Gold World News Flash |

- The Bitcoin's Bubble has Burst

- The False Economic Recovery Narrative Will Die In 2017

- The Case Against Fed Reform

- First Majestic Silver CEO Neumeyer endorses class-action suits against market rigging

- Trump Could “Blow Fuses Across the World”

- How The West Has Been Selling Gold Into A Black Hole

- Grudge Match 2017: Trump vs. Yellen

- Gold Seeker Weekly Wrap-Up: Gold and Silver Gain About 2% and 3% on the Week

- Gold Stocks Shine in 2017

- COT Gold, Silver and US Dollar Index Report - January 6, 2017

- Japan’s Role in the West to East Power Shift

- Byron King: At Some Point Economic Reality Will Set In

- Gold Stocks Shine in 2017

- 5 Reasons Why Russia Wins in 2017

- Black Magic Fraud to be exposed in 2017 – Gold up 300X

- Gold Stocks Shine in 2017

- The Gold Market in 2016

- Gold Surges Over 30% in GBP In 2016 After Brexit

- How The West Has Been Selling Gold Into A Black Hole

- The Gold Market in 2016

- Video Commentary - Gold

- GoldPrice.org chart shows metal gained in all major currencies in 15 years

- When Trump Tweets These Companies Weep

- Koos Jansen: How the West has been selling gold into a black hole

- Jamie Oliver closes six of his Italian restaurants blaming collapse in sterling and tough trading

- Gold and Silver Outlook 2017

- Breaking News And Best Of The Web

- Gold’s ‘False Dawn’ May Depend on Looming Debt Ceiling

| The Bitcoin's Bubble has Burst Posted: 06 Jan 2017 07:00 PM PST Bitcoin plunges after nearing all-time high Bitcoin feels like one of those pyramid scams where the first 20 people who were able to buy bitcoin when it was 50 to a dollar want everyone else to get on board so that they can be Bitcoin Rockefellers.Bitcoin is nothing - it is a self contained fad... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| The False Economic Recovery Narrative Will Die In 2017 Posted: 06 Jan 2017 07:00 PM PST Submitted by Brandon Smith via Alt-Market.com, Yes, the narrative of the “new normal” has been around for so long now that many people have simply grown used to it. The assumption is that the fiscal “new normal” has become the fiscal “normal,” and though the fundamentals continue to strain under the weight of poor global demand and historic debt levitated by extraneous fiat stimulus, the masses feel far less fear than is warranted. Hey, why should they? We’ve managed around eight years skating on thin ice, why shouldn’t we expect eight more years of the same? The banking elites have done the job they set out to do, which was to drive the economy to the very edge of the financial cliff, and then keep it suspended there until the general public became comfortable living next door to the abyss. Why do this? Well, the greater dynamic at play here is something the average person will not understand or refuses to examine — economics today is about mass psychology. The economy is a tool, or a weapon, by which international financiers can influence the public mind and the emotions of the mob. In order to grasp the mechanics of economics it is not enough to deal in statistics and trade principles; one must also grasp human behavior and how it is manipulated. One must acknowledge that in economics we witness the transmutation of societies by word and by force, by chaos and by order. Economics is alchemy. The globalists (in their twisted view) seek to change lead into gold, and just as in alchemy, these elements are a metaphor for psychological evolution. For the globalists, social engineering is a form of witchcraft; they see it as creation, or a grand form of architecture. But it is not creation. The globalists are incapable of such art because true art requires wisdom and empathy. All they know is how to deconstruct existing systems generated by nature and free men and rearrange the shattered pieces into something more oppressive and ultimately less interesting than what existed before. Give the internationalists a Mona Lisa and they will shred it, reconstitute it and regurgitate a paint by numbers coloring book. The globalists only know how to turn gold into lead. If you do not understand the reality of globalist influence in markets and the nature of economics as a weapon; if you actually believe that the economy operates purely on some kind of free-roaming free market principles, then you will never be able to wrap your head around the otherwise absurd behavior of our financial structure. The psychology of fiscal “recovery” is a vital tool for change and for developing false dichotomies. For example, I recently came across this article from the pervasive propaganda hub of Bloomberg. In it, Bloomberg outlines a story we are by now very used to hearing from the mainstream — that the presidential era of Barack Obama has left the economy of the U.S. in particular in “far better shape” as he leaves office than when he entered office. Now, anyone who has been reading my analysis for at least the past six months (if not the past ten years) knows exactly what I think about the current state of the economy and what is likely to happen in the near future. For those new to my position, here is a very quick summary along with linked evidence supporting my claims:

This has been my position for the past half year — that globalists were planning to allow conservative and sovereignty movements to take the reigns of power, that they would allow the passage of the Brexit and the rise of Trump, just before they pull the plug on the system’s life support. The Federal Reserve in particular has already launched the final phase by beginning a series of rate hikes which will remove the safety net of free and cheap overnight loans to companies, thereby sabotaging equities markets. I specifically warned about this over a year ago when most analysts were stating that negative rates and QE4 were “just around the corner.” And this is where we are today. As noted above, Bloomberg writes an interesting bit of propaganda starting with a bit of truth. Here’s the beginning quote from their article:

The recovery narrative from 2008 to today was imperative to the globalist’s greater agenda. For a considerable portion of the public must be made to believe that under a socialist and decidedly globalist president (Barack Obama) the general trend in the economy was positive and that “things were getting better.” The rise of conservative movements today sets the stage for the final collapse and the IMF’s great reset, in which conservatives and sovereignty activists will be blamed, whether there is any evidence of culpability or not, for the crash that the globalists have spent the better part of two decades setting in motion. After the dust has settled, the argument will be that the world was "on course" before the Brexit, before Trump and before populism. The argument will be that globalism was working and conservatives screwed it up with their selfish nationalist endeavors. After the final crash and perhaps numerous deaths from poverty and violence, the argument will be that the only conceivable solution must be a return to globalism in an extreme form; or total global centralization, so that such a tragedy will never happen again. Bloomberg helps to set up the scenario, by claiming that Trump is “inheriting” a stable and improving economy compared to the economy that Barack Obama inherited:

Of course, Bloomberg fails to mention that the standards and statistics by which they measure economic “improvement” are entirely fraudulent. For example, real GDP is at -2 percent, not +2 percent as Bloomberg claims, when one calculates for distortions such as government spending, which is counted towards GDP even though government does not actually produce anything. Government can only steal productivity from citizens and reassign that wealth elsewhere. Bloomberg also cites a vastly improved unemployment rate. They once again refuse to bring up the fact that over 95 MILLION Americans are no longer counted as unemployed by the Bureau of Labor Statistics because they have been jobless for so long they do not qualify to be included on the rolls. This lie of reduced unemployment has been pervasive through the entirety of the Obama Administration. Bloomberg then mentions a greatly improved housing market that Trump will enjoy when he takes office. They certainly do not include the fact that pending home sales are now plummeting and home ownership rates in the U.S. are so low you have to go back to 1965 to match them. They do not mention that the majority of the boost in home sales during Obama’s two terms was due to corporations like Blackstone buying up distressed mortgages and turning the homes into rentals. The housing market is NOT being supported by individuals and families seeking home ownership, but corporations snatching up real estate on the cheap and driving up prices. Wall Street is now America's landlord. And there you have it. The globalist setup continues with mainstream outlets telling Americans that the economy is in ascension as Trump and populists move into positions of power, when in truth the economy is as dire as it ever was if not worse off. To add to the theater, Donald Trump has ventured to take credit for the sharp rise in stocks and the impression of improving economic stats. In one of his latest tweets just after Christmas, he had this to say:

Now, if you know anything about the true fiscal situation, you would think this statement is a severely idiotic move by Trump. No incoming president with any sense would try to take credit for the largest equities bubble in history. But, take credit is essentially what he did. That said, if you ALSO understand that the globalist narrative is engineered so that conservatives take the blame for the coming crash, AND if you believe that Trump is knowingly participating in this narrative (as I now do after he lied about "draining the swamp" and front loaded his cabinet with banking elites), then Trump's statement makes perfect sense. Trump is playing the role of a future bumbling villain, the populist maniac who gets too big for his britches and brings disaster down on people's heads. The false recovery narrative will indeed die in 2017, and it will be because the globalists WANT it to die while nationalists are at the helm. This is perhaps the biggest con game in recent history; with conservatives as the fall guy and the rest of the public as the gullible mark. One can only hope that we can educate enough people on this scenario to make a difference before it is too late.

|

| Posted: 06 Jan 2017 06:10 PM PST Submitted by Tho Bishop via The Mises Institute, This week the 115th Congress was sworn in, and there are some indications that Fed reform may be on the agenda. The combination of populist anger fueled by Ron Paul’s Presidential campaigns and the 2008 financial crisis coupled with the repeated failings of the Federal Reserve to meet their projections has created a rare window for monetary policy to be both politically advantageous, as well as so obviously needed that even politicians can see it. The question now is what sort of reform is on the table. Congressional ReformsLast Congressional session saw proposals from both the House and the Senate. From the House we have the FORM Act, which would require the Fed to adopt a monetary policy rule and explain to Congress whenever they deviate from that rule. The FORM Act also calls for an annual GAO audit of the Federal Reserve, doubles the number of times the Fed Chairman testifies before Congress, and makes some other tweaks to the makeup and protocol of the Federal Reserve Board. Since the FORM Act passed the House in 2015, there is a good chance we will see it resurrected in 2017. On the Senate side, Banking Committee Chairman Richard Shelby has pushed for the Financial Regulatory Improvement Act. Not only does it lack a catchy acronym, but its reforms to the Fed are far more modest than the FORM Act. The meat of the bill focuses on changes to the Fed board. The head of the New York Fed would no longer be appointed the banks board of the directors, but would instead be nominated by the President and confirmed by the Senate – just like the Federal Reserve Chairman. It would also grant powers to the Fed’s regional presidents that currently only reside with the board of directors. Though early drafts of the Senate bill called for the Fed to adopt rules-based monetary policy, this ended up being stripped from the final proposal due to Democratic opposition – largely because much of the Hill focus has been on the Taylor rule, which many Fed advocates fear is too restricting. The Battle Over the Taylor RuleRecently this debate has played out in the pages of the Wall Street Journal with Neel Kashkari and John Taylor exchanging op-eds on the virtues of rules-based policy. Though Kashkari begins with a broad attack on monetary rules, it quickly devolves into a focused attack on the Taylor Rule which he argues “effectively turn[s] monetary policy over to a computer, rather than continue to let Fed policy makers use their best judgment to consider a wide range of data and economic trends.” Of course Kashkari ignores that the “best judgement” of Fed policy makers has been widely criticized – and not just by Austrians who oppose any sort of Fed policy at all. Kashkari’s allusion to a computer-guided monetary policy is may be an attempt to get readers to conflate recent monetary rules proposals to the views of Milton Friedman that have not aged particularly well. In Taylor’s response, he criticized the portrayal for being dishonest while pointing to various analysis critical of the Fed behavior since the crisis. What’s more interesting than the finer details of the debate over the relative virtues of the Taylor rule is how that specific proposal has largely been the single focus of those critical of rules-based policy. Though support for the Taylor rule has become largely split on partisan lines, there is another monetary rule that has growing support from across the ideological spectrum. The Appeal of NGDP TargetingFollowing 2008, NGDP targeting has grown from a topic of conversation largely limited to blogs such as Scott Sumner’s The Money Illusion, to something discussed openly among central banks, prominent publications, and even Presidential candidates. The proposal would require a central bank to set a nominal goal for GDP – without taking into account inflation or deflation – and allow it to use a variety of tools to reach that goal. Since the policy gives Fed critics a black and white standard to measure its performance, without putting too many restrictions on the Fed as to ruffle the feathers of Fed proponents, it has been able to build a broad coalition of support. As a result, you have progressives such as Christina Romer and Brad DeLong on the same side as the Cato Institute and the Mercatus Center. Of course widespread appeal is not the same thing as sensible policy. As Shawn Ritenour sums up his brilliant refutation of the proposal:

Unfortunately policy does not have to be sensible to become reality. Should the House succeed in creating pressure on the Senate to act on a version of the FORM Act, it would not be surprising to see the discussion move away from the Taylor rule to NGDP targeting – with advocates selling its broad appeal as its leading virtue. The Fed Audit, which has consistently been fought by the Senate, could easily be dropped – with Republican legislators being able to point to the endorsement of the beltway’s leading libertarian think tanks as evidence of being tough on the Fed. The Real Problem with Rules-Based Monetary PolicyOf course no matter if it is NGDP targeting, the Taylor rule, or even a rule that would have the Fed tie itself to gold – the entire debate about rules-based monetary policy ignores the obvious: rules are meant to be broken. We’ve already seen this play out routinely at the Fed, with both sides of the isle usually accusing the Fed of not upholding one side of its current dual mandate. History is littered with examples of government financial institutions ignoring and modifying rules whenever they directly conflict with the judgment of current leaders. As recently as 2015, the IMF arbitrarily changed a long-standing policy on loan requirements so it could help Ukraine. The US government changed long-standing monetary policy rules when faced with a crisis, such as when it cut the dollar’s connection with gold for both domestic and international payments. Be it Constitutional rights, contractual obligations, or its own self-imposed rules, when push comes to shove the government officials have proven they will side with their own judgment – no matter what the rule is. So while there are certainly arguments to be made in favor of a rules-based Fed over the pure discretion of the current PhD standard, such reform should not be viewed as a solution to the real issue, which is a central bank having a monopoly on money at all. Instead of a Fed reform, we need Fed competition: eliminate legal tender laws, remove the burdensome taxes placed on gold, Bitcoin and other potential currencies, and give Americans a true alternative to Federal Reserve notes for those who want it. Anything short of that continues to let the Fed’s monopoly on money continue, and is therefore no real solution at all. |

| First Majestic Silver CEO Neumeyer endorses class-action suits against market rigging Posted: 06 Jan 2017 04:41 PM PST 7:40p ET Friday, January 6, 2017 Dear Friend of GATA and Gold: Interviewed today by Daniela Cambone of Kitco News, First Majestic Silver CEO Keith Neumeyer endorses the class-action lawsuits in federal court in New York targeting investment banks for manipulating gold and silver prices. Neumeyer remarks that he considers activism against the market rigging to be his duty to First Majestic's shareholders but that other monetary metals mining company executives want nothing to do with the issue. He cites GATA's work. The interview is not quite eight minutes long and can be heard at Kitco News here: http://www.kitco.com/news/video/show/Kitco-News/1463/2017-01-06/Keith-Ne... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Trump Could “Blow Fuses Across the World” Posted: 06 Jan 2017 03:54 PM PST This post Trump Could "Blow Fuses Across the World" appeared first on Daily Reckoning. We open with a remarkable fact… The weeks following Trump's election provided the greatest stock market rally to greet any new president — any new president — in American history. But peer back through the thick mists of time… all the way to November if you can… and recall that a Trump win was supposed to crater the markets. All the experts said so. Remember? Yet here we are, an inch shy of Dow 20,000. But many of the same brains who said it wouldn't happen are the same brains who are now saying it won't end. And that's got us a tad worried. Some on Wall Street are apparently worried too. "Wall Street Is Starting to Get Nervous About All the Money Pouring Into U.S. Stocks," warns a Bloomberg headline today. Since the election some $2 trillion of investor money has left the "safety" of bonds for the pitfalls and blind alleys of the stock market. "One has to wonder who's left to buy," notes David Santschi, head honcho of market research firm TrimTabs. One has to wonder, indeed. So a question hangs in the air… How much longer can the show roll on? At least another day, apparently. The jobs report came out today. Economists predicted the economy would take on 178,000 new workers last month. It only added 156,000 — still good enough, though. The Dow's up a cool 64 today. But what's this ahead we see? An ill omen, a portent of evil? Could the Trump reflation trade actually be the source of a great deflation? Consider… Trump's promises of lower taxes, less regulation, more jobs and oodles of infrastructure spending have revived the animal spirits. And the dollar has surged on the ballyhoo… broaching a 14-year high against a basket of six major currencies. We're heart and soul for a strong dollar. But in a world on the dollar standard, there can be too much of a good thing… You might think the U.S. economy's weak and interest rates absurdly low. But much of the world's worse, and U.S. rates are downright Himalayan compared with others. Capital goes where it's treated best. That means it's heading into the dollar and dollar-denominated assets. If you're in Japan or Europe, why pay the bank to hold your money when you can squeak out 2.35% on the U.S. 10-year Treasury? That buying in turn drives the dollar even higher. Good, as far as it goes. But here's the problem: Many emerging markets hold seas of dollar-denominated debt. When the dollar rises, the cost of servicing that debt also rises. If too much of their capital hightails it for the dollar, they just don't have the dollars to meet their debt obligations. (China just took steps to combat capital outflows and boost the yuan. More on that soon.) And when the dollar goes too far, they risk going into this thing called default. Maybe you've heard of it? A muscle-bound dollar is therefore, "a real serious noose around the neck of the global economy," warns David Beckworth, senior research fellow at George Mason University's Mercatus Center. It all goes back to the "dollar shortage" we've covered recently. Economist James Dale Davidson with more: A stronger dollar is not only a vote of confidence in the U.S. economy. It also tightens the deflationary cinch that is strangling the world economy. So an ironic effect of Trump's efforts to improve U.S. economic performance in a collapsing world is that it may accelerate collapse. The world is already awash with dollar debt… The more negative the cross-currency swap basis for exchanging dollars for other currencies, as U.S. interest rates rise, the greater the "dollar shortage." And thus, Trump's policies — if they go anywhere — could "blow fuses across the world," in the words of the London Telegraph's Ambrose Evans-Pritchard. Including here. We have no crystal ball. And we hazard no prediction. The market's kicked sand in our mug too many times to venture upon another. But since we opened today's reckoning with a remarkable fact, it's only fitting we close with another… Since the end of World War II, the U.S. has averaged a recession every five years. It's now going on its eighth year without one. Let's hope Uncle Sam outruns the hangman one more year… Regards, Brian Maher The post Trump Could "Blow Fuses Across the World" appeared first on Daily Reckoning. |

| How The West Has Been Selling Gold Into A Black Hole Posted: 06 Jan 2017 02:00 PM PST Bullion Star |

| Grudge Match 2017: Trump vs. Yellen Posted: 06 Jan 2017 01:57 PM PST This post Grudge Match 2017: Trump vs. Yellen appeared first on Daily Reckoning. Looks as if it's game on — Trump versus the Deep State. "Deep State" is a term that originated in Turkey to describe certain actors within the structure of government who were unseen but who wielded the real power irrespective of who won elections. A few years ago, a retired congressional aide named Mike Lofgren appropriated the term to describe a similar phenomenon here in the United States. Others, including Agora founder Bill Bonner, find it a useful prism through which to view the passing scene. As you're likely aware, President-elect Trump has expressed skepticism about the "Intelligence Community" and its claims that Russia "interfered" in the 2016 campaign for purposes of electing Trump. On Monday night, the Deep State struck back — using Senate Minority Leader Chuck Schumer as its messenger. "Let me tell you, you take on the Intelligence Community, they have six ways from Sunday at getting back at you," he said on MSNBC. "So even for a practical, supposedly hard-nosed businessman, he's being really dumb to do this." This week brings word Trump plans to reorganize both the Office of the Director of National Intelligence and the CIA. "The view from the Trump team is the intelligence world has become completely politicized," said an anonymous person The Wall Street Journal describes as "close to the Trump transition." Grab the popcorn… And then there's Trump versus the Deep State's most powerful economic cell — the Federal Reserve. Wednesday afternoon, the Fed released the "minutes" from its meeting last month. While the name "Trump" appeared nowhere in the document, it nonetheless conveyed a veiled threat. The key passage was this: "Many participants [in the meeting] commented that a more expansionary fiscal policy might raise aggregate demand above sustainable levels, potentially necessitating a somewhat tighter monetary policy than currently anticipated." Translation from Fed-speak: If Trump cuts taxes, we're jacking interest rates even higher than we've already said we will. "The new Trump administration will confront the Fed," says Jim Rickards in his first big forecast of 2017, "and insist on accountability and rule-based decision making. The confrontation will present enormous risks and opportunities to investors." Recall that during the campaign, Trump declared he would fire Janet Yellen as Fed chair — although the president possesses no such power. "Trump also claimed that Yellen was keeping interest rates artificially low in order to pump up the stock market and help elect Hillary Clinton," Jim reminds us. Yellen began to strike back at her press conference right after the December Fed meeting. As Jim pointed out the day after, she said she might stick around on the Fed Board of Governors even after her term as chair is over in early 2018 — a lingering thorn in Trump's side. But she also hit out at Trump's economic plan. When it comes to "stimulus," Yellen is fond of tax credits for education, worker training and certain infrastructure. Across-the-board tax cuts that would most benefit the wealthy? Not so much. Seen in this context, yesterday's Fed minutes could be a way to turn up the heat on Trump: Yo, Mr. Big Talker, you wanna cut taxes for the rich? We'll just ratchet up interest rates some more. We've been all about easy money these last eight years, but we're gonna choke off Trumpflation at the first sign of it, bub. Remember who's in charge here! Or as Jim puts it, "The Fed expects to 'lean in' against the Trump stimulus and to avoid letting the economy run hot." But what if the economy doesn't run hot, despite the Trump stimulus? That's a possibility Jim's been entertaining for weeks now. "The problem with the Fed's assessment," he elaborates today, "is that the Trump policies may not be nearly as stimulative as the Fed expects." For one thing, the Republican leadership in Congress wants the tax cuts to be "revenue neutral." "This means," Jim explains, "that for every cut in tax rates, there must be an offsetting revenue increase from some other source, such as the elimination of tax deductions and credits, conversion of capital gains into ordinary income, repeal of Obamacare or reductions in entitlements. Trump has already said entitlement cuts are off the table." In addition, Jim says, "It will be difficult for Republicans suddenly to become the party of big spending and higher debt ceilings without extensive criticism from the Democrats, the media and parts of the Republican base. Increased spending is in the cards, but it may be far smaller than both Trump and the markets expect. "In short, the Trump 'stimulus' may turn out to be far smaller and far less stimulative than markets currently anticipate," Jim concludes. "The reflationary Trump Trade of higher stock prices, a stronger dollar, higher interest rates and a declining dollar price of gold may soon run into a brick wall of congressional opposition and budget realities. The rally in stocks and the dollar and the head winds for bonds and gold all seem overdone. The Trump Trade may continue for a few more months, but by the spring of 2017, reality will set in and a sharp reversal of market trends will be in the cards." And if the Fed keeps tightening policy at a time the Trump stimulus isn't delivering the goods? "The Fed may cause the recession it has worked so hard to avoid." In the meantime, other elements of the Deep State will continue their own scheming. The International Monetary Fund convenes its next big meeting on April 21 — at the very time Trump's first-hundred-days agenda would be hitting the wall. Then what? Dave Gonigam The post Grudge Match 2017: Trump vs. Yellen appeared first on Daily Reckoning. |

| Gold Seeker Weekly Wrap-Up: Gold and Silver Gain About 2% and 3% on the Week Posted: 06 Jan 2017 01:17 PM PST Gold fell $10.21 to $1170.99 by early afternoon in New York before it bounced back higher into the close, but it still ended with a loss of 0.69%. Silver slipped to as low as $16.307 and ended with a loss of 0.84%. |

| Posted: 06 Jan 2017 12:58 PM PST The gold miners’ stocks are rocketing higher again after suffering a rough few months. Following sharp selloffs on gold-futures stops being run, the Trumphoria stock-market surge, and a more-hawkish-than-expected Fed, this battered sector had largely been left for dead. But gold stocks’ strong fundamentals finally overcame the dismal herd sentiment last week, paving the way for this sector to shine again in 2017. This “shine again” assertion likely seems dubious to casual observers, since the gold miners’ stocks suffered a miserable Q4’16. The leading HUI NYSE Arca Gold BUGS Index plunged 21.1% in a quarter where the benchmark S&P 500 broad-market stock index surged 3.3%. Naturally gold miners’ profits are fully dependent on gold prices, and this metal fell 12.7% in Q4 which proved one of its worst quarters ever. |

| COT Gold, Silver and US Dollar Index Report - January 6, 2017 Posted: 06 Jan 2017 12:30 PM PST COT Gold, Silver and US Dollar Index Report - January 6, 2017 |

| Japan’s Role in the West to East Power Shift Posted: 06 Jan 2017 12:20 PM PST This post Japan's Role in the West to East Power Shift appeared first on Daily Reckoning. Once the dust settles, the Trump White House will gear up to make its mark on the U.S. economy. But America doesn't exist in a global vacuum, not politically, militarily, or financially. So, it's important to consider the ramifications of Trump and his Washington Co. on the quickly evolving global markets and political alliances in order to be best positioned to profit at the right time. As the third largest economy in the world, it also has the highest government debt to GDP ratio at nearly 250% vs. that of the U.S. at 105%. Recently, the Bank of Japan opted for another round of artisanal money policy (cheap money). Governor Haruhiko Kuroda cut the cost of 10-year debt to accompany negative short term interest rates. That means Japan can finance its current and new debt even more cheaply for the next decade. It's part of Japan's insistence that monetary policy combined with Abenomics fiscal policy can jumpstart economic growth. Japan's global superpower position has been overshadowed by expansion, economically and politically, of long-time adversary, China. Japan stands at the crossroads of a shot to do something about this. But that's only if it plays its cards right. For the moment, Japan has chosen to copy and adhere to U.S. Federal Reserve policy since the financial crisis began. But since it's a key pivot country in the West to East power shift, especially now, leading up to Trump's inauguration on Jan. 20, 2017, it's possible next moves deserve our keen attention. My Recent Trip to JapanI don't like to discuss countries without gathering on the ground intel. So, I hopped aboard a Boeing 777 and jetted to Japan two days after the U.S. election. There, I addressed officials and financial professionals to get the lay of the land. I spoke to a crowd at the Tokyo Stock Exchange, where I was the first American following our elections to speak publicly about their impact. The next day, I spoke at the foreign correspondents' club where I answered questions from the foreign press. Most questions related to understanding the American population's position, and what Trump would do on military expenditures and on trade.  Nomi Prins inside the corridor of the Tokyo Stock Exchange While I was conversing with officials in Tokyo, Japan's Prime Minister, Shinzo Abe flew around the world in the other direction — to the United States to meet with Trump in New York City. Abe is sitting in the middle of a U.S./China crossroads. For every $50 billion pledge that a Japanese mogul invests in the U.S., there's a plethora of side trade deals being made between China, the rest of Asia and the world. Just before Abe flew to the U.S. to talk to Trump, China's leader, Xi Jinping also reached out to Trump for a meeting on Nov. 14., but he was not given a firm time. President Xi told Trump during their phone call that "facts have shown that cooperation is the only correct choice" for the United States and China according to Xinhua, a Chinese state news agency. Trump however chose to speak with Abe, who had reached out to him on Nov. 9, the day after the election, first. The two met on Nov. 17. Not one to be shaken by that sort of dismissal, Jinping reacted by further strengthening China's trade ties throughout Asia. He championed China's own version of the Trans Pacific Partnership (TPP) in which China was not included to begin with. Why a "Dead" TPP Still MattersWithout the U.S., the TPP as it stands dies no matter what Abe might have wanted. But what happens instead? China forges ahead on its own TPP. Japan had the opportunity to do this in the wake of the U.S. election results. But it chose not to in order to maintain a good relationship with the U.S. possibly to its own detriment. What could have happened? Either both Asian giants could have worked together for a unified Sino-Japanese equivalent of the TPP, or one could have taken leadership in regional trade blocks – leaving the other behind. The opportunity presented a unique positioning for cooperation uncommon for a region so historically divided. When I was there, I suggested to senior government advisors that the leadership route would be a prudent interim course of action for Japan from an economic perspective, and it could be used to leverage a U.S. related deal later. Despite all election rhetoric from Trump and other American political figures to the contrary, Abe believed he could convince Trump to re-embrace the TPP (losing credibility in Japan as a result). Abe, while stressing the urgent nature of American involvement, said that the TPP would be "meaningless" without U.S. involvement. But, he didn't choose another direction given that the U.S. won't be involved. Trump will more likely create bilateral trade agreements with Japan and other countries. That's how he operated his business empire. Without the old TPP, China wins big though. It can strengthen its regional and global role with no competition from a broad Asian coalition in which the U.S. and Japan were taking part. Still, while the TPP door for Japan may have closed, China can now operate with Japan on finding another way to modernize its frosty relationship.  Nomi Prins prior to speaking to the Tokyo Stock Exchange Japan must consider this: Does it enter a new arrangement with China with whom it has a prickly historical relationship? Does it work with Trump on a separate bilateral trade agreement that would make the U.S. and Japanese economies (both growing more slowly than China) more co-dependent? Or does it try to do both? To hedge its bets somewhat, Japan is meanwhile forging tighter relationships with Russia, copying China. Seeking to further diversify its regional cooperation, on Nov. 11, Abe signed a new nuclear agreement with India before he left for the U.S. Both moves are harbingers of Japan's commitment to a stronger role in the region. The political rattling between these Asian states has left each respective central bank with even greater global influence. As the People's Bank of China (PBOC) faces a falling yuan, and the Bank of Japan (BOJ) is simultaneously dealing with market inflation, both banks have been given considerable power that has domestic and global implications. Both could raise rates. Central Bank ManipulationCentral banks throughout the world, have manufactured money that costs nothing. In the U.S., inflation hasn't risen except in people's pocketbooks. In Japan, inflation has risen in terms of the middle class taxation. There's been a disconnect between how inflation is measured and how it actually impacts individuals on the ground. That was one of the reasons why Trump and Bernie Sanders touched the population across conservative and liberal ideology. People know their wages aren't keeping up with the things that they need to buy. That's why they took on more debt and felt more anxious. What the Fed and the Bank of Japan has done, is altered the availability of money to the financial system and elites, not to the foundational economy. It hasn't changed the nature of economic stability. In Japan, debt ballooned even before rates went negative this January. The BOJ's latest artisanal money proposal of reducing 10-year rates is a way of dealing with Japan's epic debt to GDP levels. It effectively allows Japan to finance itself forever without paying interest for it, or issuing what Wall Street calls, perpetual bonds.  Photo of Shibuya Tokyo, Japan taken by Nomi Prins But the BOJ's role of trying to control the shape of the Japanese yield curve, or tripling down on the ineffectiveness of its massive quantitative and qualitative easing policies could also inflate the cost of getting U.S. dollars. This could lead to credit contraction, not just in Asia, but in Europe as well, given co-dependences of global banks and central banks. And also inflation. Equity markets haven't priced this in yet. But as the current bullish trend of the dollar extends, the Fed possibly tightens a bit, and as the BOJ and other central banks keep maniacally "printing" money, the global economy could reach a danger point to find and supply dollars. Meanwhile, the shifting of global power eastward forces Japan to consider shifting, or diffusing, financial alliances away from the U.S. In the wake of the financial crisis, the People's Bank of China was vocal about the risk in terms of bubbles, recklessness and lack of a reasonable exit plan from the Fed's exported zero to negative interest rate and QE policies. China continues to forge its U.S.-independent path. It has done so through inclusion of the Renminbi in the IMF's SDR basket as of October 2015. As well as a stronger relationship and side agreements with Russia, the BRICS community and increasingly with Europe and the United Kingdom post the Brexit vote. That was all part of a strategy to not be beholden to the risk that the United States posed upon the world. The power-play away from the U.S. dollar and U.S. policies portends more to come. An isolated U.S. will only push China and Japan closer together. While economic agreements will be a first step, we could be approaching a new dawn in which Sino-Japanese relations allow for diplomatic normalization and potential military cooperation. Regards, Nomi Prins, @nomiprins The post Japan's Role in the West to East Power Shift appeared first on Daily Reckoning. |

| Byron King: At Some Point Economic Reality Will Set In Posted: 06 Jan 2017 11:13 AM PST This post Byron King: At Some Point Economic Reality Will Set In appeared first on Daily Reckoning. James Howard Kunstler's podcast featured Daily Reckoning contributor Byron King for a conversation about money, metals and the economic reality in America. They start out conversation covering what is going on in gold markets and what is ahead following the patterns in 2016 and going forward in 2017. Byron King has been engulfed in research and extensive international travel, so having access to this exclusive podcast conversation is particularly insightful. Byron King is a senior geologist at Rickards' Gold Speculator. Mr. King is a Harvard-trained geologist who has been featured in a wide range of media outlets including The Guardian, Fox Business News and The Financial Times. He has worked in the oil industry and has a rolodex of experience in the natural resource sector. When asked by Kunstler about the activity of gold over the past year and allegations of price manipulation King responded, "You are absolutely correct that the price of gold is being manipulated. I am not about to say that there are little gnomes in Zurich who sit around at 3AM and dumb futures contracts into the market to kill any rise in metals." "There is an awful lot of very bad groupthink going on. The world of economics is dominated by a groupthink type of academic concepts… that have this sort of monetary theory that we can do everything monetarily. They all think the same way. There is very little difference at the very margins in terms of how do we tweak the economy for equilibrium purposes. They even think you can have an equilibrium economy." When asked who has the ability to dump so much gold at one time he responded, "First of all, they are not really dumping the gold. They are dumping the contracts. There is a hundred ounces of contracts for every physical ounce." Kunstler then pressed King on the International Monetary Fund and its application of the special drawing rights (SDR), or world money. The geologist and finance expert noted, "It is central bank money. It is intended to back up central banks in terms of national currency. Let’s back up over 18 years and look at the failure of Long Term Capital Management (LTCM). One great big hedge fund took too much risk and failed. The rest of Wall Street stepped up and bailed out LTCM. Then in 2008, 10 years later, Wall Street failed and the U.S Federal Reserve stepped in and bailed out Wall Street." "Now here we are, 10 years later, when the central banks of the world are going to fail in what looks like the next year or two. The only thing left is the International Monetary Fund with the SDRs. They are going to back everything up with this world money. It is magic money. That is truly the last step, and we might not even take that last step. The SDRs could be something that people are not quite ready to accept." When asked about the Trump impact on the U.S economy he responded, "The idea that somehow we are going to change over forty years of history in the matter of weeks is misguided." He then referred back to energy and the economy he noted, "I begin with the concept that everything within the economy, whether you subscribe to the PhD opinions or otherwise, everything is energy drive. If you take away energy, the economy goes away." The interview then shifted to a political tone and the idea that the Fed has an adversarial position against the incoming Trump administration King remarked, "The Fed has been extremely accommodating to the Obama administration. Although I think they would have been accommodating to anybody who was in office because the conventional republicans and democrats are slight variations of the same species." "I don't the the Fed and its DNA of monetary policy is looking forward to having to deal with Trump. It would not surprise me at all if they decided to raise interest rates a couple of times in the years to come. They are going to leave him holding the fire and all of the bad policies. It is a disaster waiting to happen whether it happens under Trump or not." To listen to the full interview with James Howard Kunstler click here on economic reality conditions, gold and his financial outlooks click here. Regards, Craig Wilson, @craig_wilson7 The post Byron King: At Some Point Economic Reality Will Set In appeared first on Daily Reckoning. |

| Posted: 06 Jan 2017 09:31 AM PST Zealllc |

| 5 Reasons Why Russia Wins in 2017 Posted: 06 Jan 2017 09:15 AM PST This post 5 Reasons Why Russia Wins in 2017 appeared first on Daily Reckoning. As Russia continues to be a major factor in both U.S foreign and domestic politics, its economy stands to be a major factor in the year ahead. Understanding the power alliances, geopolitical positions and economic environments in 2017 between Russia and the international community could offer great opportunity behind the mainstream news cycles. Here are the 5 reasons that Russia is positioned for fundamental positioning over the next twelve months.

Trump's Foreign Policy:While the president-elect might be the most obvious factor, he also stands to have the greatest impact. Donald Trump has taken to drastic measures (including a barrage of Twitter praise) in order to separate his approach with U.S-Russian affairs from the former administration. In May, 2014 while speaking to the National Press Club, the same location that will host the DeploraBall, Trump indicated that he had indeed visited Moscow and had talked “indirectly and directly with President Putin, who could not have been nicer.” The existing friction from the current White House could prove to be entering a thawing of relations for the incoming Republican leader. In addition to Trump's relationship with Putin, his nominee for U.S Secretary of State, Rex Tillerson has formulated a very cozy relationship with Moscow. The former ExxonMobil chief executive was even given the Russian Order of Friendship directly from Putin. The relationship that exists between the incoming chief diplomat, on both a business and personal basis with the Russians, offers an interesting crossroads for U.S foreign policy. John Hamre, former deputy secretary of defense and president of the Center for Strategic and International Studies (where Tillerson is a board member) reported to the Wall Street Journal that Tillerson, "Has had more interactive time with Vladimir Putin than probably any other American with the exception of Henry Kissinger." Though Congress is not likely to let go of its eagerness to investigate and punish Russia for any mischief during the U.S election, this growing relationship will carry weight. Regardless of political rank and file discussions over Russian policy, meddling and historical conflicts – the nature of the Trump administration will be much more interconnected. The Russian Central Bank:The head of Russia's central bank, Elvira Nabiullina, has just been selected as the best Central Bank Governor for Europe in 2016 by The Banker. The financial magazine has been deemed one of the top international financial sources and is read in over 180 countries. The publication noted the banking governor as having "helped steer the country through the difficulties," with Russia "set to return to economic growth in 2017." The Banker magazine went on to establish the governors merits, "Having started 2016 with consumer price inflation of 12.9% – highs not seen since 2008 – Ms Nabiullina highlighted the need to lower inflation to improve economic growth in Russia," with a direct dedication to the awarded distinction. If 2016 was an influential year for Nabiullina steering the Russian economy, look for 2017 to be more of the same. Nabiullina has been described as Putin's "right hand woman" by The Economist and is widely considered to be one of the most influential advisers to the Russian leader. Even Jim Rickards has noted that the the current head of the Central Bank of Russia is one of the few head bankers he has admiration for. Oh, and did we mention that Nabiullina has been taking the lead in the Russian buildup of gold reserves?

Russian Gold:In October, prior to the U.S election and at the height of looming Russian concern over a Hillary Clinton victory, it was reported that Russia purchased around 48 metric tonnes of gold bullion. One gold editorial noted that, "The Russian central bank gold purchase is the biggest monthly gold purchase of this millennium." To put this gold buildup perspective, the Russian central bank is responsible for purchases of all domestic gold production and continues to extend its reach into the international market. Currently, the Russian gold stockpile is larger than the People's Bank of China, and fifth in the world after those of the U.S., Germany, France and Italy according to the World Gold Council. That puts them in an elite category for the precious metal. While this Russian build up of gold could be seen as just U.S election hedging from 2016 (or just Western resilience) there is much more to the story. By the Russian central bank taking considerable steps into gold purchases, the government could be signaling a move away from large bond holdings and seeking options to diversity currency holdings. This attempt to diversify away from foreign currency continues to be a part of the Russian policy agenda. Prior to the 2014 Russian military incursion in Ukraine and the annexation of Crimea, the government was in formal discussion to bailout Ukraine with the equivalent of $17 billion in IMF special drawing rights, or world money. Gold offers that same alternative. Greater financial diversity, especially in the face of waning negative sentiments around gold, could make Russia a significant powerhouse in gold reserves for years to come. With the Russian central bank pushing the cart, 2017 could be the start of even greater competition for the commodity. Financial Positioning:Six days into 2017 and the Russian ruble has continued in its pattern of making gains against the euro and dollar. In 2016, the ruble ended the year as the second-best performing currency amongst its peers in emerging market currencies. Even Radio Free Europe, a U.S government-funded broadcasting organization, has cited that the ruble could be the "hottest currency of 2017." As economist and bestselling author Nomi Prins noted earlier this week in her financial road map for 2017, "Russia supplies nearly one-third of the EU's natural gas, it has also begun clean energy initiatives through the BRICS development bank and other platforms, a strategic diversification. That's why the ruble will outperform the euro and the pound sterling." While other emerging economic currency markets continue to be hit, Russia has built a resilient barrier despite Western economic sanctions. During the latest retaliatory sanctions that the Obama administration imposed on the Russian government, no economic constraints were levied. These sanctions, along with potential economic ones, are anticipated to be weakened once the new administration takes hold of the White House. Immediately following the November 8th U.S election, Reuters referenced, “Clearly the chances of sanctions being lifted on Russia have risen substantially,” Charles Robertson, Renaissance Capital’s global chief economist, said. “That would improve the investment climate for Russia.” European Divide:The European Union was once perceived to be pushing the edge of supranational theory and action, from introducing the euro for a common currency to its open border system. Now a considerable right leaning shift has taken place in the continent, one in which Russia has considerable opportunity. The Eurozone continues to be bombarded with issues related to terrorism, refugee influxes, trade and a struggling common currency. These socio-political issues were referenced by the IMF's 2016 World Economic Outlook to be factors contributing to a E.U slowdown and could be prospects for greater Russian involvement. As major elections are set for 2017, specifically in France, Germany and the Netherlands, the opportunity for Russian economic and political expansion in the region could be rolled out. Even once Russian-adversarial comedian turned leader of Italy's Five Star Movement, Beppe Grillo, has taken his anti-establishment platform to be more "Kremlin friendly." This growing anti-establishment connection to Russia, or at the very least ambivalence, could open political alliances. If the E.U continues to separate away from its de facto capital in Brussels, Moscow could certainly be positioning itself as a new force for economic influence – spreading the power shift from West to East. While many might see the open and receptive nature of Russia as a threat to U.S positioning globally, the reality could prove to be significantly different. David Stockman, former U.S Congressman and President Reagan's OMB director has made it strikingly clear that America can no longer afford to play the costly game of global brinksmanship. Stockman notes "A grand bargain with Putin’s Russia is not merely the right thing to do. It’s also the only thing to do. That’s because the US is long past the time that it can afford its global empire and neocon interventionism." While these five indicators that 2017 may bring a new economic horizon with the West and Russia, the political climate will be one to watch for building bridges. Stay tuned, Thanks for reading The Daily Reckoning, Craig Wilson, @craig_wilson7 The post 5 Reasons Why Russia Wins in 2017 appeared first on Daily Reckoning. |

| Black Magic Fraud to be exposed in 2017 – Gold up 300X Posted: 06 Jan 2017 08:54 AM PST Black Magic Fraud to be exposed in 2017 – Gold up 300X |

| Posted: 06 Jan 2017 08:53 AM PST The gold miners' stocks are rocketing higher again after suffering a rough few months. Following sharp selloffs on gold-futures stops being run, the Trumphoria stock-market surge, and a more-hawkish-than-expected Fed, this battered sector had largely been left for dead. But gold stocks' strong fundamentals finally overcame the dismal herd sentiment last week, paving the way for this sector to shine again in 2017. |

| Posted: 06 Jan 2017 07:37 AM PST How can we summarize the last year in the gold market? First of all, it was a mixed year for gold. The first half of 2016 was excellent for the yellow metal. Actually, the several-month long bull market in gold started in December 2015, when the shiny metal found a bottom at $1,049, after the FOMC historical meeting and the first interest rate hike for almost a decade. From then, the shiny metal made higher highs and higher lows, reaching a peak at $1,366 at the early July in the aftermath of the British referendum on the withdrawal from the EU. Gold was one of the best performing assets that time, and gained about 30 percent, as one can see in the chart below. |

| Gold Surges Over 30% in GBP In 2016 After Brexit Posted: 06 Jan 2017 07:27 AM PST – Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies – Gold surges 31.5% in British pounds after Brexit shock – Gold acted as hedge and safe haven in 2016 … for those who need safe haven – Further signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war and cyber war – Outlook for gold good during Trump Presidency (2017 to 2020) |

| How The West Has Been Selling Gold Into A Black Hole Posted: 06 Jan 2017 07:20 AM PST In December 2016 Chinese wholesale gold demand, measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), accounted for 196 tonnes, down 9 % from November. December was still a strong month for SGE withdrawals due to the fact the gold price trended lower before briefly spiking at the end of the month, and the Chinese prefer to buy gold when the price declines (see exhibit 1). |

| Posted: 06 Jan 2017 07:12 AM PST How can we summarize the last year in the gold market? First of all, it was a mixed year for gold. The first half of 2016 was excellent for the yellow metal. Actually, the several-month long bull market in gold started in December 2015, when the shiny metal found a bottom at $1,049, after the FOMC historical meeting and the first interest rate hike for almost a decade. |

| Posted: 06 Jan 2017 07:11 AM PST Gold is now in the advancing phase of a new intermediate cycle. Bearish sentiment at the recent bottom was among the most extreme readings we have seen in the past 40 years. This should be the fuel to drive a really big rally. |

| GoldPrice.org chart shows metal gained in all major currencies in 15 years Posted: 06 Jan 2017 07:03 AM PST 10:03a ET Friday, January 6, 2017 Dear Friend of GATA and Gold: GoldPrice.org has posted a chart of gold's performance in major currencies since 2002, and it shows far more green than red and net gains in all of them, ranging from a low of 156 percent in the Chinese yuan and a high of 496 percent in the Indian rupee. The chart is posted here: http://goldprice.org/charts/history/gold-price-performance_x.png?1924122... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Join GATA here: Vancouver Resource Investment Conference Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| When Trump Tweets These Companies Weep Posted: 06 Jan 2017 06:55 AM PST This post When Trump Tweets These Companies Weep appeared first on Daily Reckoning. In our social media-fueled world, it should come as no surprise that this week's market action started with a tweet. They didn't even get to ring in 2017 at the New York Stock Exchange without the president-elect jumping all over one of the country' most recognizable public companies. Early Tuesday morning, Trump raked General Motors over Twitter's red-hot coals, calling for America's largest automaker to move production of its popular midsize sedan north of the Mexican border…

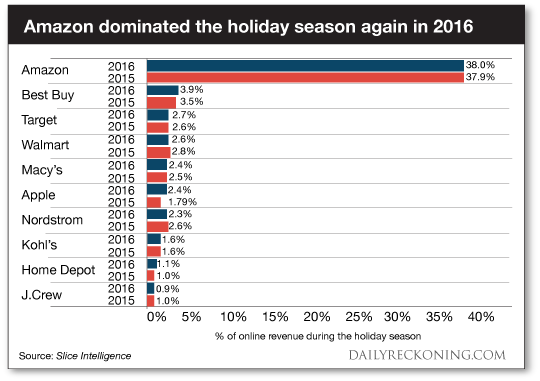

Chevy wasn't the only automaker to hear from Trump. Toyota also received a lashing from the president-elect for its plans to build a plant in Mexico. Meanwhile, Ford made Trump's nice list as the company announced plans to ditch a new plant in Mexico and add 700 jobs to a Michigan facility. With just a few taps on a smartphone, the world's biggest auto manufacturers are on notice. It's no surprise that some investors are worried about Trump's tweets about public companies. After all, there's nothing worse than unexpected news derailing a trade. And now we have to deal with the most powerful person in the world sending out potentially trend-busting tweets? It's tough to catch a break these days. But if you're concerned that the Trump train is going to derail one of your stocks, the internet has your back… "Trigger, a smartphone application that tracks movement in financial markets, unveiled Tuesday an update that allows users to set alerts for when Trump tweets about a company in which they hold shares," The Hill reports. Maybe that app is worth a second look… just in case a new Trump tweet sends billions of dollars in market cap up in smoke. Speaking of burning billions… The Retail Recession is Real Brick and mortar retail is collapsing. Shopping malls are dying much faster than anyone anticipated. As the collapse accelerates, it threatens to shake the entire retail sector to its core. Retail stocks were granted a brief reprieve during the post-election rally. But the comeback is looking more than a little shaky as some of the biggest names in the sector are now starting to roll over. All the major stores are reporting horrendous holiday sales numbers. Macy's and Kohl's notched sales declines of more than 2%. And Macy's and Sears are both shuttering more stores. The news sent many retail stocks cratering. Macy's stock dropped almost 14% yesterday. Kohl's shares lost 19% on the day. Nordstrom was the best of the worst, falling a little less than 7%. The slow-motion collapse of the traditional retailers is starting to pick up steam. As this story continues to unfold, the retail sector is becoming a wasteland. Jeff Bezos and his army of same-day Amazon delivery drivers have gutted every brick and mortar store in their path. Derelict shopping malls dot the country. It's not a pretty picture.

The Wall Street Journal notes that Amazon has absolutely dominated the holiday shopping season. The online superstore recorded ten times the sales of the next biggest seller. Physical stores don't stand a chance against Amazon. The writing is on the wall. Sincerely, Greg Guenthner The post When Trump Tweets These Companies Weep appeared first on Daily Reckoning. |

| Koos Jansen: How the West has been selling gold into a black hole Posted: 06 Jan 2017 06:50 AM PST 9:50a ET Friday, January 6, 2017 Dear Friend of GATA and Gold: Gold market researcher Koos Jansen writes today that while gold flows in and out of the London market, once gold gets into China, it doesn't come back. Jansen sees this pattern as gradually reducing the above-ground metal available for affecting gold's price and indicating that prices will increase eventually. Jansen's analysis is headlined "How the West Has Been Selling Gold into a Black Hole" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/how-the-west-has-been-sell... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Jamie Oliver closes six of his Italian restaurants blaming collapse in sterling and tough trading Posted: 06 Jan 2017 05:22 AM PST This posting includes an audio/video/photo media file: Download Now |

| Posted: 06 Jan 2017 02:54 AM PST Clint Siegner writes: Precious metals had a wild ride in 2016, launching higher in the first half of the year and then falling much of the way back to earth in the second half. Our outlook for 2017 hinges on some of the drivers that figured prominently in last year’s trading. There are also a couple of new wrinkles. |

| Breaking News And Best Of The Web Posted: 06 Jan 2017 01:37 AM PST Trading gets choppy as stocks, the dollar, bitcoin and gold reverse recent trends. US jobs growth disappoints, manufacturing expands. Global debt continues to soar. US retaliates against alleged Russian hacking. Fake news debate rages. Best Of The Web My political-financial road map for 2017 – Nomi Prins How to make America great again with […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Gold’s ‘False Dawn’ May Depend on Looming Debt Ceiling Posted: 05 Jan 2017 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment