Gold World News Flash |

- Biggest EU Banks Embark On The Mother Of All Debt Binges

- China Net Imported 1,300t Of Gold In 2016

- The Mystery Of Wikileaks' Cryptic "Vault 7": Do You Know What This Means?

- CASHLESS GRID "War on Cash" BEGINS: EUROPE BEGINS ELIMINATION of PAPER MONEY.

- Coming Soon To A City Near You: The US Military's Plan To Take Over America

- Peter Schiff : AMERİCAN ARMAGEDDON INEVITABLE 2017

- Gold Price Closed at $1223.90 Down 0.50 Or -0.04%

- The Fall Of America and Rise Of Israel As The NWO ~ Sheikh Imran Hosein

- GoldMoney's brain trust discusses the new year's market outlook

- World's 2nd Largest Stockpile Of Gold Leaves The United States

- Mineral Specimen Collecting: Silver and Gold

- Ted Butler sees explosive potential in silver futures market positioning

- What is Trump's US Dollar Policy?

- Gold Seeker Closing Report: Gold and Silver Edge Higher In Mixed Trade

- Another Unique Blow-Off Factor

- Mike Ballanger: Remembering the genius of Hunter Thompson (and GATA)

- How to Survive an Economic Collapse. Are you prepared?

- Valentine's Day Is Golden

- Greece said considering ditching euro in favor of dollar

- China Net Imported 1,300t Of Gold In 2016

- Koos Jansen: China's net gold imports in 2016 were 1,300 tonnes

- Is This Metal Flashing the Hottest Chart on the Market Right Now?

- Gold and Silver Market Morning: Feb 14 2017 - Gold consolidating but U.S. gold ETF investors buying big!

- Breaking News And Best Of The Web

- Four Extraction Companies That Top BT Global Growth's List

- Top Ten Videos — February 14

- Remembering the Genius of Hunter S. Thompson

| Biggest EU Banks Embark On The Mother Of All Debt Binges Posted: 15 Feb 2017 12:30 AM PST Submitted by Don Quijones via WolfStreet.com, Spain’s three biggest banks, Banco Santander, BBVA and Caixa Bank, have got off to a flying start this year having issued €8.6 billion in new debt, seven times the amount they sold during the same period of last year. The last time they rolled out so much debt so quickly was in 2007, the year that Spain’s spectacular real estate bubble reached its climactic peak. Santander accounts for well over half of the new debt issued, with €5.12 billion of senior bonds, subordinate bonds, and a newfangled class of bail-in-able debt with the name of “senior non-preferred bonds” (A.K.A. senior junior, senior subordinated or Tier 3) that we covered in some detail just before Christmas. Investors beware...This newfangled class of bail-in-able debt was cooked up last year by French-based financial engineers in order to help France’s four global systemically important banks (BNP Paribas, Crédit Agricole, Groupe BPCE and Société Générale) out of a serious quandary: how to satisfy pending European and global regulations demanding much larger capital and debt buffers without having to pay investors costly returns on the billions of euros of funds they lend them to do so. That’s what makes senior non-preferred debt so ingenious: it pretends to be simultaneously one thing (senior), in order to keep the yield (and the cost for the bank) down, and another (junior) in order to qualify as bail-in-able. What it amounts to is a perfect scam for big banks to bamboozle bondholders – usually institutional investors like our beaten-down pension funds – into buying something with other people’s money that doesn’t yield nearly enough to compensate them for the risks they’re taking. Put simply, if a bank is resolved, holders of these instruments could lose much or all of their money, similar to stock holders. According to Olivier Irisson, executive chief financial officer at Groupe BPCE, France’s second largest bank, it’s a “very good compromise for investors and banks.” Judging by how they’re selling, yield-starved investors seem to agree. After the new bonds were rubber stamped by the Banque de France in mid-December, investors gobbled up €1.5 billion of Credit Agricole’s senior non-preferred 10-year bonds despite only receiving about 45 basis points more than they would get on traditional senior debt and about 65 basis points less than on subordinated. Voracious AppetiteSociété Générale quickly followed CA’s lead, issuing €3.5 billion of 5-year dollar-denominated notes. Investors lapped it up. During the same week BNP Paribas sold €1 billion of bail-in-able debt, a mere drop in the ocean compared to the €30 billion of senior non-preferred debt it hopes to raise by 2019. BPCE issued its first non-preferred deal in the second week of the year, a €1 billion six-year trade that attracted $2.4 billion of orders. It then launched an even riskier samurai (yen denominated) non-preferred trade, and most investors were not put off by the A- rating. “2017 will be the year of senior non-preferred,” said Vincent Hoarau, head of financial institutions syndicate at Crédit Agricole. Europe’s biggest banks certainly have a voracious appetite for new funds. The European Banking Authority recently estimated a €310 billion gap in all the region’s banks meeting their total loss absorbing capital requirements before the 2019 deadline. And much of that gap is expected to be filled by senior non-preferred bonds. The European Commission has already endorsed the financial instrument, rating agencies have also lent their approval and the ECB can’t wait to come up with “a common framework at Union level“. However, the legislation permitting its issuance is currently only in place in France and is not expected to be passed elsewhere in Europe before the second half of 2017, at the earliest. But certain banks have already jumped the gun, including Holland’s ING and Spain’s Santander, both of which have begun issuing senior non-preferred bonds despite the fact their issuance has not been officially sanctioned by each bank’s respective national regulator. Even more ominous, Italy’s fragile superbank, Unicredit, has also expressed an interest, though it will probably have to wait for Italy’s banking crisis, of which it has a major part, to blow over (assuming it can) before joining the party. A Staggering Volume of DebtEven by today’s inflated standards, the volume of debt the G-SIBs hope to issue in the next two years is staggering. Santander alone intends to issue between €43 billion and €57 billion, in order to meet the capital requirements that are scheduled to come into effect for the world’s 30 biggest banks on Jan 1, 2019. That’s between 60% and 75% of Santander’s entire market cap. And if everything goes according to plan, most of that debt — between €28 billion and €35.5 billion worth — will be issued in the form of senior non-preferred bonds. For the moment there’s little concern over investor appetite, says Demetrio Salorio, global head of debt capital markets at Société Générale Corporate & Investment Banking. “The investor base is keen,” he says. “They are far more at ease with the instrument than they were 18 months ago.” Spreads could even tighten, he reckons. All of which is testament to just how desperately starved of yield institutional investors have become in the NIRP environment as they’re trying to get their hands on financial instruments that offer virtually no security in exchange for the slimmest of additional returns. But the investor pain, when it’s time for it, should relieve taxpayers and the public. When the bank collapses and is being resolved or recapitalized, these bondholders are supposed to get bailed in and lose some or all of their investment. This would protect taxpayers at least to some extent from getting shanghaied into doing that job. And if institutional investors who take that risk don’t get paid enough for taking that risk, so be it. It’s just pension funds and retirement nest eggs under their management that will take the hit. Unless, of course, the government, under political pressure, decides to bail out those bondholders anyway with taxpayer money, as they’re doing in Italy’s banking crisis at the moment, on the pretext that these bondholders were naive retail investors who were missold a similar version of bail-in-able junior bonds. And so it would be back to square one. In Italy, the insider blame game has begun. Read… Italy’s Banking Crisis Is Even Worse Than We Thought | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Net Imported 1,300t Of Gold In 2016 Posted: 14 Feb 2017 11:09 PM PST Bullion Star | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Mystery Of Wikileaks' Cryptic "Vault 7": Do You Know What This Means? Posted: 14 Feb 2017 11:00 PM PST Submitted by Melissa Dykes via The Daily Sheeple, Starting on February 4th, each day Wikileaks began sending out a series of cryptic question Tweets teasing the world about "Vault 7". The questions were framed in Who, What, When, Where, Why, and How format (but not in that order). Each came with an image "clue". Here they are in chronological order starting with the earliest.

The first image, What, is the Svalbard Global Seed Vault, also referred to as the "doomsday seed vault" in Norway. The second image, Where, reportedly shows a cave Nazis used to store gold and other valuables in during World War II. The third image, When, has been located here:

The fourth image, Who, shows whistleblowers Bradley Manning, Edward Snowden, and Wikileaks founder Julian Assange on newspapers under the headline "infamous spies". The fifth image, Why, shows a welder… and gives us yet another Air Force reference.

The sixth and final image asks "How did #Vault7 make its way to WikiLeaks?" and shows us a retro image of a woman in a beret mailing something at a mailbox. So… What, Where, When, Who, Why and How did WikiLeaks Acquire Vault 7? People have a lot of theories on what this series of Tweets refers to. First, the Tweet Wikileaks sent immediately before its first Vault 7 Tweet had to do with the FBI releasing "Vault 6" of Hillary Clinton's emails.

Others, however, think it might have something to do with 9/11 and Building 7, considering the references to gold vaults, welding, and drones.

Maybe its about both, considering Hillary Clinton was a New York senator at the time of the 9/11 attacks. Either way, thousands of people are waiting on pins and needles wondering if Wikileaks is going to deliver on its conspiracy theory scavenger hunt. With a build up like that, it better be something good. We could use a little truth in this world right about now... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CASHLESS GRID "War on Cash" BEGINS: EUROPE BEGINS ELIMINATION of PAPER MONEY. Posted: 14 Feb 2017 10:00 PM PST Liberals are ruining Europe.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coming Soon To A City Near You: The US Military's Plan To Take Over America Posted: 14 Feb 2017 08:30 PM PST Submitted by John Whitehead via The Rutherford Institute,

The U.S. military plans to take over America by 2030. No, this is not another conspiracy theory. Although it easily could be. Nor is it a Hollywood political thriller in the vein of John Frankenheimer’s 1964 political thriller Seven Days in May about a military coup d’etat. Although it certainly has all the makings of a good thriller. No, this is the real deal, coming at us straight from the horse’s mouth. According to “Megacities: Urban Future, the Emerging Complexity,” a Pentagon training video created by the Army for U.S. Special Operations Command, the U.S. military plans to use armed forces to solve future domestic political and social problems. What they’re really talking about is martial law, packaged as a well-meaning and overriding concern for the nation’s security. The chilling five-minute training video, obtained by The Intercept through a FOIA request and made available online, paints an ominous picture of the future—a future the military is preparing for—bedeviled by “criminal networks,” “substandard infrastructure,” “religious and ethnic tensions,” “impoverishment, slums,” “open landfills, over-burdened sewers,” a “growing mass of unemployed,” and an urban landscape in which the prosperous economic elite must be protected from the impoverishment of the have nots. And then comes the kicker. Three-and-a-half minutes into the Pentagon’s dystopian vision of “a world of Robert Kaplan-esque urban hellscapes — brutal and anarchic supercities filled with gangs of youth-gone-wild, a restive underclass, criminal syndicates, and bands of malicious hackers,” the ominous voice of the narrator speaks of a need to “drain the swamps.” Drain the swamps. Surely, we’ve heard that phrase before? Ah yes. Emblazoned on t-shirts and signs, shouted at rallies, and used as a rallying cry among Trump supporters, “drain the swamp” became one of Donald Trump’s most-used campaign slogans, along with “build the wall” and “lock her up.” Funny how quickly the tides can shift and the tables can turn. Whereas Trump promised to drain the politically corrupt swamps of Washington DC of lobbyists and special interest groups, the U.S. military is plotting to drain the swamps of futuristic urban American cities of “noncombatants and engage the remaining adversaries in high intensity conflict within.” And who are these noncombatants, a military term that refers to civilians who are not engaged in fighting? They are, according to the Pentagon, “adversaries.” They are “threats.” They are the “enemy.” They are people who don’t support the government, people who live in fast-growing urban communities, people who may be less well-off economically than the government and corporate elite, people who engage in protests, people who are unemployed, people who engage in crime (in keeping with the government’s fast-growing, overly broad definition of what constitutes a crime). In other words, in the eyes of the U.S. military, noncombatants are American citizens a.k.a. domestic extremists a.k.a. enemy combatants who must be identified, targeted, detained, contained and, if necessary, eliminated. Welcome to Battlefield America. In the future imagined by the Pentagon, any walls and prisons that are built will be used to protect the societal elite—the haves—from the have-nots. We are the have-nots. Suddenly it all begins to make sense. The events of recent years: the invasive surveillance, the extremism reports, the civil unrest, the protests, the shootings, the bombings, the military exercises and active shooter drills, the color-coded alerts and threat assessments, the fusion centers, the transformation of local police into extensions of the military, the distribution of military equipment and weapons to local police forces, the government databases containing the names of dissidents and potential troublemakers. This is how you prepare a populace to accept a police state willingly, even gratefully. You don’t scare them by making dramatic changes. Rather, you acclimate them slowly to their prison walls. Persuade the citizenry that their prison walls are merely intended to keep them safe and danger out. Desensitize them to violence, acclimate them to a military presence in their communities and persuade them that there is nothing they can do to alter the seemingly hopeless trajectory of the nation. Before long, no one will even notice the floundering economy, the blowback arising from military occupations abroad, the police shootings, the nation’s deteriorating infrastructure and all of the other mounting concerns. It’s happening already. The sight of police clad in body armor and gas masks, wielding semiautomatic rifles and escorting an armored vehicle through a crowded street, a scene likened to “a military patrol through a hostile city,” no longer causes alarm among the general populace. Few seem to care about the government’s endless wars abroad that leave communities shattered, families devastated and our national security at greater risk of blowback. Indeed, there were no protests in the streets after U.S. military forces raided a compound in Yemen, killing “at least eight women and seven children, ages 3 to 13.” Their tactics are working. We’ve allowed ourselves to be acclimated to the occasional lockdown of government buildings, Jade Helm military drills in small towns so that special operations forces can get “realistic military training” in “hostile” territory, and Live Active Shooter Drill training exercises, carried out at schools, in shopping malls, and on public transit, which can and do fool law enforcement officials, students, teachers and bystanders into thinking it’s a real crisis. Still, you can’t say we weren’t warned. Back in 2008, an Army War College report revealed that “widespread civil violence inside the United States would force the defense establishment to reorient priorities in extremis to defend basic domestic order and human security.” The 44-page report went on to warn that potential causes for such civil unrest could include another terrorist attack, “unforeseen economic collapse, loss of functioning political and legal order, purposeful domestic resistance or insurgency, pervasive public health emergencies, and catastrophic natural and human disasters.” In 2009, reports by the Department of Homeland Security surfaced that labelled right-wing and left-wing activists and military veterans as extremists (a.k.a. terrorists) and called on the government to subject such targeted individuals to full-fledged pre-crime surveillance. Almost a decade later, after spending billions to fight terrorism, the DHS concluded that the greater threat is not ISIS but domestic right-wing extremism. Meanwhile, the government has been amassing an arsenal of military weapons for use domestically and equipping and training their “troops” for war. Even government agencies with largely administrative functions such as the Food and Drug Administration, Department of Veterans Affairs, and the Smithsonian have been acquiring body armor, riot helmets and shields, cannon launchers and police firearms and ammunition. In fact, there are now at least 120,000 armed federal agents carrying such weapons who possess the power to arrest. Rounding out this profit-driven campaign to turn American citizens into enemy combatants (and America into a battlefield) is a technology sector that has been colluding with the government to create a Big Brother that is all-knowing, all-seeing and inescapable. It’s not just the drones, fusion centers, license plate readers, stingray devices and the NSA that you have to worry about. You’re also being tracked by the black boxes in your cars, your cell phone, smart devices in your home, grocery loyalty cards, social media accounts, credit cards, streaming services such as Netflix, Amazon, and e-book reader accounts. All of this has taken place right under our noses, funded with our taxpayer dollars and carried out in broad daylight without so much as a general outcry from the citizenry. It’s astounding how convenient we’ve made it for the government to lock down the nation. So what exactly is the government preparing for? Mind you, by “government,” I’m not referring to the highly partisan, two-party bureaucracy of the Republicans and Democrats. I’m referring to “government” with a capital “G,” the entrenched Deep State that is unaffected by elections, unaltered by populist movements, and has set itself beyond the reach of the law. I’m referring to the corporatized, militarized, entrenched bureaucracy that is fully operational and staffed by unelected officials who are, in essence, running the country and calling the shots in Washington DC, no matter who sits in the White House. This is the hidden face of a government that has no respect for the freedom of its citizenry. What is the government preparing for? You tell me. Better yet, take a look at the Pentagon’s training video. It’s only five minutes long, but it says a lot about the government’s mindset, the way its views the citizenry, and the so-called “problems” that the military must be prepared to address in the near future. Even more troubling, however, is what this military video doesn’t say about the Constitution, about the rights of the citizenry, and about the dangers of using the military to address political and social problems. The future is here. We’re already witnessing a breakdown of society on virtually every front. By waging endless wars abroad, by bringing the instruments of war home, by transforming police into extensions of the military, by turning a free society into a suspect society, by treating American citizens like enemy combatants, by discouraging and criminalizing a free exchange of ideas, by making violence its calling card through SWAT team raids and militarized police, by fomenting division and strife among the citizenry, by acclimating the citizenry to the sights and sounds of war, and by generally making peaceful revolution all but impossible, the government has engineered an environment in which domestic violence has become almost inevitable. Be warned: in the future envisioned by the military, we will not be viewed as Republicans or Democrats. Rather, “we the people” will be enemies of the state. As I make clear in my book, Battlefield America: The War on the American People, we’re already enemies of the state. For years, the government has been warning against the dangers of domestic terrorism, erecting surveillance systems to monitor its own citizens, creating classification systems to label any viewpoints that challenge the status quo as extremist, and training law enforcement agencies to equate anyone possessing anti-government views as a domestic terrorist. What the government failed to explain was that the domestic terrorists would be of the government’s own making, whether intentional or not. “We the people” have become enemy #1. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff : AMERİCAN ARMAGEDDON INEVITABLE 2017 Posted: 14 Feb 2017 08:00 PM PST Peter's brilliantly timed 2006 0:04 trade against the housing market 0:06 inspired the book and the Academy 0:08 award-nominated movie the big short but 0:12 now a decade after Peter first predicted 0:15 the subprime mortgage meltdown 0:18 he's issuing an even more serious 0:20 warning the warning... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1223.90 Down 0.50 Or -0.04% Posted: 14 Feb 2017 07:58 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fall Of America and Rise Of Israel As The NWO ~ Sheikh Imran Hosein Posted: 14 Feb 2017 07:30 PM PST The Fall Of America and Rise Of Israel As The NWO ~ Sheikh Imran Hosein " And the Truth Should Set You Free "... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GoldMoney's brain trust discusses the new year's market outlook Posted: 14 Feb 2017 06:07 PM PST 9:08p ET Tuesday, February 14, 2017 Dear Friend of GATA and Gold: In a conversation posted at You Tube, GoldMoney's brain trust -- founder James Turk, CEO Roy Sebag, research chief Alasdair Macleod, and Vice President John Butler -- discuss the market possibilities for the new year and how gold may figure in them. They seem to agree that big changes are in the air. The conversation is 90 minutes long and can be viewed here: https://www.youtube.com/watch?v=OqmzB0PHOcE CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| World's 2nd Largest Stockpile Of Gold Leaves The United States Posted: 14 Feb 2017 05:17 PM PST

About 20 years ago when I was still a cadet at West Point, my economics professor organized a class trip to the Federal Reserve Bank of New York.

The part of the trip that I remember most was touring the Fed’s high security vault, 80 feet below street level beneath the bank’s main office building downtown. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mineral Specimen Collecting: Silver and Gold Posted: 14 Feb 2017 05:00 PM PST Alan Leishman | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler sees explosive potential in silver futures market positioning Posted: 14 Feb 2017 04:36 PM PST 7:37p ET Tuesday, February 14, 2017 Dear Friend of GATA and Gold: James Cook of Investment Rarities today interviews silver market analyst Ted Butler about another reason why Butler thinks positioning in the silver futures market is explosive. The interview is headlined "Another Unique Blow-Off Factor" and it's posted at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/article/another-unique-blow-factor-16329 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What is Trump's US Dollar Policy? Posted: 14 Feb 2017 01:46 PM PST The United States Treasury Department has supported a strong dollar policy since its inception in 1789. Period. There were no qualifications or equivocations with that stance, especially since the ascendance of the dollar as the world's reserve currency. That's why it was so highly unusual when the newly confirmed Treasury Secretary, Steven Mnuchin, uttered this quote recently: "From time to time an excessively strong dollar could have a negative short-term effect on the economy." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Edge Higher In Mixed Trade Posted: 14 Feb 2017 01:35 PM PST Gold gained $8.50 to $1234.40 by a little after 8AM EST before it dropped back to $1222.00 in late morning trade, but it then bounced back higher in afternoon trade and ended with a gain of 0.12%. Silver jumped up to $18.072 before it fell back to $17.772, but it then rallied back higher into the close and ended with a gain of 0.67%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another Unique Blow-Off Factor Posted: 14 Feb 2017 12:58 PM PST The world's foremost silver analyst Theodore Butler has done it again. He has elaborated another bullish factor so powerful it screams at us to buy silver. As you know, Mr. Butler is the supreme expert on futures trading in silver. The reason that this knowledge is so important is because the COMEX is the primary place where silver prices are set. Forget about China, the dollar, the economy or whatever reason the media reports. Billion dollar banks, hedge funds and computerized trading monolith's set the price on the COMEX. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Ballanger: Remembering the genius of Hunter Thompson (and GATA) Posted: 14 Feb 2017 11:15 AM PST 2:17p ET Tuesday, February 14, 2017 Dear Friend of GATA and Gold: Toronto-based market analyst Michael Ballanger, in commentary posted today at Streetwise Reports, praises GATA and GATA Chairman Bill Murphy's LeMetropoleCafe.com. Ballanger's commentary is headlined "Remembering the Genius of Hunter S. Thompson" and it's posted here: https://www.streetwisereports.com/pub/na/remembering-the-genius-of-hunte... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Drills Multiple High-Grade Gold Intersections Company Announcement K92 Mining Inc. (TSXV–KNT) announces the latest results from the ongoing grade control drilling program at its high-grade Kainantu Gold Mine in Papua New Guinea. K92 is ramping up the Kainantu gold mine toward commercial production, with its longest continuous production run to date now commenced. In September 2016 K92 began a campaign of close-spaced underground diamond drilling as part of a comprehensive grade-control strategy. The current grade-control drilling program is focused on the areas of Irumafimpa and is designed to bring a high degree of confidence to the production planning and scheduling. K92 plans to mine this area in the coming six months. The closed-space drilling pattern of approximately 15 metres by 15 meters has significantly increased the confidence in this sparsely drilled area, with most holes recording high-grade intersections. Approximately 80 percent of the holes completed to date have recorded multiple high-grade intersections indicating the presence of multiple parallel to sub parallel high-grade veins. ... ... For the remainder of the announcement: http://www.k92mining.com/2017/01/k92-drills-multiple-high-grade-gold-int... Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Survive an Economic Collapse. Are you prepared? Posted: 14 Feb 2017 11:00 AM PST Too many preparedness books are written by authors envisioning a Cold War style nuclear winter, and by people who have never lived through the crisis they describe. This book is different. If you're looking for detailed information about what life will really be like during and after a financial... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Feb 2017 08:51 AM PST The world's ultimate asset, gold bullion, continues to act superbly. That's because fundamental, cyclical, and technical price drivers are very positive and are in play at the same time. Gold is poised to burst upside from a small bull wedge pattern, after recoiling from $1250 area resistance. Support sits at $1222, and testimony from Janet Yellen today along with key US retail data tomorrow could be the fundamental catalysts that launch gold's next assault on that $1250 zone. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece said considering ditching euro in favor of dollar Posted: 14 Feb 2017 07:57 AM PST By Gareth Davies Greece is said to be considering ditching the euro in favour of the U.S. dollar in a devastating move that would humiliate Brussels. Donald Trump's pick for EU ambassador Ted Malloch claimed senior Greek economists are looking into taking on the American banknotes if the country turns its back on the European currency. Due to Greece's crippling financial crisis, officials are said to be desperately searching for an alternative to the Eurozone, which would "freak out" Angela Merkel, according to Malloch. Professor Malloch was interviewed on Greek TV, where he said Greece leaving the EU would be the best option for residents, and added the current situation is "simply unsustainable." "I know some Greek economists who have even gone to leading think tanks in the U.S. to discuss this topic and the question of dollarization,' he said, according to local press. ... ... For the remainder of the report: http://www.dailymail.co.uk/news/article-4222990/Greece-considers-ditchin... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Net Imported 1,300t Of Gold In 2016 Posted: 14 Feb 2017 07:27 AM PST For 2016 international merchandise trade statistics point out China has net imported roughly 1,300 tonnes of gold, down 17 % from 2015. The importance of measuring gold imports into the Chinese domestic gold market – which are prohibited from being exported – is to come to the best understanding on the division of above ground reserves in and outside the Chinese domestic market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: China's net gold imports in 2016 were 1,300 tonnes Posted: 14 Feb 2017 06:55 AM PST 9:57a ET Tuesday, February 14, 2017 Dear Friend of GATA and Gold: Reviewing official export data from the countries that export gold to China, gold researcher Koos Jansen concludes today that China imported about 1,300 tonnes of gold in 2016 while exporting very little if any. Jansen's analysis is headlined "China Net Imported 1,300 Tonnes of Gold in 2016" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/china-net-imported-1300t-o... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

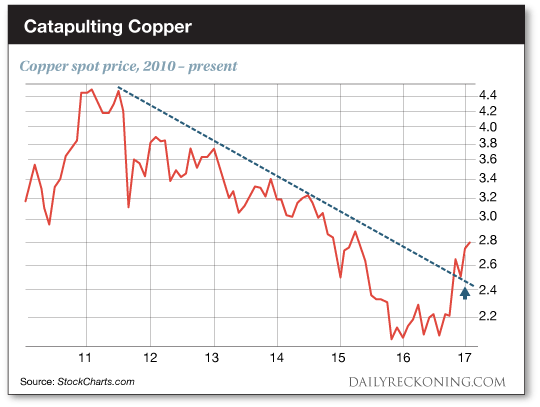

| Is This Metal Flashing the Hottest Chart on the Market Right Now? Posted: 14 Feb 2017 06:50 AM PST This post Is This Metal Flashing the Hottest Chart on the Market Right Now? appeared first on Daily Reckoning. Yesterday, we talked about how to avoid getting sucked into the collective stupidity of the "all-time high" rubberneckers. The markets continue to plow higher this week. The major averages are extending their gains. Different sectors and industries are popping up on our radar. Breakouts abound. To begin the trading week, I promised to share three powerful trends we’re looking to play in the days and weeks ahead. I'm revealing the first big idea right now. Even with all eyes on the roaring markets, this major breakout continues to build under the radar. Now's your chance to climb aboard before the herd catches on. Let's get down to business… The real moves under the surface of the major averages haven't earned much attention these days. That's too bad. Because if you want to actually profit from the next thrust higher, you have to know what names are fueling the fire. Right now, the market's giving us some clues. Just barely scratching below the market's surface reveals a couple of forgotten market niches that are set to line your pockets with profits. Just check out copper. While gold pulled back late last week, good ol' Dr. Copper launched to prices we haven't seen since 2015. Keep in mind, copper has endured a painful downtrend for six years. The metal has now exploded out of its long-term downtrend after building a solid base last year. It's time to get ready for some huge gains…

Your eyes aren't playing tricks on you. This chart goes all the way back to mid-2010 when copper prices were double what they are today. The copper bull had even trickled down to the criminal class seven years ago. Opportunistic thieves were snatching up copper wire from construction sites and selling it for scrap. Heck, they were even stealing copper downspouts off historic homes in broad daylight to make a buck. But there's no problem an extended bear market can't solve. As the commodity supercycle started to lose steam in 2011, so did the copper bandits. Spools of copper wire could safely sit overnight at jobsites once again. Back in the trading pits, folks lost interest in the metal as it sank back down near its financial crisis lows. After copper was left for dead, it took several months of bottoming action for this commodity to build a proper base. Finally, we saw the rumblings of a potential breakout back in October. Fast forward to this year and copper is ditching its downtrend for gains. Hop on the next leg of the base metals rally while you can… I'll be back tomorrow with another red-hot trading opportunity. You won't want to miss it. Sincerely, Greg Guenthner The post Is This Metal Flashing the Hottest Chart on the Market Right Now? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Feb 2017 06:18 AM PST Today sees Shanghai closed today, removing the Shanghai influence on the gold price. In the Chinese vacuum, western gold markets are using the opportunity to pull gold prices lower on a day when the dollar is slightly stronger but not sufficient to make the gold price fall. Hence, we see today as a day when we could see bargain hunters. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 14 Feb 2017 01:37 AM PST US stocks at all-time highs on Trump tax-reform promise, gold and silver near multi-week highs. Trump national security adviser quits under Russian cloud. Debate over Putin intensifies. French election becomes even more complex. Best Of The Web Witch’s brew: sentiment up, complacency up – but uncertainty also up – MATA SII The AI threat isn't […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Four Extraction Companies That Top BT Global Growth's List Posted: 14 Feb 2017 12:00 AM PST BT Global Growth's game plan is to go long and short on a wide range of investments, but in this interview with The Gold Report, Paul Beattie, cofounder and managing director of the hedge fund, focuses on four undervalued extraction companies on which the fund is definitely long. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Feb 2017 04:01 PM PST Silver has bottomed, the dollar has topped and politics will only get crazier. The post Top Ten Videos — February 14 appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Remembering the Genius of Hunter S. Thompson Posted: 13 Feb 2017 12:00 AM PST Precious metals expert Michael Ballanger ponders the timelessness of Hunter S. Thompson's "blistering attacks on the status quo" and their applicability to today's political landscape. He also reminds us of the "incredibly bullish" fundamentals for silver and lays out the evidence for why this precious metal is on its way to $25/ounce by mid-year. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment