Gold World News Flash |

- GoldSeek Radio Nugget: John Williams and Chris Waltzek

- Silver Market Set Up For Much Higher Price Move Than Gold

- Lukewarm start for new London Gold Futures Contracts

- Army Preps For Urban Warfare In MegaCities: "Mass Migration, Disaster, And Inner-City Turmoil"

- Ronan Manly: New gold futures contracts in London are open but no one trades them

- Embry – Criminal Banks & Commercials Now Short A Mind-Blowing Nearly 1 Billion Ounces Of Silver At The Comex!

- Gold Seeker Closing Report: Gold and Silver End Slightly Lower After Dollar Pop

- Gold and Crude Oil Link – What Does It Say?

- U.S. government has only itself to blame for dollar strength, Bundesbank chief says

- Short selling of silver astounds Sprott's Embry in KWN interview

- Gold in the attic

- Use This Gold Chart to Bank 20% Gains

- Gold Investing Sees Strongest January in 5 Years

- Breaking News And Best Of The Web

- Silver-rigging anti-trust lawsuits against JPMorganChase reinstated

- Gold Price Closed at $1216.70 Up $11.10 or 0.92%

- Justice Department tries to stall discovery in silver price-fixing case

- Alasdair Macleod: Price controls and propaganda

| GoldSeek Radio Nugget: John Williams and Chris Waltzek Posted: 08 Feb 2017 07:13 AM PST Rogue economist, John Williams of Shadowstats.com says the US dollar rally is a fata morgana, a rate hike bluff by Fed policymakers. The 2008 market collapse / Great Recession never ended; the Treasury / Fed merely sidestepped financial calamity at an enormous cost. Ultimately, the FOMC will be coerced by market forces, resulting in lower rates and sizable balance sheets via toxic debt purchases. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Market Set Up For Much Higher Price Move Than Gold Posted: 08 Feb 2017 07:07 AM PST When the paper markets finally collapse, the silver market is set up for much higher price gains than gold. Why? Because the fundamentals show that precious metals investment demand has put a great deal more pressure on the silver supply than gold… and by a long shot. There are three crucial reasons why the silver price will outperform the gold price when the highly inflated paper markets disintegrate under the weight of massive debt and derivatives. While many precious metals investors are frustrated by the ability of the Fed and Central Banks to continue to prop up the markets, the longer they postpone the day of reckoning, the worse the collapse. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lukewarm start for new London Gold Futures Contracts Posted: 08 Feb 2017 07:03 AM PST With neither the CME nor the ICE gold futures contracts registering any trades as of yet (according to their websites), it will be interesting to see how this drama pans out. Will they be dud contracts, like so many gold futures contracts before them that have gone to the gold futures contracts graveyard, or will they see a pick up in activity? All eyes will also be on the LME contract from 5 June onwards. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Army Preps For Urban Warfare In MegaCities: "Mass Migration, Disaster, And Inner-City Turmoil" Posted: 07 Feb 2017 07:30 PM PST Submitted by Mac Slavo via SHTFPlan.com, There will be war in the streets of America. Things have been engineered that way. The scenarios are many, the issues are complex. The current anger from the left, who are violently protesting against President Trump, is just one aspect of it. But the Pentagon and the U.S. national security structure is increasingly looking towards the shifting demographics around the globe – people have moved from rural areas, and shifted into cities. Where ever conflict stirs, there will be a need for military and SWAT response to the call. Entire cities will be locked down; door to door sweeps will often have violent ends. Baghdad could be brought home to the streets of America, and the military already knows it. The powers that be are deeply concerned about the unfolding situations with migrants, illegal immigrants, potential terrorists, political factions, violent protests, arson and riots. Increasingly, they are training for and expecting a homegrown conflict that will call for them to restore order in a major cities – and even hunt down suspects block to block, like in the Boston Marathon bombing incident, while making some significant infringement of our civil liberties. During the past several years, there have been reports about unannounced urban warfare drills in major U.S. cities, sometimes in coordination with major events; there have also been military training scenarios that have maintained a consistent theme of civil unrest, economic breakdown and widespread riots.

What do the elite know that we don’t? Now, a major military scholar is calling for the creation of “megacities combat units” – a proposal that is a major and drastic departure from warfare of the past, which has been designed away from cities. Now, military and paramilitary units, as well as local law enforcement, much engage the population itself – with all the unpredictability afforded by a real life, complex situation filled with combatants, non-combatants and friendlies behind any and all doors, etc. With a heightened focus on terrorism and reigning in undocumented immigrants, there will be a tendency, if we are not careful, for a heightened militarized and police state atmosphere to arise – both at home, and in everyplace that they take the fight. Major John Spencer, a former Ranger Instructor and scholar at West Point’s Modern War Institute called for an armed unit ready for megacities deployment in an op-ed:

Any way you slice it, the military and the national security infrastructure are watching for cracks in the system. People are at their wits end, and many are on the edge of poverty – and for many, it just won’t take much more to set them loose, and let riots erupt. Whether the system wants those to spread, or wants to suppress and contain them, they know they are coming. Population pressures, and clashing groups within growing city centers are creating more problems, and compounding old ones. If the economic stability of a given region were to give way, nearly every megacity would spiral out of control and descend into absolute madness – whether or this continent or any other. via Nicholas West: Rather than trying to guess what specific crisis may spill over into violence, or bring things to a stand still in traffic or electronic commerce, just consider the piling pressure that is growing in the techno hubs and swelling urban population centers. New York, Boston, Los Angeles, Chicago, Houston and dozens of enormous cities around the world are all completely vulnerable. Depending upon the political situation, unrest, violence or whatever else could spread across the entire Eastern half of the U.S., and the entire country could face collapse as it has never before known it. It is only a question of timing and circumstance. Preppers should take all this into account. Modern life may make a connection to the city unavoidable prior to the collapse, but being insufficiently away from major urban centers is definitely a liability in times of crisis. Even outlying neighbors can be subject to looting, natural disaster, grid shutdown, riots, and many other situations. Make arrangements to shelter away from the city, and make sure you can get there safely and quickly when something goes down. Do not rely on the services or goods of these cities, and get out while you still can. There are some very major crises brewing right now. They are preparing; you should, too. h/t Nicholas West, Activist Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: New gold futures contracts in London are open but no one trades them Posted: 07 Feb 2017 05:28 PM PST 8:30p ET Tuesday, February 7, 2017 Dear Friend of GATA and Gold: Gold researcher Ronan Manly reports tonight that two new gold futures contracts that recently opened for business in London and were announced with great fanfare -- one created by the London Metal Exchange, the other by the Intercontinental Exchance -- have yet to trade even a single contract. With British understatement Manley's report is headlined "Lukewarm Start for New London Gold Futures Contracts" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/lukewarm-start-for-new-lon... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Feb 2017 03:01 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver End Slightly Lower After Dollar Pop Posted: 07 Feb 2017 01:32 PM PST Gold dropped $6.80 to $1227.90 by a little after 8AM EST before it bounced back to $1235.70 in early afternoon trade, but it then drifted back lower into the close and ended with a loss of 0.14%. Silver slipped to $17.559 before it rallied back to $17.788 and then also fell back off, but it ended with a loss of just 0.11%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Crude Oil Link – What Does It Say? Posted: 07 Feb 2017 01:19 PM PST Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. On Monday, crude oil lost 1.52% after oil investors reacted to Friday’s Baker Hughes’ report, which showed that U.S. drillers added 17 rigs, which was the 13th increase in the past 14 weeks. Thanks to this news light crude reversed and declined to the previously-broken short-term support/resistance line. Will it manage to stop oil bears in the coming days? Is it possible that the relationship between gold and crude oil give us more clues about oil’s future moves? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. government has only itself to blame for dollar strength, Bundesbank chief says Posted: 07 Feb 2017 12:38 PM PST By Andreas Framke and Frank Siebelt MAINZ, Germany -- The U.S. administration should blame itself rather than Germany for a recent strengthening of the dollar against the euro, the head of Germany's Bundesbank said on Tuesday. Jens Weidmann said comments by a top trade adviser of U.S. President Donald Trump that Germany was exploiting the United States and its European partners with an overly weak euro were "more than absurd." "The thesis that foreign currency manipulations are to blame for the current strong U.S. dollar is not borne out by facts," he told a gathering in this western German city. "The most recent rise in the dollar is likely to be homemade, triggered by the political announcements of the new government," he said. Separately, in an interview with Redaktionsnetzwerk Deutschland media group, Weidmann said there was no point in starting a currency war. "If politicians erect trade barriers or start a currency depreciation race, there are only losers in the end," he told RND, in comments due to be published Wednesday. ... ... For the remainder of the report: http://www.reuters.com/article/us-usa-trump-bundesbank-idUSKBN15M21Y ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short selling of silver astounds Sprott's Embry in KWN interview Posted: 07 Feb 2017 11:12 AM PST 2:13p ET Tuesday, February 7, 2017 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry, interviewed today by King World News, explains why he is astounded at the short-selling of silver, which he considers the most undervalued asset in the world. The interview is excerpted at KWN here: http://kingworldnews.com/embry-criminal-banks-commercials-now-short-mind... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Feb 2017 09:36 AM PST This year marks USAGOLD's 20th year on the World Wide Web, and this newsletter has been part and parcel of our online presence from day one. In fact, we published this newsletter in hard-copy form long before the internet came along. So it is that we took the occasion to rummage around News and Views' creaky attic and dust-off the group of golden vignettes you see immediately below. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

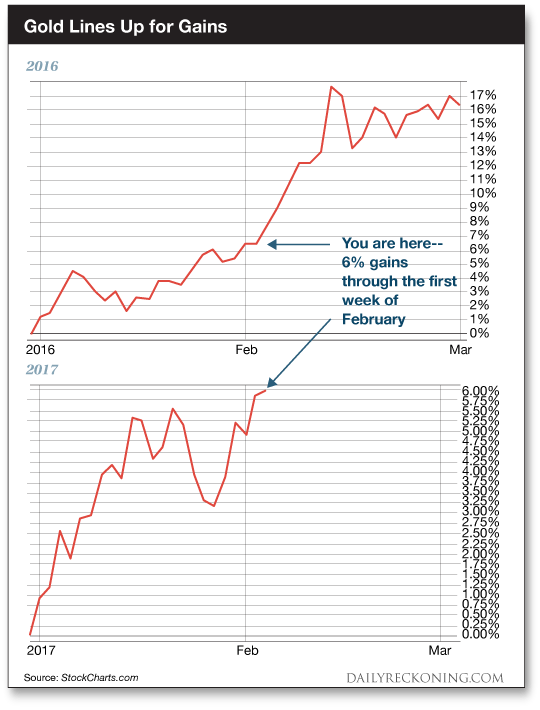

| Use This Gold Chart to Bank 20% Gains Posted: 07 Feb 2017 08:35 AM PST This post Use This Gold Chart to Bank 20% Gains appeared first on Daily Reckoning. During the first six weeks of 2016, gold soared 17%. These gains approached an incredible 27% by July, capping an epic comeback in the forgotten precious metals sector. Right now, we're seeing this exact pattern shaping up to begin 2017. If this relationship holds true, double-digit gold gains are headed your way over the next several weeks Here's how it all unfolds: Late last year, we told you precious metals had a chance at carving out support and offering us a tradable bounce once the market absorbed the December rate hike. After the calendar flipped to 2017, the bounce materialized. It was our first shot at quick, double-digit gains in 2017. After briefly visiting 11-month lows, gold quietly bottomed out. Gold and gold miner stocks firmed as the furious dollar rally lost steam. That's brings us to today's opportunity. We've noticed a curious development in gold so far this year. Gold's advance for the first six weeks of 2017 has perfectly mirrored the action we witnessed during the first six weeks of 2016. Gold has posted gains of 6% through the first week of February for the second year in a row. In both cases, gold bounced off a late December bottom. And in both cases, the gold rally dipped in late January—only to rocket to new highs at the start of February. That's where the real action begins…

If gold continues to mirror its 2016 advance this year, we're in for a strong month that could deliver double-digit gains before spring arrives. That's great news for our gold plays. When the market first told us to jump on a quick gold trade in early January, we grabbed our favorite gold plays with zero expectations. After all, gold was the Jekyll and Hyde trade of 2016. A buy-and-hold strategy last year would have caused you to leave a lot of money on the table. You could have netted double-digit gains (or more) during the first six months of 2016 as precious metals and miners vaulted to two-year highs. A nasty stock market meltdown, the Fed flip-flopping on its rate hike promise and the surprise Brexit vote fueled gold's fire, sending the metal higher by more than 25% by the end of the second quarter. But gold's trajectory changed dramatically during the second half of 2016. While the major averages chopped along, gold couldn't catch a bid. The precious metals rally completely lost its mojo. Gold's drop slaughtered traders who opted to ignore the bearish market action and count their winnings at the finish of the second quarter. By the end of the year, the Midas metal landed almost right back where it started. Will this year's gold rally fizzle at the beginning of the third quarter just like we saw in 2016? We have no way of knowing. All we can do is ride the trend. The precious metal plays we're tracking right now have endured some serious pain over the past six months. The 2016-2017 relationship might hold firm—or it could fall apart. Only time will tell. Sincerely, The post Use This Gold Chart to Bank 20% Gains appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Investing Sees Strongest January in 5 Years Posted: 07 Feb 2017 02:15 AM PST Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 07 Feb 2017 01:37 AM PST What survives the coming reset? Not your bank account or IRA. US stocks remain near all-time highs, gold and silver down on stronger dollar. Trump immigration plan challenged in court. Debate over Putin intensifies. French election uncertainty rocks euro bonds Best Of The Web Which assets are most likely to survive the inevitable “system re-set”? […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver-rigging anti-trust lawsuits against JPMorganChase reinstated Posted: 02 Feb 2017 08:23 PM PST 11:25p ET Thursday, February 2, 2017 Dear Friend of GATA and Gold: Market Slant reports tonight that the U.S. 2nd Circuit Court of Appeals in New York has reinstated the silver-market rigging lawsuits against JPMorganChase, finding that the district court judge who dismissed the lawsuits engaged in "impermissible fact finding." The case returns to the district court for more proceedings and presumably evidence discovery and deposition. Market Slant's report is posted here: https://www.marketslant.com/articles/jp-morgan-silver-rigging-dismissal-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1216.70 Up $11.10 or 0.92% Posted: 02 Feb 2017 05:44 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Justice Department tries to stall discovery in silver price-fixing case Posted: 02 Feb 2017 12:11 PM PST Silver Investors Slam Justice Department Discovery Halt in Silver Price-Fixing Case By Kelcee Griffis https://www.law360.com/articles/887079/silver-investors-slam-doj-discove... NEW YORK -- Silver investors accusing major banks of price-fixing urged a New York federal court in a document posted Tuesday to forgo the U.S. Department of Justice's proposed one-year discovery stay, asking the court to strike a compromise to "better balance the governmental and private interests at stake." In a heavily redacted document dated Jan. 19 but posted Tuesday, the investors asked to keep open the broader discovery in their consolidated proposed class action against banks including HSBC and The Bank of Nova Scotia, saying the Justice Department's timeline to accommodate its criminal investigation would severely hamper the present multidistrict litigation. ... Dispatch continues below ... ADVERTISEMENT K92 Mining Drills Multiple High-Grade Gold Intersections Company Announcement K92 Mining Inc. (TSXV–KNT) announces the latest results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine in Papua New Guinea. K92 is ramping up the Kainantu gold mine toward commercial production, with its longest continuous production run to date now commenced. In September 2016 K92 began a campaign of close-spaced underground diamond drilling as part of a comprehensive grade-control strategy. The current grade-control drilling program is focused on the areas of Irumafimpa and is designed to bring a high degree of confidence to the production planning and scheduling. K92 plans to mine this area in the coming six months. The closed-space drilling pattern of approximately 15 metres by 15 meters has significantly increased the confidence in this sparsely drilled area, with most holes recording high-grade intersections. Approximately 80 percent of the holes completed to date have recorded multiple high-grade intersections indicating the presence of multiple parallel to sub parallel high-grade veins. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/01/k92-drills-multiple-high-grade-gold-int... "The department does not proffer any time frame for when it might file charges against any of its targets. Thus, the department's proposal will result in a lengthy stay of this action," the investors wrote. The government asked to join the suit in early January and requested a partial yearlong stay of civil discovery while it conducts criminal investigations, saying the move would actually make way for the civil suit to forge ahead. "In any event -- and far from grinding to a halt -- the proposed partial stay will allow significant aspects of the civil litigation and civil discovery to continue," the department contended in a Jan. 9 memorandum. The silver investors in the multidistrict litigation made clear on Tuesday they don't oppose the government's joining the suit, but they do take issue with it potentially slowing down their discovery. The investors said they already made concessions involving depositions and proposed a type of three-month embargo that the department could renew periodically. The plaintiffs said that if the court balances the department's interests with their own, the agency could agree to produce certain documents "on an attorneys' eyes-only basis." "This would allow plaintiffs to review documents and be ready to take depositions when the embargo is lifted, but also protect the department's investigation by preventing public disclosure of the materials until the embargo ends," the opposition brief said. But the department already flatly rejected that proposal, the investors said. Still, it would not be fair to force the proposed class to move for certification without the benefit of sufficient discovery, according to the filing. In November a judge signed off on Deutsche Bank's $38 million settlement with the class of investors who participated in U.S.-related trades of silver or silver derivatives dating back to January 1999. In a December motion to file a third consolidated amended class-action complaint, the investors urged the court to add as defendants Barclays Bank and affiliates, BNP Paribas Fortis, Standard Chartered Bank, and Bank of America Merrill Lynch. The investors also asked the court to revive their previously dismissed claims against UBS. The suit had alleged Deutsche Bank, HSBC, and Bank of Nova Scotia colluded to fix the price of silver futures to ensure the banks received high returns as part of The London Silver Market Fixing Ltd., which has set the price of physical silver since 1897. Counsel for the parties could not be immediately reached for comment Wednesday. The plaintiffs are represented by Barbara J. Hart, Vincent Briganti, Geoffrey M. Horn, Raymond Girnys, Christian P. Levis, and Michelle E. Conston of Lowey Dannenberg Cohen & Hart, and James J. Sabella, Robert G. Eisler, and Charles G. Caliendo of Grant & Eisenhofer PA. Deutsche Bank is represented by Rob Khuzami, Joseph Serino and Kuan Huang of Kirkland & Ellis and Peter J. Isajiw of King & Spalding. UBS AG is represented by David J. Arp, Melanie L. Katsur, Joel S. Sanders, Peter Sullivan, Indraneel Sur, and Lawrence J. Zweifach of Gibson Dunn. The case is In re: London Silver Fixing Ltd. Antitrust Litigation, case number 1:14-md-02573, in the U.S. District Court for the Southern District of New York. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Price controls and propaganda Posted: 02 Feb 2017 11:36 AM PST 2:35p ET Thursday, February 2, 2017 Dear Friend of GATA and Gold: In his new commentary, "Price Controls and Propaganda," GoldMoney research director Alasdair Macleod explains why, despite the recent experience of Venezuela and Zimbabwe, governments are increasingly likely to resort to price controls to try to compensate their debasement of their currencies. Macleod's commentary is posted at GoldMoney here: https://wealth.goldmoney.com/research/goldmoney-insights/price-controls-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment