Gold World News Flash |

- Underperformance in Gold Stocks Argues for Interim Peak

- Watch What Happens When Silver Price Hits $26...Â

- Gold Futures Buying Yet to Start

- Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Almost 2% on the Week

- David Morgan Exclusive: Watch What Happens When Silver Hits $26...

- COT Gold, Silver and US Dollar Index Report - February 24, 2017

- Maguire describes efforts by financial houses to suppress news of gold market rigging

- FTSE 100 skids to two-week low on poor earnings but gold nears four-month high as European political worries persist

- Gold-Futures Buying Yet to Start

- Next Leg Up is Beginning (Precious Metals)

- When the Pig Tops

- When the Stock Market Flying Pig Tops

- Gold Up 9%, Silver Up 14% YTD - Trump, Le Pen, Hard Brexit, Currency Wars Support

- Gold, Second Fed Hike and Interest Rates

- WILL THE FED TELL EVERY AMERICAN TO BUY GOLD BEFORE IT DESTROYS THE DOLLAR?

- Trump’s Stock Market Report Card Says “Buy Gold”

- Bitcoin Price Hits Record High!

- Trump calls Chinese 'grand champions' of currency manipulation

- Even China can't kill bitcoin

- Another Stock Market Bubble? Bring it On!

- Breaking News And Best Of The Web

- When Was America’s Peak Wealth?

- The Oscars – Worth Their Weight in Gold?

- US Tax Reform in Jeopardy and the State of Strong Dollar Policy

- The Problem with Gold-Backed Currencies

| Posted: 24 Feb 2017 08:00 PM PST IGNORE the Stock Market Crash 2017 Predictions. I'll show you how to spot 2 HUGE warning signals so you can prepare for any so-called Massive stock market correction.There are so many economists predicting a massive stock market crash in 2017. Are we going to see a financial meltdown?Jim ... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Underperformance in Gold Stocks Argues for Interim Peak Posted: 24 Feb 2017 06:18 PM PST The early stages of Gold bull markets (this one included) are characterized by strong outperformance from the miners. They will lead the metals and turning points and register strong outperformance. We saw that in the early 2000s, late 2008 to early 2009 and we have seen it again over the past year. During the recent rebound, the miners rallied back to the “Trump” resistance while Gold is not yet close to doing so. However, unfortunately for bulls, while Gold is now pushing higher above key levels, the gold stocks are lagging. This new and recent underperformance suggests the gold stocks have made an interim peak and will remain entrenched in a correction or consolidation. |

| Watch What Happens When Silver Price Hits $26... Posted: 24 Feb 2017 06:11 PM PST Mike Gleason: It is my privilege now to welcome in our good friend David Morgan of The Morgan Report. David, thanks so much for joining us. It's great to have you on, as always. How are you doing so far here in 2017? David Morgan: I'm doing pretty good, Mike. It's great to be on your show. Thank you very much. Mike Gleason: Well, as we begin here, David, we're off to another solid start to the year in the precious metals markets. Things look quite similar today to where they did a year ago. We also saw some early momentum in 2016. |

| Gold Futures Buying Yet to Start Posted: 24 Feb 2017 06:03 PM PST Gold has powered higher in a strong new upleg since the Fed’s mid-December rate hike. But the core group of traders who usually fuel early-upleg gains has been missing in action in recent months. The gold-futures speculators have not done any meaningful buying since gold bottomed. This anomaly is a very-bullish omen for gold. Since these traders’ buying has yet to start, they need to do lots of catch-up buying. Since the day after the Fed’s second rate hike in 10.5 years in mid-December, gold has surged 10.0% higher at best as of the middle of this week. Naturally these strong gains were really amplified by the gold miners’ stocks. The leading GDX VanEck Vectors Gold Miners ETF blasted 34.6% higher over that same short span, trouncing the broad-market S&P 500’s mere 1.4% gain! The gold sector is really shining. |

| Gold Seeker Weekly Wrap-Up: Gold and Silver Gain Almost 2% on the Week Posted: 24 Feb 2017 01:17 PM PST Gold gained $11.30 to $1260.10 at about 9AM EST before it nearly erased its entire advance in the next hour of trade, but it then chopped back higher into the close and ended with a gain of 0.63%. Silver rose to as high as $18.407 and ended with a gain of 0.94%. |

| David Morgan Exclusive: Watch What Happens When Silver Hits $26... Posted: 24 Feb 2017 01:00 PM PST First of all, there's always some contingent of people that are looking for a safe haven or a hedge, and of course that ebbs and flows with market conditions and perception. However, long term investors realize that the financial situation on a global basis, the debt structure, is unsolvable. So, I think there's that and there's always people that are adding to that. There's people that invest too much or expect the market ... the gold market or the silver market to move at a certain place, and it doesn't. So again, it ebbs and flows. |

| COT Gold, Silver and US Dollar Index Report - February 24, 2017 Posted: 24 Feb 2017 12:32 PM PST COT Gold, Silver and US Dollar Index Report - February 24, 2017 |

| Maguire describes efforts by financial houses to suppress news of gold market rigging Posted: 24 Feb 2017 12:01 PM PST 3p ET Friday, February 24, 2017 Dear Friend of GATA and Gold: London metals trader Andrew Maguire today tells King World News about the successful efforts of financial houses to prevent mainstream financial news organizations from reporting the rigging of the gold and silver markets. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/andrew-maguire-trip-rabbit-hole-jp-morgan-lawye... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 24 Feb 2017 09:54 AM PST This posting includes an audio/video/photo media file: Download Now |

| Gold-Futures Buying Yet to Start Posted: 24 Feb 2017 08:59 AM PST Gold has powered higher in a strong new upleg since the Fed's mid-December rate hike. But the core group of traders who usually fuel early-upleg gains has been missing in action in recent months. The gold-futures speculators have not done any meaningful buying since gold bottomed. This anomaly is a very-bullish omen for gold. Since these traders' buying has yet to start, they need to do lots of catch-up buying. |

| Next Leg Up is Beginning (Precious Metals) Posted: 24 Feb 2017 08:46 AM PST The next leg up in a new daily cycle for the precious metals has begun. Silver is breaking away above its 200 dma with little resistance now until it reaches $19. Gold is approaching its 200 dma and once it breaks through that resistance is expected to top somewhere above $1300+. |

| Posted: 24 Feb 2017 08:41 AM PST Early in the precious metals bear market I used to talk about gold being "in the mirror" to the risk on party that was instigated by balls out monetary policy. How could it not be? The party has been all about debt, leverage and momentum. Gold carries no debt, is leveraged to nothing and really just sits there, with everything else in motion around it. That is what insurance does too. It is paid for and tucked away with a level of comfort, but in hopes that you won't need it. |

| When the Stock Market Flying Pig Tops Posted: 24 Feb 2017 08:21 AM PST Flying Pig Filed under the category ‘smartest group of subscribers in the world’, I got an email from NFTRH subscriber Joe F. last week as I was mechanically managing the gold market in my somewhat downplayed, unexciting way… “You win 9 out of 10 [I don’t, actually], but I think the setup is there for gold to go immediately.” For a writer of many words over many years, I can sometimes grunt out the most basic of responses… |

| Gold Up 9%, Silver Up 14% YTD - Trump, Le Pen, Hard Brexit, Currency Wars Support Posted: 24 Feb 2017 07:51 AM PST Gold up 1.5% in euros and dollars this week Silver up 1.4% this week and now up 14.3% and is the best performing market YTD Gold up 9% year to date – fourth consecutive higher weekly close and breaks resistance at $1,250/oz Gold up 9.4% in euros year to date as Le Pen’s lead in polls widened Gold up another 6.4% in sterling pounds year to date as ‘Hard Brexit’ looms French and Dutch elections pose risks to Eurozone itself and the entire European Union project Euro contagion risk on renewed concerns this week about new debt crisis due to extremely high public debt and very fragile banks in Greece, Italy and Portugal |

| Gold, Second Fed Hike and Interest Rates Posted: 24 Feb 2017 07:45 AM PST The narration of reflation and ‘Great Fiscal Rotation' imply that the Fed will hike interest rates in a more aggressive way in a response to accelerated growth and higher inflation. We have already covered the Fed's likely policy in 2017 in the previous edition of the Market Overview, but let's discuss the impact of higher interest rates for the U.S. dollar and gold once again. It is widely believed that higher interest rates are bullish for greenback and bearish for the yellow metal. Is that really so? Some analysts do not agree with that opinion, pointing out that the U.S. dollar did not rally during Fed tightening cycles. Therefore, the hawkish Fed may be actually good for gold, they argue. |

| WILL THE FED TELL EVERY AMERICAN TO BUY GOLD BEFORE IT DESTROYS THE DOLLAR? Posted: 24 Feb 2017 07:43 AM PST WILL THE FED TELL EVERY AMERICAN TO BUY GOLD BEFORE IT DESTROYS THE DOLLAR? |

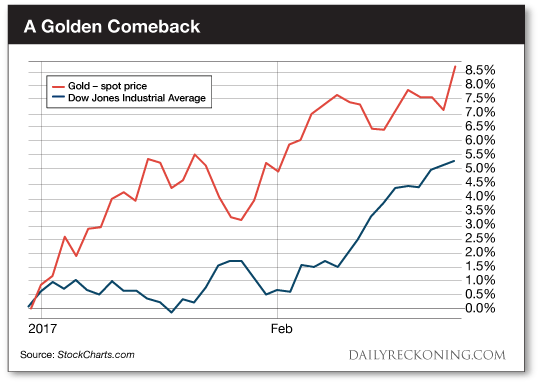

| Trump’s Stock Market Report Card Says “Buy Gold” Posted: 24 Feb 2017 06:33 AM PST This post Trump's Stock Market Report Card Says "Buy Gold" appeared first on Daily Reckoning. The Dow Jones Industrial Average marched to its 10th straight record close yesterday. That's the longest streak of record closes since 1987, MarketWatch notes. And if we aren't counting all-time highs, the last time we saw 10 straight sessions finish in the green was early 2013. It's safe to say investors are feeling giddy as the stock market blasts into uncharted territory. Heck, even the president is retweeting bullish market stories these days:

"In case there was any doubt, the Trump administration sees the stock market as a good barometer of how the economy is doing," Yahoo Finance notes. In fact, Treasury Secretary Steven Mnuchin told CNBC yesterday that the administration would look to the stock market as a "report card" for how the economy is performing. Judging by the huge post-election rally we've witnessed, it's no surprise the administration is patting itself on the back. But if early morning market action is any indication, the streak ends today. Unlike the Dow, the Nasdaq logged its second day of losses on Thursday. Momentum is beginning to wane. Falling stocks outnumbered the ones finishing higher yesterday. Many popular growth names are starting to get hit with profit taking… That's a recipe for a pullback. Markets can't shoot straight up forever. Now it looks like stocks are going to deliver this friendly reminder to investors via some downside action. Unless Trump signs an executive order banning downticks, some healthy mean reversion is on the way. I doubt a pullback will change the president's self-graded "A+" rating on the economy under his watch– no matter how sharp it is. But while every investor in the country remains focused on the record-setting major averages, we're turning our attention to gold. As the stock rally loses steam to finish the trading week, gold looks stronger than ever. The Midas metal nearly flunked out to finish off 2016. But the new year helped turn things around in the precious metals world. Thanks to its improved performance to begin the year, gold is well on its way to making the dean's list in 2017. Earlier this month, we alerted you to a curious development in gold so far this year: Gold's advance for the first six weeks of 2017 perfectly mirrored the action we witnessed during the first six weeks of 2016. Gold had posted gains of 6% through the first week of February for the second year in a row. In both cases, gold bounced off a late December bottom. And in both cases, the gold rally dipped in late January—only to rocket to new highs at the start of February. Now we're watching gold extend this rally as we approach the end of the trading month. The metal is streaking higher this morning, rising to new year-to-date highs and prices not seen since early November as world stock markets continue to retreat. As of Thursday's close, gold has easily outperformed even the celebrated Dow Industrials so far in 2017. Take a look for yourself:

As you watch the market sink into the red this morning, don't forget to check out gold's renewed momentum. If history is any indication, this rally has plenty of room to run. Sincerely, Greg Guenthner The post Trump's Stock Market Report Card Says "Buy Gold" appeared first on Daily Reckoning. |

| Bitcoin Price Hits Record High! Posted: 24 Feb 2017 06:25 AM PST Bitcoin has just smashed through its all-time high in US dollar terms. The US dollar was the last all-time fiat currency to crack as bitcoin has been hitting all-time highs in every other government/mafia mandated currency over the last few years. On CoinDesk bitcoin hit an all time high of $1206.60 which is the highest it’s been since Mt. Gox in 2013, which doesn’t count, because it was likely inflating bitcoin prices before it was shut down. |

| Trump calls Chinese 'grand champions' of currency manipulation Posted: 24 Feb 2017 05:24 AM PST By Steve Holland and David Lawder WASHINGTON -- President Donald Trump declared China the "grand champions" of currency manipulation on Thursday, just hours after his new Treasury secretary pledged a more methodical approach to analyzing Beijing's foreign exchange practices. In an exclusive interview with Reuters, Trump said he has not "held back" in his assessment that China manipulates its yuan currency, despite not acting on a campaign promise to declare it a currency manipulator on his first day in office. "Well they, I think they're grand champions at manipulation of currency. So I haven't held back," Trump said. "We'll see what happens." ... ... For the remainder of the report: http://www.reuters.com/article/us-usa-trump-china-currency-exclusive-idU... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 24 Feb 2017 05:15 AM PST By Elaine Ou Every time a government sets out to abolish something people like, the well-liked thing moves to where it can't be stopped. This has happened with prohibition, gambling, the war on drugs, and digital piracy. Now it's happening in China, where the government has been trying to crack down on bitcoin. As part of an effort to control capital outflows, the Chinese central bank required bitcoin exchanges to suspend withdrawals until they could update their compliance systems. Trading on the exchanges took a big hit, but the bitcoin activity resurfaced on less formal over-the-counter venues, like LocalBitcoins, a site where users post "advertisements" -- as on Craigslist -- to buy or sell bitcoin for local currency. Blocking LocalBitcoins would be no solution, in part because people can use virtual private networks to access it anyway. Also, plenty of trading happens on lesser-known sites and on micro-messaging services such as WeChat and QQ. The latter already have their own payment systems, allowing users to build chatbots to automate trading activity. For those who prefer a more familiar trading interface, decentralized exchange software such as Bitsquare can construct an order book based on outstanding offers accumulated from other participants. China is not alone. Peer-to-peer trading took off in Turkey after the country's only bitcoin exchange ceased to operate, and in Venezuela after the leading exchange had its bank account closed. Russia has some of the most active unofficial bitcoin markets in the world, thanks to the country's longstanding regulatory uncertainty. Although centralized exchanges provide benefits, such as bringing together large quantities of buyers and sellers and guaranteeing payment, they're not necessary for the currency's existence. Bitcoin users don't own physical coins or even digital ones. They own permanent transaction histories recorded on a global ledger, replicated by participants all around the world. Even if a government shuts down every bitcoin node in its country, a bitcoin user can still transact as long as a single node is accessible overseas. ... ... For the remainder of the commentary: https://www.bloomberg.com/view/articles/2017-02-24/even-china-can-t-kill... ADVERTISEMENT K92 Mining Drills Multiple High-Grade Gold Intersections Company Announcement K92 Mining Inc. (TSXV–KNT) announces the latest results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine in Papua New Guinea. K92 is ramping up the Kainantu gold mine toward commercial production, with its longest continuous production run to date now commenced. In September 2016 K92 began a campaign of close-spaced underground diamond drilling as part of a comprehensive grade-control strategy. The current grade-control drilling program is focused on the areas of Irumafimpa and is designed to bring a high degree of confidence to the production planning and scheduling. K92 plans to mine this area in the coming six months. The closed-space drilling pattern of approximately 15 metres by 15 meters has significantly increased the confidence in this sparsely drilled area, with most holes recording high-grade intersections. Approximately 80 percent of the holes completed to date have recorded multiple high-grade intersections indicating the presence of multiple parallel to sub parallel high-grade veins. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/01/k92-drills-multiple-high-grade-gold-int... Join GATA here: Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Another Stock Market Bubble? Bring it On! Posted: 24 Feb 2017 02:04 AM PST Anytime the Dow makes a new high you can be reasonably assured of hearing the B-word bounced around in the media. Memories of the last bubble are still vivid and painful enough to trigger flashbacks of the bubble's collapse. It's only natural then that investors fear a return of irrational exuberance. Despite these fears, the evidence of a newly formed bubble is surprisingly lacking, as we'll uncover here. |

| Breaking News And Best Of The Web Posted: 24 Feb 2017 01:37 AM PST US stocks down from yesterday’s record high. Fed likely to raise interest rates next month. Gold and silver at multi-week highs. Bitcoin near all-time high. Trump national security adviser scandal evolving, EPA chief controversy ramping up after email release. Debate over Putin and fake news intensifies. Best Of The Web Dazed & confused… Treasury […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| When Was America’s Peak Wealth? Posted: 24 Feb 2017 01:30 AM PST A few days ago, I wrote an essay entitled “Not Nearly Enough Growth To Keep Growing”, in which I posited, among many other things, that “..the Automatic Earth has said for many years that the peak of our wealth was sometime in the 1970’s or even late 1960’s” along with the question “..was America at its richest right before or right after Nixon took the country off the gold standard in 1971?” That same day, I received an email from (very) long time Automatic Earth reader and afficionado Ken Latta, who implied he thought the peak of American wealth was even earlier. That turned into a nice conversation. I really like the way his head works to frame his words. And Ken knows what he’s talking about by grace of the fact that he was a witness to it all. |

| The Oscars – Worth Their Weight in Gold? Posted: 24 Feb 2017 01:26 AM PST 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today’s prices (nearly €400k & £330k) Only some $630 worth of gold in Oscar statue Oscars cannot be sold due to regulations Steven Spielberg keeps his gold Oscar with the Academy for ‘safe-keeping’ Shows importance of owning gold in safest ways Price of gold has climbed from $20.67 since the first Oscars ceremony to over $1,237 today |

| US Tax Reform in Jeopardy and the State of Strong Dollar Policy Posted: 23 Feb 2017 04:00 PM PST |

| The Problem with Gold-Backed Currencies Posted: 23 Feb 2017 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment