saveyourassetsfirst3 |

- Is This The Long-Awaited Gold Break-Out – Or Just Another Paper Market Head Fake?

- Peter Schiff: The Very Same Day Gold Trades Above $1350 It Could Soar Past $1400

- The Top 3 Dividend Growth Stocks For A Weak Dollar

- X22 Report Breaks-Down Marshall Swing’s July 20th Global Economic Collapse Call

- Sean at SGTreport Shreds The “Q Is A Psyop” Meme

- Canadian Dollar Caught Between Hot Economy And Cold NAFTA

- The World’s Most Corrupt Man

- Social Change Will Upend the Status Quo

- Lior Gantz: China Dumping U.S. Debt Changes EVERYTHING

- Breaking News And Best Of The Web

- Rick Rule: Precious Metal Investment Demand Could Quadruple For This Reason

- Gonna Fly Now? Gold & Silver Have The Eye Of The Tiger

- One Big, Potential Catalyst for Gold in 2018

- Silver Antidote to Bubble Craziness

- Fund Manager: The Blockchain Name-Change Game And Securities Fraud

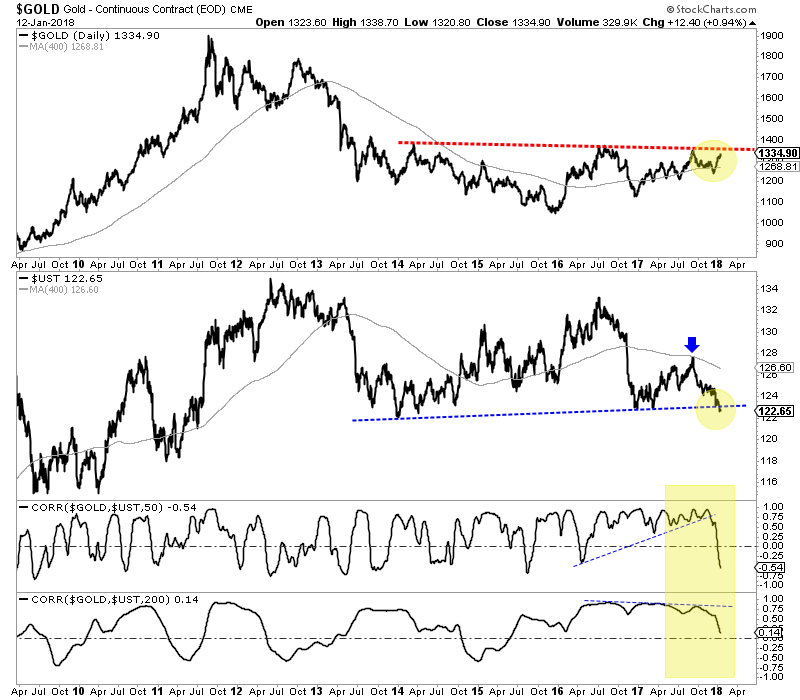

| Is This The Long-Awaited Gold Break-Out – Or Just Another Paper Market Head Fake? Posted: 13 Jan 2018 12:33 PM PST That was fun. Since mid-December gold has behaved like a tech stock, jumping from $1,240/oz to $1,337 and carrying a long list of gold mining stocks along for the ride. Now everybody's asking the same question: Is this finally the start of the long-overdue run at gold's (and silver's) 2011 record high, or just a […] The post Is This The Long-Awaited Gold Break-Out – Or Just Another Paper Market Head Fake? appeared first on DollarCollapse.com. |

| Peter Schiff: The Very Same Day Gold Trades Above $1350 It Could Soar Past $1400 Posted: 13 Jan 2018 12:00 PM PST Peter Schiff says that once gold gets moving, $1600 and $1700 are not far away. Here’s the details… Peter Schiff via Peter Schiff Podcast Peter Schiff provides a timely update […] The post Peter Schiff: The Very Same Day Gold Trades Above $1350 It Could Soar Past $1400 appeared first on Silver Doctors. |

| The Top 3 Dividend Growth Stocks For A Weak Dollar Posted: 13 Jan 2018 09:34 AM PST |

| X22 Report Breaks-Down Marshall Swing’s July 20th Global Economic Collapse Call Posted: 13 Jan 2018 09:00 AM PST Marshall Swing’s call may not be as far out in left field as many people think. Here’s why… In a recent episode of the X22 Report, Dave looks at the […] The post X22 Report Breaks-Down Marshall Swing’s July 20th Global Economic Collapse Call appeared first on Silver Doctors. |

| Sean at SGTreport Shreds The “Q Is A Psyop” Meme Posted: 13 Jan 2018 06:00 AM PST After presenting both pro-Q and anti-Q posts this week, it seems there is no longer any contention: Sean just shredded the naysayers… by Sean of SGTreport There is a growing […] The post Sean at SGTreport Shreds The “Q Is A Psyop” Meme appeared first on Silver Doctors. |

| Canadian Dollar Caught Between Hot Economy And Cold NAFTA Posted: 13 Jan 2018 04:07 AM PST |

| Posted: 13 Jan 2018 03:00 AM PST “you can bet he isn't going to be putting the curbs on this oil price rally any time soon…” by Jody Chudley via Daily Reckoning You have to admire the […] The post The World’s Most Corrupt Man appeared first on Silver Doctors. |

| Social Change Will Upend the Status Quo Posted: 12 Jan 2018 07:30 PM PST Charles Hugh Smith says that everything needs to change. From the bottom up. Here’s the details… by Charles Hugh Smith via Of Two Minds The nation is fragmenting because the […] The post Social Change Will Upend the Status Quo appeared first on Silver Doctors. |

| Lior Gantz: China Dumping U.S. Debt Changes EVERYTHING Posted: 12 Jan 2018 06:00 PM PST Lior says that there’s big changes happening and they are laid out for all to see via the U.S. bond market. Here’s the details… Lior Gantz interviewed by Rory Hall […] The post Lior Gantz: China Dumping U.S. Debt Changes EVERYTHING appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 12 Jan 2018 04:44 PM PST US retail sales and inflation both jump, Treasury yields “spike.” The next financial crisis will be worse than the last. Ted Butler’s “last great silver buy.” Bitcoin plunges to $14,000 as South Korea moves to ban crypto trading. Doug Noland on the financial markets’ dysfunctional structure. Gold and silver near multi-week highs as futures market […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Rick Rule: Precious Metal Investment Demand Could Quadruple For This Reason Posted: 12 Jan 2018 04:30 PM PST Rick Rule tells Silver Doctors why precious metals investment demand could be set to quadruple. Here’s the details… Rick Rule, President and CEO of Sprott Global Resource Investments interviewed by […] The post Rick Rule: Precious Metal Investment Demand Could Quadruple For This Reason appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Gonna Fly Now? Gold & Silver Have The Eye Of The Tiger Posted: 12 Jan 2018 03:00 PM PST SD Friday Wrap: Gold and silver finish the week with bullish momentum (plus a Dow call that’s as plausible as it is ridiculous). Here’s the details… What a gut-wrenching, difficult […] The post Gonna Fly Now? Gold & Silver Have The Eye Of The Tiger appeared first on Silver Doctors. |

| One Big, Potential Catalyst for Gold in 2018 Posted: 12 Jan 2018 01:52 PM PST

The rebound in the precious metals sector continues. Friday, Gold pushed to another new high, near $1340/oz. Gold stocks led by the HUI Gold Bugs Index and GDX also made a new high with juniors and Silver right behind. The greatest traders say the move comes first and then the reason later. When it comes to Gold we are always analyzing the reason behind the moves so we can distinguish between reactions and reflex moves and those moves that are part of a real bull market. The market may be starting to sniff out a potential big catalyst for Gold that could drive its breakout in 2018. With respect to Gold and Bonds an important change has taken place in recent months. The two asset classes had been positively correlated. When rates declined, Gold moved higher. When rates rebounded, Gold struggled. That is what happens when inflation is low and not trending. However, now we see

As we've written in the past, higher long-term yields are bullish when they rise faster than short-term yields. That is a steepening of the yield curve and indication of inflation. At present, higher long-term rates could help bid Gold in a few different ways. First, for those who are seeking income they enhance the appeal of bonds relative to stocks. Second and more importantly, higher long-term rates will hurt what is an over-indebted economy and government at somepoint. Debt payments rise. Credit growth can slow. The threshold of that remains to be seen. Perhaps it could be 3.00% on the 10-year yield. It is counterintuitive but upward pressure on long-term rates can be very bullish for Gold (in the present environment) as it necessitates the need for lower or stable long-term rates (amid an inflationary environment). It all comes back to debt. At somepoint rising rates negatively impact the economy and the government's balance sheet. If that creates the need for central bank intervention and monetization while inflation is running then that is what can push Gold to $2000-$3000/oz in the next several years. The looming, potential breakdown in long-term Bonds could be a major catalyst for the breakout in precious metals. Don't wait too long, as gold stocks remain historically and incredibly cheap. Select junior miners and explorers have the chance to be 5-10 baggers if Gold breaks resistance and trends towards its 2011 high. We seek the juniors that are trading at reasonable values but have fundamental and technical catalysts that will drive increased buying. To follow our guidance and learn our favorite juniors for 2018, consider learning more about our premium service.

Jordan@TheDailyGold.com

|

| Silver Antidote to Bubble Craziness Posted: 12 Jan 2018 01:30 PM PST  CHARACTERISTICS OF BUBBLE CRAZINESS: U.S. stocks, according to many measures, are the most over-valued in history. We live in a Bubble Zone! Bitcoin and other cryptos are definitely in a bubble, but they could rise even higher. Bonds yield little, and in many European countries, less than zero. Central banks have created this distortion to [...] CHARACTERISTICS OF BUBBLE CRAZINESS: U.S. stocks, according to many measures, are the most over-valued in history. We live in a Bubble Zone! Bitcoin and other cryptos are definitely in a bubble, but they could rise even higher. Bonds yield little, and in many European countries, less than zero. Central banks have created this distortion to [...] |

| Fund Manager: The Blockchain Name-Change Game And Securities Fraud Posted: 12 Jan 2018 01:30 PM PST Dave Kranzler says “this is an example of the blatant fraud and corruption that accompanies the top of a stock market bubble”. Here’s just how blatant it has become… by […] The post Fund Manager: The Blockchain Name-Change Game And Securities Fraud appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment