Gold World News Flash |

- Mexico Prepares Plan To Ditch U.S. Grain Imports As NAFTA Showdown Looms

- Eight Reasons Why The Dutch Election Matters

- Bitcoin Rockets to Multi-Year High of $1,132 as Winklevoss ETF Nears SEC Decision

- Orgy Enthusiast Bill Maher Defends Statutory Rape On Several Occasions - "The Crime Is That We Didn't Get It On Videotape"

- Dallas Police Pension Board Approves Benefit Cuts; Asks For More Taxpayer Money To Avoid Collapse

- As China's Housing Minister Admits There Is A Bubble, Axiom Warns "Sell Commodities Now"

- The Only Reliable Gold And Silver Futures Are Shares In Mining Companies

- Largest Spy Scandal In American History Warned Could Collapse Entire Government

- Gold Seeker Closing Report: Gold and Silver Bounce Back After Fed Minutes

- The Best Reasons to Buy Gold in the Age of Trump

- The Defense Of Liberty 13 Hour Special Broadcast - The Alex Jones Show - 02/21/2017

- Silver, The Return of Stagflation

- 2017 Global Economic Collapse Imminent

- TF Metals Report: Metals capped into FOMC minutes

- Metals Capped Into FOMC Minutes

- Trump Kills Solar – Here’s How You Profit

- China's $9 trillion moral hazard is now too big to ignore

- The Best Reasons to Buy Gold in the Age of Trump

- Why EU BrExit Single Market Access Hard line is European Union Committing Suicide

- Gold: Short End US Rates Matter More Than Long End Real Yields

- Gold: Short End US Rates Matter More Than Long End Real Yields

- Breaking News And Best Of The Web

- Gold: Short End US Rates Matter More Than Long End Real Yields

- 2017 - A Sterling Year For Silver?

- Top Ten Videos — February 22

| Mexico Prepares Plan To Ditch U.S. Grain Imports As NAFTA Showdown Looms Posted: 23 Feb 2017 01:15 AM PST America's Midwest farmers can't seem to catch a break. First, an epic collapse of grain prices over the last couple of years have threatened to wipe out family farmers (see "Midwest Farm Bubble Continues Collapse As Farm Incomes Expected To Crash In 2017") and now, thanks to the pending NAFTA showdown threatened by President Trump, Mexico, the single largest importer of U.S.-grown corn, has announced plans to find alternative grain sources in South America. Per Bloomberg:

Of course, any move by Mexican businesses to import raw materials from other countries could hit U.S. farmers hard. Mexico is the largest buyer of U.S.-produced corn, spending $2.5 billion in the 2015-2016 season, ahead of Japan's $1.8 billion, according to the U.S. Grains Council. Moreover, Mexico has spent $800 million on U.S. corn so far in the current season.

Of course, grain imports aren't the only raw materials for which Mexico is actively looking for alternative sources as Sigma Alimentos SA, Mexico's meat-packing conglomerate, is also looking to Brazil and Chile as alternative supply sources.

So where does that leave the American farmer? Well, not in a great spot given the already dire position they're in. For those who missed it, below are some stats from the USDA detailing the financial condition of the American farmer. * * * Real farm incomes in 2017 are expected to sink below 2010 levels which represents a 36% decline from the recent peak and a 14% decline since 2015.

Meanwhile farm debt continues to rise at an astonishing rate...

While farmer leverage has spiked to the highest level since at least 1960.

And of course, lower incomes means less money to spend on shiny new John Deere tractors with equipment capex expected to decline 35% compared to 2015.

And finally, farmer returns have crashed to the lowest levels ever. We're not sure about you but a 2.1% ROIC seems a "little low" even in our current rigged interest rate environment. So, there's only a couple of ways to fix that problem...either commodity prices have to recover quickly or farmland prices need to come down substantially. Which do you think will happen first?

|

| Eight Reasons Why The Dutch Election Matters Posted: 23 Feb 2017 12:30 AM PST Submitted by Saxo Bank's Martin O'Rourke via TradingFloor.com,

Now what is it about that Wilders fellow that seems so familiar? If we needed any reminders that 2016 was the year when the anti-establishment phenomena broke through the glass ceiling, then this week's Brexit-bill debate among the arch-establishment House of Lords institution was it. The irony of the non-elected house discussing the bill that will eventually pave the way for the trigger of Article 50 before March 31 will not have been lost on many. It was, after all, the protest element of the Brexit vote that saw the UK electorate deliberately snub what their elites dictated they must do and establish the barricades between the establishment and the disaffected. And that unleashed genie has gone on to cause havoc ever since. The victory of Donald Trump in the US and the rejection of Italian prime minister Matteo Renzi's constitutional reform referendum in December struck a powerful blow at the heart of the establishment foundations. Yet, the traffic has not all been one way. Austrian voters rejected the far-right Freedom Party leader Heinz-Christian Strache in December in presidential elections, and Marine Le Pen's efforts to become the next president of France still look likely to be stymied at the second round in May despite a collapse in support for scandal-hit rival Francois Fillon briefly making her the race favourite. The stage looks set, then. If 2016 was the year of the breakthrough, 2017 could see the status-quo fightback, with Europe likely to form the battleground ahead of pivotal elections. And, while next month's general election in The Netherlands may not be the biggest showdown of the year, the outcome could set the tone for 2017. The far-right PVV party, platformed on an anti-immigration, anti-European Union ticket, looks likely to emerge as the biggest party after March 15, but controversial leader Geert Wilders is almost certain to be snubbed when it comes to either the prime minister role or a top ministerial role. Nevertheless, a moderate coalition made up of numerous parties may find itself somewhat hobbled depending on the actual outcome. We give eight reasons why the Dutch elections matter.

Dreamy Amsterdam could be facing a nightmare. 1. Setting the template (version 2.0) If Brexit set the template for the anti-establishment mantra in 2016, the subsequent victories of Trump and the populist anti-EU movement in Italy have subtly altered the blueprint. The outcome of this election could see the template take yet another twist with French and German elections to follow. Like a military campaign, the domino effect of Brexit through to Italy six months later was next to impossible to stem. But with a new year and a new start, there is a different mood. While a poll of UK voters in December said 47% would still vote leave, 45% said they would go for remain and 8% were undecided. That's a shift from the 52/48 divide of the June 23 vote and came at a time when the UK consumer was spending and the economy looked robust. A slump in retail sales for January out of the UK may have shifted that sentiment further after a 0.3% fall dramatically undercut expectations for a 0.9% rise. Add that to a revision of the December slump revised to 2.1% and it is beginning to look like the post-Brexit party and big-ticket item splurge encouraged by the likes of Black Friday could be over.

With housing transactions also predicted to fall 11% in 2017, according to research conducted by The Times, this could be a trying period for sterling and UK confidence. GBPUSD plunged to below 1.24 after the retail data release for January

Source: SaxoTraderGO Some 15 weeks have also elapsed since Trump's victory. With the president embarking on a campaign-style approach since his inauguration on January 20, that has led to a standoff with the mass media, a battle with his own judiciary, some embarrassing climb downs in foreign policy and disarray within his own hand-picked team. The Dutch then have had some nine months to take on board the anti-establishment wave and what it potentially means. That includes the fallout. How will they react? A reversion to the safety of the centre is a possibility. A lurch even further to the right can also not be ruled out. We'll know in less than one month. 2. Anti-immigration reinforced However Wilders' party fares next month, the anti-immigration platform is well established in Europe and looks likely to be reinforced. The UK turned its back on an agreement to take up to 3,000 child refugees fleeing war earlier this month and, though it has faced a backlash, is sticking to its guns. The UK government's strategy is twofold. It wants to clip the wings of Ukip (more of that later) and make inroads into the working-class defection from Labour that has alighted on the immigration issue as a rallying cause. German chancellor Angela Merkel has also bowed to the inevitable and earlier this month set out tough new plans to repratriate asylum seekers designed to speed up the exit of those who have not earned asylum. A new Centre for the Support of Returns to be opened in Berlin is at the heart of the plan and marks a considerable contrast to the open-border policy that defined Germany's immigration stance in 2015. With Beppe Grillo's Five Star Movement party in Italy firmly established on the back of the referendum result ten weeks ago and with the likes of Hungarian premier Viktor Orban threatening to round up asylum seekers and detain them in shipping container camps, there is a dehumanising aspect to the right-wing rhetoric that is frightening. Wilders incendiary "Moroccan scum" comments on February 19 indicate the latitude that the far right has been granted by a lazy and complacent centre. It's going to get worse.

However you spin it, there is a reason why thousands of refugees have fled to Europe and are willing to put up with degrading conditions. 3. Le Pen's moment Just as Trump was able to jump on the Brexit bandwagon last autumn when his campaign looked like it might be hitting the buffers, Front National leader Marine Le Pen will have her fingers crossed for a strong showing from Wilders party and a potential escalation of tensions on the streets of Amsterdam and Rotterdam. Le Pen's chances of victory in May are not great but getting through to the final round on May 7 after the initial vote on April 23 would be success in itself and demonstrate that the far-right group is truly established as a mainstream party. To put that in context, the party has spent almost its entire political life since its formation in 1972 on the fringes of the political spectrum. Founder Jean-Marie Le Pen may have got into a runoff off for the presidency in 2002 but it is only since his daughter became leader in 2011 that the party has really made its breakthrough. It would be tempting to say that this is due to the new leader softening the party's stance to become more acceptable, but the reality is a corrupt and decrepit political establishment has made it easy for Le Pen to harvest voters disaffected with the ruling elites. The atrocities in Paris in November 2015 and Nice in July 2016 have bolstered her bandwagon and reportedly made her party the most popular among 18-34 year olds. The long game remains her strategy. Brick by brick, she's demolishing the establishment wall. 4. The Merkel paradox Of all the establishment figures under threat this year, none matter more than the German chancellor. She is the symbol of European solidity, an immigrant champion, a veteran of the international stage and she has demonstrated time and time again that she is able to go toe to toe with some of the most formidable opponents you could wish to encounter, including the likes of Russian leader Vladimir Putin. But, unlike much of the rest of Europe, Germans rather like the current status quo and even the far-right Alternative for Germany Party has seen support slip from around 15% in the summer of 2016 to less than 10%. The reason for that is not Merkel but rather the rise of a rival within her own coalition, the social democrats' Martin Schulz. Schulz, like Merkel, is a pro-European Union, anti-protectionist who most definitely hails from the left of the spectrum. The 'junior' party in Merkel's Christian Democratic Union coalition moved ahead in some polls this weekend ahead of the September election. It may be that Merkel's sudden shift in position on immigration is less to do with the far right and more to do with delineating her platform from that of Schultz. Merkel may be a politician of principle. She's also not above opportunism. And with Schultz breathing down her neck, it is already beginning to look like the greater public-speaking skills of the latter could land him the biggest prize of all come September. In that light, a better-than-expected showing for Wilders' party at next month's election might tip the fine margins in Merkel's favour, although it is clearly a double-edged sword and a gamble to change her stance. Merkel won't say it of course. But you can bet some of her strategists are thinking it. 5. The French/German bonds spread barometer The spread in yields between French and German 10-year bonds has become a useful indicator of political risk in Europe. It ran as high as 72 basis points when the Francois Fillion got himself into a terrible mess over nepotism earlier this month as it briefly threatened to propel Le Pen into the lead. That subsequently came back to the 65 mark after the immediate outcry receded but has once again jumped to 78 basis points on February 22. This could spread yet further depending on Wilders' showing on March 15 and demonstrates that not only is Germany decoupling from the peripheral economies like Portugal, Italy and Spain but even from a Eurozone-core economy like France, as the latter's fundamental structural problems combine with political tensions to deepen the uncertainty over its future direction. French/German 10-year yield spread out to 78 basis points

Source: Bloomberg 6. The far-right splinter The fate of Ukip should be instructive for all the far-right groups (or indeed any of the extremist movements in vogue) that are currently enjoying their moment in the sun on a platform of anti-immigration. On the crest of a wave on June 24, Ukip's progress since has been akin to someone wading through quicksand as the loss of a charismatic leader in the form of Nigel Farage has seen a catalogue of disasters beset the anti-EU party. The 18-day reign of Diane James was an unmitigated disaster but replacement Paul Nutall has fared little better and has become embroiled in a false claims controversy relating to the Hillsborough disaster of 1989 when 96 football fans died that has seriously undermined his credibility. Ukip does not yet look like a spent force but with Farage chasing the 'dream' in the US, its direction and sense of purpose has ironically been undermined by successfully seeing through the single-issue strategy that gave the party its raison d'etre. With Brexit due to be triggered next month, it's become a little bit of a rebel without a cause. The mainstream — read May's ruling Conservative party — has also stepped into the breach to effectively dilute the Ukip message by taking over some of their policies and pushing the hard Brexit stance that defined Ukip. It's a mainstream fight back through latching on to policies (a strategy which Boris Johnson unsuccessfully tried to follow through last summer) that could help re-establish the status quo, albeit with a significant lurch to the right. In the meantime, a key by-election on February 23 in the UK in the Brexit-supporting constituency of Stoke-on-Trent is a key test for Ukip. Nuttall's party is favourite to take the formerly safe Labour Party seat (the problems that have beset the Labour Party also owe much to the Brexit vote and a lack of direction under leader Jeremy Corbyn) but a Conservative victory would be a remarkable result in the circumstances as a signal of the status-quo rebirth. It could happen. The lesson for Wilders, Italy's Five-Star Movement and Spain's left-wing anti-establishment Podemos are clear. A single cause can most definitely unite disparate elements. But, the achievement of goals or an inability to break important electoral thresholds will unmask tensions. And, as Ukip is discovering, that's a recipe for disaster.

Perhaps he knew it was a good time to look for something else. 7. The euro to come under pressure Whatever the outcome of the Dutch election, the euro is likely to come into pressure as volatility stalks the continent in 2017. The potential crisis in Greece once again, the upcoming French and German elections, the triggering of article 50 next month and the unnerving and unwavering hostility from the Trump administration to all things EU, means that EURUSD in particular is likely to feel the heat. Trump may be pursuing a weaker dollar policy, but he might not get his wish granted in relation to the euro for some time. EURUSD has faced down the parity challenge on a couple of occasions already in the last few months but with the pair once again below 1.05 this morning, the debate looks set for some invigoration. EURUSD breached 1.05 Wednesday morning

Source: SaxoTraderGO EURUSD was at 1.0500 exactly at 1037 GMT, February 22. 8. The Trump reaction The Trump reaction is incendiary enough even when it turns out to be over something that is patently not true such as his ill-researched comment about Sweden at the weekend regarding a security-related terrorist incident that never happened. It's not surprising that someone with Trump's ego then chose to go on the warpath with Stockholm instead of coming clean. Expect him likewise then to react to the Dutch election, especially if it's another significant blow to the status quo. He is unlikely to let facts get in the way of his agenda either. If nothing else, Trump will seek endorsement for his selective immigration ban against seven mainly Muslim countries and the opportunity to twist the debate towards the border with Mexico which remains the most controversial pillar of his foreign policy (despite considerable competition). The oxygen of publicity. Trump can't resist it — markets will be moved.

That's the size of the immigration problem in Sweden... no France...i meant Europe. Obviously. |

| Bitcoin Rockets to Multi-Year High of $1,132 as Winklevoss ETF Nears SEC Decision Posted: 22 Feb 2017 10:09 PM PST Gold Stock Bull |

| Posted: 22 Feb 2017 09:33 PM PST What an interesting turn of events. Days after outspoken Trump-supporter Milo Yiannopoulos appeared on Bill Maher's panel of idiots where he was subject to a liberal hit-job, the left decided to execute operation McMuffin; a collaboration between liberals and former CIA "never-Trumper" Evan McMullin to strategically release dredged up flippant remarks Milo made about homosexual grooming - which led to a canceled book deal and his resignation as tech editor for Breitbart. With over 1500 sex trafficking and child exploitation arrests in the first month of Trump's presidency, this was clearly the left's desperate attempt to try and insinuate some sort of hypocrisy on the right concerning pedophilia. Weak. The MSM, predictably, wasted no time attacking Milo - a strategy which surely couldn't backfire:

Salon.com even deleted a pro-pedophilia article so they wouldn't look like total hypocrites when they ran an story quoting Bill Maher, who took credit for kicking off the Milo smear campaign:

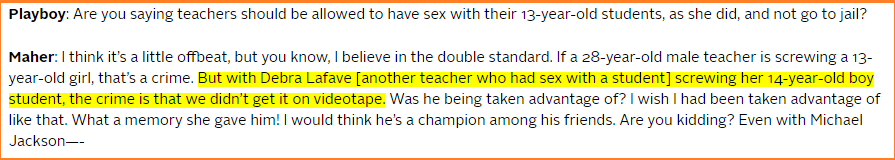

Hours later, thanks to 4chan and Reddit - the tides are turning, and Bill Maher's about to get blown the fuck out... Turns out the 61 year old host of HBO's Real Time With Bill Maher, who attends a $75K / year elite Los Angeles sex club, is also a huge fan of pedophilia as long as the abuser is a woman - as told in a 2007 issue of Playboy magazine:

This isn't the first time Maher has defended statutory rape. While the official DSM definition of pedophilia has an age cutoff of 13, the HBO host vehemently defended former teacher and convicted statutory child rapist Mary Kay Letourneau for having a sexual relationship with one of her students, which began when the boy was 12 - firmly putting Maher's advocacy for the relationship in pedo territory. (Note how Henry Rollins is completely on point?)

Karma Bill, karma. Oh, and about that sex club mentioned earlier; it appears Maher is into some Eyes Wide Shut shit. While normally I wouldn't care - the hypocrisy of his ivory tower judgment of a gay conservative, and the fact that he piled on and took credit for kicking off Milo's "downfall" for the exact same practice he's advocated several times, makes it fair game to point out that the HBO host loves him some expensive orgies!

The sex club also has an interesting initiation:

What??? AIDS tests are in the back of the store at the pharmacy counter, Bill. The crickets are warming up for yet another prolonged silence from the MSM.

|

| Dallas Police Pension Board Approves Benefit Cuts; Asks For More Taxpayer Money To Avoid Collapse Posted: 22 Feb 2017 07:35 PM PST For the past several months we've warned that the taxpayers of the City of Dallas, despite all of the tough talk coming out of their elected city council members, would ultimately be forced to bail out the failing Dallas Police and Fire Pension (DPFP) system. And just last night the DPFP board voted 9-0 to approve a plan that would do just that. The plan to save the DPFP was proposed by Dan Flynn, chair of the pensions committee in the Texas House of Representatives, and calls for Dallas taxpayers to contribute 34.5% of police and firefighter salaries each year into the failing pension system, up from 27% in 2015, plus an incremental $11 million per year. In total, the adopted plan will cost Dallas taxpayers an extra $22 million per year. That said, the plan also calls for pensioners to grant concessions, including the following:

Of course, the $7 billion shortfall in the DPFP triggered downgrades to Dallas's credit rating from Moody's and S&P in recent months which has wreaked havoc on the city's bond yields. (chart per Bloomberg).

Meanwhile, no amount of incremental taxpayer funding will ever be sufficient to stop angry pensioners from playing the victim card when the realities of their pension ponzi schemes are exposed for all to see. Per NBC 5:

Don't worry dear pensioners, there is no problem too large for taxpayers to bail out. A summary of the plan adopted by the DPFP board can be viewed below: |

| As China's Housing Minister Admits There Is A Bubble, Axiom Warns "Sell Commodities Now" Posted: 22 Feb 2017 07:26 PM PST After several months of slowing price growth across China's bubbly housing market, if mostly in the lower-tiered cities, last month we reported that China's National Bureau of Statistics confirmed that the latest Chinese housing bubble has finally popped, after housing prices across the 70 cities tracked by the NBS were up 12.7% Y/Y, below the 12.9% annual growth rate in November. This was the first deceleration in year-over-year housing price growth after 19 months of continued acceleration. Then, overnight, China reported that after the November peak, January house prices decelerated again, and according to Goldman calculations, on a year-over-year, population-weighted basis, housing prices in the 70 cities were up 12.4% vs. 12.7% yoy in December, and 12.9% in November, the second consecutive month of deceleration. On year-over-year basis, housing price growth moderated in January On a month-over-month basis, house price inflation decelerated modestly in tier-1 and tier-4 cities, and remained stable in tier 2 and tier 3 cities: In tier-1 cities, January price growth was 0.3% month-over-month after seasonal adjustment, vs. 0.5% in December. In tier-4 cities, property price growth was 0.2% month-over-month after seasonal adjustment, vs. +0.3% in December. Average property price inflation in tier 2/3 cities was 0.5%/0.4% month-over-month after seasonal adjustment respectively in January. Average house price inflation stabilized in January compared with December According to Goldman's China analyst, Maggie Wei, "we expect property transactions and house price inflation to slow this year from the rapid growth last year. On the other hand, property construction and investment activities may remain solid, supported by the strong land sales last year. We forecast only a small moderation in property FAI growth this year compared with last year." Consultancy giant McKinsey, which also is never too late to point out the obvious, said earlier on Wednesday that it sees "early signs of slowdown in China property market", with McKinsey partner Oliver Ramsbottom speaking at an iron conference in Dalian adding that "our belief is that in property market we're starting to see a slowdown." He added that slower mortgage lending will be key indicator for slowing starts and completions, and that the government's reaction to growth of price appreciation suggests increased focus on cooling, and slower starts. As a result, he expects cooling in demand for recently red hot commodities such as steel and iron ore. Another analyst who sees the bursting of China's housing bubble as a big negative for commodities is Axiom Capital's Gordon Johnson, who likewise looked at China's slowing housing data and asked, rhetorically "what's the significance of these data points?" His answer: "the last time we had 18 consecutive months of home price acceleration in China (7/31/12-to-12/31/13), iron ore prices rallied, as did steel prices; yet, when year-over-year ("y/y") growth in home prices turned negative 1/31/14, it marked the beginning of 16 consecutive months of deceleration in home prices, which also ushered in a collapse in both steel prices and iron ore prices, as well as other bulk commodity prices – we remind our readers that Chinese investors use home price growth, y/y, as a catalyst to invest in real estate in China (real estate, by far, is the most steel-intensive sector in China)."

|