Gold World News Flash |

- Germany’s Gold remains a Mystery as Mainstream Media cheer leads

- Inflation, the Dollar and Gold

- End Times Headline News - March 3rd, 2017

- Ted Butler: Has the worm turned in the silver futures market?

- Bitcoin Price Doubles in the Past 4 Months to Overtake Gold

- NEW UNCOVERED INFORMATION: Why Central Banks Were Forced To Rig The Gold Market

- Bacon Boom Busts

- Gold Price Closed at $1125.50 Down $6.40 or -0.50%

- The Fed’s Getting Ready to Raise into Weakness

- Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 2% on the Week

- More Downside Potential in the Gold Stocks

- Chart: How Bitcoin Reached Parity With Gold

- Ronan Manly: Germany's gold remains a mystery as mainstream media cheerleads

- COT Gold, Silver and US Dollar Index Report - March 3, 2017

- Stocks, Bonds, CRB and Gold Multi-Markets Summary

- The Deep State’s Gold Scam And The Demonization Of Russia

- Gold Stocks’ Spring Rally 2

- Chinese Quietly Take Over The United States Of America

- Gold Stocks’ Spring Rally 2

- Early Aught Perspective

- TF Metals Report: Gold seems to be rising with interest rates and debt

- Central banks and gold

- Multi-Market Update

- BREAKING : Bitcoin beats Gold price for first time 03 Mar 17

- Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

- IT WILL ALL GO HORRIBLY WRONG

- Stock Investors Brace For “Silent Spring”

- Bill Holter: 115 million ounces -- not even close to possible

- Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

- Macroeconomic Outlook and Gold

- Breaking News And Best Of The Web

- The Precious Metals Sector 'Tips Its Hand'

- How Trump Versus Fed Adds to Uncertainty

- Top Ten Videos — March 3

| Germany’s Gold remains a Mystery as Mainstream Media cheer leads Posted: 04 Mar 2017 12:58 AM PST Bullion Star | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inflation, the Dollar and Gold Posted: 04 Mar 2017 12:57 AM PST The Gold Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Times Headline News - March 3rd, 2017 Posted: 03 Mar 2017 11:00 PM PST News from across the globe as it applies to all of us in these days the Bible says will be the finals ones of this generation. Can Trump survive the swamp? We shall see. Be ye ready. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler: Has the worm turned in the silver futures market? Posted: 03 Mar 2017 08:15 PM PST 11:18p ET Friday, March 3, 2017 Dear Friend of GATA and Gold: Silver market analyst and market manipulation foe Ted Butler writes this week that the usual patsies in the silver futures market, what he calls "managed money" funds, are showing signs of no longer being panicked into selling on price smashes engineered by bullion banks. If this is the case, Butler writes, it means big and bullish changes in the silver market. His commentary is headlined "Has the Worm Turned?" and it's posted at GoldSeek's companion site, SilverSeek. here: http://silverseek.com/commentary/has-worm-turned-16375 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin Price Doubles in the Past 4 Months to Overtake Gold Posted: 03 Mar 2017 08:10 PM PST Gold Stock Bull | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NEW UNCOVERED INFORMATION: Why Central Banks Were Forced To Rig The Gold Market Posted: 03 Mar 2017 07:50 PM PST

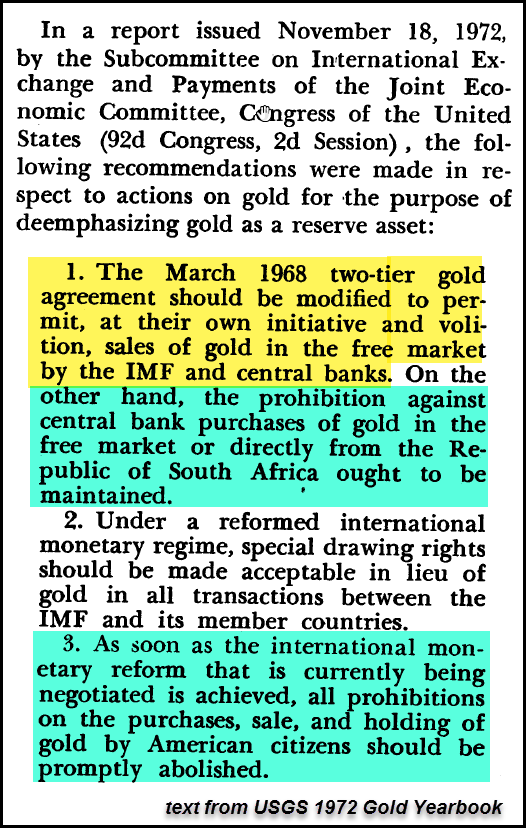

By the SRSrocco Report, According to newly uncovered information in the gold market, it provides additional evidence of why the Fed, Central Banks and the IMF were forced to RIG the gold market. Not only was the dropping of the Gold-Dollar peg going to release a great deal of pressure on the manipulated gold price, but forecasts of a massive increase in gold demand was going to totally overwhelm supply. Thus, this new information provides clear evidence that the gold market was being assaulted on "two fronts." Not only was the gold market suffering from a decades of price suppression schemes via the Fed and Central Banks, but also that surging gold demand in the jewelry and industrial sectors was going to lead to severe shortages in the gold market. Which means, the gold market was experiencing a great deal more stress than complications stemming from the debasement of the U.S. Dollar due to massive money printing. Actually, looking at this new information, I had no idea of the amount of Fed, Central Bank and IMF gold market intervention until I put all the pieces together. Now, when I say "new information", it pertains to new information and data that I dug up from older official documents. While most of the folks in the precious metals community realize that the Fed and Central Banks have sold gold into the market to depress the price, this new evidence puts the gold market it in an entirely DIFFERENT LIGHT. ---------------------------------------------------------------- PRECIOUS METALS INVESTORS.... if you think your getting the "BEST PRICE" for purchasing gold and silver, or you are receiving the best "FEE" for storing your metals, than you need not look any further. However, if you haven't checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do. ---------------------------------------------------------------- Furthermore, additional data points to a "Gold Supply & Demand" situation that would have gone completely out of control, if the Fed, Central Banks and IMF did not step in. To preface this subject matter, the Central Banks dumped a lot of gold into the market during the 1960's to maintain (suppress) the official gold price. This was known as the "London Gold Pool" where an estimated 78 million oz (Moz) of gold were dumped into the market between 1961 and 1968. I explained this in my THE GOLD REPORT- Investment Flows. However, when Nixon dropped the Dollar-Gold Peg on August 15, 1971, the problems with the global monetary system were just beginning. In a report published in November, 1972, by the U.S. Congress and Subcommittee on International Payments of the Joint Economic Committee for the purpose of "De-emphasizing gold as a reserve asset",it stated the following:

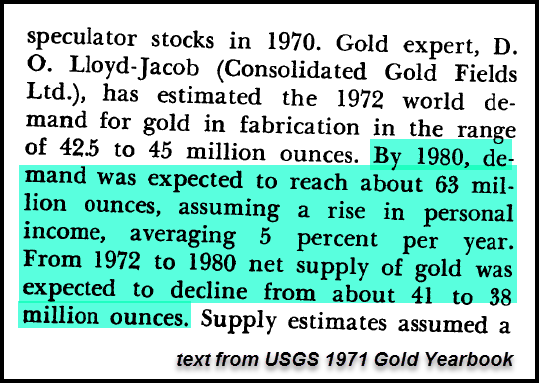

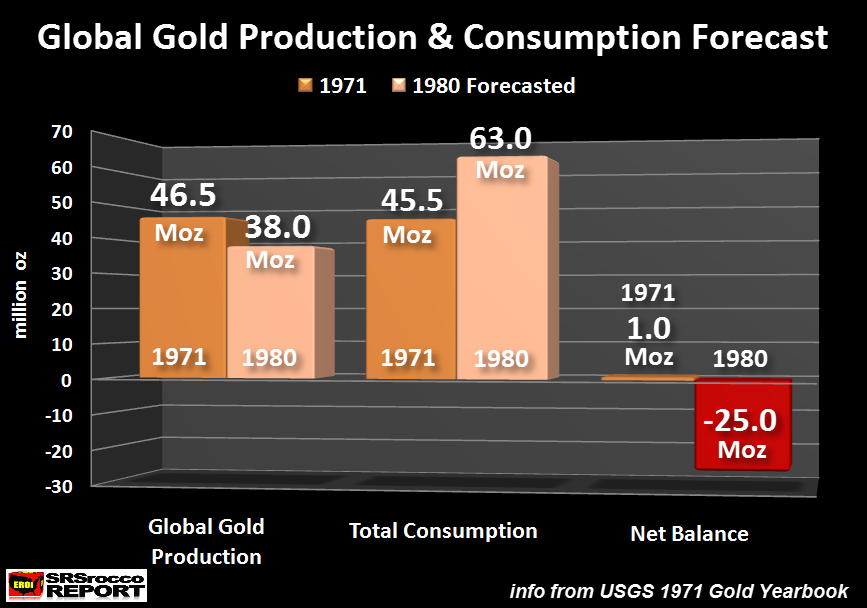

Not only did the committee suggest and permit the "voluntary" sale of official gold into the market, but also to "prohibit" against Central bank purchases. Which meant the committee was proposing a plan to only allow the DUMPING of gold into the market, but forbid any OFFICIAL BUYING. This of course was supporting the "FREE MARKET" fundamentals for proper gold price discovery.... LOL. At the bottom of that quote, the committee went on to state that when the international monetary reform had been achieved (to an IMF SDR basket), all prohibitions of gold (investment) purchases by American citizens would be promptly abolished. So, the wonderful folks up in government had an ingenious method to their madness. According to their assessment, it would have not been prudent to allow Americans to start purchasing and hoarding gold until the completion of the new fiat monetary system was achieved. Again, most of us in the precious metals community understand that the Central banks dumped a lot of gold into the market during the 1960's London Gold Pool to maintain the official gold price. However, new uncovered gold supply and demand data suggests there was another FACTOR that forced even more dumping of official gold during the 1970's. Forecast Of Massive Gold Supply & Demand Imbalance The reason that Nixon dropped the Gold-Dollar Peg in August 1971 was to keep U.S. gold from flowing overseas as the U.S. Government had been printing a great deal of paper money. Thus, countries such as France were exchanging Dollars for real gold. This forced Nixon to drop the convertibility of Dollars into gold so the United States could hold onto its remaining gold reserves. But, and here is a BIG BUT... converting Dollars into physical gold was only one part of the monumental problem facing the gold market and industry. Up until now, this was the only real problem that I was aware of as it pertained to the gold market in the 1970's. However, forecasts of future Gold Supply & Demand factors were going to totally disrupt the market unless the Fed and Central banks stepped in. This next quote comes from the USGS 1971 Gold Yearbook. The highlighted area shows just how bad the gold supply and demand situation was going to be at the end of the decade: According to a gold expert at Consolidated Gold Fields Ltd., global gold demand was forecasted to reach 63 million oz (Moz) by 1980, up from 42.5-45 Moz in 1972. You see... this was a BIG PROBLEM. Why? Because gold mine supply was also forecasted to decline to 38-41 Moz in 1980. This would have resulted in a huge net deficit. So, how well did the Consolidated Gold Fields Ltd., forecast turn out? Let's look at the chart below:

Actually, it turned out pretty darn accurate. Global gold production declined from its peak of 46.5 Moz in 1970, to 38.8 Moz in 1980. This was mainly due to the peak and decline of South African gold production. I would imagine very few individuals in the precious metals community realize just how much gold South Africa produced. No other country has come anywhere near the record annual gold production achieved by South Africa at its peak in 1970:

South Africa produced an amazing 1,000 metric tons of gold in 1970... 32 Moz. Here are the annual peak production figures from three leading gold producing countries: 1) China = 478 mt (15.4 Moz) 2014 2) USA = 366 mt (11.8 Moz) 1998 3) Australia = 276 mt (8.9 Moz) 2015 China holds the second highest annual gold production record at 478 mt (15.4 Moz) set in 2014. However, this is still less than half of the 1,000 mt that South Africa produced in 1970. According to GFMS 2016 Gold Survey, South Africa's gold production was 151 mt (4.8 Moz) in 2015. The once mighty South African gold production has declined 85% from its peak in 1970. Now, taking the 1980 forecasted supply and demand data by Consolidated Gold Fields Ltd. above, here is the result:

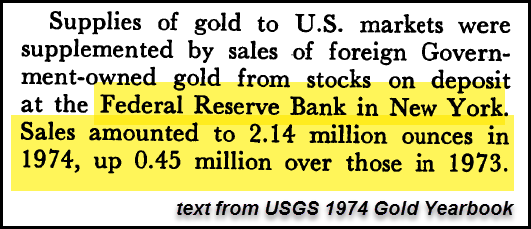

If the forecast of a 63 Moz gold demand figure was true, then the market would have suffered a 25 Moz deficit in 1980. So, not only did U.S. President Nixon stop the bleeding of gold flows out of the U.S. Treasury, but in addition, public demand for gold that decade was going to explode. This just could not fly. Which is why the Congress and the Subcommittee on International Exchange and Payments (listed above) were highly motivated to promote "Official Gold Sales" while prohibiting "Official Gold Buying." This was a "ONE-WAY PLAN" for gold... and that was the dumping of a massive amount of the yellow metal into the market. The Fed, IMF and Official Government Gold Sales During the 1970's It's hard to tell how much gold was dumped into the gold market during the 1970's decade. I have plans on putting together a more comprehensive report on the details of what took place in the gold market from the 1960's to present. This will include more detailed data on Official gold sales. However, we have some clues in the text from different USGS Gold Yearbooks. First, we have foreign gold at the Federal Reserve sold into the market in 1973 and 1974:

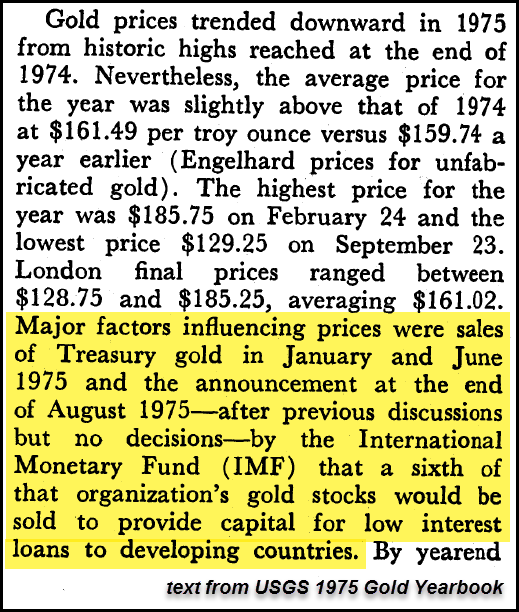

As we can see, 2.14 Moz of foreign held gold at the Fed were dumped into the market in 1974 and 1.69 Moz in 1973. Unfortunately, official sales of gold into the market did not deter the rising gold price. The gold price jumped from an average $65 in January 1973 to a high of $200 at the end of 1974. Well, the Central banks could not let this exploding gold price to continue. Which is why the IMF made this official statement in August, 1975:

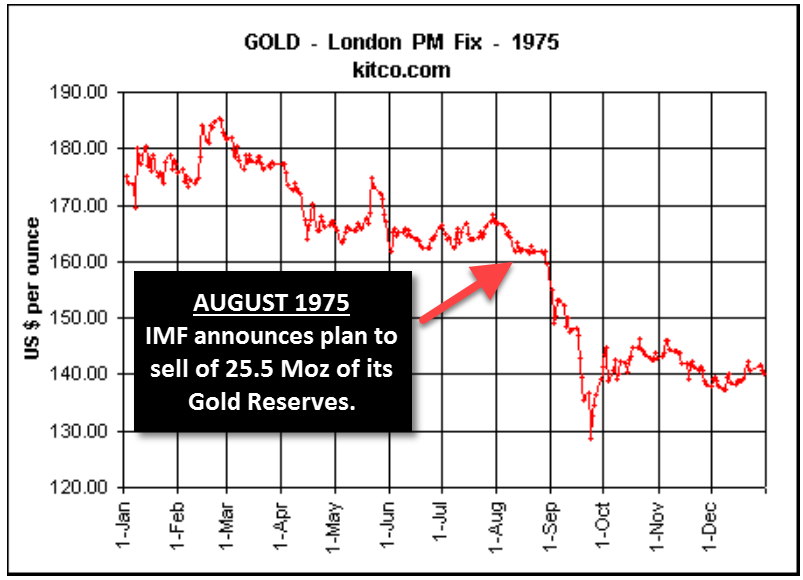

The IMF - International Monetary Fund, announced in August, 1975 to sell one-sixth of its gold stocks. At the time, the IMF held 153.4 Moz of gold. Thus, it planned to sell 25.5 Moz over the next several years to supposedly provide capital for low-interest loans to developing countries. I wonder why the IMF did not make this statement back in 1973 or 1974? And why would the IMF have to sell gold to provide capital for developing countries?? Wasn't there a new FIAT MONETARY REGIME?? Wasn't gold now a "Barbarous Relic?" With the IMF "strategic"announcement that it would sell 25.5 Moz of gold into the market, it had a profound impact on the gold price in 1975:

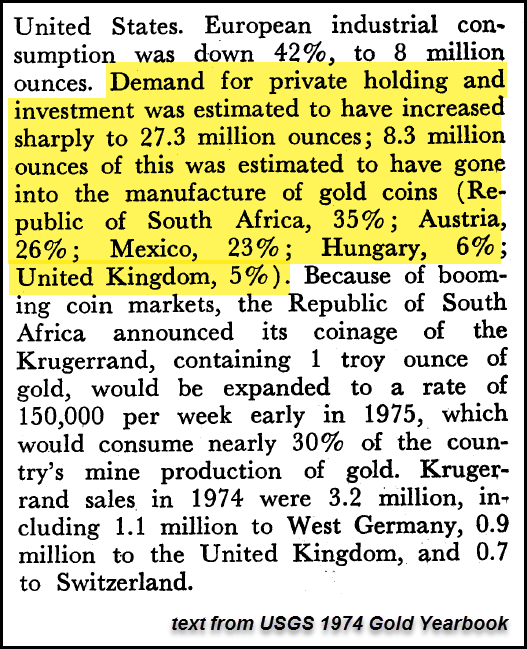

After the IMF gold sale announcement, the gold price plummeted 21% in just one month from $165, down to a low of $130. Before I came across this information, I just believed that the gold price was due for a correction.... stated by several websites, such as by analysts on King World News. However, this wasn't a typical market correction. Rather... this was a MARKET INTERVENTION FORCED CORRECTION. Big difference. So, why the IMF gold sale announcement? Was it due to a response to the rapidly rising price.. or did rising demand play a part. If we look at this next quote taken from the USGS 1974 Gold Yearbook, we find our answer:

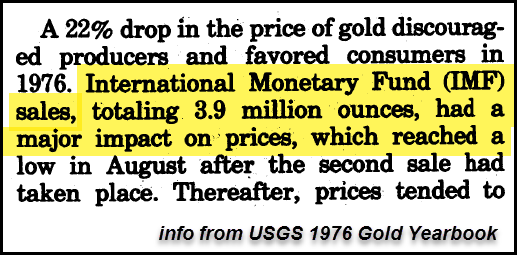

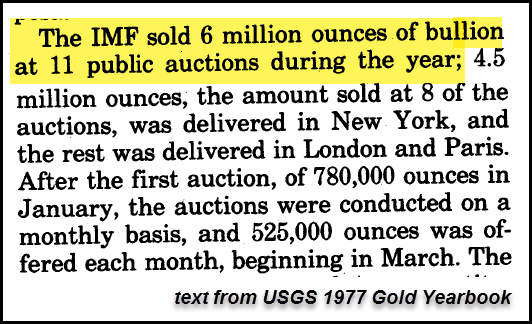

According to the data, private gold holdings and investment surged 5-fold in 1974 to 27.3 Moz. The report also stated that total gold jewelry and industrial demand was 23 Moz in 1974. Thus, total gold demand exceeded 50 Moz in 1974. I would imagine if private gold investment didn't jump 5-fold from the previous year, the IMF would have not considered it necessary to announce the sale of 25.5 Moz of its gold reserves in 1975. In order to make good on its promise, the IMF did sell 3.9 Moz of gold in 1976 and another 6 Moz in 1977 into the market:

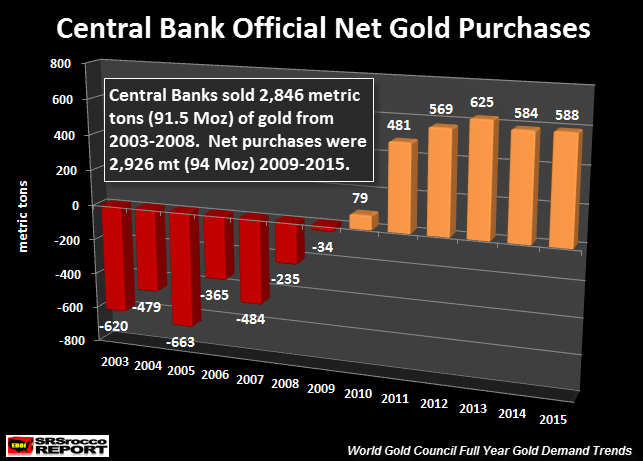

In just the first two years after its proposed 25.5 Moz gold sale in August 1975, the IMF sold 9.9 Moz, or nearly 40% of its planned amount. If we read the first quoted text above (1976), the gold price reached a low in August 1976 after the second IMF gold sale. Oh, did I forget to mention that another 2.14 Moz of foreign held gold at the Federal Reserve was dumped into the market in 1976?? So, between these two official institutions, over 6 Moz of gold were sold into the market in 1976 alone to guarantee there was a FREE MARKET PRICING mechanism for gold. I have to make a comment here. I spend a lot of time at energy and precious metals blogs. I am completely surprised at the lack of intelligence by individuals who are supposedly very "BRIGHT" in their respective industries. When I hear comments that gold is nothing more than a "13th Century Middle Ages Relic", and that digit currency is the new monetary system... the Good Lord Almighty must be enjoying one hell of a BELLY-ACHING LAUGH. These folks who seem to understand the ramifications of falling cheap energy production upon the global markets still cling to a FIAT MONETARY SYSTEM that needs an ever-increasing supply of cheap oil to survive. How on earth are they unable to CONNECT THE FRICKEN DOTS is beyond me. Regardless, the Fed, Central banks and IMF have been rigging the gold market for quite some time... and continue to do so. During the 1960's Gold Pool it was more a physical market intervention as they dumped 78 Moz of gold to maintain the official gold price of $35 an ounce. Then when Nixon dropped the Gold-Dollar Peg in 1971, these official institutions combined "Physical gold dumping" along with the "Creation of a Paper Gold Futures Market in 1975" to rig the gold market during the wild 1970 decade. I don't have a lot of data on the paper futures market in this article (will be in future Paid Report), but here is a tidbit on some of the trading volume: Global Paper GOLD EXCHANGE Annual Trading Volume: 1975 = 84 Moz 1977 = 190 Moz 1979 = 1,027 Moz From the beginning of paper gold trading on the Global Exchanges, it increased from 84 Moz in 1975 to an astonishing 1,027 Moz (1.03 billion oz) in 1979. The tremendous trading of paper gold contracts (later on including options) sucked in a massive amount of funds. Thus, paper gold trading funneled a great deal of money away from physical gold and into worthless paper gold. As I mentioned, I don't have a full reporting of all the official gold that was dumped into the market from 1971-1980. That will be included in an upcoming report. However, it was stated in the USGS 1980 Gold Yearbook, that the IMF did complete its final gold auction in May 1980. This was their final gold sale that equaled a total of 25.5 Moz from 1976 to 1980. If we include this amount with the sales of foreign gold at the Federal Reserve and other official gold sales, the amount of gold sold during the 1970 decade was quite an impressive amount... probably something north of 50 Moz. Again, this was all done to guarantee a FREE MARKET price discovery for gold. Today, most Americans and citizens around the world have no idea just how undervalued gold is. No idea whatsoever. Since the peak of the gold price in 1980, the Fed and Central Banks continued to dump physical gold into the markets at various times up until 2009. However, "Official gold sales" turned into net "Official purchases" in 2010. This put a severe KINK in the Western Central Bank plan of gold market rigging. Just seems like those problematic Chinese and Russians have a much different idea about REAL MONEY than the West.

To continue rigging the gold market in the 1990's and onwards, the West had to introduce "Gold Leasing" and more exotic "Gold Derivatives" to keep the gold price from going completely BONKERS. Again, this has been done while the public remains completely in the dark. In conclusion, the Fed and Central banks were in serious trouble in 1971. Not only was the dropping of the Gold-Dollar Peg in 1971 a sign that things were about to get very interesting with the gold price, but the forecast of exploding gold demand would have resulted in a 25 Moz deficit by 1980. This forced the Fed, IMF and Central banks to dump a massive amount of gold into the market to meet the insatiable demand. Which means, gold became too valuable to be used as money in the U.S. and Global economy. Yes, that sounds strange... but that is the truth. I mentioned this in a previous article on why silver was removed from U.S. coinage. It was due to the same reason. When I say, "too valuable to be used as money", I mean it in the way that money has degraded to. There are no real banks in the world. A bank should hold stored "ECONOMIC ENERGY" as stated by Mike Maloney. When someone deposits gold at a bank, that is REAL MONEY. A bank is supposed to store real money. Instead, banks store DIGITAL IOU balances, or worse yet, highly leveraged loans. Since Nixon dropped the Dollar-Gold Peg in 1971, the amount of debt in the world has skyrocketed. The Central Banks designed a two-tiered system to remove gold as a reserve asset:

While the ultimate revaluation of gold and silver has taken more time than most of us in the precious metals community anticipated, THAT DAY IS COMING. As I have mentioned in several articles and interviews, the timing of this event will be known by what takes place in the energy markets as they are the drivers of our economy... and the highly leverage Fiat Monetary System. Investors should not try to time the markets by selling Stocks, Bonds or Real Estate before the crash comes and then move into physical gold and silver. Rather, that should be done on an ongoing basis as the TIMING of the e | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 06:40 PM PST Great news America - After soaring to the highest price in three years, wholesale prices for pork bellies, the cut used for making bacon, are heading for a 25% loss over two weeks. As Bloomberg notes, increased demand had more than doubled prices since August, but now bellies are so expensive that the high costs are stemming demand, according to David Kruse, president of Commstock Investments Inc.

And while the average joe may see his so-called pocketbook better off as pork prices plunge (or will obviously purchase more bacon), the above-average-joes (who drive their Beamers and Benz's) are facing an ever increasing cost for their luxury lifestyles... The premium gasoline that fuels luxury cars made by Mercedes-Benz to Audi has always been more expensive than regular, but the difference keeps getting bigger. As Bloomberg points out, premium costs almost 50 cents a gallon extra, nearly doubling in the past four years. And don’t expect the trend to change -- environmental rules limiting sulfur that kicked in this year could make the higher-octane fuel scarcer and even more costly in the future. So, it seems very clear that consumer confidence is soaring because bacon prices are plunging, not Trumptopian hope...

Never mind the collapse in real wages. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1125.50 Down $6.40 or -0.50% Posted: 03 Mar 2017 05:19 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed’s Getting Ready to Raise into Weakness Posted: 03 Mar 2017 04:07 PM PST This post The Fed's Getting Ready to Raise into Weakness appeared first on Daily Reckoning. [Ed. Note: Jim Rickards' latest New York Times bestseller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis, is out now. Learn how to score your free copy here. This vital book transcends geopolitics and media rhetoric to prepare you for what areas in gold, markets and more you should be watching now.] I was surprised this week that the stock market reached new highs — despite the fact that expectations of a March rate hike by the Fed moved from 40% to 60% in three days. Today those expectations are about 75%. But I've been calling a March rate hike since late December. I was almost alone in that view. Wall Street analysts were paying lip service to the idea that the Fed might raise rates twice before the end of the year, but said the process might begin in June, not March. Market indicators were giving only a 25% chance of a rate hike within the past couple weeks. Is it because I'm smarter than all these other analysts? No, I certainly don't claim to be smarter than any of them. It's just that I use better analytical techniques based on complexity theory, behavioral psychology and other sciences that account for the ways actual markets behave. Meanwhile, most analysts are using outdated, static models that don't apply to the real world. Speculation began after Janet Yellen's testimony to House and Senate committees last month. She said a solid job market and an overall improving economy suggested the Fed would likely resume raising rates soon. But, Yellen did not say anything she hadn't said in December. But suddenly this week everything heated up. Now the markets agree that a rate hike is coming, thanks to an orchestrated campaign of speeches and leaks from senior Fed officials. Several Fed members have been talking about the need to tighten, including Fed Governor and uber-dove Lael Brainard. When she starts sounding like a hawk, it's time to pay attention. As I said, markets are now pricing in nearly a 75% chance of a March rate hike (my estimate is now 90%). But there's a big difference between the dynamics behind my view of a rate increase and the market's view. In effect, markets are saying, "The Fed is hiking rates, therefore, the economy must be strong." What I'm saying is "The Fed is tightening into weakness (because they don't see it), so they will stall the economy and will flip to ease by May." My view is the economy is fundamentally weak, the Fed is tightening into weakness. By later this year, the Fed will have to flip-flop to ease (via forward guidance) for the ninth time since 2013. Stocks will fall, while bonds and precious metals will rally. Both theses start with a rate hike, but they rest on totally different assumptions and analyses. Under my scenario, the stock market is headed for a brick wall in April or May, when weak first-quarter data roll in. But for now, it's still up, up and away. My take is that the Fed is desperate to raise rates before the next recession (so they can cut them again), and will take every opportunity to do so. I believe the Fed will raise rates 0.25% every other meeting (March, June, September and December) until 2019 unless one of three events happens — a stock market crash, job losses, or deflation. Right now the stock market is booming, job creation is strong, and inflation is emerging. So, none of the speed bumps are in place. The coast is clear for the March rate hike. There is a great deal of happy talk surrounding the market right now. But with so much bullishness around, it's time to take a close look at the bear case for stocks. It's actually straightforward. Growth is being financed with debt, which has now reached epic proportions. The debt bubble can be seen at the personal, corporate and sovereign level. Sure, a lot of money has been printed since 2007, but debt has expanded much faster. In a liquidity crisis, investors who think they have "money" (in the form of stocks, bonds, real estate, etc.) suddenly realize that those investments are not money at all — they're just assets. When investors all sell their assets at once to get their money back, markets crash and the panic feeds on itself. What would it take to set off this kind of panic? In a super-highly leveraged system, the answer is: "Not much." There's a long list of potential catalysts, including delays and disappointments with Trump's economic plans, aggressive rate hikes by the Fed, a stronger dollar, and economic turmoil due to China's vanishing reserves or the new Greek bailout. It could also be anything from a high-profile bankruptcy, a failed deal, a bad headline, a natural disaster, and so on. This issue is not the catalyst; the issue is the leverage and instability of the system. The bulls are ignoring the risks. My view is we're well into bubble territory, and stocks will reverse sooner than later. Stocks are a bubble that will certainly crash. But you must realize that the timing is uncertain. Recall that Greenspan gave his "irrational exuberance" speech in 1996, but stocks did not crash until 2000. That's a long time to be on the sidelines. Conversely, bonds are not in a bubble, despite the large number of analysts who make that claim. These analysts are looking at nominal rates. You need to look at real rates, which are still fairly high. Nominal and real yields on the 10-year Treasury note were much higher at the end of 2013 than they are today. Wall Street yelled "bubble" then and shorted the bond market when the 10-year note yield-to-maturity was 3% in 2013. Those who shorted Treasury notes got crushed when yields fell to 1.4% by early 2016 (they have reversed since). I expect another bond market rally (bonds up, rates down) to play out between now and this summer. One source of investor confusion is that the White House and Congress are moving toward fiscal stimulus, while the Fed is moving toward monetary tightening. That's a highly unstable dynamic. Markets could tip either way. Investors have to be prepared for countertrends and reversals while waiting for this picture to unfold. The Trump administration is perfectly capable of shouting "strong dollar" on Monday and "weak dollar" on Tuesday. That's one reason I recommend a cash allocation — it allows you to be nimble. Something else to remember going forward is that Trump will have a minimum of three, and perhaps as many as four or five, chances to appoint members of the Fed board of governors, including a new chairman in the next 10 months. I expect these new governors will be dovish based on Trump's publicly expressed preference for a weaker dollar. The Senate will definitely confirm Trump's choices. So get ready for an extreme makeover at the Fed, with the likelihood of easy money, more inflation, higher gold prices and a weaker dollar right around the corner. That combination of Fed ease (due to slowing) and Fed doves flying into the boardroom on Constitution Avenue in Washington will give gold prices in particular a major lift in the second half of the year. Regards, Jim Rickards The post The Fed's Getting Ready to Raise into Weakness appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver Fall About 2% on the Week Posted: 03 Mar 2017 02:31 PM PST Gold fell $12 to $1223 in early afternoon New York trade before it jumped back to $1236.00 after Yellen raised the possibility of the fed keeping rates stable, but it then drifted back lower into the close and ended with a loss of 0.05%. Silver surged to as high as $17.972 and ended with a gain of 1%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Downside Potential in the Gold Stocks Posted: 03 Mar 2017 02:21 PM PST While we expected the gold stocks to correct and test GDX $22 and GDXJ $35, we did not expect it to happen so quickly. It literally took only three days! Gold stocks rebounded on Friday and managed to close the week above those key levels. While gold stocks could bounce or consolidate for a few days, we would advise patience as lower levels could be tested as spring begins. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chart: How Bitcoin Reached Parity With Gold Posted: 03 Mar 2017 01:00 PM PST Would you rather have one bitcoin, or a single ounce of gold? The answer used to be obvious. Even at the climax of the legendary 2013 rally, bitcoin was never able to reach unit-for-unit parity with gold. However, since an off-year in 2014, the enigmatic cryptocurrency has steadily climbed in price to take the title of the best-performing currency in both 2015 and 2016. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: Germany's gold remains a mystery as mainstream media cheerleads Posted: 03 Mar 2017 12:39 PM PST 3:40p ET Friday, March 3, 2017 Dear Friend of GATA and Gold: The German Bundesbank's account of its repatriation of the nation's gold reserves remains full of holes and unanswered questions, gold researcher Ronan Manly writes today. His analysis is headlined "Germany's Gold Remains a Mystery as Mainstream Media Cheerleads" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/germanys-gold-remains-a-my... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COT Gold, Silver and US Dollar Index Report - March 3, 2017 Posted: 03 Mar 2017 12:33 PM PST COT Gold, Silver and US Dollar Index Report - March 3, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks, Bonds, CRB and Gold Multi-Markets Summary Posted: 03 Mar 2017 12:25 PM PST Using the most representative or notable index/ETF for each segment, let’s update the general status for a range of items (U.S. and global stocks, T bonds, commodities and gold) with a few informal thoughts. As it’s older brother, the Dow, exceeds our target (21,000), the S&P 500 lurks just below its target of 2410. While the market can (and probably should) correct at any time, the lack of climactic volume (ref. yesterday’s post comparing the current Dow to Silver in 2011) along with over bullish sentiment that continues to resist becoming massively (as in ‘all in’) over bullish imply that such a correction would be a pit stop, not a bear market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Deep State’s Gold Scam And The Demonization Of Russia Posted: 03 Mar 2017 12:08 PM PST As the Fiscal Year 2018 budget, and particularly its war component are floated, it has become clear that without continued, massive military spending, paid for with mass-produced electrons masquerading as money, U. S. GDP would collapse, taking the country's financial and monetary systems with it. The nation, whose real economy has been hollowed out, for profit, by the Deep State plunderers, has become significantly reliant upon deliberately contrived wars and military tensions for its economic survival. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 11:11 AM PST Zealllc | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Quietly Take Over The United States Of America Posted: 03 Mar 2017 11:00 AM PST Alex Jones breaks down the dirty dealings Democratic Senator Ted Kennedy had with the Soviet Union in the eighties. Then details the subversive Chinese government's takeover of the American Republic utilizing financial infiltration. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 08:57 AM PST The gold stocks enjoyed a strong surge early this year, fully reversing their sharp post-election losses. While they spent much of February consolidating before sliding, this sector's seasonals will soon turn very favorable again in mid-March. The gold miners have long enjoyed strong spring rallies in bull-market years. Early March's seasonal lull is a great opportunity to deploy aggressively ahead of this big spring buying. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 08:49 AM PST Since all of the Fed Goon jawboning this week has now raised the odds of a March FOMC rate hike to 147%, we thought it best to write today with some perspective on the past...perhaps unearthing some clues as to why Comex Digital Gold seems to rally every time The Fed hikes rates. The challenge for your host is to somehow make this case logically through the written word only, when this information might be better presented through a podcast. But here goes... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Gold seems to be rising with interest rates and debt Posted: 03 Mar 2017 08:47 AM PST 11:50a ET Friday, March 3, 2017 Dear Friend of GATA and Gold: The TF Metals Report today notes that a rising gold price seems to be correlating with rising interest rates rather than falling rates, perhaps in part because of the explosion in U.S. government debt. The TF Metals Report's analysis is headlined "Early Aught Perspective" and it's posted here: https://www.tfmetalsreport.com/blog/8193/early-aught-perspcetive CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT (Golden Predator will be exhibiting at Booth 2650 Golden Predator Begins Drill Program at 3 Aces Project Company Announcement Thursday, February 23, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to announce it has commenced a 20,000-meter drill program at its fully owned 3 Aces project in southeastern Yukon. The drilling program will initially focus on targets in the Spades Zone, where 2016 results included a new vein discovery at depth plus 7.5 meters of 33 grams-per-tonne gold at the Ace of Spades. Management is also pleased to announce that Golden Predator has been named a TSX Venture Top 50 company, placing fifth of 957 mining companies. ... ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_02_23.pdf Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 08:33 AM PST The very near future is likely to see a sea-change in central bankers' attitude to the gold allocation in their reserves. The failure of G20 monetary policy since the financial crisis is causing a general rethink, which may eventually lead to a new policy direction. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 08:27 AM PST Gold pierced the EMA 20, which has supported it through its 2017 rally. A loss of that level would bring on what I'd see as a buying opportunity at around 1200 and/or the now upturned SMA 50. Gold is in waiting for a counter-cyclical or risk 'off' backdrop; period. Forget inflation as a gold fundamental for now. If stocks correct sooner rather than later, I'd expect more near-term upside in gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING : Bitcoin beats Gold price for first time 03 Mar 17 Posted: 03 Mar 2017 07:46 AM PST Discussing the news that the price for one Bitcoin, has breached the price for one ounce of gold. But showing how everyone is clueless, tries to frighten people that Bitcoin is unregulated (good - as you can't print it into oblivion like the criminal central banks are doing to their... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling Posted: 03 Mar 2017 06:04 AM PST Silver fell a very sharp 85 cents from $18.40 per ounce to as low as $17.65 per ounce yesterday for a 4.25% price fall soon after the London bullion markets closed yesterday despite no market news or corresponding sharp moves in other markets. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 05:37 AM PST IT WILL ALL GO HORRIBLY WRONG | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Investors Brace For “Silent Spring” Posted: 03 Mar 2017 05:30 AM PST This post Stock Investors Brace For “Silent Spring” appeared first on Daily Reckoning. The canary in the coal mine just died… Today I’m going to show you how two press releases — posted just two hours apart — spell danger for conventional stock investors. Just like the coal mine canary seems to be a very small thing, this small indicator actually sheds light on a much bigger problem… a problem that most investors are blissfully ignorant of. Let’s take a look at this disturbing signal, and what it means for the market. And let’s also take a look at how you can protect your wealth from the approaching danger… “Silent Spring” for Stock InvestorsAs a former hedge fund manager, I’ve become very good at reading between the lines. Often, the headlines you read only tell a small part of the story. But if you can connect the dots between what is being said and what is ultimately implied, you can make a lot of money! Case in point: a recent price war that has broken out between two of the largest retail brokers in the business. On Tuesday, Fidelity announced it was cutting commissions on individual stock trades to just $4.95. Hours later, Charles Schwab released its own press release, matching Fidelity’s new commission structure. If you have an account with Fidelity or Schwab, that’s certainly good news for you. It means you’ll be paying less in commission costs when you buy or sell shares of stock. But the question I’m asking is WHY?? Why would two of the biggest retail brokers slash prices and trigger what will certainly be a price war in the industry? Are these two brokers seeing something that the media hasn’t caught in to yet? Here’s why this price cut should concern you… Supply, Demand, and Commission PricesThe price war between Fidelity and Charles Schwab is a battle to capture market share in a declining industry. More and more retail investors are parking their money into passively managed index funds and ETFs. And this takes commission business away from big companies like Fidelity and Schwab. So both brokerages are lowering prices in a desperate attempt to attract investors who actively trade stocks. The important takeaway is that trading activity is lower… much lower. It’s so low that the two biggest brokerages are slashing their prices by almost 40% in single move. Individual investors are basically going on strike, and choosing not to buy shares of stock. And this at a time when the market is overvalued by just about any measure you choose. And here’s the thing… When investors step back and stop buying, it’s only a matter of time before this inflated market starts sliding lower. So the fact that Fidelity and Charles Schwab are aggressively slashing commission costs is a very telling sign about the health of this market. Here’s How to Protect Your WealthWhen the market starts to head lower, most stock investors are going to be hurt. I’ve see this time and time again as the market moves through the inevitable boom and bust cycles. Unfortunately, traditional investors never seem to learn, and suffer big losses over and over again. But it doesn’t have to be this way! There are steps you can take to protect your wealth, even if the market moves sharply lower. Below, are three specific examples which you can use to insulate your investment account from a market crash, and set yourself up to profit when the market ultimately rebounds.

I’ll be keeping a watchful eye for more signs of danger in the market. It’s been a great run, but now it’s time to add defense to our investment game plan. Here’s to growing and protecting your wealth!

Zach Scheidt The post Stock Investors Brace For “Silent Spring” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Holter: 115 million ounces -- not even close to possible Posted: 03 Mar 2017 05:20 AM PST By Bill Holter I thought I would put today in perspective for those throwing in the towel on gold and silver. Some 23,000 silver contracts were sold in just a few minutes this morning. This equates to 115 million ounces. For perspective, there are only two countries in the world that produce this much in one year, Mexico and Peru. China roughly produces 115 million ounces but the production is not normally sold onto world markets. Looking at this from a "company" perspective, no single company even comes close to producing 115 million ounces. In fact, the three largest silver-producing companies in the world, Fresnillo, KGHM Polska, and Goldcorp, produce only about 125 million ounces combined over a year. Because of these production numbers, today's action, selling 115 million ounces of silver, is an impossibility in any real world governed by any real rule of law. As I have said for years when these raids occur, no one has this much silver to sell, and no one would be stupid enough to sell in this fashion if they were trying to get the best price possible for themselves or their client. What you witnessed today was an act of total desperation not to mention stupidity. "They" have absolutely tipped their hand and done something so obvious and egregious that they have probably ended their own game. You should understand one thing and one thing only from today: Buy as much physical silver as you can possibly afford and have it delivered out to you or a non-bank vault. ... ... For the remainder of the commentary: http://www.jsmineset.com/2017/03/02/115-million-ounces-not-even-close-to... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling Posted: 03 Mar 2017 05:03 AM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Macroeconomic Outlook and Gold Posted: 03 Mar 2017 04:37 AM PST As everyone knows, the aftermath of the U.S. presidential election was a disastrous time for the yellow metal. However, gold rebounded at the beginning of 2017, gaining almost 6 percent in January and rising further in February, as one can see in the chart below. Chart 1: The price of gold over the last year (London P.M. Fix). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 03 Mar 2017 01:37 AM PST US stocks open lower. Gold and silver down from multi-week highs. Bitcoin now higher than gold. Fed now likely to raise rates at next meeting. Trump budget to increase defense, cut EPA, State. Trump’s secretary of state forced to recuse himself from Russia investigation. Best Of The Web Fake risk, fake return? – Merk […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Precious Metals Sector 'Tips Its Hand' Posted: 03 Mar 2017 12:00 AM PST It is common for commodities to drop in unison, says technical analyst Clive Maund, and in tandem with his prediction that oil will drop, he also sees gold and silver going lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Trump Versus Fed Adds to Uncertainty Posted: 02 Mar 2017 06:48 PM PST To implement his $1 trillion dollar infrastructure plan, President Trump needs low rates, even though the Fed’s rate hikes will strengthen dollar. That means new uncertainty worldwide. In his Crippled America (2015), Trump argued that “our airports, bridges, water tunnels, power grids, rail systems—our nation's entire infrastructure is crumbling, and we aren't doing anything about it." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Mar 2017 04:01 PM PST Ron Paul on the dangers of bitcoin and Trump’s foreign policy. Marc Faber on the coming equities “avalanche” decline. Eric Sprott and Andrew Hoffman on why gold is the answer. The post Top Ten Videos — March 3 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment