Gold World News Flash |

- The Trump Weak Dollar Report - Keith Weiner

- Malls Owners Rush For The Exits As Mall-Backed CMBS Defaults Soar

- BREAKING: Massive Movement To Overthrow Globalist GEORGE SOROS Explodes In Macedonia.

- Ted Cruz Trolls Deadspin Editor Ashley Feinberg Over Stupid Basketball Challenge, Deadspin's Response: "Go Eat $hit"

- Mnuchin backs Fed independence and signals reform isn't priority

- Trump Slams The Media : ‘Among the most dishonest human beings’

- Gold Seeker Closing Report: Gold and Silver Fall Slightly While Stocks Climb To New Highs

- The Untruth About Jeff Sessions | U.S. Attorney General

- How to Profit from Trumponomics

- Mining firms see little appeal in Egypt's gold exploration terms

- Pension Funds Need Gold

- 2017’s Real Milestone (Or Why Interest Rates Can Never Go Back To Normal)

- Trump Wants Investors To Buy American Mining and Manufacturing

- CNN Declares War On President Trump, Admits Its Not Fact Based. Brian Stelter Slithers Lower

- Trump Is Gold Rally Accelerant

- How to Profit from Trumponomics

- Man Who Predicted Collapse Of Euro Against Swiss Franc Now Warns Huge Shock Will Bring The World To Its Knees

- Trump Is Gold Rally Accelerant

- Precious Metals Rally Up to Trump Inauguration... Now What?

- US Dollar may be our guide for the markets

- Using gold as money

- Gold and Silver Market Morning: Jan 24 2017 - Gold and Silver consolidating!

- Sharia Standard May See Gold Surge

- Russia expected to sell gold deposit cheap amid sanctions, sources say

- Jim’s Mailbox

- Will Trump Usher In an Era of Sound Money?

- Breaking News And Best Of The Web

- Gold price to 2 month high as fiery Trump declares New American Order

- Why Gold Is Oddly Looking Bullish

- How to Profit from Trumponomics

- Top Ten Videos — January 24

| The Trump Weak Dollar Report - Keith Weiner Posted: 24 Jan 2017 10:32 PM PST Sprott Money | |

| Malls Owners Rush For The Exits As Mall-Backed CMBS Defaults Soar Posted: 24 Jan 2017 08:00 PM PST Last week we wrote about the epic collapse of the Galleria Mall at Pittsburgh Mills which sold for $100 after once being appraised for $190 million shortly after being opened in 2005 (see "Pittsburgh Mall Once Worth $190 Million Sells For $100"). Unfortunately for mall owners, while the Pittsburgh Mills Galleria is an extreme example, crashing mall valuations are hardly an anomaly these days. In fact, just a few weeks ago Commercial Real Estate Direct wrote about the Foothills Mall in Tuscon, Arizona which was valued at $115mm in 2006 and backs a $75mm CMBS loan but recently appraised for just $18mm...or just a slight 75% loss for lenders. As pointed out by the Wall Street Journal earlier today, mall CMBS defaults are up all across the country with liquidations up 11% YoY.

And while we're frequently reminded of the stunning "Obama recovery" by the mainstream media, retailers seem to represent the one 'tiny segment' of the U.S. economy that failed to participate in that recovery as evidenced by the soaring delinquency rates of loans backing retail properties.

Meanwhile, as Barclays' U.S. REIT team points out, the key question for mall owners in 2017 isn't whether rent concessions will be granted to tenants, but rather, just how deep the cuts will have to be in order to maintain occupancy.

Alas, while mega malls were once the destination of choice for America's misunderstood youth, we fear that they're bound to suffer the same fate as the big hair, hoop earrings and creepy mustaches that once frequented their food courts in the 80s. | |

| BREAKING: Massive Movement To Overthrow Globalist GEORGE SOROS Explodes In Macedonia. Posted: 24 Jan 2017 07:30 PM PST soros needs stopped all over the world he has hi influence everywhere there is unrest The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |

| Posted: 24 Jan 2017 07:10 PM PST

After spending much of the 2016 campaign known as "Lyin' Ted" while spitting venom in Trump's general direction, Senator Ted Cruz traversed a tenuous road to redemption - earning his way back into Trump's good graces, helping with the cause, and clearly learning much about trolling along the way. The target of Cruz's hijinks is Univision owned Deadspin and editor Ashley Feinberg. Hours after Politico ran an article mentioning that Cruz was was trying to improve relations within the GOP, Feinberg latched onto this tidbit:

The Deadspin editor immediately put out the call for undercover pictures, hoping of course for some shots of Ted lookin' like an old white guy playing basketball - when Cruz himself, or Barron Trump pretending to be Ted, stopped by with an offering:

What follows is comedy gold as Deadspin loses their cool and Cruz responds:

Feinberg then swats Buzzfeed reporter Matthew Zeitlin:

Other reactions were hilarious:

Conservative review entered stage right with the comic stylings of the guy running their Twitter account:

This is the best timeline.

| |

| Mnuchin backs Fed independence and signals reform isn't priority Posted: 24 Jan 2017 04:25 PM PST By Craig Torres and Saleha Mohsin U.S. Treasury Secretary nominee Steven Mnuchin isn't jumping on the Republican bandwagon to audit the Fed. In written questions by senators following his confirmation hearing last Thursday, Mnuchin was asked about his thoughts on "politicizing decisions made by the Federal Reserve Board of Governors and the benefits of an independent central bank." Mnuchin's answer was crafted carefully. "The Federal Reserve is organized with sufficient independence to conduct monetary policy and open market operations," Mnuchin responded to Senator Bill Nelson, a Florida Democrat. "I endorse the increased transparency we have seen from the Federal Reserve Board over recent years." The response appears to lean against legislation such as the Fed Oversight Reform and Modernization Act of 2015, or FORM Act, which was introduced in the House of Representatives but never became law, which would have subjected the central bank's monetary policy decisions to greater congressional scrutiny. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-01-24/mnuchin-backs-fed-ind... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |

| Trump Slams The Media : ‘Among the most dishonest human beings’ Posted: 24 Jan 2017 04:00 PM PST US President Donald Trump and his spokesperson Sean Spicer, have chastised US media outlets, accusing reporters of understating the numbers of supporters present during the inauguration. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |

| Gold Seeker Closing Report: Gold and Silver Fall Slightly While Stocks Climb To New Highs Posted: 24 Jan 2017 02:58 PM PST Gold saw slight gains in Asia before it fell back to $1211.64 in London and then jumped up to $1217.62 in midmorning New York trade, but it then fell back off into the close and ended near its late session low of $1206.68 with a loss of 0.44%. Silver slipped to as low as $17.038 and ended with a loss of 0.41%. | |

| The Untruth About Jeff Sessions | U.S. Attorney General Posted: 24 Jan 2017 02:00 PM PST On November 18th, 2016, Sen. Jeff Sessions was announced as President Donald Trump's nominee for United States Attorney General and the mainstream media smear campaign began almost immediately. What is the Truth About Jeff Sessions? The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |

| How to Profit from Trumponomics Posted: 24 Jan 2017 01:44 PM PST While Donald Trump's election has altered a number of aspects of the economy, investors cannot ignore economic trends that were in place before the election, says Joe McAlinden, founder of McAlinden Research Partners and former chief global strategist with Morgan Stanley Investment Management. In this interview with The Gold Report, he discusses those trends and how they may be changed by Trump's election, why he is bullish on gold and which sectors he expects to thrive in the Trump era. | |

| Mining firms see little appeal in Egypt's gold exploration terms Posted: 24 Jan 2017 12:52 PM PST By Eric Knecht CAIRO -- The gold beneath Egypt's desert could make it a top global producer, but the investment terms on offer are driving away small explorers whose skills the country needs to unlock its mineral wealth. The Egyptian government launched its first international tender for gold mining concessions in eight years last week, potentially an exciting opportunity for global miners to help develop a relatively untapped gold-mining frontier. Though it has a history of gold-mining stretching back to the pharaohs, Egypt today has a single commercial gold mine, Centamin's Sukari, which produced 551,036 ounces last year. In Egypt's mineral-rich Eastern Desert alone, some exploration companies estimate potential gold reserves could be higher than 300 tonnes, although the government declines to give an estimate. But mining companies active in Egypt and Africa say the new exploration round, which offers five concession areas and closes on April 20, is unlikely to lure investors because of commercial terms they say are among the least attractive in the world. ... For the remainder of the report: http://www.reuters.com/article/us-egypt-gold-idUSKBN158263 ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |

| Posted: 24 Jan 2017 12:09 PM PST Guest Post By Jp Cortez Tens of millions of Americans and their employers pour money into pension plans each month, counting those funds to grow and to be there when needed at retirement. But a time... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | |

| 2017’s Real Milestone (Or Why Interest Rates Can Never Go Back To Normal) Posted: 24 Jan 2017 11:58 AM PST If we hope to live within our means interest rates can never be allowed to rise. But if interest rates don't rise, the Fed is forced to create a tsunami of new dollars to keep rates low, and must take its chances with inflation, currency war, crack-up boom, and all the other black swans that live in the land of monetary excess. Which is why the sound money community keeps harping on gold. All the politically-acceptable policy options have inflation/devaluation at their core, and those things are always and everywhere great for real assets. | |

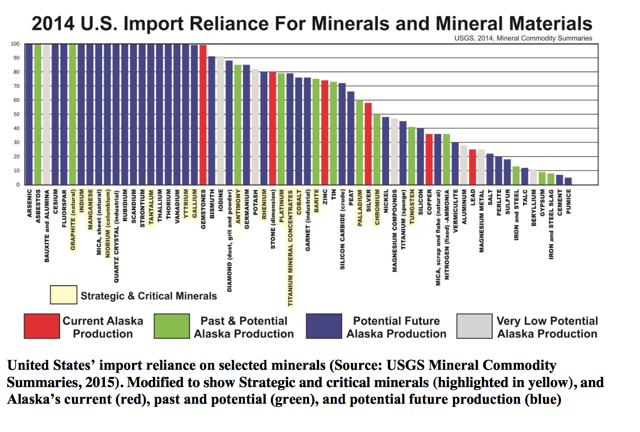

| Trump Wants Investors To Buy American Mining and Manufacturing Posted: 24 Jan 2017 10:32 AM PST I just read Trump’s inaugural speech and it can be summed up in the following sentence, “Buy American and hire American”. This policy could have a great impact on some of our US natural resource holdings including our investments in US precious metals, rare earths, graphite, lithium, uranium…which have been forgotten about for nearly twenty years as large mining companies sought mines in foreign jurisdictions which had less regulatory burdens then the US. For years I expected a renaissance in this abandoned mineral sector as a country can last only so long before people realize that their jobs have been sent overseas. Our mining and manufacturing industry has been demolished over the past twenty years being sold for pennies on the dollar to foreign interests. It seems that some of the themes I have been investing in is world class mining assets in the US will now come back into favor as we should no longer import these strategic minerals from China and Russia at inflated prices. We can mine and produce these clean energy metals right here in the US if We can transform our regulatory and taxing policies to support mining rather than make it nearly impossible to build a mine or factory through burdensome permitting and regulations. Mining in the US could change now with a completely right wing and nationalistic swing in the US. That is unwinding now. Bonds are in free fall. The dollar is topping and finally commodities are breaking out. Even the Post Fukushima hated uranium sector is booming despite Cameco’s the largest uranium producers attempts to calm down the rally. Capital still keeps flowing in to uranium. I expect domestic oil to benefit from America first. Big money could return to the energy sector. However, the biggest gains could be in lithium, graphite and cobalt. CNN Declares War On President Trump, Admits Its Not Fact Based. Brian Stelter Slithers Lower Posted: 24 Jan 2017 09:30 AM PST CNN has issued a direct threat to Donald Trump and demands he stop defending himself from their dishonest coverage. Brian Stelter slithers further to the bottom as the most dishonest person in all of legacy media. The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | |

| Trump Is Gold Rally Accelerant Posted: 24 Jan 2017 09:02 AM PST Graceland Update | |

| How to Profit from Trumponomics Posted: 24 Jan 2017 08:52 AM PST While Donald Trump's election has altered a number of aspects of the economy, investors cannot ignore economic trends that were in place before the election, says Joe McAlinden, founder of McAlinden Research Partners and former chief global strategist with Morgan Stanley Investment Management. In this interview with The Gold Report, he discusses those trends and how they may be changed by Trump's election, why he is bullish on gold and which sectors he expects to thrive in the Trump era. The Gold Report: 2017 will be a year of change. In the early days of the Trump administration, what should investors be focusing on? | |

| Posted: 24 Jan 2017 08:20 AM PST Man Who Predicted Collapse Of Euro Against Swiss Franc Now Warns Huge Shock Will Bring The World To Its Knees | |

| Trump Is Gold Rally Accelerant Posted: 24 Jan 2017 08:07 AM PST Donald "The Golden Trumpster" Trump may or may not make debt-soaked America great (he likely won't), but he's almost certainly going to make gold ownership a great investment during his presidency. I will dare to suggest it's time for the Western gold community to throw a bit of caution to the wind, and sit back and enjoy this gold price rally. This is a rally that seems poised to accelerate in quite a shocking way, as the Golden Trumpster makes one dollar-negative move after another! | |

| Precious Metals Rally Up to Trump Inauguration... Now What? Posted: 24 Jan 2017 08:00 AM PST Gold and silver are off to a good start in 2017, advancing again last week into Donald Trump's inauguration. If recent history is a guide, this year could bring some nice gains in precious metals. Bloomberg reports there have been gains in the gold market in the year following 6 of the past 7 presidents' first inauguration. The average gain is 15%, dramatically outperforming the SPX 500 which loses, on average, about 1%. | |

| US Dollar may be our guide for the markets Posted: 24 Jan 2017 07:29 AM PST In keeping our eyes on the USD, we can ascertain the moves of the rest of the market. USD futures declined to 99.88 in overnight trading, but retraced to 100.40 at 6:00 am., a 28% retracement of its last decline. Since that decline was clearly impulsive while the others were not, I am labeling the first two thrusts down with an A, while the bounce was a B Wave. We may have just seen Wave [i] of C, while Wave [ii] appears to be in progress. It has retraced 28% of the decline thus far and is easing back down. | |

| Posted: 24 Jan 2017 06:27 AM PST Gold is one of six ribawi items (the others being silver, salt, wheat, dates and barley), which are the staples of life. Strict rules are applied to ribawi to ensure injustice and inequality between transacting parties are prevented. Therefore, throughout Islamic history, gold has had a special significance as both a commodity and money. Logically, there is an understanding that gold is different from government-issued currency. And, therefore, the lawful possession of your own money, such as through a Goldmoney account or Holding, is different to being a creditor of a bank. | |

| Gold and Silver Market Morning: Jan 24 2017 - Gold and Silver consolidating! Posted: 24 Jan 2017 06:18 AM PST Shanghai was trading today just above 270 Yuan or in dollars, at today's exchange rate, $1,226,15 having touched nearly 272 during the day. The dollar is only slightly weaker across the board, as well as against the Yuan. New York, Monday, closed in line with gold prices in Shanghai earlier in the day, before New York opened. This is a first, as New York climbed up to Shanghai's levels despite an over 2 tonne sell-off from the SPDR gold ETF. | |

| Sharia Standard May See Gold Surge Posted: 24 Jan 2017 06:15 AM PST GoldCore research shows that if just 1 per cent of Islamic finance goes into gold, demand could increase by up to an enormous 1,000 tonnes a year. Even if demand comes in at half that it means the gold market will undergo a considerable shake-up. Last month the Sharia Standard was approved as a collaboration between the Bahrain-based Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI), the Islamic standard-setting body, and The World Gold Council (WGC) in London. | |

| Russia expected to sell gold deposit cheap amid sanctions, sources say Posted: 24 Jan 2017 04:31 AM PST By Polina Devitt MOSCOW -- Russia is expected to sell discounted rights to one of the world's largest untapped gold deposits this week to a joint venture of miner Polyus and a state conglomerate, industry sources and analysts said, after sanctions and restrictions discouraged other bidders. The starting price in the Jan. 26 auction of the Sukhoi Log deposit is $145 million, valuing gold there at $2 per ounce, around 10 times cheaper than deposits of a similar size elsewhere in the world, according to one analyst. The Russian government, after 20 years of promises to sell the deposit, hopes that the start of production will generate much-needed tax revenues and jobs. Moscow has also come under pressure from a two-year lobbying campaign by shareholders in the joint venture of Polyus and state-run Rostec, according to an industry source, who spoke on condition of anonymity. Rostec is headed by Sergei Chemezov, a close associate of Russian President Vladimir Putin. ... ... For the remainder of the report: http://www.reuters.com/article/us-russia-sukhoilog-idUSKBN1571MA ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |

| Posted: 24 Jan 2017 04:10 AM PST From David Perks (CIGA Dismal Dave) to all our Canadian Friends So, just sit back. Enjoy the show. This is all you need, eh…? Jim Mr Sinclair, Of the many computer internet videos and articles about gold/silver seen, I have never heard mention the official price of these metals mentioned. If the government confiscate these... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | |

| Will Trump Usher In an Era of Sound Money? Posted: 24 Jan 2017 02:44 AM PST Now that Donald Trump has been sworn in, Americans will start getting some glimpses of what his presidency actually means. Here are some educated guesses of what to expect when it comes to the dollar and sound money issues, based on what we know before the kick-off of Trump's administration. | |

| Breaking News And Best Of The Web Posted: 24 Jan 2017 01:37 AM PST US stocks trade down, gold and silver near multi-week high. President Trump begins with flurry of changes to Obamacare and NAFTA. Earnings season starting well for banks and miners. Global debt continues to soar, especially in China. Fake news debate rages. Trump and Merkel trade insults. Best Of The Web These are the countries […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |

| Gold price to 2 month high as fiery Trump declares New American Order Posted: 24 Jan 2017 01:18 AM PST – ‘Trumponomics’: Politics and economic policy in 140 characters – The ‘intelligence’ according to Trump – Trump, Putin and Russia – the great bromance – Trump – Bull in a China shop – Trade and currency wars with China and other nations – Trump – Fan of gold and golden tweets – Conclusion – Trump may be the ‘Golden Ticket’ | |

| Why Gold Is Oddly Looking Bullish Posted: 24 Jan 2017 01:10 AM PST The price of gold appears to be on yet another homerun after eight weeks of decline. The price of the yellow metal has been on an upward trending movement since December 23, 2016 amid the growing uncertainty on the potential impact of President Donald Trump’s policies on the stock market. Since the turn of the year, the US stock market has exhibited mixed reactions to Trump’s pre-and-post inauguration period, with America’s 45th president’s activity swinging the market up and down on a weekly basis. | |

| How to Profit from Trumponomics Posted: 24 Jan 2017 12:00 AM PST While Donald Trump's election has altered a number of aspects of the economy, investors cannot ignore economic trends that were in place before the election, says Joe McAlinden, founder of McAlinden Research Partners and former chief global strategist with Morgan Stanley Investment Management. In this interview with The Gold Report, he discusses those trends and how they may be changed by Trump's election, why he is bullish on gold and which sectors he expects to thrive in the Trump era. | |

| Posted: 23 Jan 2017 04:01 PM PST Gold and Trump — of course. ” frameborder=”0″ allowfullscreen> The post Top Ten Videos — January 24 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment