Gold World News Flash |

- The Endgame, Trump and Gold

- What IF Gold has a Drop Dead Line?

- SRSrocco Top 2016 Posts And My Commentary For 2017

- Dallas Pension Not Only "Ticking Time Bomb Ready To Explode," Public Policy Director Warns

- It’s War: World’s Purest Silver Producer Prepares To Join Class Action Lawsuit Against Bullion Banks For Price Rigging

- It’s War: World’s Purest Silver Producer Prepares To Join Class Action Lawsuit Against Bullion Banks For Price Rigging

- It’s War: World’s Purest Silver Producer Prepares To Join Class Action Lawsuit Against Bullion Banks For Price Rigging

- 10 Predictions for 2017: Gold, Stocks, Trump, Putin and War

- Currency & The Collapse Of The Roman Empire

- Asian Metals Market Update: Jan-3-2017

- Anonymous What Is The Obama Regime Up To?

- The Truth About NASA -- Clark McClelland

- ANONYMOUS GLOBAL FINANCIAL MELTDOWN TO ARRIVE SOON

- A Biased 2017 Forecast, Part 2

- End Times Headline News - January 2nd, 2016

- Celente -- Washington Post Retracts Power Plant Russian Hack Story

- Stock Market, Gold and Silver Stocks Forecast 2017-2022

- The No.1 Silver Stock for 2017

- ALERT: Obama is Attempting to Stay in Office Past January 20th

- 10 Predictions for 2017: Gold, Stocks, Trump, Putin and War

- Silver Prices and the Russian Connection

- WorldWide Prophecy Happening Now!! End Time Events 2017

- The Fed’s Troubled Road Ahead

- Silver Prices and the Russian Connection

- Here’s What Will Happen in 2017

- Jim’s Mailbox

- Time Talks – Clif High

- 2017 Predictions on Trump, Gold, Silver, Housing, Stocks, Bonds & Antarctica-Clif High–USAWatchdog.com

- Alert Trump To Destroy America Martial Law WW3 Latest Update USA Dollar Collapse Video

- Nomi Prins: Central Banks and the Artisanal Money Era

- This is Why January 1st 2017 is a HUGE Day for China and the Markets!

- Gold: Getting There A Little At A Time

- The Consequences of Helicopter Money

- Breaking News And Best Of The Web

- The Stock Market Has Topped. Next Up the US Dollar Driven Bloodbath

- Is China About to Demand the US Dollar Lose Reserve Currency Status?

- Gold And Silver 2017 – The Golden Lye

| Posted: 03 Jan 2017 07:11 AM PST Today, banking regulations enacted after the 2008 financial crisis are about to be repealed as Trump and his coterie of Goldman Sachs bankers—Steve Mnuchin (former Goldman Sachs partner), now Trump's nominee for Secretary of the Treasury, Steven Bannon (former Goldman Sachs managing partner), now Trump's chief strategist and senior counselor, and Gary Cohen (president and chief operating officer of Goldman Sachs), now Trump's top economic advisor—give Wall Street's criminal cabal even greater access to what remains of America's wealth, bringing the nation and the world closer to a catastrophic financial collapse. |

| What IF Gold has a Drop Dead Line? Posted: 03 Jan 2017 07:07 AM PST In part 2 of this Weekend Report we'll take an indepth look at gold and especially the long term view. Again, this is just for entertainment purposes only until gold can close below a very important trendline. I've been following this potential scenario since shortly after the US elections. Up until the elections this pattern I'm about to show you didn't show its self, but now it's one of the most important chart patterns for gold that I've posted in several years. |

| SRSrocco Top 2016 Posts And My Commentary For 2017 Posted: 03 Jan 2017 07:04 AM PST If we thought 2016 was an interesting year, 2017 will certainly top it and be even more tumultuous. With President-elect Donald Trump to head the White House in a few weeks, many in the precious metals and alternative media community believe the "WORST IS OVER." This is one hell of a lousy assumption. Matter-a-fact, President-elect Trump will likely precipitate the collapse quicker than a Clinton regime. Why? Because Trump has no idea just how much the U.S. financial and economic system are propped up. When Trump starts to open the massive "CAN OF WORMS" in the U.S. government, this will likely cause serious dislocations in the entire system. |

| Dallas Pension Not Only "Ticking Time Bomb Ready To Explode," Public Policy Director Warns Posted: 03 Jan 2017 01:15 AM PST For months, if not years, we've warned that conflicted politicians and union bosses pursue a perverse set of goals in their management of pension funds, most of which have nothing to do with the application of sound financial principles. Here's how we summarized the situation back in the summer (see "An Unsolvable Math Problem: Public Pensions Are Underfunded By As Much As $8 Trillion"):

Then, just a couple of weeks ago, CalPERS confirmed our fears when they chose to lower their discount rate by only 50bps to 7%, nearly a full point above their 6.2% projected annual returns over the next decade. Even more startling was the open admission from Richard Costigan, chairman of the CalPERS finance committee, that the decision was motivated by the board's desire to maintain the ponzi, saying: "this is just a start...municipalities and other government agencies need some breathing room before they absorb the impact." Apparently we're not the only ones growing increasingly concerned about the lack of financial discipline within these massive pension funds. Lawrence Person's BattleSwarm Blog recently interviewed the Director of the Texas Public Policy Foundation, James Quintero, who noted that many of the nation's largest pensions are relying on "fuzzy math to make them work, or at least give the appearance of working."

Unfortunately, as Quinterro points out, when all those bad assumptions about future returns finally prove to be wildly optimistic it will be taxpayers left holding the bag.

Asked whether other large pensions in Texas were as bad off as the Dallas Police and Fire Pension, Quinterro said simply, "If you're a taxpayer or property owner in one of Texas' major cities, I'd be concerned." A quick review of where some of Texas' largest pensions stand, after one of the biggest bull market runs in history, helps explain Quinterro's pessimism: While "fuzzy math" can help these ponzi schemes elude the inevitable for a very long time, at some point they will eventually collapse. And, with $6-8 trillion in outstanding liabilities at U.S. public pensions alone, we suspect the consequences of that collapse will not be pleasant. |

| Posted: 03 Jan 2017 01:09 AM PST ShtfPlan |

| Posted: 03 Jan 2017 01:09 AM PST ShtfPlan |

| Posted: 03 Jan 2017 01:09 AM PST ShtfPlan |

| 10 Predictions for 2017: Gold, Stocks, Trump, Putin and War Posted: 03 Jan 2017 12:30 AM PST Gold Stock Bull |

| Currency & The Collapse Of The Roman Empire Posted: 02 Jan 2017 11:45 PM PST At its peak, the Roman Empire held up to 130 million people over a span of 1.5 million square miles. Rome had conquered much of the known world. The Empire built 50,000 miles of roads, as well as many aqueducts, amphitheatres, and other works that are still in use today. Our alphabet, calendar, languages, literature, and architecture borrow much from the Romans. Even concepts of Roman justice still stand tall, such as being “innocent until proven guilty”. And so, as Visual Capitalist's Jeff Desjardins asks (and answers): How could such a powerful empire collapse?

Courtesy of: The Money Project

The Roman Economy Trade was vital to Rome. It was trade that allowed a wide variety of goods to be imported into its borders: beef, grains, glassware, iron, lead, leather, marble, olive oil, perfumes, purple dye, silk, silver, spices, timber, tin and wine. Trade generated vast wealth for the citizens of Rome. However, the city of Rome itself had only 1 million people, and costs kept rising as the empire became larger. Administrative, logistical, and military costs kept adding up, and the Empire found creative new ways to pay for things. Along with other factors, this led to hyperinflation, a fractured economy, localization of trade, heavy taxes, and a financial crisis that crippled Rome. Roman Debasement The major silver coin used during the first 220 years of the empire was the denarius. This coin, between the size of a modern nickel and dime, was worth approximately a day’s wages for a skilled laborer or craftsman. During the first days of the Empire, these coins were of high purity, holding about 4.5 grams of pure silver. However, with a finite supply of silver and gold entering the empire, Roman spending was limited by the amount of denarii that could be minted. This made financing the pet-projects of emperors challenging. How was the newest war, thermae, palace, or circus to be paid for? Roman officials found a way to work around this. By decreasing the purity of their coinage, they were able to make more “silver” coins with the same face value. With more coins in circulation, the government could spend more. And so, the content of silver dropped over the years. By the time of Marcus Aurelius, the denarius was only about 75% silver. Caracalla tried a different method of debasement. He introduced the “double denarius”, which was worth 2x the denarius in face value. However, it had only the weight of 1.5 denarii. By the time of Gallienus, the coins had barely 5% silver. Each coin was a bronze core with a thin coating of silver. The shine quickly wore off to reveal the poor quality underneath. The Consequences The real effects of debasement took time to materialize. Adding more coins of poorer quality into circulation did not help increase prosperity – it just transferred wealth away from the people, and it meant that more coins were needed to pay for goods and services. At times, there was runaway inflation in the empire. For example, soldiers demanded far higher wages as the quality of coins diminished. “Nobody should have any money but I, so that I may bestow it upon the soldiers.” – Caracalla, who raised soldiers pay by 50% near 210 AD. By 265 AD, when there was only 0.5% silver left in a denarius, prices skyrocketed 1,000% across the Roman Empire. The Effects With soaring logistical and admin costs and no precious metals left to plunder from enemies, the Romans levied more and more taxes against the people to sustain the Empire. Hyperinflation, soaring taxes, and worthless money created a trifecta that dissolved much of Rome’s trade. By the end of the 3rd century, any trade that was left was mostly local, using inefficient barter methods instead of any meaningful medium of exchange. The Collapse During the crisis of the 3rd century (235-284 A.D), there may have been more than 50 emperors. Most of these were murdered, assassinated, or killed in battle. The empire was in a free-for-all, and it split into three separate states. Constant civil wars meant the Empire’s borders were vulnerable. Trade networks were disintegrated and such activities became too dangerous. Barbarian invasions came in from every direction. Plague was rampant. And so the Western Roman Empire would cease to exist by 476 A.D. * * * The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. |

| Asian Metals Market Update: Jan-3-2017 Posted: 02 Jan 2017 11:02 PM PST Last year precious metals and industrial metals had been shared between bulls and bears. In the first half of last year, precious metals zoomed, while in the second half of the year industrial metals and natural gas zoomed. Over the past two years, there have been very gloomy predictions on gold and silver all over the internet. None of the extreme bearish forecast actually came. |

| Anonymous What Is The Obama Regime Up To? Posted: 02 Jan 2017 08:30 PM PST Anonymous What Is The Obama Regime Up To? 18 days till Trump in and OBUMMER can piss the he'll off back to where he ORIGINALLY hailed from, Kenya, the traitorous LIAR!!! TRUMP!!!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| The Truth About NASA -- Clark McClelland Posted: 02 Jan 2017 07:30 PM PST Jeff Rense & Clark McClelland - The Truth About NASA Clip from December 20, 2016 - guest Clark McClelland on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| ANONYMOUS GLOBAL FINANCIAL MELTDOWN TO ARRIVE SOON Posted: 02 Jan 2017 07:00 PM PST We are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| A Biased 2017 Forecast, Part 2 Posted: 02 Jan 2017 06:10 PM PST Submitted by Jim Quinn via The Burning Platform blog, In Part One of this article I discussed the failure of our brains to think rationally due to our biases and the relentless propaganda flogged by our Deep State ruling class. Viewing the future through the looking glass of the Fourth Turning keeps you focused on the three catalysts which will drive all events in 2017 and beyond. I’ve addressed my 2017 Debt forecast in Part One. Now I will make some guesses about what might happen in 2017 related to Civic Decay and Global Disorder. Civic Decay Forecast“Our comforting conviction that the world makes sense rests on a secure foundation: our almost unlimited ability to ignore our ignorance.” – Daniel Kahneman, Thinking, Fast and Slow

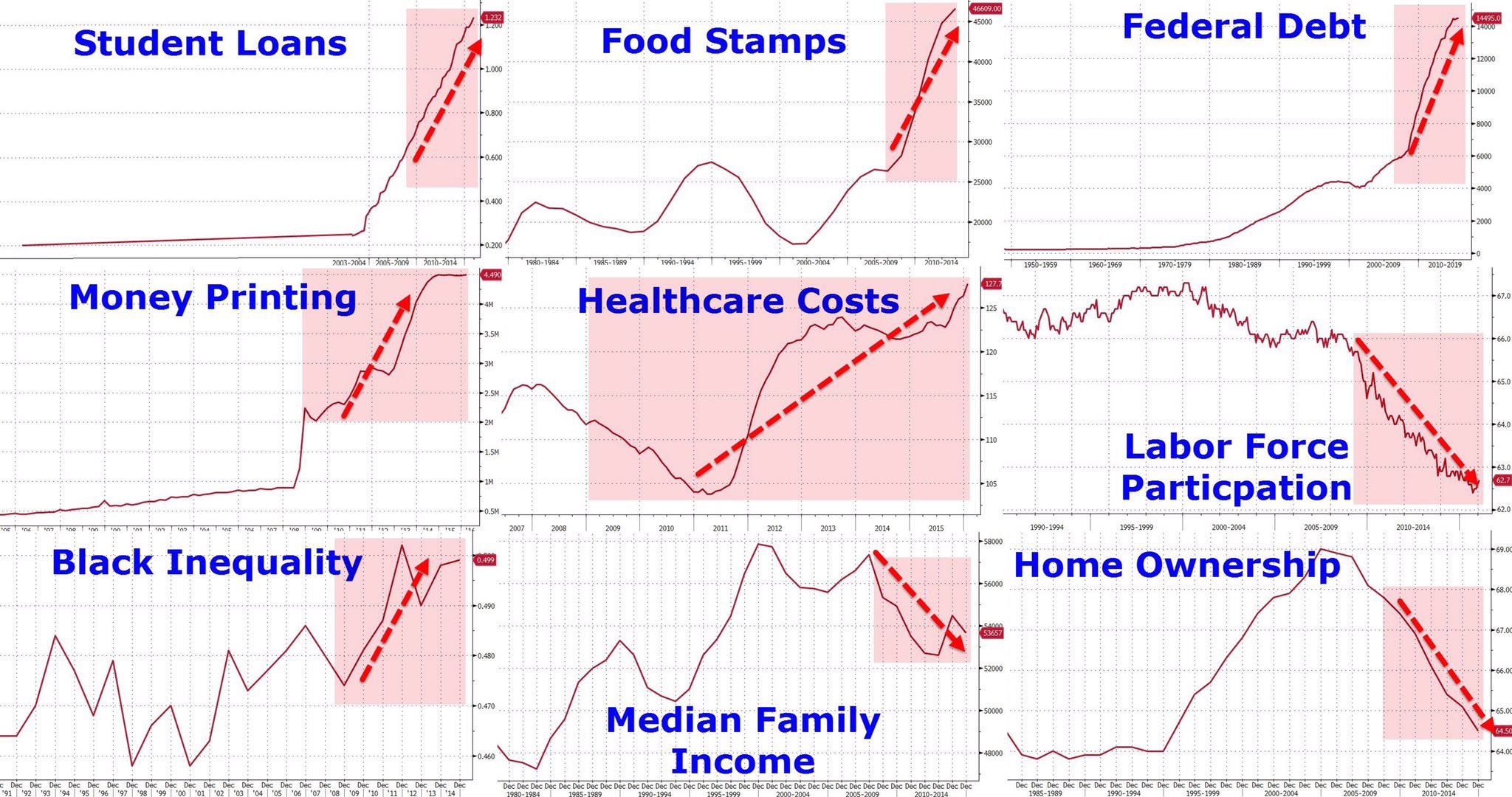

The presidential election and its aftermath tell you everything you need to know about the level of civic decay overtaking this country. The country is as divided as it was after the election of Abraham Lincoln in 1860. There is virtually no common ground between liberals and conservatives. The pure hatred and contempt between the winners and losers in the recent election does not bode well for the country over the next four to eight years. The social fabric of the country has been torn asunder. The Clinton supporters believe anyone not on their side is deplorable, racist, misogynist, and fans of Hitler. Trump supporters believe anyone not on their side is low IQ, Muslim loving, deceitful, math challenged, and fans of a criminal. The gulf between the two sides is unbridgeable. Barack Obama, the well-dressed, polished, articulate, empty suit, who has occupied the White House for the last eight years serving as the front man for the Deep State, has done more to destroy race relations and sense of community than any president in history. His divisive rhetoric and actions over the last eight years created the atmosphere for the acrimonious election and the violent protests that followed. His failure to quell the Soros funded Black Lives Matter terrorist organization has resulted in the slaughter of police across the country. Meanwhile, his hometown of Chicago has seen 800 homicides and over 4,400 shootings in 2016 – with over 90% blacks killing blacks. His legacy is one of complete and utter failure, but his hubris knows no bounds, and he actually believes his eight year reign of error was a resounding success. Facts be damned.

“A person who has not made peace with his losses is likely to accept gambles that would be unacceptable to him otherwise.” – Daniel Kahneman, Thinking, Fast and Slow Obama fears his legacy will go up in flames. When you govern through executive orders, bypassing Congress, and flaunting the Constitution, your actions can be overturned with the stroke of a pen. When your crowning achievement – Obamacare – is derided by virtually everyone in the country as an epic failure and will be repealed and replaced in short order, you realize your entire presidency was a sham and a national disgrace. Obama is flailing about in his final weeks desperately trying to keep the attention focused upon him. He is gambling with the lives of his countrymen by doing everything in his power to provoke World War III with Russia and to inflame the Middle East with his UN engineered snub of Israel. Obama doesn’t like to lose and he is acting like a churlish spoiled brat as his time runs out. He has become a laughingstock around the world. He will fan the flames of discontent in this country until he is ushered out of the White House. Here are a few suppositions about what will happen next:

Global Disorder Forecast“We focus on our goal, anchor on our plan, and neglect relevant base rates, exposing ourselves to the planning fallacy. We focus on what we want to do and can do, neglecting the plans and skills of others. Both in explaining the past and in predicting the future, we focus on the causal role of skill and neglect the role of luck. We are therefore prone to an illusion of control. We focus on what we know and neglect what we do not know, which makes us overly confident in our beliefs.” – Daniel Kahneman, Thinking, Fast and Slow

The level of global disorder hasn’t been this high since the 1930s. There are dozens of potential flash points capable of producing a cascading crisis which could blow up the world. The highly touted establishment mantra of globalization has produced an interconnected web of trillions in global debt, with one quadrillion dollars of indecipherable derivatives layered on top, all dependent upon the sustenance of insolvent mega-banks and bankrupt nation states. The only thing keeping this global Ponzi scheme alive is the unfounded belief in the brilliance of central bankers and corrupt politicians. The detonator for these interwoven financial weapons of mass destruction is rising global interest rates. The global financial system will be blown sky high by a sustained high volume sovereign bond selloff. The bond market is always the canary in the coal mine. Bonds will sell-off before stocks and real estate. Bond markets have begun to sell-off in a relatively orderly manner over the last three months, with long term Treasuries falling 13%. Bill Gross recently described the growing risk: “Global yields lowest in 500 years of recorded history. $10 trillion of neg. rate bonds. This is a supernova that will explode one day.” Will that day happen in 2017? No one knows for sure, but the probability is much higher than biased “experts” believe. The substantial concentration of cognitive biases clouding the judgement of the supposed wise men ruling the world has blinded them to the tragic consequences of what happens when the mother of all bubbles explodes like a supernova. The complacency of those in charge and the trusting masses will eventually be dealt a death blow when the high frequency trading computers run amuck and wipe out trillions of faux paper wealth in a matter of minutes. The powers that be will declare no one could have seen it coming, when in actuality anyone with a basic understanding of math could have seen it coming from a mile away. Most have chosen to remain blind to reality, because dealing with it is too painful to consider. “We can be blind to the obvious, and we are also blind to our blindness.” – Daniel Kahneman, Thinking, Fast and Slow Let’s get to a few prognostications regarding global events in 2017:

“Confidence is a feeling, which reflects the coherence of the information and the cognitive ease of processing it. It is wise to take admissions of uncertainty seriously, but declarations of high confidence mainly tell you that an individual has constructed a coherent story in his mind, not necessarily that the story is true.” – Daniel Kahneman, Thinking, Fast and Slow

I think it is pretty obvious my pessimism bias may have skewed my predictions for 2017. I’ve been pessimistic for the last eight years and the stock market is up 200%. I try to assess the world from a logical fact based frame of mind, but for the last eight years the world has been kept afloat by a combination of debt, delusions and denial. The Deep State propaganda machine has convinced the masses we are living in normal times, despite the fact the Fed printed $3.5 trillion out of thin air and handed it to the criminal Wall Street banks, interest rates have been kept at or near zero for eight years, revelations from Snowden that we truly live in a surveillance state far exceeding Orwell’s dystopian vision, the national debt doubling to $20 trillion, proof that all financial markets are rigged, undeclared wars being waged across the globe, and a reality TV star defeating a criminal to be president of the United States. Sounds pretty normal to me. My confidence level in my predictions is quite low. But, if one or two of the low probability events comes to fruition, the financial and/or human devastation will make 2008 look like a walk in the park. I don’t have an agenda in putting forth these predictions. I’m not selling anything or hawking stocks, bonds, or gold. I don’t tout myself as an expert like the over-confident, arrogant pricks on CNBC, CNN, MSNBC, or FOX. I’m just trying to understand what is happening in this crazy universe. We live in an uncertain world. I believe an unbiased appreciation of uncertainty is the cornerstone of rationality and reason. Not acknowledging the role of luck or chance in the course of human events is setting you up for a fall. Our countries, central banks, financial complex, military industrial complex, sick care complex, global mega-corporations, and government bureaucracies are ruled by men whose hubris, arrogance, greed and hunger for power has warped our world, producing unfathomable ill-gotten profits for the financial class who can abuse justice with impunity while the average man is bullied, pillaged and abused with disregard. These well dressed, highly educated, sophisticated, soulless barbarians hide their evil deeds behind the trappings of culture, but they are revealed by their grotesque schemes, murderous policies, and war profits soaked in blood. When they lose control of this global Ponzi scheme, I hope they pay the ultimate price for their traitorous deeds. Will it happen in 2017? I don’t know. But it will happen before this Fourth Turning climaxes.

End Times Headline News - January 2nd, 2016 Posted: 02 Jan 2017 05:30 PM PST Russias diplomats have left the U.S. Obama is kicking a bees nest, and we are having a shooting good time. News from around the world as we live in these Biblically described end times. Be ye ready. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Celente -- Washington Post Retracts Power Plant Russian Hack Story Posted: 02 Jan 2017 05:00 PM PST Celente: USA today put out an article saying that trump was going into office with lawsuits, once again show that the media is only strictly on the attack. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Stock Market, Gold and Silver Stocks Forecast 2017-2022 Posted: 02 Jan 2017 04:44 PM PST Two weeks ago, I was looking at a possible 2330 SPX by year’s end. By December 23rd, I told my subs to expect a rally into December 27, and then a bottom near December 29th, somewhere between SPX 2238-52. The SPX closed at 2238 on the December 30th, after tagging 2233/34. |

| The No.1 Silver Stock for 2017 Posted: 02 Jan 2017 04:36 PM PST Precious metals are an important component of every investor’s portfolio, and while gold often gets all the hype, another precious metal will be a much better bet in 2017: Silver. The market for silver continues to tighten as supply has failed to keep up with demand for much of the past decade. Silver is used in all facets of modern life, including electronics, medical devices, engines, batteries, solar panels, LED lighting, semiconductors, touch screens, dentistry, and nuclear reactors. The list goes on. |

| ALERT: Obama is Attempting to Stay in Office Past January 20th Posted: 02 Jan 2017 04:30 PM PST A civil war will keep him on seat and will get promoted to Chief of 70 nations. obama and his masters can have his new office in Prison as war criminal for his part in destroying sovereign nations and lives The Financial Armageddon Economic Collapse Blog tracks trends and forecasts... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| 10 Predictions for 2017: Gold, Stocks, Trump, Putin and War Posted: 02 Jan 2017 04:25 PM PST The quote is a paradox within itself, but sums up the outlook of anyone that has gleaned a grain of wisdom in their life. Yet, here I am offering predictions for the future, a thing one could know with even less certainty than present conditions. We study trends, monitor political events, consider “cui bono” in all events and give it the old college try. |

| Silver Prices and the Russian Connection Posted: 02 Jan 2017 04:21 PM PST Silver prices nearly reached $50.00 in April of 2011. They crashed to a low under $14 in December of 2015 and currently (December 2016) sit at about $16. Silver prices, in our increasingly unreal debt based fiat currency world, streak higher and subsequently crash to unbelievable lows. |

| WorldWide Prophecy Happening Now!! End Time Events 2017 Posted: 02 Jan 2017 02:30 PM PST This video proves that God is trying to get the worlds attention, but is anyone noticing? Watch this video, and educate yourselves on the times we live in. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 02 Jan 2017 01:00 PM PST This post The Fed's Troubled Road Ahead appeared first on Daily Reckoning. In recent decades, the Fed has engaged in a series of policy interventions and market manipulations that have paradoxically left it more powerful even as those interventions left a trail of crashes, collapses and calamities. Needless to say, for the past 20 years the Fed has gone beyond its dual mandate of price stability and full employment to engage in full-scale manipulation of markets and the macroeconomy. On Dec. 5, 1996, Alan Greenspan, then Chairman of the Federal Reserve, gave a speech in which he mused about whether valuations in the stock market reflected a degree of "irrational exuberance." The irony was that stocks measured by the Dow Jones index doubled in value over the next three years before crashing over 40% from their peak on Dec. 31, 1999. Greenspan's restraint in 1996 was the beginning of a Fed theory that said the Fed should not lean against bubbles by raising interest rates, but should let bubbles burst and then "clean up the mess." A less charitable interpretation is that the Fed encourages bubbles by misguided interest rate policy and doesn't care if everyday investors, like you, get crushed when the bubble bursts, as long as the banks are propped up. In short, the Fed has become an all-purpose backstop for failing banks and falling markets. This manipulation mindset is important to bear in mind both in assessing Fed policy going forward, and in understanding the instability that has built-up beneath the surface as the result of prior misguided manipulations. Despite the mental anguish and forecasting errors of most market analysts, the Fed policy process is quite easy to understand. Three rules will give you all of the guidance you need to accurately forecast Fed actions:

That's it. Of course, some explanation and interpretation of these rules is helpful. The Fed's desire to raise rates is unconnected to the usual business cycle considerations that go into Fed tightening or easing decisions. The Fed is making up for lost time. This means they are biased toward rate hikes even when the economy is not particularly robust. On the other hand, the Fed will pause in its tightening whenever it sees a danger of weak job creation, tighter financial conditions, deflation, or weak growth. Specifically, job creation of less than 100,000 new jobs per month would put the Fed on hold. Likewise, declining or negative readings on core price indices, especially the year-over-year PCE price deflator, will cause the Fed to pause until those readings reverse. A negative quarter or GDP growth would also cause the Fed to skip an otherwise planned rate hike. Finally, a full-blown stock market correction of 10% or more would represent a tightening of financial conditions that would make a rate hike redundant. Simply put, the Fed will raise rates in March, June, September and December of 2017, 2018, and 2019 unless growth, job creation, stock prices or inflation collapse. In that case, the Fed will pause as long as necessary until those conditions reverse. This simple formulation is the best guide to Fed policy in the years ahead based on current growth expectations. But, what if these periodic "pause factors" grow even worse than anticipated? What if weak job creation turns into job losses? What if low inflation turns into persistent deflation? What if weak growth turns into a technical recession? If the Fed needs to offer the economy more than a pause in its tightening path, it does have tools at its disposal to ease monetary conditions. It is possible that some or all of these tools may prove ineffective or not work as expected. Yet the Fed believes these tools are adequate despite the reservations of Fed critics. One of the tools the Fed has in their toolkit to stimulate the economy if recession or deflation gains the upper hand is helicopter money… The image of the Fed printing paper money, and dumping it from helicopters to consumers waiting below who scoop it up and start spending is a popular, but not very informative way to describe helicopter money. In reality, helicopter money is the coordination of fiscal policy and monetary policy in a way designed to provide stimulus to a weak economy and to fight deflation. Helicopter money starts with larger deficits caused by higher government spending. This spending is considered to have a multiplier effect. For each dollar of spending, perhaps $1.50 of additional GDP is created since the recipients of the government spending turn around and spend that same money on additional goods and services. The U.S. Treasury finances these larger deficits by borrowing the money in the government bond market. Normally this added borrowing might raise interest rates. The economic drag from higher rates could cancel out the stimulus of higher spending and render the entire program pointless. This is where the Fed steps in. The Fed can buy the additional debt from the Treasury with freshly printed money. The Fed also promises to hold these newly purchased Treasury bonds on its balance sheet until maturity. By printing money to neutralize the impact of more borrowing, the economy gets the benefit of higher spending, without the headwinds of higher interest rates. The result is mildly inflationary offsetting the feared deflation that would trigger helicopter money in the first place. It's a neat theory, but it's full of holes. The first problem is there may not be much of a multiplier at this stage of the U.S. expansion. The current expansion is 90 months old; quite long by historical standards. It has been a weak expansion, but an expansion nonetheless. The multiplier effect of government spending is strongest at the beginning of an expansion when the economy has more spare capacity in labor and capital. At this point, the multiplier could actually be less than one. For every dollar of government spending, the economy might only get $0.95 of added GDP; not the best use of borrowed money. The second problem with helicopter money is there is no assurance that citizens will actually spend the money the government is pushing into the economy. They are just as likely to pay down debt or save any additional income. This is the classic "liquidity trap." This propensity to save rather than spend is a behavioral issue not easily affected by monetary or fiscal policy. Finally, there is an invisible but real confidence boundary on the Fed's balance sheet. After printing $4 trillion in response to the last financial crisis, how much more can the Fed print without risking confidence in the dollar itself? Modern monetary theorists and neo-Keynesians say there is no limit on Fed printing, yet history says otherwise. Importantly, with so much U.S. government debt in foreign hands, a simple decision by foreign countries to become net sellers of U.S. Treasuries is enough to cause interest rates to rise thus slowing economic growth and increasing U.S. deficits at the same time. If such net selling accelerates, it could lead to a debt-deficit death spiral and a U.S. sovereign debt crisis of the type that have hit Greece and the Eurozone periphery in recent years. In short, helicopter money, which both Trump and the Fed may desire, could have far less potency and far greater unintended negative consequences than either may expect. Regards, Jim Rickards The post The Fed's Troubled Road Ahead appeared first on Daily Reckoning. |

| Silver Prices and the Russian Connection Posted: 02 Jan 2017 12:12 PM PST In accordance with the current blame-game promoted by the "fake news" diversions: We can blame Russia for HRC losing the election, releasing scandalous emails that the Democratic National Committee desperately wishes had remained private, the election of Trump, NSA spying on everyone, global terrorism, excess debt in the western world, the failure of hope and change, Federal Reserve monetary policy, unemployment, weak silver prices, strong stock markets, global bond market correction, the coming recession, derivatives disasters, slowing retail sales, Italian banking, cold weather, one brutally assassinated reindeer no longer able to pull Santa's sleigh and a tardy delivery of goodies from the Easter Bunny next year… |

| Here’s What Will Happen in 2017 Posted: 02 Jan 2017 12:00 PM PST This post Here's What Will Happen in 2017 appeared first on Daily Reckoning. The economic year that was will never be again. The new year ahead will be like none we have ever seen before. Indeed, this time last year, I forecast that panic would hit Wall Street in 2016. And immediately after the new year, the Dow Jones suffered one of its worst openings in its history. By mid-January, some $6 trillion of share value had been wiped away. Then there was Brexit in June. Despite polls showing UK citizens would support staying in the European Union, they voted to leave. That triggered a sharp, but temporary, market meltdown. Central banks promised to do all they could to stop a market beat down. Within days, led by the US Federal Reserve again reneging on its December 2015 promise to raise interest rates four times in 2016, equity markets bounced back. The supply of cheap money continued to fuel corporate stock buybacks and mergers and acquisitions. Then came Election Day. Global equity-market forecasts said Hillary Clinton would be bullish for equities and bearish for gold. A Donald Trump victory would be bearish for equities and bullish for gold. But the market forecasts and presidential polls were wrong. Following the Trump victory, all three US indexes hit record highs. Gold prices plunged 11 percent, falling to February lows. In addition to stocks posting nearly a month-long win streak, the dollar index hit 14-year highs. The markets rallied. Retail turned favorable. Wage data perked up. The CME Group’s FedWatch raised market expectations for a December interest-rate increase to 95 percent. And it happened. So, What Happens in 2017?Now here's what happens next… Tax breaks and deregulation may drive corporate profits. But continued job and wage growth will depend on the true amount of Trump-backed stimulus and overseas tax recovery. In addition, should the Trump administration renegotiate trade deals and even slightly increase manufacturing jobs in the United States, psychologically and financially it will boost the nation’s spirits and growth potential. As US interest rates rise and the dollar gets stronger, emerging-market currencies will weaken. That will dramatically increase their debt-repayment burden and increase financial market instability. In developed nations, cheap money — not corporate earnings — boosted equity markets with record-breaking merger-and-acquisition and stock-buyback activity. As interest rates rise, and the cost of borrowing increases, true price discovery and market fundamentals will drive the markets. You could call that a return to market sanity, in a way. Plus, I predict a stronger dollar will continue to push down gold prices. I forecast gold prices will rebound when global financial market volatility and increasing geopolitical unrest escalate. Which as we know could be at any moment. 2017 promises to be full of surprises, but with this basic blueprint, you'll be ready for anything. Until next time, Gerald Celente The post Here's What Will Happen in 2017 appeared first on Daily Reckoning. |

| Posted: 02 Jan 2017 11:26 AM PST I like this gold chart expressed in Canadian dollars — the only currency gold is still kind of depressed in is the US dollar! CIGA Gijsbert The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Posted: 02 Jan 2017 11:18 AM PST Jim Sinclair's Commentary If you ask Clif about the gold price, he might make me look too conservative. Happy New Year Jim timetalks….December 31, 2016 … Over $600 per ounce Silver…$20,000 DOW This work and the publications known as the ALTA reports began in 1997 with the first data gathering operations. From that time, until... Read more » The post Time Talks – Clif High appeared first on Jim Sinclair's Mineset. |

| Posted: 02 Jan 2017 11:07 AM PST 2017 Predictions on Trump, Gold, Silver, Housing, Stocks, Bonds & Antarctica-Clif HighJanuary 1, 2017 By Greg Hunter's USAWatchdog.com (Early Sunday Release) Internet data mining expert Clif High says forget about the rumors and predictions of Donald Trump being blocked from taking office. High says Trump will be sworn in as the 45th President and explains,... Read more » The post 2017 Predictions on Trump, Gold, Silver, Housing, Stocks, Bonds & Antarctica-Clif High–USAWatchdog.com appeared first on Jim Sinclair's Mineset. |

| Alert Trump To Destroy America Martial Law WW3 Latest Update USA Dollar Collapse Video Posted: 02 Jan 2017 09:14 AM PST This video is about Dangerous" President Obama, Must Be Impeached) Obama has recently discussed his new proposal of "prolonged detention," and that isn't based off of a crime you have already committed. In fact, Obama explains that he intends to incarcerate, until he sees fit, anyone that... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Nomi Prins: Central Banks and the Artisanal Money Era Posted: 02 Jan 2017 08:47 AM PST This post Nomi Prins: Central Banks and the Artisanal Money Era appeared first on Daily Reckoning. Financial journalist and bestselling author, Nomi Prins disparages on what the future of the global financial system will look like in what she has defined as the Artisanal Money Era. In attendance at the Library at the Royal College of Surgeons in London, together with affiliates at Agora Financial's UK office, she unleashed in depth analysis on central bank policy and what it means for the U.S, Europe and the global financial environment. While in discussion at the beginning of December she started out by noting, "As long as these the central bank leaders are still in their positions the same or similar policies will continue. They really don’t know what else to do. To abandon them now, particularly when they have not been working, would be an admission. There will also still be an evolution of politicians that will not want to change from the status quo." The author is a former Wall Street insider who worked in senior levels at some of the largest and most powerful banks in the world including Goldman Sachs, Bear Sterns and Lehman Brothers. She has authored investigative works including her most recent book All the Presidents' Bankers. The economist and author is currently working on her latest book, Artisans of Money, estimated to be out later this year. With former members of UK parliament in attendance in addition to a wide number of financial industry guests she noted, "These alliances have not just political implications, but trade and economic ones. The private banks, in particular the U.S private banks and to a lesser but still important extent the EU banks, were the catalyst for the global financial crisis. Many of them are now being subsidized by the central banks and the new world we are in right now." Prins then went on to pointedly remark, "Why is this all happening? We had a financial crisis. It was scary for a lot of reasons. It was started in the United States. The biggest six banks in the United States have not really suffered in the wake of this financial crisis. The biggest six banks were at the core of the financial crisis are now 86% bigger in terms of assets, they are 43% bigger in terms of deposits. They have more tract in the derivatives market. They have more tract terms of the trading assets market. They are simply more powerful than they were before. They are continuing to be batted with settlements for crimes ranging from mortgage related crimes (the crux of the crisis), to libor scandals, to rigging foreign exchange to scamming customers. These crimes manifest in several ways, as we saw when Wells Fargo, one of the big six U.S banks, charged fees to its customers that they did not even have." Speaking on the artisanal money generation Prins’ said, "These banks have only been subsidized by, first our federal reserve and then internationally the cooperation of central banks – in a way that has never existed before. In the wake of our crisis, when the Federal Reserve brought money down to zero, they created Artisanal Money. It is not actually printing money. It does not require physical activity. It is the idea of creating money in all sorts of different ways to make its availability easy, its cost zero (or negative), of buying bonds (to continue to support government debt). They have made a policy supporting government debt by moving it to the central banks – in terms of purchasing. These central banks have created a whole dislocation of the nature of pricing in every single asset class." Through her analysis on this artisanal money policy Nomi Prins then noted that, "They have created an additional supply of money to go and find the most speculative places – whether that is the stock market, or whether that is junk bonds that now trade at the levels of high grade bonds. These practices create risk around the world. When the Federal Reserve decided to do this, which was a bipartisan in action, they decided to fund instead of fix what we saw collapse in the financial crisis. What was then a crisis management solution has continued for 8 years and has now gone global." "All of the manifestations of behaviors by central banks, private banks and politicians have been reactionary to the 2008 crisis. That has related to things that have occurred now. This includes the vote for Trump, BREXIT, the Italian vote. We have seen a shift in financial and political power from the west to the more of the east with an evolution of China as a superpower. This will only continue in the future." To see the full interview recorded by Agora Financial UK, click here. Regards, Craig Wilson, @craig_wilson7 The post Nomi Prins: Central Banks and the Artisanal Money Era appeared first on Daily Reckoning. |

| This is Why January 1st 2017 is a HUGE Day for China and the Markets! Posted: 02 Jan 2017 07:31 AM PST Protect yourself from the mess that's coming with gold, silver and bitcoin. Get free from Central Powers and embrace sound, limited decentralized currency. Bitcoin continues to go up and grow organically. It has outperformed everything since its inception in 2008 (then at $1 and now at $970 and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold: Getting There A Little At A Time Posted: 02 Jan 2017 06:55 AM PST One of life’s hardest-to-learn but most necessary lessons is that things usually take a lot longer to work out than you’d like them to. That’s where the sayings “Being too early is the same as being wrong” and “The market can stay irrational longer than you can stay solvent” come from. |

| The Consequences of Helicopter Money Posted: 02 Jan 2017 06:39 AM PST This post The Consequences of Helicopter Money appeared first on Daily Reckoning. The Federal Open Market Committee, FOMC, of the Federal Reserve voted on Dec. 14 to raise interest rates 0.25%, as we expected. The vote was unanimous including doves such as Fed governor Lael Brainard. While the rate hike was fully expected by markets, what was not expected was that the Fed struck a hawkish stance on future rate increases. Prior to the December FOMC meeting, the forecast was for two rate hikes before the end of 2017. On Dec. 14, the Fed signaled its intention to increase interest rates three more times in 2017. The Fed based this more hawkish view on the fact that labor market conditions continue to improve, and slow but steady progress is being made in meeting the Fed's inflation targets. As long as labor conditions are satisfactory, and inflation is not too high, the Fed will raise rates at a tempo of 1% per year, more or less, until a "neutral" fed funds rate of about 3.25% is achieved. The Fed is engaged in this tightening cycle not because the economy is running "hot" (it's not), but because they are desperate to raise rates enough to cut them again in a future recession. The Fed is behind the curve in this process. The Fed should have raised rates to about 3.25% over the course of 2009 to 2013. But, the Fed missed this entire interest rate cycle, instead engaging in fruitless experiments in quantitative easing or QE. Unfortunately, the Fed is bent on a rate hike path at the worst possible time. Recent data on retail sales and industrial production were both weak. The super-strong dollar is deflationary at a time when the Fed is still failing to meet its inflation goals. The Fed may end up causing the recession it is trying to prevent. This policy conundrum is the result of eight years of policy manipulation. In recent decades, the Fed has engaged in a series of policy interventions and market manipulations that have paradoxically left it more powerful even as those interventions left a trail of crashes, collapses and calamities. This contradiction between Fed omnipotence and Fed incompetence is coming to a head. The new Trump administration will confront the Fed and insist on accountability and rule-based decision making. The confrontation will present enormous risks and opportunities to investors. The Consequences of Helicopter MoneyThe image of the Fed printing paper money, and dumping it from helicopters to consumers waiting below who scoop it up and start spending is a popular, but not very informative way to describe helicopter money. In reality, helicopter money is the coordination of fiscal policy and monetary policy in a way designed to provide stimulus to a weak economy and to fight deflation. Helicopter money starts with larger deficits caused by higher government spending. This spending is considered to have a multiplier effect. For each dollar of spending, perhaps $1.50 of additional GDP is created since the recipients of the government spending turn around and spend that same money on additional goods and services. The U.S. Treasury finances these larger deficits by borrowing the money in the government bond market. Normally this added borrowing might raise interest rates. The economic drag from higher rates could cancel out the stimulus of higher spending and render the entire program pointless. This is where the Fed steps in. The Fed can buy the additional debt from the Treasury with freshly printed money. The Fed also promises to hold these newly purchased Treasury bonds on its balance sheet until maturity. By printing money to neutralize the impact of more borrowing, the economy gets the benefit of higher spending, without the headwinds of higher interest rates. The result is mildly inflationary offsetting the feared deflation that would trigger helicopter money in the first place. It's a neat theory, but it's full of holes. The first problem is there may not be much of a multiplier at this stage of the U.S. expansion. The current expansion is 90 months old; quite long by historical standards. It has been a weak expansion, but an expansion nonetheless. The multiplier effect of government spending is strongest at the beginning of an expansion when the economy has more spare capacity in labor and capital. At this point, the multiplier could actually be less than one. For every dollar of government spending, the economy might only get $0.95 of added GDP; not the best use of borrowed money. The second problem with helicopter money is there is no assurance that citizens will actually spend the money the government is pushing into the economy. They are just as likely to pay down debt or save any additional income. This is the classic "liquidity trap." This propensity to save rather than spend is a behavioral issue not easily affected by monetary or fiscal policy. Finally, there is an invisible but real confidence boundary on the Fed's balance sheet. After printing $4 trillion in response to the last financial crisis, how much more can the Fed print without risking confidence in the dollar itself? Modern monetary theorists and neo-Keynesians say there is no limit on Fed printing, yet history says otherwise. Importantly, with so much U.S. government debt in foreign hands, a simple decision by foreign countries to become net sellers of U.S. Treasuries is enough to cause interest rates to rise thus slowing economic growth and increasing U.S. deficits at the same time. If such net selling accelerates, it could lead to a debt-deficit death spiral and a U.S. sovereign debt crisis of the type that have hit Greece and the Eurozone periphery in recent years. In short, helicopter money, which both Trump and the Fed may desire, could have far less potency and far greater unintended negative consequences than either may expect. Regards, Jim Rickards The post The Consequences of Helicopter Money appeared first on Daily Reckoning. |

| Breaking News And Best Of The Web Posted: 02 Jan 2017 01:37 AM PST Stocks, gold, dollar fall in last trading day of 2016. US home sales decline, London real estate boom fading. Italian bank bail-out not going well. China money markets in turmoil. US retaliates against alleged Russian hacking. Fake news debate rages. Best Of The Web As we enter 2017, keep the big picture in mind […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The Stock Market Has Topped. Next Up the US Dollar Driven Bloodbath Posted: 01 Jan 2017 06:31 AM PST The momentum driven post election rally has ended. Next up is the US Dollar driven collapse in the markets. Copper called this weeks ago as we noted before. No one listed. It’s now down nearly 10% from its peak and clinging to support for dear life. |

| Is China About to Demand the US Dollar Lose Reserve Currency Status? Posted: 01 Jan 2017 06:27 AM PST The biggest issue in the financial system… the issue that CNBC is completely avoiding… and 99% of professionals are ignoring is the US DOLLAR. The US Dollar has ripped to 103. |

| Gold And Silver 2017 – The Golden Lye Posted: 01 Jan 2017 06:08 AM PST Lye – [noun] a strongly alkaline solution, esp. of potassium hydroxide, used for washing or cleansing. There has indeed been an ongoing cleansing in the precious metals market since the spike highs five years ago. Remember, there have been calls for a massive turnaround in prices for both gold and silver since 2013…2014…again, even more so in 2015. 2016 has just freshly passed, and both metals continue to flirt with their lows from a year ago. A few years ago, all the rage was for the man and woman on the street to be buying gold and silver coins, long lines, especially in China, forming for blocks to make purchases for the inevitable rally “sure” to soon follow. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment