Gold World News Flash |

- Infographic: Bullion Banking Mechanics

- Alan Greenspan Endorses The Gold Standard

- Peak Silver And Canada

- Gold’s Fundamentals Strengthen

- Oops! The Economy Is Like A Self-Driving Car

- Google Nation - Visualizing The World's Most Valuable Brands

- Gold: The Protector and Creator of Jobs

- GoldSeek.com Radio: Rob Kirby and Bix Weir, and your host Chris Waltzek

- Don’t Short This Dog, Report 20 Feb, 2017

- Robert Kiyosaki: Why the Ultimate Stock Market Crash Will Begin in 2017?

- People Are Suddenly Worried About China (Again)

- After seven years of bailouts, Greeks just sink deeper in poverty

- Bank Closures to Happen before 2021 -- Stan Johnson The Prophecy Club

- Introducing The RCM Gold Bugling Elk, And Silver Predator Lynx!

- In The News Today

- Gerald Celente : The Robot's Rebellion and The Coming Financial Meltdown

- THE CIA & GEORGE BUSH LIED! HERE IS TRUTH ABOUT SADDAM HUSSEIN

- Returning the Nation to a Gold Standard: Make America “Grant” Again

- Bullion Star graphic describes how 'paper gold' controls the metal's price

- JPMorgan, HSBC among dozen banks facing fines for rigging S. African rand

- The Eurozone isn't Working ... Warns Greenspan, Buy Gold

- Breaking News And Best Of The Web

- Headwinds Continue for Commodities with Rising US Dollar

- A Game Of Chess And The Source Of The Federal Reserve’s Power

- Jack Chan's Weekly Gold and Silver Update

| Infographic: Bullion Banking Mechanics Posted: 21 Feb 2017 07:11 AM PST Bullion banks are some of the most influential participants in the global gold market. But who are these players and what do they actually do? And most importantly, how can these bullion banks trade thousands of times more gold each year than is actually in existence? This infographic lifts the lid on bullion banking, looking at the world of fractional-reserve paper gold trading built on the unallocated gold account system. |

| Alan Greenspan Endorses The Gold Standard Posted: 21 Feb 2017 07:09 AM PST We can only speculate the reasons why Greenspan has gone full circle back to his views expressed in his 1966 seminal essay about gold and is "coming clean" about economic systems based on fiat currencies rather than a gold standard. But the fact that the former fiat money "Maestro" is now advocating the gold standard reinforces its validity. |

| Posted: 21 Feb 2017 07:08 AM PST The annual silver production estimates for 2016 were published by the United States Geological Survey (USGS) recently and I have gone over the figures country by country in my latest newsletter. The upshot was that the USGS estimated another record year for global silver production in 2015, but this turned into an epic fail as global silver was down on 2014 by 5%. |

| Gold’s Fundamentals Strengthen Posted: 21 Feb 2017 07:00 AM PST The January headline consumer price index (CPI) came in at 2.5%, which is near a 5-year high. What happened to deflation? As a result, real interest rates declined deeper into negative territory or in the case of the 10-year yield, went from positive to negative. No this isn't a commodity-driven story. The core CPI (ex food and energy) has been above 2% since the end of 2015 when commodities were in the dumps. Inflation is perking up and couple that with a Fed that pursues rate hikes at a glacial speed and that is very bullish for precious metals. |

| Oops! The Economy Is Like A Self-Driving Car Posted: 21 Feb 2017 12:30 AM PST Submitted by Gail Tverberg via Our Finite World blog, Back in 1776, Adam Smith talked about the “invisible hand” of the economy. Investopedia explains how the invisible hand works as, “In a free market economy, self-interested individuals operate through a system of mutual interdependence to promote the general benefit of society at large.” We talk and act today as if governments and economic policy are what make the economy behave as it does. Unfortunately, Adam Smith was right; there is an invisible hand guiding the economy. Today we know that there is a physics reason for why the economy acts as it does: the economy is a dissipative structure–something we will talk more about later. First, let’s talk about how the economy really operates. Our Economy Is Like a Self-Driving Car: Wages of Non-Elite Workers Are the Engine Workers make goods and provide services. Non-elite workers–that is, workers without advanced education or supervisory responsibilities–play a special role, because there are so many of them. The economy can grow (just like a self-driving car can move forward) (1) if workers can make an increasing quantity of goods and services each year, and (2) if non-elite workers can afford to buy the goods that are being produced. If these workers find fewer jobs available, or if they don’t pay sufficiently well, it is as if the engine of the self-driving car is no longer working. The car could just as well fall apart into 1,000 pieces in the driveway. If the wages of non-elite workers are too low, they cannot afford to pay very much in taxes, so governments are adversely affected. They also cannot afford to buy capital goods such as vehicles and homes. Thus, depressed wages of non-elite workers adversely affect both businesses and governments. If these non-elite workers are getting paid well, the “make/buy loop” is closed: the people whose labor creates fairly ordinary goods and services can also afford to buy those goods and services. Recurring Needs of Car/Economy The economy, like a car, has recurring needs, analogous to monthly lease payments, insurance payments, and maintenance costs. These would include payments for a variety of support services, including the following:

Needless to say, the above services tend to keep rising in cost, whether or not the wages of non-elite workers keep rising to keep up with these costs. The economy also needs to purchase a portfolio of goods on a very regular basis (weekly or monthly), or it cannot operate. These include:

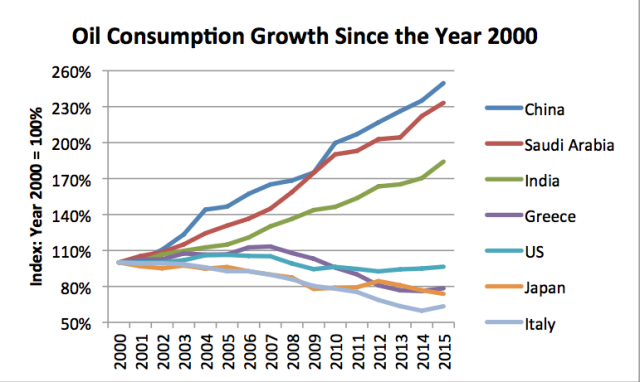

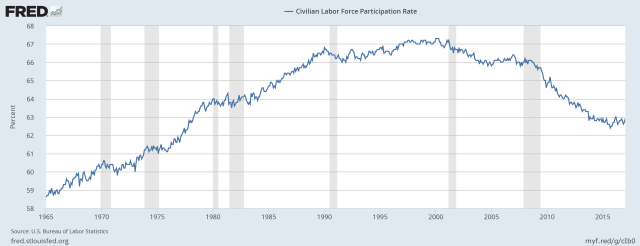

Some of these goods are needed directly by the workers in the economy. Other goods are needed to make and operate the “tools” used by the workers. It is the growing use of tools that allows workers to keep becoming more productive–produce the rising quantity of goods and services that is needed to keep the economy growing. These tools are only possible through the use of energy products and other minerals of many kinds. I have likened the necessary portfolio of goods the economy needs to ingredients in a recipe, or to chemicals needed for a particular experiment. If one of the “ingredients” is not available–probably because of prices that are too high for consumers or too low for producers–the economy needs to “make a smaller batch.” We saw this happen in the Great Recession of 2007 to 2009. Figure 1 shows that the use of several types of energy products, plus raw steel, shrank back at exactly the same time. In fact, the recent trend in coal and raw steel suggests another contraction may be ahead.  Figure 1. World Product Consumption, indexed to the year 2000, for selected products. Raw Steel based on World USGS data; other amounts based of BP Statistical Review of World Energy 2016 data. The Economy Re-Optimizes When Things Go Wrong If you have a Global Positioning System (GPS) in your car to give you driving directions, you know that whenever you make a wrong turn, it recalculates and gives you new directions to get you back on course. The economy works in much the same way. Let’s look at an example: Back in early 2014, I showed this graph from a presentation given by Steve Kopits. It shows that the cost of oil and gas extraction suddenly started on an upward trend, about the year 1999. Instead of costs rising at 0.9% per year, costs suddenly started to rise by an average of 10.9% per year.  Figure 2. Figure by Steve Kopits of Westwood Douglas showing trends in world oil exploration and production costs per barrel. CAGR is “Compound Annual Growth Rate.” When costs were rising by only 0.9% per year, it was relatively easy for oil producers to offset the cost increases by efficiency gains. Once costs started rising much more quickly, it was a sign that we had in some sense “run out” of new fields of easy-to-extract oil and gas. Instead, oil companies were forced to start accessing fields with much more expensive-to-produce oil and gas, if they wanted to replace depleting fields with new fields. There would soon be a mismatch between wages (which generally don’t rise very much) and the cost of goods made with oil, such as food grown using oil products. Did the invisible hand sit idly by and let business as usual continue, despite this big rise in the cost of extraction of oil from new fields? I would argue that it did not. It was clear to business people around the world that there was a large amount of coal in China and India that had been bypassed because these countries had not yet become industrialized. This coal would provide a much cheaper source of energy than the oil, especially if the cost of oil appeared likely to rise. Furthermore, wages in these countries were lower as well. The economy took the opportunity to re-optimize. Part of this re-optimization can be seen in Figure 1, shown earlier in this post. It shows that world coal supply has grown rapidly since 2000, while oil supply has grown quite slowly. Figure 3, below, shows a different kind of shift: a shift in the way oil supplies were distributed, after 2000. We see that China, Saudi Arabia, and India are all examples of countries with big increases in oil consumption. At the same time, many of the developed countries found their oil consumption shrinking, rather than growing.  Figure 3. Figure showing oil consumption growth since 2000 for selected countries, based on data from BP Statistical Review of World Energy 2016. A person might wonder why Saudi Arabia’s use of oil would grow rapidly after the year 2000. The answer is simple: Saudi Arabia’s oil costs are its costs as a producer. Saudi Arabia has a lot of very old wells from which oil extraction is inexpensive–perhaps $15 per barrel. When oil prices are high and the cost of production is low, the government of an oil-exporting nation collects a huge amount of taxes. Saudi Arabia was in such a situation. As a result, it could afford to use oil for many purposes, including electricity production and increased building of highways. It was not an oil importer, so the high world oil prices did not affect the country negatively. China’s rapid rise in oil production could take place because, even with added oil consumption, its overall cost of producing goods would remain low because of the large share of coal in its energy mix and its low wages. The huge share of coal in China’s energy mix can be seen in Figure 4, below. Figure 4 also shows the extremely rapid growth in China’s energy consumption that took place once China joined the World Trade Organization in late 2001. India was in a similar situation to China, because it could also build its economy on cheap coal and cheap labor. When the economy re-optimizes itself, job patterns are affected as well. Figure 5 shows the trend in labor force participation rate in the US:  Figure 5. US Civilian labor force participation rate, based on US Bureau of Labor Statistics data, as graphed by fred.stlouisfed.org. Was it simply a coincidence that the US labor force participation rate started falling about the year 2000? I don’t think so. The shift in energy consumption to countries such as China and India, as oil costs rose, could be expected to reduce job availability in the US. I know several people who were laid off from the company I worked for, as their jobs (in computer technical support) were shifted overseas. These folks were not alone in seeing their jobs shipped overseas. The World Economy is Like a Car that Cannot Make Sharp Turns The world economy cannot make very sharp turns, because there is a very long lead-time in making any change. New factories need to be built. For these factories to be used sufficiently to make economic sense, they need to be used over a long period. At the same time, the products we desire to make more energy efficient, for example, automobiles, homes, and electricity generating plants, aren’t replaced very often. Because of the short life-time of incandescent light bulbs, it is possible to force a fairly rapid shift to more efficient types. But it is much more difficult to encourage a rapid change in high-cost items, which are typically used for many years. If a car owner has a big loan outstanding, the owner doesn’t want to hear that his car no longer has any value. How could he afford a new car, or pay back his loan? A major limit on making any change is the amount of resources of a given type, available in a given year. These amounts tend to change relatively slowly, from year to year. (See Figure 1.) If more lithium, copper, oil, or any other type of resource is needed, new mines are needed. There needs to be an indication to producers that the price of these commodities will stay high enough, for a long enough period, to make this investment worthwhile. Low prices are a problem for many commodities today. In fact, production of many commodities may very well fall in the near future, because of continued low prices. This would collapse the economy. The World Economy Can’t Go Very Far Backward, Without Collapsing The 2007-2009 recession is an example of an attempt of the economy to shrink backward. (See Figure 1.) It didn’t go very far backward, and even the small amount of shrinkage that did occur was a huge problem. Many people lost their jobs, or were forced to take pay cuts. One of the big problems in going backward is the large amount of debt outstanding. This debt becomes impossible to repay, when the economy tries to shrink. Asset prices tend to fall as well. Furthermore, while previous approaches, such as using horses instead of cars, may be appealing, they are extremely difficult to implement in practice. There are far fewer horses now, and there would not be places to “park” the horses in cities. Cleaning up after horses would be a problem, without businesses specializing in handling this problem. What World Leaders Can Do to (Sort of) Fix the Economy There are basically two things that governments can do, to try to make the economy (or car) go faster:

Both of these actions work like turbocharging a car. They have the possibility of making the economy run faster, but they have the downside of extra cost. In the case of debt, the cost is the interest that needs to be paid; also the risk of “blow-up” if the economy slows. There is a limit on how low interest rates can go, as well. Ultimately, part of the output of the economy must go to debt holders, leaving less for workers. In the case of complexity, the problem is that there gets to be increasing wage disparity, when some employees have wages based on special training, while others do not. Also, with capital goods, some individuals are owners of capital goods, while others are not. The arrangement creates wealth disparity, besides wage disparity. In theory, both debt and increased complexity can help the economy grow faster. However, as I noted at the beginning, it is the wages of the non-elite workers that are especially important in allowing the economy to continue to move forward. The greater the proportion of the revenue that goes to high paid employees and to bond holders, the less that is available to non-elite workers. Also, there are diminishing returns to adding debt and complexity. At some point, the cost of each of these types of turbo-charging exceeds the benefit of the process. Why the Economy Works Like a Self-Driving Car The reason why the economy acts like a self-driving car is because the economy is, in physics terms, a dissipative structure. It grows and changes “on its own,” using energy sources available to it. The result is exactly the same effect that Adam Smith was observing. What makes the economy behave in this way is the fact that flows of energy are available to the economy. This happens because an economy is an open system, meaning its borders are permeable to energy flows. When there is an abundance of energy available for use (from the sun, or from burning fossil fuels, or even from food), a variety of dissipative structures self-organize. One example is hurricanes, which self-organize over warm oceans. Another example is plants and animals, which self-organize and grow from small beginnings, if they have adequate food energy, plus other necessities of life. Another example is ecosystems, consisting of a number of different kinds of plants and animals, which interact together for the common good. Even stars, including our sun, are dissipative structures. The economy is yet another type of a dissipative structure. This is why Adam Smith noticed the effect of the invisible hand of the economy. The energy that sustains the economy comes from a variety of sources. Humans have been able to obtain energy by burning biomass for over one million years. Other long-term energy sources include solar energy that provides heat and light for gardens, and wind energy that powers sail boats. More recently, other types of energy have been added, including fossil fuels energy. When energy supplies are very cheap and easy to obtain, it is easy to ramp up their use. With growing supplies of energy, it is possible to keep adding more and better tools for people to work with. I use the term “tools” broadly. Besides machines to enable greater production, I include things like roads and advanced education, which also are helpful in making workers more effective. The use of growing energy supplies allows growing use of tools, and this growing use of tools increasingly leverages human labor. This is why we see growing productivity; we can expect to see falling human productivity if energy supplies should start to decline. Falling productivity will tend to push the economy toward collapse. One problem for economies is diminishing returns of resource extraction. Diminishing returns cause the economy to become less and less efficient. Once energy extraction starts to have a significant problem with diminishing returns (such as in Figure 2), it is like losing energy resources into a sinkhole. More work is necessary, without greater output in terms of goods and services. Indirectly, economic growth must suffer. This seems to be the problem that the economy has been encountering in recent years. From the invisible hand’s point of view, $100 per barrel oil is very different from $20 per barrel oil. One characteristic of dissipative structures is that they keep re-optimizing for the overall benefit of the dissipative structure. We saw in Figures 3 and 4 how fuel use and jobs rebalance around the world. Another example of rebalancing is the way the economy uses every part of a barrel of oil. If, for example, our only goal were to maximize the number of miles driven for automobiles, it would make sense to operate cars using diesel fuel, rather than gasoline. In fact, the energy mix available to the economy includes quite a bit of gasoline and natural gas liquids. If we need to use what is available, it makes sense to use gasoline in private passenger cars, and save |

| Google Nation - Visualizing The World's Most Valuable Brands Posted: 20 Feb 2017 11:45 PM PST The world’s most valuable brand is owned by a company that you likely interact with every day. In fact, you may have even gotten to this web page using it. That brand is Google – and it dominates the internet with a 64% market share in search, while generating 41% of all digital advertising revenue globally. As Visual Capitalist's Jeff Desjardins notes, according to Brand Finance’s most recent 2017 list, Google’s brand value has recently increased to $109.5 billion, which is just enough to supplant Apple’s $107.1 billion brand from the top of the list. THE MOST VALUABLE BRAND IN EACH COUNTRY Today’s infographic comes from HowMuch.net, a cost information site, and it breaks down Brand Finance’s list of the top 500 brands in a different way. It shows the most valuable brand for each country, and has each country sized accordingly to the dollar value of that company. Courtesy of: Visual Capitalist It’s interesting to note the drop off in value from country to country. Google is the world’s most valuable brand at $109.5 billion – and it is followed closely by other U.S. brands like Apple ($107.1B) or Amazon ($106.4B). However, there are only two non-U.S. brands in the top 10, which are South Korean conglomerate Samsung ($66.2B) and Chinese bank ICBC ($47.8B). Two automakers also rank pretty high. Japan’s Toyota and Germany’s BMW both have significant valuations at $46.3 billion and $37.1 billion. After that, it’s a pretty steep fall in value for most countries. The top brands in countries like Canada, Italy, Switzerland, Australia, Russia, India, and Spain don’t crack $20 billion in value. On the entire South American continent, the most valuable brand is Brazil’s Itaú, a bank with a brand worth only $6.9 billion. By our count, a whopping 76 of the top 100 brands were based in either the United States, China, or Japan. |

| Gold: The Protector and Creator of Jobs Posted: 20 Feb 2017 11:01 PM PST Thanks to Hugo Salinas Price Some readers may ask themselves; "What has gold to do with protecting jobs? Gold hoarders are certainly not creating jobs, and hoarding more gold will not help at all."... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| GoldSeek.com Radio: Rob Kirby and Bix Weir, and your host Chris Waltzek Posted: 20 Feb 2017 09:00 PM PST Making his debut show appearance, Bix Weir of RoadtoRoot-A discusses his silver market research efforts. Due to financial derivatives and sophisticated algorithms, the Fed / Treasury control the PMs markets. Similar to the tragic water reservoir failure currently unfolding in California, Rob Kirby of Kirby Analytics identifies extreme risks to the financial markets. Even the mainstream press is starting to acknowledge the risks posed by market manipulation schemes, in particular, in the PMs sector. |

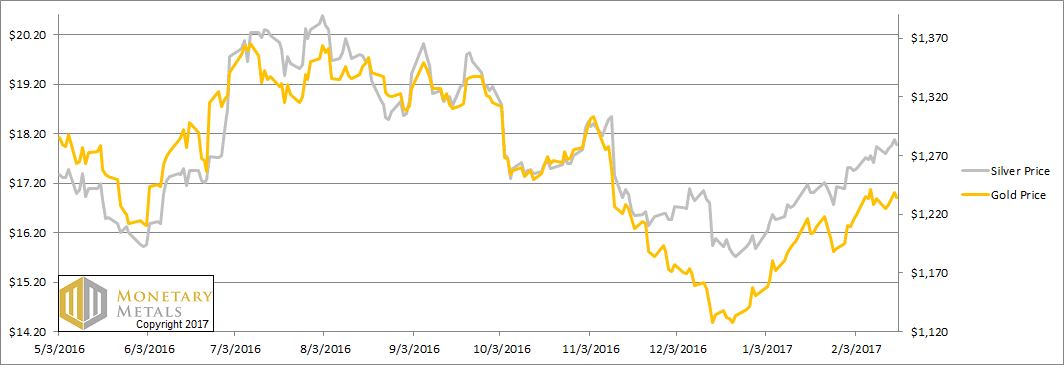

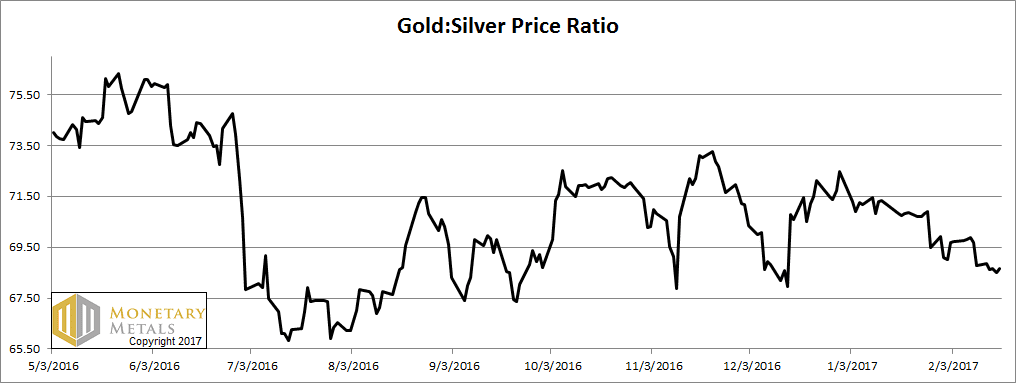

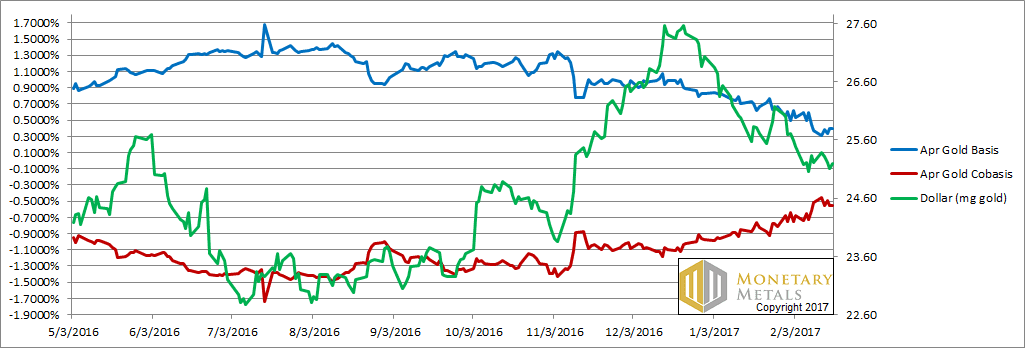

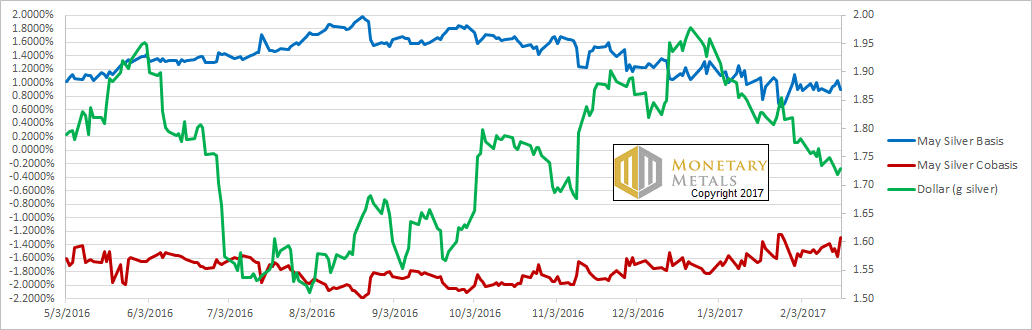

| Don’t Short This Dog, Report 20 Feb, 2017 Posted: 20 Feb 2017 07:50 PM PST This week, the prices of the metals mostly moved sideways. There was a rise on Thursday but it corrected back to basically unchanged on Friday. This will again be a brief Report, as yesterday was a holiday in the US. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. The Prices of Gold and Silver Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved sideways this week. The Ratio of the Gold Price to the Silver Price For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Price The price was unchanged, but the basis is up slightly and cobasis is down (i.e. gold became slightly more abundant). This is not the news dollar shorters (i.e. those betting on the gold price) want to see. Our calculated fundamental price is all but unchanged around $1,360. Now let's look at silver. The Silver Basis and Cobasis and the Dollar Price In silver, the basis is basically unchanged but the cobasis went up a bit. The silver market got just a bit tighter, and our calculated fundamental price is up more than 30 cents to about a quarter above the market price. Not exactly "bet the farm with leverage territory", but definitely not "short this dog" either. Watch this space. We have some exciting data science to reveal soon. © 2016 Monetary Metals |

| Robert Kiyosaki: Why the Ultimate Stock Market Crash Will Begin in 2017? Posted: 20 Feb 2017 05:30 PM PST In this segment, Economist Jerry Robinson is joined by author/investor Robert Kiyosaki to discuss why he believes the biggest stock market crash in history . The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| People Are Suddenly Worried About China (Again) Posted: 20 Feb 2017 05:28 PM PST Considering that in the past 3 months the only daily topic of relevance for the media has been "Donald Trump" both in the US and abroad, one would assume that when it comes to global policy uncertainty the primary source would be, record S&P 500 paradoxically notwithstanding, the United States. One would also be wrong, because while Trump seemingly remains the only topic worthy of discussion blanketing the airwaves, as the following chart from Goldman demonstrates, it has been China where policy uncertainty has stealthily exploded in the past three months according to policyuncertainty.com, while making virtually no new headlines. But how is it possible that China, which is seemingly far more "concerning" at this moment than it was a year ago when fears about Chinese financial conditions and devaluation led to global market selloff and pushed the S&P into correction, has had virtually no impact on risk assets so far in 2017: clearly either the chart above, or the market, is wrong. Conveneintly it is the same Goldman which has published an exhaustive report laying out the key risks to China's growth, many of which have been discounted by the market which erroneously assumes that just because the world went though a China "scare" period one year ago, that the world's second biggest economy remains contained. Far from it. For those pressed for time, below is the summary of Goldman's "Risks To China's growth In The Year of the rooster" report, from the team of MK Tan:

* * * Those interested in the details behind the report are encouraged to read on for the key select excerpts: Introduction A year ago, markets were abuzz over the possibility of a financial calamity in China and/or a "big deval" in the currency. Market pricing implied the likelihood of substantial equity price moves and CNY depreciation (Exhibit 1). Fears of a China crisis reverberated through global markets, tightening financial conditions around the world and pushing the US Federal Reserve to postpone its plans for further rate hikes. Exhbit 1: China's equity and currency markets were both under stress a year ago

Chinese policymakers wrestled with challenges throughout 2016, but large and sustained policy stimulus eventually fostered recovery. Fiscal and regulatory easing, alongside continued rapid credit growth, underpinned strong growth in infrastructure spending and a rebound in cyclical sectors like property and motor vehicles. Real GDP growth came in on target (6.7% versus a 6.5%-7.0% target range), and alternative measures of activity also improved (Exhibit 2). Our China Current Activity Indicator bottomed out at 4.3% (see dark line in Exhibit 2; this is measured on a three-month, three-month annualized basis) in early 2015, recovered to the mid-5% range last year, and is now running at 6.9%. Heavy industry, as proxied by our physical output measure (gray line in Exhibit 2), has seen an even more pronounced reacceleration. Exhibit 2: After a tough 2015, our measures of Chinese growth accelerated in 2016 Now, while forecasters still expect a little slowing in growth and some further depreciation in the renminbi, the focus is much more on policy in the US and Europe. In the US, President Trump's tweets have spawned a cottage industry of interpreters vying to understand where policy may head in the coming year. Across the Atlantic, the road map for "Brexit" as well as continued uncertainty about politics in the rest of the Eurozone occupies many market participants. While we subscribe to the view that Chinese policymakers will manage through the year with reasonably high growth, it is still prudent to review the risks ahead. After the roller coaster of the past year, most observers expect Chinese policymakers to make significant efforts to keep growth stable this year and try to reduce volatility in financial markets. Indeed, commentary following December's Central Economic Work Conference suggested that "controlling financial risks" may even take precedence over the growth target—a sensible ordering of priorities, in our view. Still, even if the Communist Party of China (CPC)'s long-term commitment to double income in this decade—as promulgated by the previous administration and reiterated last year by many senior officials—is pushed out by a year or two, it continues to carry some weight. We therefore expect the growth target to be near 6.5% for 2017, and policymakers to accept only limited flexibility around this target (sub-6% GDP growth is unlikely to be acceptable). A special motivation for minimizing market and economic "noise" in 2017 is the upcoming 19th Party Congress and associated leadership reshuffling, which will involve the majority of members in the Politburo and Standing Committee of the CPC. Global financial markets seem to have bought into the notion that China-related risks will be managed, shrugging off China's significant bond and FX market volatility in recent months. Substantial capital outflows and CNY depreciation against the USD continued in late 2016 but have not (yet) resulted in substantial tightening in global financial conditions, unlike last year (Exhibit 3). Exhibit 3: Less spillover from China to US financial conditions recently The aforementioned improvement in growth, alongside clearer messages from policymakers (publicly rejecting a large devaluation and holding the trade-weighted renminbi stable since mid-2016) and friendlier global conditions (a more dovish Fed in particular) have all helped. What could bring China fears to the fore again, and cause the markets to change their assessment? We explore some possible paths to a "hard landing" in China. (For the purposes of this discussion we define a "hard landing" as a drop of at least 4pp in our China Current Activity Indicator within one year—on this basis we've had a few near misses in the last few years, most recently in early 2015, but no hard landing. From the current growth pace, this would imply a drop in CAI to the mid-2% range or below.) We divide our review into external shocks and then domestic vulnerabilities, although clearly the two interact with each other. We emphasize these risks are not part of our baseline scenario for China in 2017, though they are more than mere "tail risks". Domestic vulnerabilities—credit and policy miscalibration We see two principal risks domestically. The first is an abrupt end to China's credit boom. A widespread perception of a "policy put", implicit guarantees to state enterprises and governments at all levels, and generally strong growth have underpinned the stability of the financial system. They have also encouraged rapid growth in leverage, including a reacceleration in 2015-16 (Exhibit 4).[5] China's post-GFC credit boom has taken debt levels well beyond those of EM peers (Exhibit 5). Exhibit 4: Credit growth has reaccelerated since 2015 and is well in excess of nominal GDP growth Exhibit 5: China's debt level well above EM peers Sustained debt booms typically lead to slower growth, greater financial volatility, and heightened risk of a financial crisis. Looking at more than a century of historical data, we found that a "large domestic debt boom" lasting at least 7 years where the debt-to-GDP ratio increases by over 52pp—China's easily qualifies—is typically followed by a 2pp slowdown in growth and a heightened risk of financial crisis (Exhibits 6 and 7). Exhibit 6: Real GDP growth decelerates after debt booms: Real GDP growth relative to average during debt boom period Exhibit 7: Financial crises common but not inevitable in large-country domestic debt booms Another way to look at the potential growth consequences is to estimate the negative "credit impulse" if credit growth were to slow to half its current pace. Using our past analysis of the relationship between credit and growth, and assuming a deceleration over one year, this would slow growth by 2-3pp or more (a more gradual deceleration would spread this growth hit over a longer period). We have seen credit booms end because of intentional tightening (Japan, where policymakers raised interest rates and imposed credit controls), external shocks (capital outflows in the Asia Financial Crisis), or to some extent collapsing under their own weight (the United States, where rising defaults led to a vicious cycle of tighter credit, falling asset prices, and weaker growth). Similarly, a structural break in China's credit expansion—a sharp tightening in credit availability—could occur because of a deliberate policy shift or because imbalances have simply grown too large to be sustained (more on both below). Regardless of the trigger, a supply-driven tightening in credit would have highly negative consequences for growth. Chinese policymakers are trying to avoid this sort of sharp pullback. Perhaps with the US experience in mind, they have been particularly attentive to "shadow banking" risks, recently taking steps to regulate off-balance sheet activities such as wealth management products, and to increase the cost of repo financing that is often used to fund shadow banking activity, even at the cost of prompting a significant bond market selloff in late 2016. In this context, our forecast remains for a "bumpy deceleration" in growth rather than a hard landing, though the longer the credit boom continues, the more difficult it will be to guide the economy to a soft landing. The second domestic risk is a major policy tightening. This could be intentional or unintentional, although we view the latter as much more plausible. Chinese policymakers' growth goals appear increasingly likely to conflict with supply-side constraints. Historically, the growth target was a "policy put" that was out of the money—a reassurance that growth would not be allowed to drop too far. However, in recent years the target appears to have become a binding constraint on policy. Actual growth is near the target instead of well above it (Exhibit 8), and our estimates suggest potential growth is slightly lower (near or below 6%). To meet the GDP growth targets, credit growth has boomed, as noted in the previous section, and a key driver of demand for that credit has been a large increase in the broadly-defined fiscal deficit (Exhibit 9). Indeed, a portion of the fiscal expansion has been underwritten by the central bank itself in the form of rising credit to the banking sector (e.g., "pledged supplementary lending" to policy banks such as CDB; see Exhibit 10). Attempting to boost growth above its potential rate for a sustained period is likely to lead to rising inflation and/or unsustainable asset price appreciation. We have already seen a large run-up in housing prices, substantial capital outflow pressures, and a sharp turnaround in producer prices (although we would attribute the latter primarily to CNY depreciation and upstream supply-side constraints rather than demand stimulus). As yet, CPI inflation is modest (Exhibit 11), but inflation could eventually force more difficult tradeoffs—and possibly a harsh policy tightening--if growth targets are not tempered further. With growth in the target range for now, policymakers have begun tightening on a number of fronts to address these risks:

The steps thus far look like "targeted tightening" designed to limit risks without too much damage to economic growth. For policymakers to cut their growth aspirations significantly and tighten very aggressively, other economic challenges such as inflation or capital outflows would have to get much worse, in our view. Exhibit 8: Policymakers have kept real GDP growth on target... Exhibit 9: ...but fiscal support has reached unprecedented levels Exhibit 10: PBOC and banking sector have helped finance stimulus Exhibit 11: PPI rebounded sharply, but CPI inflation still modest Even if policymakers do not intend to slow growth sharply, there is always a risk that they do so accidentally. The past few years have featured numerous occasions where policy tightening generated bigger effects (either in financial conditions or the real economy) than expected. Examples include the mid-2013 spike in repo rates (Exhibit 12), volatility in the equity markets around policy interventions (such as the introduction of the "circuit breaker" in early 2016), and of course the ructions in global currency and equity markets around the small renminbi devaluations in August 2015 and early 2016. Late last year, modest tightening by PBOC contributed to a significant backup in the bond market (Exhibit 13). In the real economy, efforts to reform local government finances slowed investment and heavy industry activity in late 2014 and early 2015, prompting a reversal in the spring of 2015 and substantial easing thereafter. Exhibit 12: Sharp repo spikes in earlier years; moderate increase in volatility recently Exhibit 13: Recent bond market backup ended a three-year rally The biggest vulnerabilities to unintended tightening are probably in the less formal areas of off-balance sheet spending (on the fiscal side) and non-bank credit extension (on the monetary side). On-budget fiscal policy is relatively transparent and controllable, but how local governments will respond to changing incentives—including anticorruption efforts, shifts in performance criteria, and changing availability of credit—is harder to predict. Likewise, policymakers have considerable influence on direct lending by large state banks, but less so on other bond market participants or "shadow banking" entities. This is especially true when multiple regulators/policymakers may be acting in a manner that is not completely coordinated. A particularly big challenge is how to unwind the perception of implicit guarantees on the debt of many SOEs and local governments' financing vehicles without precipitating a credit crunch. In summary, we see a policy tightening "accident" as a key domestic risk. Credit expansions can buckle under their own weight as leveraged asset prices rise to unsustainable levels and rising defaults prompt a reversal in credit availability. But with policymakers attempting to manage both housing prices and defaults directly, we think the central issue in the year ahead is policy calibration. Policymakers clearly do not want the economy to slow sharply, particularly ahead of the leadership transition later this year. At the same time, they need to address some of the imbalances in the economy to limit future volatility. Getting the balance right is particularly challenging given the leverage already in the system. Warning signs of overtightening could come from a large pullback in fiscal activity (Exhibit 9), a sharper spike in short-term interest rates (Exhibit 12), a widening in credit spreads (Exhibit 13; this might occur for example because of a reassessment of the value of implicit guarantees), or any sign that polices were causing an abrupt seizure in broad credit availability (Exhibit 4). * * * Potential shocks from abroad—export slump or hawkish Fed We see two main potential shocks from abroad that could conceivably cause a "hard landing" in China: First is a sharp decline in export demand... Despite the rapid growth of domestic demand and services, exports remain an important pillar of China's economy. In recent years, 15-20% of Chinese value-added was dependent on demand outside the country. Although this proportion has been declining, China remains sensitive both to global growth shocks and to any lurch towards protectionism in developed markets, particularly the US. ...either because of global growth… The single most important driver of Chinese exports is the pace of domestic demand growth in its trading partners. Our analysis suggests that Chinese real export growth moves slightly more than one-for-one with foreign demand growth,after accounting for exchange rate moves and |

| After seven years of bailouts, Greeks just sink deeper in poverty Posted: 20 Feb 2017 04:38 PM PST By Karolina Tagaris ATHENS, Greece -- Greek pensioner Dimitra says she never imagined a life reduced to food handouts: some rice, two bags of pasta, a packet of chickpeas, some dates, and a tin of milk for the month. At 73, Dimitra -- who herself once helped the hard-up as a Red Cross food server -- is among a growing number of Greeks barely getting by. After seven years of bailouts that poured billions of euros into their country, poverty isn't getting any better. It's getting worse like nowhere else in the European Union. "It had never even crossed my mind," she said, declining to give her last name because of the stigma still attached to accepting handouts in Greece. "I lived frugally. I've never even been on holiday. Nothing, nothing, nothing." ... ... For the remainder of the report: http://www.reuters.com/article/us-eurozone-greece-poverty-idUSKBN15Z1NM ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Bank Closures to Happen before 2021 -- Stan Johnson The Prophecy Club Posted: 20 Feb 2017 03:30 PM PST The Prophecy Club - Bank Closures & New Currency Apr. 19, 2016 Stan Johnson gives insight that is barking up the right tree on what actually happened on April 19, even though he recorded it earlier. US dollar collapse, Gold-backed Yuan, Bank Closures, and more! Support the Prophecy Club with... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Introducing The RCM Gold Bugling Elk, And Silver Predator Lynx! Posted: 20 Feb 2017 02:03 PM PST Miles Franklin |

| Posted: 20 Feb 2017 01:03 PM PST Jim Sinclair's Commentary Better said late then never said. Former Fed Chairman Warns Gold The "Ultimate Insurance Policy" as "Grave Concerns About Euro"February 20, 2017 Alan Greenspan, the former head of the Federal Reserve has warned that the euro may collapse, saying that he has "grave concerns" about its future. The imbalances in the economic... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Gerald Celente : The Robot's Rebellion and The Coming Financial Meltdown Posted: 20 Feb 2017 12:30 PM PST Gerald Celente : How to Prepare for The Coming Financial MeltdownJeff Rense & Gerald Celente & The Coming Financial Meltdown It's no longer time to pray for our leaders, because our leaders are preying on us. Stock up on essentials, because no one will be raptured. We are moving... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| THE CIA & GEORGE BUSH LIED! HERE IS TRUTH ABOUT SADDAM HUSSEIN Posted: 20 Feb 2017 11:00 AM PST This was a video about how the USA/CIA thinks it has the right to interfere in anyone's business, anytime. it also shows how the USA, since decades ago, has caused the radical islam immigration problem. Overall, though, good video. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Returning the Nation to a Gold Standard: Make America “Grant” Again Posted: 20 Feb 2017 10:58 AM PST This post Returning the Nation to a Gold Standard: Make America "Grant" Again appeared first on Daily Reckoning. [Ed Note: Explore what gold could mean in the future, how it could protect your wealth and why it should be the real standard of currency. Learn how to get your FREE copy of economist and bestselling author, Jim Rickards‘ book The New Case for Gold – CLICK HERE.) Copper and oil prices drifted down last week, while gold prices rose slightly. This is a hint that global economic activity may be slowing down, while economic uncertainty is rising. One way or another, the tea leaves are aligning in favor of gold buyers and precious metal mining companies. Meanwhile, today is Presidents' Day, a federal holiday. Those above a certain age might recall when we celebrated Abraham Lincoln's birthday on Feb. 12, every year; and George Washington's birthday every Feb. 22. Then, in 1971, Congress passed the National Holiday Act, to create three-day weekends for federal employees. (Seriously; you can check it out CLICK HERE). And voila, we now have Presidents' Day. I mention this because, the other night, I had the pleasure of speaking with the nation's 18th president, Ulysses Grant. We discussed returning the country to a gold standard, and therein lies a tale.  Ulysses S. Grant, Civil War General and U.S. President, 1869 – 1877 Okay; yes, I know. President Grant died in 1885. He's buried in Grant's Tomb – aka the General Grant National Memorial – in New York. Actually, he's not "buried;" the deceased Grant lies entombed, in an above-ground sarcophagus. Still, I had the next-best thing to meeting the real man. I spent an evening with Grant re-enactor and impressionist, Kenneth J. Serfass of Gettysburg, Pennsylvania. Since 2009, Serfass – a retired U.S. Marine – has traveled across the nation, offering tens of thousands of people a living history lesson about the life and times of Ulysses Grant. He's an impressive scholar of the mid-19th Century historical figure.  Byron King and Ken Serfass, U.S. Grant reenactor and historian. "When you mention President Grant to many people," said Serfass, "a common reaction is, 'Oh, his presidency was marred by scandal.' But when you ask them to name any scandals, they usually cannot," he stated. Per Serfass, Grant was an honest and ethical man, victimized by "fake news," back in his day, which portrayed him as something of a scoundrel. Still, in the end, over 1.5 million mourners turned out for Grant's funeral. Sad to say, Grant had the misfortune to live and preside in dishonest and unethical times, unlike today… Oh, wait. For our purposes in the Daily Reckoning, Mr. Serfass (Pres. Grant) and I discussed Grant's first inaugural address (Click HERE to read it in full), delivered in 1869, just after he was sworn in as president. "The country having just emerged from a great rebellion," said Grant, "A great debt has been contracted in securing to us and our posterity the Union. The payment of this, principal and interest, as well as the return to a specie basis as soon as it can be accomplished without material detriment to the debtor class or to the country at large, must be provided for." When Grant used the word "specie," he meant gold. In essence, Grant told the American people that the days of easy-money, paper "greenbacks," used to finance the Civil War, were over. It was time to return to a gold standard, and pay down the war debt. "To protect the national honor," declared Grant in 1869, "every dollar of Government indebtedness should be paid in gold." One cannot say it more clearly. "Paid in gold." Then, Grant added, in his address, "Let it be understood that no repudiator of one farthing of our public debt will be trusted in public place, and it will go far toward strengthening a credit which ought to be the best in the world, and will ultimately enable us to replace the debt with bonds bearing less interest than we now pay." Clearly, Grant understood the concept of national finance, and was aware that a strong dollar would help push down interest rates, and lower long-term government borrowing costs. In his speech, Grant focused on one critical source of national wealth, the mining industry. He stated that, "it looks as though Providence had bestowed upon us a strongbox in the precious metals locked up in the sterile mountains of the far West, and which we are now forging the key to unlock, to meet the very contingency that is now upon us." Mine ore, extract gold, pay down debt and create a strong nation. That was Grant's essential set of goals, at the outset of his presidency. During his two terms in office, Grant made impressive moves to implement his vision. Among other things:

It's fair to say that much of today's federal support for science has roots (history book featured HERE) in the presidency of U.S. Grant. Meanwhile, Grant's return to gold-backed currency, and his support for mining in the years after the Civil War, set up the nation for decades of industrial growth, leading to a preeminent level of global power. There's much else to discuss about President Grant, and his tenure in the White House, but time and space are limited. I'll leave you, however, with the closing remarks of Grant at his first inaugural address: "In conclusion, I ask patient forbearance one toward another throughout the land, and a determined effort on the part of every citizen to do his share toward cementing a happy union; and I ask the prayers of the nation to Almighty God in behalf of this consummation." Indeed! Perhaps we may still Make America "Grant" Again! Regards, Byron King The post Returning the Nation to a Gold Standard: Make America "Grant" Again appeared first on Daily Reckoning. |

| Bullion Star graphic describes how 'paper gold' controls the metal's price Posted: 20 Feb 2017 10:08 AM PST 1:10p ET Monday, February 20, 2017 Dear Friend of GATA and Gold: Bullion Star today publishes an elaborate informational graphic describing how bullion banks create almost infinite amounts of imaginary "paper gold" to control the monetary metal's price and prevent the price from being determined by physical demand. Bullion Star summarizes the graphic's topics this way: -- The identities of the bullion banks. -- The fractional-reserve nature of bullion banking and the paper gold creation process. -- How the staggeringly large paper gold trading volumes are generated. -- The gold price discovery process and how the price of gold is set in London by unallocated trading that channels gold demand away from real physical gold and into paper. -- The secretive nature of the bullion banking club and how its activities in the City of London are deliberately shrouded in secrecy. -- How new participants in the London gold market claim to be providing competition but are actually perpetuating the underlying unallocated gold account system of trading. The graphic can be found at Bullion Star here: https://www.bullionstar.com/blogs/bullionstar/infographic-bullion-bankin... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Drills Multiple High-Grade Gold Intersections Company Announcement K92 Mining Inc. (TSXV–KNT) announces the latest results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine in Papua New Guinea. K92 is ramping up the Kainantu gold mine toward commercial production, with its longest continuous production run to date now commenced. In September 2016 K92 began a campaign of close-spaced underground diamond drilling as part of a comprehensive grade-control strategy. The current grade-control drilling program is focused on the areas of Irumafimpa and is designed to bring a high degree of confidence to the production planning and scheduling. K92 plans to mine this area in the coming six months. The closed-space drilling pattern of approximately 15 metres by 15 meters has significantly increased the confidence in this sparsely drilled area, with most holes recording high-grade intersections. Approximately 80 percent of the holes completed to date have recorded multiple high-grade intersections indicating the presence of multiple parallel to sub parallel high-grade veins. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/01/k92-drills-multiple-high-grade-gold-int... Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| JPMorgan, HSBC among dozen banks facing fines for rigging S. African rand Posted: 20 Feb 2017 04:50 AM PST By Renee Bonorchis and Michael Cohen South Africa's antitrust investigators have urged that a dozen banks be fined for colluding and manipulating trades in the rand, potentially becoming the latest in a string of penalties handed to lenders around the world for rigging currencies. South African's Competition Commission identified lenders including Bank of America Merrill Lynch, HSBC Holdings Plc, BNP Paribas SA, Credit Suisse Group AG, HSBC Holdings Plc, JPMorgan Chase & Co., and Nomura Holdings Inc. as among those that participated in price fixing and market allocation in the trading of foreign currency pairs involving the rand since at least 2007. It referred the case to an antitrust tribunal, concluding an investigation that began in 2015. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-02-15/south-africa-to-prose... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Eurozone isn't Working ... Warns Greenspan, Buy Gold Posted: 20 Feb 2017 03:28 AM PST “The eurozone isn’t working …” warns Greenspan “I view gold as the primary global currency” said Greenspan “Significant increases in inflation will ultimately increase the price of gold” “Investment in gold now is insurance…” |

| Breaking News And Best Of The Web Posted: 20 Feb 2017 01:37 AM PST US markets closed for President’s day but futures point to record high open on Tuesday. Inflation is spiking on stronger growth, higher oil. Fed likely to raise interest rates next month. Gold and silver near multi-week highs. Trump national security adviser scandal evolving. Debate over Putin and fake news intensifies. Best Of The Web […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Headwinds Continue for Commodities with Rising US Dollar Posted: 20 Feb 2017 12:24 AM PST Recent pro-US rhetoric from the current administration is only adding to an existing multi-year renewed strength of the US dollar. The chant of "USA first" has only been the last of the drivers to push the greenback higher. Some of the other factors have been unemployment, which has reached a milestone at 4.8 percent, the second lowest level since 2006. |

| A Game Of Chess And The Source Of The Federal Reserve’s Power Posted: 20 Feb 2017 12:19 AM PST We have become pawns in the game of Chess being played by the Federal Reserve Bank. Who is their opponent? Anybody else who makes a move. Week in, week out, everyone’s eyes and ears seem fixed on what the Federal Reserve Board will say or do. Mostly, it is about what they say. That’s because they can’t really do much of anything. Except inflate the supply of money and credit. Which they have been doing for over one hundred years. And they are good at it, too. The historic erosion in value of the US dollar should merit more acclaim – or outrage. Unfortunately, the Fed is good at shifting the focus of concern to their opponent(s). |

| Jack Chan's Weekly Gold and Silver Update Posted: 18 Feb 2017 12:00 AM PST Technical analyst Jack Chan charts the latest moves in the precious metals sector. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment