saveyourassetsfirst3 |

- What Form Will The Great Confiscation Take — And How Can We Prepare?

- Gold Rally – 30% Higher

- Breaking News And Best Of The Web

- Grant Williams sees oil pricing transitioning to the yuan and gold

- Gold & Gold Stocks Hit Upside Targets. Now What?

- Top Ten Videos — February 11

- Silver Expert: If You Can Buy Silver Under $20, It’s A Gift!

- Trump, Fear, Precious Metals & the Stock Market

- But What About that ‘Big, Ugly, Red Candle’?

- MGX Shareholders Ride a Rollercoaster

| What Form Will The Great Confiscation Take — And How Can We Prepare? Posted: 11 Feb 2017 08:52 AM PST For what seems like decades, people have been warning that the next time some over-leveraged corner of the financial system implodes, bank and brokerage accounts will be either confiscated by desperate governments or lost during the resulting chaos. Here, from 2012, is a representative warning from gold mining eminence grise Jim Sinclair: My Dear Extended […] The post What Form Will The Great Confiscation Take — And How Can We Prepare? appeared first on DollarCollapse.com. |

| Posted: 11 Feb 2017 03:40 AM PST The Gold Rally will go 30% higher claims Scotty George, chief analysist at Alexander Capital. He believes, "We're about at the midpoint of what could be a price rally that could stretch for several more months." This interview on Kitco News is featured on thestreet.com Gold Rally Could Move 30 Points Higher Scotty George feels that gold is benefiting from the uncertainty coming out of Washington and the uncertainty coming out of the world. Scotty feels gold has become the metaphor for fear, an ultimate safe haven. He feels that gold is at the midpoint of its rally and could easily continue upward another 30%. Be sure to listen to the Precious Metals Investing Podcast. You can listen to some of the episodes right here at PreciousMetalsInvesting.com: Listen to the Precious Metals Investing Podcast here Or even better you can subscribe to the podcast on iTunes here:Precious Metals investing podcast on iTunes Android Users can subscribe to the Precious Metals Investing Podcast at Google Play here: Precious Metals Investing podcast on Google Play The post Gold Rally – 30% Higher appeared first on PreciousMetalsInvesting.com. |

| Breaking News And Best Of The Web Posted: 11 Feb 2017 01:37 AM PST US stocks at all-time highs on Trump tax-reform promise, gold and silver near multi-week highs. Trump immigration plan challenged in court, loses. Debate over Putin intensifies. French election uncertainty rocks euro bonds Best Of The Web Bubbles, money and the VIX – Credit Bubble Bulletin Are you prepared for "unencumbered" interest rate policy? – Daily […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Grant Williams sees oil pricing transitioning to the yuan and gold Posted: 10 Feb 2017 09:32 PM PST GATA |

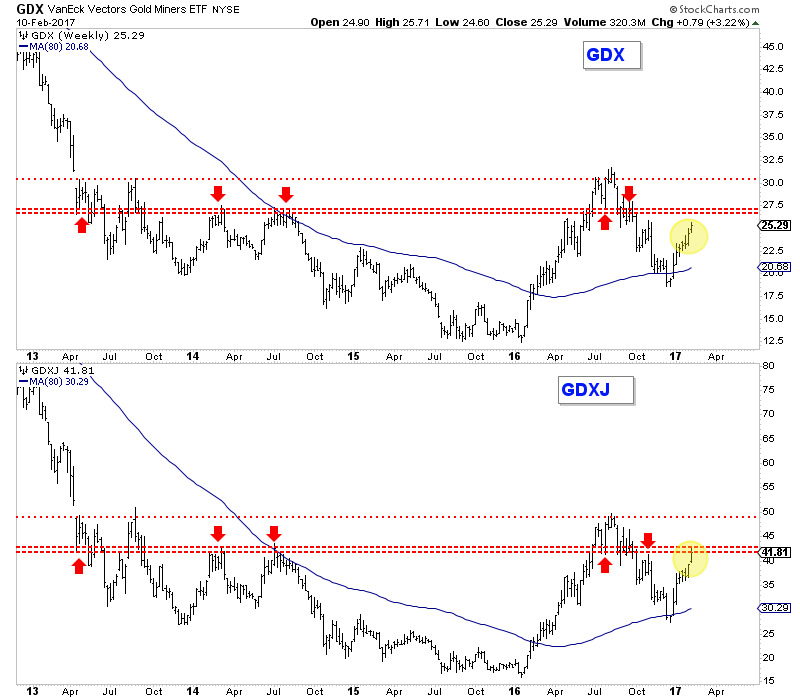

| Gold & Gold Stocks Hit Upside Targets. Now What? Posted: 10 Feb 2017 07:34 PM PST The precious metals sector has reached the upside targets we've written about since the start of 2017. Gold has touched almost $1250/oz ($1246/oz high) while GDXJ exceeded our $41 target and GDX nearly reached $26. The glass half empty case is the sector is now at strong resistance levels and any immediate upside will be difficult to sustain. On the other hand, the gold stocks are showing the internal (strong advance/decline line) and relative strength (leadership against Gold) that bodes for additional gains. There may be some more upside potential but the risk of a medium term correction looms in the background. The image below shows the weekly bar charts for GDX and GDXJ. If the miners can make a weekly close above the strong red lines then there is a chance the rally can come very close to the 2016 highs before the next sustained correction. For GDX that is a close above $27.24 and for GDXJ that is a close above $42.60. It is also quite possible that GDX peaks at $27 while GDXJ, given its relative strength exceeds $42.60 temporarily.  GDX, GDXJ Weekly Bar Charts

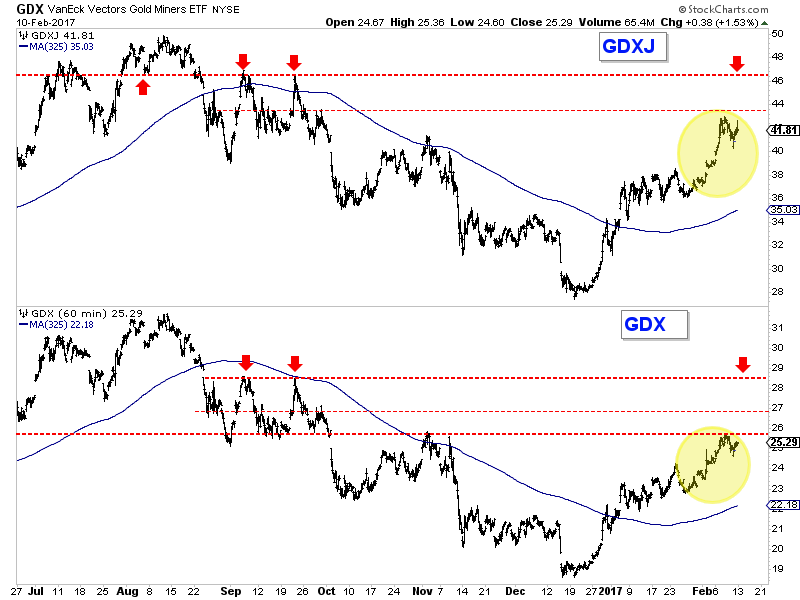

The hourly bar charts (shown below) provide better insight for the next week or two. The miners appear to be digesting the strong gains achieved since the end of January. Look for another week or two of consolidation and digestion. Ultimately, if the miners make a daily close above recent highs then the upside targets are +$46 for GDXJ and +$28 for GDX. We are currently more confident in GDXJ than GDX.  GDX, GDXJ Hourly Bar Charts

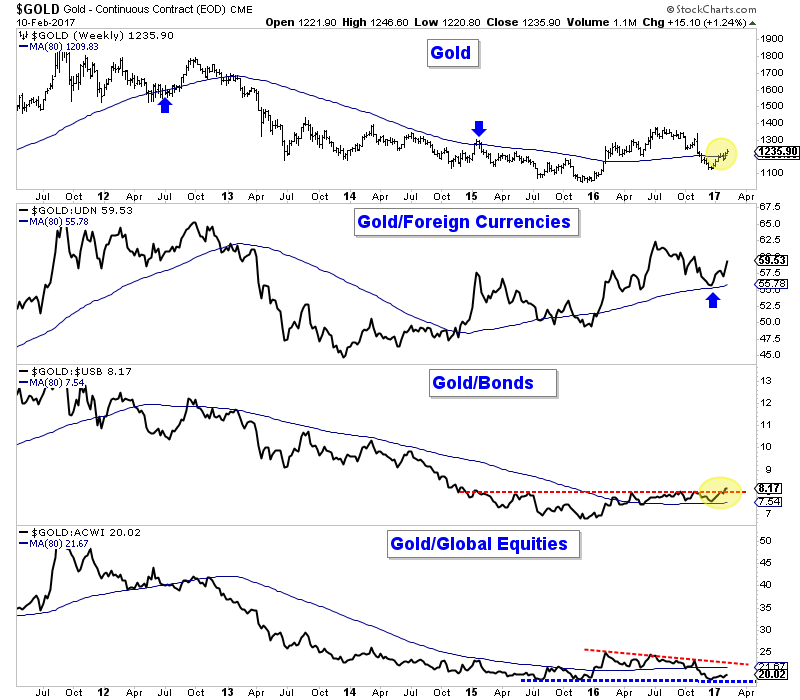

Turning to Gold, it has lagged the miners but nearly reached $1250/oz this week. It closed the week at $1236/oz. There is a strong confluence of resistance at $1250/oz and we note the 200-day moving average at $1266/oz. If the rally has a bit more time left then Gold has a good shot to reach $1266/oz. Also, as we noted a few weeks ago, Gold's performance against the other asset classes will help inform us if Gold can hold onto recent gains or if it's headed for a big retracement. The bullish scenario would entail Gold maintaining recent gains against foreign currencies and bonds while showing strength against global equities.  Gold & Gold Ratios

Gold and gold stocks appear to have a bit more upside potential but the medium term outlook urges caution and patience. The miners and Gold are nearing strong resistance at a time when the US Dollar index could be firming around 100. Regardless of where and when this rebound ends, the precious metals sector could be poised for a big move higher following the next medium term correction or consolidation. For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners.

Jordan Roy-Byrne, CMT, MFTA Jordan@TheDailyGold.com

|

| Posted: 10 Feb 2017 04:01 PM PST Max and Stacy in the middle of the road. Peter Schiff’s new beard and apocalyptic predictions. Bernie Sanders weighs in on authoritarianism. And of course the coming gold/silver boom. The post Top Ten Videos — February 11 appeared first on DollarCollapse.com. |

| Silver Expert: If You Can Buy Silver Under $20, It’s A Gift! Posted: 10 Feb 2017 03:45 PM PST Silver Expert David Morgan Joins The Show & Breaks Down the Two-Month Rally In The Metals: Is A MAJOR Bull Move Just Getting Started, Or Is Yet Another Cartel FLUSH Coming? Regardless Of What’s Next, Morgan Believes If You Can Buy Silver Under $20/oz, It’s A Gift! The Famous Silver Investor Reveals Dollar Cost Average […] The post Silver Expert: If You Can Buy Silver Under $20, It’s A Gift! appeared first on Silver Doctors. |

| Trump, Fear, Precious Metals & the Stock Market Posted: 10 Feb 2017 03:44 PM PST The general agreement is that the Trump presidency is good for the precious metals. Many believe the boost in precious metals prices will come from what traditionally causes the price of precious metals to rise - it is viewed as a safe haven investment in times of uncertainty. I think everyone will agree that is what the first three weeks of the Trump presidency have been largely about is uncertainty. This article from MarketWatch.com discusses some of the sources of that uncertainty and how the market is viewing it: Trump, Fear and the Stock Market There are others analysts who say the rise in precious metals over the coming year will come from inflation as Trump's spending on infrastructure projects boost demand and increases inflation. Precious metals traditionally move inversely to the dollar. Again Trump policies may boost Precious Metals prices. He has complained on his twitter feed that the strong dollar has hurt the United States balance of trade by making US goods more expensive. He has vowed that he will fix that problem. Is the fix he is proposing weakening the US dollar? If that is Trump's plan, and the precious metals follow their traditional path and move inversely to the dollar, a weakening dollar will mean rising precious metals prices. But since so many of the details of Trump's proposed policies are lacking that means uncertainty in how they will affect the stock market. For many that means the safe harbor of precious metals is becoming more and more attractive. The best answer that I've heard to the question of "What's the best time for precious metals investing?" was "the long time." Especially since the silver precious metals market and precious metals relatively speaking are much smaller markets than the stock market or some of the commodities markets. Because the precious metals markets are smaller they are more easily buffeted by news, events and emotions. But those short term squalls really don't affect the long term upward trajectory of the precious metals. Of course there have been some dips but when you look at the past 11 year march upward and marry it with the current uncertainty and/or inflation projections for the future it seems the precious metals future is bright. Whether the rise comes from future uncertainty or inflation the news is good for precious metals. I believe the increase in precious metals prices this year has just started and prices will continue their upward path this year. Be sure to listen to the Precious Metals Investing Podcast. You can listen to some of the episodes right here at PreciousMetalsInvesting.com: Listen to the Precious Metals Investing Podcast here Or even better you can subscribe to the podcast on iTunes here:Precious Metals investing podcast on iTunes Android Users can subscribe to the Precious Metals Investing Podcast at Google Play here: Precious Metals Investing podcast on Google Play The post Trump, Fear, Precious Metals & the Stock Market appeared first on PreciousMetalsInvesting.com. |

| But What About that ‘Big, Ugly, Red Candle’? Posted: 10 Feb 2017 11:30 AM PST Precious metals expert Michael Ballanger discusses why technical analysis does not work in the precious metals arena. Submitted by Streetwise: Buy 2017 American Silver Eagle Coins Just $2.29 Over Spot, ANY QTY! I have a great number of friends that pride themselves on being “technical analysts” and many of them are actually very good, especially […] The post But What About that ‘Big, Ugly, Red Candle’? appeared first on Silver Doctors. |

| MGX Shareholders Ride a Rollercoaster Posted: 10 Feb 2017 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment