Gold World News Flash |

- Swedish Politician Resigns After Calls To "Shoot Trump"

- Trump Kills TPP - Stop Funding of Abortion + Sterilization Overseas - Federal Hiring Freeze

- Central banks embrace risk buying stocks and bonds in era of low rates

- President Donald J. Trump Interview Today 1/23/17 on Cutting Regulations

- Building a financial defense line strategically

- Breaking Trump To Release Secret Darpa Technology To The World

- Trump's nominee for Treasury backs off support for strong dollar

- Gold Price Closed at $1215.00 Up $10.70 or 0.89%

- Feminism Funded By The CIA

- Alasdair Macleod: Using gold as money in the Muslim world

- Gold Seeker Closing Report: Gold and Silver Gain While Dollar Drops

- BREAKING -- Trump pulls out of TTP trade deal

- Northern Dynasty says it has Trump administration's support, seeks new partner

- It’s All About COMEX

- The Ice-Nine Lockdown

- The Best of 2017 Trump Rally Confrontations Compilation

- Using gold as money

- Global markets turn back on euro as economic woes reinforce dollar as the currency of choice

- FTSE 100 extends losses and pound hits five-week high as unease over Trump weakens dollar

- Shocking News From The Pentagon! Obama’s Chief Advisor Valerie Jarrett’s Real Identity Revealed

- Ronan Manly: Ireland conceals basic information about its gold reserves

- Chris Powell: Currency regime has run the world for 'America first' since 1945

- This Girl Knows All Your Secrets… And She’s A “Buy”

- SWOT Analysis: Gold Moves On Trump Inauguration

- Ireland’s Monetary Gold Reserves: High Level Secrecy vs. Freedom of Information – Part I

- Alasdair Macleod: Silver, Gold and Commodities in 2017

- The Trump Weak Dollar Report

- Gold And Interest Rates…GET IT STRAIGHT

- The New Gold Rush Of 2017!

- Breaking News And Best Of The Web

- Columbus Gold Comes to a Fork in the Road

- Gold Futures Prices Looking Bullish

- Great Rotation and Gold

- This Ratio Suggests Gold Is Entering a Major Bull Market

- Time for Crude Oil Price Drop below $50?

- Jack Chan: This Past Week in Gold and Silver

| Swedish Politician Resigns After Calls To "Shoot Trump" Posted: 24 Jan 2017 01:59 AM PST A municipal council lawmaker in the Swedish city of Kalmar, Roland Pettersson, member of the biggest Swedish Social Democratic Party, resigned on Monday after asking on Facebook if someone could "shoot" America's president, Donald Trump. "I believed that Donald Trump would calm down after he became the president [of the US]. But how wrong I was! He exceeded my worst fears! Could anyone shoot him?" Swedish Social Democratic Party member Roland Peterson, a municipal official in Kalmar's Soedermoere district, wrote on his Facebook page on Sunday. Although he later removed the post a few hours later, on Monday Peterson decided to step down as member of both his party and the Soedermoere Municipal Council and Planning Board, RT reported. "After my blunder on Facebook, there is a risk that I will become a burden for the Social Democrats in Kalmar. I do not want it, so I chose to leave all my posts," Peterson wrote in a letter to his party members, as quoted by the Oestra Smaland newspaper. Person's post provoked an angry reaction from his party members and fellow councilors. "It is good that he [Peterson] removed it [the post]," councilor Johan Persson told Oestra Smalan, adding that people should "never call for violence" regardless of their opinion of Donald Trump or other issues. The Social Democrats' leader in Kalmar, Roger Holmberg, denounced the post as "inappropriate" and "idiotic," while stressing that "even thinking about the idea of violence is completely wrong." He told Swedish broadcaster STV that he had had a conversation with Peterson and said that new party members would receive training in working with social media. Holmber said that Peterson "is deeply remorseful," explaining that he "did not understand the impact of the post in the social media." Peterson told local STV that he "would have never written" the post if he had considered the consequences, while promising he "will never do it again." He also explained to Oestra Smalan that it was Trump's environmental policy that had deeply upset him. "[Trump] risks the future of the entire Earth," he said adding that "now, when the world has started going in the right direction," Trump plans to increase oil and coal production. While Trump's ideas about the environmental are a source of controversy in the US, and social media went into meltdown after Trump's inauguration when certain hot topic issues disappeared from the White House website, including climate change, we wonder if Pettersson has heard of China's "environmental" problems, and whether the tolerant, enviornmentally savvy liberal would urge someone to nuke the entire country out of orbit if so. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump Kills TPP - Stop Funding of Abortion + Sterilization Overseas - Federal Hiring Freeze Posted: 23 Jan 2017 09:00 PM PST Trump Takes Office, Kills TPP The controversial trade deal put together by President Obama and supported by many Republicans falls under the weight of the new president The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks embrace risk buying stocks and bonds in era of low rates Posted: 23 Jan 2017 07:32 PM PST By Christopher Whittal, Jon Sindreu, and Brian Blackstone By keeping interest rates low and in some cases negative, central banks have prompted some of the most conservative investors to join the hunt for higher returns: other central banks. Central banks from Switzerland to South Africa are investing a bigger share of their growing foreign-exchange reserves in equities, corporate bonds and other riskier assets. Branching out from the traditional central-bank practice of investing primarily in ultrasafe government bonds such as U.S. Treasurys means taking on more risk. But at a time when global growth, interest rates and potential returns on many assets are low, many central bankers are becoming increasingly focused on maximizing investment returns. ... At the same time, efforts to invest reserve funds more broadly mean that more markets will be subject to what some critics describe as central-bank distortion, as large and often price-insensitive buyers run the risk of driving up prices and reducing prospective returns for other market participants. ... ... For the remainder of the report: http://www.wsj.com/articles/central-banks-embrace-risk-in-era-of-low-rat... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| President Donald J. Trump Interview Today 1/23/17 on Cutting Regulations Posted: 23 Jan 2017 07:30 PM PST This guy is a genius ! America will not be Great again but will be Greater than ever !!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Building a financial defense line strategically Posted: 23 Jan 2017 07:24 PM PST This important topic we cover in our book Splitting Pennies is possibly THE MOST importact topic in teaching personal finance, and probably the most misleading concept peddled by Wall St. Let's face it - Wall St. has a reason to mislead investors, especially retail investors - because they're on the other side of the trade! That's right. When you lose - they win. And due to hedging, they can't actually lose. The secret world of hedging - Wall St. doesn't want you to know about because like the insurance industry, it allows investors to protect themselves. "Options" are thought of as "Risky" which is a highly potent meme that is reinforced by the regulators:

Whoa- where do I sign? This is an example of how regulators manipulate the presentation of options in order to mislead investors away from something which can protect them from disaster. Financial tools like options are like any tools, they can be used like insurance, or they can be used as weapons. Take simple construction tools. A hammer can be used to build furniture, or destroy furniture. A hammer can break a window, kill someone - but also it can be used for decades to build fine woodwork (if you are a craftsman). Building a financial defense line This is the personal finance equivalent of hedging. Hedging with options for example - should be used like an insurance policy. It's better to have it and not need it than need it and not have it. Your financial defense line can be a property that's paid for cash that you can live on for the rest of your life, it could be if you are in the car business an inventory of valuable used cars, it could be a pile of gold bars. Preppers are one group that understands this concept well - it's the underlying ethos of prepping. But the majority of Americans are one paycheck away from disaster. They 'spend money on things they don't need, with money they don't have - to impress people they don't know' And of course, the problem with writing such an article is the paradox of education. Those who understand this concept, are already doing it, and those who don't understand - they don't believe that they need to know it - they have another opinion! Such thinking is never without punishment in the markets. Hedging is all about paying for something you do not need, but may need one day, should an unexpected event happen. It's a form of insurance. There's one kind of insurance that takes this concept too far - life insurance. But that's a topic for another article. Common insurance like homeowners insurance, professional insurances like directors' liability insurance, and others; are a type of financial defense line. For example, did you know in large class action cases where big corporations are involved in fraud - shareholders are settled financially primarily through insurance claims made by plaintiffs attorneys? Commonly it's thought that companies pay out these big settlements but actually, it's mostly insurance companies. Wall St. is a huge user of insurance, and hedging - which is why at companies like AIG, the lines between derivatives trading, opaque contracts, and insurance - was widely blurred. But you don't need a Wall St. bank in order to create a financial defense line, it can be as simple as investing in something for cash that you may need one day 'just in case' but don't need right now, like a property, a container full of canned food - whatever it is to you. When you HAVE the financial defense line IN PLACE - THEN and ONLY THEN can you go out into the risky market and take risks. There's a phenomenon that's difficult to quantify, but the fact that you have the defense line, it seems that those investors usually don't lose on the risks they take in the market. The only analogy that can explain this is a Sierra Club study about bears and men carrying guns; it seems that men who hike in the mountains who carry loaded guns are almost never attacked by bears - but also they never shot any bears, which means the men must emit a pheromone that the bears can sniff. Practically, it's better not to enter the market and take risks if you don't have a defense line. Another example is 'investing money you can afford to lose' - many advisors recommend investing only a percentage of a portfolio (like 5% or 10%) that if the investment is wiped out, the portfolio will remain intact. There's a few demographics that understand this other than preppers - Texas Oil Investors and Silicon Valley VCs. In Oil Investing, 9 out of 10 wells may be dry, or just barely break even. But 1 out of 10 can be a gusher - 1,000% returns, which make up for the dry and average wells. Average investors, even if you don't have any retirement or pension, can build a financial defense line - it can mean getting an extra job, doing something for extra income (like selling stuff online) or applying for a research grant you always dreamt of. It's a myth that you need money to invest. In fact, most startups are started with 99% persperation and 1% inspiration. Without money though, you'll have to put MAJOR WORK into your project to really build equity. In a simple example of a housing project, that means doing the labor yourself which can be 60% - 70% of the costs. In a business, it means you'll have to do 10 jobs, instead of hiring an accountant, a webmaster, and other things. Hey - it's better than sticking a crayon up your nose. Extended warranty? How can I lose?  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking Trump To Release Secret Darpa Technology To The World Posted: 23 Jan 2017 06:30 PM PST Donald Trump is going to move forward with his plan to reveal the secrets the globalists have been hiding to the American people. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump's nominee for Treasury backs off support for strong dollar Posted: 23 Jan 2017 05:57 PM PST Inside the Mind of Mnuchin: Too-Strong Dollar May Hurt Economy By Saleha Mohsin U.S. Treasury Secretary nominee Steven Mnuchin said an "excessively strong dollar" could have a negative short-term effect on the economy. "The strength of the dollar has historically been tied to the strength of the U.S. economy and the faith that investors have in doing business in America," Mnuchin said in a written response to a senator's question about the implications of a hypothetical 25 percent dollar rise. "From time to time, an excessively strong dollar may have negative short-term implications on the economy." The dollar slumped to the weakest in more than six weeks after the remarks, obtained by Bloomberg News today. The comments were included in answers from Mnuchin to questions from U.S. senators following his confirmation hearing last week. In that session, he had said a strong dollar is important over the long term, while noting it's currently "very, very strong." President Donald Trump expressed concern about the dollar's appreciation in an interview with the Wall Street Journal this month, saying the currency was "too strong." That prompted speculation that his administration might reverse longstanding tradition in the U.S. to support a strong-dollar policy. ... ... For the remainder of the report: https://www.bloomberg.com/politics/articles/2017-01-23/mnuchin-says-exce... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1215.00 Up $10.70 or 0.89% Posted: 23 Jan 2017 05:18 PM PST

If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Jan 2017 04:30 PM PST Alex Jones details the lunacy behind the feminist movement. Revealing Gloria Steinem's admission that she was funded by the CIA. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Using gold as money in the Muslim world Posted: 23 Jan 2017 04:19 PM PST 7:20p ET Monday, January 23, 2017 Dear Friend of GATA and Gold: Muslims have special reason to use gold as money, GoldMoney research director Alasdair Macleod writes today, because the government currencies of Muslim countries have been especially vulnerable to devaluation. Macleod notes that GoldMoney has been designated as a vehicle for purchasing gold in compliance with Muslim law. Macleod's commentary is headlined "Using Gold as Money" and it's posted at GoldMoney's internet site here: https://wealth.goldmoney.com/research/goldmoney-insights/using-gold-as-m... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain While Dollar Drops Posted: 23 Jan 2017 01:17 PM PST Gold gained $11.85 to $1219.45 in Asia before it fell back to $1209.43 by a little before 10AM EST, but it then jumped up to $1218.90 by midday in New York and ended with a gain of 0.64%. Silver rose to as high as $17.247 and ended with a gain of 0.64%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING -- Trump pulls out of TTP trade deal Posted: 23 Jan 2017 01:00 PM PST President Donald Trump has fulfilled a key campaign pledge by withdrawing the United States from the 12-nation Trans-Pacific Partnership. Trump signed an executive order on Monday pulling the US out of the trade deal. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Northern Dynasty says it has Trump administration's support, seeks new partner Posted: 23 Jan 2017 12:52 PM PST By Natalie Obiko Pearson Northern Dynasty Minerals Ltd. expects to resolve a dispute with the U.S. environmental regulator by April to enable it to move ahead with permitting one of the world's largest undeveloped copper and gold deposits. U.S. President Donald Trump's administration has "a desire to permit Pebble," the company's project in Alaska, Northern Dynasty Chief Executive Officer Ronald Thiessen said today in Vancouver. "We will come to a resolution within 100 days" with the U.S. Environmental Protection Agency, he said. In 2014 the EPA moved to impose restrictions on Pebble, blocking it from applying for a permit, citing "potentially destructive impacts" to the world's largest sockeye salmon fishery. Trump's pick to head the regulator, Scott Pruitt, is a self-described opponent of the EPA's "activist agenda" and has called for "regulatory rollback" at the agency. Thiessen said today the company isn't expecting special treatment under the Trump administration but a return to a "normalized permitting" process. That process should take about four years and cost $150 million, he said. ... ... For the remainder of the report: https://www.bloomberg.com/news/articles/2017-01-23/northern-dynasty-says... ADVERTISEMENT At 3 Aces Project, Golden Predator Finds 7.5 Meters of 33 Grams-Per-Tonne Gold Company Announcement Thursday, January 19, 2017 VANCOUVER, British Columbia, Canada -- Golden Predator Mining Corp. (TSX.V: GPY; OTCQX: NTGSF) is pleased to report assay results for the first 13 holes of a total of 54 holes completed in the winter 2016 drill program at the 3 Aces Project in southeastern Yukon Territory. Drilling has demonstrated an extension of high-grade gold at the Ace of Spades zone, as well as the exciting discovery of a blind vein and the occurrence of significant assay values in stockwork zones. Significant results reported at true width include: -- Hole 3A16-RC-032 intersected 7.54 meters of 32.86 grams per tonne gold from a depth of 16.76 meters, including 0.54 meters of 252 grams per tonne gold; and a new blind vein at a depth of 71.63 meters returned 3.23 meters of 10.04 grams per tonne gold. (The hole ended in mineralization. ... For the remainder of the announcement: http://www.goldenpredator.com/_resources/news/nr_2017_01_19.pdf Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Jan 2017 12:42 PM PST Why do gold and silver prices top overnight and come into New York cash market down significantly off the highs almost every day? Answer: The futures market that trades 24-hours a day, populated by the big gamblers and hedge funds that have the most profound effect in driving prices of all factors. These people place their bets and takes their chances and all physical market investors are taken along for the ride – good or bad. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Jan 2017 12:14 PM PST This post The Ice-Nine Lockdown appeared first on Daily Reckoning. [Ed. Note: Jim Rickards latest New York Times best seller, The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis (claim your free copy here) transcends politics and media to prepare you for the next crisis in the ice-nine lockdown.] I am often asked, "Does Ice-Nine put gold at risk of lockdown or confiscation?" First, Ice-Nine is a phrase borrowed from author, Kurt Vonnegut. Vonnegut wrote a book in the early 1960s called Cat's Cradle, and it's a doomsday scenario. In Cat's Cradle, a doomsday machine is created. Scientists discovered a molecule called Ice-Nine, very similar to water (H₂O) with two differences. Number one, it has a melting point of 114.4°F. Which means it's frozen at room temperature. The other characteristic is if a molecule of Ice-Nine comes in contact with a molecule of water, the water turns to Ice-Nine. In other words, it turns to a form of ice. The plot of the book was that there was only a small amount of this Ice-Nine and the scientist gave it to his three children in vials. As long as the vials were sealed, it was all good. If you open the vial and pour the Ice-Nine into a stream, the stream would freeze, then the lake would freeze, a river would freeze, a ocean would freeze, the entire plant would freeze. We would be in a new ice age and life on Earth would be wiped out. It's a doomsday machine. I took that as a metaphor to explain what's going to happen in the financial system and the next financial crisis. This is really what my book The Road to Ruin is about. (I describe all the critical details in The Road to Ruin. Go here now to get your copy for free, instead of paying the full $23). Physical gold and silver are the answer to Ice-Nine. I don't think they're in jeopardy in an Ice-Nine scenario. I think that gold and silver are one of the ways to survive Ice-Nine. It the crisis of 1998, which I was very involved in negotiating a solution, prior to the crisis of 1998. What we saw in 1998 was Wall Street get together and bail out the hedge fund Long-Term Capital Management. Then in 2008, the central banks got together and bailed out Wall Street. In the next crisis, 2018, maybe sooner, maybe tomorrow, who's going to bail out the central banks? Each bailout gets bigger than the one before. Each crisis gets bigger than the one before. We are now at the point where the ability of central banks to reliquify the system is in doubt because they're heavily stretched. The central bank balance sheets are extremely bloated. Central banks have printed so much money already, it's not obvious that they can do it again from the current levels without destroying confidence in the dollar, and all major currencies. The question is, where will the liquidity come from in the next financial crisis if it can't come from the central banks? The answer is the IMF. The International Monetary Fund has the only clean balance sheet out of the major financial institutions. It can print money. They call it the SDR, the Special Drawing Rights. I call new world money. The IMF can flood the market, and the world with trillions of SDRs equivalent to more than trillions of dollars which is exactly how they'll do it. There is a problem with this model at the IMF though. It's got a 24-member executive committee representing 24 nations around the world, or groups of nations. Every five years they change the voting rights. It so happens that 2017 is one of those five-year reviews where they're going to increase the voting rights of Brazil, Russia, India, China and South Africa (BRICS). The so-called BRICS are going to get more votes and potential veto power within the IMF model. When it comes time for the IMF to issue world money (SDRs) to reliquify the world, there's going to be a negotiation period. It will to take months to complete. During the last crisis this took 11 months. That was when the crisis hit in September, 2008 we saw Lehman Brothers hit a crisis, the IMF began to issue SDRs in August 2009. Even though they react on a case basis, it's going to take, an estimated 3 or 4 months at least to get SDRs issued. In that interim period between the crisis and the time the IMF can react, central banks will be paralyzed. They're likely going to lock down the system. When I say lock down, they'll start with money market funds. I can't think of a greater misnomer than the money market funds. People think that money market funds are money. They're not money; they're mutual funds regulated by the SEC. People think they can just call up their broker, sell to the money market fund and the money's in my bank the next day. That will not be true in this crisis because everyone will be doing the same thing. That is what happened in 2008 when Ben Bernanke and Hank Paulson went to the White House and said to the President that the system's melting down and he must act. That was such a shock then, that when it happens again they're not going to give you your money. They're going to lock it down. The problem is, and this is where the Ice-Nine metaphor comes in, is that when it is spreading you can't just lock down part of the system. If you lock down money market funds, people are just going to take their money out of the banks. Then you're going to have to close the banks. Then people are going to sell their stocks, then you're going to have to close the stock market. Every time you shut one path to liquidity, people are going to turn to another path. The metaphor of Ice-Nine is that it spreads from molecule to molecule, institution to institution, requiring a freeze on the entire system. It happened in part in 1914, 1931, 1933 and to gold in 1971. There's no precedent for a total freeze but we're getting closer to that point. The question is, how do you protect yourself against that? There's only so much you can do. I don't recommend running down and pulling all your money out of the bank. I would not have more than the insured amount, which in the U.S. is $250,000. You can spread it between your selected banks so that each is backed and insured up to the limit. The thing about gold and silver is that it needs to be in physical form, in safe storage, and a non-bank. Putting it in a safety deposit box in a bank is troublesome because by the time you want it the most, that will be when the banks are going to be closed. That's Ice-Nine. In the world described, the dollar price of gold will be approach the $10,000-level if not much higher. Don't wait on gold, because when all of this begins to play out, you're not going to be able to get gold. Ice-Nine is a freeze of the financial system, it's something that's happened before, it'll happen again in the next crisis. Physical gold and silver is the answer to Ice-Nine, and you should get it while you still can. Regards, Jim Rickards The post The Ice-Nine Lockdown appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Best of 2017 Trump Rally Confrontations Compilation Posted: 23 Jan 2017 11:05 AM PST Trump supporter Snaps on Protesters night before inauguration "THIS IS MY AMERICA" And people seriously still whine about the KKK. Yeah when was the last time they rioted, injured people and destroyed stuff to this extend? The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Jan 2017 10:15 AM PST Finance and Eco. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global markets turn back on euro as economic woes reinforce dollar as the currency of choice Posted: 23 Jan 2017 09:34 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FTSE 100 extends losses and pound hits five-week high as unease over Trump weakens dollar Posted: 23 Jan 2017 09:18 AM PST This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking News From The Pentagon! Obama’s Chief Advisor Valerie Jarrett’s Real Identity Revealed Posted: 23 Jan 2017 09:16 AM PST Shocking News From The Pentagon! Obama's Chief Advisor Valerie Jarrett's Real Identity Revealed, Mahmoud Ahmadinejad So Valerie Jaret is from Iran,huma abadeen is from Saudi Arabia hmmmmm. These muslims done infiltrated our gubernment The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: Ireland conceals basic information about its gold reserves Posted: 23 Jan 2017 08:20 AM PST 11:20a ET Monday, January 23, 2017 Dear Friend of GATA and Gold: Gold researcher Ronan Manly today begins a two-part series of essays showing how Ireland's central bank is striving to conceal basic information about the country's gold reserves. Manly's essay is headlined "Ireland's Monetary Gold Reserves: High-Level Secrecy vs. Freedom of Information -- Part I" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/irelands-monetary-gold-res... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chris Powell: Currency regime has run the world for 'America first' since 1945 Posted: 23 Jan 2017 07:58 AM PST Trump's Megalomaniac Delusion: 'Now I Am the People' By Chris Powell http://www.journalinquirer.com/opinion/chris_powell/trump-s-megalomaniac... President Trump's inaugural address was based on the ridiculous conceit that he somehow had received a mandate for running second in the election with just 46 percent of the vote, almost 3 million votes behind the leader, who didn't do so well herself. With his ascension, Trump said, "we are not merely transferring power from one administration to another, or from one party to another, but we are transferring power from Washington and giving it back to you, the American people." Or as the megalomanical politician invented by the Firesign Theater in 1970 said, "Now I am the people." Continuing to pander, Trump offered another ridiculous conceit -- that "a small group in our nation's capital" has been cheating all the good people of the country. ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. In fact, while the country purports to hate Congress, it loves its own congressman, almost always re-electing him because he does his best to cheat every other congressman's district for the benefit of his own. That is, nearly everyone is on the government gravy train one way or another but still fashions himself exploited. "We've made other countries rich while the wealth, strength, and confidence of our country have disappeared over the horizon," the new president said. "The wealth of our middle class has been ripped from their homes and then redistributed across the entire world. ... From this moment on, it's going to be America first." Except that since 1945, when, by international agreement, the U.S. dollar was installed as the world reserve currency, the world itself has been run on an "America first" basis. That's because for international trade the world has been required to use currency issued only by the U.S. government, allowing the United States to run huge trade deficits, thereby essentially taxing the world for using the dollar so Americans can consume far more than they produce. This currency arrangement is a primary cause of the decline of simple manufacturing in the United States, about which Trump complained during his campaign and again in his inaugural address. "America first"? It has been a long time since it was otherwise. The protectionism and tariffs the new president seemed to advocate in his address will not be good for the complex manufacturing in which the United States now excels. Protectionism and tariffs will be reciprocated and may be as bad for Boeing and Pratt & Whitney as they may be good for Airbus and Rolls Royce. Trump's address included fair grievances: "Mothers and children trapped in poverty in our inner cities. Rusted-out factories scattered like tombstones across the landscape of our nation. An education system flush with cash but which leaves our young and beautiful students deprived of knowledge. And the crime and gangs and drugs that have stolen too many lives and robbed our country of so much unrealized potential. ... We have defended other nations' borders while refusing to defend our own." But Trump's own response to these problems was only the most delusional megalomania. "This American carnage stops right here and stops right now," the new president said before hurrying off to march in the inaugural parade and dance at the inaugural balls. A new week has begun and of course the "carnage" has not stopped or even slowed, for mere proclamations are powerless against problems arising from mistaken policies of long standing. The country may not even be capable of addressing these problems while it is as divided politically, philosophically, and socially as Weimar Germany was divided between Nazis and Communists. Indeed, as the tribune of America's populist right was taking his oath, just a few blocks away the neo-Stalinist left was already rioting, smashing windows and burning cars. ----- Chris Powell is managing editor of the Journal Inquirer. Join GATA here: Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

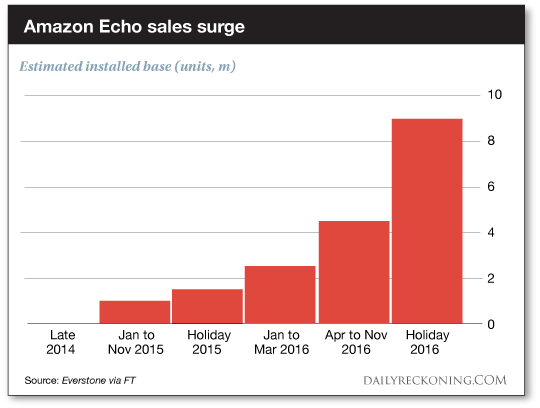

| This Girl Knows All Your Secrets… And She’s A “Buy” Posted: 23 Jan 2017 07:40 AM PST This post This Girl Knows All Your Secrets… And She’s A “Buy” appeared first on Daily Reckoning. If high-tech companies rifling through your personal information freaks you out, you're going to want to keep reading… Or you might want to just go back to bed. Today, I'm going to reveal how one of the world's biggest public companies has infiltrated every single aspect of your life. It knows your likes and dislikes. It can predict what you're going to buy and when you're going to buy it. It even knows what sports and shows you enjoy in your free time. And no, I'm not talking about Facebook. It all comes down to a product that cost this company more than $300 million in losses last year. This loss-leader has the potential to eavesdrop on many of your conversations. But it's much more than a sales gimmick. In fact, this product has a shot at vaulting its parent company to new heights. The product is called the Amazon Echo. You've probably seen these before (or at least an advertisement). The Echo is a desktop speaker that looks like a big hockey puck. It responds to voice commands with its breakthrough software called Alexa. You can tell Alexa to play your favorite music, ask her about the weather, or even tell her to order specific products through Amazon. The Echo is a neat little gadget. But our focus today revolves around the Alexa software. That's where Amazon is making its hay… "In the two years since its release, Alexa has spread like wildfire, and the voice service is now integrated into dozens of home gadgets, including refrigerators and, soon, cars," the Financial Times explains. "Amazon hopes that Alexa Voice Services, the digital mind behind the assistant, will become ubiquitous wherever voice commands are used."

Most folks don't list Amazon as a tech company. That's fair. It's "officially" a consumer stock—I get it. But this doesn't mean Bezos & Co. are mailing it in when it comes to groundbreaking technical innovations… Amazon is already dominating webhosting. Now, it's looking to control the world of artificial intelligence via a virtual assistant. Amazon revealed at CES that there are now more than 7,000 Alexa skills, which Geek Wires explains as "third-party integrations that extend the capabilities of its voice platform." Alexa developers are in this game to dominate voice. And as Alexa continues to "learn" new skills and integrate with additional products, she will be a force to reckon with in the tech world. Google owns search. Netflix owns streaming. If Amazon continues developing Alexa at the current rate, the company will own voice. This venture will entrench Amazon inside every home in America. On Friday, we highlighted the ongoing meltdown of the brick and mortar retail sector. While traditional retailers are attempting to lure you into their stores with coupons and sales, we explained, Amazon is sneaking into your home and your everyday life. It's clear that Amazon is dominating the retail landscape for one important reason: It's just plain smarter than the competition… The Echo is the Trojan Horse. Alexa—the software—is what Amazon will use to perfect its ability to gather every shred of information about you and your family to add to its consumer database. It's a scary thought. But that's one of the reasons we're so bullish on Amazon in the long run. With its technological head start in the voice segment, there's no stopping this juggernaut… Sincerely, Greg Guenthner The post This Girl Knows All Your Secrets… And She’s A “Buy” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SWOT Analysis: Gold Moves On Trump Inauguration Posted: 23 Jan 2017 07:14 AM PST The best performing precious metal for the week was palladium with a gain of 4.92 percent. Most of the gains came on Friday after Sibanya Gold's proposed acquisition of Stillwater Mining passed U.S. antitrust conditions. Not only does Stillwater produce palladium, it's also one of the largest recyclers of used automobile catalytic converters. James Steel of HSBC noted that the supply of palladium has stagnated in recent years while auto sales have soared. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ireland’s Monetary Gold Reserves: High Level Secrecy vs. Freedom of Information – Part I Posted: 23 Jan 2017 07:12 AM PST This article and a sequel article together chronicle a long-running investigation that has attempted, with limited success to date, to establish a number of basic details about Ireland's official monetary gold reserves, basic details such as whether this gold is actually allocated, what type of storage contract the gold is stored under, and supporting documentation in the form of a gold bar weight list. Ireland's gold reserves are held by the Central Bank of Ireland but are predominantly stored (supposedly) with the Bank of England in London. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Silver, Gold and Commodities in 2017 Posted: 23 Jan 2017 07:09 AM PST China launched the One Belt One Road (OBOR) project 5+ years ago and made their first rail delivery in February 2016. China has been stock piling commodities, especially base metals, like copper and steel, for the past 2+ years in order to produce all the finished goods necessary to construct the largest infrastructure the world has ever seen. In 2016 we witnessed close to a doubling of the market price for iron ore and Alasdair sees this trend continuing into 2017. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Jan 2017 07:08 AM PST The action favored bettors this holiday-shortened week (Monday was Martin Luther King day in the US), with the price of gold up 13 bucks and silver up 26 cents. We noticed a worrisome remark by newly inaugurated President Trump. The strong dollar of the past 20 years, he said, is not good for American competitiveness. Let's just tackle this straight on. Actually, we will address three distinct issues. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold And Interest Rates…GET IT STRAIGHT Posted: 23 Jan 2017 02:31 AM PST Over the past couple of months there have been several headline articles regarding the relationship between gold and interest rates. Most of them are well-meaning attempts to convey information about recent changes in the markets as interest rates head higher. In several instances, however, the author(s) have tried to explain a ‘perceived’ correlation between rising interest rates and the value of the US dollar – in a very positive manner. And they have imputed a similar correlation – albeit negative – in other statements with respect to Gold. In both cases they are incorrect. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Jan 2017 02:01 AM PST Gold to Regain Its Gleam! One question that gold investors are asking now is, will 2017 be as spectacular for the yellow metal as it was in 2016? The short and sweet answer to this is YES. The dollar, gold and the major U.S. stock exchanges will all see new highs. Gold is currently in a “complex corrective correction” while experiencing its’ last pullback, beforehand. Both the short-term outlook and the long-term outlook for gold is BULLISH! Trumps’ victory win is a positive for gold bulls. Policy uncertainty and slowing growth, following a Trump win, will stoke the yellow metals’ price in 2017. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 23 Jan 2017 01:37 AM PST US stocks set to open down, gold and silver near multi-week high. President Trump begins with flurry of changes to Obamacare and NAFTA. Earnings season starting well for banks and miners. Global debt continues to soar, especially in China. Fake news debate rages. Trump and Merkel trade insults. Best Of The Web What is […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Columbus Gold Comes to a Fork in the Road Posted: 23 Jan 2017 12:00 AM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Futures Prices Looking Bullish Posted: 22 Jan 2017 05:37 AM PST Gold has rebounded sharply higher in the past month, taking the early lead as 2017’s best-performing asset class. Normally such a big gold surge would require heavy gold-futures buying by speculators. But they’ve been missing in action, barely moving any capital into gold yet. Their collective bets on this metal remain very bearish. Since they are such a strong contrarian indicator, that’s a very-bullish omen for gold. The sole mission of speculation and investment, and thus all the endless research that feeds into it, is to multiply wealth. Traders can’t effectively buy low and sell high unless they understand what drives the prices of their trades. For years now, gold has had two overwhelmingly-dominant drivers. Their capital flows fully explain the vast majority of all gold’s price action, and thus are exceedingly important to study. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jan 2017 05:11 AM PST The performance of gold in 2017 depends largely on whether the Trump’s presidency will lead to lasting shift in the markets. What changes do we mean? Some analysts mention the reflation, others point out the ‘risk on’ sentiment and the ‘great rotation’ out of bonds and into stocks. Ray Dalio, the founder and chairman of Bridgewater, claims that the Trump’s victory was a turning point ending the period characterized by increasing globalization, free trade, and global connectedness; relatively innocuous fiscal policies; sluggish GDP growth, low inflation, and falling bond yields. The new period is believed to be characterized more by decreasing globalization, free trade, and global connectedness; aggressively stimulative fiscal policies; increased economic growth, higher inflation, and rising bond yields. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Ratio Suggests Gold Is Entering a Major Bull Market Posted: 22 Jan 2017 05:08 AM PST An often cited negative about gold is the inability for investors to value it, unlike traditional investments such as stocks and bonds. A company’s revenues and earnings can be forecast to arrive at a valuation multiple. A bond’s cash flows can be discounted to come up with a present value. But since gold bullion does not produce either, investors often struggle with assigning a fair value. Some will look at technical analysis, others fundamentals, interest rates, or expected inflation—but unfortunately there’s no correct answer, and attempting to time the market when choosing an entry point is extremely difficult. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time for Crude Oil Price Drop below $50? Posted: 21 Jan 2017 09:59 AM PST Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. On Wednesday, crude oil lost 2.57% after the head of the IEA warned of a significant increase in U.S. shale output as OPEC and non-OPEC producers cut output. This news negatively affected the investors' sentiment and pushed the black gold under important support levels. What does it mean for light crude? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jack Chan: This Past Week in Gold and Silver Posted: 21 Jan 2017 12:00 AM PST Technical analyst Jack Chan charts the latest moves in the gold and silver markets. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment