Gold World News Flash |

- Peter Schiff : America Will Lose Any Trade War

- Dow 20K … US Debt $20 Trillion … Trump and $15,000 Gold

- When Will President Donald Trump Take Out George Soros?

- How To Defeat The Globalist System

- Retail Sector - Doomed as Doomed Can Be

- The Rothschilds EXPOSED

- War Gaming - Part 2: Cyberwarfare & Disinformation

- Gold Price Closed at $1188.40 Down $1.40 or -0.1

- US Auto Industry In Crisis Amid "Inventory Bubble"

- The Dollar Will Die With a Whimper, Not a Bang

- An Omen of Global Collapse

- Have You Ever Seen a Drill Like This? Large Amounts of Military Traffic Over US

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week

- COT Gold, Silver and US Dollar Index Report - January 27, 2017

- Craig Hemke: Upside Surprise For Gold And Silver In 2017

- WATCH: Trump Adviser Reveals His Brilliant Plan to Make Mexico Pay for the Wall

- Pound, Dollar, Euro And Yen Will Be Worthless Within Five Years

- Going Long The Euro Could Be The Trade Of 2017

- Silver Stocks’ New Upleg

- Silver Stocks’ New Upleg

- Harry Dent : Trump Can't Stop Global Collapse

- The Fed and Gold in 2017

- Dow 20K, US Debt $20 Trillion, Trump and Gold

- The Fed and Gold in 2017

- Breaking News And Best Of The Web

- The Silver Lining of the 'Violent, Stunning, Historic Collapse of Palladium' and How to Profit from It

- Gold Price Bounces on Weak US GDP Data

- Precious Metals v. Mining Stocks: What You Need to Know

| Peter Schiff : America Will Lose Any Trade War Posted: 27 Jan 2017 10:30 PM PST Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar in particular. Peter was one of the first from within the professional investment field to call... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dow 20K … US Debt $20 Trillion … Trump and $15,000 Gold Posted: 27 Jan 2017 10:00 PM PST gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| When Will President Donald Trump Take Out George Soros? Posted: 27 Jan 2017 07:30 PM PST George Soros has been an enemy of freedom across the globe, this Nazi collaborator has caused the deaths of thousands through his destabilization campaigns. When will Donald Trump take him down? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How To Defeat The Globalist System Posted: 27 Jan 2017 07:00 PM PST Submitted by Brandon Smith via Alt-Market.com, In my last two articles, 'How Globalists Predict Your Behavior' and 'How To Predict The Behavior Of Globalists', I explained the base fundamentals behind a concept with which most people are unfamiliar. They are so unfamiliar with it, in fact, that I didn’t bother to name it. In this article I hope to explain it, but I highly recommend people read the previous articles in this series before moving forward. What I outlined, essentially, was a beginners course on 4th Generation Warfare. This methodology is difficult to summarize, but here I will list what I believe are some of its core tenets. Fourth Gen warfare is based on a primary lesson within Sun Tzu’s The Art Of War. Sun Tzu argues in the classical military tome that the greatest strategists win wars by NOT fighting, or at least, by not fighting their opponents openly and directly. That is to say, they win by convincing their opponents that fighting back is futile and that surrender is preferable, or, they convince their opponents to destroy themselves through internal conflict and psychological sabotage. Sun Tzu felt this method was far superior to engaging in direct combat in a real world battle space. While this might sound bizarre to some, it is becoming more and more apparent (in my view) that 4th Gen warfare is now the go-to weapon for globalists. Defeating the system established by the globalists, a system prevalent for decades, is an impossible task unless 4th Gen warfare is understood. A classic example of a tried and true form of 4th Gen attack is to initiate a civil war within a target population, and in most cases, control the leadership on both sides of that conflict. Another method is to conjure an enemy, an outside threat which may be legitimate or entirely fabricated, and use that enemy to push a target population to unify under a particular banner that benefits the globalist cabal in the long run. Fourth Gen requires patience above all else. In fact, I would say 4th Gen is the weaponization of patience. A 4th Gen attack is not carried out over days, or months, but years. To find a comparable experience is difficult, but I would suggest people who have the tenacity set out to learn how military snipers operate. Can you train for years mastering long distance marksmanship, crawl for hours from an insertion point to an observation point, then sit in a hole in the ground (if you are lucky enough to have a hole in the ground) for days waiting to take just one shot, perhaps the only important shot you will ever take in combat, at a vital target, and do it with certainty that you will not miss? The amount of planning, intense precision and foresight that goes into a sniper operation is much like the kind of effort and calm needed to complete a 4th Gen psy-ops mission. This kind of warfare is dominated by the “think tanks”, and anyone hoping to counter such tactics look into the history of one particular think tank — RAND Corporation, and their premier psy-ops tool — rational choice theory. Whenever I hear someone argue that a conspiracy of globalists could not exist because “such plans would be too elaborate and require too much power to carry out in real life,” I have to laugh and bring up RAND, which has had almost limitless funding from globalist foundations like the Ford Foundation and was built specifically to develop not only next gen weapons, but 4th Gen psychological warfare schemes. RAND's influence is everywhere, from politics, to the social sciences, to military applications and even in Hollywood. After studying their efforts for many years now I can say that these people are indeed smart. Some of them may not be aware of the greater consequences as they war game ideas for dominating the public, and some of them are undoubtedly morally bankrupt, but they are still smart, and should not be underestimated. Another reference point I would suggest to researchers would be a document called From Psyop To Mindwar: The Psychology Of Victory written by Michael Aquino and Paul Vallely for the Pentagon. In it, they make it clear that the methods of 4th Generation warfare are not limited to foreign enemies. In fact, they are recommended for use by governments against their own populations. Again, the thrust of the methodology was to manipulate a target population into subduing itself, so that force was not necessary. Aquino and Vallely note that this would be a better outcome for everyone involved, because it would help to avoid the bloodshed of insurgency and counterinsurgency. I am skeptical that these people care at all about bloodshed or collateral damage, but I do think they would very much like the process of totalitarian centralization to be less tedious. The elites hope to streamline tyranny by convincing the public that globalization must be embraced for “the greater good of the greater number.” But, in order to accomplish this vast change in society and the collective unconscious, they need crisis and calamity. They see themselves as creators, but for them, creation is about destruction. In other words, the old world must be destroyed so that they can use the leftover building blocks to make something new. If we do not embrace their solution of global centralization rising from the ashes, they believe they have a response for that problem too. Read my article 'When Elites Wage War On America, This Is How They Will Do It'; more specifically, the section on Max Boot from the Council On Foreign Relations. Boot is the CFR’s resident “insurgency expert,” and while I question his ability to apply academic models to real word conflicts as if theory is akin to practice in war, it is enough to know the mindset of these elitists. Boot’s work focuses on a particular model of quarantining insurgencies from the non-combative population, based on the methods the British used against communist guerrillas in Malaysia. In fact, Max seems to revel in the British efforts to catalog Malaysian citizens and relocate them into large cities that amounted to concentration camps. This made recruitment difficult for the insurgents and stopped them from hiding among civilian centers. It also focused food production into highly managed areas and gave the British leverage over the population. With this separation, it was much easier for the authorities to “educate” the locals on the threats of the insurgency and gain their support. So, the question is, if this array of tactics is going to be aimed at liberty proponents and free peoples within the U.S. in particular, with an increasing potential for things to become far worse in the near term, how do we fight back? Firstly, I need to point out a disturbing trend within the liberty movement, which is the propensity for activists to show far more interest talking about the problem than talking about solutions. Over the years I have noticed a consistent lower readership on articles having to do with specific solutions and strategies; not just my own articles, but many other analysts as well. It is much more popular to write on the reality of looming crisis rather than to write about what individuals can do to blunt the edge of the event. I would not be surprised if this article receives only half of the readership my other articles receive. The first step in fighting back in a 4th Gen war is to acknowledge that there is no easy way out. There is no way to change the corrupt system from within. There is no way to use politics and government to our advantage. Despite all the hopes activists have, Trump is not going to save you, or America. The Republican controlled House and Senate is not going to save us. There is nothing they could do even if they wanted to. I will write in more detail on this in my next article, but actions such as shutting down the Fed alone are half measures that will actually exacerbate a crisis in the short term, rather than defuse one. A debt jubilee (another commonly mentioned false solution) is meaningless when the value of your world reserve currency on the global market is still destroyed in the process and your treasury bonds are no longer desirable. Pushing corporations to create a few thousand manufacturing jobs here and there is a drop in the bucket when considering the 95 million people no longer counted in the U.S. labor force on top of the millions still officially considered unemployed. There is no stopping the ongoing economic collapse from running its course. We will be required to take our medicine eventually, and this will happen sooner rather than later. Here is what can be done, though, to mitigate the damage and fight back against the establishment… Separation From The System People are always looking for grand and cinematic solutions to fighting the globalists, but the real solutions are far less romantic. Defeating the “new world order” requires individuals to take smaller actions in their day-to-day lives. Becoming more self sufficient, the ability to provide one’s own necessities, the ability to defend one’s self and family, the move away from grid dependence, homeschooling your children, a healthy skepticism of web tied technologies and the “internet of things,” etc. This does not mean you have to go build a cabin in the woods and start typing up a manifesto, but it does mean that you will have to sacrifice certain modern comforts and amenities and manage your life in a way that might feel strange at first. To put it simply, it means you will have to learn to start doing most things for yourself and perhaps learn to live with less “things” and less mainstream stimulation. I know many people that have undertaken this effort while still living what you might call “normal lives.” The bottom line is, if you are dependent on the system, you will never be able to fight the system. Separation From Invasive Technologies Remove active surveillance from your life. Stop carrying a cell phone around with you everywhere you go, or at least pull the battery until you need it. Cover or remove computer cameras. Deactivate microphones when not in use. Refuse to purchase appliances with built-in web connectivity. Refuse to participate in smart grid programs. Remove GPS modules from your vehicles. Stop posting photos constantly to Facebook and sharing your entire life on social media. Give the enemy less information to work with. Build Real Community Stop trying to build hollow friendships with people on the other side of the country through a cold medium like the internet and start building relationships with the people that live right in your own neighborhood or town. The one thing the elites fear more than anything else is people organizing groups that are outside of their influence. The more community groups there are, big and small, the more effort, money and resources are required to keep tabs on them all. With localized groups populated by members that know each other and have lived in one place for a long time, infiltration is a strenuous prospect and co-option is nearly impossible. Establish Alternative Communications Make sure your group or community has at least one ham radio expert. Resistance to tyranny requires independent communications. Without this ability you will have no access to information in the event of a crisis and thus, you will have nothing. Ham radio can be used to spread information across the country and can even reach out to other parts of the world. In the event of a breakdown in civility, ham can be used to send digital mail and files, and these files can be encrypted. The founding fathers had the midnight ride, we have ham radio. Refuse To Participate In Resource Management In the event of a greater collapse, resource management will be the name of the game. For the elites to gain a stranglehold on a population, they need to isolate the insurgency (freedom loving people) from the regular (subdued) citizenry, and then they need to confiscate as many resources as possible to supply “loyalists” while starving out undesirables. I believe a successful rebellion would require rural communities to maintain complete control over their resources and refuse to allow government to dictate how these resources are dispersed. Ultimately, in order to break an establishment stranglehold over the population through Max Boot’s method of “friendly” concentration camps, the tactic would have to be reversed. Resources may need to be cut off to these places entirely. This would remove the leverage governments would have in terms of necessities, leaving no reason for anyone to want to stay in these sorts of green zones again. Vigilante Justice I am not condoning OR criticizing this kind of development, but I am pointing out that it is inevitable. If top globalists continue to engage in the use of economics as a nuclear option against the public, along with their many other crimes, then individuals with the right skill-sets will likely seek them out with the intention of ventilating them. I think the danger of lone-wolf vigilantes acting without group contact and without warning is terrifying to the globalists. They are used to being able to co-opt enemy groups or exploit informants to infiltrate and relay information. With a lone wolf, there is no trail to follow and individuals are decidedly harder to predict in their behavior and plans than groups are. I would not be surprised to see prominent globalists living in the U.S. suddenly leave the country en masse just as social unrest becomes heightened. And, I would not be surprised to see some globalists killed anyway by fed up citizens who suddenly snap and take matters into their own hands. Our Window Of Time Is Short Keep in mind that the millennial generation is about 10 years away from becoming the dominant cultural force in this country, and those precious snowflakes are like another species. The majority of them long for collectivism, and they work diligently to stifle dissent in colleges and public schools. The great danger is that in ten to fifteen years many of the people within conservative movements might be too old to effectively fight back, and while we deal with economic disaster it will be millennials steeped in cultural Marxism that are elevated as part of the globalist solution. Whatever we end up doing, I believe we have about 10 years before hitting the point of no return (with ample crisis and struggle from now until then). After this, we will either have the globalists in prison or in the ground, or, we will have a massive economic reset and a new world order. The choice is up to us, even though some people don’t want to accept it. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

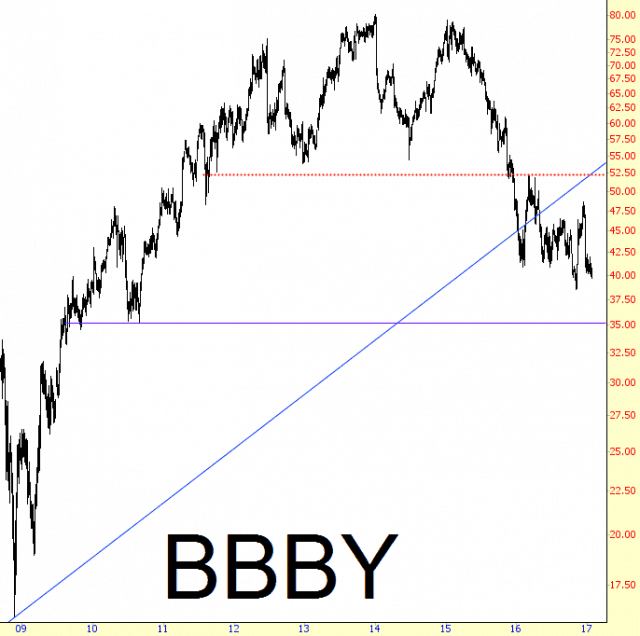

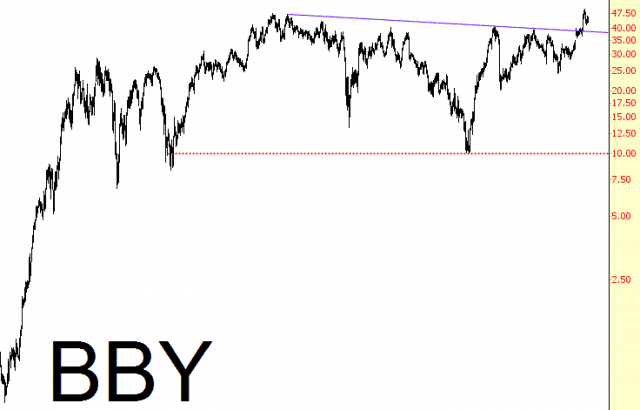

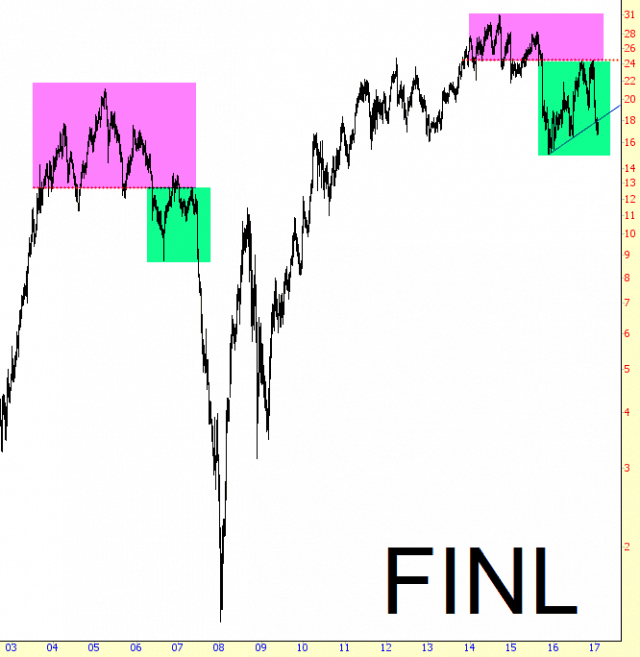

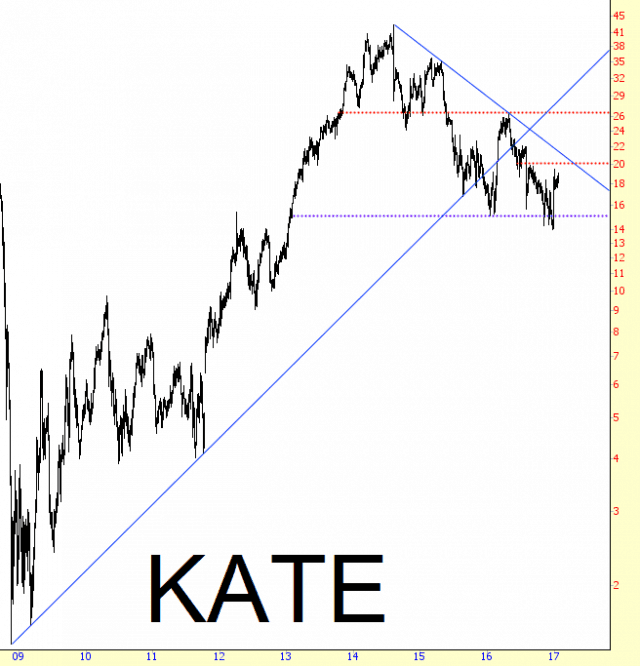

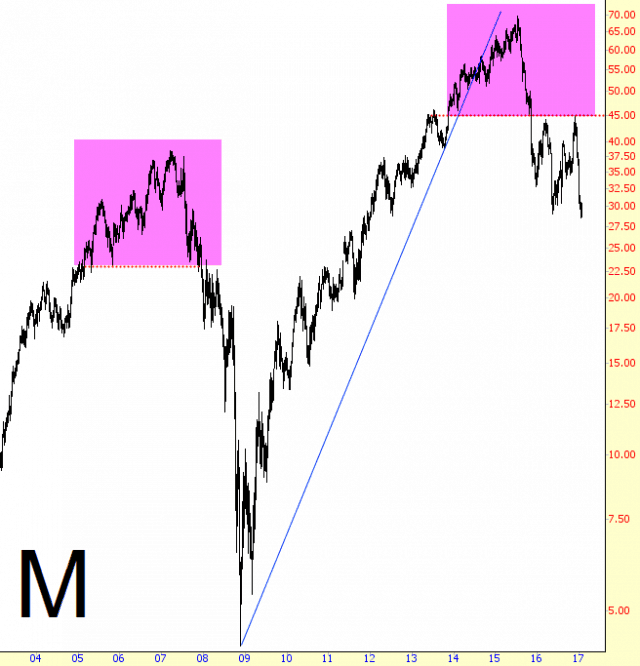

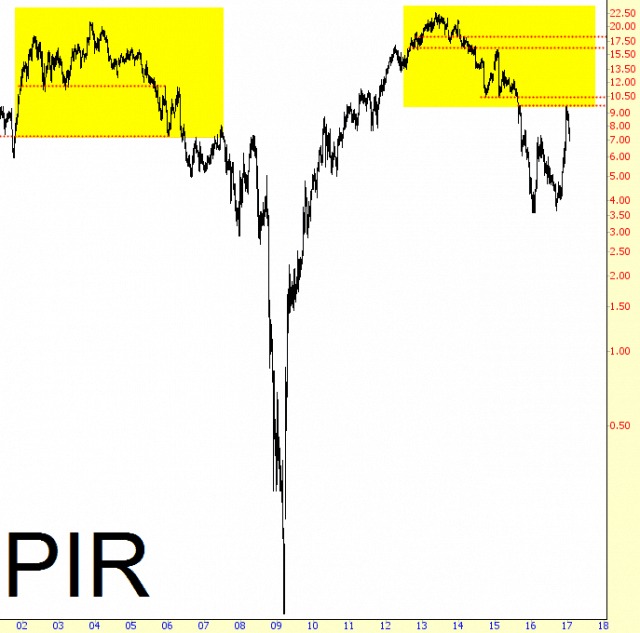

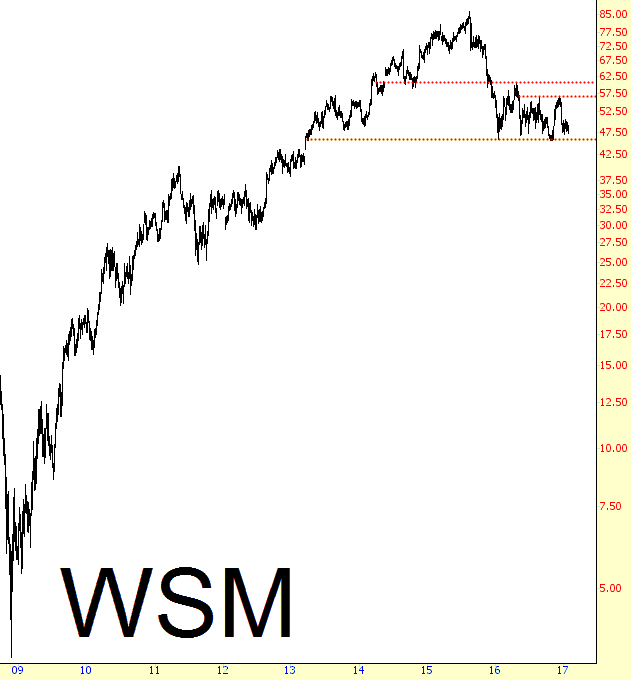

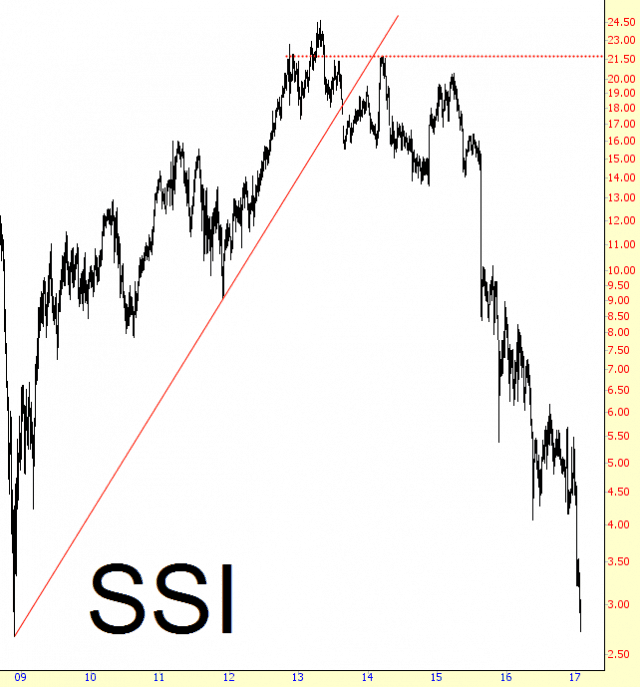

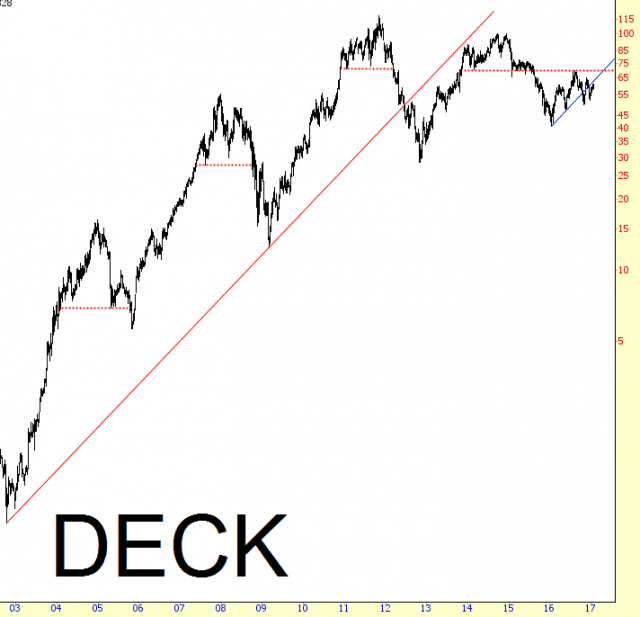

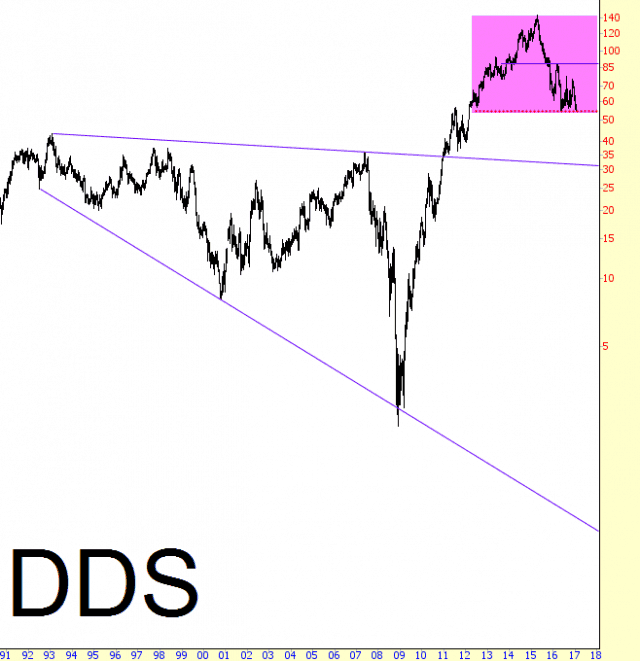

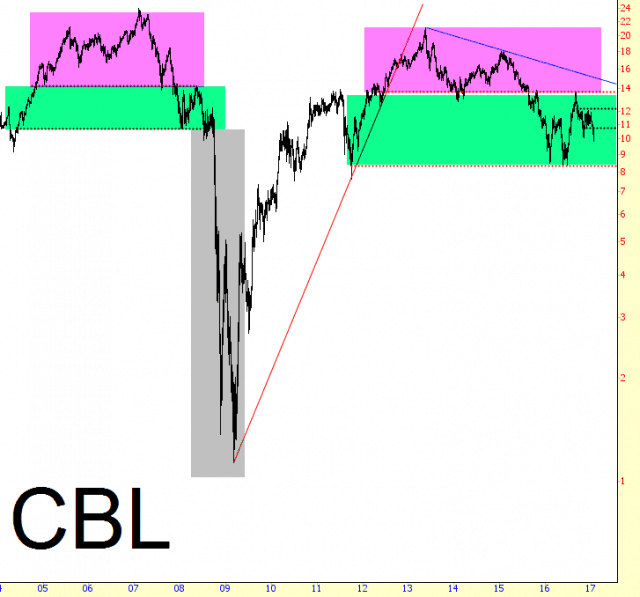

| Retail Sector - Doomed as Doomed Can Be Posted: 27 Jan 2017 06:53 PM PST From the Slope of Hope: Being an equity bear has been brutal for, oh, nearly eight years now. With the S&P up about 250% since bottoming in March 2009, equities have been, on the whole, raging higher, with some sectors in particular benefiting tremendously from the Trumpgasm. One area, though, seems to be recognizing a bitterly cold chill of reality, and that is retail. Not everything retail is weak, of course, Amazon has had an astonishing run (and we'll see if it holds together when they report next week), and some stocks such as Autozone (AZO) and O'Reilly Auto Parts (ORLY) have cranked out multi-hundred percent gains for years now. But many retail companies, particularly those having to do with clothing, have been getting whacked. Take, for instance, Abercrombie & Fitch, which I've picked on endlessly: it is actually lower than it was at the greatest depths of the financial crisis. For how many stocks could you make that statement? Bed Bath & Beyond has a quite well-formed head and shoulders pattern (whose neckline is shown with a red horizontal below) that suggests much lower prices to come. Be careful not to confuse this with a very similar symbol, however - Best Buy - which, competition from Amazon be damned, is defying gravity and broke above resistance this year. Let's get back to the bearish charts, though: Shoe retailer Finish Line has been trending lower for months, and the analog is going beautifully: Another storefront at your local luxury mall is Kate Spade. It found strength off and on recently due to buyout chatter (they are desperately trying to sell themselves), but the pattern is bearish, and just so you are clear, just because a company is for sale doesn't mean there will be any buyers. Just ask Twitter. Speaking of analogs, take a look at Macy's. Even though the stock has lost over half its value, if history is any guide, there are doomed as doomed can be (this is more impressive if you say it in an Ed Grimley voice). Hold on there........it's another analog......and from another company I pick on a lot: Pier One, purveyor of scented candles, throw pillows, and monkeys carved from coconuts. This is another fine example of how just because a stock has already suffered a momentous collapse (about 65% so far) doesn't mean it isn't just going to keep collapsing. Firm support exists at $0.00. Overpriced seller of kitchenware, Williams Sonoma, is setting itself up for a big fall. It has found support for years in the mid 40s, but don't count on that surviving the year intact. I will say, however, that some retailers are so far gone, the opportunity has already passed by. Stage Stores is a good example of a ship that's already sailed. On the other hand, Deckers Outdoor (makers of the UGG shoe line, among others) has plenty of juice left to squeeze. Dillard's is another stock which has lost about 60% of its value already but doesn't look anywhere close to being done falling. What got me thinking about all this was my best-performing short position, CBL Associates. I wasn't sure what they did, but it turns out they are a big player in retail real estate - - hence their stock is also in a terrific analog and appears to be screwed and tattooed. If anyone is looking for rumblings to signal the kind of break in 2006/2007 that preceded the financial crisis, look no further than the charts above. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jan 2017 05:30 PM PST The Rothschilds exposed. To deter censorship, all viewers are encouraged by the creator to mirror this video on bittorrent and anywhere else desired. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| War Gaming - Part 2: Cyberwarfare & Disinformation Posted: 27 Jan 2017 05:15 PM PST Submitted by Bill O'Grady via Confluence Investment Management, Yesterday, we began this two-part report by examining America’s geographic situation and how it is conducive to superpower status. This condition is problematic for foreign powers because it can be almost impossible to significantly damage America’s industrial base in a conventional war with the U.S. In addition, it would be very difficult to launch a conventional attack against the U.S. (a) with any element of surprise, and (b) without significant logistical challenges. The premise of this report is a “thought experiment” of sorts that examines the unconventional options foreign nations have to attack the U.S. Although these may not lead to regime change in America, such attacks may distract U.S. policymakers enough that foreign powers could engage in regional hegemonic actions that would otherwise be opposed by the U.S. In Part I of this report, we discussed two potential tactics to attack the U.S., a nuclear strike and a terrorist attack. Today, we will examine cyberwarfare and disinformation. We will conclude with market effects. #3: CyberwarfareCyberwarfare is a broad tactical category, ranging from the use of computer technology in conventional warfare to hacking enemies’ industrial, financial, media, utility and social networks to gain information, monitor behavior, spread disinformation and disrupt operations of these networks. Both state and non-state actors are active in cyber activities. There is a significant criminal element as well. The best known cyberattack was allegedly jointly created by Israel and the U.S. Dubbed “Stuxnet,” it was a computer virus which took control of systems that monitored Iran’s nuclear centrifuges. The virus returned information to its handlers and eventually was able to adversely affect the operation of the machinery itself, causing some of the centrifuges to spin out of control. Although Iran’s nuclear facilities were not directly connected to the internet, the bug was apparently introduced through a flash drive. This means that either a spy plugged a drive into Iran’s system or an innocent Iranian did it by mistake. Initially, as reports from Iran began emerging about problems in its nuclear facilities, it was generally assumed that the Persians simply didn’t know what they were doing or had purchased faulty equipment. Eventually, Stuxnet ruined about 20% of Iran’s nuclear centrifuges. The virus turned out to be rather pervasive, spreading to Indonesia, India, Azerbaijan and Pakistan, and, interestingly enough, also infecting about 1.6% of American computers. There are numerous other examples of cyberwarfare. The U.S. hacked insurgents’ cell phones in Iraq, allowing the American military to track their movements and even send them texts with false orders that may have led to their capture or demise. China has become notorious in its hacking of U.S. government and defense sites. Criminals routinely use “phishing” emails to gain control of individual and business computers, sometimes to “kidnap” their data (ransomware) or to simply gain their information. Cyberwarfare carries numerous risks. As seen with Stuxnet, once released, a virus can become uncontrollable, harming friends and foes alike. It is relatively easy to conceal as it can be difficult to determine where an attack originated. In other words, a state actor could make it appear that a criminal group was responsible for the hack. Or, the criminal group could act as a mercenary for a state, giving the government plausible deniability. Governments have an incentive to co-opt and coerce technology firms to build in “back doors” that allow them to monitor information from citizens. This deliberate defect makes the product less attractive to consumers. On the other hand, an impregnable information system would be a very attractive tool for terrorists and criminals. Essentially, personal privacy is always at risk in a world where cyberattacks are possible. Technology, for the most part, improves efficiency. Recently, my family traveled to the Caribbean which required a tour through U.S. Customs upon our return. We were checked into the country using an automated kiosk that scanned our passports, took a picture and sent us to a border agent. The following day the system crashed and what took us about 45 minutes to navigate took others up to six hours to clear. Payment systems have become increasingly electronic. This allows households to carry less cash and lets banks and other financial institutions move funds more easily through the economy. However, it also makes the system vulnerable to hackers. Banks are constantly facing threats from criminals trying to gain access to accounts. Fraudulent purchases on credit cards are common. These acts are more easily facilitated due to technology. In financial services, technology has changed how orders are handled. Trade execution is nearly instantaneous. The futures pits used to be populated with wildly waving traders in colorful jackets; now, these trades are executed via terminals and, in many cases, ordered by algorithm. Although this has lowered execution costs, it also makes financial markets susceptible to “flash crashes” that occasionally roil the markets. Essentially, technology has been eliminating the number of people directly involved in processing transactions, everything from financial markets to retailing and government services. Although this makes the economy more efficient, it also makes it more fragile. If a system crashes, it can cause widespread disruptions and close firms, government agencies and markets. The U.S. economy, due to its technological advances, may be more vulnerable to cyberattacks than other nations. Although cyberattacks won’t likely cause regime change in the U.S., it could seriously disrupt the American economy, giving a foreign power time to use conventional military means to establish regional hegemony. Thus, if China wanted to capture Taiwan or if Russia wanted to invade the Baltics, a major cyberattack, such as bringing down the electrical grid, causing dams to malfunction or disrupting air traffic control, may be enough to shift security and other officials’ attention in order to improve the odds of a successful attack. Cyberwarfare is a significant threat to U.S. security and has very attractive characteristics. It is stealthy; the origin of the attack can be disguised and it can cause significant damage to an economy. Although the U.S. may be vulnerable to such an attack, it should be noted that American intelligence agencies and the military have significant firepower in this area as well. The difference is that disrupting the Russian economy might not matter all that much because it’s already in poor shape. But, in the U.S., shutting down the electrical grid for several days would be considered catastrophic; in fact, simply bringing down the internet might be just as bad. The U.S. faces a constant threat from cyberattacks. The key concern is what a foreign power would do with a disruption. China has already captured defense plans and personal information. So far, it has used this information to improve its own defense materials and to create countermeasures to U.S. defense goods. But the threat of a cyberattack as cover for a regional military operation is perhaps the greatest threat the U.S. currently faces. #4: DisinformationDisinformation is nothing new. From time immemorial, governments have tried to fool their adversaries. From America’s perspective, Radio Free Europe was broadcasting the truth to those behind the Iron Curtain. To the communists, it was pure propaganda. There are two changes that make disinformation more dangerous. First, the technology behind news flow has changed dramatically. During the era of print media, disseminating news was rather expensive. Printing needed to occur. Journalists needed to be hired. The journalists were usually trained and there were standards of conduct that acted as a screen for reports. Although there was a “yellow press” in American history, the Cold War period was probably the golden age of journalism. By the 1980s, cable news became an alternative to the major networks. The cable news companies discovered that they were able to capture a more reliable viewership by taking a definite slant toward the news. AM radio, as an older technology and because of its low cost, became an avenue of more extreme views. But the real change agent was the internet and social media. The internet allowed for news to be disseminated almost instantly. Social media allows common citizens to post items and videos for all to see. Regular media companies suddenly found themselves competing with citizens and their cell phones. From 1981 to 2014, the number of daily newspapers declined by 25.3%. Social media and news aggregators have the ability to screen news flow based on the viewing habits of the reader. Essentially, if one reads off the internet uncritically, they can live in a virtual news echo chamber. Thus, news, “facts” and viewpoints become hardened. The changes in news dissemination dovetailed with changes in political polarization. This chart is a measure of party polarization; essentially, it measures partisanship. The higher the reading on the chart, the more the political structure is partisan and polarized. Before the U.S. emerged on the world stage, there were strong disagreements on policy. There was less polarization by WWI, and during the Cold War the degree of polarization reached historical lows. In other words, regardless of political party, there was a high degree of bipartisanship. When the Cold War ended, bipartisanship also deteriorated. Currently, the country is probably the most polarized it has been since the Civil War. Unfortunately, this degree of disunity is dangerous for a superpower because it creates conditions that can distract policymakers from global concerns. Perhaps the greatest risk to the evolution of American hegemony was the Civil War. Although the British were the undisputed global superpower at the time, the leadership of that nation was watching the explosive economic growth in the U.S. warily. The British probably made a strategic mistake in not supporting the Confederacy because if it had survived the U.S. would have been divided and would never have achieved the same degree of power. According to historians, the political elites favored supporting the South but the public opposed it because of slavery. In addition, Queen Victoria also supported abolition and opposed the Confederacy. The British did offer some support but never enough to turn the tide. An America divided is susceptible to disinformation. We are living in an era where “false news” is routinely disseminated. In addition, facts have become increasingly tied to social and political positions; in other words, no fact seems to exist outside a social and political context. During the Cold War, the losing political party in an election was in opposition but did work with the winner; in the current environment, the losing party believes catastrophic events are likely and the only way to ensure a better future is to resist the policy goals of the other party. This environment allows foreign powers to influence social and political beliefs. It is clear the Russians tried to influence the U.S. presidential election. This should not come as a shock to anyone. The U.S. has done this for years; what Americans see as supporting democracy-loving activists in foreign nations looks much like meddling to foreign governments. In addition, it is routine for other nations to have lobbying efforts in the U.S., ostensibly to affect American policy. What is surprising is that the Russians seem to have had some success, although we would argue that it probably wasn’t as significant as the media is suggesting. We believe the reason the Russians were able to find some traction with the leaks and its behavior is that the political environment allowed it to occur. A political environment in which the other party isn’t seen as merely an American with a different political position but one that is perhaps evil allows leaks and disinformation to have power. Essentially, it appears that our current highly partisan climate has created an environment where disinformation is more likely to be accepted. If this process makes America more divided, it will reduce our ability to project power and exercise hegemony. Although disinformation probably won’t bring regime change, it can create conditions under which an aspiring regional hegemon can try to influence American public opinion in a fashion that will reduce the likelihood that the U.S. responds negatively to the aspiring regional hegemon’s encroachment. In other words, if Russia wanted to take the Baltics, it may try to use false news and internet dissemination to sway Americans to oppose U.S. and NATO intervention. RamificationsThis report is something of a thought experiment about how foreign nations can attack a hegemon with extraordinarily favorable geographic conditions. We identified four primary methods—a nuclear strike, terrorism, cyberattack and disinformation. These are not the only methods, but we suspect these are the most likely. Two others that deserve mention are biological/chemical warfare and space. The reason we didn’t explore the former is that it is probably similar to a nuclear attack if done in scale; we would know who did it and we would not be surprised to see a state-sponsored biological attack met with a nuclear strike or a massive conventional attack. Of course, a terrorist attack using these methods could be effective but these weapons are notoriously difficult to deploy effectively. And, the U.S. has an advanced medical sector that would probably be able to cope with a small biological attack. A space attack, which could range from attacking satellites to launching weapons, is possible. However, the U.S. is probably as well prepared as any nation for such conflicts and so a pre-emptive strike would probably be met in kind. Thus, for considerations of length, we didn’t explore either of these methods in detail. We are not likely to face a nuclear attack but the other three are quite likely and, in fact, have occurred and will likely continue to occur. Of the remaining three, we are most worried about the two discussed this week. Computer hacking by China and Russia is common; although it hasn’t led to anything that threatens civil order, the potential does exist that it could at some point. Disinformation is another rising concern. Although this method has existed for centuries, the internet allows dissemination without filters. Thus, the ability to affect the unity of the nation and America’s capacity to mobilize against enemies to support allies could be compromised. As noted, we believe a conventional military attack on the continental U.S. is highly unlikely. However, that doesn’t mean that aspiring regional hegemons won’t use the last three methods to improve their odds of success in local actions. The Russian concept of “hybrid war” uses the last three in combination to undermine nations in its near abroad and weaken any opposition to Russian goals of regional domination. The U.S. may become a more likely target of similar actions in order to distract America from opposing the aims of aspiring regional hegemons to expand their areas of control. The market ramifications are complicated. Technology security firms should find steady business from the private and public sector. Media companies may face additional burdens of screening news for potential “false news” stories. Overall, though, the biggest impact may be that these factors are part of a trend where the U.S. continues to move away from the superpower role it has played since the end of WWII. We have documented and discussed these issues at length. The bottom line is that a G-0 world is one that is negative for foreign investment but probably bullish for commodities. The dollar and U.S. financial assets will likely benefit relative to foreign assets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1188.40 Down $1.40 or -0.1 Posted: 27 Jan 2017 04:34 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Auto Industry In Crisis Amid "Inventory Bubble" Posted: 27 Jan 2017 04:25 PM PST Despite record U.S. auto sales last year, the number of vehicles on car-dealer lots remains near record highs, and, as J.D.Power analyst Thomas King warned this week, 2016 ended with an inventory "bubble" that will require less production or more incentives to clear. With near record high inventories of 3.9 million vehicles...

U.S. auto inventory finished 2016 at about 66 days supply, up from 60 days a year earlier. Inventory would last 2.23 months at the November sales pace, according to the latest available data from the Census Bureau. The stock-to-sales ratio in 2016 is extremely elevated compared to historical norms... More problematically, King warns, about one-third of inventory were older model-year vehicles, rather than more typical level of less than a quarter. Of course this massive stockpile hits just as President Trump pressures the auto-industry to onshore more jobs and more production...

So - produce more to employ more people and please President Trump (only to dramatically worsen the inevitable collapse), or cut workforces and productin further (as we have already seen) and face the wrath of Trump's tweets? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Dollar Will Die With a Whimper, Not a Bang Posted: 27 Jan 2017 04:17 PM PST This post The Dollar Will Die With a Whimper, Not a Bang appeared first on Daily Reckoning. The same force that made the dollar the world's reserve currency is working to dethrone it. July 22, 1944, marked the official conclusion of the Bretton Woods Conference in New Hampshire. It was at Bretton Woods that the dollar was officially designated the world's leading reserve currency — a position that it still holds today. Under the Bretton Woods system, all major currencies were pegged to the dollar at a fixed exchange rate. The dollar itself was pegged to gold at the rate of $35 per ounce. Indirectly, the other currencies had a fixed gold value because of their peg to the dollar. Other currencies could devalue against the dollar, and therefore against gold, if they received permission from the International Monetary Fund (IMF). However, the dollar could not devalue, at least in theory. It was the keystone of the entire system — intended to be permanently anchored to gold. From 1950–1970 the Bretton Woods system worked fairly well. Trading partners of the U.S. who earned dollars could cash those dollars into the U.S. Treasury and be paid in gold at the fixed rate. Trading partners of the U.S. who earned dollars could cash those dollars into the U.S. Treasury and be paid in gold at the fixed rate. In 1950, the U.S. had about 20,000 tons of gold. By 1970, that amount had been reduced to about 9,000 tons. The 11,000-ton decline went to U.S. trading partners, primarily Germany, France and Italy, who earned dollars and cashed them in for gold. The U.K. pound sterling had previously held the dominant reserve currency role starting in 1816, following the end of the Napoleonic Wars and the official adoption of the gold standard by the U.K. Many observers assume the 1944 Bretton Woods conference was the moment the U.S. dollar replaced sterling as the world's leading reserve currency. In fact, that replacement of sterling by the dollar as the world's leading reserve currency was a process that took 30 years, from 1914 to 1944. The real turning point was the period July–November 1914, when a financial panic caused by the start of the First World War led to the closures of the London and New York stock exchanges and a mad scramble around the world to obtain gold to meet financial obligations. At first, the United States was acutely short of gold. The New York Stock Exchange was closed so that Europeans could not sell U.S. stocks and convert the dollar sales proceeds into gold. But within a few months, massive U.S. exports of cotton and other agricultural produce to the U.K. produced huge trade surpluses. Gold began to flow the other way, from Europe back to the U.S. Wall Street banks began to underwrite massive war loans for the U.K. and France. By the end of the First World War, the U.S. had emerged as a major creditor nation and a major gold power. The dollar's percentage of total global reserves began to soar. Scholar Barry Eichengreen has documented how the dollar and sterling seesawed over the 20 years following the First World War, with one taking the lead from the other as the leading reserve currency and in turn giving back the lead. In fact, the period from 1919–1939 was really one in which the world had two major reserve currencies — dollars and sterling — operating side by side. Finally, in 1939, England suspended gold shipments in order to fight the Second World War and the role of sterling as a reliable store of value was greatly diminished apart from the U.K.'s special trading zone of Australia, Canada and other Commonwealth nations. The 1944 Bretton Woods conference was merely recognition of a process of dollar reserve dominance that had started in 1914. The significance of the process by which the dollar replaced sterling over a 30-year period has huge implications for you today. Slippage in the dollar's role as the leading global reserve currency is not necessarily something that would happen overnight, but is more likely to be a slow, steady process. Signs of this are already visible. In 2000, dollar assets were about 70% of global reserves. Today, the comparable figure is about 62%. If this trend continues, one could easily see the dollar fall below 50% in the not-too-distant future. It is equally obvious that a major creditor nation is emerging to challenge the U.S. today just as the U.S. emerged to challenge the U.K. in 1914. That power is China. The U.S. had massive gold inflows from 1914-1944. Although China's gold purchases may have fallen off recently, it has been experiencing massive gold inflows. Gold reserves at the People's Bank of China (PBOC) increased to 1,842 tonnes at the end of 2016, according to the China Gold Association. That's up 11% from the 1,658 tonnes it held in June, 2015. But China has acquired thousands of metric tonnes since without reporting these acquisitions to the IMF or World Gold Council. Based on available data on imports and the output of Chinese mines, actual Chinese government and private gold holdings are likely much higher. It's hard to pinpoint because China operates through secret channels and does not officially report its gold holdings except at rare intervals. China's gold acquisition is not the result of a formal gold standard, but is happening by stealth acquisitions on the market. They're using intelligence and military assets, covert operations and market manipulation. But the result is the same. Gold's been flowing to China in recent years, just as gold flowed to the U.S. before Bretton Woods. China is not alone in its efforts to achieve creditor status and to acquire gold. Russia has greatly increased its gold reserves over the past several years and has little external debt. The move to accumulate gold in Russia is no secret, and as Putin advisor, Sergey Glazyev told Russian Insider, in April 2016, 'The ruble is the most gold-backed currency in the world'. Iran has also imported massive amounts of gold, mostly through Turkey and Dubai, although no one knows the exact amount, because Iranian gold imports are a state secret. Other countries, including BRICS members Brazil, India and South Africa, have joined Russia and China to build institutions that could replace the balance of payments lending of the International Monetary Fund (IMF) and the development lending of the World Bank. All of these countries are clear about their desire to break free of U.S. dollar dominance. Sterling faced a single rival in 1914, the U.S. dollar. Today, the dollar faces a host of rivals. In addition, there is the world super-money, the special drawing right (SDR), which I expect will also be used to diminish the role of the dollar. The U.S. is playing into the hands of these rivals by running trade deficits, budget deficits and a huge external debt. The decline of the dollar as a reserve currency started in 2000 with the advent of the euro and accelerated in 2010 with the beginning of a new currency war. In his 1925 poem The Hollow Men, T. S. Eliot writes: "This is the way the world ends/ Not with a bang but a whimper." Those waiting for a sudden, spontaneous collapse of the dollar may be missing out on the dollar's less dramatic, but equally important slow, steady decline. The dollar collapse has already begun. The time to acquire inflation insurance is now. Regards, Jim Rickards The post The Dollar Will Die With a Whimper, Not a Bang appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

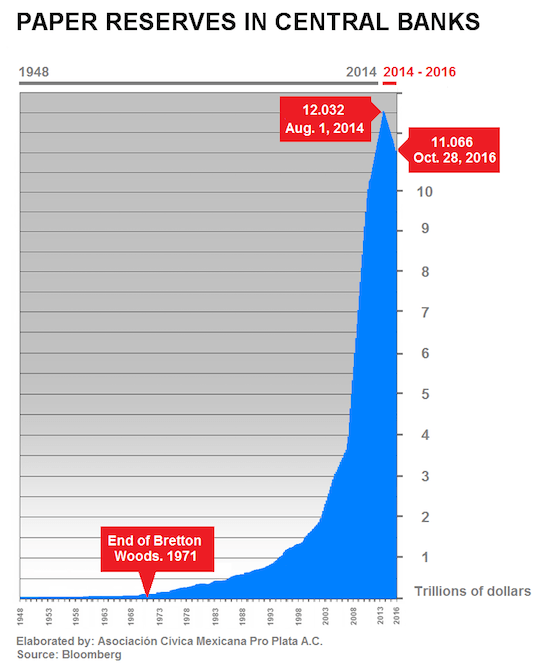

| Posted: 27 Jan 2017 04:12 PM PST This post An Omen of Global Collapse appeared first on Daily Reckoning. While the media fixate on Dow 20,000… who'll build "the wall"… and Trump's latest treason against the decencies… the next global financial crisis may be quietly unspooling. "The world doesn't realize it yet," fears independent analyst Steve St. Angelo of the SRSrocco Report. "But the implosion of the global markets has started and can't be stopped… While this may be slow at first, it will pick up speed over the next several years." Why's this fellow croaking such a brassy tune? The answer shortly. But first, a check of the markets… Today brings news that U.S. GDP growth slowed to 1.9% in last year's final quarter. Analysts expected 2.2%. So 2016 marks the 11th year running that annual growth failed to crack 3%. Stocks took a random walk into red territory today. Dow, S&P, Nasdaq, all down. But not much. The Dow's still holding the line north of 20,000. Oil's off a hair. Gold's down a few bucks. Back to that implosion of global markets… the one that can't be stopped… In the absence of a gold standard, the modern economy runs largely on credit. The Daily Reckoning's Richard Duncan argues for example that credit must increase 2% to avoid recession. But Fitch Ratings reports that global credit growth slowed last year to its lowest level since the financial crisis in 2009. And St. Angelo thinks the contraction represents "the popping of the massive inflationary asset bubble" that began inflating after 1971. That, curiously enough, is the year Nixon closed the gold window and ended Bretton Woods. Jim Rickards has recently raised hackles by showing that China's going broke burning through its dollar reserves. It's doing so to support the yuan and halt capital flight out of the country. Jim says China may have only about a trillion dollars left in spendable reserves. The rest are tied up. Why's all this important? Foreign countries build dollar and other currency reserves to support their own currencies and power domestic growth. They sustain credit growth. As investor Hugo Salinas Price notes, "All 'money' today represents debt: fiat money comes into existence as the counterpart to the creation of a credit." And a lot of that money meandered its way into the financial sector and inflated the stock market. What's the Dow again? Price spends his time tracking international reserves. Those dollar reserves had been building since the early 1970s (again, when Nixon closed the gold window). But his data show that the growth rate drooped in 2011. Then on Aug. 1, 2014, they reached their peak of $12.03 trillion. But then they started dropping. And by Oct, 28, 2016, they fell to $11.06 trillion. The trend, starting in 1971, has now gone into reverse. Look:

But here's Price on its true significance:

True, $11 trillion is far from zero. And the dollar remains the world's reserve currency, bar none. It won't collapse tomorrow. But as Price notes, it's the trend that counts. And it'll take a lot to reverse the new trend:

Again, that new trend according to Price: "Deflation, contraction of credit." This contraction is still in the early stages. But that can change, quick as a wink: "Deflation can take place at great speed, feeding on itself as fear of losses in investments propels the public to liquidate investments as quickly as possible." Hemingway's famous quote about bankruptcy leaps to mind. How do you go bankrupt? Slowly at first… then all at once. Yesterday Jim said the global economy's poised on a knife edge between inflation and deflation. Both creatures have been spotted. This Price clearly thinks deflation's the real bugbear. So what can you expect if he's right?

Postponed, that is. Not avoided. But borrowed time is better than none at all, we hazard. Please kick that can as far down the road as it can roll. The Super Bowl's next week, for heaven's sake. Regards, Brian Maher The post An Omen of Global Collapse appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Have You Ever Seen a Drill Like This? Large Amounts of Military Traffic Over US Posted: 27 Jan 2017 02:30 PM PST WW3 happening now. people Obama had been setting up everything needed for Trump to come in and finish the NWO. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Mixed on the Week Posted: 27 Jan 2017 01:29 PM PST Gold fell $8.48 to $1180.62 at about 8:45AM EST, but it then chopped back higher for most of the rest of trade and ended near its last minute high of $1191.60 with a gain of 0.15%. Silver surged to as high as $17.228 and ended with a gain of 1.9%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COT Gold, Silver and US Dollar Index Report - January 27, 2017 Posted: 27 Jan 2017 01:04 PM PST COT Gold, Silver and US Dollar Index Report - January 27, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Craig Hemke: Upside Surprise For Gold And Silver In 2017 Posted: 27 Jan 2017 12:43 PM PST To date, the price of gold and silver have followed a very similar trading path that was taken by the metals in early 2016, with gold and silver bottoming in mid-December and staging a strong rally through mid-January. Technically, as our Shadow of Truth guest Craig "Turd Ferguson" Hemke point s out, all of the stars were aligned for a take-down of the gold price using paper derivative gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WATCH: Trump Adviser Reveals His Brilliant Plan to Make Mexico Pay for the Wall Posted: 27 Jan 2017 10:30 AM PST Put a tax on all wired monies ie:Western Union transactions.They send their money home to families etc...A good percentage of W.U. Monies transactions get sent back to Mexico. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pound, Dollar, Euro And Yen Will Be Worthless Within Five Years Posted: 27 Jan 2017 10:01 AM PST Pound, Dollar, Euro And Yen Will Be Worthless Within Five Years | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Going Long The Euro Could Be The Trade Of 2017 Posted: 27 Jan 2017 09:06 AM PST BY JARED DILLIAN : For a long time now I've held the theory that you have to be completely insane to be a successful investor. Like, right out of your tree. Let me put it this way: Just a few weeks ago we were all sure, 100% positive that the US dollar would continue to appreciate against the euro, because the Fed was more hawkish, and the ECB was going to have negative rates and QE forever. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jan 2017 09:04 AM PST The silver miners' stocks have surged higher in this young new year, putting the Trumphoria general-stock rally to shame. Following its fourth-quarter drubbing, this tiny contrarian sector is embarking on a major new upleg as traders return. Silver-stock uplegs tend to grow to massive proportions, and silver-mining fundamentals remain strong today. So odds are the silver stocks are going to power far higher in 2017. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jan 2017 08:48 AM PST The silver miners’ stocks have surged higher in this young new year, putting the Trumphoria general-stock rally to shame. Following its fourth-quarter drubbing, this tiny contrarian sector is embarking on a major new upleg as traders return. Silver-stock uplegs tend to grow to massive proportions, and silver-mining fundamentals remain strong today. So odds are the silver stocks are going to power far higher in 2017. Because silver stocks aren’t widely followed, most investors and speculators are unaware of this sector’s stellar upside potential. Silver mining is a challenging business both geologically and economically, so there aren’t many primary silver miners out there. And their stocks’ collective market capitalization is small, a rounding error compared to the broader stock markets. That doesn’t leave much room for funds to buy. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harry Dent : Trump Can't Stop Global Collapse Posted: 27 Jan 2017 08:32 AM PST Economist Harry Dent tells Alex Jones that he believes we have gone too far over the edge for Donald Trump to be able to stop the collapse, all he can do is try and cushion the fall. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jan 2017 07:07 AM PST As everyone already knows, the Fed has finally hiked its interest rates for the second time in a decade and for the first time since December 2015, when it ended the zero interest rate policy. The chart below shows the current level of the effective federal funds rate after the recent move. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dow 20K, US Debt $20 Trillion, Trump and Gold Posted: 27 Jan 2017 02:32 AM PST by Jan Skoyles, Editor Mark O’Byrne In case you’ve been hiding under a rock, the Dow Jones Industrial Average reached 20,000 earlier this week for the first time in its 132 year history to much media fanfare. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jan 2017 02:18 AM PST As everyone already knows, the Fed has finally hiked its interest rates for the second time in a decade and for the first time since December 2015, when it ended the zero interest rate policy. The chart below shows the current level of the effective federal funds rate after the recent move. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 27 Jan 2017 01:37 AM PST US stocks down, gold and silver flat. President Trump begins with flurry of changes to Obamacare and NAFTA. Earnings season starting well for banks and miners. Global debt continues to soar, especially in China. Fake news debate rages. Brexit hits speed bumps. Best Of The Web These are the countries with the biggest debt […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jan 2017 12:00 AM PST Palladium took a dive this week, and Chen Lin, author of the popular newsletter What Is Chen Buying, What Is Chen Selling?, explains what happened and how investors can profit from the drop. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Bounces on Weak US GDP Data Posted: 26 Jan 2017 04:00 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals v. Mining Stocks: What You Need to Know Posted: 26 Jan 2017 06:47 AM PST By David Smith : Most readers of this column own (or plan to own) physical precious metals – gold and silver, perhaps even some platinum or palladium. They may also own mining stocks. But which category is "best"? It's like asking, "What's the most efficient exercise?" or "What's the best fishing lure?" Truth be known, it's really about what you wish to accomplish! Here is my considered opinion... |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment