Gold World News Flash |

- Silver Guru David Morgan On Trump, The Police State and Precious Metals in 2017

- Investors Shift Back into Gold as Trump’s Honeymoon Period Ends

- April Gold Needs One More Inch

- Pound skids to two-week low but gold nears three-month high as political risks stoke safe-haven demand

- The Big Snapchat IPO Question: Will Investment Dollars Also Go Poof?

- When The Money Supply Dries Up

- ALERT: Largest US Forex Broker FXCM Shut Down and Permanently Banned from NFA

- President Trump Full Speech at MacDill Air Force Base 2/6/17

- Gold Price Hits $1230, Silver Comex Bets Jump, as France's Le Pen + Ukraine 'Add to Trump Risk' on Iran

- Gold Price Closed at $1230 Up $11.50 or 0.94%

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% While Stocks and Oil Drop – Miners Shine

- The 46-Year Record of Platinum-Gold Ratios

- Indicators of a Chinese Collapse

- The Year of the Ruble

- Four Exciting Small Cap Canadian Stocks Breaking Out of Cup and Handle Patterns

- This Gutsy Call Could Cost You a Fortune…

- Where are the Gold Traders?

- SWOT Analysis: Gold Moves As Trump Rattles Markets

- Gold Price Trend Forecast, Where are the Gold Traders?

- Gold Bullion Banks To “Open Vaults” In Transparency Push?

- US Dollar and Gold Markets Update

- Breaking News And Best Of The Web

- Top Ten Videos — February 6

- Jack Chan: This Past Week in Gold

| Silver Guru David Morgan On Trump, The Police State and Precious Metals in 2017 Posted: 07 Feb 2017 07:17 AM PST We recently had the pleasure of interviewing David Morgan of the Morgan Report regarding several topics including Donald Trump, the police state, and the future of the precious metals market. David mentioned that he thinks this year in the precious metals is likely to be a repeat of last year's price movement. His viewpoint is consistent with ours and if we are correct, it means the metals are going to perform very well again. He also emphasized the importance in his mind of using no more than 25% of one's investable funds in their trading portfolio and especially not on one particular trade. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investors Shift Back into Gold as Trump’s Honeymoon Period Ends Posted: 07 Feb 2017 07:07 AM PST That didn't take long. After little more than two weeks, President Donald Trump's honeymoon with Wall Street appears to have been put on hold—for the moment, at least—with major indices making only tepid moves since his January 20 inauguration. That includes the small-cap Russell 2000 Index, which surged in the days following Election Day on hopes that Trump's pledge to roll back regulations and lower corporate taxes would benefit domestic small businesses the most. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| April Gold Needs One More Inch Posted: 07 Feb 2017 07:04 AM PST It's late Monday night and April Gold has stolen up on the 1237.70 'external' peak (see inset) that I wrote here yesterday was crucial to the short- to intermediate-term picture. The so-far high tonight has precisely tied the peak, but it would be hard to imagine the futures coming this far without mustering the tiny push it would take to get past it. That would refresh the bullish energy of the daily chart, shifting our attention to election night's watershed peak at 1343.90. First things first, though: Assuming buyers can get past the 1238.80 'secondary pivot' of the pattern shown, a two-day close above it would put the 1257.10 target solidly in play over the near term. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Feb 2017 02:02 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Big Snapchat IPO Question: Will Investment Dollars Also Go Poof? Posted: 07 Feb 2017 02:00 AM PST If your head is still spinning made possible by last weeks news cycle? Congratulations – you’re normal. Trying to keep up with any news, even just one element (e.g., business) has been a near task in futility. Politics (understandably) in one form or another is currently dominating everything, even business. So with that said, it could be argued why the most anticipated, hailed, saving grace for all that is “The Valley”, IPO to save the IPO world Snap™ (aka Snapchat™) filed its former “confidential” papers on Thursday. And the reaction? (insert crickets here) Sure there has been the usual high-fiving chorus throughout the tech world, and in particular “The Valley” world. That’s to be expected. However, with that said, I want to offer up the following headline as possibly the reasoning behind so little fanfare. It comes from none other than Vanity Fair™ and ask if you have the same reaction as I did. Ready? “Silicon Valley, Rejoice: Snapchat Files For Huge $3 Billion I.P.O.” My initial thoughts?: Silicon Valley dreams of working for “stock options” and IPO riches meets its WTF moment into reality. Why you ask? Hint: “rejoice”, “huge”, “$3 Billion.” equals “It’s different this time.” And not in a good way. Let me phrase it this way: All this waiting, all the hype, all those “dreams” placed squarely on the shoulders of this forthcoming IPO – and all they get is a lousy $3 Billion and the CEO gets to keep (and wears) the “lousy T-shirt.” Yep: “rejoice” just seems a little out-of-place after that, doesn’t it? Now $3 Billion is nothing to sneeze at. Especially if it’s “your” money that’s going to be the content for the counting. But this is Snapchat! You know, the supposed next Facebook™ (FB) if not FB killer. Comparisons to other tech companies (e.g., Twitter™) brings a swift response from roadshow messaging, “We’re the next Facebook, Not The Next Twitter.” All I’ll say is investors better hope, pray, and give burnt offerings to help that insinuation along before the possibility the “burnt offerings” is their money up-in-smoke after the fact, just saying. Again, here we have “the” most anticipated IPO to come down the pike in quite some time. Their shopping for this IPO has been done in near secrecy where “confidentiality” was the term used as to describe the process. Many thought since they waited till the “markets” once again were tractor-beamed into never-before-seen-in-history-highs that this IPO would be priced at the whisper number of $5 Billion reminiscent of FB’s. Especially given all that seems to be riding on this “unicorn’s” back. Sorry, to be the bummer, but $3 Billion is closer both in math, and reality, to Twitter’s $1.8 IPO offer range, than it is to FB’s $5 Billion. And what may be even worse? Their filings seem to make that case even further. In my opinion: This isn’t a good sign if you’re the supposed “David” in “The Valley’s” version of “Goliath” killers. Especially if you’re simultaneously held to be the IPO savior of tech. And there’s only one thing worse than “expectations” not being met, even if it is hopes, or dreamlike infused wishes. What’s that you ask? Hint: When you state publicly that your business, a business that is looking to garner other people’s money who will someday be looking for a return on that investment read – they may never find that scenario ever possible. Think I’m kidding? From their S-1 filing, page 19, in bold, italicized text. To wit:

So, I’m going to ask you a question from a business standpoint: Why in the world would you include such a statement? Some will argue this was just some boilerplate legal mumbo-jumbo that is constructed and stated in more differing ways than there are ants on the planet, and needs to be included somewhere within the fine print, where all this form of legalese gets inserted to be glossed over. And that would be a fair argument. However, if that’s the reasoning: Why in the world would you make this statement front, center, and unable to miss? Unless? (I’ll just pause here, and let you fill in that thought you just had on your own. Remember, “investors” at these levels are supposed to be “sophisticated”, as in, they inherently understand potential losses. So why the need to make it so uncharacteristically prominent? Think that line over a few times, and try to square-that-circle on your own.) From my perspective this not only appears troubling at first-blush, it get’s even further problematic as the cloud of “confidentiality” gets lifted further into the light of true business fundamentals. Why do I say such a thing? Again, from their own filings, page 36, and, once again, in bold and italicized, to wit:

Translation? If you don’t like what we’re doing with your investment dollars and assumed because you gave us your money we needed to listen to you? Screw you – it was right there in the S-1. Cha-ching! The more I perused this S-1, the more I found myself thinking this seems to be nothing more than a legalesed filled document to do nothing more than solidify a founders cash-out with no chance of recourse. Or said differently: Screw what ever befalls the company and investors later. i.e., The “I’ve got mine – who cares about yours.” type of mentality that seems to plague much of what is commonly known as “tech” or “The Valley” stylized entity. As always: Don’t take my word, or conclusions for it. Read the document for yourself, and come to your own conclusions. Especially if you are one of those just “chomping at the bit” as to be the first to ride this long-awaited unicorn. For there are warning signs throughout this document that anyone with a modem of business acumen will find troubling. I’m sorry, did I hear you say, “It can’t be any worse than what the above portends?” Fair enough, so here’s another detail contained within page 4, once again, to wit: Revenue increased to $404.5 million compared to $58.7 the year before. Sounds great, right? Yep, until you also read they incurred a net loss of $514.6 million up from $372.9 million in the same period. Translation? More users – more losses. See above statements for what that may translate to “your” returns on investment hopes. And try not to think about the old “We sell dollar bills at 98 cents – but we make it up on volume!” joke as you try to evaluate what this business model should be worth, or better yet, how anyone could ever value it at $25 Billion or more. Only in “The Valley” is all I’ll say. I’ll just end with this one statement, or observation: Remember when making profits was seen as “just not getting tech” and you were relegated to “doesn’t have a clue” status if you dared to ask questions such as “profitability”, “net profits”, “return on investment”, and more? You know, when The Fed. was pumping in all that QE money? What’s happened since then? Hint: A dried up IPO market, IPO’s that are still “in transition” that may never see light of day, IPO’s that were supposedly “the” new markets for their relative products are now seen as investment disasters. i.e., Look to TWTR, FIT, GPRO, TWLO, P, and others for clues, always remembering how they too were “cutting edge” when it came to messaging, cameras, wearables, and more. Because today? Hint: look to any stock chart. And yet, here we are (again) today with another “app” that takes pictures so that people can augment their pictures or message – then goes “poof.” Just like it’s cash-burn status. And we’re told – “it’s different this time” (again) when evaluating its business model and metrics. Sure it is. You know what truly is different this time? The inclusion of the term “poop” on a S-1 filing. Oh yes – that’s not a misprint. It’s right there on page 110 as to give credence to the “ads for eyeballs” fallacy. You just can’t make up stuff like that. No one would believe it. No wonder this was all done originally under the cloak of “confidentiality.” Now that it’s hit the light-of-day? “Poop” may indeed have been a good term to include, because from my perspective… This whole thing stinks to high-business heaven. Where many an “investors” bank account may also find itself. i.e., “Money Heaven.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| When The Money Supply Dries Up Posted: 07 Feb 2017 12:30 AM PST Submitted by Jeff Thomas via InternationalMan.com, In 1944, the US had been the primary supplier for arms for the allies during World War II and, as such, exited the war with more wealth than any of the other nations that had entered the war earlier, draining their treasuries of money. Since payment was largely demanded in gold, the US held three-quarters of the world’s gold and therefore was in a position to call the shots with regard to the free world’s economic future. At Bretton Woods, the US took advantage of this situation, setting up the World Bank and the IMF and declaring the dollar to be the default currency for all countries concerned. From that point on, the US was in the catbird seat, able to dictate economic terms to other countries and even to behave irresponsibly, eventually creating previously unheard-of levels of debt, thereby inspiring other nations to do their best to create their own debt in order to keep pace as best they could. Eventually, of course, such irresponsible economics will cause any country, no matter how powerful, to collapse economically, no matter how many Keynesian economists such as Thomas Piketty, Paul Krugman, and Larry Summers declare otherwise. Beginning in 1944, the US became the world’s foremost empire, for the strongest of reasons—it held the world’s wealth. This advantage led to a period of great power and, in the latter years, as the empire began to stumble economically under its own great weight, led to the creation of organisations and legislation designed to bring in new revenue, as the old forms of revenue declined. In recent years, we’ve seen the rise of the extraordinary assumption that “money laundering” (the practice of protecting one’s wealth from rapacious governments), should be regarded as a crime. As such, “tax havens”—those jurisdictions that provide freedom from governmental usurpation—have also been vilified as being somehow criminal because they recognize the basic right of freedom to prosper. Along the way, we’ve witnessed the creation of the Organisation for Economic Co-operation and Development (OECD), a euphemistic appellation that might rightfully be termed the “Organization for Forced Compliance with Arbitrary Taxation Diktat by Powerful Nations.” This US-led organisation has served to periodically threaten freer nations to comply with the less free nations, so that citizens in the latter group cannot escape being stripped of the fruit of their labours. In addition, the US has created the Foreign Account Tax Compliance Act (FATCA), which is ostensibly intended to enforce taxation of US citizens abroad, but which has been used almost entirely to bilk foreign banks that have US citizens as clients. (Again, the rules are arbitrary and ever-changing, and banks that fail to satisfy the US are fined enormous sums in a rather colossal Mafia-style shakedown.) Along the way, the US has increasingly created legislation restricting the international movement of money by its people in addition to such a patchwork quilt of laws that every citizen is likely to break several laws each day, simply by existing normally. All of this is taken for granted as a “given” by both Americans and those of us who view the US from afar. However, we rarely, if ever, take the time to reflect on the fact that, historically, this is nothing new. This is, in fact, quite the norm for an empire in decline. From the latter days of the Roman Empire, such practices (if in a less sophisticated form) have been implemented in order to have a last squeeze of the lemon before economic collapse takes place. So, what then, in these many instances, has been the deciding factor that ends such draconian usurping of private wealth? Well, in fact, what tends to occur is that enforcement increases serially, right up until the moment when such enforcement can no longer be funded. Sooner or later, the amount that’s being bilked from those who are productive is insufficient to force them to continue to be bilked. In ancient Rome, once the system had deteriorated to the point that the military was almost entirely mercenary, all that was needed was for the government to fail to provide full, regular payment to the troops. Once “the cheques began to bounce,” the military turned on their former benefactors. In addition to the cessation of enforcement, the military itself was now a threat to the leadership. And of course, we have seen this in other empires since that time. Even with all the gold that Spain was pulling out of the New World in the 16th century, it wasn’t sufficient to pay for the excessive foreign military adventures of Philip II and eventually the coffers ran dry, collapsing his ability to even maintain control at home. When even the interest on the debt could not be serviced, the ability to maintain control not only ceased to advance—it went into reverse. Whenever the ability to enforce draconian legislation goes into decline, the people of a nation suddenly realise that they’ve been living in fear of a paper tiger. It doesn’t take long before some people choose to defy the system. When they’re seen to succeed, others follow in droves. So, what does this say of the US and its power? Well, as Doug Casey has been known to say, “Countries fall from grace with remarkable speed.” Quite so. On an international level, this means that international leaders will be watching the economic decline of the US closely. Countries such as China and Russia have been loading up on precious metals in preparation for a collapse in fiat currency. In addition, they’ve created their own version of the World Bank, the Asian Infrastructure Investment Bank, and have been hard at work inking deals with other nations for international settlement in currencies other than the dollar. Most people in the world today cannot remember a time before Bretton Woods, yet they may soon witness the Bretton Woods agreement becoming a dead duck. But, if we extend this premise, we also should be questioning the other constructs of the postwar period that have become dinosaurs. What of the United Nations? This organisation was once meant to be a body for arbitration and world planning, but has in latter decades become a quagmire of bickering and gainsaying—with its decisions rarely being adopted by the nations in question. And yet the US alone pays some $8 billion annually to keep the UN afloat. Surely, when the world at large ceases its willingness to carry further US debt, the US government will jettison the expense for the UN before it cuts either its military spending or its entitlement programmes. Similarly, NATO, which requires $2.8 billion annually (with only five of its 28 members currently meeting the recommended payments) would experience a similar fate. With the above entities heading south, the Wolfowitz Doctrine, which has since 1992 been the basis of US aggression policy, would become unachievable. In addition to the decline or cessation of the above international adventurism, enforcement of revenue pursuit in the guise of FATCA and OECD schemes would equally suffer from a loss of funding. It would not be a question of whether the empire still wished to squeeze the lemon more than ever before—it would. But once the funds to do so dried up, the US and EU would find themselves in the situation that we currently observe in Venezuela: The money to pay for the enforcement is simply not there anymore. The decline would begin with bounced cheques, followed by massive layoffs in the enforcement departments, followed by a decline in receipts, necessitating further layoffs, and continuing in a downward spiral. At present, countless people live in fear of the present empires and their ever-increasing efforts at usurpation. However, as history shows, once debt has reached its nadir and begins its rapid fall, so does the empire’s ability to enforce draconian confiscations. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ALERT: Largest US Forex Broker FXCM Shut Down and Permanently Banned from NFA Posted: 06 Feb 2017 08:08 PM PST It comes as no surprise to many, that the US biggest and baddest Forex broker, FXCM, has been shut down by regulators, and permanently banned from future membership, including the firm itself and several APs, including Dror "Drew" Niv, its founder, says the NFA's website. We talk about this a lot in our book Splitting Pennies- for those of you who want to understand more about what's going on here - pickup a copy on Amazon. FXCM simply could not run an honest business. It's important for those not in FX to understand that, just because FXCM is a fraud, it doesn't mean that FX is a fraud. Simply, that FX was a fertile ground for ponzi scammers, criminals, banksters, and the lowest level of white collar criminals. WHY is that you ask? Because FX is so greatly misunderstood, it's possible for those with slightly higher IQ's than the average investing public to pull the wool over the eyes of the retail customer, and in FXCM's case - the regulators too. Well, thanks to the NFA for bringing this case to a close, I'm sure all the victims who have lost money due to FXCMs petty scams and tricks will be comforted to hear the news that at least for our lifetime, they will not be able to continue their games. And, because of the lack of understanding - legitimate more high brow entities simply don't want to touch it, and especially retail, it's like getting their hands dirty. FXCM has shown the world how NOT to run an FX business. FXCM's collapse is expected, by those in the know. But the good news, at least for customers, your accounts will be safely transferred to Gain Capital. Here's a snapshot of the key info from the complaint and decision filed by the NFA: Here's how FXCM's petty scam worked. So, around the time of 2006 - 2008 the dealing desk model of trading against customers was getting old. Too many complaints, and too much competition. Finally, FXCM settled a lawsuit for something a genius lawyer labelled 'assymetric price slippage' which is high paid lawyer lingo for screwing the customer. The only thing assymetric about the slippage was the ass, that is, customers always took it in. You think that this is tongue in cheek humor, but this is how FXCM ran their business. The scam sham company they setup to trick regulators they sarcastically named "Effex" a full phonetic spelling of FX. If FXCM was really professional they could have resorted to naming it something regal, such as The Sapiano Organization or Wellington Capital Group, LP. - the name use "Effex" shows how petty and sloppy FXCM's management is. I mean, some people on Wall St. have that sense of humor. But, customers don't think it's so funny when they're losing money on positive trades. FX is difficult enough - and the fact that FXCM would resort to petty tricks like reversing positive trades in your account weeks after the profit was booked, it made for many angry customers. Yes, they did that. And worse, much worse. Anyway, so at some point FXCM knew they couldn't perpetuate their dealing desk operations (trading against the customer) at least in plain sight, which they were. So what they did, they created a model that was truely, STP, or sending orders directly to the banks. However, what they did - in agreement with the banks, FXCM's order flow was 'tagged' electronically, and sent straight into the new fancy dealing machine that was now a super robot on steroids, waiting to take a look at your order and hold it, change it, reject it, slip it - all in the name of another company - NOT FXCM (this is really important to understand how this scam works). So, FXCM could state, that they were not trading against the customer. But they were sending their orders mostly to a firm that did trade against the orders, "Effex" - and this company was not only owned and controlled by FXCM, it was in their office, run by an ex-employee, on FXCM's computer network, using the same IT. To see a legal perspective of how FXCM's .. excuse me.. "Effex" dealing operations worked, take a look at this statement from the complaint:

"Hold Timer" is the key here. Traders that use FXCM's "Trading Station" platform know the various messages when you go to buy, such as 'please wait' and 'order processing' and so on. What's happening during that time, they are waiting for a number of things to happen; the market to move in their favor (and in this case, they'll fill your order at the worst possible price, like the moment you clicked) - or another customer to place the opposite order, where they could capture a huge spread, or for them to receive a huge discounted order on the wholesale market, and fill your order at a slipped price (but extremely profitable for FXCM). It's true - this is a money making machine! But, like the Casinos, it was FXCM getting rich, not the customer. The full complaint makes for great reading for those who want to understand - from a compliance and legal perspective - how the inner workings of a dealing desk broker work. Note several key points that 1) FXCM was not a dealing desk broker (no broker will admit to using this model, they are all STP.. yeah right) 2) FXCM had their head up their rear so far they didn't have an exit plan - they thought they were above scrutiny, because NFA was in their pocket. Well, maybe they were - maybe this is all because of Trump! Did I write that, or it just materialized on the screen - ... In any event, traders should at least say "Thank You" to the NFA for finally bringing down this huge petty scam, that we can start to rebuild from the rubble, and build a real FX business, based on profitable FX alpha generating strategies, sophistocated liquidity algorithms that can manage risk in a complex market, and computing power. To contrast that statement, FXCM had an employee policy, to hire good sounding NYU grads that didn't know about finance and were good on the phones. FXCM invested zero in R&D. Their IT was horrendous - except of course, their dealing software, which they invested millions in. Thank you to all the participants of this case, to the NFA, to Trump for creating a pro-business environment, thank you to the clients who started the class-action against FXCM that led to the ass-slippage case; now let's create a REAL FX market! To learn more about the inner workings of FX and how to survive, checkout FC Trading Academy. To read a good book on the topic of FX - checkout Splitting Pennies - Understanding Forex.  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| President Trump Full Speech at MacDill Air Force Base 2/6/17 Posted: 06 Feb 2017 06:00 PM PST Trump gives a speech at MacDill Air Force Base in Tampa, Florida. Operation Make America Safe Again continues. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2017 04:29 PM PST GOLD PRICES extended last week's 2.4% gains to reach new 3-month highs on Monday in London, briefly breaking above $1230 per ounce even as the US Dollar rose on the FX market amid news of French presidential candidate Marine Le Pen calling for 'Frexit' from the European Union, writes Steffen Grosshauser at BullionVault. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1230 Up $11.50 or 0.94% Posted: 06 Feb 2017 03:49 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% While Stocks and Oil Drop – Miners Shine Posted: 06 Feb 2017 01:27 PM PST Gold gained $5.98 to $1224.98 in early Asian trade and rose to as high as $1230.08 in London before it pared back in midmorning New York trade, but it then rallied back higher again into the close and ended near its late session high of $1235.52 with a gain of 1.29%. Silver rose to as high as $17.748 and ended with a gain of 1.55%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The 46-Year Record of Platinum-Gold Ratios Posted: 06 Feb 2017 01:00 PM PST In my opinion, gold is the only real money. Thus it is my safe haven of choice and insurance policy against financial calamity. Platinum functions both as a precious and industrial metal. It is usually tied to the price of gold in both short- and long-term trading patterns. In times of financial distress and economic turmoil, platinum tends to behave more like gold with widespread hoarding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indicators of a Chinese Collapse Posted: 06 Feb 2017 11:50 AM PST This post Indicators of a Chinese Collapse appeared first on Daily Reckoning. [Ed. Note: Jim Rickards’ latest New York Times best seller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis, claim your free copy here – transcends politics and media to prepare you for the next crisis in the ice-nine lockdown.] I recently returned from a weeklong trip to China, specifically Shanghai and Nanjing. In Shanghai, I met with a group of forty of the top China economists, mostly from major Chinese banks and brokers, at an annual event called the China Chief Economist Forum. I was a keynote presenter at the forum to 400 invited guests made up of major institutional investors and wealth managers in China. In Nanjing, I met with provincial government officials and economic development experts. They are building a high-tech research center of excellence called UTown on the southern outskirts of the city. I was even permitted to enter a top-secret Huawei laboratory used for testing new internet data-mining algorithms. Huawei is closely affiliated with the People's Liberation Army — and is banned from most business in the United States because they are suspected of hacking and espionage aimed at U.S. critical infrastructure. In addition to our proprietary models and analytic techniques — including complexity theory, causal inference, and behavioral psychology — I have always been of the view that there is no substitute for foreign travel and face-to-face contact with both experts and everyday citizens in the countries we are trying to understand. That's why I also took every opportunity I could find to speak with drivers, clerks, bellhops, and passersby. That's not as difficult as it sounds. In a country like China, few citizens have traveled abroad and they are often eager to practice English conversation with a real American. People you meet in the street are often a better source of information than the experts in the hotel conference rooms. I asked one student if people in China were trying to get their money out of the country. His eyes lit up and he replied, "Yes, everybody I know!" Why are the Chinese moving their money out of the country? Because they know, as I'll explain below, the yuan could lose its value any day now. China's Hurricane Strength HeadwindsThe process of connecting the dots between the political, economic, and social forces buffeting China is complicated. By using technical analysis and information gathered on the ground, we are able to cut through the haze of political rhetoric and propaganda coming from Washington and Beijing. Then we bring you a reasoned estimate of what the near future holds in store for markets as the world's two largest economies — China and the U.S. — work out their differences for better or worse. In 2016, we know that China, the world's second largest economy, defied predictions of a slowdown by unleashing massive amounts of government spending and adding mountains of debt to stimulate its economy. But we expect 2017 may turn out very differently. China is encountering hurricane force headwinds that will cause its nonsustainable debt-driven policies to reach a critical state. These headwinds include: confrontations with President Trump on issues of trade, tariffs and currency manipulation; internal political instability from Chinese President Xi's efforts to expand and centralize his political power; possible geopolitical crises connected to North Korea, Taiwan or the South China Sea; Trump's pivot toward Russia and away from China; the Chinese credit bubble; capital flight; and China's delicate relations with the IMF. In an interview with Chris Wallace on Fox News Sunday on Dec. 11, 2016 then President-elect Trump was asked about a phone call he had taken from the President of Taiwan. Trump replied as follows:

That one quote neatly summarizes the bundle of challenges confronting China as a result of the election of President Trump. The first challenge is that Trump is plainspoken and does not hide behind the usual diplomatic babble. That can be difficult for the Chinese to tolerate because their culture is dominated by the concept of "face" or the need to avoid direct conflict or embarrassment. When Chinese lose face as the result an adversarial thrust, they try to regain face by being adversarial in return. The result can be an escalation of tensions independent of the policy substance involved. That can make agreements more difficult to achieve. President Trump and President Xi are on a collision course involving issues of trade, tariffs, and currency manipulation. Geopolitical issues will make the economic issues even harder to resolve. The quote also lists the main areas of contention — trade, tariffs, taxation, currency manipulation, North Korea, Taiwan, and the South China Sea. China's response to these conflicts might take the form of a maxi-devaluation of the yuan, much tighter capital controls, a severe downturn in its economy or all three. But none of the extreme outcomes will be contained to China. Any significant departure from China's current growth trajectory has serious negative implications for investors around the world. In short, we may be witnessing a break-up in the China-U.S. global condominium that has dominated world growth and world politics since 2001. The Trump ChallengeU.S. policy for the past sixteen years through the Bush and Obama administrations had been soft-pedaling all of these issues in return for cheap manufactured goods and China's willingness to finance trillions of dollars of U.S. government debt. Now Trump is changing the rules of the game. He's saying lost jobs in the U.S. are not worth the cheap goods and cheap financing. He's betting that China has no alternative but to keep producing those goods and keep buying our debt, even if the U.S. imposes tariffs to help create manufacturing jobs here. Trump is willing to use leverage from the geopolitical sphere on issues like Taiwan, North Korea, and the South China Sea in order to get concessions from China on the currency issue and China's trade subsidies such as state support for money losing export sectors (like steel). As Trump settles into office, he's backing up his words with actions. His team is now packed with seasoned officials and advisors who have been vocal critics of China's trade policies for decades. The new U.S. Trade Representative, Robert Lighthizer, has a record of imposing tariffs on unfair trading partners going back to the Reagan administration in the 1980s. Trump's transition advisor on trade, Dan DiMicco, is the former CEO of Nucor steel and has been on the receiving end of China's steel dumping. Another senior Trump advisor, Peter Navarro, is an academic and outspoken critic of China. Navarro wrote the book "Death by China," and his work is a roadmap for the kinds of policies Trump will pursue. While Obama advisors such as John Kerry and Jack Lew were mostly talk and no action, the Trump team is ready to rumble. The problem is that China may not have much to offer, despite the pressure. Trump may not realize that China's currency is going down not because of government manipulation, but because of market forces in the form of capital flight. In fact, China's main currency manipulation today is an effort to strengthen, not weaken, the yuan to keep the U.S. appeased — although those efforts appear to be failing. China may not be in a position to keep buying Treasury debt either. China's reserves are dropping and it has become a net seller of Treasuries. It looks like the days of cheap foreign finance are over for the U.S. regardless of Trump's policies. This does not mean U.S. interest rates will spike, despite recent increases. The U.S. will simply force U.S. banks to buy the Treasury debt that China cannot. To the extent that China still runs trade surpluses, it is allocating its reserves into gold, euros, and special drawing rights (SDR or world money) and away from dollars. The bottom line is that China cannot end its subsidies to exports because it needs the jobs that its export industries create. The Chinese Communist Party is an illegitimate regime that will remain in power only so long as it provides jobs and a rising living standard for the Chinese people. Once the Chinese job machine stalls out, popular unrest could emerge on a scale much greater than the 1989 Tiananmen Square protests. This is an existential threat to Communist power and will not be allowed to happen for that reason. Therefore, the subsidies will continue. China cannot prop up the yuan indefinitely because it will run out of reserves and go broke in the process. In effect, Trump is trying to force China to adopt policies on trade and currency that it cannot pursue for political and financial reasons. And Trump's leverage (the "art of the deal") including North Korea, Taiwan, and the South China Sea involves matters of existential importance to the Chinese where there is no room for compromise. The result is likely to be confrontation rather than cooperation. This outcome involves costs for both sides. U.S. consumers may pay more for Chinese goods. China's factories may slow down as a result of higher costs. Some U.S. manufacturing jobs may be gained, but job losses in other sectors (entertainment, technology, pharmaceuticals, aircraft) may offset those gains.

We've seen this movie before. It happened in the 1930s. It was called The Great Depression. Best regards, Jim Rickards The post Indicators of a Chinese Collapse appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2017 09:48 AM PST This post The Year of the Ruble appeared first on Daily Reckoning. To see my first take on the Russian ruble and the economy for 2017 click here. Last year, the Russian ruble appreciated about 21 percent against the dollar. The currency had fallen 55% against the dollar over 2014 and 2015 during the height of the Ukraine situation and sanctions. But the ruble outperformed all other emerging market currencies for 2016. Even with that 2016 rally, Radio Free Europe, the U.S. government-funded media outlet, believes the ruble is the currency to watch in 2017. Part of this is thanks to Elvira Nabiullina, head of the Russian central bank. While other key central bankers followed the Fed, Nabiullina, was able to distinguish herself in the international community. She was named central bank governor of the year by Euromoney magazine in 2015. Even IMF chief, Christine Lagarde praised Nabiullina this past December for doing "a fantastic job" with Russia's financial problems, particularly with inflation. Nabiullina was named the best central banker in Europe for 2016 by the prestigious international financial publication, The Banker. The magazine noted that she had "helped steer the country through the difficulties," and Russia is "set to return to economic growth in 2017." Under Nabiullina's tutelage, consumer price inflation, which began 2016 at a rate of 12.9%, dropped to below 6% by the end of 2016. In addition, The Economist also noted that "corporate profits rose by 50% last year as the ruble value of foreign earnings jumped." As a result, companies have plenty of cash to invest. If they are anything like U.S. companies, they will buy back their own shares with cheap money and debt to bolster their stock market with the extra cash. The Russian Ruble and The MICEX Stock Market IndexRussia's stock market index rallied 24% in 2016, surpassing the performance of most developed nations. The RTS index (a capitalization-weighted index of 50 major Russian stocks denominated in the U.S. dollars) gained 50.4 percent in 2016—rising 18.4 percent in the time between the U.S. election and the end of 2016. There's every reason to assume these trends will continue. On Jan. 9, even ace investor Jim Rogers expressed optimism on Russia. He suggested that with U.S. stock markets at all-time highs, it's time to consider more undervalued markets. He believes relations between the U.S. and Russia will improve under Trump, and that there's a chance the sanctions on Russia could be lifted or eased. Russia boasts a winning combination of relatively high interest rates (at 10%) that would attract bond investors, a positive geo-political outlook, a growing sphere of influence in its region, and a sweet-spot between the U.S., Europe and China. As I noted in my 2017 outlook, Russia supplies nearly one-third of the EU's natural gas, but it has also begun clean energy initiatives through the BRICS development bank and other platforms, a strategic diversification. All this translates into positive capital inflows into Russia's businesses, economy and stock market. That's why the ruble should outperform the euro and the pound sterling, and the MICEX index of Russian stocks will rise. As Trump assumes the White House and strengthens U.S. ties to Russia, many investors should be presented with a good opportunity to take advantage of Russia's gain. Russian companies are undervalued now. Western investors are returning to the Russian market, pursuing cheap stocks in a world of expensive stocks. Even if the U.S. dollar strengthens on potential rate hikes or an expanding of the US economy, the interest rate differential relative to Russia is wide enough to push investment capital into Russia relative to US markets and firms. Regards, Nomi Prins, @nomiprins The post The Year of the Ruble appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

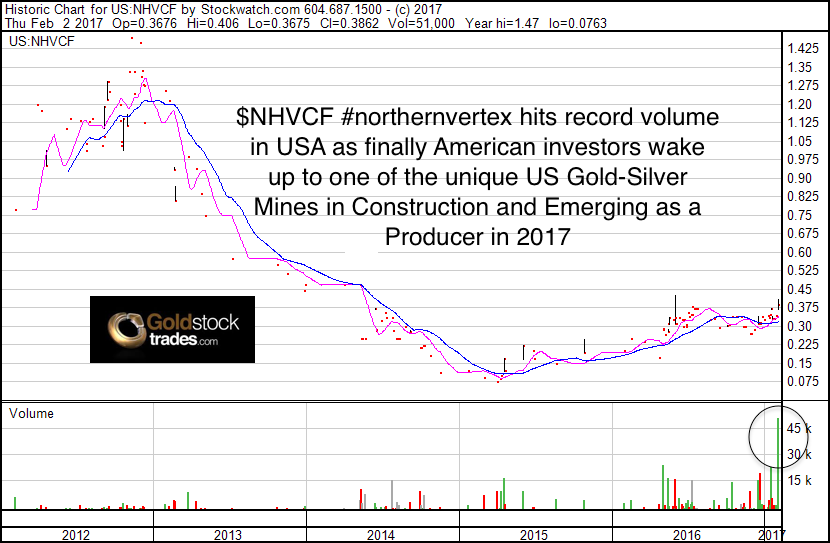

| Four Exciting Small Cap Canadian Stocks Breaking Out of Cup and Handle Patterns Posted: 06 Feb 2017 08:32 AM PST It’s exciting times for our subscribers as some of our top featured companies are breaking out higher leading the indices both on the US and Canadian side. The GDXJ is breaking above the 200 DMA and the TSX Venture index which tracks small cap junior miners may be on the verge of a big breakout. Some of our high quality gold juniors are beginning to move parabolic. So I am quite content that we were patient and held onto our positions especially in precious metals and energy that are now breaking out of classic technical patterns that could lead to outsized parabolic moves. 1)First off one of our new holdings and sponsors which I featured last week has broken out higher on huge volume. It is an exciting emerging gold producer right here in the US who is constructing a new gold mine which I believe has tons of upside potential. They are drilling away. If they make a high grade hit this season I believe they will be a takeout target as there are very few gold mines that can produce below $700 per ounce of gold.

3)For months now I featured a small Canadian company with big time scientists and entrepreneurs working on nanostructured materials for batteries which could drive down costs for lithium-ion battery makers. This is a huge $2 billion plus market that ranges from consumer electronics, electric vehicles and power storage. The company is filing new patents and advancing the pilot plant. Once it is completed it may gain further recognition especially from Asian battery makers. The stock is currently breaking out of a cup and handle.

http://goldstocktrades.com/blog/ Section 17(b) provides that: _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

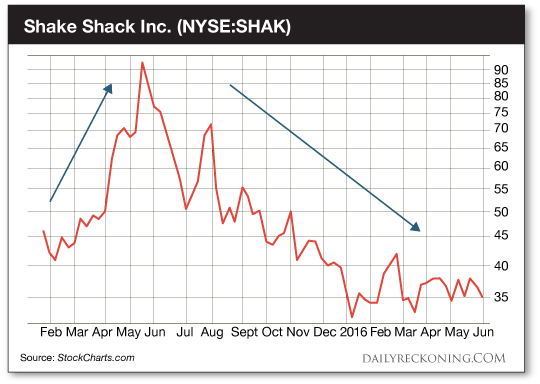

| This Gutsy Call Could Cost You a Fortune… Posted: 06 Feb 2017 07:48 AM PST This post This Gutsy Call Could Cost You a Fortune… appeared first on Daily Reckoning. The Super Bowl is all about gutsy plays. Last-minute drives and incredible comebacks like we saw during last night's overtime thriller show why football is still America's favorite sport. Great athletes like Tom Brady often talk about being in the zone and letting their instincts and training take over during these critical moments. And because the business world loves sports analogies, we often try to apply these ideas to life and the stock market. But when it comes to trading, this stuff just doesn't work. The market is a manipulative machine. It will twist your mind—and your wallet if you aren't careful. In an unpredictable market like we're experiencing right now, a gutsy call can cost you a fortune. Listening to your heart (instead of your mind) is a great way to lose money and confidence in your trading abilities. That's why it's so important to have trading rules. Your rules will keep you from following your gut down the wrong path. They'll maintain your sanity. And get this, knucklehead: If you're doing it right, your set of rules will lead you to consistent profits. Of course, you don't have to take my word for it. Ask any successful trader and they'll tell you they've concocted a set of rules that have helped them along the way. Take Walt Deemer. He's one of my favorite "old school" technicians. When it comes to how Deemer operated during his storied career with Merrill Lynch and Putnam, he always brings it back to the rules laid out by his mentor, Bob Farrell. In his book Deemer on Technical Analysis (which is an excellent read, by the way), he lays out Farrell's 10 rules—plus an extra one from the man himself. Even if you never look at another stock chart again in your life, these rules will "make you look at the market intellectually, not mechanically," Deemer writes. Most importantly, they are as true now as they were fifty years ago. Here are Paul Farrell's 11 market rules to remember. I've made some notes for you in italics and added some charts for your viewing pleasure: 1. Markets tend to return to the mean over time. 2. Excesses in one direction will lead to an opposite excess in the other direction. Hmmm, where have we seen phenomenon recently? Perhaps this Shake Shack chart will jog your memory:

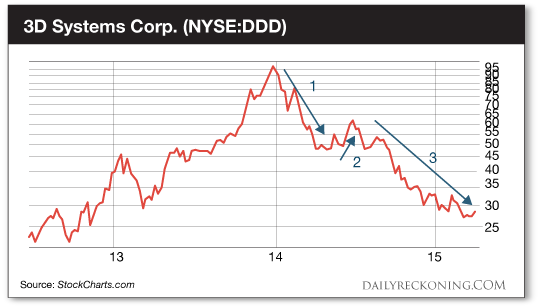

3. There are no new eras– excesses are never permanent. Does the dot-com bust ring a bell? 4. Exponentially rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways. Biotech, anyone? Sure, this epic rally might still have legs. But when it's over, don't expect these stocks to tread water. Parabolic moves don't plateau. 5. The public buys the most at a top and the least at a bottom. 6. Fear and greed are stronger than long-term resolve. 7. [Bull]… markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names. Breadth matters. It's not a perfect timing tool– but you shouldn't go all-in on the long side when most stocks have already broken trend. 8. Bear markets have three stages– sharp down, reflexive rebound, [and] a drawn-out fundamental downtrend. DDD's 2014-2015 meltdown is a great example of a three-stage bear:

9. When the experts and forecasts agree– something else is going to happen. Don't be a contrarian just to go against the grain. Look for sentiment extremes to gauge when it's time to bet against the crowd. 10. Bull markets are more fun than bear markets. 11. Though business conditions may change, corporations and securities may change, and financial institutions and regulations may change, human nature remains essentially the same. We aren't going to wake up tomorrow to a rational market. Emotions reign supreme– whether stocks are moving up, down, or sideways. Add these gems to your trading rulebook today… if you have the guts. Sincerely, Greg Guenthner The post This Gutsy Call Could Cost You a Fortune… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2017 06:45 AM PST This is the 3rd piece on gold that highlights how unloved gold remains today. Considering the 2016 rally in gold and the turbulent times we now find ourselves in, to be honest I'm rather surprised there are not significantly more gold traders all over this market. Part 1 and Part 2 cover the initial stages of this rally from the December lows. Below is an excerpt from the Financial Tap Member weekly weekend report. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SWOT Analysis: Gold Moves As Trump Rattles Markets Posted: 06 Feb 2017 06:12 AM PST The best performing precious metal for the week was gold, followed by silver, with a 2.03 percent gain. Nearly $1.6 billion went into the 10 precious metal-backed ETFs that have attracted the most money in January, reports Bloomberg. Frankfurt-listed Xetra-Gold drew in more than any other commodity ETF. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Trend Forecast, Where are the Gold Traders? Posted: 06 Feb 2017 06:04 AM PST This is the 3rd piece on gold that highlights how unloved gold remains today. Considering the 2016 rally in gold and the turbulent times we now find ourselves in, to be honest I'm rather surprised there are not significantly more gold traders all over this market. Part 1 and Part 2 cover the initial stages of this rally from the December lows. Below is an excerpt from the Financial Tap Member weekly weekend report. I am rather surprised to read across the blogosphere how a majority of Gold Traders appear to discount and undermine the current gold market. I can appreciate that the longer term cyclical outlook remains unresolved, but in the short-term at least, I believe the gold sector looks to be in great shape. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bullion Banks To “Open Vaults” In Transparency Push? Posted: 06 Feb 2017 05:02 AM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar and Gold Markets Update Posted: 06 Feb 2017 03:42 AM PST As longer Cycles typically dominate shorter ones, this update will provide both longer and shorter views on the USD and Gold. Why the two together? Obviously due to the negative correlation. No correlation works all the time, however, and I fully expect to see periods where the USD and Gold rise and perhaps fall together. That said, the correlation has been fairly strong over the past year so I find it best to sometimes cover these assets together. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 06 Feb 2017 01:37 AM PST Fed leaves rates unchanged, Yellen says optimistic things. US stocks open down after Friday’s big gains, gold and silver up again on weakening dollar. President Trump bans immigration from several countries, fires acting attorney general for refusing to enforce ban, names supreme court nominee. Debate over Putin intensifies. Best Of The Web A murderous […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Feb 2017 04:01 PM PST Is your IRA safe? No. Is China taking over the gold market? Maybe. Is the financial system about to break? James Grant and John Williams think so. The post Top Ten Videos — February 6 appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jack Chan: This Past Week in Gold Posted: 04 Feb 2017 12:00 AM PST Technical analyst Jack Chan charts the latest moves in the gold and silver markets. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment