Gold World News Flash |

- GoldSeek Radio Nugget: Peter Grandich and Chris Waltzek

- Outlook for Precious Metals in 2017

- A Path for Gold to as High as $1434

- Venezuela's March Toward Default

- Asian Metals Market Update: Jan-6-2017

- The Era Of Cheap Money Is Ending: "This Is The Calm Before The Storm"

- Silver Dumps, Peso Jumps As Mexican Central Bank Intervenes (Again)

- 2017 The Year on An EMP Attack -- Anonymous

- Trump’s Twitter “140 Characters” To Push Gold To $1,600/oz in 2017?

- Harry Dent predicts The Biggest Economic Collapse in modern history in 2017

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% More

- The Endgame, Trump & Gold

- Is the Correction in Precious Metals, Uranium, Lithium and Rare Earths Stocks Over?

- Alasdair Macleod: Fiat money quantity breaks $15 trillion

- Bullion Star posts primer on China's especially secretive gold reserves

- China's choices narrowing as it burns through FX reserves to support yuan

- The Rising U.S. Dollar and the Impact on Commodities

- Chart of the Day - Gold Half Cycle Low Due Soon

- Gold – Half Cycle Low Due Soon

- Gold and Silver Market Morning: Jan 5 2017 - Gold and Silver prices follow Shanghai higher!

- A Terrifying Warning That The West Is Now Approaching The ‘Brick Wall’

- Breaking News And Best Of The Web

| GoldSeek Radio Nugget: Peter Grandich and Chris Waltzek Posted: 06 Jan 2017 07:09 AM PST Peter Grandich of Peter Grandich and Company says the recent correction has cleared the skittish, speculative crowd, presenting a valuation opportunity. In 2016, the PM sector performed solidly - silver added 14%, gold 10% and the XAU gold / silver shares advanced over 63%. Due to the marked improvement in the supply / demand environment, the PMs markets are primed for better performance. |

| Outlook for Precious Metals in 2017 Posted: 06 Jan 2017 07:04 AM PST The election of Donald Trump is what makes this year different. Many people are optimistic about the prospects for a major infrastructure program, tax cuts, and less regulation. Investors are ready to take on risk. Since the election, they have been mostly getting out of safe haven assets such as bonds and gold, while paying top dollar for stocks. The rub is that Trump has yet to assume office. The expectations are high and, frankly, something has to give. Trump might deliver a big infrastructure program and some tax relief. However, that would spell trouble for the current dollar rally as people anticipate ballooning deficits and borrowing. |

| A Path for Gold to as High as $1434 Posted: 06 Jan 2017 07:01 AM PST Gold's rally, which took off in earnest a week ago, signaled more to come on Thursday when it pushed above two prior peaks on the daily chart (see inset). This indicates a new and healthy trend, according to the proprietary Hidden Pivot Method that we use to trade and forecast the markets. Notice that with just a little more oomph, the March contract could surpass two additional 'external' peaks on the daily chart (see inset). That would put them within a few ticks of tripping a theoretical 'buy' signal, shifting our focus, if not yet our expectations, to the 1434.80 target. |

| Venezuela's March Toward Default Posted: 06 Jan 2017 12:30 AM PST |

| Asian Metals Market Update: Jan-6-2017 Posted: 05 Jan 2017 11:03 PM PST If the US December nonfarm payroll comes in in the same way as the private ADP jobs number, then gold has a higher chance of rising to $1230 in the immediate term and $1314 in the medium term. One needs to look into the nonfarm payrolls on an overall context and not just the headline number. Headline number can be misleading, leading to trading losses. |

| The Era Of Cheap Money Is Ending: "This Is The Calm Before The Storm" Posted: 05 Jan 2017 11:00 PM PST Submitted by Mac Slavo via SHTFPlan.com, We’re living in the calm before the storm. That much everyone can sense. The stock market highs and holiday spending spree will soon be over, the inauguration will presumably go as planned, but that’s when everything could start to go off course. The only question is how the storm is going to stir into a frenzy – there will be a pretext of some kind. What seems certain is that it is past time to get ready for a difficult period. This could be the big, slow squeeze and the long winter. The economy became immune to stimulus and quantitative easing; the market can only be propped up so long, and the realities of raised interest rates a matter of timing for the Fed to decide. Now, President-elect Trump provides the catalyst necessary for a dramatic rise and fall in the economy. With the force of the economic avalanche that is poised to fall upon us all, the policies and actions of President Trump will do little to stem the tide of what is already coming; for better or worse, there is little that Trump himself can do even though it may fall squarely on his administration. There are many putting out the talking points now; the warnings are reaching a crescendo. Jay L. Zagorsky, Economist and Research Scientist at Ohio State University, is predicting a recession for 2017, in spite of glowing outlooks, that could dominate headlines:

Recession, of course, is a euphemism for something much more far reaching… yet the sense of true panic is there. This could be bad. Regardless, people across the spectrum are warning about the financial blowback that is likely headed our way. Many prominent economists are currently signalling either slow growth, or the onset of a crisis that no Trump could contend with, as RT notes:

If these guys are right, the Trump Administration promises of boosting the economy could end up a no go, nothing more than “magical thinking” and an overly-optimistic sales pitch. Hopefully they are wrong. Mike Adams emphasized the gravity of this massive monetary shift – it will rock global events, and likely overshadow almost anything else taking place during 2017 and the years that follow it:

Once that happens, there will be a backlash from the federal government and the emergency infrastructure that could swiftly implement a police state, tight cash and monetary controls, violence, looting and unrest in the streets and short supplies everywhere. If the crisis is widespread enough, almost any level of draconian measures could be justified. With nearly 50 million people dependent on food stamps in this country, no job growth, stagnant wages and a hungry, desperate and idle population drowning in debt, there will indeed by unrest as no one in this country has ever seen it. If they are fueling the fire so that it burns with spectacular destruction, it may be wise to get as far back and away as possible. |

| Silver Dumps, Peso Jumps As Mexican Central Bank Intervenes (Again) Posted: 05 Jan 2017 09:43 PM PST If at first you don't succeed, intervene again! For the second time today (at midnight ET), Banxico officials confirmed the central bank entered the market to sell US dollars in an attempt to strengthen the peso. Now we await the next Trump tweet to take the peso back down...

For now the move is far less impressive - which is odd given the lack of liquidity and an irrational peso buyer... We have one other question... Is Banxico dumping its silver to receive dollars to sell to buy pesos? Around $200mm notional of Silver was dumped in those few minutes. As we noted at their earlier attempt, we can't really blame Banxico for intervening: with the local population, of which over half lives in poverty, angry and protesting the recent "Gasolinazo", or 20% increase in the price of gas, the crashing currency is sure to send many other prices, especially of imported goods, through the roof while sending much of the population over the edge. Which is why Goldman's Alberto Ramos agrees that the central bank had to do something:

So much for a "brave new world" in which global trade imbalances can be resolved without central bank intervention. If anything, the events from the first 4 days of 2017, in which we first saw a dramatic indirect intervention by the PBOC which sent the overnight CNH deposit rate to the highest ever in a desperate attempt to crush shorts, and then the Mexican direct intervention, have confirmed that 2017 will be very much like 2016 when it comes to central bank intervention, if not more so. However, as Goldman admits, Banxico made one mistake which explains why virtually the entire post-intervention move has been faded:

There is a problem with using reserves to fight a currency war, one which China is very familiar with: On the other hand, using USD swaps is precisely what the PBOC shifted to late in 2015 (perhaps as advised by Goldman then too) when it too realized that using reserves was a very rudimentary (if effective) attempt at intervention. The only problem is that it eventually catched up to the central bank, and just like in the case of China which used swaps for about 3-4 months even as the capital outflows persisted, it ultimately had to return to draining reserves for a full blown intervention. Ironically, even that has failed, and as we have documented extensively in the past 2 months, the PBOC is now scrambling with intraday gimmicks like crushing shorts using deposit rates. That too only works for a while. Meanwhile, Mexico is caught between a rock and a hard place, because while the currency is depreciating, and the "MXN is now visibly undervalued versus theoretical fundamental fair-value under any of the three model metrics we use" Goldman warns that any further depreciation can undermine the inflation backdrop and/or risk unleashing destabilizing financial forces. Which is all Trump needs: a several economic crisis just south of the border.

Actually, there is another thing Trump "needs": Mexico launching an all out currency war against the US, whether through reserve draining (which would hit US assets) or USD swaps. Should the central bank intervene on a few more occasions to offset today's failed revaluation attempt, which the market is now openly mocking, we eagerly await the barrage of tweets that will be launched by the Trump account as the president-elect, having slammed the occasional stock, shifts to FX. Trump aside, what happens next? Once today's intervention fails, the Peso is looking at a lot more downside, and as Rabobank's Christina Lawrence writes,the MXN could fall as far as 23, as there "is little room for MXN relief as Banxico is highly unlikely to provide any lasting support for peso as market is too liquid and Mexico’s reserves will start to evaporate very quickly." Putting trading volumes in context, MXN is the 10th most liquid currency globally with an average daily volume in the spot market of $43b and $112b when including options. Rabo says that it “expects volatility to rise further and for the skew to continue moving to the right as market participants move to protect themselves from further USD/MXN upside” Finally, the real message here is that the Banxico’s intervention "may also be seen as sign of greater underlying problems." Bingo. |

| 2017 The Year on An EMP Attack -- Anonymous Posted: 05 Jan 2017 09:00 PM PST 2017 The Year on An EMP Attack -- Anonymous EMP will completely collapse The whole economy. EMP probably one of the worst threats to mankind specially in this day and age where everyone depends on electric devices No wonder they opted for guillotines instead of electric chairs. EMP what we... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Trump’s Twitter “140 Characters” To Push Gold To $1,600/oz in 2017? Posted: 05 Jan 2017 04:00 PM PST gold.ie |

| Harry Dent predicts The Biggest Economic Collapse in modern history in 2017 Posted: 05 Jan 2017 03:00 PM PST HARRY DENT: THE SALE OF A LIFETIME: HOW THE GREAT BUBBLE BURST OF 2017 CAN MAKE YOU RICH Biggest bubble in world history in almost every asset class. Bond bubble is enormous. The catalyst I am looking for is if the Saudis abandon the petrodollar. If that doesn't happen, we are toast by February.... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% More Posted: 05 Jan 2017 01:16 PM PST Gold gained $15.41 to $1178.91 in Asia before it pared back to $1170.62 in London, but it then rose to a new session high of $1184.82 in New York and ended with a gain of 1.52%. Silver rose to as high as $16.709 and ended with a gain of 1.16%. |

| Posted: 05 Jan 2017 12:58 PM PST In the bankers’ endgame, slowing economic growth and excessive central bank liquidity forces investor capital into financial markets; driving up the price of stocks, bonds and commodities and creating financial bubbles whose collapse pose a systemic threat in overly-indebted capitalist economies. |

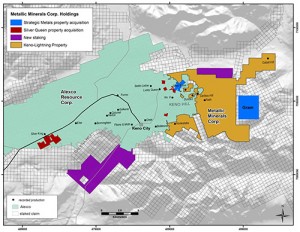

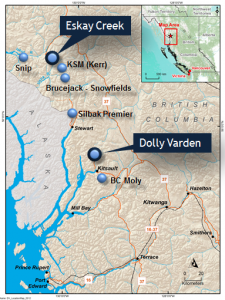

| Is the Correction in Precious Metals, Uranium, Lithium and Rare Earths Stocks Over? Posted: 05 Jan 2017 12:50 PM PST It appears that New Year 2017 has brought in with it renewed interest and new buy signals in the commodity sector and the junior miners. The TSX Venture is making a parabolic move as all the shorts have dried up and a whole new group of buyers appears to be entering. The Junior Gold Miner ETF (GDXJ) is breaking a 5 month downtrend and so is the silver miners etf (SIL). Now the next technical bullish breakout is regaining the 200 DMA, which I expect to come quickly. Uranium Miners ETF (URA) are breaking out of cup and handle breakout along with the Lithium Stocks ETF (LIT) as investors look to clean energy commodities. Notice the huge volume since the US presidential election. For weeks now I have been highlighting to my readers to be prepared for a nuclear revival under President Trump. For 8 years the nuclear industry has been under attack by ignorant forces who do not realize the potential of clean and reliable atomic energy. This will change dramatically with the new Presidential administration who will no longer allow the US to be reliant on imported uranium and Rare Earths (REMX) especially when we have so much uranium and rare earths in the domestic US that can be mined. Look at the Lithium ETF (LIT) especially after the recent news of Tesla turning on the Gigafactory producing lithium ion batteries. This should be a catalyst for the sector. Its important to take note of the recent breakout as I expect we could be on the verge of a big increase of interest in this sector which could benefit junior lithium, graphite and cobalt developers. Important news has also crossed my desk this week. I think silver is going to have an explosive move especially high grade silver found in Canada a safe mining jurisdiction. You see a lot of silver comes from crazy places like Bolivia. I love the high grade found in Canada especially the Golden Triangle and Keno Hill where Alexco (AXU) has made a major silver discovery called Bermingham which is getting the geological community quite excited as it is high grade and open at depth which means it could be large as well. This major discovery could also benefit Metallic Minerals (MMG.V or MMNGF) who just added key properties expanding their Keno Hill portfolio 60% with several new high grade targets to be explored in 2017. Remember the Keno Hill district in the Yukon has produced over 200 million ounces of silver with some of the highest grades in the world. See my interview with Metallic Minerals $MMG.V $MMNGF CEO Greg Johnson by clicking here… In addition to Keno Hill pay close attention to Dolly Varden (DV.V or DOLLF) who owns an advanced exploration high grade silver asset in the Golden Triangle in Northwest BC. In late November they released drill results which showed multiple areas of high grade expansion. Only a few weeks later they got a new CEO and VP of Exploration who have a known track record for silver M&A. They may have been impressed with the drill results which the market generally ignored at the end of 2016. One should pay attention now. Disclosure: I own shares in GDXJ, SIL, LIT, AXU, MMG and DV. MMG and DV are website sponsors. This should be considered a conflict of interest as I could benefit from price/volume increase and have been compensated by those companies. See full disclaimer and current advertising rates by clicking on the following link: http://goldstocktrades.com/blog/ Section 17(b) provides that: I am biased towards my sponsors (Featured Companies) and get paid in You must do your own due diligence and realize that small cap stocks is an _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

|

| Alasdair Macleod: Fiat money quantity breaks $15 trillion Posted: 05 Jan 2017 11:12 AM PST By Alasdair Macleod The fiat money quantity has now breached the $15 trillion level, standing at $15,108 trillion on November 1, 2016, the last calculable date. This is now $6.3 trillion above the pre-Lehman crisis trendline, exceeding it by 72 percent. Instead of the Lehman rescue being a temporary fix, the increase in the quantity of fiat money has continued to grow over eight years later. After the Fed responded to the financial crisis, monetarist commentators warned that the accumulation of bank reserves at the Fed would one day be unleashed into an expansion of bank lending, because every dollar held in reserves could become more than $10 of bank credit. The accumulation of these reserves had had no precedent, and monetary policy was therefore in uncharted territory. The only way bank reserves can be discouraged from leaving the Fed's balance sheet is for the Fed to increase the Fed Funds Rate (FFR), which is the interest rate the Fed pays commercial banks on these reserves. The original concern is now becoming justified, because banks have been gradually withdrawing reserves held at the Fed over the last 18 months. For this reason, the Fed had no alternative but to raise the FFR in December 2015 and in December 2016, to start the process of normalizing rates. The Federal Open Markets Committee should be watching the withdrawal of reserves as a key indicator in formulating interest rate policy, not that it is openly admitted in the FOMC's statements. ... ... For the remainder of the commentary: https://wealth.goldmoney.com/research/goldmoney-insights/fmq-breaks-15-t... ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Bullion Star posts primer on China's especially secretive gold reserves Posted: 05 Jan 2017 07:25 AM PST 10:25a ET Thursday, January 5, 2017 Dear Friend of GATA and Gold: Bullion Star's latest primer on central bank gold reserves is about China's, which, Bullion Star notes, are among the world's most secret. The primer is posted here: https://www.bullionstar.com/gold-university/central-bank-gold-policies-p... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China's choices narrowing as it burns through FX reserves to support yuan Posted: 05 Jan 2017 07:21 AM PST By Nichola Saminather SINGAPORE -- As China's foreign exchange reserves threaten to tumble below the critical $3 trillion mark, the biggest fear for investors is not whether Beijing can continue to defend the yuan but whether it will set off a vicious cycle of more outflows and currency depreciation. Data this week is expected to show China's forex reserves precariously perched just above $3 trillion at end-December, the lowest level since February 2011, according to a Reuters poll. While the world's second-largest economy still has the largest stash of forex reserves by far, it has been churning through them rapidly since August 2015, when it stunned global investors by devaluing the yuan CNY=CFXS and moving to what it promised would be a slightly freer and more transparent currency regime. Since then, authorities have repeatedly intervened to support the yuan when it weakened too sharply, burning through half a trillion dollars of reserves and prompting them to sell some of their massive holdings of U.S. government bonds. They also have put a tightening regulatory chokehold on individuals and businesses who want to move money out of the country, while denying they were imposing new capital controls. ... ... For the remainder of the report: http://www.reuters.com/article/us-china-economy-forex-reserves-analysis-... ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Join GATA here: Vancouver Resource Investment Conference Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Rising U.S. Dollar and the Impact on Commodities Posted: 05 Jan 2017 07:12 AM PST The FOMC has raised its benchmark interest rate up for the second time since the recession of 2008 and 2009. And as the U.S. is the only G8 country, over the last eight years, to start increasing its rate, there is little to no competition for the currency. The impact of a raising currency are many. On the plus side, it creates higher demand for U.S. Treasuries, lower borrowing costs for the Federal government and foreign demand for U.S. assets (including stocks). |

| Chart of the Day - Gold Half Cycle Low Due Soon Posted: 05 Jan 2017 07:08 AM PST Gold is 13 days into its daily cycle. At some point soon there will be a dip into a half cycle low. That will be the next opportunity to buy long. |

| Gold – Half Cycle Low Due Soon Posted: 05 Jan 2017 07:02 AM PST Gold is 13 days into its daily cycle. At some point soon there will be a dip into a half cycle low. That will be the next opportunity to buy long. |

| Gold and Silver Market Morning: Jan 5 2017 - Gold and Silver prices follow Shanghai higher! Posted: 05 Jan 2017 06:03 AM PST Shanghai gold prices continue to rise slightly on a daily basis and both London and New York are moving higher, faster as they appear to be catching Shanghai up. This again confirms that demand in Shanghai is solid and solid enough to pull gold out of the developed world gold markets. The strength or weakness of the dollar is not affecting this as you can see in Yuan prices. These appear to be rising in a relatively stable pattern over the last month. It is the translation into dollar prices that reflects dollar moves. |

| A Terrifying Warning That The West Is Now Approaching The ‘Brick Wall’ Posted: 05 Jan 2017 02:31 AM PST A Terrifying Warning That The West Is Now Approaching The 'Brick Wall' |

| Breaking News And Best Of The Web Posted: 05 Jan 2017 01:37 AM PST Trading gets choppy as stocks, the dollar, bitcoin and gold reverse recent trends. US jobs growth disappoints, manufacturing expands. Global debt continues to soar. US retaliates against alleged Russian hacking. Fake news debate rages. Best Of The Web My political-financial road map for 2017 – Nomi Prins How to make America great again with […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment