Gold World News Flash |

- US Mint Releases New Fort Knox “Audit Documentation”. The First Critical Observations.

- Resume Inflation at the NSC: Lt. General McMaster’s Silver Star Was Essentially Earned for Target Practice

- WILL THE FED TELL EVERY AMERICAN TO BUY GOLD BEFORE IT DESTROYS THE DOLLAR?

- Karen Hudes Shocking Revelation : Fort Knox Gold is Buried in The Philippines !!

- Curious Gold-Silver Ratio That Did Not Fall, Report 26 Feb, 2017

- GoldSeek.com Radio: Bob Hoye and Andy Schectman, and your host Chris Waltzek

- New Declassified CIA Memo Presents Blueprint for Syrian Regime Collapse

- Gold Price Closed at $1256.90 Up $6.70 or 0.5%

- US Mint Releases New Fort Knox “Audit Documentation”. The First Critical Observations.

- U.S. Mint flunks Koos Jansen's gold audit document request, refunds his fee

- Cashin tells KWN he's worried about central bank interference in the markets

- Warning! The Banks Will Collapse Very Soon – Will That Cause A Complete And Total Collaps

- Central banks may have been evil with gold but not stupid

- Do Gold Miners Need to Lead the Metals?

- GATA Chairman Bill Murphy's presentation to the Dollar Vigilante conference in Acapulco

- Central banks may have been evil with gold but not stupid

- "In The Name Of Fairness", A Very Touchy Subject…

- Underperformance in Gold Stocks Argues for Interim Peak

- Breaking News And Best Of The Web

- Continued Metals Strength

- Jack Chan's Weekly Gold and Silver Update

- Chevrier Gold Project: A New District-Scale Start With Lots Of Upside For Genesis Metals

| US Mint Releases New Fort Knox “Audit Documentation”. The First Critical Observations. Posted: 27 Feb 2017 01:35 AM PST Bullion Star | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Feb 2017 01:32 AM PST Counterpunch | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WILL THE FED TELL EVERY AMERICAN TO BUY GOLD BEFORE IT DESTROYS THE DOLLAR? Posted: 27 Feb 2017 01:00 AM PST Matterhorn AM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Karen Hudes Shocking Revelation : Fort Knox Gold is Buried in The Philippines !! Posted: 26 Feb 2017 11:45 PM PST The criminals, the same ones that brought us 911 and own the non federal reserve stole it along with the 2.3 trillion dollars that they said was unaccounted for the day before 911 as well as trillion more. The sleepy heads will figure it out eventually...I hope The Chinese government... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

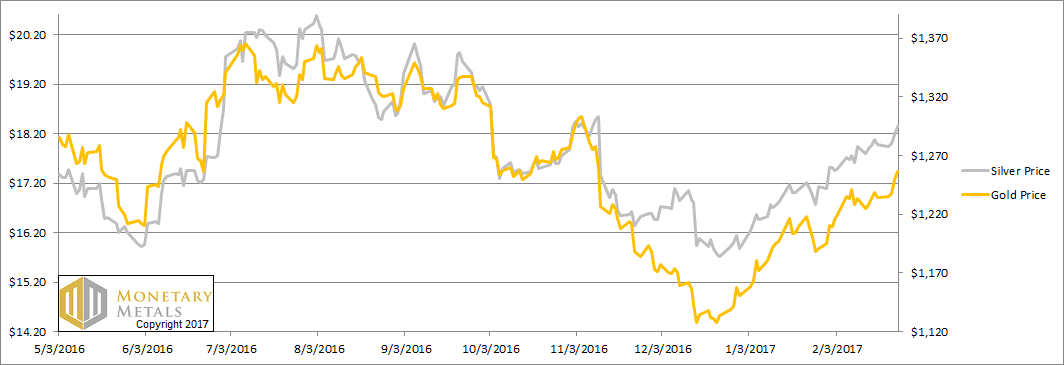

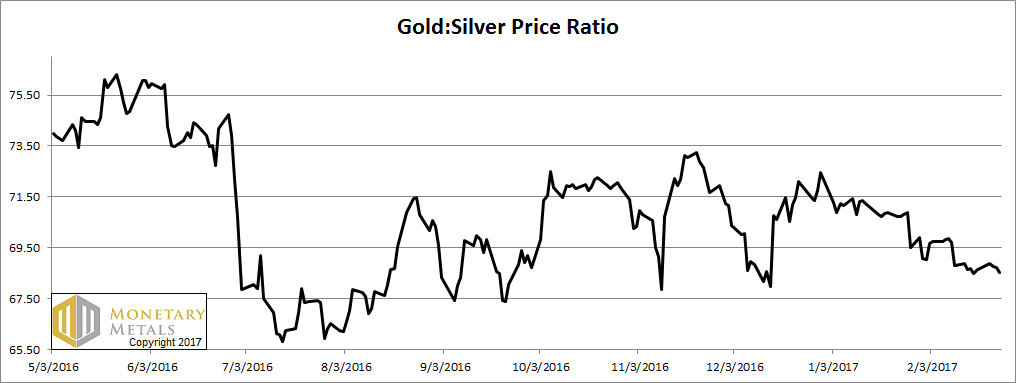

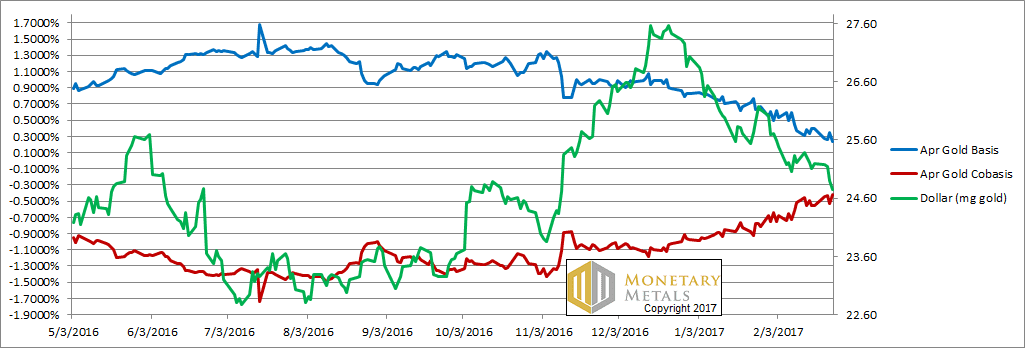

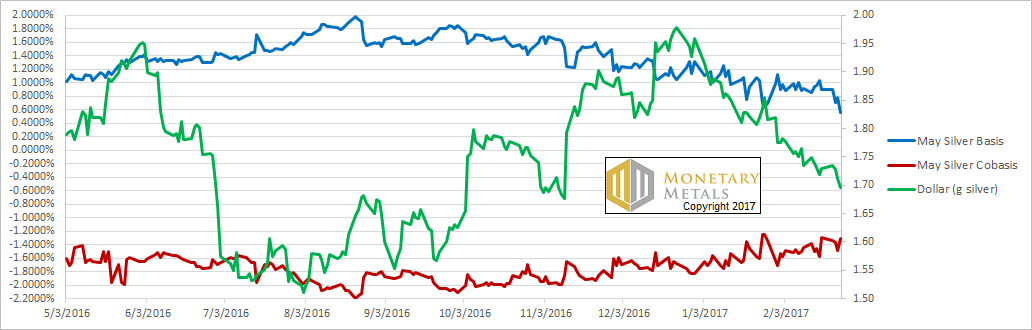

| Curious Gold-Silver Ratio That Did Not Fall, Report 26 Feb, 2017 Posted: 26 Feb 2017 10:01 PM PST This holiday-shortened week (Monday was President's Day in the US), the price of the dollar fell. In gold, it fell almost half a milligram to 24.75mg, and prices in silver it dropped 30mg, to 1.7 grams of the white monetary metal. Flipped upside down, gold went up 23 notes from the Federal Reserve, and silver appears to go up by 41 cents. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. The Prices of Gold and Silver Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways again this week, which would normally be odd for a time when the prices of the metals are rising. The Ratio of the Gold Price to the Silver Price For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Price For a very long time, we would post graphs that looked almost the same. Oh, the specifics of month, price, and basis would be different. But they had a certain sameness. The price of the dollar (i.e. inverse of the price of gold, in dollar terms) would move along with the cobasis (i.e. scarcity of gold). So as the dollar would rise (i.e. the price of gold would fall), the scarcity would rise. And vice versa. This means changes in price were due to changes in behavior by speculators. And now we have a clear picture of … the opposite. The dollar has been falling since mid-December. And for that same time, the cobasis (scarcity of gold) has been rising. Yes, gold has been getting scarcer as it becomes pricier. How could this be possible? Doesn't the law of supply and demand work for gold? You know, the standard "X" graph from Econ. 101? Gold has several unique properties. One is that it is not purchased for consumption, but for monetary reserves or jewelry (which in most of the world is monetary reserves). Contrast that to copper which is purchased by plumbing manufacturers to make pipe. It's a competitive market, and if the price of copper plumbing goes up too much then home builders will switch to plastic. Demand drops as price rises. Also, the marginal copper mine will increase production. Supply rises as price rises. It is self-correcting. Gold, not being bought to consume, does not have a limit to demand as price rises. If anything a rising price (i.e. a falling currency) signals to people that holding gold is a good thing. They were wise to get out of their falling paper currency, and should consider buying more gold. Also, virtually all of the gold ever mined in human history is still in human hands. All of this gold is potential supply, at the right price and under the right conditions. Even if gold mining worked like copper mining, and miners could just produce more, changes in mine production at the margin are not material to the overall gold supply. By official estimates, the total inventory of gold would take over 70 years to be produced at current mine production rates (and we believe this is a low estimate). Readers may object that this question is a bit unfair, as any commodity can experience rising tightness and that will accompany its rising price for a while until the market can correct itself. That is true, but what we are looking at in gold is not that at all. When the market corrects itself—which we think is very likely, we do not see Armageddon just yet—it will not be because gold miners have cranked up their outputs, nor because gold users have substituted another metal. There is no substitute for monetary reservation, particularly as paper currencies are in the terminal stages of failure. Our calculated fundamental price is now up to almost $1,400. Now let's look at silver. The Silver Basis and Cobasis and the Dollar Price The trend of falling dollar (i.e. rising price of silver) and rising cobasis (scarcity) is here in silver, too, but it's weaker. Silver does not quite have the same stocks to flows ratio as gold, but it has far and away a higher ratio than copper or any ordinary commodity. That is why silver is the other monetary metal. The fundamental price of silver is now up to about $18.70. While this is over the market price of the metal, it's not nearly so much above as gold. This is why we calculate a fundamental on the gold-silver ratio over 74. © 2017 Monetary Metals | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GoldSeek.com Radio: Bob Hoye and Andy Schectman, and your host Chris Waltzek Posted: 26 Feb 2017 09:00 PM PST Top money manager, John Ing recently presented to China his forecast for $2,200 an ounce. Our guest is bullish on gold, in the LT. Bob Hoye notes that during every previous post bubble contraction, the real price of gold has ascended, making the PMs a solid portfolio asset, today. Andy Schectman of Miles Franklin Institute ($6 billion in sales) outlines why every investor should diversify their PMs holdings via an offshore account. In 1933, President Roosevelt announced an executive order designed to confiscate gold that included at $10,000 fine. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Declassified CIA Memo Presents Blueprint for Syrian Regime Collapse Posted: 26 Feb 2017 08:25 PM PST Submitted by Brad Hoff via The Libertarian Institute, A newly declassified CIA document explored multiple scenarios of Syrian regime collapse at a time when Hafez al-Assad’s government was embroiled in a covert “dirty war” with Israel and the West, and in the midst of a diplomatic crisis which marked an unprecedented level of isolation for Syria. The 24-page formerly classified memo entitled Syria: Scenarios of Dramatic Political Change was produced in July 1986, and had high level distribution within the Reagan administration and to agency directors, including presidential advisers, the National Security Council, and the US ambassador to Syria. The memo appears in the CIA’s latest CREST release (CIA Records Search Tool) of over 900,000 recently declassified documents. A “severely restricted” reportThe memo’s cover letter, drafted by the CIA’s Director of Global Issues (the report itself was prepared by the division’s Foreign Subversion and Instability Center), introduces the purpose of presenting “a number of possible scenarios that could lead to the ouster of President Assad or other dramatic change in Syria.” It further curiously warns that, “Because the analysis out of context is susceptible to misunderstanding, external distribution has been severely restricted.” The report’s narrowed distribution list (sent to specific named national security heads, not entire agencies) indicates that it was considered at the highest levels of the Reagan administration. The coming sectarian war for SyriaThe intelligence report’s contents contain some striking passages which seem remarkably consistent with events as they unfolded decades later at the start of the Syrian war in 2011:

The “second Sunni challenge” is a reference to the Syrian government’s prior long running war against a Muslim Brotherhood insurgency which culminated in the 1982 Hama Massacre. While downplaying the nationalist and pluralistic composition of the ruling Ba’ath party, the report envisions a renewal and exploitation of sectarian fault lines pitting Syria’s Sunni population against its Alawite leadership:

Regime change and the Muslim BrotherhoodThe possibility of the Muslim Brotherhood spearheading another future armed insurgency leading to regime change is given extensive focus. While the document’s tone suggests this as a long term future scenario (especially considering the Brotherhood suffered overwhelming defeat and went completely underground in Syria by the mid-1980’s), it is considered one of the top three “most likely” drivers of regime change (the other scenarios include “Succession Power Struggle” and “Military Reverses Spark a Coup”). The potential for revival of the Muslim Brotherhood’s “militant faction” is introduced in the following:

The Brotherhood’s role is seen as escalating the potential for initially small Sunni protest movements to morph into violent sectarian civil war:

The CIA report describes the final phase of an evolving sectarian war which witnesses the influx of fighters and weapons from neighboring countries. Consistent with a 1983 secret report that called for a US covert operation to utilize then US-allied Iraq as a base of attack on Syria, the 1986 analysis says, “Iraq might supply them with sufficient weapons to launch a civil war”:

A Sunni regime serving Western economic interestsWhile the document is primarily a theoretical exploration projecting scenarios of Syrian regime weakening and collapse (its purpose is analysis and not necessarily policy), the authors admit of its “purposefully provocative” nature (see PREFACE) and closes with a list desired outcomes. One provocative outcome describes a pliant “Sunni regime” serving US economic interests:

Ironically, the Syrian government would accuse the United States and its allies of covert subversion within Syria after a string of domestic bombings created diplomatic tensions during the mid-1980’s. Dirty tricks and diplomacy in the 1980’sAccording to Patrick Seale’s landmark book, Asad of Syria: The Struggle for the Middle East, 1986 was a year that marked Syria’s greatest isolation among world powers as multiple diplomatic crises and terror events put Syria more and more out in the cold. The year included “the Hindawi affair”—a Syrian intelligence sponsored attempt to hijack and bomb an El Al flight to Tel Aviv—and may or may not have involved Nezar Hindawi working as a double agent on behalf of Israel. The foiled plot brought down international condemnation on Syria and lives on as one of the more famous and bizarre terror conspiracies in history. Not only were Syria and Israel once again generally on the brink of war in 1986, but a string of “dirty tricks” tactics were being utilized by Syria and its regional enemies to shape diplomatic outcomes primarily in Lebanon and Jordan. In March and April of 1986 (months prior to the distribution of the CIA memo), a string of still largely unexplained car bombs rocked Damascus and at least 5 towns throughout Syria, leaving over 200 civilians dead in the most significant wave of attacks since the earlier ’79-’82 war with the Muslim Brotherhood (also see BBC News recount the attacks). Patrick Seale’s book speculates of the bombings that, “It may not have been unconnected that in late 1985 the NSC’s Colonel Oliver North and Amiram Nir, Peres’s counter-terrorism expert, set up a dirty tricks outfit to strike back at the alleged sponsors of Middle East terrorism.” Consistency with future WikiLeaks filesThe casual reader of Syria: Scenarios of Dramatic Political Change will immediately recognize a strategic thinking on Syria that looks much the same as what is revealed in national security memos produced decades later in the run up to the current war in Syria. When US cables or intelligence papers talk regime change in Syria they usually strategize in terms of exploiting sectarian fault lines. In a sense, this is the US national security bureaucracy’s fall-back approach to Syria. One well-known example is contained in a December 2006 State Dept. cable sent from the US embassy in Syria (subsequently released by WikiLeaks). The cable’s stated purpose is to explore Syrian regime vulnerabilities and weaknesses to exploit (in similar fashion to the 1986 CIA memo):

Another section of the 2006 cable explains precisely the same scenario laid out in the 1986 memo in describing the increased “possibility of a self-defeating over-reaction” on the part of the regime.:

And ironically, Rif’at Asad and Khaddam are both mentioned extensively in the 1986 memo as key players during a speculative future “Succession Power Struggle.” [p.15] An Islamic State in Damascus?While the 1986 CIA report makes a case in its concluding paragraph for “a Sunni regime controlled by business-oriented moderates” in Syria, the authors acknowledge that the collapse of the Ba’ath state could actually usher in the worst of all possible outcomes for Washington and the region: “religious zealots” might seek to establish “an Islamic Republic”. The words take on a new and special importance now, after the rise of ISIS:

What continues to unfold in Syria has apparently surpassed even the worst case scenarios of intelligence planners in the 1980’s. Tinkering with regime change has proven itself to be the most dangerous of all games. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1256.90 Up $6.70 or 0.5% Posted: 26 Feb 2017 06:34 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Mint Releases New Fort Knox “Audit Documentation”. The First Critical Observations. Posted: 26 Feb 2017 04:24 PM PST In response to a FOIA request the US Mint has finally released reports drafted from 1993 through 2008 related to the physical audits of the US official gold reserves. However, the documents released are incomplete and reveal the audit procedures have not been executed proficiently. Moreover, because the Mint could not honor its promises in full the costs ($3,144.96 US dollars) of the FOIA request have been refunded. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Mint flunks Koos Jansen's gold audit document request, refunds his fee Posted: 26 Feb 2017 03:53 PM PST 6:54p ET Sunday, February 26, 2017 Dear Friend of GATA and Gold: Gold researcher Koos Jansen reports tonight that the U.S. Mint has provided him with some documents in response to his freedom-of-information request for documents related to audits of the U.S. gold reserve but the documents provided are incomplete, redacted, and hundreds of pages short of the number of pages he was told were involved for which he was charged, and so the Mint has refunded his payment. As the money for his payment was raised by crowdfunding from his readers, Jansen is refunding their contributions. This is more proof that something dishonest has been going on with the U.S. gold reserve. Jansen's report is headlined "U.S. Mint Releases New Fort Knox 'Audit Documentation' -- the First Critical Observations" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/us-mint-releases-new-fort-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cashin tells KWN he's worried about central bank interference in the markets Posted: 26 Feb 2017 03:14 PM PST 6:15p ET Sunday, February 26, 2017 Dear Friend of GATA and Gold: Art Cashin, director of floor operations for UBS at the New York Stock Exchange and a commentator for CNBC, tells King World News today that he is concerned about interference in the markets by central banks. Cashin's interview is excerpted at KWN here: http://kingworldnews.com/alert-legend-art-cashin-just-issued-a-dire-warn... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT (Golden Predator will be exhibiting at Booth 2650 Golden Predator Begins Drill Program at 3 Aces Project Company Announcement Thursday, February 23, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to announce it has commenced a 20,000-meter drill program at its fully owned 3 Aces project in southeastern Yukon. The drilling program will initially focus on targets in the Spades Zone, where 2016 results included a new vein discovery at depth plus 7.5 meters of 33 grams-per-tonne gold at the Ace of Spades. Management is also pleased to announce that Golden Predator has been named a TSX Venture Top 50 company, placing fifth of 957 mining companies. ... ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_02_23.pdf Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Warning! The Banks Will Collapse Very Soon – Will That Cause A Complete And Total Collaps Posted: 26 Feb 2017 03:00 PM PST by AMY S.WARNING!!! The banks will collapse very soonIf the United States experiences a horrifying economic collapse (and it most definitely will), will that cause a complete and total collapse of society? Will we experience crime, violence, riots and social unrest on a scale that is... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks may have been evil with gold but not stupid Posted: 26 Feb 2017 12:42 PM PST GATA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Do Gold Miners Need to Lead the Metals? Posted: 26 Feb 2017 11:01 AM PST It’s a common misconception that miners always lead the metals sector. As you can see in this chart the miners often produce false signals. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GATA Chairman Bill Murphy's presentation to the Dollar Vigilante conference in Acapulco Posted: 26 Feb 2017 08:01 AM PST 11:09a ET Sunday, February 26, 2017 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy's presentation Friday at the Dollar Vigilante Internationalization and Investment Summit in Acapulco, Mexico, was titled "GATA and the Gold and Silver Markets" and the notes for it are appended. CHRIS POWELL, Secretary/Treasurer * * * GATA and the Gold and Silver Markets Hello, everyone. It is great to be here. I want to thank Jeff Berwick for the invitation to make a presentation on behalf of GATA and for the opportunity to see a number of friends again, ones made over so many years. (Bitcoin at $1,200.) GATA was formed in January of 1999 by Chris Powell and myself to thwart the manipulation and suppression of the gold price by the leading bullion banks. It became apparent this was the case after the very visible hedge fund, Long Term Capital Management, blew up in September of 1998. They were short some 400 tonnes of gold on their books, which should have been covered, liquidated like all their other positions. To prevent the price of gold from soaring in that event, the likes of a JP Morgan and Goldman Sachs banded together to keep the price below $300 an ounce. No one knows this better than their attorney at the time, Jim Rickards, who has gone on to gain huge visibility in the gold world. And no one knows better than Jim Rickards how right GATA has been all these years, even though he took public exception in the WSJ back then to what we had to say -- but who some 12 years later spoke at one of our conferences in London. As time went by, GATA learned the operation was much bigger than we initially thought and included the Fed, US Treasury, Exchange Stabilization Fund, BIS, and other central banks. ... Dispatch continues below ... ADVERTISEMENT Golden Predator Begins Drill Program at 3 Aces Project Company Announcement Thursday, February 23, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to announce it has commenced a 20,000-meter drill program at its fully owned 3 Aces project in southeastern Yukon. The drilling program will initially focus on targets in the Spades Zone, where 2016 results included a new vein discovery at depth plus 7.5 meters of 33 grams-per-tonne gold at the Ace of Spades. Management is also pleased to announce that Golden Predator has been named a TSX Venture Top 50 company, placing fifth of 957 mining companies. ... ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_02_23.pdf Our term for the lot of them is the Gold Cartel. In essence, we learned we would be taking on the most substantial money and power in the world. Right after inception, only a few in the gold world would give us the time of day. The months rolled by and we got to May 6, 1999, when I wrote the following in my daily, LeMetropoleCafe commentary: "Deutsche Bank has been especially aggressive and noticeable in their selling the past few days. We got word late this afternoon that their bullion desk is calling their clients saying that the gold price is stopping at $290." The very next day the Bank of England announced, in advance, they were going to sell some 400 tonnes of gold, or more than half of their gold. It was unprecedented in that no entity which wants to get as high a price as they can would announce such a sale in advance. This stunning event was the beginning of some very visible people in the gold world, such as James Turk, coming into the GATA camp. From the beginning we decided to be an activist organization -- not just to talk about the problem, but to do something about it. So, this presentation is first about this effort and what it has led to recently. But then more importantly, why what GATA has learned is going to lead to an explosion in the gold/silver prices, and probably in the not too distant future. -- Ironically enough, just a few weeks after our inception, I was interviewed by Ron Insana of CNBC. Once they heard what GATA had to say, that was it. Have not been invited back since. -- We have gone to Washington numerous times to see what we could do. -- Met with James Saxton, chairman of Joint Economic Committee. -- Congressman Ron Paul too. -- And James Hastert, speaker of the House. Who hastily set up a meeting that afternoon with Spencer Bachus, chairman of the Subcommittee on Domestic and International Monetary Policy. Delivered this "Gold Derivatives Bank Crisis" packet to members of Congress during the trip to meet with Hastert. There was a well attended gathering in D.C. which was televised by C-Span. Those trips to Washington were made in our early years, and gave us an inkling of what we would be up against. -- Many years later another trip to Washington would prove further how formidable our opposition was. I had met with CFTC Commissioner Bart Chilton, who was willing to give us the time of day. GATA was then invited to speak at a CFTC hearing in March 2010, which included a number of our issues. Three highlights of the all day event were: -- Being able to introduce London's Andrew Maguire's documentation how JP Morgan was rigging the precious metals. -- GATA's Board member Adrian Douglas coaxing antagonist Jeff Christian to disclose that the LBMA trades 100 times the gold it has to back it up. -- And the hearing was televised on the internet with ONLY my five minute testimony blacked out, which was right out of a Hollywood B movie script. Returning to GATA's early period, we mobilized numerous GATA supporters to write to members of Congress to get truthful answers about what was really going on with America's gold, etc. Many, many letters, such as this one from Denver's Hank Fellerman were sent to House and Senate members. Yeoman efforts were made with various members of the financial market press to bring attention to the manipulation of the gold and silver markets. No one in the world has done more in this regard than my colleague Chris Powell. -- Then there was mega effort made to get the word out there by going to the press via some ads. Here are two in particular. Roll Call. And this WSJ ad in 2008, which cost a small fortune -- $264,000. Love to have that back, if we only knew then that nothing about our subject would be able influence the bought-off financial market press and affect the big money and power in the America. Actually, that effort has led to some disturbing revelations… -- We don't have a free press in America. Veteran Bloomberg News gold reporter Claudia Carpenter told John Embry, Chris and I in London she is not allowed to mention GATA, and she has not all these years. -- We don't have free markets either. In addition to The Gold Cartel we learned there is a Plunge Protection Team constantly operating in our stock market, and so on. -- No free press, no free markets. So much for fighting the Communists all those years for being the same! -- In that regard my colleague Chris Powell has long said the U.S. would rather release our nuclear secrets than our gold secrets. And the press knows this, so they just won't go there. They are too afraid of the repercussions for doing so -- which by itself reveals how correct GATA is. But, after all these years, there is the potential for a blockbuster change and one reason has to do with this GATA ad. Based on what we have learned, GATA believes a good portion of the U.S' 8,135 tonnes of official gold reserves are not there -- ergo the ad. The U.S. cannot legally sell any of our gold without an Act of Congress. However, we can swap our gold with another country and sell that country's gold. We believe this has occurred as part of the gold price suppression scheme. No one knows about the status of our gold reserves because there has not been an official audit since 1955 or so. So why a potential change now? Only that it would fit into the manner in which President Trump is operating and in terms of his "cleaning up the mess he inherited." And how is that? -- If it is revealed a fair amount of our gold is gone as GATA believes is the case, the dollar would tank badly, which would be a huge boon for his pledge to change the jobs picture in America. -- He can blame this eventual scandal on his predecessors and fortify his reputation as a truth teller. -- And if all our gold is revealed to not be all there, Trump can blame a resulting explosion in the gold price on his predecessors and not due to economic policies he is putting in place. According to former Fed Chairman Paul Volcker, and others, gold is regarded as the barometer of U.S. financial market health. Up is bad, down is good. A gold market scandal would completely defuse that notion as it relates to that barometer in terms of current U.S. economic policies. Time will tell on that one. Hope springs eternal. -- Before starting my own internet site, I worked with Frank Veneroso who wrote The Gold Book, which gained all kinds of notoriety in the late 1990's. It is the backbone of GATA's discovery about the gold price manipulation scheme, as Frank exposed the fact that central banks were secretly leasing out their gold, which was suppressing the price and why we think a fair amount of the U.S. gold is gone. We also decided to speak at as many conferences as we could. Over the years CP and I have been to England, Germany, Hong Kong, Singapore, Fairbanks, Alaska, Palm Springs, Glendale, Arizona, Spokane, Washington, Vancouver, Toronto, South Africa, etc. to make presentations on behalf of GATA. The most notable and gratifying effort has been with the four major international conferences we have held. There were in: -- 2001 in Durban, South Africa. -- 2005 in Dawson City, way up in The Yukon. -- 2008 right out side of Washington, D.C. -- 2011 in London. All the conferences were well attended from people all over the world. The speakers were terrific, much fun, and in some cases electrifying. There is no way to do all of them justice in this presentation, but want to make a note for a few reasons on the first South African conference, which received some coverage by SABC and was attended by representatives of five African countries. Before the conference I toured South Africa to drum up interest, making presentations to such disparate people as the South African Central Bank, who just snickered … And to Zulu monarch, King Goodwill Zwelithini, great grandson of the legendary Zulu leader, Shaka. Around 100,000 Zulus work in South Africa's gold mines. What an engaging man. And then there is the distinct memory of meeting the renowned Brett Kebble, who helped put GATA on the map with a $50,000 contribution so we could hire our first legal firm to take on The Gold Cartel. Brett was assassinated four years later. Former attorney Reg Howe, Frank Veneroso, and James Turk came over to make presentations. Reg went on to sue the entire Gold Cartel in a Boston court. It was Reg against the world and nine lawyers representing the BIS, Goldman Sachs, Deutsche Bank, J.P. Morgan/Chase, Citigroup, the U.S. Treasury Department, the Federal Reserve Board, and the New York Federal Reserve Bank -- which is as good a representation of The Gold Cartel in one room as you will ever find. Which leads us to GATA suing the Fed, spearheaded by my colleague Chris. and we received a check for nearly $3,000 from the Fed for its illegally withholding a document. As mentioned, Frank was the one who discovered the gold leasing scheme by the central banks and he made a supply/demand presentation in which he stated the longest the central banks could hold out suppressing the price was 10 years. Fast forward 10 years: 2011, one month following GATA's London conference in August of that year, gold took out $1,900 on the upside and it appeared Frank's analysis could not have been more spot on. But then it all began to fall apart. In retrospect we did not realize how the use of financial market innovation (a.k.a. derivatives) could be mobilized to engineer a multi-year, devastating attack on the gold and silver prices. How much has it fallen apart? The third of those speakers who traveled all the way to Durban, South Africa on GATA's behalf, the highly regarded James Turk, recently stated that if gold had just been allowed to keep up with inflation in the U.S. (based on the CPI numbers since 1934 when gold was $35 an ounce), it should be $3225 today. That is how much The Gold Cartel has interfered with the gold price. So here we are, all these years later with The Gold Cartel still visibly making their mark on the precious metals via blatant attacks in the paper markets. Anyone who follows the price action on a daily basis knows what that is all about. GATA consultant James McShirley, a lumber company CEO who spoke at GATA's London conference, has documented for years just how precisely The Gold Cartel operates. This includes: -- Stopping the price of gold on 1% advances on a given day, sometimes to the tick. -- Selling around 10,000 contracts per 1% of a price advance. -- Selling at precisely the same time of day. -- Not allowing any follow-through after a good day, etc. At the same time, after all these years, it appears that GATA's time is at hand and just starting to be so. To begin with, many of our critics have been silenced by some recent lawsuit revelations which have revealed how correct we have been. The most stunning and disgusting of all is what was revealed in early December in the lawsuit against Deutsche Bank (there they are again) when a judge released 150,000 pages of documents and 75 audio tapes to settle charges in that suit. The revelations implicated other bullion banks "in a very serious way." What caught everyone's attention was the specific verbiage. Here's a sample of that evidence: Deutsche Bank: I got the Fix in 3 minutes HSBC: I'm bearish DB: Hahahaha HSBC: Massively. Really want to smash silver HSBC: Let's go smash it together Then, how about this exchange on May 11, 2011 when silver was still not far from $50 an ounce. DB: the fix dude u guys. WERE THE SILVER MARKET UBS: why you say that DB: haha on the fixes UBS: someone told u? DB: my 1DN UBS: Ah OK DB: you guys short some funky options? DB: well you told me too but I told no one, you just said you sold on Fix UBS: we smashed it good DB: F-ing hell UBS now you make me regret not joining UBS: By the way keep it to yourself. * * * There were 150,000 pages of that stuff. Silver has never had a chance since then, well until about now, which we will get into. Then just four weeks ago: A U.S. appeals court on Wednesday revived three private anti-trust lawsuits accusing JPMorgan Chase & Co. of rigging a market for silver futures contracts traded on COMEX. This is the same JP Morgan, the biggest silver short on the Comex, who has been burying the price ever since the top of the market near $50. It's going to take some time for these continuing lawsuits to get resolved. But, the cat is out of the bag on what GATA has been banging the table about all these years. And then it even gets a bit better. Wikileaks revealed a cable from the early 1970's which was sent to the State Department from the US Embassy in London and describes the embassy's extensive consultations with London bullion dealers about the imminent re-legalization of gold ownership in the United States and possible substantial gold purchases by oil-exporting Arab nations. The cable reads: "The major impact of private U.S. ownership, according to the dealers' expectations, will be the formation of a sizable gold futures market. Each of the dealers expressed the belief that the futures market would be of significant proportion and physical trading would be minuscule by comparison. Also expressed was the expectation that large-volume futures dealing would create a highly volatile market. In turn, the volatile price movements would diminish the initial demand for physical holding and most likely negate long-term hoarding by U.S. citizens." This is a big deal in my opinion because it is a direct linkage between the U.S. Government and bullion dealers to deflect interest in the gold market. Nothing has changed over the last 43 years. The Gold Cartel is still at it in the most sophisticated of ways. Now, that is all fine and dandy to be aware of. What is most important is how does this all affect the gold/silver markets and your investing in the sector? IMO the most important fact to appreciate is that gold and silver are presently at incredibly low artificial prices -- ones that have been forced down all these years due to the suppression scheme. Remember what James Turk said about what that $3,000+ gold price should be just if it had kept up with inflation. Will get into silver in a bit, but first some reflection on the most remarkable/stunning market development I have witnessed over the last 45 years and it has to do with the Trump election and aftermath. -- Before the election, one in which few thought Trump would prevail, each time there was any serious indication he had a serious chance to win, the Dow would plunge and the gold price would pop. There was little to NO commentary from the elite in the mainstream financial world touting how an unexpected Trump win would be so great for the stock market. None from no one! Well, we all know what occurred immediately after the election and since then. Going back to right pre-election thinking, what has occurred would have been called beyond confounding -- with the DOW soaring and soaring and gold getting bombed. My opinion is that the PPT and Gold Cartel were fully prepared for the election outcome and were laying in the weeds ready to make their moves. They knew what had occurred following the unexpected Brexit win and weren't about to allow that sort of market reaction again, especially with insider concerns over the real fragility of our markets and economy. Petrified of a Trump win, they needed to change the investment world's psychology about what a Trump win would mean. In essence, this meant a 180 degree change of perception about the win -- from a disaster to fantastic. Price action makes market commentary. And boy did it work. With our stock market indices making record high after record high, American investors are the happiest of campers. The question for us is where do gold/silver investments go from here as today is the first day of the rest of our lives? Will leave the stock market to smarter minds than mine, but I have some very strong opinions about gold and silver, and they are quite bullish as you would imagine. Besides being so undervalued historically, it is my opinion that The Gold Cartel bombed the gold price following the Trump win because they know that he is going to have to inflate the system to save the system. At the time they were still massively short gold and silver. The bombing terrorized speculative longs who exited their positions in droves. As a result the gold open interest on the Comex (which is the number of long and short futures positions) fell from its all-time high of 668,000 in the middle of the year to around 388,000 contracts in the middle of December. The silver open interest dropped from 225,000 to 158,000 contracts. The Gold Cartel forces made a fortune. The spec longs were routed. Since The Gold Cartel's blitzkrieg, the precious metals prices have been grinding their way higher and, IMO, are now on their way to all-time highs in combination with the U.S system being inflated to an enormous degree. Also, IMO, it will be silver leading the way in stunning fashion. There are two market veterans who have had my attention over the years about the silver price: David Morgan and Eric Sprott. Since you just heard what David has to say, I am going to reflect on Eric's big picture thought on silver, a thought which has been so wrong in recent years … but one which soon should be so right. My confidence that Eric's view we have $100 silver coming in the not too distant future is based on my history of having the good fortune in my early days to come across and follow three of the most exceptional trading minds in all of America, all who became my friends… -- I mentioned Frank Veneroso, whom as his broker, watched him sell the high tick of the bond market surge back in 1980 when rates reached 20%. In 1987 Frank, a consultant to The World Bank, realized the world was forget | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks may have been evil with gold but not stupid Posted: 26 Feb 2017 06:47 AM PST Western central banks may be the corrupt and even evil instruments of the financial class, and to preserve their power they may be prepared to do any amount of damage to the world, particularly by destroying markets, the engines of humanity's economic progress. But stupid? Not when central banks have gained and kept control of the world's money and thus control of the valuation of all capital, labor, goods, and services in the world. What's stupid is any society that doesn't rise up against them or at least demand disclosure of their surreptitious operations. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "In The Name Of Fairness", A Very Touchy Subject… Posted: 26 Feb 2017 06:45 AM PST If this theory is correct, at least we will have a true American as president and working on our behalf as opposed to a leader giving up the keys to the kingdom and throwing its people under the bus in the name of "fairness"? The "One World Government," or "New World Order Types" as they identify themselves, are strongly opposed to the individual liberty movement rearing it's head here there and everywhere. Seemingly, the "people" have thrown a monkey wrench into their plans for a One World Order; here and there and everywhere. Populism to them is like a rapidly spreading cancer, that must be stopped dead in it's tracks. My assumption is; THE WORLD IS ABOUT TO BE HUNG ON A CROSS OF GOLD. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Underperformance in Gold Stocks Argues for Interim Peak Posted: 26 Feb 2017 06:01 AM PST The early stages of Gold bull markets (this one included) are characterized by strong outperformance from the miners. They will lead the metals and turning points and register strong outperformance. We saw that in the early 2000s, late 2008 to early 2009 and we have seen it again over the past year. During the recent rebound, the miners rallied back to the "Trump" resistance while Gold is not yet close to doing so. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 26 Feb 2017 01:37 AM PST US stocks finish at record high. Gold and silver at multi-week highs. Bitcoin near all-time high. Trump national security adviser scandal evolving, EPA chief controversy ramping up after email release. Debate over Putin and fake news intensifies. Best Of The Web Risk on/risk off face-off – Credit Bubble Bulletin It's bubble time! – Peak […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 25 Feb 2017 11:03 PM PST We saw some volatility come into stocks this past week after the slow solid grin higher we've been enjoying since early November. I do not think this is a top, rather, a little shakeout, or shake and bake. Volatility comes on the upside and downside so we should see some more explosive moves to the upside after this little correction, if you can call it that. The metals continue to show strength even while some miners were flashing weakness mid-week, which had me a bit worried, but gold continues to act great. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jack Chan's Weekly Gold and Silver Update Posted: 25 Feb 2017 12:00 AM PST Technical analyst Jack Chan charts the latest moves in the gold and silver sectors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chevrier Gold Project: A New District-Scale Start With Lots Of Upside For Genesis Metals Posted: 24 Feb 2017 12:00 AM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment