Gold World News Flash |

- FTSE 100 scales new peak as pound drops below $1.23 on resurgent dollar and Brexit bill defeat

- Beware the Ides of March

- #Trump & #LePen compared in 90 seconds

- Gold Seeker Closing Report: Gold and Silver End Mixed While Stocks Surge Higher

- Gold Resource Corporation Announces 2017 Annual Meeting of Shareholders

- Warning of Looming Inflation and Dollar Collapse by Rob Kirby

- The Next Signal to Watch

- The Diversification Benefits of Gold

- Gold Pressured By Increasing Odds of March FED Rate Hike

- Gold Pressured By Increasing Odds of March FED Rate Hike

- Save Your Portfolio – Sell These Losers Today

- Stocks are higher, but the Fed trumps Trump

- Art Market Bubble Bursting – Gauguin Value Collapses 74% To $22 Million

- Art Market Bubble Bursting – Gauguin Priced At $85 Million Collapses 74%

- Gold – It’s Still All About The US Dollar

- NEW UNCOVERED INFORMATION: Why Central Banks Were Forced To Rig The Gold Market

- Breaking News And Best Of The Web

- Irving Resources, Tightest Shares in Canada

- The Fantasy Continues

- Gold Stumbles, Dollar Strengthens as Market Prices in March Rate Hike

- Gold Stocks Enormous Daily Slide

- Will Gold Prices Finally Pull Back or Continue Marching Ahead?

| FTSE 100 scales new peak as pound drops below $1.23 on resurgent dollar and Brexit bill defeat Posted: 02 Mar 2017 01:57 AM PST This posting includes an audio/video/photo media file: Download Now |

| Posted: 01 Mar 2017 03:15 PM PST This post Beware the Ides of March appeared first on Daily Reckoning. Trump's speech last night sure set the river ablaze… Tax cuts, deregulation, infrastructure spending, defense spending — American Greatness on a dozen fronts — and something for everyone! The Big Board blasted 303 points skyward today… all the way past 21,000… for the first time ever. Dow 20,000, we hardly knew ye. And the dollar had its best day in six weeks. Treasuries slumped as yields on the telltale 10-year topped 2.45%. Gold slipped 3½ bucks. All hale and hearty signs of an economy building steam. But hard schooling has conditioned us to meet good news with mild alarm. Matching H.L. Mencken's definition of a cynic, when we smell flowers… we start looking around for a coffin. Today's the first of March, two weeks from March 15… the ides of March… Beware the ides of March, the soothsayer Spurinna allegedly warned Caesar about his approaching doom. He didn't. David Stockman doesn't claim to be a soothsayer. But he's a crackerjack analyst with 40 years of government and market experience. And David too says to beware the ides of March: "What people are missing is this date: March 15, 2017." Why March 15?: That's the day that this debt ceiling holiday that Obama and House Speaker Boehner put together right before the last election in October 2015. That holiday expires. The debt ceiling will freeze in at $20 trillion. It will then be law. It will be a hard stop. The Treasury will have roughly $200 billion in cash. We are burning cash at a $75 billion-a-month rate. By summer, they will be out of cash. Then what?: Then we will be in the mother of all debt ceiling crises. Everything will grind to a halt. I think we will have a government shutdown. There will not be Obamacare repeal and replace. There will be no tax cut. There will be no infrastructure stimulus. There will be just one giant fiscal bloodbath over a debt ceiling that has to be increased and no one wants to vote for. Here David draws a dark sketch. And March 15 is just two weeks away. Does the debt ceiling raise the curtain on "one giant fiscal bloodbath," as David fears? We don't know. And David says the crisis won't necessarily strike March 15. He says it'll probably start "slowly at first" followed by "accelerating intensity" as the Treasury runs short on cash. We'll see. But there may be other reasons to beware the ides of March… The Fed's Open Market Committee concludes its two day meeting March 15. Do they raise rates? Last week, the fed funds futures indicated just a 20% chance of a hike. But after Trump's stemwinder, today they're flashing a 69% chance. But Bloomberg says the timing of the next rate hike is a "balancing act." Raise too soon and it could strangle growth in its crib. Raise too late and it could give inflation too much running room. And some signs indicate inflation is percolating amid all the growth talk. That's why Dallas Fed head Robert Kaplan argues, "We want to guard against a situation where we get behind the curve." Just so. But maybe the economy's weaker than they think… Despite the low official unemployment rate and mounting inflation, the economy grew only a skinny 1.6% for all of 2016 — its lowest rate since 2011. MarketWatch says the number of distressed U.S. retailers is at the highest level since the Great Recession of 2009–09. Forbes told us yesterday that the U.S. economy is "weaker than you think." Is this an economy in need of a rate hike? Some other potential market movers clustered around the ides of March: The European Central Bank (ECB) meets March 9. U.S. employment data for February comes out March 10… The Netherlands holds the first European election of the year on March 15, the ides… The G-20 gaggle of finance ministers and central bankers meets March 17–18. Who knows if any surprises lay in store? Maybe the ECB surprises. Maybe a populist, anti-EU party wins in the Netherlands, throwing more doubt on the EU's future. Maybe something big comes out of the G-20. Or maybe nothing at all. But add something else to a looming debt ceiling crisis and a potentially botched rate hike… and bewaring the ides of March might be sage advice… Regards, Brian Maher The post Beware the Ides of March appeared first on Daily Reckoning. |

| #Trump & #LePen compared in 90 seconds Posted: 01 Mar 2017 01:30 PM PST Gideon Rachman, the FT's chief foreign affairs commentator, compares the movements behind US president Donald Trump and French presidential candidate Marine Le Pen – in 90 seconds. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold Seeker Closing Report: Gold and Silver End Mixed While Stocks Surge Higher Posted: 01 Mar 2017 01:26 PM PST Gold fell $14.50 to $1237.10 at about 9AM EST before it climbed back to $1250.50 in early afternoon trade and then chopped back lower, but it ended with a loss of just 0.13%. Silver slipped to as low as $18.265 before it bounced back to $18.459 and then also fell back off, but it still ended with a gain of 0.33%. |

| Gold Resource Corporation Announces 2017 Annual Meeting of Shareholders Posted: 01 Mar 2017 01:23 PM PST Gold Resource Corporation ( NYSE MKT : GORO ) (the "Company") announced today that it will hold its annual meeting of shareholders at 8:00 a.m. Mountain Time on Thursday, June 29, 2017 at Embassy Suites located at 10250 East Costilla Avenue, Centennial, CO 80112. Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. |

| Warning of Looming Inflation and Dollar Collapse by Rob Kirby Posted: 01 Mar 2017 12:16 PM PST Macroeconomic analyst Rob Kirby says, "The world is flush with money, extremely flush with money." This is causing some to worry about the instability of hyperinflation. So, is this the reason some of the biggest money managers and investors on the planet are talking about moving money into gold... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 01 Mar 2017 10:43 AM PST This post The Next Signal to Watch appeared first on Daily Reckoning. Trump advisors believe they can avoid a debt crisis through higher than average growth. This is mathematically possible but extremely unlikely. A debt-to-GDP ratio is the product of two parts — a numerator consisting of nominal debt and a denominator consisting of nominal GDP. In this issue, we have focused on the numerator in the form of massively expanding government debt. Yet, mathematically it is true that if the denominator grows faster than the numerator, the debt ratio will decline. The Trump team hopes for nominal deficits of about 3% of gross domestic product (GDP) and nominal GDP growth of about 6% consisting of 4% real growth and 2% inflation. If that happens, the debt-to-GDP ratio will decline and a crisis might be averted. This outcome is extremely unlikely. As shown in the chart below, deficits are already over 3% of GDP and are projected by CBO to go higher. We are past the demographic sweet spot that Obama used to his budget advantage in 2012–2016 (As I noted HERE – Obama Has Tied Trump's Hands).  The Congressional Budget Office, CBO, estimates that inflation and real GDP will each grow at about 2% per year in the coming ten years. This means that nominal GDP, which is the sum of real GDP plus inflation, will grow at about 4% per year. Since debt is incurred and paid in nominal terms, nominal GDP growth is the critical measure of the sustainability of U.S. debt. The Fiscal BudgetThe Congressional Budget Office, CBO, estimates that inflation and real GDP will each grow at about 2% per year in the coming ten years. This means that nominal GDP, which is the sum of real GDP plus inflation, will grow at about 4% per year. Since debt is incurred and paid in nominal terms, nominal GDP growth is the critical measure of the sustainability of U.S. debt. From now on, retiring Baby Boomers will make demands on social security, Medicare, Medicaid, Disability payments, Veterans benefits and other programs that will drive deficits higher. The CBO projections show that deficits will increase to 5% of GDP in the years ahead, substantially higher than the hoped for 3% in the Trump team formula. As for growth, we are now in the eighth year of an expansion — quite long by historical standards. This does not mean a recession occurs tomorrow, but no one should be surprised if it does. Official CBO projections, shown in the chart below, expect approximately 2% growth and 2% inflation for the next ten years. That would yield 4% nominal growth, not enough to match the deficit projections. The debt-to-GDP ratio is projected to soar even under these rosy scenarios.

The Congressional Budget Office, CBO, estimates that inflation and real GDP will each grow at about 2% per year in the coming ten years. This means that nominal GDP, which is the sum of real GDP plus inflation, will grow at about 4% per year. Since debt is incurred and paid in nominal terms, nominal GDP growth is the critical measure of the sustainability of U.S. debt. There are numerous problems with the CBO projections. They make no allowance for a recession in the next ten years. That is highly unrealistic considering that the current expansion is already one of the longest in history. A recession will demolish the growth projections and blow-up the deficits at the same time. CBO also makes no allowance for substantially higher interest rates. With $20 trillion in debt, most of it short-term, a 2% increase in interest rates would quickly add $400 billion per year to the deficit in the form of increased interest expense in addition to any currently project spending (as was noted prior on the Unencumbered Interest Rate Policy – CLICK HERE). The Impact Signal of Debt on GrowthFinally, CBO fails to consider the ground-breaking research of Kenneth Rogoff and Carmen Reinhart on the impact of debt on growth. We have discussed the 60% debt ratio danger threshold in this article. But there is an even more dangerous threshold of 90% debt-to-GDP revealed in the Rogoff-Reinhart research. At that 90% level, debt itself causes reduced confidence in growth prospects — partly due to fear of higher taxes or inflation — which results in a material decline in growth relative to long-term trends. These headwinds practically insure that the Trump growth projections are wholly unrealistic. With higher than expected deficits, and lower than projected real growth, there is one and only one way for the Trump administration to reduce the debt ratio — inflation. If inflation is allowed to rip to 4% and Fed financial repression can keep a lid on interest rates at around 2.5%, then it is possible to achieve 6% nominal growth with 5% deficits, which would be just enough to keep the debt ratio under control and even reduce it slightly. Can Trump pull-off this finesse? Are his advisors even analyzing the problem along these lines? We will know soon. As we'll discuss in upcoming issues, Trump will have the chance to make an unprecedented five appointments to the Fed board of governors in the next 16 months, including a new chair and two vice chairs. If he appoints doves, that will be the signal that inflation in the form of helicopter money and financial repression is on the way. That will also be the signal to move out of cash and increase our allocation to gold beyond the current 10% level. If Trump appoints hawks to the board, that will be a signal that his team does not understand the problem and is relying on overoptimistic growth assumptions. In that case, we could expect a recession, possible debt crisis and strong deflation. That is a signal to keep our 10% gold allocation as a safe haven, but also buy Treasury notes in expectation of lower nominal rates. We are watching for a signal on Trump's nominations to the Fed board. The first three should be announced soon. Once the names and their views are known, the die will be cast. Regards, Jim Rickards The post The Next Signal to Watch appeared first on Daily Reckoning. |

| The Diversification Benefits of Gold Posted: 01 Mar 2017 09:43 AM PST Gold posted its second straight monthly gain in February, the first such time it has done so since the summer, when Brexit-fueled uncertainty shook world markets. In 2017, the yellow metal has now advanced close to 9 percent, cracking the $1,260 an ounce ceiling on Monday for the first time since soon after the November election. Compared to the same number of trading days last year, gold was up 15 percent. |

| Gold Pressured By Increasing Odds of March FED Rate Hike Posted: 01 Mar 2017 09:38 AM PST Gold Stock Bull |

| Gold Pressured By Increasing Odds of March FED Rate Hike Posted: 01 Mar 2017 08:07 AM PST The gold price has corrected by roughly $25 over the past few days. This pullback has been driven by increased odds of a Fed rate hike during March. Federal Reserve officials have been making hawkish comments lately, which has been supportive of the USD index and thus bearish for precious metals. After hitting a 2017 high of $1,265 on Monday, the gold price has since dropped back to $1240 today. On Monday the odds of a March rate hike were around 40%, but they have since increased to around 70% to 80% today. New York Fed President William Dudley told CNNMoney on Tuesday that the case for raising interest rates is growing. |

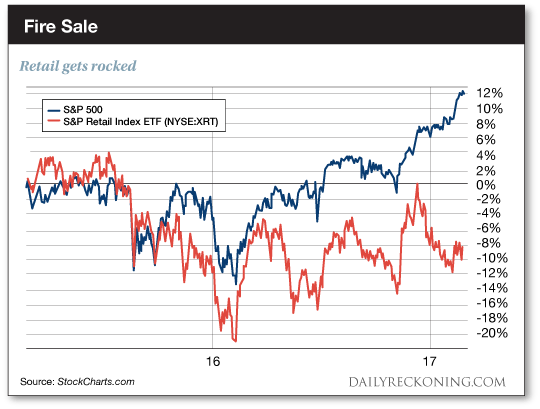

| Save Your Portfolio – Sell These Losers Today Posted: 01 Mar 2017 07:09 AM PST This post Save Your Portfolio – Sell These Losers Today appeared first on Daily Reckoning. There's nothing worse than a group of stocks trending lower during a roaring bull market. Unless you're looking to go broke, these are the stocks you need to purge from your portfolio. Luckily, they're easy to spot. These poisonous stocks emit a radioactive glow. Even a novice investor can't miss these losing positions draining the gains from his brokerage account. While most major sectors are humming along this year, one in particular is falling behind. If you don't clean these losers out of your portfolio, you're at risk of even bigger losses. In case you haven't figured it out, I'm talking about retail stocks. Retailers are off to a terrible start in 2017. The S&P Retail Index ETF (NYSE:XRT) is off by nearly 3% year-to-date, compared to a gain of almost 6% for the S&P 500. Retailers and the major averages began to part ways during the 2016 market bottom. After a weak start to the year, the gap is widening…

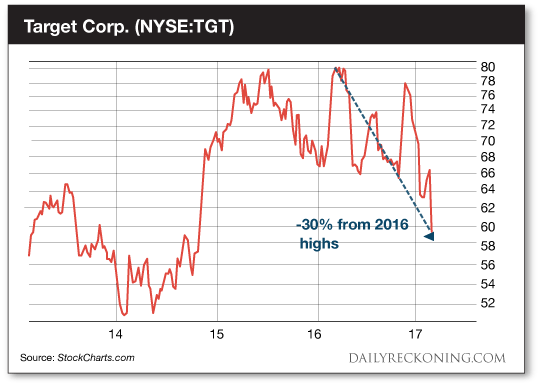

Retailers are in big trouble. The number of retailers with distressed credit ratings has tripled since 2009, according to Moody's. the firm estimates a record number of retailers will enter junk territory over the next five years. "The main factors causing downgrades are stressed liquidity, weak credit profiles, challenged competitive positions, sponsor ownership and erratic management structures," MarketWatch notes. And don't forget Amazon… The undisputed heavyweight champion of e-commerce has become a one-man retail wrecking ball. We've highlighted the ongoing meltdown of the brick and mortar retail sector for quite some time in these pages. While traditional retailers are still attempting to lure you into their stores with coupons and sales, Amazon is sneaking into your home and your everyday life. It's clear Amazon is dominating the retail landscape for one important reason: It's just plain smarter than the competition. The retail sector has become a wasteland. Jeff Bezos and his army of same-day Amazon delivery drivers have gutted every brick and mortar store in their path. As a result, no one's really expecting stellar performance from any of the major retail brands this earnings season. But even the added cushion of low expectations can't stop some of these stocks from crashing. Want more retail carnage? Check out Target Corp. (NYSE:TGT) We were talking up Target as recently as November when big-box retailer reported improved traffic and sales. The stock bounced off its lows, gaining 20% in the weeks leading up to Black Friday. Unfortunately for shareholders, Target's rebound was short lived. Management slashed its fourth quarter sales outlook after the holidays. But even with the bar lowered all the way to the floor, Target tripped and fell flat on its face… Target whiffed on all its fourth quarter numbers. It missed revenue expectations. Earnings weren't exactly rosy, either… "The bottom-line results were even uglier: fourth quarter net earnings plunged 42.7% to $817 million, resulting in earnings of $1.45 per share," Forbes reports. "The per-share result was five cents lower than the analyst consensus and marked a 37.6% decline compared to the year-ago quarter." Management blames "rapidly-changing consumer behavior" for this disaster of an earnings report. But that's just a fancy way of saying Amazon is eating their lunch. By the end of the day, Target shares had dropped nearly 13%. That brings the stock down to levels we haven't seen since November 2014. Look away if you're squeamish. This is one ugly chart…

Targets nosedive is sticking out like a sore thumb. I don't know if this marks the beginning of the end for the retailer. But the company has proven over the past year that's it's still not capable of seriously competing with Amazon. As the market glides toward the end of earnings season, it's once again telling investors to avoid these retail disasters like the plague. Meanwhile, we'll continue to stick to our Amazon trade while big retail struggles to keep up… Sincerely, Greg Guenthner The post Save Your Portfolio – Sell These Losers Today appeared first on Daily Reckoning. |

| Stocks are higher, but the Fed trumps Trump Posted: 01 Mar 2017 06:39 AM PST Good Morning! President Trump’s speech appeared to be his most “presidential,” but was short on details. The surging dollar and rising SPX futures give some indication that Trump is still getting the benefit of the doubt. |

| Art Market Bubble Bursting – Gauguin Value Collapses 74% To $22 Million Posted: 01 Mar 2017 06:35 AM PST – Art Market Bubble Bursting? – Russian Billionaire Takes 74% Loss On “Investment” – $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008 – Christie’s auctioned the work at its evening sale in London – Global art sales plummet, but China rises as ‘art superpower’ – China soon to dominates global art and gold market – Art price volumes doubled since 2009 – As currencies debase super rich seek out stores of value – Gold remains accessible store of value for all – Stocks, bonds and many assets at record prices – Gold half it’s real price in 1980 |

| Art Market Bubble Bursting – Gauguin Priced At $85 Million Collapses 74% Posted: 01 Mar 2017 05:02 AM PST gold.ie |

| Gold – It’s Still All About The US Dollar Posted: 01 Mar 2017 03:05 AM PST The US dollar is the world’s reserve currency. And that isn’t likely to change in any radical way, anytime soon. Unless there is some kind of calamitous implosion of the dollar. I am talking about outright rejection and repudiation. And that could happen. The problem is that there isn’t another currency that could likely take its place. By the time that possibility becomes a reality, any possible candidates would likely be in worse shape. This includes the Euro and Chinese Yuan. |

| NEW UNCOVERED INFORMATION: Why Central Banks Were Forced To Rig The Gold Market Posted: 01 Mar 2017 03:03 AM PST According to newly uncovered information in the gold market, it provides additional evidence of why the Fed, Central Banks and the IMF were forced to RIG the gold market. Actually, looking at this new information, I had no idea of the amount of Fed, Central Bank and IMF gold market intervention until I put all the pieces together. Now, when I say “new information”, it pertains to new information and data that I dug up from older official documents. While most of the folks in the precious metals community realize that the Fed and Central Banks have sold gold into the market to depress the price, this new evidence puts the gold market it in an entirely DIFFERENT LIGHT. |

| Breaking News And Best Of The Web Posted: 01 Mar 2017 01:37 AM PST US stocks open higher after major Trump speech. Gold and silver down from multi-week highs. Bitcoin near all-time high. Trump budget to increase defense, cut EPA, State. Debate over Putin and fake news continues. Best Of The Web Contemplations for a Sunday (unless you can’t get around to it til Monday) – Economica Risk […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Irving Resources, Tightest Shares in Canada Posted: 01 Mar 2017 12:00 AM PST Bob Moriarty of 321 Gold discusses Irving Resources, a spinoff from Gold Canyon Resources that has assets in northern Japan. |

| Posted: 01 Mar 2017 12:00 AM PST Rudi Fronk and Jim Anthony, co-founders of Seabridge Gold, assess President Donald Trump's speech to a joint session of Congress and find it wanting. |

| Gold Stumbles, Dollar Strengthens as Market Prices in March Rate Hike Posted: 28 Feb 2017 04:00 PM PST |

| Gold Stocks Enormous Daily Slide Posted: 28 Feb 2017 09:42 AM PST Yesterday was just another period of back-and-forth movement for gold, silver, the USD Index and even the general stock market – but not for precious metals mining stocks. Gold stocks and silver stocks plunged very visibly - there are very important implications of this move and they are not bullish. Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com), starting with the GDX ETF (proxy for both gold and silver stocks). |

| Will Gold Prices Finally Pull Back or Continue Marching Ahead? Posted: 27 Feb 2017 10:49 AM PST Gold prices are up more than 11% since bottoming last December. Their gains last week took the gold market right up to its 50-week moving average. In 2015, attempted rallies reversed at the 50-week moving average. Could this level once again serve as a barrier to further price advances? Either way, long-term gold bulls shouldn’t sweat this particular technical level. Major bull markets need to pull back and reconsolidate periodically. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment