Gold World News Flash |

- FTSE 250 sets new record high and dollar hits two-week high as 'Trump trade' resumes after US-Japan summit ends smoothly

- FTSE 100 eyes 7,300 and dollar hits two-week high as 'Trump trade' resumes after US-Japan summit ends smoothly

- The Norwegian Economy In 2017: Black Swans Hovering Overhead

- Silver Futures Market Assistance, Report 12 Feb, 2017

- GoldSeek.com Radio: John Williams and Peter Grandich, and your host Chris Waltzek

- Western central bank gold is running low, von Greyerz tells KWN

- The Inevitability of Economic Collapse

- The "Fake News" Psyop: Our Freedom Depends on the Freedom of the Press

- Gold Bull Market Surprises

- Chart of the Day - $GOLD

- Death of the Dollar: A New World Money

- Breaking News And Best Of The Web

- Jack Chan's Weekly Update on Gold and Silver

| Posted: 13 Feb 2017 02:02 AM PST This posting includes an audio/video/photo media file: Download Now |

| Posted: 13 Feb 2017 01:56 AM PST This posting includes an audio/video/photo media file: Download Now |

| The Norwegian Economy In 2017: Black Swans Hovering Overhead Posted: 13 Feb 2017 12:00 AM PST Submitted by Nick Kaman of Letters from Norway Introduction: Norwegians are just now starting to grapple with the effects of their “single cylinder” economy, mostly dependent on oil and gas (ca. 60% of exports). Despite optimism about $50-$70/barrel oil, American crude output is surging, on track to be the highest ever, since 1970, while cracks start to form in OPEC’s latest agreement. In addition to the oil tailspin, a flock of “black swans” have taken flight, led by one with a very orange beak.

The global sovereignty movement is in full swing. People are finally asking about the role of government, what they are getting in return for their taxes, and what they can do at home. The Chinese economic risks as well as the continued fracking proliferation, now going global, pose the greatest threat to oil prices in 2017. That is already evident in the latest supply report. Meanwhile, Norway continues to spend its’ savings instead of investing it into a new economic engine. Even worse, individual Norwegians keep digging themselves into debt. Oil: Global Fracking Proliferation: When OPEC challenged America, it forced the engineers on the Great Plains to innovate. Fracking continues to get better cheaper and faster, driving the costs down to $45 per barrel! Now the technology is going global, bringing more oil to market. That may explain the surging inventories.

Sources: Baker Hughes and EIA The chart above illustrates that when oil held $50 per barrel, the rigs started to come back online markedly, proving that fracking breakeven costs fell substantially. Innovation and cost reduction are now a way of life for the American Roughnecks. Moreover, there are almost 2000 more rigs standing by. Rarely acknowledged are the breakeven costs lowered by bankruptcy and the subsequent reassignment of assets. For example: If Joe’s Fracking Service purchased a brand new rig for $1000 and then went bankrupt during the last downturn, the rig and accompanying exploration data still remain. At a fire sale, Jimmy’s Energy can pick up that rig for $300-$400, if not cheaper, and start drilling at a much lower cost level, making money even with low prices. Perhaps that explains the surging inventories. Hence, the EIA predictions (below) may be overly optimistic.

On a side note: Although Norway’s Johan Sverdrup field now breaks even at $20-$30 per barrel and is one of the largest discoveries made on the Norwegian continental shelf (2-3 billion barrels of oil in reserves), the Norwegian Government requires $70 per barrel oil to break even, balancing the budget. Statoil estimates that construction will take 51,000 man-years (ca. giving 17,000 people a job for three years) and 2,700 man years in the production phase (ca. 54 people a job for 50 years). After going online, it will account for 25% of total Norwegian oil production. Putting this find, ca. 3 billion barrels, into perspective, America consumes 7 billion barrels of oil per year. Hence, Sverdrup, spread over 50 years, may buffer the economy but not save it. Trade: Fishing for Deals: After oil and minerals, fish is the next largest export. 2016 was the year of awakening: With the lowest trade surplus in 17 years, The Norwegians realized their vulnerability to the oil and gas sector.

The chart below further illustrates the oil dependency predicament. The trade surplus is what made Norwegian’s rich, giving them a strong currency and funding the welfare state without consequences. That allowed for some of the highest salaries (before the oil bust) in the world while maintaining the shortest work weeks. As the trade surplus diminished, the NOK went down with it. Overall 2016 exports were $90 billion vs. $149 billion in 2013.

Source: SSB.no and Norges Bank for FX Rates A weakened currency, in theory, is good for exports. However, one needs something to sell abroad to take advantage of that. Since early 2013, the NOK fell 46% against the USD, moving from ca. 5.7 to 8.3 now. It almost hit 9, just after New Year 2016! Ironically, Norway was exporting more and running a larger surplus when the currency was stronger.

Source: Yahoo Finance – USDNOK over 10 years. Realizing that oil, priced in dollars, was not viable, no matter the exchange rate, the Norwegian Government started to panic. Instead of looking for ways to industrialize or make the economy smart, “they went fishing.” Although fish exports are rapidly growing, they are still relatively small, compared to overall exports: only around $11 billion in 2016. Moreover, they already forgot that commodity-based economic models are either be overcome with technology or replicated. Fish farms only require and open ocean, preferably in cold water, and a pen. It is a matter of time before people in Maine, New Foundland, Alaska, Russia and Greenland pick up on this trend. Moreover, large-scale salmon farming has its’ own issues like sea lice, which have plagued the fish farms in recent years. From a position of disadvantage and without leverage, at the behest of the fishing industry, they started selling out everything to gain access to new seafood markets. Currently, the Norwegian government is selling their souls to China, agreeing not to criticize them on human rights, and their brains to India, potentially compromising domestic labor standards to accommodate cheap offshore labor. Over time, such deals will diminish Norway’s national identity as a humanitarian country. Moreover, the “fish for brains” deal with India will deter Norway’s best and brightest from entering the engineering profession altogether, fearing offshore replacement and limited salary potential. Right now Norway is in dire need for homegrown talent, with a vision, innovating and moving the country forward and away from resource dependence. If the Government compromises labor standards to appease the fishing industry, the best and brightest will choose other professionals or go abroad, seeking higher pay and a better life. Engineering has been a part of Norway’s history, selling it off is a bad idea!

One great example of Norway’s engineering ability is in their defense sector. One company, in particular, is very interesting; Kongsberg Gruppen which has been growing through both by increasing sales and performing acquisitions. Their surface to air missiles system protects President Trump! Considering the current state of the world and where it’s going, this sector should be developed. Additionally, defense technologies often result in consumer applications: sensors, security, and electronics. Norway will increase defense spending in coming years, reaped from cost-cutting in other areas, hinting that they are at least moving in the right direction on industrial development. Hence, this industry should be emphasized: not fishing. Interest Rates & Inflation and the Wealth Fund Despite real interest rates and economic growth remaining negative for almost four years, there is no indication of raising rates to curb inflation or lowering them to continue support housing. Nevertheless, the bias remains downwards, willing to step in if needed (indicated in a September release by Norges Bank). Although interest rates are at historical lows, Norwegian economic growth remains anemic. Just like with the exchange rates and exports paradox mentioned earlier, low-interest rates are not helping the economy. It’s only boosting inflation, caused by having to pay more for imports due to cheaper currency.

Source: Norges Bank and SSB Norway started cashing in the Sovereign Wealth Fund in 2016, denominated in foreign currency. Norges Bank needed to buy NOK to fund the local economy, unintentionally supporting the Krone. Perhaps these purchases are all that kept the Norwegian Krone from turning into the Nordic Peso. The purchases started in October 2014 at 500 million NOK per day, quickly jumped to 700 million and now reached 1 billion NOK per day. At this level, the fund has 20 years, assuming stocks and bonds remain stable and they don’t hike the daily purchase rate again. That is only one generation of the good life left! However, the market’s tone has turned markedly bearish: Larry Fink of BlackRock recently warned about hidden risks (the “Horrifying” Chart) Ironically, Norway is a labor country that depends on strong corporate earnings. As American companies start paying their employees better, bringing more money to the middle class, the corporate profits will suffer, perhaps impacting the fund. Norges Bank sold all of its’ gold in 2004, but perhaps they should think about buying it back. Although off highs in USD it’s at near all-time highs in NOK.

Government Spending Although the government reined in the budget compared to previous years, the surplus (source 32 below) is the lowest in ten years. Moreover, the expenditure per person (Budget/Person) has dropped substantially due to rapidly rising population on the back tax revenues, which have not risen in lockstep. Every Norwegian has almost $170,000 in national savings, but when considering the local prices, it won’t last long. Although having an economy buffered better than any other in the world, the policy makers need to make a strategic shift. Otherwise, Norway will diminish over time. The risk of social unrest lingers along this path: when people see a reduction in benefits or a decline in the quality of public services. |

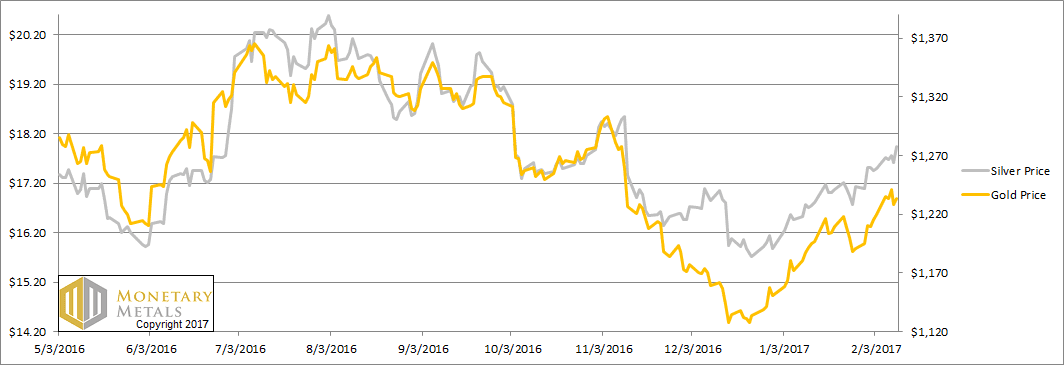

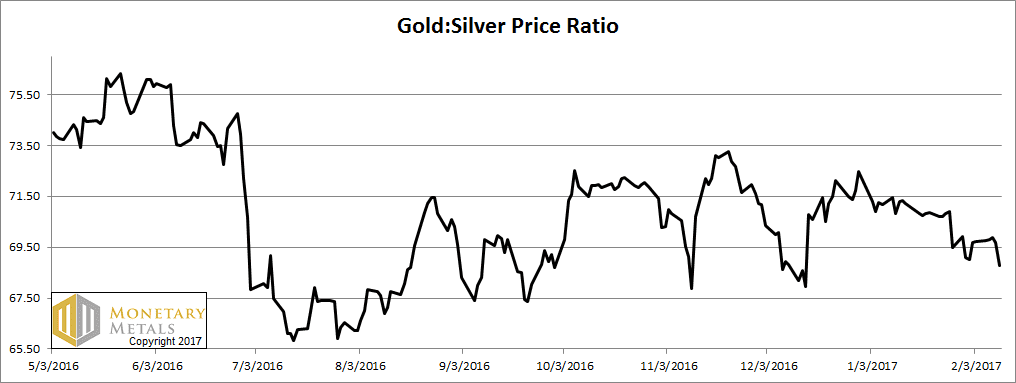

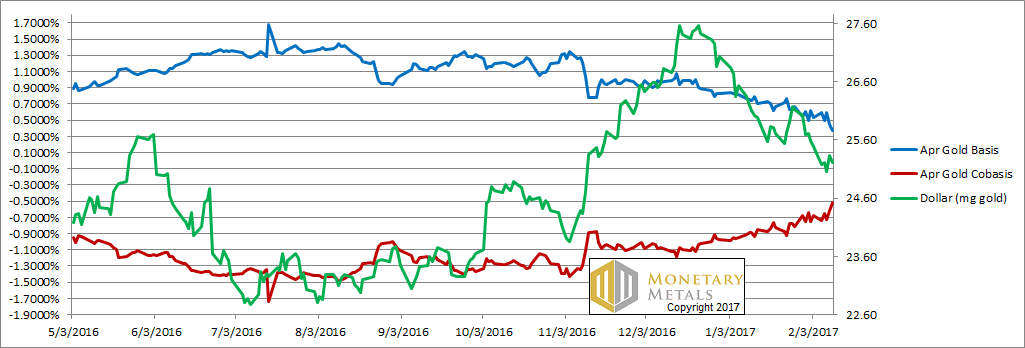

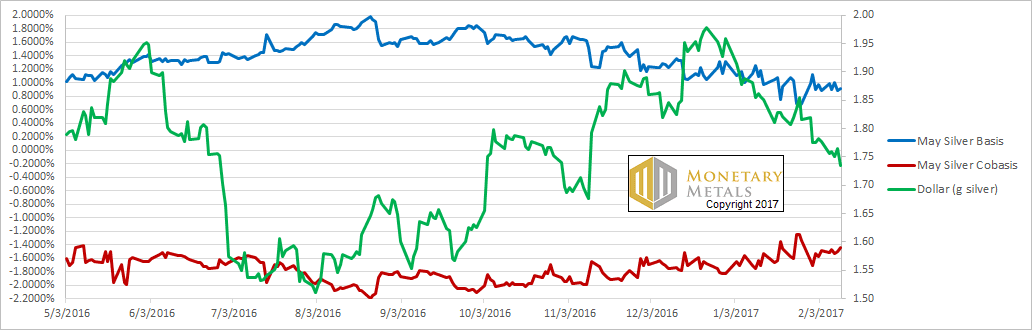

| Silver Futures Market Assistance, Report 12 Feb, 2017 Posted: 12 Feb 2017 09:35 PM PST This week, the prices of the metals moved up on Monday. Then the gold price went sideways for the rest of the week, but the silver price jumped on Friday. Is this the rocket ship to $50? Will Trump's stimulus plan push up the price of silver? Or just push silver speculators to push up the price, at their own expense, again? This will again be a brief Report this week, as we are busy working on something new and big. And Keith is on the road, in New York and Miami. Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. The Prices of Gold and Silver Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell this week. The Ratio of the Gold Price to the Silver Price For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Price Again, we see a higher price of gold (shown here in its true form, a lower price of the dollar) along with greater scarcity (i.e. cobasis, the red line). This pattern continues. What does it mean? First, it means the price of gold is being pushed up by buyers of physical metal. Not by buyers of futures (which would push up the basis, and reduce scarcity). Second, if it continues too much more, it means nothing good for the banking system. There is one force that can make all the gold in the world—which mankind has been accumulating for thousands of years—disappear faster than you can say "bank bail in". The force is fear of counterparties, fear of banks, fear of currencies, fear of central bank balance sheets… fear of government finances. We want to emphasize that the gold basis is not signaling disaster at the moment. It is merely moving in that direction, for the first time in a long time. It has a ways to go yet. Our calculated fundamental price is up another $40 (on top of last week's +$40). It is now about $130 over the market price. Now let's look at silver. The Silver Basis and Cobasis and the Dollar Price Note: we switched to the May contract, as March was becoming unusable in its approach to expiry. In silver, the story is a bit less compelling. The scarcity of the metal is holding, as the price rises. However, scarcity is not increasing. Were we to take a guess, we would say there is some good demand for physical, and the price action had futures market assistance. While the market price moved up 44 cents, our calculated fundamental price moved up … 46 cents. © 2016 Monetary Metals |

| GoldSeek.com Radio: John Williams and Peter Grandich, and your host Chris Waltzek Posted: 12 Feb 2017 09:00 PM PST Rogue economist, John Williams of Shadowstats.com says the US dollar rally is a fata morgana, a rate hike bluff by Fed policymakers. The 2008 market collapse / Great Recession never ended; the Treasury / Fed merely sidestepped financial calamity at an enormous cost. Peter Grandich of Peter Grandich and Company and host discuss one analyst's call for a seemingly outlandish silver price range of $100,000-1,000,000 silver. Bix Weir makes a solid case for a 1:1:1 gold / silver / Dow ratio due to unique supply / demand conditions. |

| Western central bank gold is running low, von Greyerz tells KWN Posted: 12 Feb 2017 04:31 PM PST 7:32p ET Sunday, February 12, 2017 Dear Friend of GATA and Gold: Swiss gold fund manager Egon von Greyerz, in commentary at King World News, says he believes that Western central bank gold is running low after many years of plugging supply shortages and that this conclusion is supported by the U.S. Federal Reserve's inability to return to the German Bundesbank the metal Germany thought it had deposited there. Von Greyerz's commentary is posted at KWN here: http://kingworldnews.com/alert-gold-is-rallying-because-western-central-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Inevitability of Economic Collapse Posted: 12 Feb 2017 02:31 PM PST While I haven't had the privilege of divine revelation, I do try to look at the forces that are in play that have the power to move nations economically. Two dominant countervailing forces right now are those who have George Soros nearly in tears — who make up the anti-global revolution — and then all the globalists like Soros who are panicking that their new world order is being shredded accompanied by all the raging anarchists that Soros can sponsor as his mercenaries. |

| The "Fake News" Psyop: Our Freedom Depends on the Freedom of the Press Posted: 12 Feb 2017 02:00 PM PST "Our liberty depends on the freedom of the press, and that cannot be limited without being lost." ~Thomas Jefferson The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 12 Feb 2017 10:31 AM PST In a bull market surprises come to the upside and it’s never advisable to lose one’s core position. This rally isn’t going to top until sentiment gets excessively bullish. Right now sentiment is dead neutral and it will take 5-10 more weeks before sentiment reaches 75% or higher. |

| Posted: 12 Feb 2017 09:37 AM PST In a bull market surprises come to the upside and it's never advisable to lose one's core position. This rally isn't going to top until sentiment gets excessively bullish. Right now sentiment is dead neutral and it will take 5-10 more weeks before sentiment reaches 75% or higher. |

| Death of the Dollar: A New World Money Posted: 12 Feb 2017 09:33 AM PST This post Death of the Dollar: A New World Money appeared first on Daily Reckoning. Since the creation of the international monetary system, the divide over financial and monetary policy has always been present. With the evolutionary rise in power of a new world money, everything has changed. Understanding the history, construction and evolution of this new world money system will allow you to better position yourself for the future. The U.S dollar has been the world’s reserve currency for decades since World War II. The dollar has been synonymous with strength, stability and general confidence in the United States Government. That is all in question now. Studying the real history of the special drawing rights (SDR), what some have coined as new world money, will allow you to understand exactly why the evolution of the international currency matters even more today. "Good as Gold"Following the conclusion of World War II, the United States held an estimated 60% of all of the world's gold reserves officially on record. As one of the few regions that was geographically isolated from being a physical battleground, war-inflicted countries had high demand for U.S goods and services that were continuing to produce at high levels without major disruption. The massive flow of capital both in and out of the United States in the 1940s left considerable fear of dollar shortages in order to account for demand. As European countries began to rebuild, so did their gold and dollar reserves. Once the European continent and other developed countries began reinstituting their national currency institutions, an overwhelming demand to convert dollars back to gold began. The U.S status as "good as gold" was no longer as hot on demand as the ultimate reserve currency. The international demand hit critical mass and pressure mounted for a diplomatic resolution. The IMF: Aftermath of WWIIDeveloped at a United Nations gathering in Bretton Woods, New Hampshire in 1944 the international community sought to build a new monetary system. The gathering was officially titled the United Nations Monetary and Financial Conference. The outcome would bring about the creation of International Bank for Reconstruction and Development (IBRD) and the International Monetary Fund (IMF). These institutions were the first of their kind. The IBRD would later develop under the World Bank Group of organizations which would be responsible for developing poverty reduction programs. The World Bank primarily functions as an institution that offers loans to developing countries and a variety of infrastructure based projects in the developing world. At the time the organization was built up with 44 member state countries. Respectively, every participating member put forward constructive efforts to build a method for economic cooperation in order to not only save succeeding generations from the scourge of war but to avoid another Great Depression of the 1930s that devastated the global economy. At the time of its creation the IMF was established in order to maintain stability and effectiveness of the international monetary system. The IMF was directed by the participating member states to ensure a secure system of exchange rates and ultimately facilitate countries in having international financial transactions with one another. TraditionThe IMF maintains a history of selecting executive leadership of European nationality. The organization was a de facto European rebuilding and restructuring facility upon its creation at the conclusion of World War II. The European continent was in economic disarray and required significant coordinated effort to emerge from the deep divide created. As an institution created primarily by western member states, it became a mechanism for the west – by the west in many ways. Monetary policy and financial discrepancy was, then, at the forefront of IMF focus in redeveloping Europe. That would quickly evolve as the IMF began to reach into the financial dealings of nearly every major economy around the world. Since that time, the modern age of the IMF has held tight to its tradition of promoting Europeans to lead as Managing Directors of the Fund. Recently, scandal has flooded the leadership ranks of the Fund. The former head of the IMF, Dominique Strauss-Kahn, was forced in 2011 to resign after a major required him to step down. Currently, Christine Lagarde, another French national holds the title of Managing Director. Lagarde is the fifth French head of the organization and the first female to hold such a role. She has also face considerable legal backlash and eventually was convicted in French courts on charges of misusing public funds. Examining its counterpart, the World Bank is currently under leadership of its 12th American leader. American nationals have unanimously held the Presidency role at the World Bank since the Bretton Woods inception. Both organizations are headquartered in Washington, D.C and are within several blocks of the White House. The traditions held of both the IMF and the World Bank will later prove to be critical in the shaping of this new world money. As the spread of the fiat currency system continued, it took leadership finesse to not only sell the system being proposed – but to impose a system to rival the dominance of the U.S dollar in the future. World money was not the end goal, it was a byproduct of leadership understanding and member state desires for separating from the U.S dollar. Soviet OppositionAt the time, the United States controlled nearly two thirds of all of the official gold reserves in the world. Under these conditions, the U.S dollar and gold would be the standards at which the world would flock toward for security and stability.

The USSR would charge that the institutions creation were simply, "branches of Wall Street." A later Soviet Foreign Ministry memorandum discovered from December 1945 revealed the central sentiments of the gathering by summarizing,

Ben Steil, author of "The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order," even theorizes that the Soviet Union saw the gathering as a point to instruct a senior U.S. Treasury official who was deemed a Soviet spy, Harry Dexter White to undermine efforts of major British economists. The Soviets viewed the gathering at the Mt. Washington Hotel in Bretton Woods as the U.S positioning itself to take over from Great Britain's history of dominance as a global financial power and to officially lament the dollar as the major global reserve currency. The USSR was not entirely isolated from the international community, however. The Soviets maintained firm engagements at the United Nations where the remained a permanent voting member of the Security Council – allowing them veto power on any international action to be taken by the body. The Chinese would later take the understanding of the Soviet empire and apply it when navigating world money to come. Triffin's Dilemma 1961Robert Triffin was a Belgian economist that was an academic and professor at Yale and Berkeley College. He is widely celebrated as a gold, international monetary system and overall currency expert. Within his writing from 1961 on Gold and the Dollar Crisis: The Future of Convertibility, the IMF received its greatest pushback on the value systems inherent flaw, commonly known as the Triffin Dilemma. What Triffin theorized was that as long as the U.S dollar remained the leader in foreign exchange reserve assets, the world would continuously elevate trade and finance that comes with a growing supply of dollars. The increase in stock of dollars would, in effect, require a constant deficit in the U.S balance of payments. What Triffin believed was that along with continued deficits, the pressure on the U.S dollar would shake confidence and disrupt the Bretton Woods established monetary systems in place. This would continue to place considerable pressure on the overall value of the U.S dollar. Throughout the 1960s and 1970s, the Vietnam War raged on which caused the United States to build up considerable trade deficits, causing the dollar to be seen as overvalued. Those governments who held dollars believed they had to offload, diversify or attain gold in reserves. The theory highlighted a clear division of interests between domestic and international objectives in the global economy. Those official holders of U.S dollars would continue to have a concern that the value of their reserves would (or could) decrease in comparison to the value of gold. Group of 10 Meeting 1966

Schweitzer was a French national who even survived internment in a Nazi concentration camp. Under his leadership the IMF produced a now infamous annual report that highlighted the "Need for Reserves." He understood well the need for monetary funds outside of a centralized system. The report concluded that:

It went on to set the foundation that, "Drawing rights are thus effectively transferred from the drawing country to the drawee country; the currencies purchased are used directly, or after conversion, for the settlement of international transactions." Keynes and Visions of World MoneyJohn Maynard Keynes, a British economist, developed his own type of international currency after elaborating in his notable works in The Means to Prosperity (1933) and his proposal for the creation of an International Clearing Union (1944). Keynes developed a conceptual theory of expanding the global integration of a single international monetary policy. Keynes took it a step further. His proposal was for a new supranational currency, which he titled bancor, that the celebrated economist later devised should be used as international standard. He wrote: "We need an instrument of international currency having general acceptability between nations… We need an orderly and agreed upon method of determining the relative exchange values of national currency units… We need a quantum of international currency which is governed by the actual current [liquidity] requirements of world commerce, and is capable of deliberate expansion. We need a method by which the surplus credit balances arising from international trade, which the recipient does not wish to employ can be set to work…" Sourced via IMF reform on Keynes Plan What Keynes developed was what some consider the original groundwork for SDR's. His idea of bancor may have been more cosmopolitan, but the theoretical commodity at least had a proposed backing that included gold. In comparison, what would later become SDRs are constructed purely of confidence in the system. While Keynes might have had commodities integrated in support of his fictitious currency, the SDR does not even offer to make such arrangements in the future. September 1967Finance ministers gathered in Rio de Janeiro to discuss bookkeeping issues in September 1967. The creation of the Special Drawing Rights was officially outlined. The terminology of "special drawing rights" were given as an alternative to "reserve drawing rights" after the French leadership of the organization insisted that the SDR unit would be observed as a loan from the IMF, not a currency unit. This SDR would be offered as a direct substitute for supplementary gold and dollar reserves held by government organizations, primarily central banks. After continued French opposition to currency unit status and pressure toward creating an autonomous IMF "loan unit," the SDR would be implemented for repayment purposes, and not have associated inflationary fluctuations. This distinction would be highly disputed and shape the eventual direction of new world money. U.S ReactionThe U.S Treasury Secretary in 1967, Henry Fowler, remarked, "”This is the most ambitious and significant effort in the area of international monetary affairs since Bretton Woods.” Even the U.S Federal Reserve Chairman William McChesney Martin, who rarely made public statements or positive reaction called the agreement for SDRs a true "milestone" for the United States. By 1968, a year later, Chairman Martin testified before the United States Senate Committee on Foreign Relations noting that, "Establishment of the system of Special Drawing Rights in the International Monetary Fund will mean that the growth of international monetary reserves will for the first time be subject to rational international decision. The need for establishing such a system arises from vital interests in maximum employment, production, and trade. All countries want their reserves to grow over time, with the growth of international trade and payments, but the supply of existing kinds of reserve assets, including gold, clearly will not be enough to meet this need." The Fed had officially made its argument to the U.S government in full, following the international efforts, to back the SDR and have the U.S be an active participant in the monetary system. This new world money not only had a name, now it had value given from the strongest economic authority. New World Money Emerges 1969Meeting on October 2, 1969 the "Group of 10" would officially agreement to support the creation and applications of the SDRs. The unanimous vote was met with caution from all sides, as the U.S viewed the European block as a threat and consequently the Europeans (in particular the French) were hesitant about the influence of the U.S dollar. News of the drawing rights vote never managed to make it to front headline news. The New York Times ran the story on page 78 and devoted a meager 10 lines to the landmark deal. The new world money at the time of its creation was set at an equivalent to 0.888671 SDR for a gram of fine gold. At that time, the exact figure just so happened to also be the amount of gold that could be purchased with one U.S dollar. This world money would officially equal the amount of foreign exchange reserves for which a member country was allowed to contribute. The SDR could only be held and utilized by member countries, the IMF (which applied it as a unit of reserve accounts in holding), and specifically designated organizations (like the World Bank). As one academic study concluded:

Economist Jim Rickards reviews, "So the U.S ran trade deficits, the world got dollars and global trade flourished. But if you run deficits long enough, you go broke. That was Triffin's dilemma." "Any system based on dollars would eventually cause the dollar to collapse because there would either be too many dollars or not enough gold at fixed prices to keep the game going." "This paradox between dollar deficits and dollar confidence was unsustainable." In the chart listed you will find the first allocation of special drawing rights listed out with the top ten net contributors to the mechanism from January 1, 1970. The underdeveloped countries that contributed had allocations of SRD's that totaled $275 million, or about one half of the amount allocated to the U.S in the first year. The benefits of this |

| Breaking News And Best Of The Web Posted: 12 Feb 2017 01:37 AM PST US stocks at all-time highs on Trump tax-reform promise, gold and silver near multi-week highs. Trump immigration plan challenged in court, loses. Debate over Putin intensifies. French election uncertainty rocks euro bonds Best Of The Web Bubbles, money and the VIX – Credit Bubble Bulletin Are you prepared for "unencumbered" interest rate policy? – Daily […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Jack Chan's Weekly Update on Gold and Silver Posted: 11 Feb 2017 12:00 AM PST Jack Chan charts both long- and short-term buy signals for gold and silver. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

"Even in 1967, Otmar Emminger the Vice President of the German Bundesbank asked whether the SDR

"Even in 1967, Otmar Emminger the Vice President of the German Bundesbank asked whether the SDR

No comments:

Post a Comment