Gold World News Flash |

- GoldSeek Radio Nugget: Andrew Maguire and Chris Waltzek

- Let's Get Real: Why You Must Own Precious Metals

- Now that the silver rig is as obvious the gold rig, will anyone else speak out?

- Silver's Kamikaze Dive

- How Trump Versus Fed Adds to Uncertainty

- Is The Tyranny Of A Cashless Society Coming?

- Paul Craig Roberts Fears "The Resurrection Of Armageddon"

- Globalist's Biggest Secret LEAKED

- Now that the silver rig is as obvious the gold rig, will anyone else speak out?

- Gold Price Closed at $1231.90 Down -1.36% Silver Price Closed Down 4%

- Silver Is Collapsing On Massive Volume

- Jim Willie New Update Banking System COLLAPSE Here s What Comes NEXT

- 115 Million Ounces…Not Even Close To Possible!

- Gold Moves Higher Even if the Fed Raises Rates

- Gold Seeker Closing Report: Gold and Silver Fall With Stocks

- Gold Fundamentals Strong As PDAC Looms - Peter Diekmeyer

- Alasdair Macleod: Central banks and gold

- FTSE 100 stutters after hitting new record high as pound drops below $1.23 on US dollar strength and Brexit fears

- How the U.K. Turned Trump’s Tweet into a $125 Million Contract

- Is the Euro Going to Send Gold to the Moon?

- Will Trump’s Talk Turn the Trump Rally into Lasting Gold or End in the Trump Dump?

- India's February gold imports surge on pent-up demand, GFMS says

- Trump Avoid Debt Crisis ? “Extremely Unlikely†says Rickards

- The Myth of Gold Confiscation

- Breaking News And Best Of The Web

- Broadway Gold Ramps Up Exploration at Madison Mine

- Save Your Portfolio – Sell These Losers Today

| GoldSeek Radio Nugget: Andrew Maguire and Chris Waltzek Posted: 03 Mar 2017 07:11 AM PST Andrew Maguire, of Andrew Maguire Gold Trading a 40 year gold market veteran and whistleblower, returns with startling news on the precious metals. Our guest examines the minutiae of the markets noting that decades of manipulation has broken the gold / silver paper markets. As a result, the physical market is reasserting dominance over paper promises. Analysis of the options markets suggests that the 6 major bullion banks via the BOE are locked into losing short-sale positions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Let's Get Real: Why You Must Own Precious Metals Posted: 03 Mar 2017 07:05 AM PST It can be difficult, even for dyed-in-the-wool perma-bulls to hold onto precious metals, let alone buy more. We see the Dow trading above 20,000 (placing this into perspective, is that since 2000, the Dow is up around 65% versus gold's 300%), gold and silver currently languishing below multiple "resistance" points; suspended just above a couple of "support" lines. For long-suffering holders, it feels like the fabled Sword of Damocles dangling over their head, suspended by that proverbial single strand of hair. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Now that the silver rig is as obvious the gold rig, will anyone else speak out? Posted: 03 Mar 2017 07:03 AM PST Central banks gave their gold game away in April 2013 when they used the futures markets to knock the price down by more than $200 with relentless selling over several days. The selling had to be inspired by central banks because there was no important relevant news in the market to spook investors and because nobody else would have had access to the huge amounts of metal and capital involved. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Mar 2017 07:00 AM PST May Silver hit an air pocket Thursday morning, dropping 70 cents, or nearly four percent, in the space of an hour. From a technical standpoint the kamikaze dive tripped a short-sale signal at 17.755 that is tied to a 15.355 target. I expect the nastiness to come down to at least 16.948, the midpoint pivot indicated by the red line. If bulls are going to turn things around, that's where they'll have the best chance of succeeding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Trump Versus Fed Adds to Uncertainty Posted: 03 Mar 2017 12:48 AM PST To implement his $1 trillion dollar infrastructure plan, President Trump needs low rates, even though the Fed’s rate hikes will strengthen dollar. That means new uncertainty worldwide. In his Crippled America (2015), Trump argued that “our airports, bridges, water tunnels, power grids, rail systems—our nation's entire infrastructure is crumbling, and we aren't doing anything about it." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is The Tyranny Of A Cashless Society Coming? Posted: 02 Mar 2017 11:00 PM PST Via Capt. William E Simpson of WesternJournalism.com, Like many people, I am a careful person when it comes to digital commerce, yet nonetheless I had two of my credit cards hacked (twice in the last four years) — one time by a supposedly reliable online retail company, another time when I rented a trailer. And both times, it required an incredible amount of time, police reports, phone calls, etc., just to get back to square one and get my money back. But my experience was not unusual. Nearly 18 million Americans suffered from some form of identity theft in 2014 alone. Digital commerce and credit cards are very problematic and are not the panacea that companies and the government want the public to believe. Looking to a future in which governments abolish cash in useful denominations, it follows that they will then focus on eliminating personal and commercial commerce through the use of compact high-value commodities such as gold and silver, a natural progression if $100 bills are taken out of circulation in the United States. People today who are living in the legacy of the Barack Obama economy already need a fistful of $20 bills just to buy a week’s supply of groceries. And it’s easy to spend $400 a week on fresh groceries for two people, especially if you buy premium products and organic. If we consider the increasing trend where banks, institutions and big retailers are regularly hacked, combined with identity theft, digital commerce and credit cards aren’t all they’re cracked up to be, and in reality are posing an ever-increasing level of liability on all levels through their use. The relatively few people who may ultimately control all of the digital wealth of Americans will virtually have control of all the people in a cashless society. This results in a definite loss of freedom and liberty. There are many, many other ways for law enforcement to hammer criminals and curtail their enterprises, if that is truly the goal. But any method that inhibits or erodes the freedoms of Americans in any way, including limiting or infringing upon person-to-person commerce and personal privacy in any manner, is to be shunned and runs counter to the intents and spirit of our beloved U.S. Constitution. Digital currency transactions in lieu of cash would allow virtually 100 percent tracking of all Americans, including law-abiding citizens and all that we do. We have already learned over the past eight years of the Obama-led government that governments don’t necessarily work for or even represent the will of the people. So how can anyone justify giving the government this much power over Americans? There is no such justification. The vast majority of Americans are not criminals, and therefore any action by government that affects or targets the vast majority of people in order to deal with a small factional percentage of criminals in the population is manifestly unfair. Politicians simply need to do the jobs they are being paid to do, and come up with anti-criminal tactics that strictly focus upon the bad actors, not the majority of law-abiding Americans. If the minds behind a cashless society are allowed to have their way, America would become little more a monumental ant farm, where the elitist class studies Americans to a much greater extent than ever before — how we move around and what we do, use, eat, watch and listen to — and then uses this deeply insightful personal information, potentially to plot how to control everyone. Things like if we’re allowed to be born (abortions already control this to some extent), how long we get to live, and what we are allowed to do in between. Orwellian, yes, but possible nonetheless. Brazil played around in past decades on many occasions with reissuing, devaluing and recalling currency to limit amounts in circulation. And the Marxists paid close attention to that exercise. However, India’s currency games are more immediate and could have a sinister effect, since it is already a socialist state and we know how fond socialists and communists are of controlling all aspects of their populations. Here’s a video that should be alarming. Is India executing a plan similar to what may soon be in the works for Americans? I have to say, it’s looking like living in the countryside on a piece of land that provides sustainable sustenance and a firewall from a population that may recoil and strike out in anger sometime soon is the only viable path to surviving past what may be an ugly and austere future. Anyone who cares to look at the news these days will see riots, murders and unrest all around inside the United States, a result of numerous factors. Even as much as many Americans admire and respect President Donald Trump, the Marxist-socialist momentum that has already metastasized in America might be too much for him and his team to overcome. Our new president definitely needs our continued strong support more than ever. Smile and pray for the best, but adequately prepare for the worst. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts Fears "The Resurrection Of Armageddon" Posted: 02 Mar 2017 08:05 PM PST

It only required 24 days for the Deep State to castrate President Donald Trump and terminate the promise that the high tensions with Russia created during the Clinton, George W. Bush, and Obama regimes would be terminated by Trump’s presidency. As Gareth Porter shows conclusively, the case against General Flynn, Trump’s 24-day National Security Adviser, and by implication against Trump himself, is a fake news creation. Obama’s CIA director, John Brennan, planted fake reports, none of which contained any evidence whatsoever, on the CIA-compliant media whores known as “presstitutes.” The CIA’s media whores knew that the reports were a CIA response to the threat to the $1,000 billion annual budget of the military/security complex that desperately needs “the Russian threat” for its justification. But the media whores—-principally the New York Times, Washington Post, CNN, MSNBC—-and all the rest as well are more dedicated to serving their CIA master than they are to serving peace between nuclear powers. Interesting, isn’t it, that the US and Western media are more committed to conflict with Russia than they are to peace, despite the brutal fact that 10 percent of the nuclear arsenal of either the US or Russia is sufficient to terminate all life on earth. As Patrick Lawrence says: “The lights upon us are dimming. We have been more or less abandoned by a press that proves incapable of informing us in anything approaching a disinterested fashion. As suggested, either the media are Clintonian liberals before they are newspapers and broadcasters, or they are servants of power before they serve us.” All we have left, says Lawrence, is the alternative media. “To put this simply and briefly, they and we must learn that they are not ‘alternative’ to anything. In the end there is no such thing as ‘alternative media,’ as I often argue. There are only media, and most of ours have turned irretrievably bad.” The alternative media is the Internet media, websites such as this one, RT, the Intercept, USAWatchdog, Alex Jones, Information Clearing House, Global Research, Unz Review, etc. These independent news sites are under attack. Remember the list of 200 “Russian agents/dupes”? Every source of information that does not subscribe to the Deep States’ Matrix creation of “the Russian Threat,” which is the Deep State’s replacement for the orchestrated “Soviet Threat,” has been selected for shutdown. Apparently, Alex Jones is already having problems with Google. Several websites managed to get off the 200 List, and those that have seem to have collapsed as members of the opposition. As the Nazis said, all it takes is fear, and the people collapse. Trump’s presidency is effectively over. Even if he is permitted to remain in office, he will be a figurehead for the Deep State’s presidency. President Trump has already fallen into line with the military/security complex. He has said Russia has to return Crimea to Ukraine, whereas in fact Crimea returned itself to Russia. He has rejected a new strategic arms limitations treaty (START) with Russia, stating that he wants supremacy in nuclear armaments, not equality. Obama’s one trillion dollar upgrade of the US nuclear arsenal is likely to get a boost from Trump. After one month in office the goal has changed from reduced tensions with Russia to greater tensions. Greater tensions might soon be upon us. There are plans to occupy part of Syria with US troops in order to prevent Syria with Russia’s help from reuniting the country. http://www.globalresearch.ca/rand-corporations-plan-for-dicing-up-syria/5577009 Part of Syria is to go to Turkey, part to the Kurds, and Washington will keep a chunk. This way Washington can keep the turmoil going forever. The Russians brought this problem on themselves. Ever hopeful for Washington’s cooperation against ISIS, Russia dallied in cleaning out ISIS. The prospect that Trump would work with Russia as part of better relations assumed that Trump would actually be in charge, which has turned out to be delusional. It is difficult to know if the new Trump regime is more Iranophobic than Russophobic. The Trump regime’s inclination to jettison the Iran agreement and reopen the conflict means more conflict with Russia. Washington’s continued provocations of both Russia and China will dispel any lingering Russian expectations of better relations with Washington. It is bizarre to see the liberal-progressive-left allied with the warmongers against Trump. As the neoconservatives pull nuclear Armageddon out of the grave that Reagan and Gorbachev put it in, the American left demands the impeachment of the president whose goal was better relations with Russia. Once the champion of the working class, the left now champions Identity Politics. Trump’s goal of jobs for the working class leaves the leftwing cold. The left wants to destroy the “Trump deplorables,” which the left describes as “racist, misogynist, homophobic, gun nuts.” In Identity Politics, every identity is a victim except the oppressor identity—white heterosexual males. Where then is the opposition to the neoconservative ideology that is driving US foreign policy toward world hegemony? There are a few of us, but we are being cast as “Putin agents.” In other words, those who have sufficient intelligence to understand that Washington is not going to achieve hegemony over Russia and China or even Iran, but is likely to provoke nuclear war by trying, are relegated to the traitor class. The reason that there is still life on earth after more than a half century of nuclear weapons is that American presidents and Soviet leaders worked together to reduce tensions. During these decades, there were numerous false alarms of incoming ICBMs. However, because the leadership of both countries were working together to avoid nuclear conflict, the warnings were disbelieved both by the Soviets and Americans. Today the situation is vastly different. The last three US presidents, and now apparently Trump also, worked overtime to increase tensions between the two nuclear powers. Moreover, it was done in ways that convinced the Russian government that Washington is completely untrustworthy. The ongoing vicious lies about the Russian connections of Trump and his associates are so obviously false as to be laughable, but the Russians are seeing that the falsity of the charges notwithstanding, Trump’s National Security Adviser has fallen and Trump himself might be next. In other words, the Russians are observing that in America facts are not relevant to outcomes. The Russians have already experienced this with regard to themselves with the lies about Putin, the Ukraine, Georgia, and Russian intentions toward Europe. Putin is routinely called a “thug,” “murderer,” “the new Hitler” by US politicians, presstitutes, and the Democratic Party’s candidate in the recent presidential election. Ranking US generals describe Russia as the “principal threat to the US.” NATO commanders assert that the Russian Army could occupy the Baltics and/or Poland at any moment. These nonsensical accusations and predictions suggest to the Russians that the West is preparing its populations for an attack on Russia. In such a tense state of affairs, how will false alarms be interpreted? Will Americans convinced that Putin and Russia are evil incarnate believe the false alarms this time? Will Russians convinced that they have been set up for attack believe them this time? This is the extreme risk to which the insane neoconservatives, the idiot liberal-progressive-left, the greedy military/security complex, and the aggressive generals have exposed life on earth. And the few voices warning of the risk are dismissed as “Russian agents.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Globalist's Biggest Secret LEAKED Posted: 02 Mar 2017 08:00 PM PST Alex Jones reveals the globalists biggest secret and their weak point, how they can be defeated. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Now that the silver rig is as obvious the gold rig, will anyone else speak out? Posted: 02 Mar 2017 06:47 PM PST 10:08p ET Thursday, March 2, 2017 Dear Friend of GATA and Gold: Central banks gave their gold game away in April 2013 when they used the futures markets to knock the price down by more than $200 with relentless selling over several days. The selling had to be inspired by central banks because there was no important relevant news in the market to spook investors and because nobody else would have had access to the huge amounts of metal and capital involved. All major central banks had to be participating or at least acquiescing in the smash, because any of them could have used it to buy metal at a discount. For many months before April 2013 the gold market was said to have official Chinese support underneath it. In April 2013 that support disappeared. ... Dispatch continues below ... ADVERTISEMENT K92 Mining is producing much more gold than planned Company Announcement Wednesday, March 1, 2017 K92 Mining Inc. is pleased to report that mining production has shown a steady ramp up over the last three months with ore tonnes mined being over 50 percent above budget in January while contained gold ounces were almost 20 percent above budget. The company mined more than 8,000 ore tonnes by February 24 and is on target to achieve 10,000 tonnes by month end, which is 40 percent above February budget. The increased ore production is in part due to significant lower-grade ore being identified outside the planned ore envelope, which was identified by our ongoing grade-control program, highlighting the importance and success of this program. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/03/k92-provides-operational-update/ Today someone took the hammer to silver futures to an extent not seen in a long time, driving the price down by almost a dollar in less than an hour. The news potentially affecting the market was only the usual speculation about an increase in U.S. interest rates. Of course the invaluable Zero Hedge quickly took note of the smash and the "massive volume" of sudden selling: http://www.zerohedge.com/news/2017-03-02/silver-collapsing-massive-volum... GATA Chairman Bill Murphy's "Midas" commentary at LeMetropoleCafe.com reviewed the smash in detail, as with commodity broker J.B. Slear's minute-by-minute tracking of the smash as contracts were dumped on the market in great bulk "starting at 11:25 a.m. for 40 minutes straight." Slear counted it this way: 1,071 contracts at 11:25. "That's a total of 30,192 contracts in 40 minutes." Toronto gold and silver market analyst Harvey Organ estimated that these contracts represented more than $2 billion in notional value even as that amount of metal is not available anywhere in the world. Even the most obtuse apologists for the monetary metals markets will have to admit that this kind of selling was not designed to get a good price for the seller but to undertake a bear raid and protect or profit from a short position being managed by the biggest player or players in the market. The only players that big are central banks or investment banks fronting for them. But as of this hour the silver smash seems to have gone unnoticed by mainstream financial news organizations. Even most internet sites devoted to the monetary metals appear to be silent about it. And if the smash itself is to be overlooked, no one will be asking who perpetrated it and why -- not even the monetary metals mining industry itself, though documents filed in 2014 with the U.S. Securities and Exchange Commission and Commodity Futures Trading Commission certify that governments and central banks are surreptitiously trading all major U.S. commodity and financial futures contracts: http://www.gata.org/node/14385 http://www.gata.org/node/14411 The longstanding policy and mechanisms of Western governments and central banks in suppressing the monetary metals and thereby impairing all markets have been summarized and documented by GATA here: http://www.gata.org/node/14839 Yes, governments and central banks have enormous power. But their power here is still limited here because it cannot succeed without deception. Markets cannot be rigged unless buyers and sellers can be fooled. So the greatest power of governments and central banks here is only the power conferred on them by the monetary metals industry's fecklessness and by the cowardice and corruption of mainstream financial news organizations. Now that the rigging is as obvious in silver as it has been in gold, will anyone in the mining industry speak out? Will anyone in a mainstream financial news organization dare to pose a few specific, critical questions to governments and central banks and report their answers or refusals to answer? Or must opposing this cosmic injustice still be left to the amateurs of GATA? CHRIS POWELL, Secretary/Treasurer Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1231.90 Down -1.36% Silver Price Closed Down 4% Posted: 02 Mar 2017 05:53 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Is Collapsing On Massive Volume Posted: 02 Mar 2017 04:17 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Willie New Update Banking System COLLAPSE Here s What Comes NEXT Posted: 02 Mar 2017 03:00 PM PST Jim Willie Warns Dollar Headed For Dustbin of History! Gold is up $100 and silver is up $2 since the beginning of the year. Silver is approaching a short term breakout point, Jim Willie says. But still, manipulation is rampant in the precious metals markets, Willie reveals. There are up... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 115 Million Ounces…Not Even Close To Possible! Posted: 02 Mar 2017 02:57 PM PST I thought I would put today in perspective for those throwing in the towel on gold and silver. 23,000 silver contracts were sold in just a few minutes this morning. This equates to 115 million ounces. For perspective, there are only two countries in the world that produce this much in one year, Mexico and... Read more » The post 115 Million Ounces…Not Even Close To Possible! appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Moves Higher Even if the Fed Raises Rates Posted: 02 Mar 2017 01:55 PM PST This post Gold Moves Higher Even if the Fed Raises Rates appeared first on Daily Reckoning. [Ed. Note: Jim Rickards' latest New York Times bestseller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis, is out now. Learn how to score your free copy here. This vital book transcends geopolitics and media rhetoric to prepare you for what signal areas to watch and how to thrive in the event of an ice-nine lockdown.] When the Fed raised interest rates in December, many believed gold would plunge. But it didn't happen. Gold bottomed the day after the rate hike, but then started moving higher again. And for the last 10 weeks it's been up about 12%, despite some up and down fluctuations. Incidentally, the same thing happened last year when the Fed tightened in December 2015. Gold had one of its best quarters in 20 years in the first quarter of 2016. So it's very interesting to see gold going up despite headwinds from the Fed. Normally when rates go up, the dollar strengthens and gold weakens. They usually move in opposite directions. So how could gold be going up when the Fed's tightening and the dollar's strong? That tells me that there's more to the story, that there's more going on behind the scenes that's driving the gold price higher. It means you can't just look at the dollar. The dollar's an important driver of the gold price, no doubt. But so are basic fundamentals like supply and demand in the physical gold market. I travel constantly, and just in recent months I was in Shanghai meeting with the largest gold dealers in China. I was also in Switzerland not too long ago, meeting with gold refiners and gold dealers. I've heard the same stories from Switzerland to Shanghai and everywhere in between, that there are physical gold shortages popping up, and that refiners are having trouble sourcing gold. Refiners have waiting lists of buyers, and they can't find the gold they need to maintain their refining operations. And new gold discoveries are few and far between, so demand is outstripping supply. That's why some of the opportunities we've uncovered in gold miners are so attractive right now. One good find can make investors fortunes. My point is that physical shortages are becoming an issue. That is an important driver of gold prices. Now, when we talk about the gold market, it's very important to distinguish between the paper gold market and the physical gold market. When I refer to the paper gold market, I'm talking about gold ETFs, COMEX gold futures and the like. There's only a small amount of gold backing these markets. Think of an inverted pyramid, with a small amount of gold at the bottom supporting a vast amount of paper gold contracts on top. So the paper market is not an honest reflection of the physical gold market. And there's no question that the paper gold market has been manipulated downwards. That's not a conspiracy theory. I've spoken to expert witnesses in some of the pending litigation involving price manipulation. These are PhD statisticians who've looked at 20 years of data and tell me there's no question that the paper gold market is being manipulated. Who's behind it, and their motivation, is a matter of some speculation. But more importantly, gold has been moving higher despite higher interest rates and price suppression through the paper gold market. That tells me we're seeing a flight to quality, meaning people are losing confidence in central banks all over the world. They realize the banks are out of bullets. They've been printing money for eight years and keeping rates close to zero or negative. But it still hasn't worked to stimulate the economy the way they want. So gold has been moving up in what I would consider a challenging environment of higher rates and a manipulated paper market. The question is, where does gold go from here? First, I think the Fed's on track to raise rates in March. As I’ve been saying since last December, the Fed is on track to raise rates in March. The market gave this a 30% probability until recently while I gave it a 75% probability. Now the market has moved to a 70% probability just in the past few days. I’ve moved to the 90% confidence level. It’s “game on” for a rate hike on March 15. The logical question is, "If the Fed's raising rates, doesn't that make it a more difficult environment for gold?" I've partly answered that question. But there's more to it… The Fed is raising at the worst possible time, if we bring President Trump and his economic plan into the equation. Here's what I mean… The stock market has gone up 2,000 points, or more than 10% since Trump was elected. The expectation was Trump would mean lower taxes, more infrastructure spending, more defense spending, less regulation, and all this would help the economy. Now, the last time gold sold off dramatically was on election night, when Stan Druckenmiller, a famous gold investor, sold all his gold. It's only natural that when someone dumps the amount of gold he deals in, the price will go down. That move reflected a change in sentiment. What Stan said at the time was very interesting. He said, "All the reasons that I own gold in the first place have gone away because Trump was elected president." In other words, he was buying into the story that Hillary Clinton would be bad for the economy but Donald Trump's policies would be beneficial. If we were going to have strong economic growth with a Trump presidency, maybe you didn't need gold for protection. So he sold his gold and bought stocks on the assumption that the economy would grow under Trump. But just in the past couple weeks, Stan has said he's buying gold again. What that means is that after the initial Trump euphoria, people are now reconsidering the reflation trade. They're wondering where the money for all this infrastructure spending is going to come from. If our debt-to-GDP ratio is already over 100% and we're 20 trillion dollars in debt, there doesn't seem to be much room for more debt. And the faction of Republican budget hawks in Congress are saying that tax cuts must be paid for, meaning spending cuts elsewhere or raising taxes somewhere else. That means for the economy as a whole, there is no tax cut. If you make tax cuts revenue neutral, which means that for every dollar cut you've got to raise it someplace else, there's no simulative effect. Plus, the infrastructure spending looks like that's already been put off to 2018. And the deregulations Trump promised sound good, but they'll take a very long time to play out. So many are taking a closer look at the Trump reflation trade and concluding there's a lot less there than meets the eye. And we also need to realize that the Fed looking to raise rates, even though the economy might not be as rosy as many originally thought. But the reason the Fed wants to raise rates is telling. It's not because they think the economy's strong — we might even be looking at negative GDP for the first quarter — but because they're worried they'll have to raise them before the next recession arrives. So the Fed is on a mission to raise rates as soon as possible so they can cut them when the recession comes. That's a very strange reason to be raising rates, but that's why. They should have raised rates in 2011 but didn't. If they raised then, they'd be in a good position to cut rates today, but they didn't. Now they're trying to make up for lost time, but as usual the Fed's getting it wrong. So the Fed's raising rates in the face of a weak economy. That will become obvious and by April or May the Feds going to have to reverse course. What's going to happen when the Fed reverses in April or May? Gold's going to go higher again, because people are going to realize the Fed can't raise rates even though they want to. They'll have to cheapen the dollar again, and that's very bullish for gold. To sum it all up, I'm very impressed with the present gold action because it should be going down based on higher rates and price suppression of the paper gold market. But it's not, it's rising. So I expect gold to really take off in the spring. Regards, Jim Rickards The post Gold Moves Higher Even if the Fed Raises Rates appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Fall With Stocks Posted: 02 Mar 2017 01:15 PM PST Gold fell $18.70 to $1231.20 in midafternoon New York trade before it bounced back higher in the last 90 minutes of the day, but it still ended with a loss of 1.19%. Silver slipped to as low as $17.711 and ended with a loss of 3.53%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Fundamentals Strong As PDAC Looms - Peter Diekmeyer Posted: 02 Mar 2017 12:47 PM PST Sprott Money | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Central banks and gold Posted: 02 Mar 2017 12:31 PM PST 3:33p ET Thursday, March 2, 2017 Dear Friend of GATA and Gold: GoldMoney research director Alasdair Macleod today examines the world's geo-political and economic situation and sees the dissolution of the European Union, flight from the U.S. dollar, and a trend toward the yuan and gold. Macleod's analysis is headlined "Central Banks and Gold" and it's posted at GoldMoney here: https://wealth.goldmoney.com/research/goldmoney-insights/central-banks-a... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Mar 2017 10:28 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How the U.K. Turned Trump’s Tweet into a $125 Million Contract Posted: 02 Mar 2017 08:58 AM PST This post How the U.K. Turned Trump’s Tweet into a $125 Million Contract appeared first on Daily Reckoning. In the future, U.K PM Theresa May could look back on the canceled meeting between President Trump and Mexican President Peña Nieto on January 26 as the luckiest break in her political career (recent analysis on Mexico featured HERE). The U.S. and U.K. "Special Relationship”May and Trump are already linked by the nationalist sentiment that brought them both to power. In the U.K., the citizens voted to leave the EU because they felt it would be beneficial to their personal economic conditions. May played to Trump's ego. She congratulated him on his "stunning election victory." She also announced that the Queen has invited him to pay a state visit. Trump told her more than once that, when he goes to the U.K. later this year, "I want to see you first." In their talks, Trump promised to establish a bilateral deal with Britain after Brexit takes. This is important to the U.K. The U.S. provides the second biggest market for U.K. good and services, buying 20% of U.K. exports. In 2015, the U.S. and U.K. transacted about $235 billion in total trade. (For comparison, this is less than half the amount the U.S. trades with Mexico.) Thus, the trade aspect of the "special relationship" is more important to Britain. The U.K. is the sixth largest trading partner of the U.S. For now, only about 5% of the $5 trillion total U.S. annual trade is with the U.K. If there's a new trade deal though, this could mean that there is a lot of room for growth. Any new trade agreement between the U.S. and U.K. won't happen before mid-2019, after Brexit is fully executed. In the meantime, Trump has promised to do a "quick trade deal" and a "smooth deal" with the U.K. and to honor any trade deals Britain already has with the U.S. via its EU membership until a bilateral deal goes into full effect. Trump and May have agreed to create working groups to determine what a deal would look like and get as much done as possible. They want to hit the ground running after Brexit is complete. EU and U.K Negotiations over BrexitThis budding personal alliance provides the U.K. with a stronger bargaining position as it enters Brexit negotiation talks with the EU. When May became Prime Minister, she promised to trigger Article 50 to leave the EU by the end of March 2017. On Feb. 1, the U.K. parliament voted to allow the government to begin its negotiations. That gave May the authority to stick to the March timeline.

As an EU member, the U.K. is a member of the European Single Market. There are no tariffs on trade between member states. The EU has implemented other free trade agreements between the U.K. and non-EU countries that the U.K. would want to keep after it leaves the EU. After May's meeting with Trump, it's clear that the U.S. is willing to enter a bilateral trade deal. While this gives her leverage when negotiating with EU and creating other bilateral deals, the tariffs on trade between the U.S. and U.K. are just 3%. There's not much room to move that percentage down, but certainly the U.K. wouldn't want it to be higher. This means we can speculate that, as part of the negotiation of trade deal with the U.S., other things will come up for discussion, including bank regulations, agriculture and the insurance markets. When she left the U.S. with the promise of a "smooth" bilateral deal from Trump, May went to Turkey and met with its controversial president, Recep Tayyip Erdogan. She touted a U.K.-Turkey fighter jet project and stressed her desire for a better trade relationship between the two nations. She called Erdogan "an important NATO ally" and promised to bolster his country's defenses. On Jan. 28, Britain and Turkey signed a 100 million pounds ($125 million) defense deal to develop Turkish fighter jets, paving a path to more cooperation later. May said this deal showed "Britain is a great, global, trading nation and that we are open for business." It is a harbinger of what can happen as a result of the U.S. and U.K.'s special partnership. In early February, the Israeli and Italian Prime Ministers were hosted in the U.K. May is also going to visit China soon to discuss post Brexit trade agreements. As a hedge to any trade issues with the EU, she is seeking to revive the "golden age" between the U.K. and the Four Asian Tigers — Hong Kong, Singapore, South Korea and Taiwan. May is on a mission to secure the best trade deals she can for the U.K., not unlike Trump. After laying the ground work of a bilateral trade agreement with the U.S. — which Trump happily encouraged after the impasse with Nieto — May used that leverage to negotiate with many other countries. This allows the U.K. to come to the EU negotiating table in March with a stronger financial industry, and growing transportation, shipping and defense companies. Increased Investment in the U.K.The Bank of England (BOE) raised its 2017–19 growth forecast for the UK economy after Philip Hammond, a Member of Parliament and Chancellor of the Exchequer, announced a plan for higher infrastructure investment in the U.K. This is similar to Trump's plan to increase infrastructure spending. As Jim Rickards has detailed in his recent article, governments will use spending to try to provide fiscal stimulus and growth. The BOE is a part of the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD). They have raised their global growth forecasts on expectation of more fiscal stimulus and infrastructure projects from the U.S. under Trump in 2017 and 2018. Because the pound is still relatively weak, we can expect U.K. exports to increase even further. Regards, Nomi Prins, @nomiprins The post How the U.K. Turned Trump’s Tweet into a $125 Million Contract appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is the Euro Going to Send Gold to the Moon? Posted: 02 Mar 2017 07:48 AM PST The biggest trade in the world is staring everyone in the face. According to a Bank of America/ Merrill Lynch fund manager survey, the US Dollar is the single most crowded trade on the planet. In a fiat world, the value of a given currency is based on where it trades relative to other currencies. In the case of the $USD, the Euro comprises 56% of the basket of currencies against which the $USD is valued. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Trump’s Talk Turn the Trump Rally into Lasting Gold or End in the Trump Dump? Posted: 02 Mar 2017 06:58 AM PST Trump is market magic. The Donald spoke, offering nothing he hasn't said hundreds of times before in his campaign speeches, and the Dow parted its way through the 21,000 barrier without hesitation. The stock market's rise from 20k to 21k also tied a record for the quickest 1,000-point gain. How long will this rampaging bull market last? Is 22,000 now an easy reach? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India's February gold imports surge on pent-up demand, GFMS says Posted: 02 Mar 2017 04:39 AM PST By Rajendra Jadhav MUMBAI, India -- India's February gold imports surged to 50 tonnes, up more than 82 percent from a year ago, on pent-up jeweller demand and as retail consumers ramped up purchases for weddings, provisional data from consultancy GFMS showed on Wednesday. The rise in imports by the world's second-biggest consumer of the precious metal will support global prices that are trading near their highest level in 3 1/2 months, but could widen the South Asian country's trade deficit. "Pent-up demand on the ease of the cash crunch and wedding related demand lifted imports in February," said Sudheesh Nambiath, a senior analyst at GFMS, a division of Thomson Reuters. ... ... For the remainder of the report: http://in.reuters.com/article/india-gold-imports-idINKBN1683LK ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump Avoid Debt Crisis ? “Extremely Unlikely†says Rickards Posted: 02 Mar 2017 04:24 AM PST The upcoming March 15 U.S. debt ceiling deadline is something that is being largely ignored by markets and most media for now. Despite it being just 9 trading days away. This will change in the coming days and is one of the many reasons why we are bullish on gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Mar 2017 04:19 AM PST If we experience a debt crisis, as many economists believe is inevitable, many people believe that their holdings of gold and silver bullion will be confiscated, just as in 1933. This article reviews the probability of confiscation and compares it to other more likely measures to generate government solvency. An appropriate starting point when addressing concerns about gold confiscation is to define the word 'confiscation.' Merriam Webster says 'to seize or buy as if by authority' and 'to seize without compensation as forfeited to the public treasury.' Almost without exception, it is expropriation that is the actual risk, not confiscation. Confiscation, as in forfeiture, is usually the result of theft, treason, insurrection, war or genocide. Expropriation is defined as 'to take (property) of an individual in the exercise of state sovereignty' (Merriam Webster). The key difference between confiscation and expropriation is the appropriate compensation of the individual for the transfer of his or her property. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 02 Mar 2017 01:37 AM PST US stocks open higher flat Wednesday’s melt-up. Gold and silver down from multi-week highs. Bitcoin near all-time high. Trump budget to increase defense, cut EPA, State. Debate over Putin and fake news continues. Best Of The Web 19,20,21…faster, faster! – Doug Wakefield What financial disaster awaits us next – Jay Taylor Contemplations for a […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Broadway Gold Ramps Up Exploration at Madison Mine Posted: 02 Mar 2017 12:00 AM PST Broadway Gold Mining has recently begun both surface and underground mining at its Madison Mine, advancing exploration at the historic gold-copper project in the Butte-Anaconda mining district of Montana and netting the attention of industry watchers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

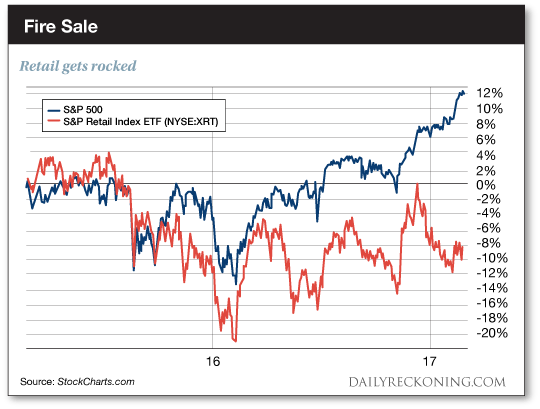

| Save Your Portfolio – Sell These Losers Today Posted: 01 Mar 2017 07:09 AM PST This post Save Your Portfolio – Sell These Losers Today appeared first on Daily Reckoning. There's nothing worse than a group of stocks trending lower during a roaring bull market. Unless you're looking to go broke, these are the stocks you need to purge from your portfolio. Luckily, they're easy to spot. These poisonous stocks emit a radioactive glow. Even a novice investor can't miss these losing positions draining the gains from his brokerage account. While most major sectors are humming along this year, one in particular is falling behind. If you don't clean these losers out of your portfolio, you're at risk of even bigger losses. In case you haven't figured it out, I'm talking about retail stocks. Retailers are off to a terrible start in 2017. The S&P Retail Index ETF (NYSE:XRT) is off by nearly 3% year-to-date, compared to a gain of almost 6% for the S&P 500. Retailers and the major averages began to part ways during the 2016 market bottom. After a weak start to the year, the gap is widening…

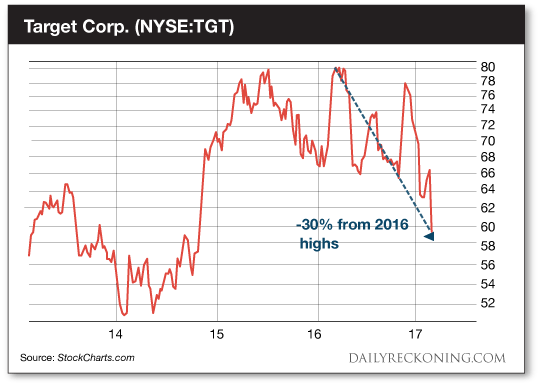

Retailers are in big trouble. The number of retailers with distressed credit ratings has tripled since 2009, according to Moody's. the firm estimates a record number of retailers will enter junk territory over the next five years. "The main factors causing downgrades are stressed liquidity, weak credit profiles, challenged competitive positions, sponsor ownership and erratic management structures," MarketWatch notes. And don't forget Amazon… The undisputed heavyweight champion of e-commerce has become a one-man retail wrecking ball. We've highlighted the ongoing meltdown of the brick and mortar retail sector for quite some time in these pages. While traditional retailers are still attempting to lure you into their stores with coupons and sales, Amazon is sneaking into your home and your everyday life. It's clear Amazon is dominating the retail landscape for one important reason: It's just plain smarter than the competition. The retail sector has become a wasteland. Jeff Bezos and his army of same-day Amazon delivery drivers have gutted every brick and mortar store in their path. As a result, no one's really expecting stellar performance from any of the major retail brands this earnings season. But even the added cushion of low expectations can't stop some of these stocks from crashing. Want more retail carnage? Check out Target Corp. (NYSE:TGT) We were talking up Target as recently as November when big-box retailer reported improved traffic and sales. The stock bounced off its lows, gaining 20% in the weeks leading up to Black Friday. Unfortunately for shareholders, Target's rebound was short lived. Management slashed its fourth quarter sales outlook after the holidays. But even with the bar lowered all the way to the floor, Target tripped and fell flat on its face… Target whiffed on all its fourth quarter numbers. It missed revenue expectations. Earnings weren't exactly rosy, either… "The bottom-line results were even uglier: fourth quarter net earnings plunged 42.7% to $817 million, resulting in earnings of $1.45 per share," Forbes reports. "The per-share result was five cents lower than the analyst consensus and marked a 37.6% decline compared to the year-ago quarter." Management blames "rapidly-changing consumer behavior" for this disaster of an earnings report. But that's just a fancy way of saying Amazon is eating their lunch. By the end of the day, Target shares had dropped nearly 13%. That brings the stock down to levels we haven't seen since November 2014. Look away if you're squeamish. This is one ugly chart…

Targets nosedive is sticking out like a sore thumb. I don't know if this marks the beginning of the end for the retailer. But the company has proven over the past year that's it's still not capable of seriously competing with Amazon. As the market glides toward the end of earnings season, it's once again telling investors to avoid these retail disasters like the plague. Meanwhile, we'll continue to stick to our Amazon trade while big retail struggles to keep up… Sincerely, Greg Guenthner The post Save Your Portfolio – Sell These Losers Today appeared first on Daily Reckoning. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment