Gold World News Flash |

- Infographic: Gold ETF Mechanics

- The Outlook for 2017

- 2016 Year-End Review and Forward Analysis for 2017

- Gold Starts 2017 with an Encouraging Pop

- Silver Prices and the Russian Connection - Gary Christenson

- Top 10 Types of Silver and Gold Sold at JH MINT

- Bitcoin: The Best Performing Currency For A Second Year In A Row

- Asian Metals Market Update: Jan-4-2017

- What 12 'Financial Experts' Predict For The Economy in 2017 (Spoiler Alert: It's Ugly)

- Morgan Stanley Warns to Sell the Inauguration While Greatly Increasing 2018 Earnings Forecast

- There's A Massive Restaurant Bubble, And It's About To Burst

- Are Chinese Philosopher Kings Losing Their Yuan FX Religion?

- The Gold Owner's Guide to 2017

- Gold Price Closed at $1160.40 Up $10.40 or 0.90%

- Leaked Audio of Sec. Kerry: Obama Wanted ISIS To Grow

- Why We Could See Silver Prices Spike In 2017

- SIGNS OF THE END PART 255 - DECEMBER 2016/JANUARY 2017

- End Times Headline News - January 3rd, 2016

- China Inc.'s large dollar debts fuel Beijing's efforts to curb yuan plunge

- Alan Watts ~ The Art Of Dealing With Pain

- Gold Seeker Closing Report: Gold and Silver Gain Roughly 1% and 2%

- Are You Prepared for “Unencumbered” Interest Rate Policy?

- What Will the World Look Like in 10 Years? Government Beta Test Revealed

- Mike Kosares: The gold owner's guide to 2017

- US Jobs Report: Key Driver For Gold

- The Gold Owner's Guide to 2017

- Political – Financial Road Map for 2017

- GATA's Ed Steer to speak at Vancouver Resource Investment Conference

- Anonymous: If you think you can handle the truth, well here it is!

- BREAKING: Obama is FURIOUS After What This CIA Agent Just Revealed About Putin and Russia

- EU Back in the Bailout Business

- Soros Plots Economic Collapse To Blame Trump!

- New year, new highs: FTSE 100 smashes 7,200 and dollar index hits 14-year peak

- BREAKING: "We Will ‘Punish’ Hillary Clinton!" Trump New WH Press Secretary

- THE Precious Metal Stock for 2017

- These 2017 Market Predictions are Dead Wrong

- US Dollar – The Big Picture

- What IF Gold has a Drop Dead Line?

- Breaking News And Best Of The Web

- 'True Safe Haven' Gold Prices Firm vs. Rising Dollar as Trump Argues Trade War With China

| Infographic: Gold ETF Mechanics Posted: 04 Jan 2017 07:09 AM PST Gold-backed Exchange Traded Funds (ETFs) have grown strongly in scale and popularity over the last decade and their combined gold holdings now surpass all but the largest central bank gold reserve holdings. However, its important to understand the mechanics of these gold-backed ETF investment vehicles and to appreciate what they can and can't provide to gold investors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 Jan 2017 07:04 AM PST So despite the fact that my actual gold portfolio, constructed in late 2015, has had a great year, it would have had an even better year if I'd taken my advice and hedged it in July with the Large Speculators at +340,000 contracts, versus Commercials short an equal amount. I did not follow my own trading advice and I took a few hits in the latter half of 2016—not big hits, but just enough to annoy me. The lesson I learned this year is just one of many I continue to learn after 40 years in the space: Trust the Commercials—they do not lose. (And listen to my own advice.) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 Year-End Review and Forward Analysis for 2017 Posted: 04 Jan 2017 07:03 AM PST The gold sector as represented by $HUI had a major buy signal early in 2016, but it was a price spike and no entries could be made. No consolidation with no trendline support has been established so far to set up for a long-term allocation. The copper sector also had a major buy signal in 2016. TECK went straight up, while FCX consolidated. We entered near the bottom of the consolidation range, with a 10% allocation for the long term. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Starts 2017 with an Encouraging Pop Posted: 04 Jan 2017 07:00 AM PST Although the trade initially went against buyers, subscribers who applied a simple rule avoided getting stopped out and subsequently got a ride to the 1165.50 target — precisely — for a quick gain of as much as $1400 per contract. Although the futures retraced moderately before the regular session ended, they looked poised for another leap to as high as 1174.20. That target will remain viable as long as the recent low at 1156.70 holds. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Prices and the Russian Connection - Gary Christenson Posted: 04 Jan 2017 01:20 AM PST Sprott Money | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top 10 Types of Silver and Gold Sold at JH MINT Posted: 04 Jan 2017 01:06 AM PST Silverstockreport | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bitcoin: The Best Performing Currency For A Second Year In A Row Posted: 04 Jan 2017 12:00 AM PST Bitcoin is no stranger to extreme fluctuations. As Visual Capitalist's Jeff Desjardins notes, for each of the last four years, the cryptocurrency has either been the best or the worst performing currency – with nothing to be found in between. Luckily, for those that follow the digital currency closely, those fluctuations were mostly pointed in an upwards direction for 2016. The currency finished the year at $968.23, which is more than double its value from the beginning of the year.

Were any other global currencies able to compete with bitcoin’s strong performance throughout the year? The following chart compares major currencies (paired with the USD) over 2016:

Brazil’s real rallied 21.9% on the year, the most in seven years. Traders are hoping that center-right President Michel Temer can ease public spending following the departure of Dilma Rousseff. Russia’s ruble also finished the year with double-digit gains, up 17.8% against the U.S. dollar. This was largely due to the recovery in Brent oil prices, which gained $10/bbl over the course of 2016. However, a rosier picture for oil was not enough to buoy all producers. Africa’s biggest economy, Nigeria, fell into its first recession in 25 years during the opening half of 2016. Ripple effects from low oil prices caused the Nigerian naira to lose more than one-third of its value throughout the year, making it the worst performing currency (at least officially). Unofficially, Venezuela’s struggling economy has been pushed to the brink by its ongoing currency crisis. The massive hyperinflation is not reflected in official numbers, since the bolívar is technically “pegged” arbitrarily by the government. Based on black market activity, however, experts estimate that the currency ended the year with inflation of roughly 500%. Bitcoin in 2017?Bitcoin is now the best performing currency for two years in a row (2015, 2016):

And in the opening days of 2017, the cryptocurrency has already gained a head start on other global currencies. It passed the vital $1,000 mark in the first days of New Year trading, and could be poised to three-peat for the title of best-performing currency of the year. To do it again, bitcoin prices would likely need to rise at least 30% on the year, closing in on the $1,300 mark. Will it be another extreme for 2017 – or will the bitcoin price finally settle for middle ground among other global currencies? * * * The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asian Metals Market Update: Jan-4-2017 Posted: 03 Jan 2017 11:02 PM PST Last year it was proved that silver prices were heavily manipulated by a combination of very large and too big to fail banks. Banks are used to court cases and pay penalties. Yet they end up with massive profit on manipulation of any financial instrument. Bank rig prices when either trading volumes are low or there is lack of large retail investment or fundamentals are weak. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What 12 'Financial Experts' Predict For The Economy in 2017 (Spoiler Alert: It's Ugly) Posted: 03 Jan 2017 11:00 PM PST Submitted by Daisy Luther via The Organic Prepper blog, What lies ahead for the economy this year? Will the economy finally collapse as predicted by many or will the early positive signs in stock markets around the world continue and the global economy will flourish? I’ve taken a lot of heat for being “gloomy” and for “fear-mongering” lately when I’ve said that President-Elect Trump is inheriting a mess of epic proportions and that we may still be in for a rough financial ride. While I do think that Trump is a far better choice than Hillary Clinton ever could have been, when a situation has been declining as long as ours has, it would take an absolute miracle to turn it around without some pain. And it turns out, I’m not alone in my concern about the worst for our economic situation during the upcoming year. Here’s what 12 prominent financial experts are predicting.Lawrence Yun is the chief economist at The National Association of Realtors® (NAR).

Gerald Celente is a trends forecaster who has a long history of accuracy. You can find his work at TrendsResearch.com. He predicts:

James Dale Davidson. He’s the economist who correctly predicted the collapse of 1999 and 2007.

Marc Faber is an investment advisor and fund manager. He is the publisher of the Gloom Boom & Doom Report newsletter and is the director of Marc Faber Ltd. Last month, he wrote:

Faber was also quoted in an article on The Sovereign Investor:

Harry Dent, Harvard economist, predicts the safe-haven of gold will be wiped out during 2017. From a conversation with Economy and Markets:

Incidentally, here is his latest report. Ann Rutledge is a fixed income analyst who is a regular writer for Forbes. She analyses economic patterns and feels the slide has been underway since 2013. Last year, she wrote:

Peter Costa, president of Empire Executions, has taken the unprecedented step of pulling out of the markets ,believing that they are overpriced and that a major correction is on the way. In an interview, he said:

Chris Martenson, an economic researcher, wrote:

Michael Covel, a teacher of trend-following and financial strategy ,thinks the collapse will start in Europe and then spread to the rest of the world. He explains why in great detail, calling it chillingly “the next Lehman moment.”

Alessandro Lombardi, a former global investment banking analyst wrote:

Jim Rogers, who founded the Quantum Fund with George Soros, is on the record as saying:

Andrew Smithers, an economist with an unsettling history of being prophetic, was quoted in the same article.

What do you think?Personally, I’m prepping harder than ever before. I’ve spent too much time researching the collapse of Venezuela to sit idly by and let my family face the same hunger and desperation that is rampant there. Right now, a few rocks are falling, warning of an imminent disaster. If you aren’t prepped, you still have time. Go here to learn more. If you wait until the avalanche begins, it will be unstoppable. You will have waited too long. My suggestions are:

We’ve been in a decline for years. Our national debt has reached monstrous proportions. Even if Trump is able to pull off a miracle and turn things around, there will have to be drastic cuts for this to happen. Painful ones. People will suffer. And I’ll do everything I can to protect my family before that happens. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Morgan Stanley Warns to Sell the Inauguration While Greatly Increasing 2018 Earnings Forecast Posted: 03 Jan 2017 08:10 PM PST Morgan Stanley is out with a helter skelter note of caution on markets, warning investors to sell the Trump inauguration while upping earnings estimates by 18% for 2018 -- citing material upside in earnings and multiple contraction.

Content originally generated at iBankCoin.com | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| There's A Massive Restaurant Bubble, And It's About To Burst Posted: 03 Jan 2017 08:00 PM PST In January 2009, just three days after his inauguration, an arrogant President Obama, a "community organizer" and one-term senator from Illinois, proclaimed to then Republican Whip Eric Cantor that "elections have consequences, and at the end of the day, I won." Unfortunately, he was absolutely right and the consequences of Obama's election, having already crushed the coal industry, are about to bring the restaurant industry crashing down as well. To be fair, Obama hasn't crushed the restaurant industry single-handedly. While Obamacare went a long way toward destroying the industry, it's demise would not have been certain without a little help from leftist state legislators that have passed a slew of egregious minimum wage hikes in recent years (not that Obama didn't try and fail twice to accomplish the same thing at the federal level). Add to that a multi-year run of near 0% interest rates that have driven commercial real estate soaring and a dash of "hope" from culinary grads looking to become America's next famous celebrity chef and it's easy to see that you've had a recipe for disaster simmering on low heat for years. And while he avoided the political attributions we note above, a recent Thrillist article by Keven Alexander highlights the demise of one independently owned restaurant in San Francisco, AQ, that will be shutting down later this month for all the same reasons. When it comes to minimum wage, Alexander highlights that just a $1 per hour minimum wage increase can reduce an independent restaurant's already thin profit margins by $20,000, or 10%. So we imagine the $5 minimum wage hike that California just passed is probably slightly less than optimal for companies like AQ in San Francisco.

And while California is certainly the poster child for misinformed liberal policies, as the Wall Street Journal recently pointed out, they're hardly alone in their implementation of a massive minimum wage hike in 2017.

Meanwhile, when it comes to Obamacare, Alexander notes that AQ was hit with an incremental $72,000 of annual expenses in 2015 that didn't exist in 2012, which eroded another ~30% of the company's peak net income.

Then there are those pesky rental rates which have been driven ever higher by nearly a decade of 0% interest rates that have resulted in artificially high demand for "yieldy" commercial real estate.

For all the reasons above, Alexander notes that "AQ will serve its last meal sometime in January, 2017"...an inconvenient fact that we're sure the liberal politicians in Sacramento will promptly ignore. And while the publicly-traded restaurant companies have potentially started to take note of some of the risks above... ...the broader markets, which are also exposed to the same risks albeit to varying degrees, couldn't seem to care less. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are Chinese Philosopher Kings Losing Their Yuan FX Religion? Posted: 03 Jan 2017 07:35 PM PST Submitted by Eugen von Bohm-Bawerk via Bawerk.net, It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching up to reality. We never bought into it and our prediction for 2017 is that most of the pundits commenting on the red Dragon will realize how bad the situation in China really is. That being said, there were still Japan-bulls in the late 1990s that still believed Japan would eventually become the largest economy on the planet and dominate the world. If we are right, the heliocentric worldview China apparently is taking will quickly turn geocentric, just as it is about to do in the western world. Domestic problems will engulf the leadership in Beijing, and there will be less time to squabble over petty reefs in the South China Sea. The danger is obviously that the political establishment in China will be in dire need to distract the hordes of angry masses that are about to lose their life savings. Champions of authoritarian rule saw in China a way to Kallipolis, whereby the platonic Philosopher Kings finally get to rule the world. Not few times have we debated the “China Model” with Chief Economists, Ph.Ds. and other “serious” people, and in just as many times have we been surprised to discover the passionate disdain for so-called lower classes and the unabashed need to guide these fully grown-up children onto the righteous path. A small tax tweak here, a subsidy there and people can allegedly be incentivized to do the “right” thing. Right, obviously, is whatever the philosopher kings deem it to be. China epitomized Kallipolis for all the kings out there, which is probably why criticism of the system felt personal to them. The China Model has thus been embraced wholeheartedly by the Western elite and explains why China’s many faults have not been addressed properly. Another reason for the kings to be a bit evasive is that the China model is, as aforementioned, exactly what they want, but they cannot really say that. China, as we all know, is extremely simple. The lowest platonic classes, the laboring classes, are unbalanced in the sense that greed and foolishness rule these people, therefore they can, and should, be used as lowly paid slaves to the betterment of the whole. The savings they accumulate are controlled and directed as the kings see fit. By plowing enormous amounts of savings back into the system, the economy, as measured by GDP, “grows” and the kings can point to all wonders they are able to create. There is a great downside to this system though. The hapless laboring classes cannot afford to live the life their output from production would suggest they should. Since the kings set both wages and return on savings, a mismatch is created between domestic purchasing power and domestic output. In their infinite wisdom, the kings decided to rectify this little glitch by sending excess production abroad through heavy-handed exchange rate manipulation. Should foreigners not spend enough though, then the politburo could always resort to domestic boondoggles as convenient safety valves. After the financial crisis of 2008 and 2009 this is exactly what happened on a scale never ever witnessed before. However, in the period leading up to the great financial crisis foreigners bloated on credit were more than happy to indulge themselves with cheap Chinese goods. The Chinese on their side had to adjust their monetary policy to subsidies exports and penalize imports through a low valued Yuan. In order to do so the PBoC were forced to buy billions of dollars and other FX flowing into mainland China. Despite raising banks’ reserve requirements, printing up RMBs at this pace led to a massive inflationary boom in the Chinese economy. In other words, the Chinese monetary policy was extremely pro-cyclical as they essentially were forced to copy the folly conducted in the Eccles building. But as everyone loves the effects of inflation and the false prosperity that spreads throughout society, no one complain whilst the good time lasts. When the imbalances become too great to hide though, it all turns ugly quite quickly. The inflation correspondent with capital inflows must necessarily become deflationary when money starts to flow out. As domestic bubbles start to deflate and economic prospects turn sour, capital will flow out and the whole process reverses. Downward pressure on the exchange rate forces the PBoC to buy back legacy Yuan’s by selling FX reserves. At this stage reserve requirements are lowered in order to free up more Yuan by leveraging banks’ balance sheets, but as the inflationary boom could not be fully mitigated on the way up, the deflationary forces on the way down are impossible to control.

The blue and red circles are represented with the same color code in the Yuan chart below. In the blue area the exchange rate is kept stable despite inward capital flow as the PBoC sells Yuan to buy dollars. In the red area the Yuan is falling against the dollar and the PBoC is forced to buy back Yuans with previously accumulated dollars. Since liquidity is withdrawn domestically a falling exchange rate is associated with internal deflation.

We can see the abovementioned process in bank reserve requirements and FX reserves. Reserve requirements, in blue below, are lifted as FX reserves increases and in red we see the reverse process as reserve requirements are lowered alongside falling FX reserves. These are coordinated in order to mitigate negative effects from changes in the domestic money supply.

The problem for PBoC is that their task is impossible to pull off. The enormous amount of waste embedded in the system as a result of years of inflationary policies has left the Chinese economy riddled with bad debt and probably trillions in non-performing loans. Consequently, investors believe further exchange rate depreciation will be needed and the offshore (CNH) forward market price in the typical Chinese approach of incremental change. As long as FX reserves are plentiful, complacency will be the name of the game, but that will leave a lot of people exposed to a rude awakening.

With the PBoC fighting to defend the Yuan they will certainly create trouble in domestic money markets. Draining banks for Yuans as dollars flow abroad; in times when debt-funded boondoggles must roll-over credit lines is a recipe for financial crisis. Banks will be forced to scale back, the infamous Chinese shadow system is under regulatory attack and in any case, debt funding costs will be more expensive for the thousands upon thousands of companies with restricted cash-flows.

In conclusion, the Chinese miracle is built on a pile of debt with only an unconstrained printing press to support it. As use of the printing press now is heavily restricted, the balancing act of supporting the Yuan and supplying enough money to local markets, will be nigh on impossible. Some argue that there will not be a funding crisis in China, simply because the PBoC can always fund a highly centralized credit system. The problem with this line of thinking is that the exchange rate target will have to be abandoned if they do. Either there will be large scale devaluation or alternatively a domestic financial crisis. All this does not necessarily mean a Lehman-moment, where everything crashes overnight, but rather a “managed” transition whereby further credit creation is hamstrung by the lack of real capital funding available. In short, China will evolve more like Japan, with something close to zero growth for years, if not decades, as the legacy of credit fuelled “growth” is never properly dealt with. The question of whether to let the exchange rate or the banking system take the hit seems to be a question up for debate, even among the red kings in Beijing. Late 2014 it seemed like they wanted the domestic banking system, and hence “growth” adjust. The PBoC decided to put the brakes on and slow the economy down. Commodity prices collapsed as the China Miracle probably grinded to a halt. The fantasy GDP numbers obviously did not reflect an economy at a standstill, but neither money flows nor commodity prices do lie in that regard. Inclusion into the SDR basket was probably so important that they were willing to sacrifice short-term growth. However, from mid-2016 it seems Beijing panicked and with the SDR inclusion secured, the PBoC seem hell-bent on stimulating the economy again. As they crank up the printing press once more, further Yuan depreciation will be the way forward. That being said, internal inconsistencies have grown so large that the printing press might not do much good meaning they will end up with a weaker Yuan and no ultimately no growth.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Owner's Guide to 2017 Posted: 03 Jan 2017 07:24 PM PST Reversal, resurgence and renewal on the road to the new year Quietly, while all attention was riveted on the U.S. election, gold made a notable comeback in 2016. The gain was not spectacular at 8.7%, but it was respectable, and it came after three straight down years. (Silver had an even better year with a 15.2% gain.) In addition and perhaps even more importantly, global investment demand registered its fourth largest increase since the 2011 post-crisis peak. That resurgence suggests that down years for gold did not temper the global inclination to own it. To be sure, these numbers in tandem represent an important turnaround for gold and a break from the near-term past. It is also perhaps the first hint that we may have turned the page from the corrective phase of the cycle to resumption of the long-term secular bull market for both gold and silver. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1160.40 Up $10.40 or 0.90% Posted: 03 Jan 2017 07:08 PM PST

Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leaked Audio of Sec. Kerry: Obama Wanted ISIS To Grow Posted: 03 Jan 2017 06:30 PM PST Just exposing the crooked Obama... The invasive politic of USA created the ISIS, and wasted two millions dollar in the failure CIA for buy traitors in Latin America . U.S created and trained Taliban and el qaeda to fight the USSR in Afghanistan which eventually led to the fall of the... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why We Could See Silver Prices Spike In 2017 Posted: 03 Jan 2017 05:38 PM PST ShtfPlan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 255 - DECEMBER 2016/JANUARY 2017 Posted: 03 Jan 2017 04:30 PM PST end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Times Headline News - January 3rd, 2016 Posted: 03 Jan 2017 03:30 PM PST Wild day of news. 33's everywhere. Its hard to tell whats real anymore. Be ye ready. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Inc.'s large dollar debts fuel Beijing's efforts to curb yuan plunge Posted: 03 Jan 2017 03:11 PM PST By Lingling Wei BEIJING -- The large pile of foreign debt owed by Chinese companies, from state-owned banks to airlines, is giving added impetus to Beijing's efforts to keep the yuan from falling too steeply against the rallying dollar. The yuan dropped by 4 percent over the past three months, as the dollar recently hit a 14-year high against 16 currencies. The faster-than-expected depreciation is causing more businesses and individuals to try to get out of yuan, further pressuring the currency. To bolster the yuan, the central bank and other agencies have ratcheted up controls on Chinese companies as well as citizens investing offshore. In the latest move banks were ordered over the weekend to step up scrutiny of individuals' purchases of foreign currency. ... ... For the remainder of the report: http://www.wsj.com/articles/china-inc-s-large-dollar-debts-fuel-beijings... ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alan Watts ~ The Art Of Dealing With Pain Posted: 03 Jan 2017 02:00 PM PST In This video Alan Watts speaks of how we as humans ,learn to deal with suffering and the pain of life .for more information or interest on the lectures visit .alanwatts.org The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain Roughly 1% and 2% Posted: 03 Jan 2017 01:25 PM PST Gold gained $8.17 to $1158.77 in Asia before it fell back to $1146.24 in London, but it then rallied to a new session high of $1163.18 in New York and ended with a gain of 0.77%. Silver rose to as high as $16.485 and ended with a gain of 2.07%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are You Prepared for “Unencumbered” Interest Rate Policy? Posted: 03 Jan 2017 01:22 PM PST This post Are You Prepared for "Unencumbered" Interest Rate Policy? appeared first on Daily Reckoning. In September Janet Yellen gave a speech in Jackson Hole, Wyoming titled "Designing Resilient Monetary Policy Frameworks for the Future." That title at least suggested that some new thinking and new policies might be on display. They weren't. Yellen basically said that interest rate cuts, quantitative easing, interest on excess reserves and forward guidance were sufficient to pull the U.S. economy out of a future recession if needed. In short, Yellen said the Fed's existing toolkit is adequate, and is unwilling to consider more radical tools or remedies. The real lesson was that if you like weak growth, money printing and market manipulation, get ready for more of the same. She dismissed the idea of negative rates. She also agreed that "helicopter money" (really fiscal policy supported by Fed bond purchases to finance deficits) could be useful, but made it clear that it was up to Congress to implement that and the Fed would not lead the charge. Investors should ignore Fed noise. But that doesn't stop markets from overreacting to every syllable of Fedspeak. Gold investors just have to live with day-to-day volatility until the world finally realizes that central banks are impotent and can safely be ignored in favor of global macroeconomic fundamentals. Yellen was not the only one speaking at Jackson Hole, though. Another major speech was by an economist named Marvin Goodfriend, from Carnegie Mellon University. His speech was called The Case for Unencumbering Interest Rate Policy at the Zero Bound. On its face, the Goodfriend speech was about negative interest rates — and just because Yellen doesn't like them now doesn't mean they're not coming in the future. That negative rate idea has been around for a few years. But Goodfriend's focus was to promote "unencumbered" negative interest rate policy, which means getting rid of things standing in your way. Specifically, the No. 1 thing standing in the way of negative rates is cash. If citizens can go to cash, that makes it difficult to impose negative rates on digital bank accounts. That's also not a new insight. The war on cash has been going on for a while, and prominent economists from Larry Summers to Ken Rogoff have called for an end to cash. Rogoff did so in a front-page article in the "Review" section of The Wall Street Journal. He's also written a recent book called The Curse of Cash. The title removes any doubt about his position. What is new in all of this are ideas that Goodfriend presented to the Fed to neutralize the role of cash. His preferred way is just to "abolish paper currency," as his paper outlines in Section 5A. But then Goodfriend laments that "the public is likely to resist the abolition of paper currency." He's right about that. So Goodfriend comes up with a new concept called the "flexible market-determined deposit price of paper currency." (Seriously, I'm not making this up; you can find it in Section 5B of his paper.) In plain English, this means the "money" in your bank account and the "money" in your purse or wallet would be like two different kinds of currency. There would be an exchange rate between the two, just as there is an exchange rate between dollars and euros. The Fed could set this exchange rate at whatever level it wanted and would not be obligated to "defend" that rate at any particular level. What this means is if you go to the bank and withdraw $1,000, the bank might only give you $980 in cash because of the "exchange rate" between your bank account and cash. Or if you deposit $1,000 in cash, the bank might only credit your bank account $980 because of the same "exchange rate" between your cash and the bank account balance. In short, it's a way to impose negative interest rates on physical cash. It's true that Goodfriend is an academic, not a policymaker. But Yellen and other Fed bigwigs like William Dudley and Stanley Fischer were sitting in the audience. In my experience, this is how things start. Some ivory-tower academic writes about a policy proposal. A few other ivory-tower academics and beltway think tanks take the idea and run with it. Then one of those academics gets appointed to a policy position. The next thing you know, the policy is in effect. That's how I saw special drawing rights (SDRs) coming years in advance, and that's how I see the war on cash now. That's why I also see a war on gold… Curiously, academic policymakers have spent so many years disparaging gold they seem to have forgotten that gold is money. Once the war on cash heats up — and certainly when that war is in full swing, out in the open — people everywhere will turn to gold as an alternative form of money. And then, once policymakers see the massive shift to gold, they will launch a war on gold also. So my advice to people interested in gold is — get it now while you still can. What are you waiting for? But it's not just the government and the banks that are doing everything they can to make it impossible for you to get your own money in the form of cash. Now they have a new partner — big business! It seems that businesses have their own war on cash. They hate handling it and it's expensive to transport, store and insure. More and more, businesses are refusing to take your cash. This is just another form of discrimination against the poor who may not have banking accounts or who rely on check cashing services and live paycheck to paycheck. It's also aimed at you because it forces you into a digital system where your money can be hit with negative interest rates, service fees, account freezes, bail-in charges and other forms of theft. When pigs are going to be slaughtered, they are first herded into pens for the convenience of the slaughterhouse. When savers are going to be slaughtered, they are herded into digital accounts from which there is no escape. The war on cash may be a losing battle for you and me, but there is still shelter in physical gold, silver, land and other hard assets. The key defensive play is to obtain your gold now, while you still can, before the war on gold begins. As this realization sinks in, it will create more demand for physical gold, which is already in short supply. That demand-driven tail wind for physical gold will take gold mining stocks much higher. These scenarios are more disturbing, and the tempo more rapid, than I imagined just a short time ago. The time to position yourself in gold and gold miners is now; don't wait. Regards, Jim Rickards The post Are You Prepared for "Unencumbered" Interest Rate Policy? appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Will the World Look Like in 10 Years? Government Beta Test Revealed Posted: 03 Jan 2017 12:30 PM PST The government loves sheep. It loves obedient slaves. A guaranteed income is a way to create an army of supportive people. Bread and Circus at its finest.Those who get out of line will get their skulls crushed. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: The gold owner's guide to 2017 Posted: 03 Jan 2017 11:47 AM PST 2:45p ET Tuesday, January 3, 2017 Dear Friend of GATA and Gold: In his "Gold Owner's Guide to 2017," Mike Kosares of USAGold in Colorado writes that gold remains in a long-term uptrend and the U.S. dollar in a long-term downtrend despite the movements of the last several years. Silver, Kosares adds, has been doing especially well. His analysis is posted at USAGold here: http://www.usagold.com/publications/NewsViewsJan2017.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Jobs Report: Key Driver For Gold Posted: 03 Jan 2017 11:43 AM PST Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Owner's Guide to 2017 Posted: 03 Jan 2017 11:38 AM PST Quietly, while all attention was riveted on the U.S. election, gold made a notable comeback in 2016. The gain was not spectacular at 8.7%, but it was respectable, and it came after three straight down years. (Silver had an even better year with a 15.2% gain.) In addition and perhaps even more importantly, global investment demand registered its fourth largest increase since the 2011 post-crisis peak. That resurgence suggests that down years for gold did not temper the global inclination to own it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Political – Financial Road Map for 2017 Posted: 03 Jan 2017 11:34 AM PST This post Political – Financial Road Map for 2017 appeared first on Daily Reckoning. Happy New Year! May yours be peaceful, safe and impactful! As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet. My prognosis is for more destabilization, financially and politically. Over 2016, I circled the earth to gain insight and share my thoughts on this path from financial crisis to central bank market manipulation to geo-political fall out, while researching my new book, Artisans of Money. (I'm pressing to hand in my manuscript by February 28th – the book should emerge in the Fall.) I traveled through countries Mexico, Brazil, China, Japan, England and Germany, nations epitomizing various elements of the artisanal money effect. I spoke with farmers, teachers and truck-drivers as well as politicians, private and central bankers. I explored that chasm between news and reality to investigate the ways in which elite power endlessly permeates the existence of regular people. In last year's roadmap, I wrote we were in a "transitional phase of geo-political-monetary power struggles, capital flow decisions, and fundamental economic choices. This remains a period of artisanal (central bank fabricated) money, high volatility, low growth, excessive wealth inequality, extreme speculation, and policies that preserve the appearance of big bank liquidity and concentration at the expense of long-term stability." That happened. Going forward, as always, there's endless amount of information to process. The state of economies, citizens and governments remains more precarious than ever. Major areas on the upcoming docket include – central bank desperation, corporate defaults and related job losses, economic impact of political isolationism, conservatism and deregulation, South America's woes, Europe's EU voter rejections, and the ongoing power shift from the West to the East. For now, I'd like to share with you some specific items – which are by no means exhaustive, that I'll be analyzing in 2017. 1) Watching the Artisans of Money (Central Banks)On December 16th, 2015, after equivocating for seven years, the Fed raised rates by 25 basis points. To hedge itself against its own decision, the Fed claimed that despite this move (that the financial press considered indicative of an actual policy shift) its “stance of monetary policy remains accommodative after this increase." Sure enough, the Dow opened January, 2016 with a 10% drop. The US stock market exuded its worst 10-day start to a year since 1897. Other global markets fared worse. Four hikes were initially predicted for 2016. We got just one. Another 25 basis points followed – nearly to the day, on December 14, 2016. The Fed has now forecast another three hikes, for 2017. If you do the math, consider the reasons behind the Fed's wishy-washy language, and ignore economic rhetoric, that translates to one hike this year. Last year, I noted that the Fed's December 2015 rate move was "tepid, and it's possible the Fed moves rates up another 25 or 50 basis points over 2016, but less likely more than that." This happened. Given the tempestuous state of the world and over-optimism surrounding Trump's ability or desire to follow through on certain campaign vows, I see no reason for a different rate pattern in 2017. 2) Volatility for Stock MarketsFollowing a volatile start to 2016, markets rebounded. Not because fundamental economic conditions of the world's major countries improved instantly or geo-political tension declined. But as other major central banks took over the cheap money mantle. The cavalry appeared. The Bank of Japan hit negative rate territory in January, 2016. The European Central Bank adopted negative rates in March, 2016. As a result of these major central banks equalizing the cost of global money back to zero, the stock market bubble marched on. And if that wasn't enough to show that liquidity and crisis concerns still exist, both central banks introduced additional manifestations of quantitative easing during the year with the ECB extension in time and BOJ extension up their yield curve. In November, Donald Trump's victory further elevated stock markets, especially sectors most likely to be deregulated by the incoming billionaire club administration, like banks. Yet, the idea that any President can control the economy with a tweet and a set of disparaging or aggrandizing comments is foolish. Once the hype of a reality TV show president subsides into prevailing political and economic uncertainty, stock and bond markets will end the year crumbling in the dust of broken promises. 3) Rising Corporate Defaults and Oil PricesExtending a disturbing trend, the number of large global corporations that defaulted in 2016 outpaced those in 2015 by 40 percent. The figure for 2016 hit 150, making 2016 the worst year for corporate defaults since the financial crisis. If Trump wants to make America great again, he should start by examining the leverage in corporate America, where 2/3s of global corporate defaults occurred. Of those, 50 out of 63 globally, were in the oil and gas sector. (Emerging markets accounted for 28 defaults and Europe for 12). S&P expects the default rate to rise in 2017. And if Trump's nominee for Secretary of State, Rex Tillerson, has anything to do with it, oil prices won't move up much for 2017. This will mean more defaults in that sector. Based on his recent statements, his policies are cushioned in the ideology of pumping more oil, not less. 4) Turmoil in South AmericaLast year, given how scandal-plagued Brazil was, I thought no matter what happened regarding now-former Dilma Rousseff's government, its markets would slip along with its economy. Yet, against all logic, interim President Michel Temer, even more plagued by scandal than his ejected predecessor, got a Hail Mary from the international investor community. Much of that had to do with Wall Street's old friend Henrique Mereilles nabbing the minister of finance spot (having run Brazil's Central Bank under President Luiz Inácio Lula da Silva (a.k.a. "Lula") from 2003 to 2010.) I also said that Argentina wouldn't be having a "walk in the park." The new centrist government removed currency capital controls in order to attract foreign money, which had the side effect of crushing the Argentinean peso. Unemployment and general angst increased. A group of protestors recently stoned the car of President Macri amidst growing resentment of his austerity measures. Venezuela, a nation dependent on oil for 96% of its exports has erupted into total chaos. As perhaps the desperation move "currency controls" or restrictions were introduced in early December President Maduro announced plans to withdraw the 100 bolivar note which makes up 77 percent of all currency in circulation and closed the borders to stop people holding Venezuelan currency outside of the country. That caused mass panic and Depression like bank lines, looting and violence. The government chose to keep the 100-note in circulation until January 20. That's a temporary measure. So is a large year-end bond issue from the government forced on the state banks. Things will get uglier. Restricting currency circulation is a harbinger of the war on cash everywhere. Contagion in South America is more likely to be acute this year. 5) First Half: Rising Dollar/ Sideways Gold, Second Half: Reverse and CashLast year, I said that despite other countries (and the IMF) seeking to battle the almighty Greenback, global malaise would "keep the dollar higher than it deserves to be." Then, I expected gold "to rise during the summer as a safe haven choice" which it did and to "end the year lower in US dollar terms" which it also did. This year, it's likely that the dollar will remain strong in the beginning given the recent Fed hike, expectations of more, and initial enthusiasm for Trump's promises. This will keep a lid on gold. Yet once it becomes clear that US economic conditions remain lackluster and inequality rampant, the dollar will weaken and gold will appreciate. In the backdrop, though the US remains the world's biggest gold holder, nations like China, India and Russia will continue to stockpile gold in a bid to diversify against the dollar. In addition to watching the yellow metal, as I've urged over the past few years, routinely extracting cash from bank accounts remains a smart defensive play for 2017. People have asked me where to keep it. The answers depend on individual financial situations, but paying down debt, buying necessary hard assets and staying liquid with the rest in physical reach (there's a reason for the term, keeping it 'under the mattress' is practical. 6) Power Shift from West to East Through China and JapanAs it has done since cheap money became US economic and financial policy in the wake of the financial crisis, China continues to forge a US-independent path. It did so through inclusion of the Renminbi in the IMF's SDR basket in October 2016. It also established a stronger relationship and side agreements with Russia, the BRICS community and increasingly with Europe and the United Kingdom post the Brexit vote. That was no accident, but part of a strategy to be distanced from the risk the US and its central and private banking system poses. The New Development Bank (formerly referred to as the BRICS bank) headquartered in Shanghai, China, offers alternatives to old institutions like the IMF, and allows for a rise of eastern and emerging nations to succeed in a collective format. The trajectory of this power shift from the US dollar and US policies will escalate. If Trump and his team go the isolationist, or bilateral trade agreement routes, it will only push China to increases its economic, military and diplomatic presence globally. While Trump (and the outgoing Obama administration) accuse China of currency devaluation, the People's Bank of China (PBOC) has actually been selling US treasuries to bolster its currency – hit by capital outflows, not manipulation. China sold $22 billion of US treasuries in July. Its US government debt holdings are at their lowest level in more than three years, and these sales, especially in the face of Trump's scorn, will continue. These accusations and geo-bullying will also push former adversaries, China and Japan closer together. The two nations are already negotiating some historic agreements. We could be approaching a new era in which Sino-Japanese relations allow for diplomatic normalization and more economic partnerships, which would be mutually beneficial. Over 2016, Japan entered greater cooperation with India and Russia. The agreements it arranged will bolster Japan's potential for 2017. The Yen should appreciate as a result. Even in the case of further economic turmoil in the US and around the world, the Yen will benefit, as it did during the financial crisis, from being a safe haven currency. 7) More Anti-EU Sentiment and Economic Hardship in EuropeIn 2015, Mario Draghi, European Central Bank (ECB) head decided to extend Euro-QE into March 2017. At the start of last year, I said that, "The euro will continue to drop in value against the dollar" and "negative interest rates will prevail." That happened. And despite no evidence of any economic benefit (and purely to help ailing banks) Draghi extended Euro-QE to December 2017, with a promise to do more if necessary. Meanwhile, mega banks in Europe continue to buckle, economies continue to stagger and the uprising of populations increasingly apprehensive of the entire EU apparatus will be felt in votes this year. Already, much of Eastern Europe (with notable exceptions of Austria and Romania) has elected anti-EU politicians. With major elections approaching – in the Netherlands in March, France in May and Germany likely in October, the only way for the sitting elite to retain power is to make the markets seem frothy. That means more QE manifestations from Draghi, a weaker euro, more bubbles in major European stock markets and greater presence from conservative, protectionist politicians. In Europe, weaker countries are struggling more than ever. In Greece, more than one out of every three people now lives in poverty and 25% of Greeks are unemployed and receive no benefits. Even stronger countries like Norway and Switzerland will be at economic risk as they begin to negotiate trade agreements with the central EU. 8) Upside for RussiaAny way you look at it, Russia will be a key economic beneficiary for 2017. The ruble appreciated about 21% vs. the dollar in 2016, outperforming all other emerging market currencies for the year. This trend will continue. Russia's MICEX stock market index rallied 24% for 2016. Russian bonds will maintain that path amid high interest rates (around 10%) and a positive geo-political outlook relative to the US. Russia will enjoy warmer relationships with the US under the Trump administration and find and ally in Rex Tillerson as Secretary of State. It has strategically engaged in trade agreements with China to diversity against US ones. Simultaneously it has furthered relations with many Eastern European countries that have been disillusioned with the EU. As more pro-Russia officials are being voted into power, the positive impact on Russia's economy will carry on. These alignments could provide Russia more impetus militarily. Having stepped in to assuage the situation in Syria while the US remained relatively silent, it can also capitalize on its Middle East relationships. Russia supplies nearly one-third of the EU's natural gas, but energy but, it has also begun clean energy initiatives through the BRICS development bank and other platforms, a strategic diversification. That's why the ruble will outperform the euro and the pound sterling. 9) Angst in the United KingdomBefore being picked as Trump's Commerce Secretary, billionaire, Wilbur Ross called Brexit a "God-given opportunity” for UK rivals. As commerce secretary, he can act upon that characterization – through negotiations of new US-UK trade agreements that favor the US. That would increase UK reliance on more optimal EU negotiations, by no means a given. The UK can also hope that China and the BRICS will offer better opportunities, which increases the West to East power shift. The sterling fell 14% in 2016, due to Brexit and anxiety over what form it will eventually take. Despite a year-end dead-cat bounce, uncertainty can only mount once negotiations truly begin. As the Financial Times noted, the number of times the words "uncertain" and "uncertainty" appeared in the Bank of England's Monetary Policy Committee meeting minutes in 2016 rose 78 per cent vs. 2015. That doesn't bode well for the sterling. But in the event of a Bank of England rate cut (to compensate for the Fed hike), there would be another temporary boost to the UK stock and bond market. 10) The Trump Effect Will Accentuate UnrestTrump is assembling the richest cabinet in the world to conduct the business of the United States, from a political position. The problem with that is several fold. First, there is a woeful lack of public office experience amongst his administration. His supporters may think that means the Washington swamp has been drained to make room for less bureaucratic decisions. But, the swamp has only been clogged. Instead of political elite, it continues business elite, equally ill-suited to put the needs of the everyday American before the needs of their private colleagues and portfolios. Second, running the US is not like running a business. Other countries are free to do their business apart from the US. If Trump's doctrine slaps tariffs on imports for instance, it burdens US companies that would need to pay more for required products or materials, putting a strain on the US economy. Playing hard ball with other nations spurs them to engage more closely with each other. That would make the dollar less attractive. This will likely happen during the second half of the year, once it becomes clear the Fed isn't on a rate hike rampage and Trump isn't as adept at the economy as he is prevalent on Twitter. Third, an overly aggressive Trump administration, combined with its ample conflicts of interest could render Trump's and his cohorts' businesses the target of more terrorism, and could unleash more violence and chaos globally. Fourth, his doctrine is deregulatory, particularly for the banking sector. Consider that the biggest US banks remain bigger than before the financial crisis. Deregulating them by striking elements of the already tepid Dodd-Frank Act could fall hard on everyone. When the system crashes, it doesn't care about Republican or Democrat politics. The last time deregulation and protectionist businessmen filled the US presidential cabinet was in the 1920s. That led to the Crash of 1929 and Great Depression. Today, the only thing keeping a lid on financial calamity is epic amounts of artisanal money. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GATA's Ed Steer to speak at Vancouver Resource Investment Conference Posted: 03 Jan 2017 11:07 AM PST 2:07p ET Tuesday, January 3, 2017 Dear Friend of GATA and Gold: GATA Board of Directors member Ed Steer, publisher of the daily Ed Steer's Gold and Silver Digest letter -- http://www.edsteergoldandsilver.com -- will speak at Cambridge House's Vancouver Resource Investment Conference, to be held Sunday and Monday, January 22 and 23 at the Vancouver Convention Centre West in Vancouver, British Columbia, Canada. Also speaking, among others, will be Peter Schiff of Euro-Pacific Capital, Frank Holmes of U.S. Global Investors, Doug Casey of Casey Research, Peter Spina of GoldSeek.com and SilverSeek.com, David Morgan of The Morgan Report and Silver-Investor.com, Thom Calandra of The Calandra Report, Rick Rule of Sprott U.S. Holdings, Tommy Humphreys of CEO.ca, Keith Neumeyer of First Majestic Silver Corp., and Andy Schectman of the Miles Franklin bullion dealership. As usual scores of resource companies will be exhibiting. A discounted rate will be available to conference participants at the Fairmont Waterfront hotel across the street from the convention center. Admission will be free with advance registration and otherwise will cost C$20 at the door. For more information about the conference and to register, please visit: https://cambridgehouse.com/event/54/vancouver-resource-investment-confer... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canadian Government Issues Key Water License Company Announcement TORONTO -- Seabridge Gold Inc. (TSX: SEA) (NYSE:SA) announced today it has received a license from the Government of Canada required for the construction, operation, and maintenance of the water storage facility and associated ancillary water works at its 100 percent-owned KSM Project in northwestern British Columbia. The license, as authorized within the International Rivers Improvement Act, regulates all structures and activities situated on transboundary waters shared with the United States that have the potential to affect water quality and quantity. The Water storage facility and its ancillary water works (water diversion ditches and tunnels) are the primary water management control systems for the KSM Project. These facilities separate water that has not contacted mined material from so-called contact water originating from disturbed areas of the mine site and then contain the contact water prior to treatment and eventual release to the receiving environment. These facilities are situated on Mitchell and Sulphurets creeks, tributaries of the transboundary Unuk River system that flows into Alaska. The license was granted for a term of 25 years under the International Rivers Improvements Regulations as administered by Environment and Climate Change Canada. ... ... For the remainder of the announcement: http://seabridgegold.net/News/Article/642/federal-government-issues-key-... Join GATA here: Vancouver Resource Investment Conference Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Anonymous: If you think you can handle the truth, well here it is! Posted: 03 Jan 2017 10:30 AM PST Anonymous Message 2017 - You have to watch this! Something big is going to happen! THEY don't want this video on YouTube! This is the latest Anonymous message to the global public. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Obama is FURIOUS After What This CIA Agent Just Revealed About Putin and Russia Posted: 03 Jan 2017 10:02 AM PST BREAKING: Obama is FURIOUS After What This CIA Agent Just Revealed About Putin and Russia. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EU Back in the Bailout Business Posted: 03 Jan 2017 09:58 AM PST This post EU Back in the Bailout Business appeared first on Daily Reckoning. Despite the surprise victories of Donald Trump in the US and the Brexit vote in the UK, 2016's first "leftovers to go sour" in 2017 could very well turn out to be from bailouts in Italy. The government of Italy will take on the majority of a bank bailout, covering a total of 6.6 billion euros out of the 8.8 billion due for the floundering Monte dei Paschi di Siena (BMPS). Italians are no stranger to political shakeups. Following a recent government turnover, and the increase in fragility economically, the most paramount problem in Italy might be felt most significantly throughout its massively troubled banking and finance sector. On July 29, 2016 when the European Central Bank completed its "stress test," the ailing Italian bank, BMPS, deemed the world's oldest bank was found to be the worst in the European Union. Since then the bank has been under fire as being the greatest concern for its inability to sustain toxic loans within its system. While news of Deutsche Bank might be concerning, Monte dei Paschi does not have the same complexity or financial wherewithal. Just last week the European Central Bank noted that the bank would need "recapitalization" if it was to keep its doors open. The ECB then took to recommending that the total capital required would even need to be increased by three billion more euros. While debates over recapitalization stream out of the political corridors of the ECB, the fact is Europe has returned to the failed policy of bailing out banks. This time investors stand to lose even more and confidence could hit an all time low. Why the Italian Bank Bailout MattersItaly might be a relatively small factor on the global scale, and Monte dei Paschi is certainly a smaller bank with relation to the major banking powerhouses, but the collapse of one bank could rock global investors. If this particular bank was to completely fall, there are wide beliefs that other Italian banks may be hit by the contagion effect and that the 20 billion euro that was given a green light by the Italian parliament to assist troubled banks might not be enough. There was also a tiny bombshell dropped by the US Treasury's Office of Financial Research which showed that US banks have more than $2 trillion in exposure to European banks. The interconnectedness of the US and Europe is alive, dangerous and very present. While the Italian economy minister, Pier Carlo Padoan told his parliament that, “The impact on savers, if a (government) intervention should take place, will be absolutely minimized or non-existent” the impact on confidence is something that cannot be guaranteed. If the bailout is felt by the general population and the economy does trend even further negative, the voter backlash could also have tremendous fallout. The anti-establishment 5 Star Movement appears to be well seated to capitalize on any traction given. As Jim Rickards told MarketWatch yesterday, "The problem with the "no" vote in Italy is not the vote itself, but what comes next. We're already seeing fallout including the resignation of the Renzi government, the failure of the Italian bank private recapitalizations, the emergence of a public recapitalization, and possible spillovers into Germany's Deutsche Bank and Spain's Banco Popular." Rickards went on to note that, "It's important to recall that the 1998 crisis started in 1997, and the 2008 crisis started in 2007. Large systemic crises can take a year to incubate and spread." While racing against time before the bank hit crisis mode, last Thursday Italy got European Commission approval to have an extension of 150 billion euros in government allocations to be guaranteed for its struggling banks. This at a time when Monte dei Paschi's share price has tanked more than 80% this in 2016. This type of European collective action could very well be the beginnings of a European Union undoing. While speaking to German daily newspaper Tagesspiegel the head of Germany's leading economic institute Ifo said he believes Italians will want to quit the euro if the standard of living does not improve. While Italy may not be seeking a holistic economic rescue plan, the head of Ifo said that if Germany’s parliament were to approve a European rescue program for Italy, it would impose on German taxpayers risks “the size of which it does not know and cannot control.” Elections are scheduled to take place later this year in Germany which could spell trouble for any pro-European leaders, including Chancellor Merkel, at a time when EU bank bailouts begin rolling out. The bailout news from Italy could be a strong indicator that 2017 might be the start of a very troubling trend for the grand experiment in shared currency throughout the Eurozone. The way that Monte dei Paschi plays out could set the stage for a renewed series of bailouts, or a renewed crash in confidence. Trouble is seeping out of Tuscany. Dark clouds seem to be on the horizon for the Eurozone. Arrivederci, Craig Wilson, @craig_wilson7 The post EU Back in the Bailout Business appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Soros Plots Economic Collapse To Blame Trump! Posted: 03 Jan 2017 09:30 AM PST Soros is a despicable twit. He is a Jew who helped Nazis parse through the clothes and belongings of dead jews in concentration camps. He passed himself off as a gentile during WWII and helped the authorities against his own Jewish people. Some give him a pass saying he was trying to stay alive but... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New year, new highs: FTSE 100 smashes 7,200 and dollar index hits 14-year peak Posted: 03 Jan 2017 09:07 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: "We Will ‘Punish’ Hillary Clinton!" Trump New WH Press Secretary Posted: 03 Jan 2017 08:43 AM PST BREAKING: Trump New WH Press Secretary: We Are Going To 'Punish' Hillary Clinton! - Sean Spicer. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE Precious Metal Stock for 2017 Posted: 03 Jan 2017 08:36 AM PST One precious metal will rocket in 2017... And it WON'T be gold. Now, while we recommend every investor own some gold as a hedge against uncertain times... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

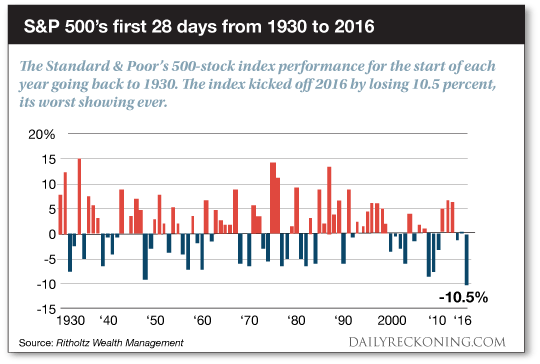

| These 2017 Market Predictions are Dead Wrong Posted: 03 Jan 2017 07:20 AM PST This post These 2017 Market Predictions are Dead Wrong appeared first on Daily Reckoning. I have a confession to make… I don't know how the stock market will perform this year. I don't know if stocks will finish up or down in 2017. I don't know which commodities will rise and which ones will fall. No one does. But I don't need to make any bold forecasts to make money in the markets in 2017. Neither do you. We're skipping prediction season again this year. A cop out? Hardly. Consider this little act of kindness your late Christmas present… But we're apparently the only ones who haven't carved the market's 2017 performance in stone. After exhausting every "Dow 20,000" storyline in the universe, financial pundits and reporters have switched gears to hot New Year's market calls. The 'net is now brimming with bold prognostications for stocks, bonds, commodities, and which celebrity is next in line to kick the bucket. Everyone from the big bank analysts to lowly bloggers is taking a stab at what the New Year will unleash on unsuspecting investors. Yet no matter how much data they use to back up their claims, even the best predictions are nothing but empty guesses. And we don't have to dig very deep to prove it… Just one short year ago, stocks suffered their worst start in history. The major averages rang in 2016 with a thud. After the first week of trade, only about 25% of stocks in the S&P remained above their respective 200-day moving averages. Market breadth was downright awful. Cracks appeared in several vulnerable sectors. Meanwhile, transports and small-caps were quickly entering bonafide bear markets. The S&P approached the end of the first month of the year down a cool 10%. That was the worst start ever for the index. It was all too easy to get caught up in the carnage. Prophesizing a major market meltdown in January 2016 wasn't crazy talk. From the average investor to the smart-money portfolio manager, the world's markets looked like they were ready to come crashing down. Of course, we now know how these doomsday scenarios played out. After dropping double-digits to start the year, stocks came roaring back to life.

Ultimately, the long-term investors who panicked early last year were forced to watch stocks rip off their lows. The S&P 500 finished the year with 10% gain. But the hardest-hit groups were the real champions of 2016. "Had you sold in January, you would have missed a 45 percent rise in small-cap stocks, a 36 percent gain in Japan, 25 percent gain in U.S. large-cap stocks, 31 percent gain in emerging markets, and a whopping 57 percent gain in energy-related stocks," Barry Ritholtz reminds us as we kick off the new year. "Missing rallies of this nature can be devastating to the long-term performance of any portfolio." Those are some impressive numbers. Did I see any of these incredible moves coming as despair set in during the first weeks of 2016? Nope. But that didn't stop us from successfully playing these trends as they started to unfold. Stocks popping off their lows and gold getting jiggy last winter were pleasant surprises that helped contribute to some of our biggest gains of the year. The best part? We didn't predict any of 'em. I don't know what's in store for us in 2017. No one does. But I do know we'll be able to book gains by shutting out the noise and following the market's most powerful trends. Sincerely, Greg Guenthner The post These 2017 Market Predictions are Dead Wrong appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Jan 2017 04:32 AM PST The U.S. dollar index (DXY) continues to strengthen following very positive long-term bullish price behavior. Although retracements will be seen in the short-term, upward pressure should remain for some time. Classic bullish trend continuation price behavior: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||