saveyourassetsfirst3 |

- Mannarino: They’re Suppressing Gold & Silver So That Govts, Banks And The Elite Can Buy Physical

- Silver Set To Shine: SchiffGold Friday Gold Wrap 01.05.18

- David Morgan: The “Oh My” Moment Is Coming For Silver

- Jim Rickards: The Gold Bull Market Will Last Until At Least 2028

- Gold & Silver Will Offer Protection When The 4th Industrial Revolution Takes A Turn For The Worse

- Central Bank Tightening Will Cause More Volatility in 2018

- TheDailyGold Premium Update #551

- Harley Schlanger: We Are In A Great Ponzi Scheme – The Economy IS NOT Growing

- Breaking News And Best Of The Web

- Here are the Key Levels in Gold & Gold Miners

- Interview with Korelin Economics Report: Why Gold Could Breakout in 2018

| Mannarino: They’re Suppressing Gold & Silver So That Govts, Banks And The Elite Can Buy Physical Posted: 07 Jan 2018 12:00 PM PST Gregory Mannarino says that while the public remains oblivious, those in the know are scarfing up physical gold & silver. Here’s the details… Gregory Mannarino interviewed by Greg Hunter on […] The post Mannarino: They’re Suppressing Gold & Silver So That Govts, Banks And The Elite Can Buy Physical appeared first on Silver Doctors. |

| Silver Set To Shine: SchiffGold Friday Gold Wrap 01.05.18 Posted: 07 Jan 2018 09:14 AM PST |

| David Morgan: The “Oh My” Moment Is Coming For Silver Posted: 07 Jan 2018 09:00 AM PST David says that right now the people are brainwashed, but the “oh my” moment is coming when the people will return to gold & silver… David Morgan interviewed by World […] The post David Morgan: The “Oh My” Moment Is Coming For Silver appeared first on Silver Doctors. |

| Jim Rickards: The Gold Bull Market Will Last Until At Least 2028 Posted: 07 Jan 2018 06:00 AM PST JIm says that this new bull market is the real deal, with his initial target of $1400 by year’s end. Here’s more… by Jim Rickards via Daily Reckoning A new, […] The post Jim Rickards: The Gold Bull Market Will Last Until At Least 2028 appeared first on Silver Doctors. |

| Gold & Silver Will Offer Protection When The 4th Industrial Revolution Takes A Turn For The Worse Posted: 07 Jan 2018 03:00 AM PST Lynette Zang says that gold & silver will give a person options when things take a turn for the worse. Here’s the details… Lynette Zang interviewed by Sean of SGTreport […] The post Gold & Silver Will Offer Protection When The 4th Industrial Revolution Takes A Turn For The Worse appeared first on Silver Doctors. |

| Central Bank Tightening Will Cause More Volatility in 2018 Posted: 06 Jan 2018 08:30 PM PST Peter Boockvar discusses what effects increasing volatility will have on markets in 2018, including the potential for a stock market crash… Peter Boockvar interviewed on Wall St For Main St […] The post Central Bank Tightening Will Cause More Volatility in 2018 appeared first on Silver Doctors. |

| TheDailyGold Premium Update #551 Posted: 06 Jan 2018 07:09 PM PST TDG #551, a 32-page update was published and emailed to subscribers Saturday evening. It was also uploaded to the members section. This update included, among other things, notes on five companies, two of which we do not own (p3-p4), Q&A on two other companies (p5), updated junior bull analog charts (p20-p21) and some historical Gold & Silver charts (p7-p9). We mentioned a company which we do not own but consider to be the best buy right now. It rates strong as far as fundamental value and the chart is very bullish.

|

| Harley Schlanger: We Are In A Great Ponzi Scheme – The Economy IS NOT Growing Posted: 06 Jan 2018 06:00 PM PST Harley says President Trump is trying to buy more time to get the American people behind him so that we can begin to rebuild together… Harley Schlanger interviewed on the […] The post Harley Schlanger: We Are In A Great Ponzi Scheme – The Economy IS NOT Growing appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 06 Jan 2018 04:44 PM PST Global stocks jump to all-time highs. Jeremy Grantham's strongest "bubble burst" alarm just went off. Is the “QE party over”?And should we embrace the “twilight of the debt bubble age”?Gold and silver rising again, now at multi-week highs. Best Of The Web Market structure – Credit Bubble Bulletin Jeremy Grantham’s strongest “bubble burst” […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Here are the Key Levels in Gold & Gold Miners Posted: 05 Jan 2018 08:37 PM PST

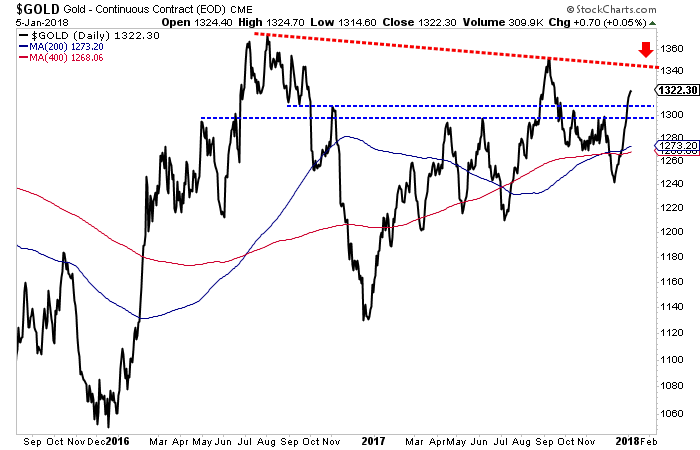

The rally in Gold and gold mining stocks easily surpassed our expectations and targets. The strength has been far more than we anticipated. The gold stocks blew past their 200-day moving averages while Gold blew past $1300/oz. Now it is time to take a technical look and focus on the key support and resistance targets. The strength of the rebound pushed the miners well beyond their 200-day moving averages and to their June and October highs. GDX is consolidating just below $24 while GDXJ is consolidating just below $35. If this consolidation turns into a correction then GDX and GDXJ could find support at their 200-day moving averages which are at $22.71 and $33.37 respectively. As you can see, should GDX and GDXJ be able to exceed recent peaks then they could rally towards important resistance levels. Those are $25.50 for GDX and $38 for GDXJ.

The rally has been just as strong in Gold as it surpassed resistance in the $1300-$1310/oz zone. Gold closed the week at $1322/oz. Should Gold pause or correct here then the sellers could push the market down to previous resistance but now current support at $1300-$1310/oz. Trendline resistance will come into play near $1340/oz while the 2016 and 2017 peaks would provide resistance in the $1350-$1370/oz zone.

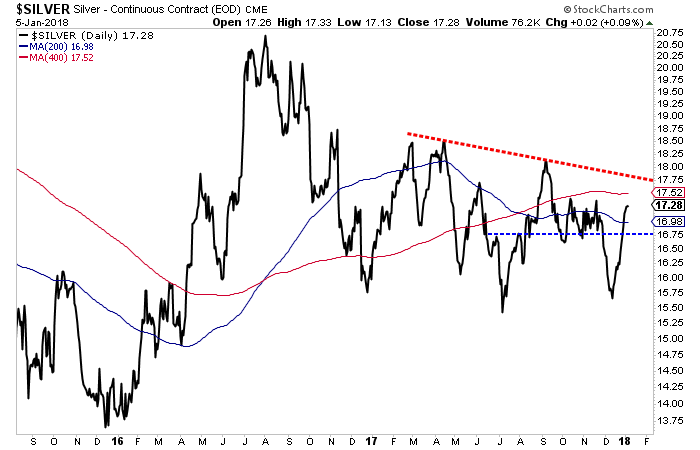

While we are at it, let us take a look at Silver which exploded past resistance in the mid $16s. Silver will face resistance first at $17.75 then at $18.50. A break above $17.75 and the red trendline is the first step for Silver. The second would be reaching $18.50, a new 52-week high. Next week Silver will face immediate resistance around $17.30 (the October and November highs) but it will have strong support in the mid to upper $16s.

The precious metals complex has made important progress in recent weeks. Markets have broken key resistance levels and have showed no signs of slipping anytime soon. Gold is holding above previous resistance at $1300-$1310/oz while not being far from multi-year resistance in the mid to upper $1300s. The gold mining stocks have reclaimed their 200-day moving averages while consolidating tightly beneath the June and October highs. If and when GDX and GDXJ break those levels then they will be only one step away from a full blown bull market. That step is breaking above the September highs. In recent weeks our tone has shifted and as such we have accumulated a few new positions. We seek the juniors that are trading at reasonable values and have technical and fundamental catalysts to drive increased buying. To follow our guidance and learn our favorite juniors for 2018, consider learning more about our premium service.

|

| Interview with Korelin Economics Report: Why Gold Could Breakout in 2018 Posted: 05 Jan 2018 01:17 AM PST Jordan Roy-Byrne, Founder of The Daily Gold posted a great article outlining why he thinks gold could breakout in 2018. The link to the full post in below. In the interview we focus on the potential of inflation and how long term bonds play a roll in telling us. Also how historical recoveries seem to repeat themselves. Click Here to Learn More & Subscribe to TheDailyGold Premium

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment