saveyourassetsfirst3 |

- Speculators Extend Long Dollar-Bloc Positions

- The Washington Post Actually Takes Russian Government Money (Unlike the Websites It Helped Slander)

- What Now For The Dollar?

- U.S. Political Crisis Foments While China India Devour Gold - Dave Kranzler

- Week Ahead: Dollar Higher Ahead Of Fed Minutes

- A Civil War For Control Of The US Government Has Erupted Between ‘The Deep State’ And Donald Trump

- Why Extreme Inequality Causes Economic Collapse

- Breaking News And Best Of The Web

- Gold’s Fundamentals Strengthen

- Gold: the protector and creator of jobs

| Speculators Extend Long Dollar-Bloc Positions Posted: 18 Feb 2017 12:34 PM PST |

| The Washington Post Actually Takes Russian Government Money (Unlike the Websites It Helped Slander) Posted: 18 Feb 2017 10:30 AM PST The fact that The Washington Post would give credibility to a obviously ridiculous organization with an entirely invented list of "Russian propaganda websites," knowing all the while that they themselves were the ones taking Russian government money is the height of hypocrisy, dishonesty and deceitful journalism. Once again proving the obvious point: The mainstream media is the real […] The post The Washington Post Actually Takes Russian Government Money (Unlike the Websites It Helped Slander) appeared first on Silver Doctors. |

| Posted: 18 Feb 2017 07:21 AM PST |

| U.S. Political Crisis Foments While China India Devour Gold - Dave Kranzler Posted: 18 Feb 2017 06:02 AM PST Sprott Money |

| Week Ahead: Dollar Higher Ahead Of Fed Minutes Posted: 18 Feb 2017 05:42 AM PST |

| A Civil War For Control Of The US Government Has Erupted Between ‘The Deep State’ And Donald Trump Posted: 18 Feb 2017 05:00 AM PST The ruthless political assassination of Michael Flynn was just one battle of a major civil war that has erupted for control of the U.S. government. Donald Trump and his new administration are now under relentless assault by "the Deep State", and at this point it is not clear who will emerge as the victor… From […] The post A Civil War For Control Of The US Government Has Erupted Between 'The Deep State' And Donald Trump appeared first on Silver Doctors. |

| Why Extreme Inequality Causes Economic Collapse Posted: 18 Feb 2017 02:17 AM PST |

| Breaking News And Best Of The Web Posted: 18 Feb 2017 01:37 AM PST Inflation is spiking on stronger growth, higher oil. Fed likely to raise interest rates next month. US stocks down from all-time highs, gold and silver near multi-week highs. Trump national security adviser quits under Russian cloud, labor secretary nominee withdraws under pressure. Debate over Putin and fake news intensifies. Best Of The Web 11 […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

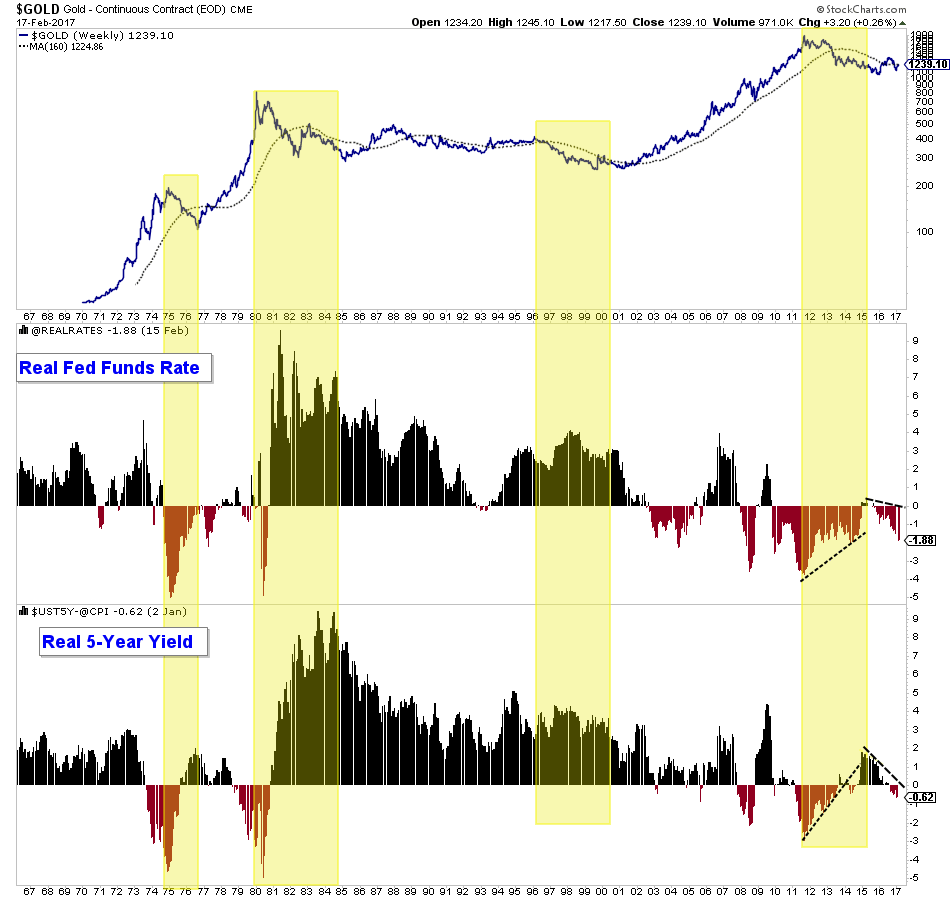

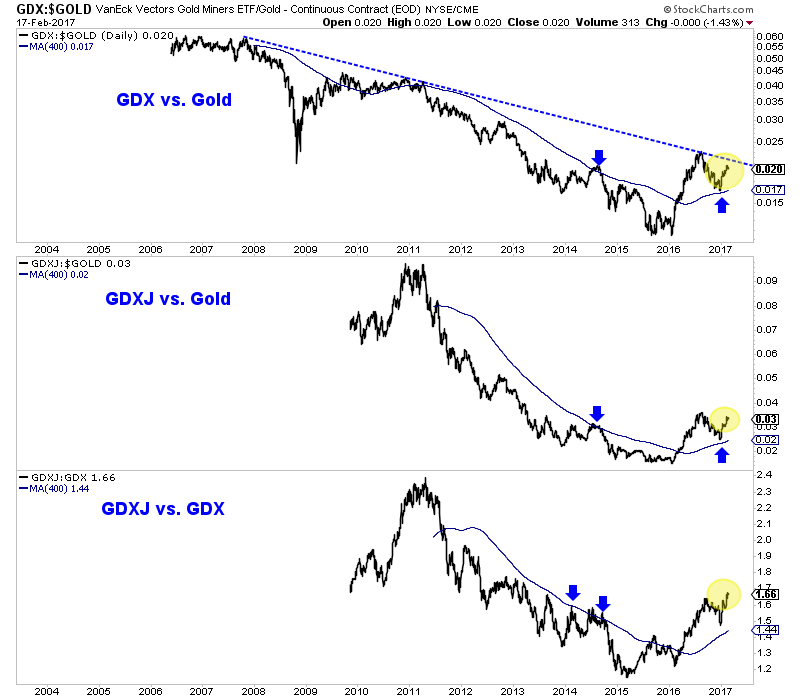

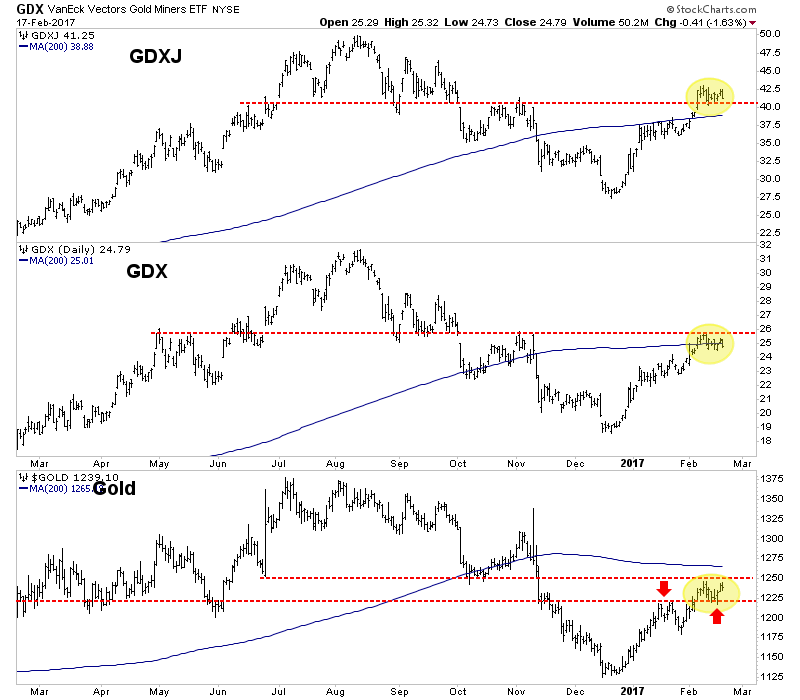

| Gold’s Fundamentals Strengthen Posted: 18 Feb 2017 12:12 AM PST The January headline consumer price index (CPI) came in at 2.5%, which is near a 5-year high. What happened to deflation? As a result, real interest rates declined deeper into negative territory or in the case of the 10-year yield, went from positive to negative. No this isn't a commodity-driven story. The core CPI (ex food and energy) has been above 2% since the end of 2015 when commodities were in the dumps. Inflation is perking up and couple that with a Fed that pursues rate hikes at a glacial speed and that is very bullish for precious metals. The chart below is what I refer to as our master fundamental chart for Gold. It plots Gold along with the real fed funds rate and the real 5-year yield. In short, negative and/or declining real interest rates drive bull markets in Gold while rising real rates or strongly positive real rates (like in the 1980s and 1990s) drive bear markets in Gold. Since the middle of 2015 both the real fed funds rate and the real 5-year yield have declined by +2%. The real fed funds rate has declined from a fraction above 0% to now almost -2% (-1.88%). Meanwhile, the real 5-year yield has declined by roughly 2.5% in the past two years from nearly 2% to now -0.60%. Fundamental analysis can be backward looking and that is why it is so important to verify fundamentals through the lense of technical analysis. While there are numerous charts we could show we want to present a fresh look at some sector relationships which help confirm the strong fundamentals currently supporting the sector. In the chart below we plot the gold stocks (both the seniors and juniors) against Gold and we plot the juniors against the seniors. During a healthy bull market in precious metals, the miners should show strength relative to the metals and secondarily, the riskier and more volatile stocks should also show relative strength. First, we note the GDX to Gold ratio appears poised to break its 10-year downtrend this year. Second, we see that the GDXJ to GDX ratio (juniors versus the seniors) is one month short of a 4-year high.

Turning to the short-term, we note that Gold successfully tested its support at $1220/oz while the miners decline on Friday suggests they may need more time to digest recent gains.

With negative real interest rates in place and the gold stocks trading well above their rising 400-day moving averages while showing relative strength against Gold, it is quite clear the gold stocks are in the early stages of a new bull market. It's also difficult for us to argue that Gold and Silver are not in a bull market. The technical setup is potentially in place for the sector to make an explosive move higher over the next 9 to 18 months. Pullbacks in 2017 need to be bought due to the upside risk over the intermediate term. For professional guidance in rising this new bull market, consider learning more about our premium service including our current favorite junior miners.

Jordan Roy-Byrne CMT, MFTA

|

| Gold: the protector and creator of jobs Posted: 17 Feb 2017 03:00 PM PST Plata.com |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment