Gold World News Flash |

- The Goal Of Socialists Is Socialism - Not Prosperity

- The Public Should Demand To See The Michael Flynn Transcript

- The Difference Between "F##k You Money" And "F##k Everybody Money"

- Agnico plans to invest $1.2 billion in gold projects in Canada's north

- Silver, Gold Stocks and Remembering the Genius of Hunter S. Thompson

- Gold Price Closed at $1231.70 Up $7.80 or 0.64%

- China's holdings of Treasuries dropped in 2016 by most on record

- Gold Seeker Closing Report: Gold and Silver Erase Early Losses and End Higher

- Four Signs U.S-China Relations are Destined for Conflict

- TF Metals Report: Inflation's 'sudden' onset isn't sudden at all

- Biggest News Story Of The Year And you've never heard about it Until Paul Craig Roberts

- 2017 POPULISM WORLDWIDE

- Gold Bull Market? Or was 2016 Just a Gold Bug Mirage?

- Gold and Silver Market Morning: Feb 15 2017 - Gold not moving except to adjust to exchange rates!

- Silver Price To Surge As “Investors and Users Fighting Over Available Physical Supplies”

- Now devout Muslims can help bullion banks and central banks short gold

- Jim Rogers Reiterates His Call For A Crash Of Epic Proportions

- Gold Intermediate Cycle Update

- Gold Bull Market? Or was 2016 Just a Gold Bug Mirage?

- Silver Price To Surge As “Investors and Users Fighting Over Available Physical Supplies”

- Breaking News And Best Of The Web

- What is Trump's US Dollar Policy?

| The Goal Of Socialists Is Socialism - Not Prosperity Posted: 16 Feb 2017 01:00 AM PST Submitted by William Anderson via The Mises Institute, About 40 years ago, economist Bruce Yandle went to Washington to work for the Council on Wage and Price Stability, ready to apply his knowledge of economics and educate his fellow workers. After all, he reminisces, one eye-rolling, head-scratching decision after another was coming from government regulators that surely someone versed in economics could expose as stupid, wasteful, and downright ridiculous. Government Serves the Interests of GovernmentAt some point, Yandle realized that the lay of the regulatory land looked quite different in Washington than it did in Clemson, South Carolina, where he was on the faculty at Clemson University. Regulators — and the representatives of the enterprises they regulated — were not looking to create an atmosphere in which the government tried to find the “optimal” set of regulatory policies that both minimized regulatory costs and allowed for the maximum removal of whatever “externalities” were created. No, as Yandle writes:

The more he examined the situation, the more he realized that all of the various actors in the system were acting in their own perceived self-interests — regulators, politicians, and those being regulated — and the combination of their interests created perverse outcomes. The “big picture” view that those on the outside of the situation might have is irrelevant to what actually happens, and understandably so. Far from the stated goals of the regulators and those involved in the process - that regulation was pursued in order to promote a lofty “public interest” - the real purpose of the regulatory apparatus is the promotion of the regulatory apparatus. The system exists to preserve and protect itself. Socialists Are Interested in Control, not Economic ProsperityAs I observe (and participate in) a few discussions on Facebook and elsewhere about socialism, I have come to a few conclusions about the nature of the arguments and the reasons why socialists remain socialists even as we see the utter failure of socialist economies throughout history. Maybe the meme that appears once in a while — “If socialists understood economics, they wouldn’t be socialists” — might be true, but I doubt it. As I see it, the purpose of establishing socialism is to further promote socialism, not improve the lot of a society and certainly not to promote prosperity. First, and most important, the minds of socialists work differently than do the minds of economists that see an economy as a mix of factors of production, prices, final goods, markets, and entrepreneurs that drive the whole route. Those of us who are economists are fascinated by this process because we see human ingenuity, the coordination of the goals of numerous people, and, when the system works, a higher standard of living for most people. Socialists, however, don’t see what we see. Instead, they see chaos and unequal outcomes. Not everyone benefits, right? In some situations, someone may lose a job or a way of doing things becomes obsolete. In the end, some people won’t be helped at all, at least not directly, and in the mind of someone that has an organic view of society, the fact that certain entrepreneurial actions taken by some individuals have created goods that meet the needs of others is irrelevant. Society should be providing those goods for free! People should not have to pay for what they need! Are you a surgeon who had done well financially because you have performed medical miracles for people who desperately needed your services? You have exploited sick people! Are you like Martha Stewart, who became wealthy in part by showing people how to make holiday celebrations better? What about the poor? They don’t have nice houses! When I first started writing about economics nearly 40 years ago, I was like Bruce Yandle, believing that all that was needed to convince socialists to stop being socialists was a well-reasoned economic argument. You know, explain that entrepreneurs don’t earn profits by exploiting workers, but rather entrepreneurs make workers better off by directing resources to their highest-valued uses. You know, explain how a price system really does result in morally-just outcomes because, in the end, it directs resources toward fulfilling the needs of consumers. And so on. I still believe the arguments, and over the years have come to understand them even better than I did when I wrote my first article for The Freeman in 1981. (It’s funny how Economics in One Lesson continues to become increasingly relevant to my thinking each time I read it.) However, I believe that the end of all of this activity is — or should be — the improvement of life for people in a way that is not predatory and brings about voluntary cooperation among economic actors. In other words, economic activity is a means to an end, and the end is free people gaining in wealth and standards of living. A socialist does not and will not see things this way. The end of socialism is not a higher living standard or even making life better for the poor, as much as a socialist will talk about the well-being of poor people. No, the end of socialism is socialism, or to better put it, the ideal of socialism. Once socialism is established, as it was in Venezuela or in the former USSR or Cuba, the social ideal had been met no matter what the actual outcome might be. But what about the problems that inevitably occur in a socialist economy? Are not socialists shaken by the economic meltdown in Venezuela? The answer is a clear NO. For example, The Nation, which has supported various communist movements for generations, takes the position that Venezuela suffers from not enough socialism:

The author assumes, of course, that socialism can be separated from the state, which shows either dishonesty or naivety, or perhaps both. After all, the author continues by claiming that the vast system of price controls the government has laid down over Venezuela’s economy has had little economic effect and certainly has not been harmful, just as the author assumes that because most businesses in Venezuela officially are privately-owned, the government has little economic control over their operations. (As we know, the government there has seized businesses, arrested store owners for raising prices in the face of blizzards of paper money, and made ridiculous claims about conspiracies to overthrow the government.) The one thing the author does not suggest is the government backing off its policies and its socialist ideology. To do so, obviously, would mean that socialism had failed and no socialist is going to ever embrace the idea that socialism could fail. Perhaps the best example of this is Robert Heilbroner’s famous 1989 New Yorker article, “The Triumph of Capitalism,” written even before the Berlin Wall went down, along with the communist governments of Eastern Europe and the USSR. He followed this a year later with “After Communism,” also in the New Yorker. In his first article, the Marxist Heilbroner wrote:

Yet, it is clear, especially after the second article, that Heilbroner was not advocating the establishment of free markets, but rather saw the collapse of the communist system as little more than a strategic pause of the Long March to Socialism. To reach that Utopia, wrote Heilbroner, socialists needed to turn to environmentalism to deliver the goods. (That most of the socialist countries also were ecological disasters did not penetrate Heilbroner’s mind, and that should not surprise anyone. To Heilbroner, the end of socialism was not a better way to produce and equally distribute goods; no, the end of socialism was socialism.) In other words, even after seeing the socialist system that economists like he, John Kenneth Galbraith, and Paul Samuelson praised for a generation melt down right in front of him, Heilbroner could not bring himself to admit that maybe socialists needed to turn in their membership cards and promote capitalism. No, Heilbroner decided that socialists simply needed new strategies to find ways to have state (read that, social) control of resources and economic outcomes. Interestingly, he wrote these words even after acknowledging that Ludwig von Mises and F.A. Hayek were correct in their assessment of socialism’s “economic calculation problem,” but even that admission did not bring Heilbroner to the logical end of his analysis: total rejection of the socialist system. Like the Fonzie character from Happy Days that never could admit being “wrong” on an issue, Heilbroner — and others like him — could not concede that socialism in any form still would run aground, be it in providing medical care, establishing strict environmental policies, or the establishment of a vast welfare state. The central problem facing socialism — economic calculation — does not disappear just because a government does not directly own factors of production and engage in five-year economic plans. This hardly means that economists like me should stop writing about the failures of socialism or stop explaining how a private property order and a free price system work. First, one never can be too educated in economic analysis and neither can anyone in public life. Socialists may not be able to abandon their faith, but others who might like to hear well-reasoned arguments might not be willing to join the Church of Socialism in the first place. Second, there is nothing wrong in speaking the truth and just because socialists and their followers are averse to truth does not mean we give up saying what we know to be true. Just because socialists refuse to believe that socialism fails - even when the evidence points otherwise - does not mean they have the moral and intellectual high ground. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Public Should Demand To See The Michael Flynn Transcript Posted: 15 Feb 2017 08:00 PM PST Submitted by Mike Krieger via Liberty Blitzkrieg blog,

I never intended to write about the Michael Flynn affair. I figured it had been covered to death and I probably wouldn’t have anything to add to the conversation. That said, I hadn’t been following the story closely so I decided to get caught up by reading a diverse selection of articles on the topic. One of my favorite sources on such subjects is Glenn Greenwald, and I eagerly read his latest piece on the matter: The Leakers Who Exposed Gen. Flynn’s Lie Committed Serious — and Wholly Justified — Felonies. There are several key points he outlines in the piece, most of which I agree with. First, he proves that the leakers committed serious felonies under the law. Second, he states that if illegal leaks lead to the disclosure of information that is clearly very much in the public interest, then such action is not only justified, but ethically necessary. I agree with this as well. Where he doesn’t really convince me, is the argument that this particular leak represented some sort of great public service. He writes:

Glenn’s conclusion here is that the Flynn leak exposed high-level wrongdoing. What wrongdoing are we talking about specifically? Yes, it seems he clearly lied to the public and Mike Pence about the content of his conversation with the Russian ambassador. The lie to Mike Pence in particular led to Pence embarrassing himself publicly by repeating that lie, and this betrayal seems to be the primary motivator (from my seat) of why Trump fired him. Others are referring to potential violations of the Logan Act, but as we learned from Lawfare:

Yes, Flynn was a private citizen, but he was less than a month away from being a high-level government official, and the Obama administration was doing everything it possibly could to antagonize Russia during its last few weeks in office. I’m not justifying what Flynn said in those conversations, or the lies he told about it, but there’s a key problem with this whole leak. It wasn’t really a leak meant to inform the public. It was a leak to specific journalists, at specific papers, with a clear intent of political assassination through the manipulation of public opinion via cryptic releases of filtered information. For example, here’s how the New York Times reported on the information in its February 9 article, Flynn Is Said to Have Talked to Russians About Sanctions Before Trump Took Office:

How do we know what was really said without the transcript?

I have so many issues with the above reporting it’s hard to know where to start. Everything mentioned above is given to us secondhand via “anonymous American officials.” Nowhere do I see any specific quotes from the transcript, despite the fact that the paper admits it talked with federal officials who read it. Why not? Why must we hear about the content of the transcripts secondhand from anonymous officials? This is the most significant red flag with this whole story. If the leakers were truly interested in transparency, and wanted the public to know the truth, why not leak the transcript to Wikileaks and let the public decide? I’ll tell you why. They didn’t do this because transparency was never the goal here. They wanted to illegally use intelligence information to take a scalp from a Trump administration they hate, and they knew they could do this via mainstream media journalists. I know what you’re thinking, Edward Snowden didn’t leak everything to Wikileaks either. He likewise picked a few journalists and trusted them to responsibly report the information. How is this any different? It’s different in two important respects. First, we are talking about a single transcript, or a few transcripts, as opposed to the enormous intelligence data-dump that Snowden provided. Secondly, The Intercept and others who reported on the Snowden material provided a huge amount of primary source documentation for the public to see so that it could come to its own conclusion. They didn’t simply tell everyone what to think about leaked documents while refusing to share any actual content. Where are the specific, comprehensive quotes from the Flynn transcript? Why doesn’t the public have a right to see the entire thing? Instead, we are being told what happened and what to think via secondhand anonymous sources. Sorry, but this doesn’t cut it for me. I have yet to see any excerpts from the transcript. All I’ve seen is what anonymous officials say was discussed. This is absurd. We the people should demand the content of the relevant transcripts so we can decide for ourselves just how bad Flynn’s actions were. In the absence of this, we’re essentially being manipulated on a massive scale by rogue intelligence agents and told what to think through the major newspapers. This doesn’t cut it for me. I want to see the content of these conversations so I can make up my own mind. Perhaps it’s even worse than we know. So be it. We should be treated as adults and allowed to see the actual conversation if it’s going to be made into a story of such huge national importance. Finally, I want to end with the mind-boggling absurdity of those who wanted Edward Snowden’s head on a platter, but are somehow ok with these leaks. As Lawfare explains:

Somehow I doubt the Flynn leakers will find themselves in the same position as Snowden, scrambling to get to a country that will provide them safe haven from the vast, vindictive reach of the U.S. government. That’s because the leakers in this case are powerful operatives of the deep state. As Greenwald explained:

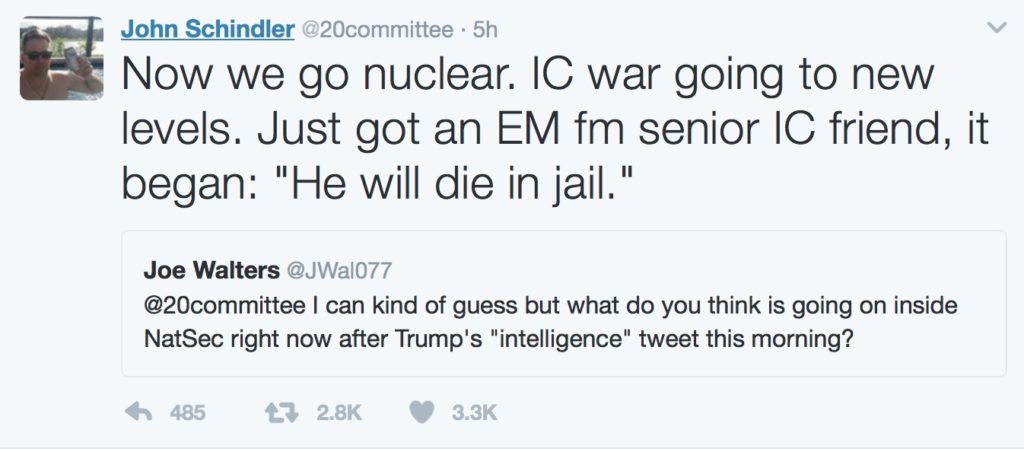

Finally, if you want to get a sense of the mindset behind the most adamant defenders of the Flynn leaks, take a look at the following tweets from former NSA analyst and Naval War College professor, John Schindler.

If that’s “the resistance,” I want no part of it. As I summarized on Twitter:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Difference Between "F##k You Money" And "F##k Everybody Money" Posted: 15 Feb 2017 07:10 PM PST Submitted by Daniel Drew via Dark-Bid.com, Something strange happened at Google recently. Bloomberg alleges that Google paid its top level employees so much that they crossed the line into "F*** You Money" territory, prompting the employees to pack up and quit. While this intriguing turn of events may have transpired at Google and other technology companies, this would never happen on Wall Street for one reason alone: "F*** You Money" is simply not good enough for the fast money crowd. The pinnacle achievement in the investment industry is "F*** Everybody Money." As the Wall Street Journal aptly noted in their concise chart, most people making less than $10,000 are dissatisfied with life. As people approach the $100,000 mark, most of them are satisfied. That's why it's not terribly surprising to see stories like this one. Bloomberg reports,

The whole purpose of compensation is to prevent employees from leaving. Ironically, Google's high pay caused just the opposite, turning traditional compensation theory on its head. This whole episode will be a case study for human resources departments for years. Why does high pay cease to be an incentive after a certain point? The compensation analysts apparently forgot to read the Wall Street Journal study. Most people are satisfied with "F*** You Money." Legitimate retention efforts start at the hiring process. If you have such a valuable project, finding highly qualified people is not enough. You have to find people who are both qualified and exponentially driven by money - with no cutoff point. You need someone who isn't satisfied with "F*** You Money." What you need is someone who settles for nothing less than "F*** Everybody Money." What is "F*** Everybody Money," and where can you find these people? Look no further. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agnico plans to invest $1.2 billion in gold projects in Canada's north Posted: 15 Feb 2017 06:09 PM PST By Danielle Bochove Agnico Eagle Mines Ltd. plans to invest more than $1.2 billion in Canada's subarctic in the next three years as it builds one new mine and expands another. North America's fourth-largest gold miner by market value is moving ahead with plans to develop its Meliadine project and a deposit near its Meadowbank mine in Nunavut, the company said today in its fourth-quarter earnings statement. The decision will boost Agnico's gold production to 2 million ounces a year by 2020, about 20 percent more than last year's output of 1.66 million ounces. "This is very much low-risk, high-quality growth because it's an extension of what we've been doing for the last many, many years," Chief Executive Officer Sean Boyd said in an interview at the company's Toronto offices. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-02-15/agnico-to-invest-1-2-... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver, Gold Stocks and Remembering the Genius of Hunter S. Thompson Posted: 15 Feb 2017 05:56 PM PST Precious metals expert Michael Ballanger ponders the timelessness of Hunter S. Thompson's "blistering attacks on the status quo" and their applicability to today's political landscape. He also reminds us of the "incredibly bullish" fundamentals for silver and lays out the evidence for why this precious metal is on its way to $25/ounce by mid-year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1231.70 Up $7.80 or 0.64% Posted: 15 Feb 2017 05:01 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's holdings of Treasuries dropped in 2016 by most on record Posted: 15 Feb 2017 04:40 PM PST By Sarah McGregor and Andrea Wong China's holdings of U.S. Treasuries declined by the most on record last year, as the world's second-largest economy dipped into its foreign-exchange reserves to buttress the yuan. Japan, America's largest foreign creditor, trimmed its holdings for a second straight year. A monthly Treasury Department report released in Washington today showed China held $1.06 trillion in U.S. government bonds, notes, and bills in December, up $9.1 billion from November but down $188 billion from a year earlier. It was the first monthly increase since May. The People's Bank of China, owner of the world's biggest foreign-exchange reserves, has burned through a quarter of its war chest since 2014 in an effort to underpin the yuan and deter capital from fleeing the country. Chinese sales have made borrowing more costly for the U.S. government: 10-year yields rose to 2.6 percent last year, from as low as 1.3 percent. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-02-15/china-s-holdings-of-t... ADVERTISEMENT K92 Mining Drills Multiple High-Grade Gold Intersections Company Announcement K92 Mining Inc. (TSXV–KNT) announces the latest results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine in Papua New Guinea. K92 is ramping up the Kainantu gold mine toward commercial production, with its longest continuous production run to date now commenced. In September 2016 K92 began a campaign of close-spaced underground diamond drilling as part of a comprehensive grade-control strategy. The current grade-control drilling program is focused on the areas of Irumafimpa and is designed to bring a high degree of confidence to the production planning and scheduling. K92 plans to mine this area in the coming six months. The closed-space drilling pattern of approximately 15 metres by 15 meters has significantly increased the confidence in this sparsely drilled area, with most holes recording high-grade intersections. Approximately 80 percent of the holes completed to date have recorded multiple high-grade intersections indicating the presence of multiple parallel to sub parallel high-grade veins. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/01/k92-drills-multiple-high-grade-gold-int... Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Erase Early Losses and End Higher Posted: 15 Feb 2017 02:01 PM PST Gold fell $10 to $1217.40 by a little after 8:30AM EST, but it then rallied back higher for most of the rest of trade and ended with a gain of 0.42%. Silver slipped to as low as $17.76 before it jumped back to $17.982 and then chopped back lower at times, but it still ended with a gain of 0.17%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Four Signs U.S-China Relations are Destined for Conflict Posted: 15 Feb 2017 01:58 PM PST This post Four Signs U.S-China Relations are Destined for Conflict appeared first on Daily Reckoning. The drums to conflict between U.S-China relations have reached fever pitch. President Trump had direct diplomatic contact and conversations with at least 18 world leaders before extending such offerings to Chinese leader Xi Jinping. While acting as president-elect, Trump held a very provocative conversation with the Taiwanese president. It became clear that the incoming administration was not going to be acting on standing protocols that had existed for decades. Since then, President Trump and President Xi have opened communications, but upon first impressions the indicators for a U.S-China conflict are greater than recent memory. As Xi Jinping remarked while at the World Economic Forum in January 2017, 'It was the best of times, it was the worst of times.' These are the words used by the English writer Charles Dickens to describe the world after the Industrial Revolution. Today, we also live in a world of contradictions." It is not only contractions in rhetoric, but the actions that should be evaluated when looking at what could build into a very real conflict between the U.S and China. Here are the four signs that U.S-China relations could reach a crisis level: 1. Advisors: Strategy for DisasterAfter the U.S inauguration and the breaking of its one China policy, the U.S has seemingly reversed course. “President Trump agreed, at the request of President Xi, to honour our ‘one China’ policy,” read a statement released by the Chinese government. This type of quick shifting in policy can present dangerous situations. The advisors for both respective government leaders will be key to navigating norms and policy. They will also present the greatest adversarial paths to conflict and power maneuvering. Economist and bestselling author, Jim Rickards while referencing Steve Bannon, the president’s chief strategist, reminds us that only a few months back the National Security Council member indicated that "we're going to war in the South China Sea…no doubt." Rickards reports, "Admittedly, this forecast was made before Trump's election and was a long-term forecast, not an immediate warning. Still, such comments do not go unnoticed in Beijing." "A conflict between the U.S. and China would be the most momentous confrontation since the end of the Cold War, in 1991, with enormous consequences for investor portfolios." These comments come as the Secretary of State Rex and former ExxonMobil CEO, Rex Tillerson made reflective comments. During his confirmation hearing the former CEO added that, "we're going to have to send China a clear signal that, first, the island-building stops and second, your access to those islands also is not going to be allowed." It should also be noted that his former oil company, ExxonMobil, maintains relations and drilling operations in the region – specifically with with Indonesia and Vietnam. While military conflict is a more blatant possibility between the U.S and China, the economic friction might be an even greater urgent matter for advisors. U.S trade representative Robert Lighthizer has heavily voiced his concern about the history of exports to the U.S rising faster than U.S. exports to China. This export history built up a considerable trade deficit. In 2010, Lighthizer was a leading advocate for tariffs on China that would "force change in the system" even if it elevated "trade frictions." While the new U.S trade representative might have been in favor of retaliatory tariffs, the Chinese side has also offered its caution to the incoming administration. From the Chinese leadership, an American-educated political figure and arguably the top economic adviser, Liu He, has ranked as President Xi Jinping's right hand man. He will continue to offer signals toward which way the Chinese government will direct its policy and the sentiment toward U.S-China relations. The economic adviser has been relatively mute in public about his plans but in a study that was released over three years ago the New York Times reported that the advisor argued China "cannot shoulder excessive responsibility" for reducing its trade deficits with other economies. The top Chinese economic figure wrote, "Populist policies adopted by the governments of developed countries are often the instigators of crisis." What that translates to is a vocal defamation of what the new White House proposals both in rhetoric and in action. The Chinese Ambassador to the U.S, Cui Tiankai was referenced by Chinese state media run operation, The People's Daily, where he remarked that "the talks on formulating the Code of Conduct in the South China Sea and maritime cooperation." Ambassador Cui said, "countries from outside the region should support such efforts to restore tranquility instead of creating new hurdles." While the remarks may be mild in tone, the Chinese have made clear their position that the U.S government should stay away. The Chinese Ambassador, if these issues continue to escalate, will be a vocal center for his respective government. He will also be forced to reckon with translating policy between the world's two largest economic forces. The influence and advisory direction on matters of economic and military action will be vital to watch in the months and years ahead. These advisors could present clear signals of things to come between a U.S-China conflict and shape policy that impacts governments and extends all the way through to everyday investors. 2. Power Dynamics: Pivot East to WestThe nature of China and Japan relations has defined the Asian region for over half a century. The two powerhouse economies for the region have also had two of the most divided diplomatic channels in the world. As the U.S and other regional powers continue to push at China, the government has been looking to bridge the gap in once taboo relations. Nomi Prins, a former Wall Street insider who is currently working on her latest book, Artisans of Money, was recently in Japan and China. While there she met with government and financial figures. She reports that, "geo-bullying will also push former adversaries, China and Japan closer together. The two nations are already negotiating some historic agreements." "We could be approaching a new era in which Sino-Japanese relations allow for diplomatic normalization and more economic partnerships, which would be mutually beneficial." China has also begun considerable infrastructure projects that would allow it to navigate outside of the U.S. With these considerations it has gone as far as to initialize plans for a One Belt, One Road program. This program will expand and establish greater trade between Europe and Asia. Chinese development banks have made more than $3 billion available for projects in a number of along those routes. The Chinese government views this infrastructure generation as a step forward for eastern relations, and a way to diversify away from the western hemisphere. The move eastward, instead of strengthening relations between the world's top two economic forces, has mounting considerations. The closer trade and investments are between states, the less likely they are to come into direct economic and physical conflict. Enter the Trump administration where it has enacted an immediate exit from any further Trans-Pacific Partnership trade negotiations. The withdraw of the U.S from the TPP, a deal that included 12 Pacific Rim countries, was part of a series of Trump's executive orders. These efforts were made in an effort to withdraw the U.S government from global trade institutions. While the TPP had its serious flaws, it was to put forward a U.S centered trade policy that would set the standard for technology and regulatory systems in Asia. The TPP, if imposed correctly, would have forced China to follow a new trading standard and provided challenge to its undisputed regional influence throughout Asia. What the U.S left, the Chinese government picked up. “China will forge ahead with the negotiation of the Regional Comprehensive Economic Partnership (RCEP) and the construction of the Free Trade Area of the Asia-Pacific (FTAAP) so as to add new impetus to regional and global economic development,” read the statement from the Chinese Foreign Ministry immediately after the U.S withdraw. The Chinese government is now creating its own TPP and seeking to build on regional trends toward partnership. What all this signals is a further shift east by the Chinese government, and a greater divide between U.S-Chinese relations that defined trade for an era. Further indicators of U.S-China relations edging toward separation will only create a larger potential for rivalry and opposition. The shift from western integration to an eastern pivot will heighten the stakes between U.S-China relations for decades to come. 3. South China Sea: Theatre for Proxy SkirmishesThe South China Sea has the second highest frequency in sea travel through its channels in the world. To put that into perspective, every year an estimated $5.3 trillion of trade passes navigates through those waters. For the U.S, its trade share accounts $1.2 trillion of the total commerce that passes through the South China Sea. According to the U.S. Energy Information Administration the South China Sea has an estimated 11 billion barrels of oil. That makes it nearly equal to Mexico's reserves. It also holds 190 trillion cubic feet of natural gas. That makes the watershed and sea channel a bastion for natural resources in a region where energy demands are in abundance. It also makes the region an even greater target for competition and has caused economic and military backlash. The Chinese government has also stated that it has historical rights to over 80% of the South China Sea. Disruptions to that trade patterns from land and sea grabs would not only negatively impact local economies along the sea routes, it would drastically impact domestic markets. Many have speculated that under president Trump, sectors in logistics, shipping and transportation would be major areas of improvement in the economy with infrastructure stimulus. Any economic, military or trade frictions could jeopardize all of the speculative investments that have been placed into the market. Currently, the U.S government has active operations and government access to at least five publicly disclosed military outlets. Kyle Bass while speaking on Bloomberg remarked that in the instance that a tariff is imposed on Chinese imports by the United States government certain responses will be given directly, and sharply by the Chinese government. In this shift, Bass poses, "The question is does all of this economic wrangling really start a fire that ends up moving into a kinetic response in the South China Sea? That is something we hope does not happen." Bass is the founder of Hayman Capital who was spot on in predicting the U.S. subprime mortgage crisis before the devastating real estate bubble burst. He poses that, "The big question is, where is this all going as far as trade? When I look back at armed conflicts I think they are all rooted in some sort of economic [origin]." "This is a fire that's been smoldering and it's now starting to burn, and Trump is just more gasoline." How that fire continues to burn will be important to watch from a military, financial and trade perspective. 4. Chinese Debt: The Next Financial CrisisThe outstanding loans held by China has topped $28 trillion. That total equals nearly the entire commercial banking systems in both the U.S and Japan combined. Courtesy of: Visual Capitalist Beginning in September 2016, the Bank for International Settlements (one of the most influential banking organizations in the world), released for the first time data on the credit-to-GDP ratio gaps since 1961. The information revealed that China reached an astronomical total of 30.1 in this ratio gap. Typically anything over a figure of 10 offers room for concern and the Chinese economy has tripled that. That puts the major Asian giant at the highest ratio to date, and above all other major economies evaluated by the governing institution. The 30.1 ratio gap is higher than the numbers seen during the Asian boom in 1997 and the subprime mortgage bubble experienced just prior to the Lehman Brothers crisis of 2008. All of this mounts the story for a Chinese debt bubble that continues to inflate. Former Reagan White House insider and bestselling author David Stockman noted even at the beginning of 2016 that, "The fact is, no economy can undergo the fantastic eruption of credit that has occurred in China during the last two decades without eventually coming face to face with a day of reckoning." Stockman did not skip a beat saying that, "Massive borrowing to pay the interest is everywhere and always a sign that the the end is near. The crack-up phase of China’s insane borrowing and building boom is surely at hand." While a collapse in China might be unlikely, it is clear that the Asian giant has lost its economic swagger. The Chinese economy acting with a muddled sense of direction could cause mass confusion amongst foreign exchange markets. That alone should offer concern to investors both domestically and on an international scale. The looming Chinese debt build up has caused the government to continue a program of burning through trillions of foreign currency reserves. With a population of well over a billion people, the prospect of a collapse and no reserves to back it up would threaten global stability and disrupt trade. Kenneth Rogoff wrote in Project Syndicate that, "China has financial weapons, including trillions of dollars of US debt. A disruption of trade with China could lead to massive price increases in the low-cost stores – for example, Wal-Mart and Target – on which many Americans rely." That means that what happens in the Chinese economy will directly impact the wallets of Americans. As the global economy continues to recover from the global financial crisis, and further shock to the system could generate a conflict that no country would be capable of affording. Jim Rickards, the author of Road to Ruin states, "While the exact path and timing of such a conflict may be unclear, it's not too soon to start building a defensive allocation in your portfolio just in case. "The single best asset class for the coming conflict is gold. When trade and monetary cooperation between the U.S. and China break down, gold will re-emerge as genuine world money, as it has many times before." During the elite power games that continue to unfold, those in the real economy could be caught between the conflict of these two world powers. While these indicators may shift in the months ahead, U.S-China relations will be vital to understand and monitor. Staying aware of the changes and updates in these will allow you to better position yourself for the road ahead. Thanks for reading, Craig Wilson, @craig_wilson7 The post Four Signs U.S-China Relations are Destined for Conflict appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Inflation's 'sudden' onset isn't sudden at all Posted: 15 Feb 2017 12:39 PM PST 3:40p ET Wednesday, February 15, 2017 Dear Friend of GATA and Gold: Inflation is not suddenly surging, as the financial establishment wants people to believe, but has been rising steadily all along as the U.S. dollar has been depreciating. That's today's commentary from the TF Metals report, headlined "The Sudden Onset of Inflation," posted here: https://www.tfmetalsreport.com/blog/8163/sudden-onset-inflation CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Biggest News Story Of The Year And you've never heard about it Until Paul Craig Roberts Posted: 15 Feb 2017 09:15 AM PST The Empire of Chaos has Russia backed into a corner and Putin says we are on the brink of WWİ. Darrin McBreen talks to Paul Craig Roberts about NATO's . The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 15 Feb 2017 07:52 AM PST thumbs up for Farage, Trump, Putin, Italian 5star, Orban, Wilders, Le Pen, Hofer, German AFD, the Swedish Democrats, Danish Peoples Party, Polands Korwin-Mikke and Australia's Pauline Hanson. any ive missed, let me know. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bull Market? Or was 2016 Just a Gold Bug Mirage? Posted: 15 Feb 2017 07:04 AM PST The consensus view in the precious metals sector is that we have embarked on the next great bull market in gold and silver. The story is gold and the entire mining sector bottomed in early 2016 and launched into its first leg up into early August. The sector then underwent a stiff correction from August to December, and has now finally found its legs and the upward advance has resumed. Money is now flowing into exploration and development plays reflecting the belief in this narrative. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Market Morning: Feb 15 2017 - Gold not moving except to adjust to exchange rates! Posted: 15 Feb 2017 06:03 AM PST Shanghai was trading at 273.34 Yuan towards the close today. This equates to $1,238.40, but allowing for the different quality of gold being traded [.9999 fineness] and on today's exchange rate, to align it with New York and London prices it equates to $1,233.41. LBMA price setting: The LBMA gold price was set today at $1,225.15 down from yesterday's $1,229.65. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price To Surge As “Investors and Users Fighting Over Available Physical Supplies” Posted: 15 Feb 2017 05:59 AM PST What Mr. Butler's brilliant analysis has uncovered is extremely complex, so I've had to simplify it so I could understand it myself. Over the years, he has pointed to the technical hedge funds as the big buyers and sellers who move prices up and down. The big banks such as JPMorgan take the other side of these trades. These technical funds usually go long as prices rise and short as prices fall. They trade in and out of their positions based on price movements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Now devout Muslims can help bullion banks and central banks short gold Posted: 15 Feb 2017 05:27 AM PST Top Gold ETF Gets Islamic Finance Certification to Tap New Markets By Bernardo Vizcaino and Arpan Varghese The world's largest physically-backed gold fund said today it has been certified as sharia-compliant, the latest effort aimed at spurring demand for bullion from investors across majority-Muslim countries. Gold had traditionally been classified as a currency in Islamic finance, confining its use to spot transactions, but new guidance issued in December is making room for a wider range of investment products. The SPDR Gold Trust, an exchange-traded fund that holds 836.7 tonnes of bullion worth $33 billion, now falls in line with rules from the Accounting and Auditing Organization for Islamic Financial Institutions. World Gold Trust Services, a subsidiary of the World Gold Council (WGC), said in a statement to Reuters that the ETF had received the certification from Malaysia-based Islamic advisory firm Amanie Advisors. ... ... For the remainder of the report: http://www.reuters.com/article/islamic-finance-gold-idUSL4N1G005C ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rogers Reiterates His Call For A Crash Of Epic Proportions Posted: 15 Feb 2017 05:20 AM PST Last year we covered a number of big name investors’ warnings regarding the future of financial markets. Many had quite a stark view including George Soros’ Quantum Fund co-founder, Jim Rogers. This past May, Rogers had such a dismal outlook that he warned “A $68 trillion ‘Biblical’ collapse is poised to wipe out millions of Americans.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Intermediate Cycle Update Posted: 15 Feb 2017 05:14 AM PST NOTHING is certain or guaranteed in Markets.... ever. Anyone who tells you otherwise is a charlatan. That said, within Bressert's Cycle framework the norm is that a new Intermediate Cycle in any asset should test or breach the Intermediate Cycle downtrend before topping and those are my expectations based on my current analysis on both Gold and the USD. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bull Market? Or was 2016 Just a Gold Bug Mirage? Posted: 15 Feb 2017 05:03 AM PST The consensus view in the precious metals sector is that we have embarked on the next great bull market in gold and silver. The story is gold and the entire mining sector bottomed in early 2016 and launched into its first leg up into early August. The sector then underwent a stiff correction from August to December, and has now finally found its legs and the upward advance has resumed. Money is now flowing into exploration and development plays reflecting the belief in this narrative. I have an alternative interpretation of the markets action and I would like to share it with you. Intellectual integrity requires me to remain objective and skeptical of the market action since Jan 2016 due to various reasons we will discuss. As an investor I participated in last year’s colossal rally from start to finish, however I am NOT convinced the epic gold bear market which began in 2011 ended in early 2016. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price To Surge As “Investors and Users Fighting Over Available Physical Supplies” Posted: 15 Feb 2017 05:02 AM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 15 Feb 2017 01:37 AM PST US stocks at all-time highs on Trump tax-reform promise, gold and silver near multi-week highs. Trump national security adviser quits under Russian cloud. Debate over Putin intensifies. French election becomes even more complex. Best Of The Web Vice-chairman of EuroThinkTank: "euro may already be lost" – Mish Witch’s brew: sentiment up, complacency up – but […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What is Trump's US Dollar Policy? Posted: 14 Feb 2017 09:46 AM PST The United States Treasury Department has supported a strong dollar policy since its inception in 1789. Period. There were no qualifications or equivocations with that stance, especially since the ascendance of the dollar as the world's reserve currency. That's why it was so highly unusual when the newly confirmed Treasury Secretary, Steven Mnuchin, uttered this quote recently: "From time to time an excessively strong dollar could have a negative short-term effect on the economy." |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment