Gold World News Flash |

- Central Bank Gold Policies – People’s Bank of China

- What Is This "Neutral" Interest Rate Touted By The Fed?

- Asian Metals Market Update: Jan-5-2017

- Bitcoin Nears Parity With Gold -- Peter Schiff

- Let’s Play FOMC Bingo: Minutes Show 15 Instances of Uncertainty

- It's The "Most Volatile" Year For Political Risk Since World War II

- Now Is the Time to Buy Gold

- A painless path to publishing on Amazon

- Gold ETF Mechanics: An Infographic

- James Rickards: An End to Globalism

- Bitcoin Moonshots to $1,150, Doubling in Past Six Months

- Gold Seeker Closing Report: Gold and Silver Gain Again

- Bullion Star 'infographic' on gold ETFs shows how they undermine the gold price

- The Fed’s Playbook for 2017

- Saville doesn't get it: Rig the gold price and you rig all prices

- Saville doesn't get it: Rig the gold price and you rig all prices

- 'Audit the Fed' bill gets new push under Trump

- Profit from Gold’s January Revival

- Why Japan Refuses Immigration and Multiculturalism

- State Dept. cable confirms gold futures market was created for price suppression

- State Dept. cable confirms gold futures market was created for price suppression

- Northern Vertex – Gold-Silver Moss Mine Project in Arizona

- U.S. LIBOR breaks above 1 percent for first time since 2009

- RED ALERT: NEW WIKILEAKS LEAK - Exposes STOLEN Hard Drive With Clinton Docs! TOTAL MSM COVER-UP!

- 42 Years of Fractional Reserve Alchemy

- Low Oil Prices Will Make Russia More Aggressive in 2017

- Gold’s Dead. Here’s Why We’re Buying…

- Gold Investing Sentiment Starts 2017 at 4-Year High

- Stock Market, Gold Outlook for 2017

- Breaking News And Best Of The Web

- The Gold Owner's Guide to 2017

- Key Themes for 2017: Earnings, the Dollar, Tax Cuts and Stimulus

| Central Bank Gold Policies – People’s Bank of China Posted: 05 Jan 2017 07:02 AM PST Through it's central bank, the People's Republic of China holds the world's 6th largest central bank gold holdings, with over 1800 tonnes of gold held in its official reserves of the People's Bank of China. These gold reserves holdings are notable for having quadrupled since the early 2000s amid much secrecy. Since mid 2015, however, the Chinese government has embarked on a revised communication policy of releasing monthly updates on the size of its gold holdings. Although there is no official confirmation of gold storage arrangements, it is thought that the Chinese official gold reserves are vaulted in Beijing, China's capital, and may be under the protection of the Chinese army. |

| What Is This "Neutral" Interest Rate Touted By The Fed? Posted: 05 Jan 2017 12:30 AM PST Submitted by Mark Spitznagel via The Mises Institute, There’s a lot of talk these days about the so-called “neutral” (or “natural” or “terminal”) interest rate projections of the Federal Reserve. In fact, their projection of this number is a key argument in their ongoing decision to keep rates at historically very-low levels for what has been an extended period of time. (Specifically, Federal Reserve officials have argued that the neutral interest rate has sharply declined in recent years, meaning that apparently ultra-low interest rates do not really signify easy monetary policy.) What is this neutral rate? The neutral rate, it is argued, is simply the federal funds rate at which the economy is in equilibrium or balance. If the federal funds rate were at this mysterious neutral rate level, monetary policy would be neither loose nor tight, and the economy neither too hot nor too cold, but rather just chugging along at its long-run optimal potential. The underlying theory is that loose monetary policy — where the Fed’s policy rate is set below the neutral rate — can temporarily stimulate the economy, but only by causing price inflation that exceeds the Fed’s desired target (which, by the way, eventually causes overheating and a crash). On the other hand, if the Fed is too tight and sets the policy rate above the neutral rate, then unemployment creeps higher than desired and price inflation comes in below target. In short, the neutral interest rate is one where the central bank is not itself distorting the economy. Monetary policy would really be nonexistent, as the Fed would not be altering the interest rate resulting from a free market discovery process between borrowers and savers. (This of course raises the question, why do central planners need to fabricate something that would naturally exist in their absence?) This is near where Yellen actually thinks we are these days, hence she sees little urgency in raising rates and thus lessening what, on the face of it, looks like a very loose current monetary policy. The Theory of the Neutral or Natural RateMuch of this neutral rate talk at the Fed is supposedly supported by the work of Swedish economist Knut Wicksell (1851–1926), who argued that the “natural” interest rate would express the exchange rate of present for future goods in a barter economy. If in practice the banks actually charged an interest rate below this natural rate, Wicksell argued that commodity prices would rise, whereas if the banks in practice charged an interest rate above the natural one, then commodity prices would fall. But that’s where Wicksell — often associated with the free-market Austrian school of economics — would cease to recognize his own ideas in current central bank thinking. Wicksell’s natural rate was a freely discovered market price in an economy, which reflected the implicit (real) rate of return on capital investments. For Wicksell, the natural interest rate was not a policy lever to be manipulated, in order to hit some employment or output goal. Yellen and the other Fed economists writing on this topic have conveniently (and probably unwittingly) co-opted Wicksell into their own Keynesian (and exceedingly un-Austrian) framework. Can the Neutral Rate Be Used to Tweak the Economy?That’s the theoretical explanation of the neutral or natural rate. From a more practical standpoint, one must ask: How do we even know what that neutral rate is? The neutral rate is, by its current definition, inherently unobservable, as there is no discovery process in short-term interest rates (and there hasn’t been for as long as any of us have been around). Central banks calculate the neutral rate based on their formulas and identifying assumptions about output gaps and what interest rates, according to those models, will close those gaps. Here we have an immense circularity problem: Policymakers think they know the neutral rate because the assumptions of their interventionist model that they impose on the data say so, not because they have any insight that the market would actually clear at that rate, sans intervention. There is an underlying assumption that “markets, left on their own, are wrong, while our model is right.” Moreover, they are using observable data as model inputs that are the result of interventions that are already in effect. There are no controlled experiments in economics. Only market participants, acting freely in borrowing and lending at whatever interest rates make sense for that borrowing and lending, can ever discover what the neutral rate should be. (To give a specific example: One of the key alleged pieces of evidence that the neutral rate has fallen in recent years is the sluggish growth of productivity. But suppose the ZIRP of the Fed itself has been choking off real savings and distorting credit allocation among deserving borrowers, and hence has crippled sustainable growth in output? In this case, the Fed models would conclude, “Nope, our policy rate hasn’t been too low, look at the weak productivity growth,” confusing cause and effect.) In fact, the circular logic is such that economists are far from an agreement on the current calculation, and their admitted model estimation errors are enormous. Contrary to Yellen’s recent monetary policy ruminations, reputable estimates using two different approaches have concluded that the Fed has set policy rates below the neutral rate since 2009. Things get worse. It’s not merely that we can’t know in real-time what the neutral rate is; we can’t even know after the fact. Suppose the Fed gradually hikes rates, and then the economy crashes. Dovish Keynesians would no doubt say, “We told you not to tighten! The neutral rate was obviously lower than the Fed realized, and they just raised the policy rate above it.” But this isn’t necessarily so. It could be that the policy rate had been below the neutral rate for years, fostering a giant asset bubble which eventually had to collapse. Both theories are consistent with the observed outcome of modest rate hikes leading to a crash. The great Austrian economist Friedrich Hayek stressed the role of market prices in communicating information to firms and households, and the impossibility that central planners can ever effectively calculate those prices. If the Fed’s economists think they are able to estimate what the neutral interest rate is, then we can dispense with prices altogether. The Fed’s economists can estimate the “neutral wage rates” for various types of labor, the “neutral commodity prices” for various inputs, and so forth, and issue comprehensive plans for the economy, all calculated in kind. Of course, this is absurd. The point is, in a capitalist economy, the interest rates themselves — as determined in a competitive discovery process in the bond and credit markets — are central to the coordination of the economy. To assume experts at the Fed could determine the proper, optimal interest rate, without that discovery process, is to assume away the real-world information problems that we all can agree market prices solve. Indeed, perhaps this is why our economic problems persist? |

| Asian Metals Market Update: Jan-5-2017 Posted: 04 Jan 2017 11:02 PM PST Gold imports to Turkey jumped to 36.7 tons in December recording a 688 percent after its president Erdogan called for its citizens to convert their foreign exchange into Turkish Lira or gold. The Chinese are buying a lot of gold. There is higher demand for gold all over the Eurozone over fears of Islamic terrorism. Physical gold demand is on the rise. Investment demand in ETFs keeps on fluctuating. Physical gold demand is a long term indicator of gold prices. In the short term and medium term ETF inflows/outflows and other news affect prices. |

| Bitcoin Nears Parity With Gold -- Peter Schiff Posted: 04 Jan 2017 08:00 PM PST Ordinary people like me like both gold and bitcoin. They are complementary, both add good diversification. My suggestion [for ordinary people like me] is to own perhaps 10 - 20 times as much gold (or other PMs, but prefer gold) vs. BTC. BTC will be a great speculation, and just a little will... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Let’s Play FOMC Bingo: Minutes Show 15 Instances of Uncertainty Posted: 04 Jan 2017 07:53 PM PST Submitted by Mish Shedlock of MishTalk The Fed released Minutes of the December 13-14, 2016 FOMC Meeting today. Let’s dive into the minutes to dissect the amount of Fed uncertainty.

Uncertainty Scorecard

FOMC Minutes Bingo In FOMC Bingo you have to get every box filled. There were better cards. Wizard was a killer. Otherwise, I had a chance. Fed Uncertainty Principle Let’s review the Fed Uncertainty Principle and its corollaries as I wrote them on April 3, 2008, before the crash.

Economists Predict Uncertainty to Clear Up If and when the economists are ever “certain” about the economy, I am certain they will be wrong. Back in August, I noted Economists Expect “Mount Everest” of Uncertainty to Clear Up by December What happened? Attempts by the Fed and economists to measure uncertainty are certainly ridiculous. |

| It's The "Most Volatile" Year For Political Risk Since World War II Posted: 04 Jan 2017 07:30 PM PST "In 2017 we enter a period of geopolitical recession," warns Eurasia Group president Ian Bremmer, adding that international war or "the breakdown of major central government institutions" isn't inevitable, though "such an outcome is now thinkable." In the company's 19th annual outlook, Eurasia fears that U.S. unilateralism under Donald Trump, China’s growing assertiveness and a weakened German Chancellor Angela Merkel will make 2017 the "most volatile" year for political risk since World War II.

As Bloomberg reports, the warning is a reminder of the range of threats to stability in 2017, from elections in Germany, France and the Netherlands and Britain’s planned exit from the European Union to setbacks in emerging nations such as Brazil and refugee crises.

In China, a scheduled leadership transition makes it likely that President Xi Jinping will be “more likely than ever to respond forcefully to foreign policy challenges,” potentially leading to spikes in U.S.-China tensions, according to Eurasia. To maintain domestic stability, Xi might “overreact” to any sign of economic trouble, leading to a risk of new asset bubbles or capital controls, Eurasia said. Merkel, who is seeking re-election in the fall, faces likely disputes over Brexit, Greece’s simmering debt crisis and an “increasingly authoritarian” Turkish President Recep Tayyip Erdogan, threatening a refugee accord between the EU and Turkey.

Other risks cited by Eurasia include:

Eurasia concludes...

Full Eurasia Group Report below... |

| Posted: 04 Jan 2017 06:12 PM PST John Grandits : The Fed finally raised its target interest rate and issued guidance for 2017. Trump shocked the political world and stocks seem to be making new highs daily. Investor sentiment is at two-year highs, fueled by optimism for renewed economic growth, de-regulation, and tax cuts. |

| A painless path to publishing on Amazon Posted: 04 Jan 2017 05:42 PM PST You've written hundreds of articles on markets, gold, government, and perhaps monetary theory. You've hammered politicians and economists with merciless logic and unflagging scholarship. Some of your writings are more valuable than gold, but where are they now? Scattered, that's where. Why not put the best ones in one place: A book. Make that two books. For writers who have yet to publish a book and would like to, this brief article will show you step-by-step how to get it done. It's easy. Yes, easy. Briefly, what you'll do is create a word processing file then duplicate it. You'll use one file for a Kindle ebook, the other for a paperback. For the Kindle eBook, you'll use your word processor to create an ePub file. For the print version, you'll change the document dimensions to fit Amazon's 6" x 9" paperback format, then save it from your word processor as a PDF. You'll then go to https://kdp.amazon.com, if necessary register, then go through three steps for each book to put them up for sale on Amazon's site. You've already done the hard part by creating the content. Your books will need a cover, and you can create your own or use Amazon's hand-holding Cover Creator, which you'll see during step two of the three-step process. You'll upload the ePub to create the Kindle version and the PDF for the print edition. That's it. Amazon will email you when they're live and available for purchase on Amazon's site, usually within a few hours of completing the three-step process. Manuscript preparation (In what follows I'm referencing MS Word for Mac 2011 version 14.4.5 and Apple Pages version 6.0.5. Some details may differ depending on your version.) To create a good reader experience it's important to get your word processing files formatted consistent with Amazon's requirements. It is, as they say, a piece of cake. Let me show you: 1. Crank up your word processor and prepare your manuscript. Keep it as vanilla as possible — no fancy fonts or drop caps. You're marketing thoughts, not typefaces. If you're gathering articles already written, you'll copy and paste until they're all home in one place. Otherwise, write as you normally would, keeping in mind that the sections you want to appear in an active table of contents for Kindle editions should have paragraph style titles rather than ordinary text titles. Here's what I mean. Below, I've typed the text then applied paragraph style Heading 2 to the title of a chapter: Chapter One: They all laughed So, for example, if you have 12 chapters in your book, each chapter title would have the Heading 2 style. Your word processor (Word or Pages) will incorporate all chapter titles as entries in the table of contents. 2. Create an active table of contents. Create a new page at the beginning of your manuscript by inserting a page break at the top of your first page. Then on the blank page: Apple Pages: Insert —> Table of Contents —> Document MS Word: Document elements —> Table of Contents In our example, all 12 chapter titles would appear magically in the table of contents — because you've applied paragraph styles to each title in the body of your manuscript. With an active table of contents you can click on a chapter title and jump directly to the actual chapter. Test it, you'll see. It's neat. 3. Add a page break at the end of each chapter. 4. All images should be inline, not floating. Select each image, then: Apple Pages: Format —> Arrange —> Text wrap —> inline with text MS Word: Format picture —> Position —> Inline with text If the image is a picture make sure it's high-resolution. Important: Insert images into your document, rather than copying and pasting. 5 . Do not include headers or footers. You will use this file to create a Kindle version, which doesn't support headers or footers. 6. Finish writing the manuscript and make sure it's as clean as possible — no misspellings, omitted words, etc. If you use hyperlinks test them to make sure they're accurate. I think it's a good idea to put them in an end notes section, using superscripts in the body to reference them. For help strengthening your writing, even for powerhouse authors, see my little book, Write like they're your last words (paperback & Kindle). 7. Add the usual book front matter. In your manuscript add at minimum a title page and copyright page. You might also wish to add a dedication page and another page listing books you've published, honors received, k |

| Gold ETF Mechanics: An Infographic Posted: 04 Jan 2017 04:46 PM PST Gains Pains & Capital |

| James Rickards: An End to Globalism Posted: 04 Jan 2017 02:14 PM PST This post James Rickards: An End to Globalism appeared first on Daily Reckoning. Jim Rickards joined the BBC's Gordon Brewer on Radio Scotland to discuss globalism and his latest best seller The Road to Ruin. During the conversation Rickards outlines exactly what he believes is a strategy by global elites' to disguise a looming financial collapse. When asked about the Donald Trump positioning he responded, "Donald Trump is not a conservative. He is a populist. He is a nationalist. He is a bit of a "Trumpist." His policies are mercurial, subject to change. He ran as a "champion of working people." That's why he got those votes in Pennsylvania, Michigan and Wisconsin that broke up Hillary Clinton's "blue wall." So I could very well imagine Trump adopting pro-labor policies to help the working man." Jim Rickards is a lawyer and financial analyst who just released his New York Times best selling book, The Road to Ruin. Rickards has advised the U.S intelligence community and has also worked in the world of Wall Street for decades. When asked about the big thesis of his latest book, The Road to Ruin, he is asked to explain what Ice 9 and the premise of his book relates to when examining the next financial crisis. "I look at three crises. I look at 1998, 2008 and 2018 – which is obviously hypothetical. But the point is it could be tomorrow. Each crisis is bigger than the one before it. Each response is bigger than the one before." "We are now at the point where central banks no longer have the ability to respond because they have not normalized their balance sheets or interest rates following the crisis of 2008. All of the money that was printed is still there, those near-zero interest rates are still there. The ability to print more money and lower rates is highly constrained." “The question is, where will the money come from? How will we reliquify the system in the next global liquidity crisis, which is – as I have said – just a matter of time? The answer is the International Monetary Fund (IMF). The IMF can print world money. They call it the Special Drawing Rights, or SDR, which is a rather technical name designed to throw people off. It is world money, printed by a world printing press and run by the IMF.” "(But when the crisis happens) it will take three to six months to gather some consensus… so what will happen when the entire world wants their money back but there is no money? The answer is, they will lock down the system. Money market funds will suspend redemptions, ATMs will be reprogrammed to only allow a certain amount of money.” When posed the question about why the public doesn't do anything regarding the threat of a crisis and globalism he responded, "The answer is that the bankers control the system.” The BBC's Gordon Brewer then asked, "Do you think there is an argument for completely and radically separating out into different institutions – than banks that take depositors money? Rickards responded emphatically, "Absolutely. Number one, separation. Take deposit taking along with lending, and then take securities, underwriting and sales – they have to be completely separated. We learned this lesson when the United States did this in 1933 under Glass-Steagall legislation.” "The best example, snow is building up on the mountainside. Any mountaineer can look at it and say there is a danger of an avalanche. What do ski patrols do in the morning? They go out and they set up dynamite. They purposefully break up the snowpack so that it doesn’t turn into an uncontrolled avalanche that kills skiers. We need to do the same thing." To listen to the full BBC Radio interview on globalism and what he believes is next for the world financial system click here. If you are interested in learning how to get your own FREE copy of Jim Rickards' latest book, The Road to Ruin, click here. Regards, Craig Wilson, @craig_wilson7 The post James Rickards: An End to Globalism appeared first on Daily Reckoning. |

| Bitcoin Moonshots to $1,150, Doubling in Past Six Months Posted: 04 Jan 2017 01:27 PM PST Gold Stock Bull |

| Gold Seeker Closing Report: Gold and Silver Gain Again Posted: 04 Jan 2017 01:17 PM PST Gold gained $8.25 to $1167.75 by a little after 8AM EST before it chopped back lower at times, but it still ended with a gain of 0.34%. Silver rose to as high as $16.522 and ended with a gain of 0.86%. |

| Bullion Star 'infographic' on gold ETFs shows how they undermine the gold price Posted: 04 Jan 2017 01:03 PM PST 4:03p ET Wednesday, January 4, 2017 Dear Friend of GATA and Gold: Bullion Star today has posted an interesting "infographic" about exchange-traded gold funds and its main point seems to be to remind investors that when they buy shares in gold ETFs, they are facilitating the fractional-reserve gold banking system -- that is, facilitating the artificial inflation of the gold supply, making gold seem more plentiful than it is and thus undermining the gold price. The Bullion Star "infographic" is here: https://www.bullionstar.com/blogs/bullionstar/infographic-gold-etf-mecha... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 04 Jan 2017 01:00 PM PST This post The Fed's Playbook for 2017 appeared first on Daily Reckoning. [Ed. Note: Jim Rickards latest New York Times best seller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis (claim your free copy here) goes beyond the election and prepares you for the next crisis] Fed forecasting is surprisingly easy despite the sturm und drang of the talking heads. It's a matter of considering what we know, and what we don't know, and observing the indications and warnings that presage the unknown. What we know is that the Fed is biased toward rate increases as long as the economy is growing. This is because the Fed needs to raise rates to 3.25% before the next recession in order to cut them back to 0% when the recession hits; approximately the amount of cutting needed to pull the economy out of recession. The Fed is unlikely to reach this goal without either causing a recession, or facing one anyway, but they will try. Simply because the Fed wants to cut rates does not mean they will. The entire course of 2015 and 2016 was a case study of not being able to raise rates more despite wanting to. What stands in the way of rate hikes? There are four hurdles, which can arrive singly or in combinations. These are deflation, job losses, technical recession, and tighter financial conditions from sources other than rate hikes. The last hurdle includes a number of conditions such as global contagion or a stock market correction. There are many examples to illustrate this. The Fed was on track to raise rates in September 2015, but did not do so because of the Chinese devaluation and U.S. stock market correction in August. The Fed was on track to raise rates in March 2016, but did not do so because of the stock market correction from January 2 to February 10, 2016. The Fed also did not raise rates in September or November 2016 because of the U.S. election, but that's a one-off constraint on policy. The Fed is highly political, protestations to the contrary notwithstanding. So, forecasting the Fed is straightforward. If you do not see any of these hurdles, the Fed will raise rates every March, June, September, and December from now until the end of 2019. If you do see these hurdles in strong form, the Fed will not raise rates. Insiders call this a "pause," and that's a good way to understand it. As of now, none of the pause indicators are flashing red so the Fed will raise rates in March. That rate hike is not fully discounted in the market yet. The Fed's job from now until March will be to communicate the likelihood of a rate hike through speeches, leaks, and various statements. This will be a headwind for gold and it should not be surprising if gold trades lower in the next few months. What about Trump? The Fed has not changed its policy bias as of now because they simply do not have enough information about Trump's actual policies. (Ignore the "dots" from the Federal Open Market Committee (FOMC) meeting in December. They are nothing more than the median of 17 blind guesses forced upon the FOMC participants). But using causal inference (also known as Bayes Theorem), our estimate is that Fed chair Janet Yellen expects Trump policy to be stimulative because of the combination of tax cuts, reduced regulation, and higher spending on defense and critical infrastructure. This tips the Fed's bias even more strongly toward tightening and creates a strong case for a rate hike in March. I've written a lot about helicopter money and about how it's one of the "tools" the Fed has in its toolkit. But at least for now, it doesn't appear that the Fed will use helicopter money to accommodate Trump's stimulus. That's primarily because of their misplaced reliance on the Phillips Curve that posits lower unemployment means higher inflation. There's also the fact that monetary policy works with a lag. The Fed does not want to get behind the curve on inflation. Yellen will lean-in against Trump stimulus with rate hikes. Besides, Yellen personally dislikes Trump and is not out to do him any favors. But beyond that, there's good reason to believe that the Trump stimulus will not arrive as many expect. Congress is already pushing back against tax cuts that are not revenue neutral. This means tax cuts have to be offset with either spending cuts or other tax increases thereby diluting the stimulative impact. There's no evidence for a Laffer Curve effect that will make up for tax cuts with higher growth despite claims. The most stimulative tax cut would be a reduction in social security taxes (this helps poorer people with a higher marginal propensity to consume), but that is not on the table. Reductions in regulation can be stimulative, but they take months to implement and even longer to affect investment decisions. Spending increases will also be held in check because the U.S. has $20 trillion in debt and a debt-to-GDP ratio of 104%. This is already well in the danger zone of 90% or higher identified by Kenneth Rogoff and Carmen Reinhardt. Congress will balk at busting budget caps. Even if Congress goes along with more spending, the economy is at the stage of diminished or negative marginal returns after eight years of growth. Neo-Keynesian solutions work best, if at all, in the early stages of recovery not the late stages. Further deficit spending will push the U.S. toward the same debt-deficit death spiral already achieved in Greece. In addition to the lack of stimulus from Trump's tax, regulatory and fiscal policies, there may be additional headwinds to growth coming from Trump's trade and foreign policies, especially as they relate to China. The Fed has given the prospect of a trade war little weight so far. There are even more troubling global tremors coming from the dollar shortage and a looming crisis in dollar-denominated emerging markets corporate debt. European banking problems are another wild card. This disjunction between the Fed's (and the market's) view of the Trump reflation trade and the reality of little or no stimulus in the pipeline will cause a head-on collision between perception and reality. This collision will take place in the spring. At that point a technical recession or a violent stock market correction may occur. The Fed will be late to react, but either outcome will throw the Fed off its rate hike path once again. The Fed will be forced to ease by forward guidance; rate cuts are still some way off. Still, markets will get the easing message and gold will resume its long march higher. I view the next several months as an excellent entry point for gold buyers before this next episode of Fed flip-flopping becomes apparent. Regards, Jim Rickards The post The Fed's Playbook for 2017 appeared first on Daily Reckoning. |

| Saville doesn't get it: Rig the gold price and you rig all prices Posted: 04 Jan 2017 12:57 PM PST The problem is that gold, an international reserve currency, is powerfully connected to all other markets. Manipulate the gold price and you manipulate all currency values. Manipulate all currency values and you manipulate the price of everything valued in currencies. That covers just about everything except maybe your dog's affections. |

| Saville doesn't get it: Rig the gold price and you rig all prices Posted: 04 Jan 2017 12:47 PM PST 3:49p ET Wednesday, January 4, 2017 Dear Friend of GATA and Gold: Manipulation of the gold market by investment banks, technical analyst Steve Saville writes this week in the Speculative Investor, is not necessarily long-term price suppression: http://tsi-blog.com/2017/01/market-manipulation-is-not-price-suppression... Yes, GATA strives to distinguish between market activity by investment banks and market activity by governments and central banks. GATA is much more interested in the latter activity. ... Dispatch continues below ... ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Yet all the investment banks targeted for gold and silver market rigging by the antitrust lawsuit in federal court in New York enjoy the U.S. Federal Reserve's coveted classification of primary dealer in U.S. government securities: http://www.gata.org/node/17037 And while the transcripts disgorged by Deutsche Bank in that lawsuit, showing trader collusion in gold market rigging by all the defendant banks, have been public for many weeks now, the Fed has taken no action against the banks. It seems as if the Fed doesn't mind if its primary dealers manipulate the gold market as long as the manipulation is, as the transcripts suggest, primarily downward. This at least tacit approval would be even more probable if the investment banks lease gold from governments and central banks, making the investment banks effectively the agents of governments and central banks in the gold market. Saville expresses no curiosity about these connections. But Saville misses even more when he argues that gold price suppression over a long period is disproved by "the close relationship over the past three years between the U.S. dollar gold price and the bond/dollar ratio (the T-bond price divided by the dollar index)." For even Saville might admit that governments are intervening around the clock in the bond and currency markets. Making such interventions stick requires preventing gold from giving the markets contrary signals, signals that could put bond and currency prices in question. So why wouldn't governments intervene surreptitiously in the gold market too to protect their bond and currency market interventions? In any case no one's charts or philosophy can contradict the documentation of gold price suppression by governments and central banks that is summarized here -- http://www.gata.org/node/14839 -- documentation that Saville and other deniers of gold price suppression never bother to examine and dispute. Maybe one may argue over why governments and central banks intervene surreptitiously in the gold market, but the fact of that intervention right up to the present day is well established. Indeed, Saville seems determined to abandon the subject entirely before being forced to examine the documentation. He writes: "You are allowed to make money in the financial markets by doing something other than buying or owning gold. Therefore, if you truly believe that a powerful group has both the means and the motive to suppress the gold price, then the solution is obvious: Don't buy gold." The problem is that gold, an international reserve currency, is powerfully connected to all other markets. Manipulate the gold price and you manipulate all currency values. Manipulate all currency values and you manipulate the price of everything valued in currencies. That covers just about everything except maybe your dog's affections. Thus the choice is far more profound than Saville's framing of it -- whether to buy gold. It is whether to aspire to free and transparent markets or just try to trade on the side of the governments manipulating markets -- that is, whether to accept totalitarianism and totalitarians, who may be grateful for the camouflage offered to them by Saville and his charts. CHRIS POWELL, Secretary/Treasurer Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| 'Audit the Fed' bill gets new push under Trump Posted: 04 Jan 2017 11:55 AM PST By Peter Schroeder Controversial legislation to subject the Federal Reserve's monetary policy powers to outside scrutiny is getting new life in Washington. Rep. Thomas Massie, R-Ky., and Sen. Rand Paul, R-Ky., have re-introduced legislation to "audit the Fed" after a similar effort stalled in the last Congress. But such a proposal, which has been vocally opposed by Federal Reserve Chairwoman Janet Yellen, may face its best odds ever of becoming law. Both chambers are controlled by Republicans long critical of the Fed's policies, and President-elect Donald Trump has heaped scorn on the central bank since the beginning of his presidential campaign. Paul specifically mentioned Trump in a statement about the bill today, making clear the measure's proponents believe they have an ally in their cause coming to the White House. ... ... For the remainder of the report: http://thehill.com/policy/finance/312662-audit-the-fed-bill-gets-new-pus... ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Profit from Gold’s January Revival Posted: 04 Jan 2017 10:19 AM PST This post Profit from Gold’s January Revival appeared first on Daily Reckoning. I spent this past Thanksgiving traveling in the Middle East and Africa. No mashed potatoes and turkey for me; my Thanksgiving repast was chicken, lamb and rice at a Persian restaurant (menus in Farsi!) in Doha, Qatar, before flying to Turkey the next day. During my trip, I spoke with many people who mine basic materials, like copper and zinc. These people are well-connected with users and supply chains across the globe, and they think that the world is ready for a breakout in basic materials. In essence, after several years in the investment doghouse and despite a widespread sense of global economic doom and gloom — like Eurozone blues, a cash crisis in India, China's capital crisis and more — there are dollar-signs ahead in this basic materials space. In the U.S. and Canada, we've seen global optimism reflected in the post-election market run-up. The thinking process seems to be that, with President-elect Trump coming soon to the White House, and his campaign promises to Make America Great Again by rebuilding infrastructure, we're looking at good times for companies that produce basic things like cement, steel, aluminum, and heavy machinery. But while Trump's rebuilding plan is one big element of the basic materials resurgence, there's a deeper story here, too. If you're new to the natural resource space, particularly with respect to basic materials, you need to know that it's been a tough six years. Since 2011, the fortunes for many a mining firm have faded. It's a long story. But the short version is that overbuilding in the early/mid-2000s led to gross oversupply, and then a price crash. To illustrate, here's a chart that shows several large names in the mining space, showing the depths of decline. But as you can see in the chart, the current mining revival began early in 2016, long before Donald Trump won the U.S. election. For most of the year, while the "smart money" bet on Trump's opponent to win, the fortunes of basic material producers have been on an upswing. Why? It comes down to fundamentals of supply and demand. First, the supply chain. What the chart doesn't show you is how much corporate pain the mining space underwent during its decline. As share prices fell due to over-production from over-built facilities, many companies were forced to slim down. They closed mines, laid off workers and sold assets and equipment. Indeed, management teams did everything possible to pare costs to the utter bone. It's fair to say that the companies we see today bear little resemblance to what they were just five years ago. Because of that, we're looking at much leaner companies today. They adopted every cost-avoidance technique that could possibly be available. This has caused effects in the supply chain as well. Many formerly marginal mines are closed, and will likely not reopen. That is, some of these old mines were producing on inertia, simply because they were there; but once closed, it'll never be economic to reopen them. At the end of the day, we're now staring right into the abyss of shortages in certain commodities, which creates opportunity, if you know where to look. What about demand? It's out there, to be sure. In the past few years, for example, global auto sales have been strong, and a key component of autos is steel — meaning steel galvanized with zinc. We've also seen steady demand for zinc-based products in construction. Now we're looking at the looming boom for infrastructure (and zinc) under incoming President-elect Trump. The charts below show this phenomenon better than I can describe it. Here's the five-year chart of warehouse levels for zinc, showing a significant de-stocking trend.  Byron King on Right at Mine in Africa

The facts are clear, though; there's a looming problem of supply chain shortages, and that will translate into future pricing strength for basic elements, whether from continuing auto sales or Trump's infrastructure plays. Regards, Byron King The post Profit from Gold’s January Revival appeared first on Daily Reckoning. |

| Why Japan Refuses Immigration and Multiculturalism Posted: 04 Jan 2017 09:30 AM PST Funny that Japan wants to keep their borders, language and culture and no one dare calls them racists or bigots or xenophiles! Good for Japan! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| State Dept. cable confirms gold futures market was created for price suppression Posted: 04 Jan 2017 08:43 AM PST The cable reads: "The major impact of private U.S. ownership, according to the dealers' expectations, will be the formation of a sizable gold futures market. Each of the dealers expressed the belief that the futures market would be of significant proportion and physical trading would be miniscule by comparison. Also expressed was the expectation that large-volume futures dealing would create a highly volatile market. In turn, the volatile price movements would diminish the initial demand for physical holding and most likely negate long-term hoarding by U.S. citizens." |

| State Dept. cable confirms gold futures market was created for price suppression Posted: 04 Jan 2017 08:28 AM PST 11:31a ET Wednesday, January 4, 2016 Dear Friend of GATA and Gold: The U.S. gold futures market was created in December 1974 as a result of collusion between the U.S. government and gold dealers in London to facilitate volatility in gold prices and thereby discourage gold ownership by U.S. citizens, according to a State Department cable written that month, obtained by Wikileaks, and disclosed today by the TF Metals Report: http://www.tfmetalsreport.com/blog/8075/42-years-fractional-reserve-alch... The cable was sent to the State Department from the U.S. embassy in London and signed by someone named Spiers, apparently Ronald I. Spiers, the embassy's deputy chief at that time: https://en.wikipedia.org/wiki/Ronald_I._Spiers The cable describes the embassy's extensive consultations with London bullion dealers about the imminent re-legalization of gold ownership in the United States and possible substantial gold purchases by oil-exporting Arab nations. The cable reads: "The major impact of private U.S. ownership, according to the dealers' expectations, will be the formation of a sizable gold futures market. Each of the dealers expressed the belief that the futures market would be of significant proportion and physical trading would be miniscule by comparison. Also expressed was the expectation that large-volume futures dealing would create a highly volatile market. In turn, the volatile price movements would diminish the initial demand for physical holding and most likely negate long-term hoarding by U.S. citizens." The cable is interesting not just for confirming the assertions by GATA and others in the gold-price suppression camp that futures markets function largely as mechanisms of commodity price suppression and support for government currencies, an assertion perhaps first made comprehensively in 2001 by the British economist Peter Warburton -- -- but also for showing the close connection between the U.S. government and London gold dealers, some of which are cited by name, including Samuel Montagu & Co., Sharps Pixley & Co., Mocatta & Goldsmid, and Consolidated Gold Fields. The cable is posted at the Wikileaks internet site here: https://wikileaks.org/plusd/cables/1974LONDON16154_b.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Join GATA here: Vancouver Resource Investment Conference Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Northern Vertex – Gold-Silver Moss Mine Project in Arizona Posted: 04 Jan 2017 08:09 AM PST Gold-silver stockwork, brecciated, low sulphidation, epithermal vein system Vein system outcrops at surface for 4,000 ft. No major structural complications Robust Geological Model - November 2014 Reactivating the historic Moss Mine area in Arizona Premier mining jurisdiction in NW Arizona Excellent site access - only 20 minutes from Bullhead City (pop. 35,000) |

| U.S. LIBOR breaks above 1 percent for first time since 2009 Posted: 04 Jan 2017 07:58 AM PST By Richard Leong and Dan Burns The rate banks charge each other to borrow dollars for three months rose above 1 percent today for the first time since May 2009 as global interest rates extend their climb on expectations of accelerating growth and inflation. The London interbank offered rate, or LIBOR, for three-month dollars was fixed at 1.00511 percent, the highest level since 1.00688 percent on May 1, 2009, which was also the last date the rate topped 1 percent. ... ... For the remainder of the report: http://www.reuters.com/article/us-usa-moneymarkets-idUSKBN14O1GC ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| RED ALERT: NEW WIKILEAKS LEAK - Exposes STOLEN Hard Drive With Clinton Docs! TOTAL MSM COVER-UP! Posted: 04 Jan 2017 07:38 AM PST NEW 2017 Wikileaks Julian Assange HUGE Information on National Archives "STOLEN DOCUMENTS." RED ALERT: WikiLeaks Just Exposed Hard Drive With Clinton Documents Stolen! See The Media Cover Up! ~~ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| 42 Years of Fractional Reserve Alchemy Posted: 04 Jan 2017 07:26 AM PST It has now been 42 years since The Global Bankers successfully alchemized gold through the advent of futures trading so we begin the new year by looking back at how we got into this position in the first place. To that end, let's start 2017 by going back to 1974. Over the past few years, you've often heard me reference the HISTORY and FACT of gold price suppression and manipulation. |

| Low Oil Prices Will Make Russia More Aggressive in 2017 Posted: 04 Jan 2017 06:57 AM PST BY GEORGE FRIEDMAN : Russia has had a hard time since the collapse of global oil prices which began in August 2014. This will continue in 2017. The Russian people are starting to feel the effects of prolonged low oil prices. This was bound to happen. And this will shape Moscow's foreign policy in the year to come. Russia’s money problems start with the economy’s structure. The country’s budget depends on income from oil exports. Low oil prices have had huge effects. And the country hasn’t even recovered from the 2008 decline. |

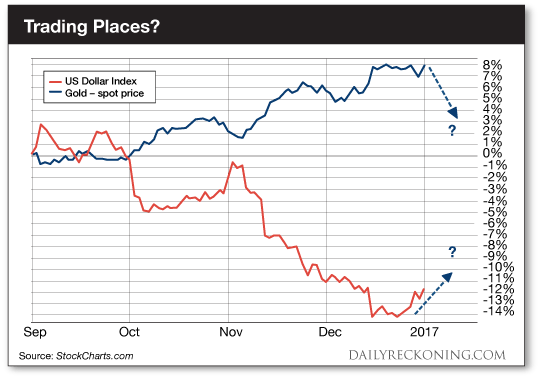

| Gold’s Dead. Here’s Why We’re Buying… Posted: 04 Jan 2017 06:53 AM PST This post Gold's Dead. Here's Why We're Buying… appeared first on Daily Reckoning. Gold was the Jekyll and Hyde trade of 2016. You could have netted double-digit gains (or more) during the first six months of the year as precious metals and miners vaulted to two-year highs. A nasty stock market meltdown, the Fed flip-flopping on its rate hike promise and the surprise Brexit vote fueled gold's fire, sending the metal higher by more than 25% by the end of the second quarter. But gold's trajectory changed dramatically during the second half of 2016. While the major averages chopped along, gold couldn't catch a bid. The precious metals rally completely lost its mojo. Gold's drop slaughtered traders who opted to ignore the bearish market action and count their winnings at the finish of Q2. By the end of the year, the Midas metal landed almost right back where it started. On our official scorecard, gold posted 2016 gains of more than 8%. The S&P 500 and the Dow both topped gold's performance—despite starting the year deep in the hole. We promised we would watch the gold breakdown for signs of a bottom early last month. By our calculations, precious metals had a chance at carving out support and offering us a tradable bounce once the market absorbed the reality of the December rate hike. Today, we're seeing signs that this bounce is materializing. Your first shot at quick, double-digit gains in 2017 has arrived. And it could be a wild ride… But before we get ahead of ourselves, here's a quick disclaimer: The precious metal plays we're tracking right now have endured some serious pain over the past six months. I can't promise you that the lows are in. What we're looking at right now is a quick trade. Get in, get out, and get paid. That's it! Is the constructive action we've noticed in gold and other precious metals the beginning of another leg higher? Has gold blown off enough steam to give the early 2016 bull a new life? Only time will tell. For now, we must think of precious metals as a quick trade. And nothing more… Let's get to the evidence. You probably recall that gold's do-or-die moment came into play as it tested its 200-day moving average in October. Gold finally crashed through its 200-day moving average the day after the presidential election. After losing its grip on its longer-term trend, the metal dropped below $1,200—a level that had held strong since gold's initial breakout last winter. That certainly wasn't bullish. At the start of December, we told you the chances for a meaningful gold rally into the holidays went from slim to none. That's exactly how it played out. Gold wandered lower, eventually cracking below $1,130 just before the Christmas break. That's when things got interesting… After briefly visiting 11-month lows, gold has started to quietly bottom out. Its spot price has risen five out of the last six trading sessions. Now we have a situation where gold is firming and the furious dollar rally is losing steam…

That's a great recipe for a successful short-term trade. A little mean reversion can go a long way… Sincerely, Greg Guenthner The post Gold's Dead. Here's Why We're Buying… appeared first on Daily Reckoning. |

| Gold Investing Sentiment Starts 2017 at 4-Year High Posted: 04 Jan 2017 03:20 AM PST Bullion Vault |

| Stock Market, Gold Outlook for 2017 Posted: 04 Jan 2017 02:50 AM PST Precious metals expert Michael Ballanger reflects on how events of 2016 affected the markets, and lays out his strategy for 2017, which includes diamonds and uranium. One of the most bothersome peccadillos of the advisory community, be it emanations from home computer blogs or the Ivory Towers of Wall Street, is the annoying tendency to accentuate good calls and understate bad ones. |

| Breaking News And Best Of The Web Posted: 04 Jan 2017 01:37 AM PST Stocks, the dollar, oil and gold open the year on a bullish note. US manufacturing expands. Global debt continues to soar. US retaliates against alleged Russian hacking. Fake news debate rages. Best Of The Web Fears of a ‘massive’ global property price fall – Telegraph Happy New Year! – FOFOA Currency and the collapse […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The Gold Owner's Guide to 2017 Posted: 03 Jan 2017 06:24 PM PST Reversal, resurgence and renewal on the road to the new year Quietly, while all attention was riveted on the U.S. election, gold made a notable comeback in 2016. The gain was not spectacular at 8.7%, but it was respectable, and it came after three straight down years. (Silver had an even better year with a 15.2% gain.) In addition and perhaps even more importantly, global investment demand registered its fourth largest increase since the 2011 post-crisis peak. That resurgence suggests that down years for gold did not temper the global inclination to own it. To be sure, these numbers in tandem represent an important turnaround for gold and a break from the near-term past. It is also perhaps the first hint that we may have turned the page from the corrective phase of the cycle to resumption of the long-term secular bull market for both gold and silver. |

| Key Themes for 2017: Earnings, the Dollar, Tax Cuts and Stimulus Posted: 03 Jan 2017 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment