to play." "Passively" managed funds — on the other hand — make no effort to pinpoint winners. "Passive" because they sit back on their oars… and let the flowing tide lift their boat. They track an overall index or asset category — not the individual components. It is a strategy that has yielded handsome dividends this past decade of rising waters, as Tim Decker, president and CEO of ISI Financial Group, explains:

Passive investing has increased from 15% in 2007 to perhaps 35% by the end of 2017. It is a percentage that is only rising. All is swell as long as rainbows appear in the skies over Wall Street and the tide continues to rise. But the risk is this: When the tide recedes… it recedes. As Jim Rickards explains:

But comes the central question: How far might stocks have to sink before unleashing the hounds — and another Black Monday? The aforesaid Bassman's investigations have yielded an answer… A 4% single-day drop could prove sufficient: It seems possible that as little as a 4% decline in a single day could be enough to create critical mass. From today's stratospheric Dow reading of 26,555 … a 4% single-day swoon translates to an 1,062-point loss. A thumping drop, yes — but not beyond imagining. The Dow Jones plunged nearly 3% just this March after the Trump administration announced tariffs on China. Must we stretch our minds far to conceive a 4% loss? Not much… we dare say. And then what happens, Jim Rickards?

Consequently: "This is one more reason why the next stock market crash will be the greatest in history." Let the record reflect… that history includes 1929, 1987, 2000… and 2008. Perhaps passive investing will write the next harrowing chapter… Regards, Brian Maher The post The Tripwire on the Next "Black Monday" appeared first on Daily Reckoning. |

| Exploration and Development Plans Expand on Carlin Trend Project Posted: 24 Sep 2018 01:00 AM PDT The gold explorer and developer announced that three new exploration targets will be drill tested. |

| Site Visit to Quebec Project Leaves 'Positive' Impressions Posted: 24 Sep 2018 01:00 AM PDT A BMO Capital Markets report provided one analyst's takeaways from his trip to this gold major's Canadian mine. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment