Gold World News Flash |

- Brace Yourself for THE GREAT COLLAPSE OF 2017

- BREAKING: Edward Snowden Re-emerg & Backs Wikileaks! He Confirms EVERYTHING!

- Are We Witnessing The Weirdest Moment In Economic History?

- Fed Ripples? Yuan Tumbles To 2017 Lows As Chinese Money Market Liquidity Dries Up (Again)

- Sprott makes hostile $3.1 billion bid for Central Fund of Canada

- Ron Paul urges Arizona lawmakers to end capital gains tax on gold coins

- Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

- Gold Price Closed at $1208.50 Down $6.60 or -0.54%

- The Real Reason for the Trump Rally?

- This Mini-Bubble Could Burst at Any Moment

- Gold Seeker Closing Report: Gold and Silver Fall As Dollar Tops 102

- A Whole New World of Gold Demand Is Opening Up... Muslims

- No Surprise in Recent Moves in Gold and Silver Markets

- EURUSD: When Price Pattern Trumps Other "Reasons"

- A Whole New World of Gold Demand Is Opening Up... Muslims

- #Wikileaks #Vault7 : Here's All You Need To Know

- 1 Bitcoin = 1 Oz. Gold?

- Home Again, and Hello Dante

- Will Gold Continue to Drop? Rate Hikes, COMEX Shorts, Divergent Tops, Oh My!!

- Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Institutions (Part II)

- Trump's Monetary Intervention, A Repeat of the Plaza Accord

- Indian gold imports said to almost triple on wedding demand

- Hochschild Mining swings back to profit as gold and silver prices rise

- Breaking News And Best Of The Web

- No Surprise in Recent Moves in Gold and Silver Markets

- Gold Price Hits 5-Week Low as Dollar Gains on ADP Jobs Data, Trade Deficit 'Looms'

- Gold Investing 101 – Beware eBay, Collectibles and “Pure” Gold Coins that are Gold Plated

| Brace Yourself for THE GREAT COLLAPSE OF 2017 Posted: 08 Mar 2017 11:00 PM PST Current stock market valuations are not sustainable. In 1929, 2000 and 2008, stock prices soared to absolutely absurd levels just before horrible stock market crashes with economic collapse. What goes up must eventually come down, and the stock market bubble of today will be no exception and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Edward Snowden Re-emerg & Backs Wikileaks! He Confirms EVERYTHING! Posted: 08 Mar 2017 10:00 PM PST BREAKING: Edward Snowden Just Re-emerged & Backed Wikileaks! What He Said Confirms EVERYTHING! The evidence will be too overwhelming to ignore or pass over. Somebody is going to jail. Guaranteed. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are We Witnessing The Weirdest Moment In Economic History? Posted: 08 Mar 2017 08:15 PM PST Via Brandon Smith of Alt-Market.com, It is an unfortunate reality that most people tend to be oblivious to massive sea changes in geopolitics and economics. You would think that these events would catch the immediate attention of everyone as they happen, but usually it is not until they realize that the microcosm of their personal lives is subject to the consequences of the macrocosm that they wake up and take notice. There are, however, ways to train yourself to pick up on signals within the news cycle and within political and financial rhetoric; signals that indicate a great shift is perhaps on the way. Sometimes these initial signs are subtle, sometimes they are as subtle as a feminist slut-walk. I would point out that over the next few months there are dangerous correlations so numerous and blatant in the economic sphere that I would almost rather watch a marching gaggle of frumpy feminists wearing nothing but electrical tape than bear witness to the mayhem that is about to strike the unwitting public. What am I talking about? Well, let’s go through the list…

If You Thought 2016 Was Weird… If you thought 2016 was weird, I suggest you get comfortable with the surreal because it is not going away anytime soon. 2017 is a veritable treasure trove of falling elevators, and I haven’t even covered half of the issues facing the economy this year. But what about the macro-analysis? To summarize, it seems to me that many of these events, stacked so closely together, are not coincidental in their timing. As I have noted in articles such as The Economic End Game Explained, globalists have been openly planning for decades to set in motion a vast financial overhaul and the launch of a single global economy and currency (the seeds being planted starting in 2018). If this is still their timeline, then it would follow that they would need a series of fiscal earthquakes designed to shake up the “old world order” to make way for a “new world order.” Perhaps each of these events will result in a “stable” outcome and there is nothing to be concerned about. That said, I don’t believe in chance. Most geopolitical outcomes are influenced by internationalist players, which makes the outcomes of these events predictable. This is what made the Brexit predictable, and it is what made Trump’s victory predictable. Everything about the confluence of political and economic events in 2017 suggests to me a festering crisis atmosphere. As I have always said, economic collapse is a process, not a singular moment in time. This process lulls the masses into complacency. You can show them warning sign after warning sign, but most of them have no concept of what a collapse is. They are waiting for a cinematic moment of revelation, a financial explosion, when really, the whole disaster is happening in slow motion right under their noses. Economies do not explode, they drown as the water rises one inch at a time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed Ripples? Yuan Tumbles To 2017 Lows As Chinese Money Market Liquidity Dries Up (Again) Posted: 08 Mar 2017 07:54 PM PST In what could be the beginning of ripples from The Fed's jawboned 'certainty' of a March rate-hike, Chinese money market liquidity conditions appear to be drying up once again as overnight offshore yuan rates surge 142bps to one-month highs. Additionally, 1-week CNH Hibor +1.05 ppts to 4.53017%; and 1-month CNH Hibor +70bps to 4.9395%

At the same, spot offshore Yuan rates have plunged to their lowest since January 4th's massive short squeeze.

As it appears 2017 is Shangahi Accord Redux time - (China 'agrees' to weaken the Yuan against non-USD currencies, while "stabilizing" the Yuan against the USD... until that breaks)

The question is - will a sudden renewed but of volatility in credit markets (high yield crashed this week), commodity markets (crude and copper collapse this week), emerging market stocks (tumbling), and now China money markets, be enough to stall a determined Fed, and crush their credibility once and for all? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sprott makes hostile $3.1 billion bid for Central Fund of Canada Posted: 08 Mar 2017 05:19 PM PST From the Canadian Press http://www.cbc.ca/news/canada/calgary/sprott-takeover-bid-central-fund-c... Toronto-based Sprott Inc. said Wednesday it's making an all-share hostile takeover bid worth $3.1 billion US for rival bullion holder Central Fund of Canada Ltd. The money-management firm has filed an application with the Court of Queen's Bench of Alberta seeking to allow shareholders of Calgary-based Central Fund to swap their shares for ones in a newly-formed trust that would be substantially similar to Sprott's existing precious metal holding entities. The company is going through the courts after its efforts to strike a friendly deal were rebuffed by the Spicer family that controls Central Fund, said Sprott spokesman Glen Williams. "They weren't interested in having those discussions," Williams said. ... Dispatch continues below ... ADVERTISEMENT Golden Predator Begins Drill Program at 3 Aces Project Company Announcement Thursday, February 23, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to announce it has commenced a 20,000-meter drill program at its fully owned 3 Aces project in southeastern Yukon. The drilling program will initially focus on targets in the Spades Zone, where 2016 results included a new vein discovery at depth plus 7.5 meters of 33 grams-per-tonne gold at the Ace of Spades. Management is also pleased to announce that Golden Predator has been named a TSX Venture Top 50 company, placing fifth of 957 mining companies. ... ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_02_23.pdf Sprott is using the courts to try to give holders of the 252 million non-voting class A shares a say in takeover bids, which Central Fund explicitly states they have no right to participate in. That voting right is reserved for the 40,000 common shares outstanding, which the family of J.C. Stefan Spicer, chairman and CEO of Central Fund, control. If successful through the courts, Sprott would then need the support of two-thirds of shareholder votes to close the takeover deal, but there's no guarantee they will make it that far. "It is unusual to go this route," said Williams. "There's no specific precedent where this has worked." Sprott did have success last year in taking over Central GoldTrust, a similar fund that was controlled by the Spicer family, after securing support from more than 96 percent of shareholder votes cast. The firm says Central Fund's shares are trading at a discount to net asset value and a takeover by Sprott could unlock US$304 million in shareholder value. Central Fund did not have any immediate comment on the unsolicited offer. Williams said Sprott had not yet heard from Central Fund on the proposal but that some shareholders had already contacted them to voice their support. Sprott's existing precious metal holding companies are designed to allow investors to own gold and other metals without having to worry about taking care of the physical bullion. Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul urges Arizona lawmakers to end capital gains tax on gold coins Posted: 08 Mar 2017 05:07 PM PST By Howard Fischer http://tucson.com/news/ron-paul-to-az-lawmakers-end-capital-gains-tax-on... PHOENIX -- Invoking claims of illegally printed paper money, the use of gold in the Bible and even foreign entanglements, former Congressman Ron Paul urged Arizona lawmakers Wednesday to let coin collectors and investors escape the state's capital gains tax. Paul, a three-time presidential hopeful, told members of the Senate Finance Committee it's not fair or even legal from his perspective for the government to take its share when someone who bought a coin at $300 later sells it for $1,200. ... Dispatch continues below ... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: He said the value of the coin really remains the same. It's the value of that paper money -- money he contends is "fraud" -- that's gone down. Paul's testimony helped buttress similar claims by Rep. Mark Finchem, R-Oro Valley, who already has ushered the tax break in HB 2014 through the House. The result was the Senate panel giving its OK on a 4-3 party-line vote and sending it to the full Senate. But the real hurdle remains Republican Gov. Doug Ducey who vetoed similar measures in 2015 and again last year saying he feared the unintended consequences of such a change in tax law. That isn't a unique concern. In 2013, Republican Jan Brewer also used her veto stamp. "This would result in lost revenue to the state, while giving businesses that buy and sell collectible coins or currency originally authorized by Congress an unfair advantage," she wrote at the time. That was exactly the complaint made Wednesday by Sen. Steve Farley, D-Tucson, in urging colleagues to kill the measure. He said the legislation would make sense if a $20 gold piece sold for $20 in what most people recognize as legal currency. But what it sells for, Farley said, is based on a combination of the amount of precious metal, the condition of the coin and the demand for what might be a rare coin. "So to give someone a capital gains tax break on the money they make ... from selling that coin seems like just simply a tax giveaway that other people would be paying for because we're going to need to get enough money to pay for our roads and schools anyway," Farley said. "Why does the government need the money is the big question," Paul said. Anyway, he said, if the government needs money it should tax people "more honestly" than by making them pay capital gains for their efforts to protect themselves against inflation. Farley, for his part, said the flaw in the arguments by supporters of the legislation is that somehow the type of investment decision should govern its tax liability. "There's a lot of places people can decide to invest their money as a hedge against inflation," he said. "You can invest it in stocks, you can invest it in real estate, your house, a lot of other things," Farley continued. "That also goes up in value over time and that represents, at least in some part, inflation." The difference here, Farley said, is that people pay capital gains taxes when they sell a stock or any other investment for a profit; this bill creates a special exemption for gold and silver coins. "So to me that's picking winners and losers," he told the former Texas congressman. "I understand your point," Paul responded. "But the important point is stocks are not money and gold and silver are money." And that goes to his contention that there's no legal basis for all this paper money out there. "Congress is allowed to coin money," Paul said. "They don't have the authority to print money." One thing the panel did not consider is what would be the cost to the state of such an exemption. No one was able to provide a figure of the tax implications of such an exemption. Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Mar 2017 04:18 PM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1208.50 Down $6.60 or -0.54% Posted: 08 Mar 2017 04:10 PM PST

Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Real Reason for the Trump Rally? Posted: 08 Mar 2017 03:02 PM PST This post The Real Reason for the Trump Rally? appeared first on Daily Reckoning. We like to nose around obscure crannies of the financial press. Among these lonely crags, we find rare clues, half-buried pearls… far away from the Page 1 hustle and bustle. It is here that we chanced upon a neglected aspect of the looming debt ceiling deadline… but an aspect with potentially large ramifications… It suggests the post-election Trump "reflation trade" may have been not a sign of economic vigor but a phantom rally, wispy as the morning fog and about as lasting. More on that anon. But first a check of the markets… Another red day on Wall Street. The Dow's down 69, to 20,855. The S&P's off five points. But take heart — the Nasdaq's up… three whole points. Oil's off three bucks. And gold's down about eight, probably on word that fed funds futures are now suggesting a 100% chance of a rate hike next week. Why 100%? New data from ADP Research indicate the private sector added a thumping 298,000 jobs in February. The sages and soothsayers hazarded only 190,000. It seems only an act of the Big Fellow himself could stop a rate hike now. But maybe Ms. Yellen and co. should gander a report by Gavekal Capital: "A Massive Liquidity Illusion." The report suggests this massive liquidity illusion is a "really important element missing from this [mainstream] analysis." And it could "change very quickly over the next several weeks." Their argument is this: To prepare for the March 15 debt ceiling, the Treasury's been drawing down its deposits held at the Federal Reserve. In 2015 — the last time the debt ceiling was suspended — Congress passed a law prohibiting the Treasury from squirreling away large cash reserves to prepare for the debt ceiling. A large cash reserve could keep the Treasury in funds for months and months, dragging the thing out. And since November, reads the report, U.S. Treasury deposits at the Fed have dropped from over $400 billion to about $175 billion. Just as the law required. Further driving home the nail: "To be clear, the increase in bank reserves is entirely a function of the U.S. Treasury making preparations to hit the debt ceiling in the next couple months." But what does all this have to do with the Trump rally? This: The report says the process has unleashed over $200 billion of liquidity into the markets these past few months — a smaller-scale round of quantitative easing. That rising tide of liquidity "has served to create the appearance that the Federal Reserve has been easing lately." Even though it hasn't. "The net effect of this," concludes the report, "is an unintended liquidity injection into the economy." The Dow's up a meteoric 3,000 points since the beginning of November — among its most dramatic three-month runs ever. Coincidence? Maybe. Maybe not. But what happens when a new debt ceiling deal is reached? Reads the report: Let's say the debt ceiling is raised and the U.S. Treasury wants to rebuild its account at the Fed [as it did after the 2011 debt ceiling crisis]. The U.S. Treasury will then issue a bunch of bonds, stick the proceeds at the Fed and basically remove several hundred billion in liquidity from the markets. This will manifest itself in lower commercial bank deposits at the Fed and a reduction in banking liquidity. That is, it could shatter the liquidity illusion… the illusion that may have been floating stocks these past few months. And: "Experience over the last few years is that each major reduction in commercial bank reserves leads to… a stumble in stocks." But experience runs a hard school, as old Ben Franklin said. "Fools will learn in no other." Something else about fools: They're soon parted from their money. And if this report is right maybe sooner than they realize… Regards, Brian Maher The post The Real Reason for the Trump Rally? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

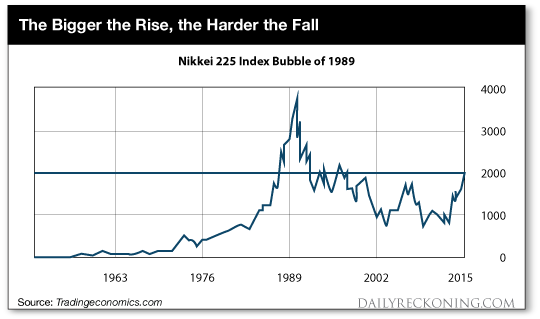

| This Mini-Bubble Could Burst at Any Moment Posted: 08 Mar 2017 02:05 PM PST This post This Mini-Bubble Could Burst at Any Moment appeared first on Daily Reckoning. [Ed. Note: Jim Rickards' latest New York Times bestseller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis, is out now. Learn how to score your free copy here. This vital book transcends geopolitics and rhetoric from the Fed to prepare you for what areas in gold, markets and more you should be watching now.] Whenever stocks rise sharply for a sustained period, or rise more than a few days or weeks in a row, as had been the case until these past few days, there is always some pundit quick to label the trend a "bubble" and advise investors to run for the exits. Usually the pundits are wrong. Most so-called bubbles are not bubbles at all, they're just short-term trends driven by sentiment or momentum. Those trends may slow down or even reverse, but they don't burst catastrophically the way real bubbles do. So pundits who yell "bubble" too often are marginalized as doom-and-gloomers, perma-bears, or the boy who cried wolf. Yet bubbles are real. They do burst suddenly and catastrophically, and most investors do lose fortunes when they burst. The art of analysis consists of recognizing the difference between real bubbles and mere short-term trends. My job is to use the right tools to spot real bubbles, and warn readers in time to avoid losses and even make gains as markets are crashing. U.S. equity markets today are flashing red when it comes to bubble potential. True bubbles happen for a variety of fundamental and psychological reasons. Below are two of the most famous stock charts in history. Chart 1 traces the Japanese stock bubble of 1983 to 1989, which resulted in a spectacular collapse of the Nikkei 225 Index beginning on January 1, 1990. Famously, that Japanese bubble included real estate as well as stocks. In 1989, the land inside the Imperial Palace Walls in central Tokyo (a three-mile circumference) was said to be worth more than all the land in California. At the end of Japan's lost decade, the Nikkei Index stood almost 75% below the peak it reached in late 1989.

Chart 2 is the U.S. stock bubble of the "Roaring Twenties" as shown in the Dow Jones Industrial Average. That crash began on October 24, 1929 ("Black Thursday") and reached a crescendo on October 29, 1929 ("Black Tuesday"). The 1929 crash ushered in the Great Depression, which persisted until 1940. At the lows, the Dow Jones index had fallen more than 85% from the 1929 high. Stocks did not recover their pre-crash levels until 1954, a full quarter-century after the crash.

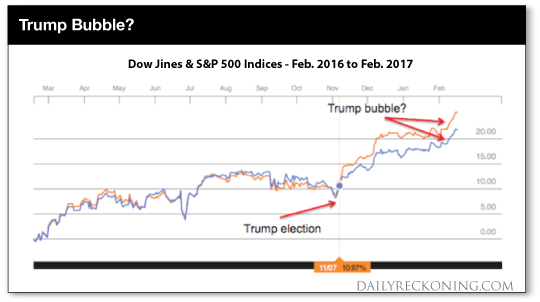

The bubble dynamics are easily seen from these charts. Bubbles do not emerge from depressed conditions or prior collapse. The memories of prior losses are usually enough to prevent investors from engaging in bubble behavior. Instead, bubbles follow periods of growth and persistent stock market gains. The original stock gains are based on fundamentals. Japan in the 1980s and the U.S. in the 1920s were both highly productive and fast-growing economies. Stock market gains made perfect sense. Bubbles emerge at the end of long expansions when memories of the last crash fade, and euphoria replaces common sense. At that stage, the slope of the market index curve steepens at an accelerating rate. The chart no longer rises gently; it rises vertically in a hyperbolic fashion. The result is the famous "hockey stick" image of a gently sloping base with a steeply sloping handle. That is visible in both Chart 1 and Chart 2. The other characteristic of bubbles is that they persist much longer than many observers expect. It would have been easy (and not wrong) to yell, "bubble" in the U.S. in late 1928 or in Japan in late 1988. Yet markets powered higher despite the warnings. Those who issue early warnings are regarded as cranks. Those who short the market too soon can lose their shirts. Yet, those issuing warnings ultimately proved correct. The Dow is up over 25% and the S&P 500 is up over 20% over the past year. More than half the gains for both indices were realized in the 3 ½ months since Donald Trump's election as president:

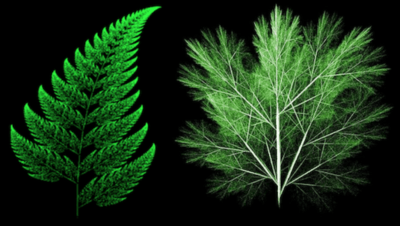

Is the stock market in a bubble now? Has the "Trump Trade" resulted in the same bubble dynamics we saw in 1929 and 1989? Superficially, Chart 3 does not exhibit the extreme hockey stick behavior of Charts 1 and 2. It's true that stocks have been rallying since Trump's election. But Chart 3 covers only a one year period, compared with the five year build-up to the 1929 and 1989 crashes. This goes to the point that bubbles persist much longer than investors expect. Based on the history of 1929 and 1989, an analyst might expect a bubble bursting in 2020 from a level of Dow 50,000! That might even be a good prediction, but investors who sit on the sidelines until 2020 could miss the greatest market rally in history. But, there's a lot more to dynamic systems analysis than superficial chart comparisons. For a short-term prediction, it's helpful to utilize the concept of scale-invariance. This concept applies to complex systems such as capital markets, and derives from fractal mathematics. Scale-invariance simply means that the same patterns repeat themselves at all scales large and small. The images below are a good example of scale-invariance in nature. If you look at the leaf on the left, you'll notice that the individual petals on the leaf are exact replicas of the leaf as a whole. Look closer and you'll see that the petals have separate offshoots that are exact replicas of the petal, and so on. The basic shape of the leaf repeats itself at progressively smaller scales.

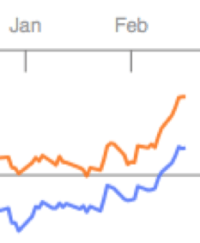

The same is true in the spiky bush on the right. You'll notice that the pattern of large spikes with small spikes sticking out and smaller spikes sticking out is repeated over-and-over at every scale. Scale-invariance is ubiquitous in nature and can be seen in everything from sand ripples to waves, mountain ranges and the shapes of clouds. Guess what? Research proves that scale invariance applies to the time series of stock prices also. Stock markets are complex systems that behave just like many natural systems. In fact, stocks markets can be regarded as a "natural" system because their patterns are dictated by human behavior and human nature. Now take a closer look at the 2016-2017 stock market chart above and isolate the segment for January and February 2017. It closely resembles the pre-crash dynamics of the 1929 and 1989 crashes on a smaller scale. Here's that segment in isolation:

Scale invariance metrics teach us that there can be many "mini-crashes" that exactly resemble the great crashes on a smaller scale. This is exactly like the small leaf petals that closely resemble the larger leaf in nature. We don't have to conclude that the Dow Jones will crash 80% to Dow 4,000 (it might someday, but probably not yet). Scale invariance teaches that a mini-crash could cause the Dow to give up 80% of its gains since January 1, 2017, which would put it down almost 700 points to 19,935. A comparable drop would push the S&P 500 down 90 points to the 2,260 level. Both corrections would be "80% crashes," but the 80% would be measured on a smaller segment of the timeline. That's exactly what scale-invariance says to look for. What could trigger such a mini-crash? There's a long list of potential catalysts, including delays and disappointments with Trump's economic plans, aggressive rate hikes by the Fed, a stronger dollar, and economic turmoil due to China's vanishing reserves, a new Greek bailout or rising geopolitical tensions. The cause of the bubble burst is less important than the initial condition of the bubble. The stock market is exhibiting a small-scale bubble formation ready to burst at the first sign of stress. This is not the "mother of all bubbles." That may come in time. For now, it's a clear "mini-bubble" that exhibits the same dynamics as a larger bubble, but on a smaller scale. Bond market signals are contradicting signals from the stock market, which recently had the most consecutive days of new highs since 1987. In effect, the stock market is betting on stronger growth, while the bond market is betting on economic cooling. The bond market has a much better track record of predicting economic turns than the stock market. This recent bond market rally suggests stocks are due for a correction. Many consider gold the ultimate safe haven asset. And all these factors have increased the attraction of gold as a safe haven asset. Regards, Jim Rickards The post This Mini-Bubble Could Burst at Any Moment appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Fall As Dollar Tops 102 Posted: 08 Mar 2017 01:47 PM PST Gold fell $9 to $1206.80 in early New York trade before it chopped back higher into the close, but it still ended with a loss of 0.58%. Silver slipped to as low as $17.213 and ended with a loss of 1.37%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Whole New World of Gold Demand Is Opening Up... Muslims Posted: 08 Mar 2017 10:29 AM PST Most analysis of gold and silver markets tends to be U.S.-centric. However, the next secular trend in precious metals markets may have less to do with U.S. debt, U.S. politics, the U.S. central bank, and the U.S. dollar and more to do with a gigantic new source of demand. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Surprise in Recent Moves in Gold and Silver Markets Posted: 08 Mar 2017 10:27 AM PST Given the big down move this week in the precious metals, it would certainly follow that the activities of the Commercials would be no surprise. They matched all of the demand brought to bear on the Crimex gold pit by selling over 40,000 contracts representing over 4,000,000 ounces of synthetic gold, and then nudged the gold market off the ledge. They did it with much-revered aplomb, but nowhere more daunting than in the nearly $1.00 collapse in silver that had the blogosphere buzzing last week. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EURUSD: When Price Pattern Trumps Other "Reasons" Posted: 08 Mar 2017 09:31 AM PST Waves of market psychology often warn of trend changes before the news -- see how This was an eventful week in politics, monetary policy and the markets -- and to many observers, the three seemed to be linked. On Wednesday (March 1), the U.S. dollar did something it hadn't done in almost two months: It got stronger. Two reasons were behind the move, said analysts: The Fed's imminent rate hike, and, President Trump's widely-covered address to Congress: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Whole New World of Gold Demand Is Opening Up... Muslims Posted: 08 Mar 2017 09:12 AM PST Most analysis of gold and silver markets tends to be U.S.-centric. However, the next secular trend in precious metals markets may have less to do with U.S. debt, U.S. politics, the U.S. central bank, and the U.S. dollar and more to do with a gigantic new source of demand. It’s not the 1970s anymore. Back then, big moves in the metals markets were centered on United States. The great gold and silver mania of the late 1970s was driven by inflation fears and a rush of speculative demand. Although coin dealers struggled to keep up, there was no actual global shortage of physical metal, and spot prices crashed after manic buying peaked in January 1980. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| #Wikileaks #Vault7 : Here's All You Need To Know Posted: 08 Mar 2017 08:01 AM PST Well there are a few clues we can work on:1) the seed vault signifies 'life insurance' 2) the gold etc stored underground is self-explanatory 3) the jet engine is an F119 - 119 alludes to 9/11 (and F=6 could be a reference to WTC6) 4) the who picture shows 2 government contractors/workers plus... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Mar 2017 07:46 AM PST This post 1 Bitcoin = 1 Oz. Gold? appeared first on Daily Reckoning. Today, one bitcoin is trading for the same price as an ounce of gold. The price of bitcoin has surged almost 200% over the past year. Yet some experts think the cryptocurrency is still too cheap. In fact, a talking head popped up on my TV yesterday and predicted that bitcoin would jump another 150% to $3,000 before the end of the year. That's a wild guess if I've ever seen one…

I'm not certain bitcoin can continue to rise uninterrupted at its current pace. But we are seeing more developments in the global war on cash that could act as powerful price catalysts. China's crackdown on money laundering and demonetization in India have both help increase bitcoin's popularity as a store of value, CNBC notes. But until we see some more traditional means of trading bitcoin, we're going to stick to the mainstream alternative payment investments. If you're looking to ditch cash but you don't have any interest in figuring out how to open a bitcoin wallet, PayPal's popular new payment app has a solution for you. The app is called Venmo—and it's quickly becoming an everyday name in the mobile payments game. Getting started is as easy as adding a new credit card to your Amazon account. The app automatically syncs your contacts through your phone. Then you're ready to make payments to friends, coworkers, and family. To make a payment, all you have to do is pick up your phone. No checks, cards, or cash necessary. It's that simple. Folks are using the app for everything from buying a cup of coffee to paying rent. Venmo's growing success makes PayPal the top dog in mobile payments. In the last quarter alone Venmo processed $4.9 billion in payments, the Wall Street Journal reports. That's a lot of coffee… Cash is dead. Whether you like it or not, currency is going digital. The days of pulling a wad of greasy bills out of your pocket are numbered. You can fight this powerful trend. Or you can profit from it. Right now you have a shot at a white-knuckle ride as the use of mobile payment platforms begins to skyrocket. Of course, PayPal isn't the only player in the game. Other major players are going to step up and challenge Venmo in the very near future. There's Zelle, the brainchild of Bank of America, Wells Fargo, and JPMorgan that is desperately trying to grab some attention before its official launch. Apple Pay transactions totaled nearly $11 billion last year, barely beating the $10.2 billion in payments processed by Square Inc. (NYSE:SQ). But when it comes to explosive growth, PayPal Holdings (NASDAQ:PYPL) is our top pick. Late last year, PayPal reported that its active customer accounts rose 11% to 192 million. The number of average transactions per active account increased. Mobile payment volume is way up, jumped more than 50% to $26 billion in the third quarter. Oh, and it doesn't hurt that mobile payment snow make up nearly 30% of PayPal's business. PayPal has also teamed up with Facebook and even Snapchat in the latest innovations for peer-to-peer payments. These partnerships should have a big impact on PayPal's growth over the next couple of years as more consumers flock to mobile payment options. It's safe to say the company has released some incredible numbers lately that have helped prop up the stock even as the market sinks this week… PayPal shares briefly tagged new 2017 highs yesterday before retreating to a modest gain in the late afternoon. The stock appears to be setting up for a strong move higher. If it can get a little traction above $43, it has a great shot at taking out its October highs… Sincerely, Greg Guenthner The post 1 Bitcoin = 1 Oz. Gold? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Mar 2017 07:23 AM PST Hey! Look! Here I am! Over here! I'm back! (Sound of thunderous applause). Thanks! Wonderful to be here! I know that you, like most people, are probably scratching your head quizzically, asking yourself "Who is this doofus who calls himself Mighty Magnificent Mogambo in the next paragraph, which doesn't even make sense? And who cares that he is back, which is not to mention why am I reading this stupid crap in the first freaking place?" | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Gold Continue to Drop? Rate Hikes, COMEX Shorts, Divergent Tops, Oh My!! Posted: 08 Mar 2017 06:25 AM PST Gold Stock Bull | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Institutions (Part II) Posted: 08 Mar 2017 06:05 AM PST Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II) Investors looking to gold again but gold buyers need to exert caution Royal Mint – a royally expensive way to help the government Unallocated gold – unsecured creditor of a bank? If you cannot hold it, you do not own it Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth Conclusion – Reduce counter parties, Don’t over complicate | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump's Monetary Intervention, A Repeat of the Plaza Accord Posted: 08 Mar 2017 05:43 AM PST Forecast A strong dollar will undermine U.S. President Donald Trump's plans to reduce the United States' trade deficit. If the dollar's value continues to rise, Trump may consider unilateral or, failing that, multilateral currency interventions to bring it back down. Negotiating a new coordinated monetary intervention in the spirit of the 1985 Plaza Accord will be onerous, however. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indian gold imports said to almost triple on wedding demand Posted: 08 Mar 2017 05:27 AM PST By Shruti Srivastava and Swansy Afonso Gold imports by India, which competes with China for the role of world's biggest consumer, are said to have risen almost three-fold in February from a year earlier as jewelers increased stockpiles before the festival and wedding period that starts next month. Shipments jumped 175 percent to 96.4 metric tons in February from a year earlier, according to a person familiar with provisional data from the finance ministry, who asked not to be identified as the data aren't public. Overseas purchases slid 32 percent to 595.5 tons in the 11 months to February. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-03-08/gold-imports-by-india... ADVERTISEMENT K92 Mining is producing much more gold than planned Company Announcement Wednesday, March 1, 2017 K92 Mining Inc. is pleased to report that mining production has shown a steady ramp up over the last three months with ore tonnes mined being over 50 percent above budget in January while contained gold ounces were almost 20 percent above budget. The company mined more than 8,000 ore tonnes by February 24 and is on target to achieve 10,000 tonnes by month end, which is 40 percent above February budget. The increased ore production is in part due to significant lower-grade ore being identified outside the planned ore envelope, which was identified by our ongoing grade-control program, highlighting the importance and success of this program. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/03/k92-provides-operational-update/ Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hochschild Mining swings back to profit as gold and silver prices rise Posted: 08 Mar 2017 02:35 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 08 Mar 2017 01:37 AM PST US stocks set to open lower. Gold and silver down again. Bitcoin down but still higher than gold. Fed expected to raise rates at next meeting. Obamacare replacement on the table. Wikileaks drops another bombshell. Best Of The Web What the hell is going on? – Burning Platform A new look at NYSE margin […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Surprise in Recent Moves in Gold and Silver Markets Posted: 08 Mar 2017 12:00 AM PST Precious metals expert Michael Ballanger reflects on the cause of this week's decline in precious metals markets, and contemplates the factors that will help him determine a bottom. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Hits 5-Week Low as Dollar Gains on ADP Jobs Data, Trade Deficit 'Looms' Posted: 07 Mar 2017 04:00 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Investing 101 – Beware eBay, Collectibles and “Pure” Gold Coins that are Gold Plated Posted: 07 Mar 2017 10:50 AM PST gold.ie |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment