Gold World News Flash |

- GoldSeek Radio Nugget: Bill Murphy and Chris Waltzek

- Silver Market Poised For Big Reversal When Institutional Investors Move In

- China As A Superpower: "They Will Not Be Humiliated Again"

- Exponential Solar Power Growth Means Fossil Fuels Are Toast

- Bitcoin ( BTCUSD ) Warning Stage

- What The Hell Is Going On? - Part 3

- Gold Price Closed at $1202.40 Down 0.5% - Silver Price Closed at 16.99 Down 1.53%

- Fossil Fuels Are Toast – But Real Assets Are Still The Place To Be

- It’s Tulip Time!

- Gold Seeker Closing Report: Gold and Silver Fall Back to About $1200 and $17

- Fossil Fuels Are Toast – But Real Assets Are Still The Place To Be

- Zinc Stocks May Be Top Buy of #PDAC2017 As Commodity Soars to 5 Year Highs

- Gold And Silver: Legal Weapons Against The Deep State

- (VIDEO) What Drives the Price of Gold?

- The Privacyless, Freedomless Smart City of 2030 the Elite Are Engineering

- Why It’s a Mistake to Buy Gold Right Now

- Alasdair Macleod: The fateful date

- Silver Very Undervalued from Historical Perpective of Ancient Greece

- Forex Trading Alert: USD/CAD at Fresh Highs

- No Surprise in Recent Moves in Gold and Silver Markets

- Breaking News And Best Of The Web

- Gold Standard Ventures Offers District-Scale and Takeout Potential

- Integra Gold's Lamaque Looking Better Than Ever After Updated PEA Announcement

| GoldSeek Radio Nugget: Bill Murphy and Chris Waltzek Posted: 10 Mar 2017 07:14 AM PST Following a remarkable 9 week silver market rally, Bill Murphy of GATA.org says that the gold cartel is back in play in the silver market. Another likely explanation for recent volatility includes the upcoming stealth rate hike by Fed policymakers. Chairwoman Janet Yellen's comments last week startled investors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Market Poised For Big Reversal When Institutional Investors Move In Posted: 10 Mar 2017 07:04 AM PST The Silver Market is going to experience a big reversal when the Hedge Funds and Institutional investors rotate out of highly inflated stocks and into precious metals investments. This is not a matter of if, it's a matter of when. And the when, could be much sooner than we expect due to the huge problems with the U.S. debt ceiling deadline on March 15, 2017. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China As A Superpower: "They Will Not Be Humiliated Again" Posted: 09 Mar 2017 11:00 PM PST Via Erico Matias Tavares of Sinclair & Co., China as a Superpower – An Interview with Prof. Toshi Yoshihara

E Tavares: Prof. Yoshihara, thank you for being with us today. China has been very busy building up their military capabilities in recent years. Broadly speaking, what are their medium and long term intentions? T Yoshihara: One way to gauge China’s longer term intentions is to assess what Chinese leaders are saying today. President Xi Jinping has articulated a vision for China over the next few decades. This vision has been termed the “Chinese Dream” or the “great rejuvenation of the Chinese nation.” These slogans capture goals, milestones, and timelines. In terms of timeframe, the Chinese refer to the “two one hundreds”: i) the centenary of the founding of the Chinese Communist Party in 2021; and ii) the centenary of the founding of the People’s Republic of China in 2049. By 2021 China hopes to become what the Chinese call a “moderately well-off society.” By mid-century China hopes to be on par with other developed countries. Most measures for tracking China’s progress are socio-economic in nature: disposable income, socioeconomic equality, access to higher education, access to healthcare and so forth. To achieve these objectives, China still hews to the basic principle laid out by paramount leader Deng Xiaoping, namely, peace and development. The concept of peace and development derives from the notion that China needs a peaceful external environment to develop economically. But there are also external components to China’s long term goals, particularly China’s relations with the rest of the world. President Xi Jinping offers some hints. He has discussed the prospects for “democratizing” the international system. This is code for a transition from a unipolar world dominated by the United States to a multipolar world. As China rises, China envisions the emergence of a new global configuration in which China is a great power among other coequal great powers, including the European Union, India, and Russia, in the international system. This aligns with the “rise of the rest” hypothesis. As China gets very strong, it would also seek to amend the rules that have governed the current international order in ways that accommodates China’s interests as a great power. China’s rise thus raises a series of important questions about the implications for Asia. What does China want in East Asia as it rises? Would China seek to become the dominant power in East Asia? Would it seek a dramatically reduced role for the United States? More troubling, would China seek a Sino-centric regional order in which many of its neighbors, including Japan, must acquiesce to its strategic prerogatives? ET: So “power” for China is not just economic power, where they have performed spectacularly in recent decades. What they also envision is establishing themselves as a great military power to adequately achieve the goals you outlined, correct? TY: Absolutely. China’s rise must be measured in terms of “comprehensive national power,” a phrase Chinese strategists use to asses China’s ascent. Comprehensive national power includes all instruments of national power, including political, diplomatic, economic, social, ideological, cultural, and, importantly, military power. For decades after China opened itself in the late 1970s, China more or less accepted the U.S.-led liberal international order. Being a member of the order was essential for China’s national development. But to join the order, it struck a bargain with the United States: it would accept American primacy in East Asia in exchange for access to the U.S.-led order. However, as China has gotten much stronger, this grand bargain has come under strain, especially over the last decade. This strain is reflected in an ongoing debate within China: should a great power like China continue to depend on the goodwill of another great power, the United States, for its economic well-being and national security? As China becomes more powerful, some Chinese believe that no self-respecting power should depend on outsiders but should rely on its own power, including military power, to determine its destiny. ET: Is it fair to say that the bulk of their impressive military development of late is intentionally targeting U.S. capabilities in the region, and even bypass defense protocols to strike the U.S. homeland? YT: If China seeks to revise the grand bargain it struck with the United States, if China seeks to be a great power in a multipolar world, and if China seeks to be the dominant power in East Asia, then China needs to seek a significantly reduced role of the United States in the region. If you accept these propositions, then China clearly needs the capability to counterbalance America’s military dominance in Asia today. But there are specific contingencies, including those related to Taiwan, that have compelled China’s military modernization. In particular, the 1995-1996 Taiwan Strait crises demonstrated to China that it needed military capabilities to respond to American military power. At the height of the crises, the Clinton Administration deployed two carrier battle groups in the vicinity of Taiwan as show of American resolve. Chinese leaders learned to their utter horror that they lacked credible military options to respond to this U.S. show of force. They thus concluded that they needed certain capabilities to ensure that they are not humiliated again. Given the structural change in the balance of power in Asia and the various regional flashpoints that might involve China and U.S. intervention, it is not surprising that many Chinese military capabilities frequently match a discernible U.S. military target. ET: Have they reached military parity with the U.S. and if so in what terms? YT: In terms of conventional military power, China has not reached parity with the US across the board. The United States is also qualitatively superior across many measures of military power. However, such broad military parity is not necessary for China to pose serious challenges to the United States. In certain niche areas China has already achieved tremendous advances and has even surpassed those of the United States. It is actually more useful to think about asymmetries in the competition through which China has pitted its strengths against America’s military weaknesses. For instance, China has developed a very large family of missiles that can be launched from ships, submarines, aircraft, and trucks to attack U.S. platforms and bases in the Pacific. These missiles have furnished China a competitive advantage at sea: relatively inexpensive Chinese anti-ship missiles could inflict crippling damage to a U.S. aircraft carrier that costs billions of dollars to build. And, it takes only one missile to get through to put out of action a surface combatant essential to America’s regional strategy in Asia. Chinese missiles also threaten U.S. bases in the Western Pacific. American bases there represent massive concentrations of U.S. capital in a few key locations. This means that China can direct the bulk of its missile prowess against a few positions to do some real damage to, if not severely cripple, America’s ability to project power in the region. China is becoming very competitive in the missile arena, in part, because it is filling a strategic vacuum left behind by the superpowers during the Cold War. The Intermediate-Range Nuclear Forces Treaty committed both the US and the then Soviet Union (and now Russia) to eradicate entire classes of missiles prohibited by the treaty. Unconstrained by the treaty, China embarked on a missile buildup that has now made it the most potent conventional missile power in the world. ET: North Korea is also aggressively developing their missile capabilities, which could be used to deliver their nuclear arsenal. Its economy can only survive because of Chinese support. And this situation could precipitate the occurrence of some of the scenarios you described. Is China using that country as a proxy to test the resolve of, and even wage war against, the U.S. and its regional allies? Or are they equally concerned with what’s going on in Pyongyang? YT: China is in an unenviable position. China’s prime directive is stability including stability along its periphery. North Korea clearly falls in that category. North Korea has served as a geostrategic buffer on the Korean Peninsula. After all, Mao intervened in the Korea War to prevent a noncommunist power from being established on China’s borders. China abhors the possibility of countless Korean refugees pouring across the border owing to regime collapse or war. Perhaps even worse from China’s perspective is a unified Korea led by Seoul and aligned with the United States. But, stability has to be balanced against other liabilities. North Korea’s nuclear ambitions could trigger broader regional proliferation across threshold nuclear powers like Japan, South Korea, and Taiwan. During different periods of the Cold War, all three powers have considered or pursued an independent nuclear option. North Korea’s actions are putting even more pressure on these countries to revisit the unthinkable option. A nuclear Japan would presumably be a nightmare for China. ET: It is an odd situation that the U.S. has to deal with serious security concerns engendered by one of its key trading partners, in fact a major supplier of manufactured products. How has the U.S. government reacted to this? President Obama tried that pivot to Asia, which did not seem to be that successful. Do you sense any change in this regard with the new Trump administration? YT: The United States has long pursued a dual-pronged approach to China. One prong is engagement. For decades, the U.S. has engaged China economically, diplomatically, culturally, and, to a lesser extent, militarily. This can be described as comprehensive engagement with China. However, engagement is not (or should not be) an end in and of itself. It seems to me the intermediate goal is to make China a responsible stakeholder. In theory, enmeshing China in the U.S.-led liberal international order would give China an ever larger stake in the current order and thus incentivize Beijing to build on and defend the order. The other prong is deterrence. Deterrence requires the United States to maintain significant military presence in the western Pacific to deter China from changing the status quo unilaterally. Deterrence helps to lock in the current order and to buy time so that engagement with China can do its work. Engagement and deterrence are thus very much interrelated. But, the risk is that engagement has made China very wealthy and powerful. If fact, China has become so wealthy that it has acquired the tools, both military and non-military, to unilaterally change the status quo. This is sort of like feeding the beast. And, it undermines deterrence. This dual-pronged approach is thus in tension with each other as well. The Obama administration’s pivot to Asia was in part designed to bolster the deterrence piece of the equation even while engaging China. The Trump administration’s strategy toward China is still unclear, but we see glimmers of his approach. By questioning China’s trade practices and by promising a military buildup, Trump may be revisiting both prongs of engagement and deterrence. It remains to be seen if modifying both prongs will be more effective in managing the relationship between China in the U.S. ET: Certainly as part of that engagement both countries have deepening cultural ties. Many Chinese students attend American universities, including children of prominent party officials. Likewise, the U.S. has been investing significantly in China on many fronts, including learning institutes. This raises the question of how aggressive China would actually be in all these scenarios. Throughout its extensive history it has never really ventured much beyond its borders, militarily at least. In fact quite the opposite, they have been the victims of invasion, including the Mongols and even several Western powers during the “century of shame”. Can we not say that their geopolitical ambitions are driven more by defensive rather than offensive ambitions? YT: This engagement strategy has clearly produced a great deal of people-to-people and cultural exchanges. The question is to what extent such exchanges are fundamentally reshaping Chinese perceptions towards the U.S. It is not clear to me that there is necessarily and always a positive correlation. Let’s look at history. The UK and Germany prior to World War I were very close. Many members of the German royal family studied in Britain. Kaiser Wilhelm was the grandson of Queen Victoria. There was a great deal of economic, diplomatic, and cultural interchange between the two. Yet, Germany made strategic choices that stimulated a diplomatic and naval rivalry with Britain. More generally, it is easy to misread the resolve of other nations. Past adversaries have grossly misread the United States. The notion that you could get the U.S. to back down by giving America a bloody nose informed Imperial Japan’s calculation when it attacked Pearl Harbor and Osama Bin Laden’s calculation when he orchestrated 9/11. The question is whether these cultural exchanges will dispel Chinese misconceptions and biases about the United States. That’s hard to tell. Whether China has been defensive historically is a subject of intense debate. But, even if we accept that China is primarily defensive, it is worth considering how China’s neighbors view China’s strategic orientation. Even if China genuinely believes that it is only seeking to defend its interests in East Asia, those inhabiting Asia, like Japan, might draw some very different conclusions about China’s posture. ET: When we look back at history one of the major driving factors – and an often forgotten one – is demographics. And China appears to be in trouble here. What are your views here? YT: As a result of the one-child policy, China is already suffering from rapid ageing and population decline. India will overtake China in terms of population size in the not so distant future. China’s labor force began shrinking in 2012. The elderly population as a percentage of the total population is rising fast. As the cliché goes, China will get old before it gets rich. This is meant as a contrast to Japan, which reached its stage of demographic decline after it had developed into an advanced economy. What this means for China’s security is unclear. On the one hand, an aging society might become more risk averse. In a one-child society, parents may be less willing to risk losing their sole offspring in a bloody conflict. On the other hand, it is plausible that demographics might compel China to act sooner rather than later to resolve disputes before population decline constrains China’s options. In other words, China may feel it needs to hurry to settle security problems before it’s too late. ET: The U.S. is also facing some internal issues. As everyone knows its society is incredibly divided today. Both parties can’t even agree on building a wall south of the border, much less on a broader defense policy. Is this undermining the U.S.’ ability to project power and defend its allies in a time of crisis? And how is China viewing all this? YT: America’s allies and friends in the Western Pacific are watching the United States very closely. While they have always worried about U.S. commitments to the region, political developments in the US have only added to the anxiety. China, too, is closely observing the U.S. As I explained earlier, China still needs a stable external environment to grow economically. That means unstable or even hostile relations with the United States could do real harm to China’s long-term goals. For the United States, the question is whether it can maintain the longstanding consensus about its power and purpose in Asia. Since the end of World War II, the consensus has been that American primacy in the Pacific disproportionately benefits U.S. economic and security interests. To what extent this consensus will hold will be the question on the minds of everyone on both sides of the Pacific. ET: Thank you very much for your insightful thoughts. YT: Thank you. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exponential Solar Power Growth Means Fossil Fuels Are Toast Posted: 09 Mar 2017 10:46 PM PST With all the oil-related headlines we’re exposed to each day, you might assume that “black gold,” along with other fossil fuels like coal and natural gas, matter to humanity’s future. You’d be wrong. Like Keynesian economics and fiat currencies, fossil fuels are near the end of their run. From here on out, solar is the story. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin ( BTCUSD ) Warning Stage Posted: 09 Mar 2017 09:47 PM PST Bitcoin Review Last year , Bitcoin was still considered as a fading project and many expected its price to keep dropping and break below $100. However in the recent months, the crypto-currency kept rising significantly and finally managed to make new all time high and break above $1200 last week ! That’s only $50 short of the equivalence to 1 ounce of GOLD which could have a big impact in the future . | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What The Hell Is Going On? - Part 3 Posted: 09 Mar 2017 08:05 PM PST Via Jim Quinn of The Burning Platform blog, In Part One and Part Two of this article I revealed how the Deep State’s fake data and fake news propaganda machine can be overcome by opening your eyes, observing reality, understanding how Fed created inflation has destroyed our lives, and why the election of Trump was the initial deplorable pushback to Deep State evil. “The notion that a radical is one who hates his country is naïve and usually idiotic. He is, more likely, one who likes his country more than the rest of us, and is thus more disturbed than the rest of us when he sees it debauched. He is not a bad citizen turning to crime; he is a good citizen driven to despair.” – H.L. Mencken

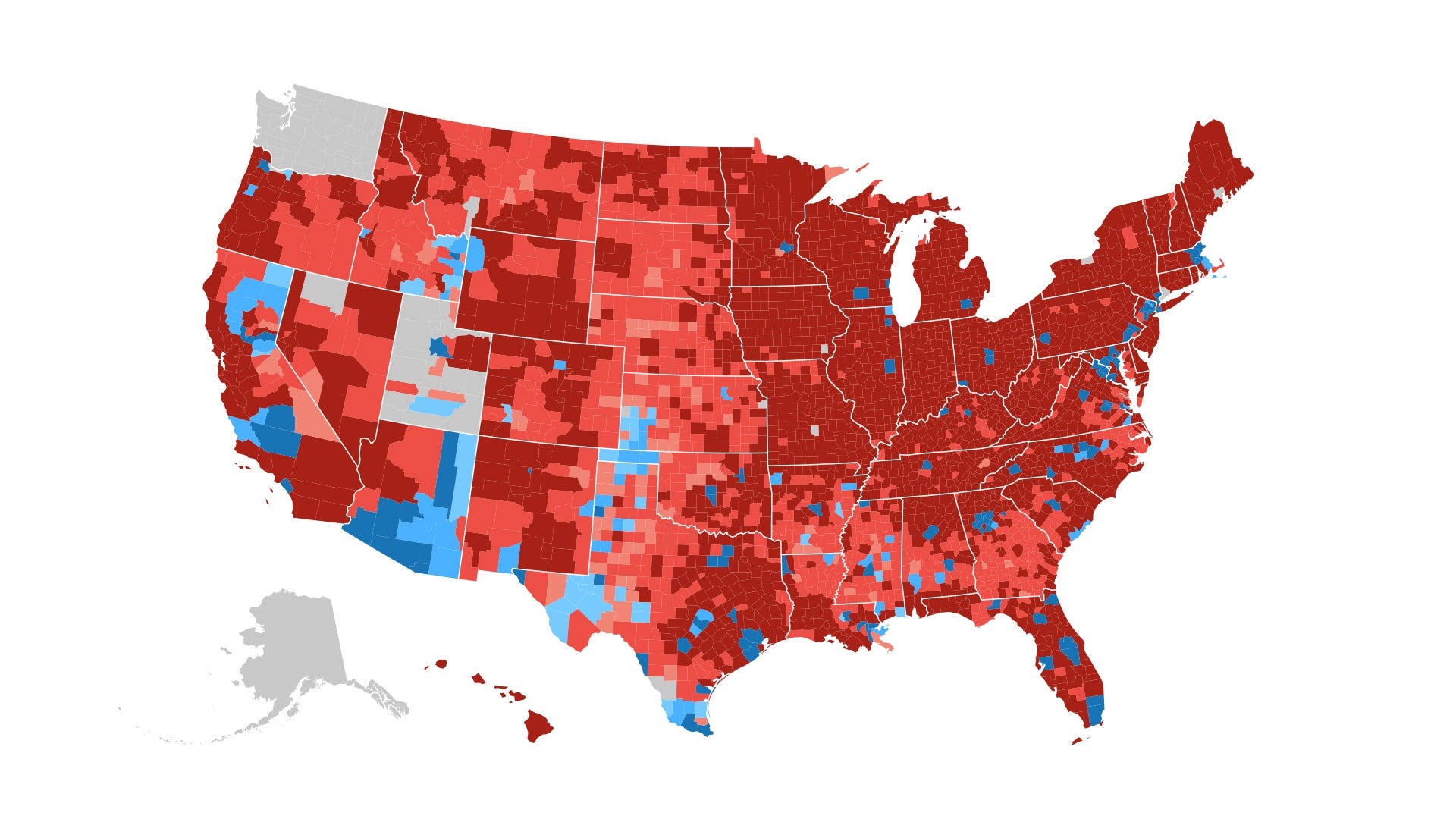

“This new regime will enthrone itself for the duration of the Crisis. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Where leaders had once been inclined to alleviate societal pressures, they will now aggravate them to command the nation’s attention. The regeneracy will be solidly under way.” – The Fourth Turning – Strauss & Howe We are now seven weeks into the Trump presidency and it seems like seven years with amount of incidents that have occurred before and since his inauguration. When in doubt, Trump’s brain dead, hyperventilating with hate, opponents either blame the Russians or declare him Hitler. The histrionics displayed by the low IQ hypocritical Hollywood elite, corrupt Democratic politicians, fake news liberal media and Soros paid left wing radical terrorists over the last two months has been disgraceful, revolting, childish, and dangerous. A counter-revolution by the gun owning normal people in the 85% red area of the country that voted for Trump would not be a pleasant experience for the paid protesters, vagina hat wearing feminazis, and the safe space anti-free speech lefties on campuses across the land.

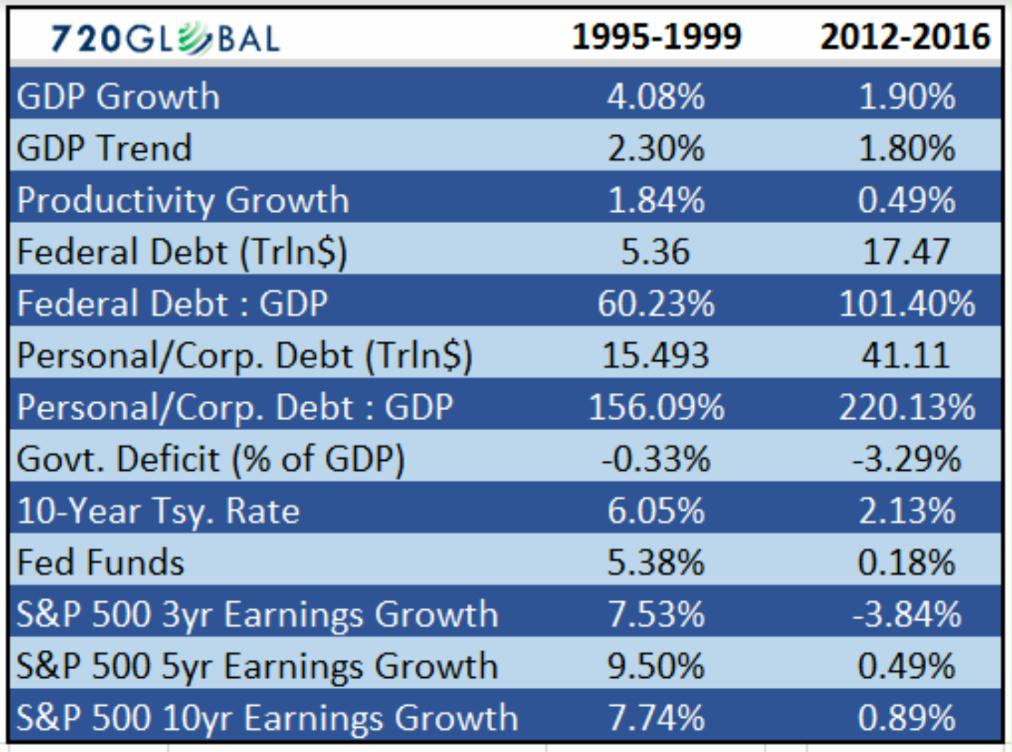

I must admit I love Trump’s pugnacious style. I love how he treats the despicable corporate media. I love how he responds to baseless accusations by his contemptible opponents on the left and right. The representatives of the Deep State – Schumer, Pelosi, Obama, McCain, Graham, Kristol, CNN, NYT, Washington Post, MSNBC, Soros, and anyone else willing to confront Trump are met with disdain, contempt, and abuse from the president. I love that he continues to go on the road and hold rallies with the people who elected him. I love how he demoralized his opponents by giving one of the best State of the Union speeches in history. I love how he put his opponents back on their heels by accusing Obama of wire-tapping Trump Tower. No punch is taken without two being thrown. He will never conform to the way the liberal corporate media and his opponents want him to behave. Twitter is the dagger he uses to avoid the fake news media filter and plunge into his opponents hearts. The faux journalists despise his use of Twitter. When you see the violence beginning to break out between Trump haters and Trump supporters, and read stories about Obama leading an insurgency to undermine Trump’s presidency, every normal person must be prepared to do whatever necessary to support his radical agenda of draining the swamp. “Every normal man must be tempted, at times, to spit on his hands, hoist the black flag, and begin slitting throats.” – H.L. Mencken The fake news media scoffed when Trump declared what an awful economic mess Obama had left after eight years of a debt fueled Keynesian failure of epic proportions. These fake journalists are good at looking stylish, speaking in serious tones, and reading false narratives written for them by their corporate bosses, but impartially assessing our economic situation is beyond their pea brain comprehension. The eye opening chart below shows you how far we’ve come since 2000, or how far we’ve fallen, depending on your point of view. It looks to me like Trump has been handed a bucket of shit by his egotistical sociopathic boastful predecessor. Obama can now concentrate on his true passions – his NCAA pool and golf – while Trump is left to try and clean up a $20 trillion mess.

The Bush and Obama administrations frittered away any chance for a sustainable long-term economic paradigm by fighting unnecessary wars of choice, expanding unfunded entitlements, and allowing Wall Street and their Federal Reserve puppets to fraudulently pillage the nation’s wealth. Trump has been left with a debt saturated stagnant economy with rising interest rates and declining corporate profits. This is where reality meets slogans like Make America Great Again. This is where understanding what happens during Fourth Turnings keeps you focused on what is likely to happen, not what you wish to happen. Slogans and false hope don’t fly during Fourth Turnings. My natural skepticism kicks in when politicians, including Trump, make promises that are mathematically impossible. I know we are less than two months into his presidency and no legislation has actually been submitted, let alone passed, but impartially assessing his wish list of economic priorities makes me uneasy. I’m not hubristic enough to declare his presidency a failure already, like Karl Denninger, Paul Craig Roberts and some other blowhards. Judging a man before he’s actually done anything tells me more about the judger rather than the man being judged. He has certainly made some questionable cabinet choices and the number of senior advisors with ties to the Vampire Squid on the Face of America (aka Goldman Sachs) is worrisome. But whenever my doubts about Trump’s agenda begin to surface, I immediately picture the crooked globalist Deep State tool Hillary Clinton making the State of the Union speech last week. And all is well with the world again. My mental funk would be a full blown suicide watch level depression if Crooked Hillary was running the show.

But that isn’t going to keep me from pointing out the mathematically provable impact of his plans on the budget. We already have a $20 trillion national debt, with 10,000 Baby Boomers turning 65 years old every day for the next decade. Annual deficits are already on automatic pilot to reach $1 trillion over the next few years. This is reality. Slogans won’t change it. Hope won’t change it. Delusional optimism by consumers won’t change it. With this backdrop, Trump has proposed the following economic initiatives:

Discretionary spending only accounts for 15% of the entire budget. There isn’t savings anywhere near the level of spending increases baked into the budget, let alone Trump’s new grand spending plans. If Trump gets everything he has proposed, without touching entitlements, he would depart in eight years with a $30 trillion national debt and an entitlement crisis just over the horizon. Of course, the likelihood of reaching $30 trillion in debt without triggering a global financial catastrophe beforehand is about as likely as Trump making a sobbing apology to Obama for accusing him of wiretapping Trump Tower. As I stated at the beginning of this article, I am less sure about just about everything, as time goes on. Every day I see pronouncements from people I respect like David Stockman, Chris Martenson, Peter Schiff, Jim Rogers, Marc Faber and many others predicting a great crash in the immediate future. They will be right eventually, but they’ve been saying the same thing for the last five years. I agree with their reasoning, but I’ve given up on predicting the timing. They all have one thing in common – their living depends on you buying their newsletters and books. Certainty about looming disaster sells. Since my living doesn’t depend on selling anything, I’m comfortable pondering possibilities and trying to understand how the mood of the country will ultimately propel the unfolding events of this Fourth Turning. Trump has been referencing the 16% rise in the Dow since his election as proof his proposed economic policies will create millions of jobs, 4% GDP growth, and a new economic boom. That seems a little bit disingenuous, as during the debates and on the campaign trail he said the stock market was a giant bubble. He said the Fed had created multiple bubbles in stocks, bonds and real estate with their QE and ZIRP “Make Bankers Rich Again” schemes. Of course, he was right. His honesty was refreshing. When an extremely overvalued market rises another 16% over a four month period, one might ponder whether we’ve got a blow-off top in progress. Certainly the brainless spokesmodels on CNBC or the bevy of Bloomberg stock shills paraded on camera to bloviate about why this seven year Fed induced bull market is just getting started, will not be telling Joe Sucker to sell. Any honest financial analyst, who has taken a Statistics course in college, knows whenever something is 2 standard deviations beyond the mean you have a rarely occurring extreme outcome. In fact, the average stock has only been more overvalued one time in stock market history – 2001. Since that market overvaluation was solely driven by dot.com stocks, median stock valuations today are even higher than 2001. This isn’t opinion or survey data. Doug Short and John Hussman have used impartial valuation metrics which have been accurate for over 100 years. These valuation levels are 160% above historical norms and imply a market crash of 50% to 60%, which would only bring the market back to historical averages. I wonder how many Boomers and GenXers could survive the third stock market bust in the last seventeen years.

The cock sure Wall Street analysts are as smug about this market as they were in 2000 and 2007. They scoff at the possibility of a 50% crash even though the market crashed by 45% in 2000/2001 and plummeted by 51% over a sixteen month period in 2008/2009. As usual, there are a myriad of ridiculous rationales for why it’s different this time. There will always be absurd justifications for outlandish valuations made by those whose paychecks depend on the greater fool theory. John Hussman, Doug Short, Robert Schiller, and dozens of other rational thinking, honest, data oriented people are right. But that doesn’t mean the market won’t go up another 20% before the inevitable collapse. I have no idea when it will happen, but it will happen. Considering we are in year nine of a twenty year or so Fourth Turning, with the worst part yet to come, I’d venture a guess we will see the next financial crisis during Trump’s first term. The nattering nabobs of nonsense at the Fed and in the financial mainstream press insist their monetary machinations over the last eight years have not created inflation. They clearly believe in the theory of the bigger the lie, the more likely it is to be believed by a math challenged, technologically distracted, normalcy bias ridden populace. Anyone who thinks the $3.5 trillion of QE money was to help the people on Main Street is either a government bootlicker or an establishment crony paid to spread false propaganda. In addition to the BLS under-reporting inflation by 100%, the Fed’s monetary inflation was pumped straight into the veins of the monetary drug addict Wall Street banks. While Main Street wages declined and senior citizens have gotten minuscule increases in their life sustaining Social Security payments, the Wall Street bankers, who committed the greatest control fraud in world history, have gotten record bonuses and the freedom to fake their profits through legal accounting fraud (mark to fantasy). The purpose of TARP, QE and ZIRP has been to sustain, enrich, and keep in power a ruling class of sociopaths hell bent on pillaging the last vestiges of global wealth from unsuspecting citizens. Jamie Dimon believes everything done by the Fed and Treasury has been wonderful, as he plays tennis in his $5 million opulent NYC penthouse suite. Meanwhile, your granny has to decide between her overpriced heart medication or groceries driven higher by the Fed generated inflation.

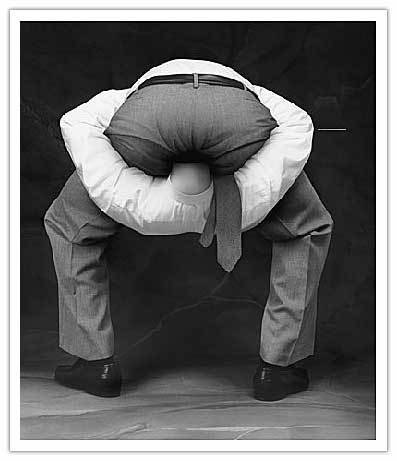

I don’t know when the center will give way. I don’t know when the stock market will crash. I don’t know when the Federal’s Reserve and other central banks’ shamefully reckless and illegal monetary machinations will blow up the world. I don’t know whether Trump will succeed or fail in his quest to drain the swamp. I don’t know whether the Deep State forces will take him out. I don’t know whether a civil war is on the horizon. I don’t know whether a global military conflict is in the offing. I don’t know when this greater depression will be revealed in all its glory to the millions of people with their heads up their asses in denial about reality. But, I do know whatever happens during the remainder of this Fourth Turning will be driven by debt, global disorder and civic decay, just as it has from the beginning.

I don’t know what the hell is going on. And more often than not, I don’t care anymore. I’m tired of howling at the moon, with no result. Life gets put into perspective when a family member is struck with a totally random health issue and you have to see them suffer through treatments that make them sicker than the actual condition. I know times are going to get much tougher. I have no misconceptions Trump can somehow reverse the course of the US Titanic after it has struck the iceberg of debt. I believe what’s wrong with this country is unfixable. I think Trump’s legacy will be the tearing down of the corrupt, decrepit, self-serving, evil status quo. His in your face, no holds barred style so angers the established social order; they come out of the shadows to fight him. The sinister intelligence services and Soros/Obama left wing terrorists are being revealed as the true enemies of the common people. We know our enemy. That’s the first step. I will do my best to get my kids through college debt free as long as they pursue a serious degree. I will continue to pay down my mortgage debt as quickly as possible. I will try to deal with my own health issues and help my wife deal with hers. We will take care of our aging mothers. Family will always come first. We’re only on this earth for a short time and while I get intellectual satisfaction from trying to change hearts and minds through writing, the only thing that truly matters to me is my wife and the futures of my three sons. I’ll prepare to the best of my ability for the worst, while trying to enjoy the present. Over the last nine years we’ve created a dysfunctional family of internet misfits on my website. I feel an obligation to keep that alive, especially for the talented writers who have blossomed with an open platform for their views, even though my own enthusiasm has been waning for a while. I’ve tried my best to seek truth, reveal government deception, and generally be a thorn in the side of the establishment. Based on Mencken’s definition, I’m a dangerous man to the government, who has spread discontent among those capable of thinking things out for themselves. You may not realize it, but the war has already begun. No matter what the hell is going on, I sure hope the good guys win.

“The most dangerous man to any government is the man who is able to think things out for himself, without regard to the prevailing superstitions and taboos. Almost inevitably he comes to the conclusion that the government he lives under is dishonest, insane and intolerable, and so, if he is romantic, he tries to change it. And even if he is not romantic personally he is very apt to spread discontent among those who are.” – H.L. Mencken | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1202.40 Down 0.5% - Silver Price Closed at 16.99 Down 1.53% Posted: 09 Mar 2017 07:42 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fossil Fuels Are Toast – But Real Assets Are Still The Place To Be Posted: 09 Mar 2017 02:52 PM PST With all the oil-related headlines we’re exposed to each day, you might assume that “black gold,” along with other fossil fuels like coal and natural gas, matter to humanity’s future. You’d be wrong. Like Keynesian economics and fiat currencies, fossil fuels are near the end of their run. From here on out, solar is the […] The post Fossil Fuels Are Toast – But Real Assets Are Still The Place To Be appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

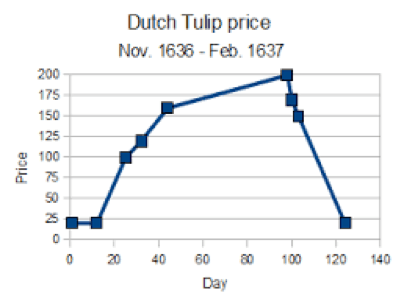

| Posted: 09 Mar 2017 02:30 PM PST This post It's Tulip Time! appeared first on Daily Reckoning. [Ed. Note: To see exactly what this former Reagan insider has to say about Trump and the fiscal threats from politics and the debt ceiling, David Stockman is sending out a copy of his book Trumped! A Nation on the Brink of Ruin… And How to Bring It Back to any American willing to listen – before it is too late. To learn how to get your free copy CLICK HERE.] At the peak of the Dutch tulip mania, bulbs sold for more than 10 times the annual income of a skilled craftsman and a single rare specimen bulb (Semper Augustus) purportedly changed hands for the equivalent of 12 acres of prime land. But after rising 8X in a few months, the reckoning came in February 1637. The tulip bulb price index came crashing back to where it had started in, well, November of the prior year!

So it might be wondered whether this most recent November to February (into March) mania is “there” yet. That question is especially important in light of the fact that Trump’s recent address to Congress amounted to the proverbial clanging bell at the top. In giving the most fiscally irresponsible speech since LBJ’s “guns and butter,” the Donald proved beyond a shadow of a doubt that he and his team have no clue about the horrific fiscal facts of life confronting them. They are utterly unaware, apparently, that they are plowing right into a Grand Debt Trap that will put the kibosh on not only the vaunted Trump Stimulus, but on the entire 30-year era of Bubble Finance. But before I get back to more detail on the Grand Debt Trap ahead, it is worth noting what happened during a more recent November to March blow-off rally. I am referring to the infamous dotcom mania, of course, and it just so happens that there is a nice symmetry in the numbers as they pertain to the present. Between October 24, 1999 and March 22, 2000, the NASDAQ 100 rose from 2,460 to 4,600 or 87%. After that parabolic climb, however, it soon plunged back to where it had started in October. Nor was the year 2000 collapse close to done — it plunged a further 67% through October 2002. Like the NASDAQ blow-off of 2000, the current Trump-O-Mania rally started on November 2. As it happened back then, however, the NASDAQ 100 peaked shortly after the Fed raised interest rates (again) on March 21. Yet as CNN reported that day, the Fed’s action was considered to be no big threat to a then unstoppable bull: For financial markets, the rate increase and the short announcement that followed was a non-event, mostly because Wall Street had widely expected the Fed to do exactly what it did. There wasn't a black swan in the sky, it seemed — until there suddenly began a dizzying two-year plunge of almost 85% from the nosebleed peak. This time there is an Orange Swan hovering above the market, but it appears equally unrecognized by today’s punters. I am referring to the fact that the headline reading algos have totally misread the Trump Stimulus. The robo-machines — and the remaining troop of day-trading carbon units that mimic them — can only read words, not the political tea leaves. Accordingly, when the Donald promised a “big, big” corporate cut and a “massive tax reduction for the middle class” and also a $1 trillion infrastructure bill to rebuild “America’s roads, bridges, airports, hospitals and schools,” the machines dutifully “priced it in.” But what they haven’t reckoned with is that the debt ceiling clock starts ticking on March 15 when the current “holiday” expires. It will then freeze in at approximately $20 trillion, leaving the Treasury’s coffers with about $200 billion in cash. But the Trump Administration blew through $204 billion of cash during its first 35 days in office. That fact was apparently unbeknownst to the President, who tweeted the complete falsehood that he had already reduced the public debt by $12 billion. Au contraire! The U.S. Treasury is bleeding red ink profusely — notwithstanding Janet Yellen’s comical claim that the American economy is closing in on the Keynesian nirvana of “full employment.” During the first four-and-one-half months of FY 2017, in fact, Uncle Sam’s net debt increased an astonishing $532 billion. That amounts to an annualized borrowing rate of $1.3 trillion. Given the Treasury’s cash burn rate of $3-4 billion per calendar day, the U.S. Treasury will have 50-75 days of cash when the debt ceiling clock starts ticking again on March 15. That's less than a week away. And that means it will run out of cash long before any tax bill even gets out of the House Ways and Means Committee or infrastructure bill even gets tabled. Indeed, the Wall Street robo-machines are abysmally un-programmed with respect to the entire budgetary process. The fact is, none of the components of the Trump Stimulus can happen until both houses pass and agree to a FY 2018 budget resolution with its 10-year path for revenues, spending, deficits and the public debt. It is only through a budget resolution that encompasses a comprehensive long-term fiscal plan that it is possible to get a “reconciliation instruction” for the tax bill; and without that parliamentary mechanism, tax reform will die in a Senate 60-vote filibuster stage managed by the K-Street lobbies. But here’s the thing. The ticking debt ceiling clock will mightily interfere with — if not block completely — the process of reaching an agreement within the GOP caucuses on the FY 2018 budget resolution. In fact, the legislative and political maneuvering in the run up to this summer’s debt ceiling vote will powerfully concentrate the minds of the backbench fiscal hawks. It will remind them that their fate under the massive deficits embedded in the Trump Stimulus will be to walk the plank time after time to raise the debt ceiling! Moreover, as the media finally begins to focus on the rapidly dwindling cash balance at the Treasury, it will elicit a maneuvering, bargaining and posturing spectacle inside the GOP caucus that will make Speaker Ryan wish to send the gavel back to John Boehner. The fiscal conservatives will demand entitlement reforms, but Trump says no. The Trump White House has embraced an utterly stupid and unnecessary plan to bust the sequester caps and add $54 billion to the already bloated $600 billion defense budget for FY 2018 alone — and proposed to offset it with draconian cuts to domestic agencies and the State Depart/foreign aid budget which are already “dead in the water” in the GOP Senate. But here’s the newsflash. The FY 2018 sequester caps of $548 billion for defense and $518 billion for non-defense discretionary spending are chiseled in law under the BCA (Budget Control Act). There is not a snowballs chance in the hot place that a bill could pass the House which raised defense to more than $600 billion, while slashing the domestic cap to under $500 billion. There would be blood on the floor from one end of the Capitol Building to the other. By the same token, there would be an outright revolt by the Freedom Caucus if both caps are raised — which is the only way to assemble a legislative majority. In the meanwhile, the drive to “repeal and replace” Obamacare is already deeply fracturing the House GOP, and it’s going to get progressively worse. What’s happening is that the Freedom Caucus is quickly figuring out what I documented already. Namely, that the Ryan plan for “repeal and replace” is actually little more than Obamacare Lite. Not only will the $7 trillion 10-year cost under current law not be reduced in any material way, but the Ryan plan will also establish what amounts to a new age-based entitlement to health tax credits. Taken together, all of these battles over the sequester caps, Obamacare repeal, a new continuing resolution for FY 2017 appropriates which will be needed to avoid a government shutdown in later April will take their toll. Accordingly, the Mother of All Debt Ceiling Crisis will occur for the simple reason that there is no pathway to a House and Senate majority for a multi-trillion debt ceiling increase. Perhaps that’s because Washington has never been there before. That is, facing down a $20 trillion public debt with $10 trillion more in the pipeline over the next decade, and a clueless team in the White House that wants to pile trillions more of red ink on top of that. In a word, the algorithms driving the stock averages to tulip bulb mania highs can’t possibly anticipate the political firestorm that is coming down the pike. When it hits, the machines will begin puking up a tsunami of sell orders like never before. When the dust finally settles, there will surely be some new charts that will give the October-March plunges depicted above a run for their money. Regards, David Stockman The post It's Tulip Time! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Fall Back to About $1200 and $17 Posted: 09 Mar 2017 01:39 PM PST Gold fell $5.20 to $1203.50 in late Asian trade before it bounced back to $1209.00 at about 8AM EST, but it then fell to a new session low of $1201.40 in the last minutes of the day and ended with a loss of 0.56%. Silver slipped to as low as $16.943 and ended with a loss of 1.57%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fossil Fuels Are Toast – But Real Assets Are Still The Place To Be Posted: 09 Mar 2017 01:25 PM PST With all the oil-related headlines we're exposed to each day, you might assume that "black gold," along with other fossil fuels like coal and natural gas, matter to humanity's future. You'd be wrong. Like Keynesian economics and fiat currencies, fossil fuels are near the end of their run. From here on out, solar is the story. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zinc Stocks May Be Top Buy of #PDAC2017 As Commodity Soars to 5 Year Highs Posted: 09 Mar 2017 01:19 PM PST

For many weeks I highlighted a commodity that was hitting 5 year highs and is still relatively unknown especially amongst the most important group of investors…US Retail. While gold and silver are still way below 2011 highs, zinc is breaking out into new 5 year highs. The last time it made a breakout like this pre credit crisis it went parabolic to $2. There is the possibility of that happening again. If it does a huge Zinc Deposit in Canada I highlighted to you a few weeks ago could soar as it has billions of pounds of zinc and they are about to publish a PEA any day now which will put numbers on the economics of this project and answer some questions about the metallurgy. It could silence a lot of the naysayers and competitors. The Chairman is a winner with a track record of building major mining companies from pennies. Some of the smartest mining investors such as Lundin and Mcewen financed this company. They just recently started marketing for the first time in the US in early February when it traded record volume but has since pulled back to its 50 DMA providing what could be a secondary buypoint. I expect a lot more attention for this company following the publication of its updated Preliminary Economic Assessment. See my interview with the Chairman of $DBL.V $DNLYF by clicking here… https://www.youtube.com/watch?v=Mxd6Z1713Pk In addition, I have made my second zinc investment in a newly restructured company focused in one of the worlds best zinc domains Ireland with only around 33 million shares outstanding. Its led by a great bunch of explorers I have known for years who specialize in zinc exploration and mining. The CEO worked for one of the largest zinc producers for years in exploration. He knows what the majors look for. Management has the ability to raise a lot of money for exploration as some of the big funds have invested in some of there other major discoveries in Europe. Ireland is the largest producer of zinc in Europe and tenth in the world with over 200k tonnes of zinc mined in 2015. Management believes Ireland is one of the best places to explore for a zinc discovery using modern exploration techniques. There have been 222 holes drilled which indicate a large zinc mineralized zone with grades up to 10% zinc and 80 g/t silver. It remains open in all directions. Hannan Metals $HAN.V $KMNFF released news that they are beginning exploration on what could be the most exciting zinc exploration target in Ireland. This target has a 1.5 km strike length with better drill intersections including DH46: 20.5m @ 7.5% Zn, 9.9% Pb, 74.6g/t Ag; and DH06: 21.3m @ 11.0% Zn, 4.8% Pb, 94.4g/t Ag. Its 100% owned and drilling will start in April on one of the best zinc discoveries made over the past decade. I believe this management team has the ability to expand this deposit and make additional discoveries. In conclusion, zinc may be one of the best commodities to own right now as it is breaking out into new highs. Supply remains tight. Look for zinc developers with management who knows zinc with great track records. See the full news release of the beginning of exploration on this zinc project by clicking here… http://bit.ly/2lZ0B7z Disclosure: I already own shares in these junior zinc miners and they are website sponsors. This should be considered an advertorial and I should be considered biased as I could benefit from a higher price by selling and have been paid for a website sponsorship. I may buy or sell at anytime with no notice. This contains forward looking statements which may not come to fruition. Buyer beware small cap mining stocks are very risky and you can lose all of your money! http://goldstocktrades.com/blog/ Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof."

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold And Silver: Legal Weapons Against The Deep State Posted: 09 Mar 2017 12:49 PM PST Just like everything else in the western financial system, the paper trading markets are leveraged beyond redemption. The amount of paper "claims" on actual physical gold was estimated to be 100:1 in 2010. We can assure you that ratio is much higher now. On the Comex alone, for instance, if more than 9% of the April open interest in gold futures were to stand for delivery – based on the currently declared 1.4 million ounces of gold reported as being "available for delivery" (registered) – the Comex would default. The entire open interest in gold futures is 60x greater than the amount of gold available for delivery. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (VIDEO) What Drives the Price of Gold? Posted: 09 Mar 2017 12:21 PM PST In my more than 35 years of investing in hard assets, precious metals and mining, I've learned to manage my expectations of gold's short-term price action. Sure, there have been surprises along the way, but generally, the yellow metal has behaved relatively predictably to two macro drivers, the Fear Trade and Love Trade. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Privacyless, Freedomless Smart City of 2030 the Elite Are Engineering Posted: 09 Mar 2017 09:00 AM PST If you look around at the way things are being manipulated on nearly every level right now, you can clearly see how society is being engineered for this future, as insane as it sounds... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

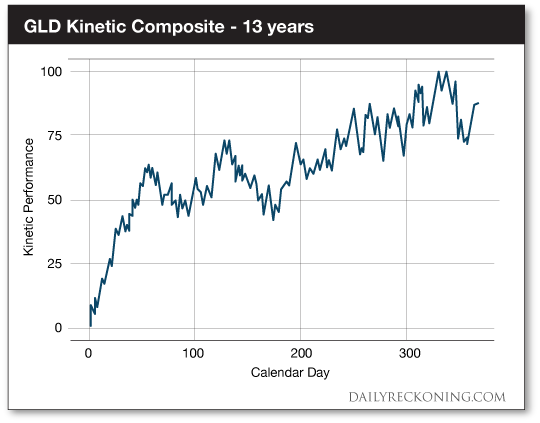

| Why It’s a Mistake to Buy Gold Right Now Posted: 09 Mar 2017 08:16 AM PST This post Why It’s a Mistake to Buy Gold Right Now appeared first on Daily Reckoning. If you own gold right now, maybe it’s time to consider taking some profits. That’s because, a unique gold chart I’ll show you in a moment is signaling a correction in everybody’s favorite precious metal. We’ve already seen this correction start to play out in March – and it could have a lot further to go. That’s the bad news. The good news is that the same indicator is also signaling when it makes sense to start buying gold again later this year. More on that in a moment… First, here’s the chart I’m talking about.

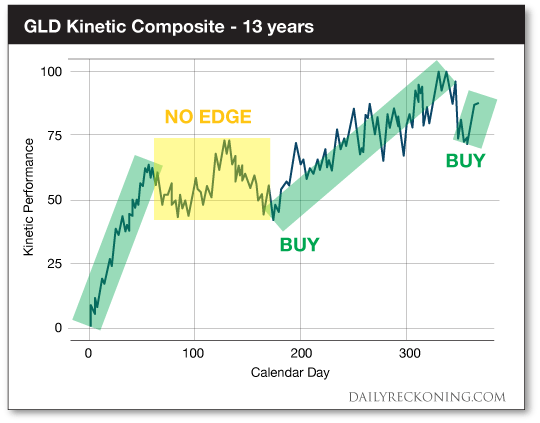

This chart may look a little bit familiar to you if you read last Thursday’s issue. In it, my colleague Jonas Elmerraji shared a “Kinetic Composite” chart of the S&P 500 Index. The chart above is actually Kinetic Composite for the SPDR Gold Trust (NYSE:GLD), a popular ETF that tracks gold prices. In case you missed, it here’s a quick refresher on what the Kinetic Composite measures. "For starters, it’s not a typical price chart," Jonas says. "In this case, it’s a special composite of the average calendar year for the last 13 years’ price action since GLD was launched." This chart boils down the times when markets are most likely to be in motion year after year – thus the 'Kinetic' part of the name. "I created the Kinetic Composite as a way to visualize the strongest time to own a stock year after year," Jonas explains. "In other words, from a statistical standpoint, when is the wind at investors’ backs?" In GLD’s case, the answer is not now! Have a look at GLD’s Kinetic Composite with some trend annotations drawn on it:

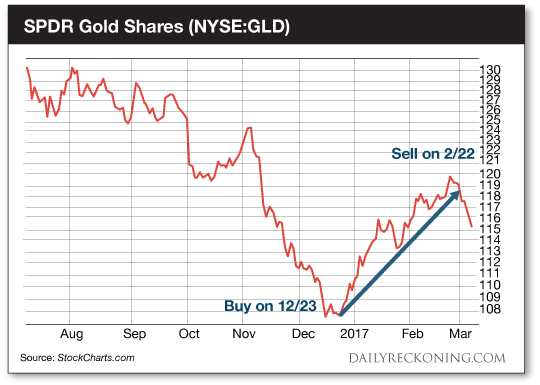

You interpret the Kinetic Composite a little differently from a regular price chart. As you might guess, an upward trend in the chart is a buy signal (it means that the wind is at investors’ backs). The tighter and sharper that uptrend, the stronger the Kinetic buy signal it’s showing us is. A downward trend is a sell signal. But a choppy sideways trend doesn't mean that the stock generally trends sideways during that timeframe. "Instead it means that the data doesn’t favor a statistic advantage during that period," Jonas says. "In other words, we don’t have an edge." And when you don’t have an edge, you don’t want to be exposed to an investment. As you can see, GLD generally starts the year with a sharp uptrend – one that actually starts before the calendar flips to the new year. That buy signal kicks off on December 23, to be precise. Then, the trend fizzles out by February 22, and we enter the yellow range on the chart. We don’t get another (slightly less attractive) Kinetic buy signal until June 23. Have a look at how that played out this year in shares of GLD:

Just following the obvious longer-term signals on the Kinetic Composite chart would have been good for a 9.4% gain in GLD in the last few months. (And in case you’re curious, it was good for about a 20% gain the year before.) Since GLD’s Kinetic sell signal hit two weeks ago, this gold ETF has been tumbling lower. And now we’re in that “no man’s land” on the Kinetic Composite chart where we don’t have a trading edge. "That means it probably makes sense to steer clear of gold until the middle of the summer, at least," Jonas concludes. Obviously, the Kinetic Composite isn’t a crystal ball. It’s not predicting the future – no indicator can do that. Instead, it’s simply pointing out the timeframes that are statistically strongest for GLD. But as I’ll show you soon, combining the Kinetic Composite with another simple tool turns it into an immensely profitable combo. Stay tuned… Today's Kinetic Buy Signal Now we know GLD’s Kinetic buy window just slammed shut. But there are thousands of stocks on the market. And a new buy signal is triggering in shares of another stock right now: UDR Inc. (NYSE:UDR). "This apartment REIT has a seasonal window that kicks off at the beginning of March," Jonas says. "UDR’s Kinetic Composite bottoms around March 9, and then rallies until May 17. Over the past 26 years, that pattern has had an 81% win rate in the market, paying investors as much as a 28% gain in that short 49 trading day stretch." When you’re looking at statistical market patterns, it’s just as important to take a close look at what happens in the rare years when the pattern doesn’t work. For UDR, the worst downside in that stretch was a 5% loss. So, if you decide to buy UDR here, consider parking a 5% trailing stop below your entry price. That guarantees a quick exit if shares start meaningfully diverging from its historical pattern. Sincerely, Greg Guenthner The post Why It’s a Mistake to Buy Gold Right Now appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: The fateful date Posted: 09 Mar 2017 07:31 AM PST By Alasdair Macleod Caesar: What sayest thou to me now? Speak once again. This famous advice, according to Shakespeare, was ignored with fatal consequences for Julius Caesar. Markets may be being similarly complacent ahead of this anniversary date next week. The Fed has signaled that it will raise interest rates at the FOMC's March meeting, timed for the same day. It so happens that this fateful date coincides with the end of the suspension of the U.S. debt ceiling. Dare Janet Yellen raise rates at such a sensitive juncture? We shall see. But it is worth pointing out that gold rose strongly following the last two rate rises. It is likely that it was a "sell the rumour, buy the fact" response, and was also impelled by being the other side of the dollar trade. And the last time debt brinkmanship came up was with an agreement between the president and Congress to suspend the debt ceiling in end-July 2011, following which gold rose $200 in the ensuing weeks. ... ... For the remainder of the commentary: https://wealth.goldmoney.com/research/goldmoney-insights/the-fateful-dat... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Very Undervalued from Historical Perpective of Ancient Greece Posted: 09 Mar 2017 05:01 AM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forex Trading Alert: USD/CAD at Fresh Highs Posted: 09 Mar 2017 04:21 AM PST Forex Trading Alert originally published on March 8, 2016, 9:32 AM Earlier today, the U.S. dollar extended gains against its Canadian counterpart as declining crude oil prices pushed the Canadian currency lower. As a result, USD/CAD reached the next resistance zone. Will it stop currency bulls in the coming days? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Surprise in Recent Moves in Gold and Silver Markets Posted: 09 Mar 2017 02:54 AM PST Michael Ballanger | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 09 Mar 2017 01:37 AM PST US stocks open slightly higher. Gold and silver down again. Bitcoin down but still higher than gold. Fed expected to raise rates at next meeting. Obamacare replacement on the table, facing opposition. Wikileaks drops another bombshell. Best Of The Web What the hell is going on? – Burning Platform A new look at NYSE […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Standard Ventures Offers District-Scale and Takeout Potential Posted: 09 Mar 2017 12:00 AM PST Gold Standard Ventures' aggressive 2017 drill program has the potential to substantially increase resources at its Nevada project, and with Goldcorp and OceanaGold already owning substantial percentages of the company, Gold Standard could be attractive to majors looking to add resources in the high-grade Carlin Trend. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Integra Gold's Lamaque Looking Better Than Ever After Updated PEA Announcement Posted: 09 Mar 2017 12:00 AM PST Integra Gold's updated 2017 PEA on the Lamaque South Gold Project highlights a doubled life of mine estimate, increased total ounces of 156% and a reduction in total mine costs to CA$86/tonne. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment