Gold World News Flash |

- Very Bullish Set Up In The Metals Complex

- Critically High U.S. Silver Supply Reliance In Jeopardy When Paper Markets Crack

- Harry Dent: Stocks Will Fall 70-90% Within 3 Years

- Stock Market Melt-up Brings Volatility to Precious Metals

- The History Of Money (In One Simple Infographic)

- 'Stop Operation Soros' Movements to ban billionaire-funded groups sweep across Europe

- FATCA Needs To Go, But Unfortunately, The FATCA "Refugees" Are Never Coming Back

- This Won't End Well - China Skyscraper Edition

- The Other 'Ban' That Was Quietly Announced Last Week

- The European Union Trembles

- Dollar Faces Death Knell -- John Williams of Shadowstats

- This Bond Bull Isn’t Dead Yet

- 30 Charts Proving We’re In The Mother of All Financial Bubbles

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 2%

- How Trump’s tax cut plan affects manufacturing

- Gold Price is One Tweet Away from New Highs

- Jobs Report Week: Gold Stays Firm

- FTSE 100 falters but pound enjoys best January since 2011 as Trump policy jitters weigh on dollar

- Gold Braces for the Trump Dump

- Jobs Report Week: Gold Stays Firm

- Gold Price +8% in 2017 Says Top LBMA Forecast

- Anyone Who Believes Trump Will Ignite a $USD Bull Market Will Get Taken to the Cleaners

- The Chinese Credit Bubble

- Silver, Platinum and Palladium As Safe Havens – Reassessing Their Role

- More hints that Trump's trade policy will focus on currency valuations

- Cycles for Gold and USD

- Breaking News And Best Of The Web

- The Crack-up Boom Is Ending and That’s Very Bullish for Gold

- Environmental Permitting Process Advancing at NOVAGOLD's Donlin Gold Project

- Long Liquidation Looks Bullish for Gold

- Trump's Trade Policy to Drive Price Inflation and Gold Buying

- US Dollar Chartathon

| Very Bullish Set Up In The Metals Complex Posted: 01 Feb 2017 07:09 AM PST So, in the bigger picture, as long as we do not break our support levels, I will be looking for a break out over resistance. Should we see a strong break out over the highs struck this past week in GDX, as well as silver taking out 17.50, that is our trigger telling us the market is likely heading back up towards the August highs to complete wave 1 of wave iii. And, since we only deal in probabilities and not absolutes, should we break the cited supports before such break out is seen, it would make me question the potential bullish set up. But, for now, the market has done exactly what it needs to do to set us up in a larger degree bullish posture. |

| Critically High U.S. Silver Supply Reliance In Jeopardy When Paper Markets Crack Posted: 01 Feb 2017 07:06 AM PST The U.S. silver supply will likely be in jeopardy in the future when the highly inflated paper markets finally crack. This is not a matter of if, but WHEN. If we consider the top two precious metals and copper, silver has the highest net import reliance as a percentage of domestic consumption. |

| Harry Dent: Stocks Will Fall 70-90% Within 3 Years Posted: 01 Feb 2017 12:30 AM PST Submitted by Adam Taggart via PeakProsperity.com, Economist and cycle trend forecaster Harry Dent sees crushing deflation ahead for nearly every financial asset class. We are at the nexus of a concurrent series of downtrends in the four most important predictive trends he tracks. Laying out the thesis of his new book The Sale Of A Lifetime, Dent sees punishing losses ahead for investors who do not position themselves for safety beforehand. On the positive side, he predicts those that do will have a once-in-a-generation opportunity to buy assets at incredible bargain prices once the carnage ends (and yes, for those of you wondering, he also addresses his outlook for gold):

Click the play button below to listen to Chris' interview with Harry Dent (44m:31s). |

| Stock Market Melt-up Brings Volatility to Precious Metals Posted: 31 Jan 2017 09:37 PM PST Our recent analysis bases on a previous report of the potential for a further run in the US markets based on a number of technical and fundamental factors leads to the question of "what could happen with Gold and Silver". A broad US market rally may put some pressure on the metals markets initially, but, in our opinion, the increase in volatility and uncertainty will likely prompt more potential for upward price action in precious metals. As with most things in the midst of uncertainty and transition, the US Presidential election has caused many traders to rethink positions and potential. As foreign elections continue to play out, wild currency moves are starting to become more of a standard for volatility. Combine this with a new US President and a repositioning of US global and local objectives and we believe we are setting up for one of the most expansive moves in recent years for the US general markets and the metals markets. This week, alone, we have seen a flurry of action in DC and the US markets broke upward on news of the Dakota Pipeline and other Executive actions. |

| The History Of Money (In One Simple Infographic) Posted: 31 Jan 2017 07:25 PM PST Today’s infographic from Mint.com highlights the history of money, including the many monetary experiments that have taken place since ancient times...

Courtesy of: Visual Capitalist As VisualCapitalist's Jeff Desjardins notes, some innovations have stood the test of time – precious metals, for example, have been used for thousands of years. Paper money and banknotes are also widespread in use, after first being turned to in China in 806 after a copper shortage prevented the minting of new coins. Other experiments didn’t have much staying power. The adoption of strange currencies such as squirrel pelts, cowry shells, or parmesan cheese are only remembered for their peculiarity. Further, other attempts to stabilize the monetary system were abandoned early as well. The original U.S. gold standard lasted just 54 years, after FDR ditched it during the Great Depression. The Bretton Woods version (gold-exchange standard) lasted even shorter, abandoned after being in place for 26 years when Nixon ended all convertibility between the U.S. dollar and gold in 1971. THE NEWEST CHAPTER IN OUR MONETARY HISTORYAlthough the infographic ends with the introduction of cryptocurrency in 2009, it should be noted that the newest chapter in the history of money is taking place right before our eyes. The “War on Cash” has been accelerating in recent years, as governments and central banks have called for the elimination of high denomination banknotes. While these anti-cash motions have also been made in many Western countries, the most vivid example of the demonetization is currently happening in India. In November 2016, Indian Prime Minister Narendra Modi demonetized 500 and 1000 rupee notes, eliminating 86% of the country’s notes overnight. While Indians could theoretically exchange 500 and 1,000 rupee notes for higher denominations, it was only up to a limit of 4,000 rupees per person. Sums above that had to be routed through a bank account in a country where only 50% of Indians have such access. There have been at least 112 reported deaths associated with this demonetization – including suicides and the passing of elderly people waiting in bank queues for days to exchange money. India’s largest organization of manufacturers, the All India Manufacturers Organization, also estimates in a report that micro-small scale industries suffered 35% jobs losses and a 50% dip in revenue in the first 34 days since demonetization. While demonetization in India is off to a rough start, some believe it can still be ultimately successful in the long-term. Regardless, the “War on Cash” still has incredible global momentum – and the end result – however it turns out – will likely form another important chapter in the history of money. |

| 'Stop Operation Soros' Movements to ban billionaire-funded groups sweep across Europe Posted: 31 Jan 2017 07:00 PM PST One of those who supported nationwide anti-Trump protests in the US is billionaire investor and philanthropist George Soros, who's well known for his charity organizations across the globe. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| FATCA Needs To Go, But Unfortunately, The FATCA "Refugees" Are Never Coming Back Posted: 31 Jan 2017 07:00 PM PST Submitted by Duane via Free Market Shooter blog, GotNews posted an article yesterday about a “refugee problem” America has, referring to approximately 20,000 Americans who have renounced their citizenship under Obama’s leadership, and suggesting America “repatriate” said citizens:

What was missing from the article? Discussion of the Obama-sponsored law that caused many citizens (mostly expats) to renounce their citizenship: FATCA (Foreign Account Tax Compliance Act). FATCA has been beaten to death by other sources, but surprisingly, very few people are aware of what it does. The whole purpose of the law was to “crack down” on overseas tax evasion. Simon Black of Sovereign Man did an excellent job of summarizing the net effect:

In a nutshell, if you are an American expat living abroad, you just had to jump through thousands of hurdles to prove to the IRS that you aren’t evading any taxes, report all this information correctly, and within a confusing legal framework that leaves even the best accountants stumped, often triggering audits for “violation” of FATCA, even if it was not violated at all. Unsurprisingly, since the law was enacted, the amount of expatriates who renounce their citizenship has risen exponentially: FATCA forces any American opening a bank account overseas to be in compliance with the law, by having the IRS punish foreign nations that do not comply. Because of FATCA, the majority of foreign banks quickly turned to outright refusal of US clients. Good luck finding one that doesn’t charge a ridiculous litany of fees. Obviously, you need to live abroad to renounce your citizenship. But who is doing the renouncing? For the most part, permanent expats who have no intention of ever moving back. Eduardo Saverin, the Facebook co-founder whose story was on full display in the movie The Social Network, is the biggest name of the group. However, billionaires like Saverin aren’t most people. A more pertinent real-world example is Rachel Heller:

Yes, it is true, the majority of US expats are willing to give up their citizenship. It’s not because they aren’t American. It’s because by not living in America, FATCA has effectively rendered them second-class citizens. The USA is one of only two countries in the world that has this system of taxation. The other is Eritrea, which levies a simple 2% flat tax on its citizens who live abroad. And still, the media, and even the UN have weighed on Eritrea’s simple regime, calling it “authoritarian”:

FATCA is far more onerous, costly, and authoritarian than anything Eritrea does. But don’t hold your breath expecting the UN to condemn what the USA is doing to its own citizens. Rachel Heller went into detail on how difficult the renunciation process is in her above linked article, but even after months and months of interviews, the USA piles on a $2,350 “renunciation fee” and an exit tax on your net worth, in addition to a “doxxing” of your name and personal details in a Federal register, done to “name and shame” you for renouncing your citizenship. It is sad that Americans have been forced to renounce their citizenship to comply with the onerous restrictions on their rights as a result of the Obama administration’s FATCA law. But they didn’t give up their citizenship because they all of a sudden became un-American; no, they did it because of a law that has turned living and/or working abroad into an expensive, onerous, bureaucratic nightmare for the ordinary American citizen. Repealing FATCA should be almost as high on Trump’s list as repealing Obamacare, but unfortunately for the citizens living abroad, a repeal of this law is not likely anytime soon, as Trump seems quite preoccupied with other affairs at the moment. What is even more sad, however, is that these citizens who have renounced will not be coming back, or re-applying for citizenship anytime soon. Most were already living abroad permanently, and had no interest in ever moving back. Because of FATCA and the IRS, and nothing else, they will no longer enjoy the protections of afforded to them when they were born. FATCA and its ridiculous system has ensnared law-abiding American expats into a constant battle with the IRS, all over the day-to-day activities all citizens engage in. Regrettably, no new legislation can change that fact, undo all of the damage FATCA has already caused, or magically bring back the citizenship rights of those who have chosen to give it up, solely to avoid FATCA’s unjust burden. |

| This Won't End Well - China Skyscraper Edition Posted: 31 Jan 2017 06:35 PM PST China has been on a skyscraper-building boom for years, but, we suspect, 2016 may have seen the mal-investment boom jump the shark. As Goldman Sachs illustrates in the following chart, China was head, shoulders, knees, and toes above the aggregate of the rest of the world in terms of skyscraper completions in 2016... Could record-setting skyscrapers signal economic over-expansion and a misallocation of capital? EWN Interactive, a subscription service focused on technical analysis, thinks so. The following infographic follows the “Skyscraper Curse” through six different market tops and subsequent crashes over the past century. It is gigantic in size, so please click here or the below image to access the legible version: Courtesy of: Visual Capitalist EWM Interactive sums up the infographic with these words:

* * * In January we noted a perfect example of the smoke-and-mirror-ness of China's credit-fueled expansion, as a 27-storey high-rise building which was completed on November 15th 2015 was just demolished, "having been left unused for too long." And just this week, another illustration of Keynesian perfection as China created, then destroyed 19 massive structures, to make room for an even bigger skyscraper. The epic explosion that took place in Wuhan, the capital city of Hubei province, leveled 19 seven to 12-story structures in a controlled demolition, the South China Morning Post newspaper reported, citing local media. The city authorities are planning to demolish at least 32 buildings to make way for a new business center that will reportedly feature a 707-meter tall skyscraper, which is to be one of the tallest buildings in the world. * * * The silver-lining - now workers can clean up the mess, dig a bigger hole... and fill that in - all in the name of Keynesian "growth." |

| The Other 'Ban' That Was Quietly Announced Last Week Posted: 31 Jan 2017 06:12 PM PST Submitted by Simon Black via SovereignMan.com, Most of the world is in an uproar right now over the travel ban that Donald Trump hastily imposed late last week on citizens of seven predominantly Muslim countries. But there was another ban that was quietly proposed last week, and this one has far wider implications: a ban on cash. The European Union’s primary executive authority, known as the European Commission, issued a “Road Map” last week to initiate continent-wide legislation against cash. There are already a number of anti-cash legislative measures that have been passed in individual European member states. In France, for example, it’s illegal to make purchases of more than 1,000 euros in cash. And any cash deposit or withdrawal to/from a French bank account exceeding 10,000 euros within a single month must be reported to the authorities. Italy banned cash payments above 1,000 euros back in 2011; Spain has banned cash payments in excess of 2,500 euros. And the European Central Bank announced last year that it would stop production of 500-euro notes, which will eventually phase them out altogether. But apparently these disparate rules don’t go far enough. According to the Commission, the presence of cash controls in some EU countries, coupled with the lack of cash controls in other EU countries, creates loopholes for criminals and terrorists. So that’s why the European Commission is now working to standardize a ban on cash, or at least implement severe restrictions and reporting, across the entire EU. The Commission’s roadmap indicates that forthcoming legislation, likely to be enacted next year. This is happening. And it may serve as the perfect case study for the rest of the world. A growing bandwagon of academics and policy makers in other countries, including the United States, UK, Australia, etc. has been calling for prohibitions against cash. It’s always the same song: cash is a tool for criminals and terrorists. Harvard economist Ken Rogoff is a leading voice in the War on Cash; his new book The Curse of Cash claims that physical currency makes the world less safe. Rogoff further states “all that cash” is being used for “tax evasion, corruption, terrorism, the drug trade, human trafficking. . .” Wow. Sounds pretty grim. Apparently pulling out a $5 bill to tip your valet makes you a member of ISIS now. Of course, this is total nonsense. A recent Gallup poll from last year shows that a healthy 24% of Americans still use cash to make all or most of their purchases, compared to the other options like debit cards, credit cards, checks, bank transfers, PayPal, etc. And the Federal Reserve Bank of San Francisco released a ton of data late last year showing that:

This doesn’t sound life nefarious criminal activity to me. It seems that perfectly normal, law-abiding citizens still use cash on a regular basis. But that doesn’t seem to matter. A bunch of university professors who have probably never been within 1,000 miles of ISIS think that a ban on cash would make us all safer from terrorists. You probably recall the horrible Christmas attack in Berlin last month in which a Tunisian man drove a truck through a crowded pedestrian mall, killing 12 people. Well, the attacker was found with 1,000 euros in cash. The logic, therefore, is to ban cash. I’m sure he was also found wearing pants. Perhaps we should ban those too. This idea that criminals and terrorists only deal in bricks of cash is a pathetic fantasy regurgitated by the serially uninformed. I learned this first hand, years ago, when I was an intelligence officer in the Middle East: criminals and terrorists don’t need to rely on cash. The 9/11 attackers spent months living in the United States, and they routinely used bank accounts, credit cards, and traveler’s checks to finance themselves. And both criminal organizations and terrorist networks have access to a multitude of funding options from legitimate businesses and charities, along with access to a highly developed internal system of credit. A cash ban wouldn’t have prevented 9/11, nor would it have prevented the Berlin Christmas attack. What cash controls do affect, however, are the financial options of law-abiding people. These policymakers and academics acknowledge that banning cash would reduce consumers’ financial privacy. And that’s true. But they’re totally missing the point. Cash isn’t about privacy. It’s one of the only remaining options in a financial system that has gone totally crazy. Especially in Europe, where interest rates are negative and many banks are on the verge of collapse, cash is a protective shelter in a storm of chaos. Think about it: every time you make a deposit at your bank, that savings no longer belongs to you. It’s now the bank’s money. It’s their asset, not yours. You become an unsecured creditor of the bank with nothing more than a claim on their balance sheet, beholden to all the stupidity and shenanigans that they have a history of perpetrating. Banks never miss an opportunity to prove to the rest of the world that they do not deserve the trust that we place in them. And for now, anyone who wishes to divorce themselves from these consequences can simply withdraw a portion of their savings and hold cash. Cash means there is no middleman standing between you and your savings. Banning it, for any reason, destroys this option and subjects every consumer to the whims of a financial system that is stacked against us. |

| Posted: 31 Jan 2017 05:30 PM PST The leadership of the EU think the EU is beset by enemies on all sides and are currently in the middle of an existential crisis. The EU needs to be disposed of. Whatever countries left under it need to leave immediately. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Dollar Faces Death Knell -- John Williams of Shadowstats Posted: 31 Jan 2017 02:30 PM PST Economist John Williams says, "We are facing a terrible crisis. . . . In terms of the Fed (getting control) and the long term solvency issues, these are death knells for the dollar. Unless those are addressed, you are going to see massive selling of the dollar, a debasement of the dollar and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

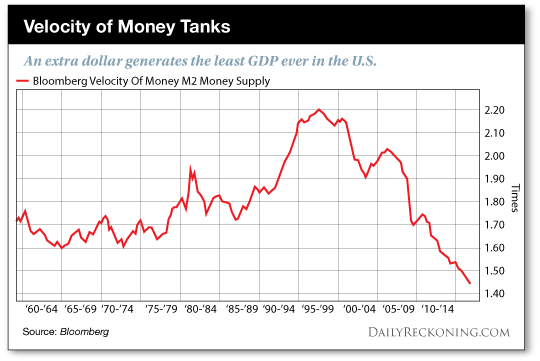

| Posted: 31 Jan 2017 02:19 PM PST This post This Bond Bull Isn't Dead Yet appeared first on Daily Reckoning. "The bond bull market is over!" How many times have you heard that in the past six months? The past year? Or, for that matter, the past five years? Time and again, the bond bears have declared the bull market over. They just can't believe U.S. rates can possibly go lower. Time and again the bears have been proved wrong, and the bond market rally continues. We may be on the brink of another reversal in temporary bear market conditions. The bond market has been down for the last five months. As bond yields rise, bond prices fall (and vice-versa). Yields to maturity on benchmark ten-year Treasury notes have backed-up over a full percentage point since their record low of 1.36% in July 2016 shortly after the Brexit shock. They currently trade around 2.4%. This follows the recent high yield of 2.6% in December 2016 after the Trump election victory, and the "Trump Trade" that affected stocks, bonds and currencies. The bears are unanimous that this breakout in yields — from 1.4% to 2.6% and resulting capital losses to bond holders — is the death-knell for the 35-year old secular bond bull market. Just to put that in perspective, the yield on ten-year Treasury notes hit an all-time high of 15.82% in September 1981. Yields have tumbled, albeit with zigs and zags and nasty bear markets along the way, for the entire 35-year stretch since then. It's not unreasonable to estimate that most of the bond traders on Wall Street weren't even born when this secular bull market began in 1981. At the 1.4% level reached last summer, it seemed that yields just could not get any lower. Just about all market participants, young and old, were ready to write "RIP" on the bull market, and brace for a new secular bear. Market behavior since then has supported that view. But the bond bull market may still have legs. As Mark Twain observed after reading a false obituary of himself, "Reports of my death have been greatly exaggerated." The same might be said for the bond bull market. Hedge funds and leveraged players look trapped in a massively leveraged short position. They are being set up for slaughter by the real money accounts. What are the bears missing? The most important thing they are missing is that rates are really not that low to begin with. It's true that nominal rates have been low, but real rates are nowhere near their all-time lows due to the impact of inflation. A real rate is simply the nominal rate minus inflation. Prior to the super-spike in yields in 1981, nominal rates were around 13% while inflation was about 15%. This meant that real rates were negative 2%, (13 – 15 = -2). Today, with nominal T-rates around 2.4% and inflation about 1.6%, the real rate is positive 0.8%, (2.4 – 1.6 = 0.8). Even though nominal rates were 10.6% percentage points higher in 1980, the real rate was 1.2% lower. Since real rates are what determine investment decisions, it's the case that interest rates are relatively high today. This simple concept of real versus nominal rates is not discussed much on financial TV or blogs, but it's a crucial distinction. Simply put, interest rates are still high today and could fall a lot lower. Another concept missed by the bond bears is velocity. That refers to the turnover of money. It's also easy to understand. If I have a dollar, go to dinner, tip the waiter, and the waiter takes a taxi home, and the taxi driver buys gasoline, my dollar has velocity of three in the tip, the taxi fare, and the gasoline (1 + 1+ 1 = 3). If I stay home, watch TV, and leave my money in the bank, my money has velocity of zero since it was never spent. The notional value of GDP is defined as money supply (M) times velocity (V), or M x V = GDP. Bears keep looking at the expanded money supply and expecting inflation right around the corner. It's true that the Fed has expanded the money supply enormously since the 2008 crisis. But guess what? Velocity is sinking like a stone. In fact, velocity has been plunging since the 1998 financial crisis due to demographics and lost confidence in money as shown in the chart below.

The math is inescapable. If M0 (base money) is $4 trillion and V is zero, then the economy has disappeared; the gross nominal GDP would be zero ($4T x 0 = 0). Of course, that won't happen (with 0 nominal GDP, we'd all be living in a new Stone Age), but the extreme example makes the point that as long as velocity is plunging, there's no inflation. And without inflation, real rates will remain high even at very low nominal rates. It's not difficult to imagine a U.S. scenario where nominal rates are 0.5%, inflation is negative 1% (called deflation), and real rates are still relatively high at 1.5%, [0.5 – (-1.0) = 1.5]. Indeed, this is precisely the situation that has plagued Japan for decades and appeared in Europe recently. It may be coming to the U.S. also. The recent back-up in yields looks just like the yield increases in 2013 before they hit a peak and fell sharply. Far from the start of a bear market, early 2017 looks like early 2014. It's déjà vu all over again. What are the reasons for believing that yields actually will decline again as they did in 2014? And why should investors expect a new bond market rally even in the midst of the secular bull market?

With the ingredients for lower rates and a bond market rally in place, the most straightforward trade is to go long ten-year Treasury notes. The problem there is that the Treasury market looks like the Gunfight at the OK Corral. On one side are hedge funds and leveraged players who are massively short bonds. On the other side are real money players like banks and institutions who see what we see. One side is going to lose big (my view is it will be the hedge funds again), but there could be huge volatility and violent countertrends as the two sides fight it out. Regards, Jim Rickards The post This Bond Bull Isn't Dead Yet appeared first on Daily Reckoning. |

| 30 Charts Proving We’re In The Mother of All Financial Bubbles Posted: 31 Jan 2017 01:46 PM PST This post 30 Charts Proving We're In The Mother of All Financial Bubbles appeared first on Daily Reckoning. Sentiment about the U.S economy continues to rise, but the looming threat of financial bubbles and economic crisis on a global scale could not be higher. "The 'big, fat, ugly bubble' that Trump as a presidential candidate identified in the stock market is real and is currently being allowed to fester. Financial bubbles have multiple facets (China, property market, etc) and could very well be expanded beyond this list. But selected below you will find 30 charts from government, private sector and independent research outlets proving that we're in the mother of all bubbles. The higher these bubbles get, the more dangerous the fall. 1.The Inflationary BoogeymanEconomist Lance Roberts delves into exactly what interest rates and economic growth reveal in the economic environment – it does not look pretty. The Effective Federal Funds Rate seen below in a flatline shows just how big a problem the U.S central bank is in.

Roberts writes, "With Yellen, and the Fed, once again chasing an imaginary inflation 'boogeyman' (inflation is currently lower than any pre-recessionary period since the 1970's) the tightening of monetary policy, with already weak economic growth, may once again prove problematic." "The biggest fear of the Federal Reserve has been the deflationary pressures that have continued to depress the domestic economy. Despite the trillions of dollars of interventions by the Fed, the only real accomplishment has been keeping the economy from slipping back into an outright recession." 2. Even The Rich Are Feeling the SqueezeThe Hamptons, deemed by Forbes as Where Wall Street's Richest Retreat, are experiencing a considerable slowdown in the residential housing market. When even the top 1% of the 1% of Americans are in a housing slowdown, questions begin to rise as to how sustained our economic recovery is. The Wall Street Journal reported this slowdown and noted that it was in part due to "too much overpriced inventory—and it is rising." When prices are too outrageous for even the top income earners, a Wall Street housing bubble could follow. 3. Big Money Hits Historic LevelsBloomberg ran an article looking at the growth of the hedge from industry noting that "Hedge Fund Assets Pass $3 Trillion in 2016 for First Time." The article expands upon this massive growth in assets, "The industry, which saw about $70 billion in outflows last year, had about $2.9 trillion in assets in 2015." The bigger they grow, the harder they fall. 4. Debt Slaves At Risk of Debt CrisisDebt is no stranger to the American public. From financing cars to massive home mortgages, debt is a part of everyday life – and getting bigger. While an abundance of methods track just how debt burdens impact households, it is clear that America has a massive debt problem. Wolf Richter writes, "There are many ways to measure household indebtedness and debt burdens. Comparing total household debt to the overall size of the economy as measured by GDP is one of the measures." "And per this household-debt-to-GDP measure, Americans are in 10th place with 78.8% and look practically prudent compared to the peak just before the Financial Crisis (via Trading Economics): 5. China is Going BrokeGoldman Sachs reveals its estimate on size of China’s debt… It ain’t pretty. China has a massive difference between the overall debt burden it currently holds in contrast to the overall GDP level it has been able to maintain for growth. The indicators above were created by financial giant Goldman Sachs’ research in which they claim the unfolding trend, "raises questions of sustainability over the medium term, given the already-large increase in China’s debt-to-GDP ratio in recent years." When the top dogs on Wall Street begin to raise questions, the party is almost over. 6. Subprime Auto Loans: The Next Financial Bubble?Jamie Dimon, head of JPMorgan Chase during a call with investors last July noted his growing worry about the "stretched" automotive loan market. Dimon noted that while he does not believe it is "a systemic issue" there are considerable risks. If Dimon's record speaks for anything, be worried and know that it will likely be much worse (Wall Street does not have a great record for calling crashes – hell, look at 2008). Jeff Desjarins notes at the Visual Capitalist, "Subprime auto loans – which are riskier loans made to customers with poor credit – have helped to drive the market since the Great Recession." "However, with auto loan delinquencies ticking up in recent months, investors have been searching for answers about the sector." 7. Latest Cause of U.S. Economic Depression: DemographicsNot only is our economy slowing, but our population is now hitting its oldest on record. Economist Jim Rickards reports that, "Since economic growth is simply the sum of workers and productivity, the lack of population growth means fewer workers and, therefore, less economic growth." "Productivity is declining, also making the situation worse." The last time this happened to such an extent in the U.S. was during the Great Depression of 1929–1940." 8. Too Big To Fail – AgainThe top bank holding derivatives Citigroup, was the same bank in 2008 that saw its toxic derivatives and subprime debts explode, has over $55.6 trillion in holdings. That means that not only are Citigroup and banks of its size and complexity holding a massive amount of money being speculatively bet, but that the risks are being backed by the U.S government. During a press conference in March 2016 while speaking on financial reform President Obama said: "Irresponsible, risky bets with inadequate safeguards and that reward executives who take those risks greatly, can cause enormous damage to our economy overall.." He went on to champion the reforms made and the false accusations by the press noting that, "Wall Street reform, Dodd-Frank, the laws that we passed have worked. I want to emphasize this because it is popular in the media, in political discourse, both on the left and the right, to suggest that the crisis happened and nothing changed. That is not true…" In retrospect, the most disappointing and dangerous part of his conversation was when he announced that the administration was taking action. President Obama said: "We are moving in the derivatives sector; a huge amount of oversight and regulation and now you have clearinghouses that account for the vast majority of trades taking place so that we know if and when somebody is doing something that they shouldn't be doing; if they're over-leveraged in ways that could pose larger dangers to the financial system." The derivative world, where Wall Street continues to hedge its bets, has not been stopped. A large percentage of activity surrounding derivatives continues to happen in the dark. If and when this bubble pops, the extent of its damage could present catastrophic levels of burden on the U.S government and its taxpayers. Office of the Comptroller of the Currency 9. Housing Prices in Western Economies on SteroidsGrowing fears of a ‘massive’ global property price drop take root under growing conditions that signal a slow-down in the market. Across three different continents, housing prices have increased in exponential ways. This rapid ascension surpasses the pre global financial crisis levels and offers an entirely new standard from which the world's economy could fall in the perils of a housing bubble. Catherine Mann, the Organization for Economic Co-operation and Development (OECD) chief economist said a "number of countries", including Canada and Sweden, had "very high" commercial and residential property prices that were "not consistent with a stable real estate market". 10. Chinese Credit SoarsChina has been a leading supplier of global goods over the past several decades. As many economist have written about the booming Asian giant, the demand for credit in the country since the global financial crisis has taken on in drastic ways. The threat of economic turmoil and what it might do to the Chinese (and therefore global) economy is real. Jim Rickards tells us, "So far, the Chinese government has been able to contain the damage from these bursting bubbles with monetary ease, bailouts and market manipulation. But the biggest bubble of all — the credit bubble — may now be getting ready to burst." 11. Recession Speculation Swirls: Federal Reserve is StuckAmbrose Evans-Pritchard notes that, "The world has never before been so leveraged to dollar borrowing costs. The Bank of International Settlements data show that debt ratios in both rich countries and emerging markets are roughly 35 percentage points of GDP higher than they were at the onset of the Lehman crisis." The fact that the Federal Reserve cannot get out of its own way, in the face of a potential recession shows how grave an economic bubble threat is. “It is a little scary. When nominal GDP slows like that, you can be sure that financial stress will follow. Monetary policy is too tight and the slightest shock will tip the US into recession,” said Lars Christensen, from Markets and Money Advisory. 12. Holiday Shopping Numbers Signal Lost ConfidenceBlack Friday is dead. Even holiday spenders know something is wrong. According to the National Retail Federation, 36% of shoppers said all of their buys were sale items. When big even big ticketed items (electronic appliances, high-end retail) are not selling on traditionally high volume days – the economy should realize that deterioration is real. Greg Guenthner tells us, "The data is clear: it's becoming increasingly difficult to get customers out to stores on Black Friday." To this point, not only is it difficult to get them out – but it is even more of a challenge to get them to spend on normal priced inventory. 13. Government Holding the BillBelow is the total consumer loans that are currently being held by the U.S government that are outstanding.These consumer loans are made up primarily of mortgage loans and other big ticket real |

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 2% Posted: 31 Jan 2017 01:22 PM PST Gold gained $7.18 to $1202.98 in early Asian trade before it dropped back to $1196.33 at about 4AM EST, but it then rose to as high as $1215.31 by midmorning in New York and ended with a gain of 1.36%. Silver surged to as high as $17.609 and ended with a gain of 2.45%. |

| How Trump’s tax cut plan affects manufacturing Posted: 31 Jan 2017 12:00 PM PST Alliance for American Manufacturing's Scott Paul discusses how a delay in President Donald Trump's tax cut plan will affect the manufacturing sector. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold Price is One Tweet Away from New Highs Posted: 31 Jan 2017 11:18 AM PST President Trump's recent comments on Mexico and building a wall should give gold investors optimism, says Daniel Ameduri, cofounder of Future Money Trends. President Trump's recent open display on Twitter regarding Mexico and the wall should give gold investors a surge of optimism. Over the next year, it's highly likely that we will see trade wars erupt with the U.S. and several of its major trading partners, like Mexico, China and the EU. |

| Jobs Report Week: Gold Stays Firm Posted: 31 Jan 2017 10:12 AM PST Graceland Update |

| FTSE 100 falters but pound enjoys best January since 2011 as Trump policy jitters weigh on dollar Posted: 31 Jan 2017 09:57 AM PST This posting includes an audio/video/photo media file: Download Now |

| Gold Braces for the Trump Dump Posted: 31 Jan 2017 09:05 AM PST This post Gold Braces for the Trump Dump appeared first on Daily Reckoning. Blame Trump's weekend travel ban shenanigans. Blame the market gods. Or those damn algos… But we know the real culprit behind yesterday's market slide:

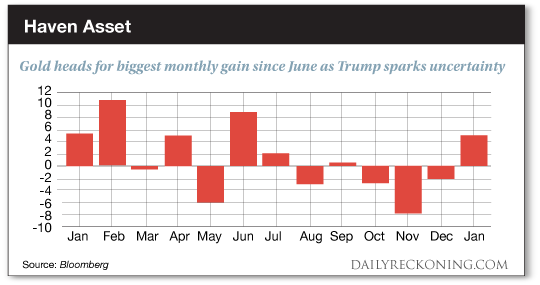

*Sigh* here we go again… We would accuse President Obama of having a hand in this mess. But he left for vacation more than a week ago. So we're going to have to instead chastise the financial press for this epic market jinx… Thanks a lot, Barrons. Just weeks removed from the financial mag's Dow 20,000 cover and we're graced with this doozy. Granted, if you were to read the smaller text, you'd notice that Barron's isn't calling for Dow 30,000 by the end of the year—or even the end of the decade. No, the prognosticators at Barron's see the Big Board topping 30K by… 2025. Of course, we aren't a nation that bothers with the fine print. I seriously doubt anyone even read the article. A gaudy number in bold font is all we need to make it through the day… Trump's not sweating the details, either. He doesn't seem to mind that investors are nervously selling stocks to start the week on the heels of his grab-bag of executive orders hitting the wire. The Dow Jones Industrial Average gave back the 20,000 level after losing more than 100 points yesterday. The tech-heavy Nasdaq led the way lower with drop of more than 0.8%. We're seeing more selling in the futures market early this morning as an endless parade of Trump news and analysis flickers across our screen. Every market watcher on the planet believes the Trump rally is finished. Now's the time to watch for the Trump Dump, they say. But there's one asset that's enjoying this week's chaos: Gold. Gold is about to post its strongest month since the Brexit vote in June. After last week's brief pullback, the Midas metal is off to the races again this morning, gaining $11 in early trade to overtake $1,200 once again. "The gold market is in thrall to the Donald Trump show," David Govett, head of precious metals trading at Marex Spectron, tells Bloomberg. "If Trump sticks to his immigration policy of the last few days, then gold should remain supported."

We've closely tracked gold's attempt to carve out a bottom since December. Last month, gold wandered lower, eventually cracking below $1,130 just before the Christmas break. That's when things got interesting… After briefly visiting 11-month lows, gold has started to quietly bottom out. Its spot price has risen back in the neighborhood of its 2-month highs. Now we have a situation where gold is firming and the dollar is losing steam… Of course, it's important to remember that the precious metal plays we're tracking right now have endured some serious pain over the past six months. I can't promise you that the lows are in. But Trump is doing everything he can to spook investors right now. Gold loves investor anxiety. So it's entirely possible that the constructive action we've noticed in gold and other precious metals is the beginning of another leg higher. Sincerely, Greg Guenthner The post Gold Braces for the Trump Dump appeared first on Daily Reckoning. |

| Jobs Report Week: Gold Stays Firm Posted: 31 Jan 2017 08:32 AM PST A rally to $1250 would likely see GDX surge to $28, and a bigger move to $1650 for gold should see GDX make a new all-time high. That's a bit further down the road, but eager gold stock investors should ensure they are building a solid block of core positions now, to partake in all the upside fun! |

| Gold Price +8% in 2017 Says Top LBMA Forecast Posted: 31 Jan 2017 08:12 AM PST Bullion Vault |

| Anyone Who Believes Trump Will Ignite a $USD Bull Market Will Get Taken to the Cleaners Posted: 31 Jan 2017 07:43 AM PST The $USD is about to collapse. This is not fear mongering, nor is it just a bold statement. The $USD has peaked and is about to breakdown in a BIG way. See for yourself, the greenback has taken out critical support. The spike higher that occurred starting election night is looking more and more like a bullish headfake. This means the $USD will reverse this entire move and THEN some. |

| Posted: 31 Jan 2017 07:24 AM PST This post The Chinese Credit Bubble appeared first on Daily Reckoning. The confrontations between the U.S. and China on trade, currencies and geopolitics will begin immediately at a rhetorical level, but may take a year or two to play out at a policy level. Supply chains, long-term contracts, and reserve positions don't turn on a dime even when new administrations are sworn in. Yet, one issue that will not wait and is a ticking time bomb is the Chinese credit bubble. That bubble is primed to explode with or without new policies from Trump. When it happens and how it happens will have profound implications for your portfolio. The dimensions of the problem are vast. China's growth has become captive to what economists call Goodhart's Law. This law says that when an economic metric becomes the goal of policy, it loses meaning as a metric. Goodhart's Law applies in the case of Chinese GDP. Once the Chinese government decided to "target" GDP growth of 8 percent, or 7 percent, or 6.5 percent more recently, GDP growth lost its meaning as a reliable guide to Chinese economic performance. Instead the Chinese hit the economic target by non-economic means merely to say they hit the target. For instance, my trip from Shanghai to Nanjing was on one of the new high-speed rail lines being built under direction from the central government in Beijing. The train is the best in the world. It travels at 200 mph and is almost silent as it speeds down specially welded high-speed rails. I had a business class seat that was nicer than most airline business-class seats. The train stations in both cities are spacious, clean, and efficient and put American train stations to shame. In fact, they're even nicer than some of the newest major airports around the world. Best of all the ticket was cheap! Just ¥429.50 (about $62.00) round-trip. A comparable trip on Amtrak's Acela would have cost $400 and the service would have been far inferior (not to mention having to endure the cramped confines of New York's Pennsylvania Station). While I enjoyed the ride, a thought crossed my mind: How do you pay for billion-dollar train stations, and billion-dollar railroads by charging $62.00 for a 350-mile round-trip? The answer is, you can't. The entire enterprise in being financed with unpayable debt. The state-run China Railway Corporation is losing over $1 billion per year and various other state owned enterprises (SOEs) are losing billions more in construction and equipment manufacturing. If you have a 6.5 percent GDP growth target, it is easy to achieve just by building infrastructure, which counts in the "investment" category of a standard GDP definition. Billion dollar train stations and rail lines count as investment and therefore GDP whether the railroads ever make money or not. The same is true for highways, pipelines, even entire cities. On various visits to China I've seen so-called "ghost cities" stretching to the horizon entirely empty of residents and businesses. Yet the construction costs are added to GDP even though there are few or no paying tenants. (I've spoken with some business owners who do occupy offices in ghost cities. They pay no rent and are there just to make the buildings look partially occupied and help the sales office attract others). The problem is that the rail transportation infrastructure I found so impressive, and most of the other infrastructure in China, was built with debt. The debt was financed by the mega-Chinese banks on government orders. Since the ghost city buildings don't have tenants and the train tickets are heavily subsidized, there's no way that debt can be repaid. Instead new loans are made to pay interest on the old, or the debt is refinanced or rolled-over in a never-ending stream of zombie lending. The banks finance their lending with customer deposits or sales of wealth management products (WMPs, something like the CDOs that brought down Lehman Brothers). WMP's have been described by the former Chairman of the Bank of China as the greatest Ponzi scheme in history. Banks rely on sales of new WMPs to redeem the old ones at maturity. The projects financed by the original WMPs cannot repay them. How big is this mountain of debt? Total Chinese debt at all levels (household, corporate, bank and government) is now more than 250% of GDP as shown in the chart below:

However, this 250% figure understates the problem. It does not include the WMPs, which are technically investments kept off the balance sheets of the book. It also does not include provincial obligations that take the form of guarantees. Those will have to be bailed out by Beijing. The real debt-to-GDP figure is easily 500%. It's like owing $100,000 on a MasterCard when your salary is $20,000 per year. That's a sure recipe for bankruptcy. You can see from the graph that most of the debt is coming from the corporate sector. But, these are not normal corporations as understood in the U.S. These are mostly SOEs, controlled by the government. That means they may have to be bailed-out by the government when the system finally crumbles. Much of this debt is denominated in U.S. dollars so the situation is made even worse by the strong dollar and the global dollar shortage. Both of those factors make dollar-denominated debt much harder to repay. The debt system is propped up — for now — by more debt and dishonest accounting. If the banks were forced to write-down bad loans, the system would have collapsed a long time ago. But one dysfunction that cannot be finessed is cash-flow. As every entrepreneur and small businessperson knows, cash never lies. You either have it or you don't. Because of excessive debt and inability to pay, cash flow problems are now reaching epidemic proportions in China. China observer Valentin Schmid, writing in the Epoch Times in late 2016, reports: "If firms can't borrow more or squeeze their suppliers, they will go bankrupt. According to research by Goldman Sachs surveying companies in China, four have defaulted on $3 billion worth of bonds since the middle of November. These defaults are a break with the record in the previous five months from June to October, when only three of the companies surveyed didn't meet their payments. Given that China's companies are drowning in debt, this squeeze on cash flow does not bode well for stability in 2017." Of course, China could try to grow its way out of the debt problem. This is like the person in the above example suddenly getting a $50,000 raise so he can manage the payments on his $100,000 in MasterCard debt. This is where the Trump administration seems set to throw a monkey-wrench in China's already dubious growth plans. Trump's plans for tariffs, taxes, and a strong yuan will slow China's growth at exactly the moment it needs to grow faster. Geopolitical analysts at Stratfor summarize the situation as follows: “Clearly there are no easy answers to China's debt problem, which is looking grimmer by the day. The only painless escape would be on a wave of economic growth, but at this point that seems unlikely. Achieving growth rates of more than 10 percent is much more difficult for an economy that is already the second-largest in the world, and the global economic environment is not half as favorable to China as it was 15 years ago because the developed world is struggling to manage debt problems of its own. At home, Chinese wages are considerably higher than they were in 1991, and the economy is less competitive. Because China's working-age population will soon begin shrinking, ending the productivity gains from the decades long "demographic dividend," these wage hikes will make it harder for the country to achieve prodigious growth.” China is faced with a mountain of unpayable debt, weaker growth, and a stronger dollar that will make the debt even harder to repay. The Chinese credit bubble has only one feasible solution, China must use its hard currency reserves to bail-out the entire banking and SOE sector and try to start over with a relatively clean balance sheet. The problem is that the reserves needed for a bail-out are evaporating and liquid reserves may hit zero by the end of 2017. Kind regards, Jim Rickards The post The Chinese Credit Bubble appeared first on Daily Reckoning. |

| Silver, Platinum and Palladium As Safe Havens – Reassessing Their Role Posted: 31 Jan 2017 05:02 AM PST gold.ie |

| More hints that Trump's trade policy will focus on currency valuations Posted: 31 Jan 2017 04:50 AM PST Trump's Top Trade Adviser Accuses Germany of Currency Exploitation By Shawn Donnan Germany is using a "grossly undervalued" euro to exploit the United States and its EU partners, Donald Trump's top trade adviser has said in comments that are likely to trigger alarm in Europe's largest economy. Peter Navarro, the head of Mr Trump's new National Trade Council, told the Financial Times the euro was like an "implicit Deutsche mark' whose low valuation gave Germany an advantage over its main partners. His views suggest that the new administration is focusing on currency as part of its hard-charging approach on trade ties. In a departure from past U.S. policy, Mr Navarro also called Germany one of the main hurdles to a U.S. trade deal with the EU and declared talks with the bloc over a Transatlantic Trade and Investment Partnership dead. ... ... For the remainder of the report: ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 31 Jan 2017 02:29 AM PST Did Gold find a Trading Cycle Low last Friday? Perhaps. Silver was definitely leading the way as it often does at bottoms. But Silver also delivers many head-fakes and with the USD is due for a new Trading Cycle bounce, Gold will likely move lower next week. My first chart on the USD, shows it is deep in its timing band to find a DCL or short term Trading Cycle Low. Thursday may well have been the TC Low I was looking for. If so, to confirm a new Trading Cycle the USD should close above the 10ema and then test/break my Red down trend cycle line. |

| Breaking News And Best Of The Web Posted: 31 Jan 2017 01:37 AM PST US stocks down, gold and silver up. President Trump bans immigration from several countries, fires acting attorney general for refusing to enforce ban. Global debt continues to soar, especially in China. Marine Le Pen catches a break. Best Of The Web The persuasion filter and immigration – Dilbert Liberals, not Trump, to blame for […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The Crack-up Boom Is Ending and That’s Very Bullish for Gold Posted: 31 Jan 2017 01:30 AM PST Kitco |

| Environmental Permitting Process Advancing at NOVAGOLD's Donlin Gold Project Posted: 31 Jan 2017 12:00 AM PST |

| Long Liquidation Looks Bullish for Gold Posted: 31 Jan 2017 12:00 AM PST Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, examine the gold COMEX data and find it supports a bottom in the gold correction. |

| Trump's Trade Policy to Drive Price Inflation and Gold Buying Posted: 30 Jan 2017 08:48 AM PST Donald Trump's trade policy is likely to spark higher consumer price inflation, and that has ramifications for gold and silver prices. Regardless of where investors stand regarding the president's plan to make Mexico "pay" for the border wall, if he is successful in getting Congress to impose a hefty tax on imports it will mean higher prices for things. A tax on goods from China could be even more inflationary. |

| Posted: 30 Jan 2017 08:37 AM PST In this Weekend Report I'm going to show you some updated charts on the US dollar which has been in a bull market since the low in 2011. It's hard for a lot of investors to admit, but until the charts change the bull market continues. A bull market is characterized by a series of consolidation patterns forming one top of the next, until the last pattern is a reversal pattern which reverses the bull trend. The old expression, the trend is your friend, also applies to the US dollar as well. Until the US dollar negates the series of higher highs and higher lows on an intermediate term basis, we have to assume the bull market is in tact. Lets start by looking at a daily line chart for the US dollar which shows the horizontal trading range beginning back in March of 2015. The breakout topside of the horizontal trading range took place a little over 2 months ago in November of last year. After the initial breakout there was the initial backtest which could have been the beginning of the next impulse move up, but the US dollar stalled out a month later and is currently backtesting the top rail around the 100 area again. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment