Gold World News Flash |

- Gold: Getting There A Little At A Time

- Gold Market Charts - A Month in Review

- Silver Prices and the Russian Connection

- End Times Headline News - January 1st, 2017

- How A United Iran, Russia, & China Are Changing The World

- 2017 Chilling Predictions By Baba Vanga

- Drug Cartels Get Involved As Mexicans Rage, Protest Surging Gas Prices

- A Biased 2017 Forecast, Part 1

- Note ban seen shaving a third of India's gold demand in 2017

- Clif High-2017 Predictions on Everything

- BREAKING: WIKILEAKS Just PROVED OBAMA IS LYING ABOUT RUSSIA & Trying To SABOTAGE TRUMP’s PRESIDENCY!

- Alan Watts ~ The Freedom To Make Mistakes

- Gold: Getting There A Little At A Time

- The Stock Market Has Topped. Next Up the US Dollar Driven Bloodbath

- Is China About to Demand the US Dollar Lose Reserve Currency Status?

- Take The Blue Pill?

- Gold And Silver 2017 – The Golden Lye

- Breaking News And Best Of The Web

| Gold: Getting There A Little At A Time Posted: 02 Jan 2017 12:01 PM PST One of life's hardest-to-learn but most necessary lessons is that things usually take a lot longer to work out than you'd like them to. That's where the sayings "Being too early is the same thing as being wrong" and "The market can stay irrational longer than you can stay solvent" come from. A current case in point is gold. After the metal's decade-long bull market, a correction was inevitable. But when it finally came, rather than being short and cathartic it was long and grinding, stretching from 2012 through 2015 and causing many who got back in prematurely to eventually walk away in disgust. |

| Gold Market Charts - A Month in Review Posted: 02 Jan 2017 01:05 AM PST Gains Pains & Capital |

| Silver Prices and the Russian Connection Posted: 01 Jan 2017 11:01 PM PST Silver prices nearly reached $50.00 in April of 2011. They crashed to a low under $14 in December of 2015 and currently (December 2016) sit at about $16. Silver prices, in our increasingly unreal... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| End Times Headline News - January 1st, 2017 Posted: 01 Jan 2017 09:30 PM PST Wars, wars, wars...when we aren't in a war we are hearing about wars. Yeshua told us all about the wars. CERN shaking our dome and causing massive earthquakes just like Yeshua said. Its gonna get worse and there is only 1 way out. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| How A United Iran, Russia, & China Are Changing The World Posted: 01 Jan 2017 07:30 PM PST Submitted by Federico Pieraccini via Strategic-Culture.org, The two previous articles have focused on the various geopolitical theories, their translations into modern concepts, and practical actions that the United States has taken in recent decades to aspire to global dominance. This segment will describe how Iran, China and Russia have over the years adopted a variety of economic and military actions to repel the continual assault on their sovereignty by the West; in particular, how the American drive for global hegemony has actually accelerated the end of the 'unipolar moment' thanks to the emergence of a multipolar world. From the moment the Berlin Wall fell, the United States saw a unique opportunity to pursue the goal of being the sole global hegemon. With the end of the Soviet Union, Washington could undoubtedly aspire to planetary domination paying little heed to the threat of competition and especially of any consequences. America found herself the one and only global superpower, faced with the prospect of extending cultural and economic model around the planet, where necessary by military means. Over the past 25 years there have been numerous examples demonstrating how Washington has had little hesitation in bombing nations reluctant to kowtow to Western wishes. In other examples, an economic battering ram, based on predatory capitalism and financial speculation, has literally destroyed sovereign nations, further enriching the US and European financial elite in the process. Alliances to ResistIn the course of the last two decades, the relationship between the three major powers of the Heartland, the heart of the Earth, changed radically. Iran, Russia and China have fully understood that union and cooperation are the only means for mutual reinforcement. The need to fight a common problem, represented by a growing American influence in domestic affairs, has forced Tehran, Beijing and Moscow to resolve their differences and embrace a unified strategy in the common interest of defending their sovereignty. Events such as the war in Syria, the bombing of Libya, the overthrowing of the democratic order in Ukraine, sanctions against Iran, and the direct pressure applied to Beijing in the South China Sea, have accelerated integration among nations that in the early 1990s had very little in common. Economic IntegrationAnalyzing US economic power it is clear that supranational organizations like the World Trade Organization, International Monetary Fund and the World Bank guarantee Washington’s role as the economic leader. The pillars that support the centrality of the United States in the world economy can be attributed to the monetary policy of the Fed and the function of the dollar as a global reserve currency. The Fed has unlimited ability to print money to finance further economic power of the private and public sector as well as to pay the bill due for very costly wars. The US dollar plays a central role as the global reserve currency as well as being used as currency for trade. This virtually obliges each central bank to own reserves in US currency, continuing to perpetuate the importance of Washington in the global economic system. The introduction of the yuan into the international basket of the IMF, global agreements for the Asian Infrastructure Investment Bank (AIIB), and Beijing’s protests against its treatment by the World Trade Organization (WTO) are all alarm bells for American strategists who see the role of the American currency eroding. In Russia, the central bank decided not to accumulate dollar reserves, favoring instead foreign currency like the Indian rupee and the Chinese yuan. The rating agencies - western financial-oligarchy tools -have diminishing credibility, having become means to manipulate markets to favor specific US interests. Chinese and Russian independent rating agencies are further confirmation of Beijing and Moscow’s strategy to undermine America’s role in western economics. De-dollarization is occurring and proceeding rapidly, especially in areas of mutual business interest. In what is becoming increasingly routine, nations are dealing in commodities by negotiating in currencies other than the dollar. The benefit is twofold: a reduction in the role of the dollar in their sovereign affairs, and an increase in synergies between allied nations. Iran and India exchanged oil in rupees, and China and Russia trade in yuan. Another advantage enjoyed by the United States, intrinsically linked to the banking private sector, is the political pressure that Americans can apply through financial and banking institutions. The most striking example is seen in the exclusion of Iran from the SWIFT international system of payments, as well as the extension of sanctions, including the freezing of Tehran's assets (about 150 billion US dollars) in foreign bank deposits. While the US is trying to crack down on independent economic initiatives, nations like Iran, Russia and China are increasing their synergies. During the period of sanctions against Iran, the Russian Federation has traded with the Islamic Republic in primary commodities. China has supported Iran with the export of oil purchased in yuan. More generally, Moscow has proposed the creation of an alternative banking system to the SWIFT system. Private Banks, central banks, ratings agencies and supranational organizations depend in large part on the role played by the dollar and the Fed. The first goal of Iran, Russia and China is of course to make these international bodies less influential. Economic multipolarity is the first as well as the most incisive way to expand the free choice before each nation to pursue its own interests, thereby retaining its national sovereignty. This fictitious and corrupt financial system led to the financial crisis of 2008. Tools to accumulate wealth by the elite, artificially maintaining a zombie system (turbo capitalism) have served to cause havoc in the private and public sectors, such as with the collapse of Lehman Brothers or the crisis in the Asian markets in the late 1990s. The need for Russia, China and Iran to find an alternative economic system is also necessary to secure vital aspects of the domestic economy. The stock-market crash in China, the depreciation of the ruble in Russia, and the illegal sanctions imposed on Iran have played a profound role in concentrating the minds of Moscow, Tehran and Beijing. Ignoring the problem borne of the centrality of the dollar would have only increased the influence and role of Washington. Finding points of convergence instead of being divided was an absolute must and not an option. A perfect example, explaining the failed American economic approach, can be seen in recent years with the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (TTIP), two commercial agreements that were supposed to seal the economic trade supremacy of the US. The growing economic alternatives proposed by the union of intent between Russia, China and Iran has enabled smaller nations to reject the US proposals to seek better trade deals elsewhere. In this sense, the Free Trade Area of ??the Asia Pacific (FTAAP) proposed by Beijing is increasingly appreciated in Asia as an alternative to the TPP. In the same way, the Eurasian Union (EAEU) and the Commonwealth of Independent States (CIS) have always been key components for Moscow. The function these institutions play was noticeably accelerated following the coup in Ukraine and the resulting need for Russia to turn east in search of new business partners. Finally, Iran, chosen by Beijing as the crossroad of land and sea transit, is a prime example of integration between powers geographically distant but with great intentions to integrate vital structures of commerce. The Chinese model of development, called Silk Road 2.0, poses a serious threat to American global hegemonic processes. The goal for Beijing is to reach full integration between the countries of the Heartland and Rimland, utilizing the concept of sea power and land power. With an investment of 1,000 billion US dollars over ten years, China itself becomes a link between the west, represented by Europe; the east, represented by China itself; the north, with the Eurasian economic space; the south, with India; Southeast Asia; the Persian Gulf and Middle East. The hope is that economic cooperation will lead to the resolution of discrepancies and strategic differences between countries thanks to trade agreements that are beneficiary to all sides. The role of Washington continues to be that of destruction rather than construction. Instead of playing the role of a global superpower that is interested in business and trade with other nations, the United States continues to consider any foreign decision in matters of integration, finance, economy and development to lie within its exclusive domain. The primary purpose of the United States is simply to exploit every economic and cultural instrument available to prevent cohesion and coexistence between nations. The military component is usually the trump card, historically used to impose this vision on the rest of the world. In recent years, thanks to de-dollarization and military integration, nations like Iran, Russia and China are less subject to Washington's unilateral decisions. Military deterrenceAccompanying the important economic integration is strong military-strategic cooperation, which is much less publicized. Events such as the Middle East wars, the coup in Ukraine, and the pressure exerted in the South China Sea have forced Tehran, Moscow and Beijing to conclude that the United States represents an existential threat. In each of the above scenarios, China, Russia and Iran have had to make decisions by weighing the pros and cons of an opposition to the American model. The Ukraine coup d’état brought NATO to the borders of the Russian Federation, representing an existential threat to the Russia, threatening as it does its nuclear deterrent. In the Middle East, the destruction of Iraq, Libya and Syria has obliged Tehran to react against the alliance formed between Saudi Arabia, Turkey and the United States. In China, the constant pressure on South China Sea poses a serious problem in case of a trade blockade during a conflict. In all these scenarios, American imperialism has created existential threats. It is for this reason natural that cooperation and technological development, even in the military area, have received a major boost in recent years. In the event of an American attack on Russia, China and Iran, it is important to focus on what weapon systems would be used and how the attacked nations could respond. Maritime Strategy and DeterrenceCertainly, US naval force place a serious question mark over the defense capabilities of nations like Russia, China and Iran, which strongly depend on transit via sea routes. Let us take, for example, Russia and the Arctic transit route, of great interest not only for defense purposes but also being a quick passage for transit goods. The Black Sea for these reasons has received special attention from the United States due to its strategic location. In any case, the responses have been proportional to the threat. Iran has significantly developed maritime capabilities in the Persian Gulf, often closely marking ships of the US Navy located in the area for the purposes of ??deterrence. China's strategy has been even more refined, with the use of dozens, if not hundreds, of fishing boats and ships of the Coast Guard to ensure safety and strengthen the naval presence in the South and East China Sea. This is all without forgetting the maritime strategy outlined by the PLA Navy to become a regional naval power over the next few years. Similar strategic decisions have been taken by the navy of the Russian Federation. In addition to having taken over ship production as in Soviet times, it has opted for the development of ships that cost less but nevertheless boast equivalent weapons systems to the Americans carrier groups. Iran, China and Russia make efficiency and cost containment a tactic to balance the growing aggressiveness of the Americans and the attendant cost of such a military strategy. The fundamental difference between the naval approach of these countries in contrast to that of the US is paramount. Washington needs to use its naval power for offensive purposes, whereas Tehran, Moscow and Beijing need naval power exclusively for defensive purposes. In this sense, among the greatest weapons these three recalcitrant countries possess are anti-ship, anti-aircraft and anti-ballistic systems. To put things simply, it is enough to note that Russian weapons systems such as the S-300 and S-400 air-defense systems (the S-500 will be operational in 2017) are now being adopted by China and Iran with variations developed locally. Increasingly we are witnessing an open transfer of technology to continue the work of denying (A2/AD) physical and cyberspace freedom to the United States. Stealth aircraft, carrier strike groups, ICBMs and cruise missiles are experiencing a difficult time in such an environment, finding themselves opposed by the formidable defense systems the Russians, Iranians and Chinese are presenting. The cost of an anti-ship missile fired from the Chinese coast is considerably lower than the tens of billions of dollars needed to build an aircraft carrier. This paradigm of cost and efficiency is what has shaped the military spending of China, Russia and Iran. Going toe to toe with the United States without being forced to close a huge military gap is the only viable way to achieve immediate tangible benefits of deterrence and thereby block American expansionist ambitions. A clear example of where the Americans have encountered military opposition at an advanced level has been in Syria. The systems deployed by Iran and Russia to protect the Syrian government presented the Americans with the prospect of facing heavy losses in the event of an attack on Damascus. The same also holds for the anti-Iranian rhetoric of certain American politicians and Israeli leaders. The only reason why Syria and Iran remain sovereign nations is because of the military cost that an invasion or bombing would have brought to their invaders. This is the essence of deterrence. Of course, this argument only takes into partial account the nuclear aspect that this author has extensively discussed in a previous article. The Union of the nations of the Heartland and Rimland will make the United States irrelevantThe future for the most important area of ??the planet is already sealed. The overall integration of Beijing, Moscow and Tehran provides the necessary antibodies to foreign aggression in military and economic form. De-dollarization, coupled with an infrastructure roadmap such as the Chinese Silk Road 2.0 and the maritime trade route, offer important opportunities for developing nations that occupy the geographical space between Portugal and China. Dozens of nations have all it takes to integrate for mutually beneficial gains without having to worry too much about American threats. The economic alternative offered from Beijing provides a fairly wide safety net for resisting American assaults in the same way that the military umbrella offered by these three military powers, such as with the the SCO for example, serves to guarantee the necessary independence and strategic autonomy. More and more nations are clearly rejecting American interference, favoring instead a dialogue with Beijing, Moscow and Tehran. Duterte in the Philippines is just the latest example of this trend. The multipolar future has gradually reduced the role of the United States in the world, primarily in reaction to her aggression seeking to achieve global domination. The constant quest for planetary hegemony has pushed nations who were initially western partners to reassess their role in the international order, passing slowly but progressively into the opposite camp to that of Washington. The consequences of this process have sealed the destiny of the United States, not only as a response to her quest for supremacy but also because of her efforts to maintain her role as the sole global superpower. As noted in previous articles, during the Cold War the aim for Washington was to prevent the formation of a union between the nations of the Heartland, who could then exclude the US from the most important area of ??the globe. With the fall of the Iron Curtain, sights were set on an improbable quest to conquer the Heartland nations with the intent of dominating the whole world. The consequences of this miscalculation have led the United States to being relegated to the role of mere observer, watching the unions and integrations occurring that will revolutionize the Eurasian zone and the planet over the next 50 years. The desperate search to extend Washington's unipolar moment has paradoxically accelerated the rise of a multipolar world. In the next and final article, I will throw a light on what is likely to be a change in the American approach to foreign policy. Keeping in mind the first two articles that examined the approach by land theorized by MacKinder as opposed to the Maritime Mahan, we will try and outline how Trump intends to adopt a containment approach to the Rimland, limiting the damage to the US caused by a complete integration between nations such as Russia, China, Iran and India. |

| 2017 Chilling Predictions By Baba Vanga Posted: 01 Jan 2017 05:30 PM PST In the year 2030. Gender no longer exists. Everyone identifies as Doritos flavors. I am Spicy Nacho, and this is my story..... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Drug Cartels Get Involved As Mexicans Rage, Protest Surging Gas Prices Posted: 01 Jan 2017 04:47 PM PST Even as Mexico has reasons to be concerned about the upcoming presidential inauguration of Donald Trump, who has vowed to make life, and especially trade relations, for Mexicans far more "complicated" under his administration, the population of Mexico has far more pressing problems at this moment, because just days after the finance ministry announced on December 27 that it would raise the price of gasoline by as much as 20.1% to 88 cents per liter while hiking diesel prices by 16.5% to 83 cents, the hikes went into effect on January 1, welcoming in the new year with a surge in the price of one of Mexico's most important staples and leading to widespread anger, protests and in some cases violence. As Telesur reports, the people of Mexico "are entering the New Year in a state of rage and anxiety" with protests planned for Sunday to strongly denounce the government's huge hike in gasoline prices. The sharp rise in gasoline prices has been called the "gasolinazo" in Spanish, which roughly translates to "gasoline-punch."

The price increase comes as part of a planned liberalization of Mexico's energy market, which involves the move from subsidies that kept gas prices low to a market-based pricing scheme that will adjust prices at the pump based on supply and demand. And while Mexico's unpopular president Enrique Pena Nieto had promised that fuel prices will fall thanks to his 2014 energy reforms, which dismantled the seven-decade-old national ownership of petroleum resources by state-owned firm Pemex, the initial move in prices has been higher, and decidedly so, by roughly 20% for gasoline and slightly less for diesel. The price ceiling will then be adjusted daily starting Feb. 18, before letting supply and demand determine them in March, although it is the immediate shock that is of concern to the peace and stability in Mexico. Case in point, around 100 protestors blocked a service station in Acapulco on Friday, while on Saturday an assembly of popular organizations in Chihuahua state's capital pledged to block all commercial transportation from entering or exiting the city as a means toward paralyzing the economy and pressuring the federal government to reverse the hikes. The assembly of people's organizations also announced their intention to block major highways and railways in response to what they see as a neoliberal looting of Mexico and handover of its resources to private capital, according to a statement. On Sunday, the day the price hikes went into effect, Excelsior reported that angry citizens protested in several spots of the capital, Mexico City, blocking roads, demanding a return to lower gas prices. But before readers blow this off as just another protest by an angry population which fails to grasp the "global deflationary collapse" while focusing on "fringe, outlier events" - at least in the words of central bankers - things suddenly got serious when none other than the country's powerful Jalisco New Generation cartel has entered the fray, threatening to burn gas stations in response to the price hikes, according to Jalisco authorities cited by TeleSur.

"They are speculating in order to obtain million dollar profits from the majority of the people who don't make even a minimum wage, we have already realized that the (shortage) of fuel is because dealers don't want to sell fuel unless they can do so at a profit, all of our people are now ready to start the mission," the Mexican drug cartel stated in a WhatsApp message circulating in Jalisco. "The CJNG, in support of the working class, commits itself to making burn all the gasoline stations that to December 30 of the current year, at 10:00 p.m." — before the price increases go into effect — "have not normalized the sale of fuel at the fair price," the message said, according to the Mexican news outlet Aristegui Noticias. Making matters worse is that Mexico was already facing fuel shortages prior to the price hike, angering Mexicans in several states. Ahead of the price hike many people have said they'd hoard gasoline, buying it from stations that in many states are already dealing with supply shortages. Illegal gas sales have popped up, and protests have already taken place in some parts of the country, with more planned in the days of the new year. "The fuel price increase causes outrage. People are right: it's not fair. I support each family, I share their outrage and anger," Aristoteles Sandoval, the governor of western Jalisco state, wrote on Twitter. Sandoval's criticism drew particular attention because he is a member of Pena Nieto's ruling Institutional Revolutionary Party or PRI. Furious opposition governors plan to meet with federal government officials next week to discuss the price hike. Meanwhile, the unpopular price hike is also becoming a key political talking point: "We just had a security meeting (between governors and Pena Nieto) days ago and there was not one comment about this situation," said Mexico City's Mayor Miguel Angel Mancera, a member of the opposition Party of the Democratic Revolution or PRD. The protests are the latest expression of widespread antipathy toward Pena Nieto, whose popularity according to Telesur has plummeted below 25% this year due to his government's widespread perception of collusion with cartels and failure to address drug-related violence, disappointing economic growth, violent repression of social movements and his unpopular decision to host Donald Trump before the anti-immigrant Republican won the U.S. presidential election. Not helping matters, Finance Minister Jose Antonio Meade defended the fuel price increase, saying it would not trigger more inflation and that eventually the "final price for consumers will be among the most competitive in the world." For now, however, the response has been a negative one, with social media criticism leveled at Meade, who has been portrated as "chupasangre", or "bloodsucker."

But ultimately, the price shock will hit those who are hurting the most. The increases would mean Mexicans, of whom 52% live in poverty, would spend more of their annual income on fuel than the residents of 59 other countries, according to data compiled by Bloomberg. "We see the gasolinazo as an attack against the population, as a robbery, taking into account the levels of income of the population," Jose Narro, director of the workers' group Coordinadora Nacional Plan de Ayala, told Reforma. Making matters worse, and refuting the promises of the finance minister, the Mexican central bank has warned that gas price increases would boost inflation at a time when the peso has already plunged against the US dollar due to the Trump victory. With or without the involvement of the cartels, Mexico's economy is likely to undergo a turbulent period of decline, which will be music in the ears for Mexico's opposition politicians, such as leftist opposition leader Andres Manuel Lopez Obrador who is likely to benefit from Pena Nieto's error, and who has put blame for the gasolinazo on the shoulders of Pena Nieto's center-right Institutional Revolutionary Party and the conservative National Action Party, calling the former "corrupt and cynical" and the latter hypocrites. The policy and its rollout have further diminished the perception of the Mexican president and his party, which has been a trend for some time. "Mexicans were promised lower electricity prices, they got higher electricity prices. Mexicans were told austerity was needed, they got a congress that showers itself with bonuses," Dutch journalist Jan-Albert Hootsen, wrote on Facebook. "Mexicans were promised more security and a fairer justice state, they got homicide rates back at the level of 2012, the Ayotzinapa massacre and its botched investigation, etc." "If you say one thing and are then time and time again perceived to do the exact opposite, what starts off as irritation among the public at some point will simply boil over," Hootsen concluded. For those on the lookout for new gray, or even black swans, in the new year, keep an eye on the public mood in Mexico as a result of the now effected surge in gas prices. |

| A Biased 2017 Forecast, Part 1 Posted: 01 Jan 2017 04:00 PM PST Submitted by Jim Quinn via The Burning Platform blog, “The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project. This was a completely new direction from his financial crisis books. I wasn’t sure whether it would keep my interest, but the story of Daniel Kahneman and Amos Tversky and their research into the psychology of judgement and decision making, creating a cognitive basis for common human errors that arise from heuristics and biases, was an eye opener. In psychology, heuristics are simple, efficient rules which people often use to form judgments and make decisions. They are mental shortcuts that usually involve focusing on one aspect of a complex problem and ignoring others. These rules work well under most circumstances, but they can lead to systematic deviations from logic, probability or rational choice theory. The resulting errors are called “cognitive biases” and many different types have been documented. Heuristics usually govern automatic, intuitive judgments but can also be used as deliberate mental strategies when working from limited information. Kahneman and Tversky created the heuristics and biases research program, which studies how people make real-world judgments and the conditions under which those judgments are unreliable. Their research challenged the idea that human beings are rational actors, but provided a theory of information processing to explain how people make estimates or choices. Kahneman won a Nobel Prize in economics for his work in behavioral economics. To put their research into terms the common person can understand, human decision making is extremely flawed due to our biases, feelings, irrational thought processes and beliefs in falsehoods. It’s over-confidence in our decision making ability that causes us the most problems. For the average person this can result in financial hardship, frustration or a premature death. When high level government officials, bankers or corporate executives make flawed decisions due to their biases, it can mean war, financial disasters, depressions, or disastrous legislation like Obamacare. Hubris, egotism and faulty reasoning, as noted by Mark Twain one hundred and fifty years ago, can kill you and in some cases lead to war and unthinkable levels of death and destruction. “It’s not what you don’t know that kills you, it’s what you know for sure that ain’t true.” – Mark Twain In the seven weeks since the election of Donald Trump as our next president, I’ve witnessed the largest case of hindsight bias in world history. Hindsight bias, also known as the knew-it-all-along effect or creeping determinism, is the inclination, after an event has occurred, to see the event as having been predictable, despite there having been little or no objective basis for predicting it. On November 7 the “expert” pollsters like Nate Silver; every corporate mainstream media network, newspaper, and website; along with elitist economists, professors, Hollywood movie stars, Wall Street bankers, and billionaire oligarchs; were 100% sure Hillary Clinton was going to be elected president. Only the deplorables thought otherwise – and they spoke loudly. Putin had nothing to do with the result. These very same “experts” and “deep thinkers” now act as if Trump’s election was foreseeable, predictable and the likely outcome. They bloviate about how and why he won as if they knew it was going to happen. When 99% of all establishment “experts” were sure Trump was going to be crushed in a Clinton landslide, why should anyone listen to a word they say? The same people who didn’t see even the faintest possibility of a Trump victory now expect the ignorant masses to believe their analysis of what will happen next. I would like to attribute their obtuseness to cognitive biases, but I believe it is more insidious. The Deep State propaganda machine is hard at work spreading falsehoods. “A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.” – Daniel Kahneman, Thinking, Fast and Slow The onslaught of 2017 predictions from a myriad of Wall Street “experts” talking their book, highly educated economists demonstrating their lack of prescience, mainstream media pundits peddling propaganda and cheerleaders cheering for their home teams, has already begun. I haven’t written an annual forecast article in a few years because I was tired of being wrong. Since I have no newsletters or books to sell, no investments to peddle, and no agenda to push, an annual forecast will just be my best guess at what will happen in 2017. The two biases most likely to color my analysis are confirmation bias (The tendency to focus on information in a way that confirms my preconceptions) and pessimism bias (The tendency to overestimate the likelihood of negative things happening). My family and friends think I’m a pessimist. I think I’m a realist. I try to use data to back-up my conclusions, but as George Dvorsky points out, our brains often lead us astray. “The human brain is capable of 1016 processes per second, which makes it far more powerful than any computer currently in existence. But that doesn’t mean our brains don’t have major limitations. The lowly calculator can do math thousands of times better than we can, and our memories are often less than useless — plus, we’re subject to cognitive biases, those annoying glitches in our thinking that cause us to make questionable decisions and reach erroneous conclusions.” – George Dvorsky My predictions will be framed by my belief we are midway through a Fourth Turning era of crisis. The three catalysts framing this Fourth Turning are debt, civic decay, and global disorder. No amount of normalcy bias, optimism bias, over-confidence, or desire for the status quo, will take precedence over the uncontrollable mechanisms propelling this Fourth Turning. We are in the midst of a once in a lifetime crisis and there is only one thing more frightening than not knowing what is coming next, and that is living in a world run by “experts” who think they know exactly what is going to happen next. These are the same “experts” who didn’t see the 2005 housing bubble, the 2008 financial collapse, the EU implosion, Brexit, or the Trump presidency. “It’s frightening to think that you might not know something, but more frightening to think that, by and large, the world is run by people who have faith that they know exactly what is going on.” – Amos Tversky I try to understand the world around me every day, but the hyper-complexity, noise, Deep State propaganda, and volume of data points is overwhelming to our easily distracted brains. I have constructed a story in my mind of how things will develop over the next five to ten years based upon the generational theory put forth by Strauss & Howe in their book The Fourth Turning. It is not a story with a happy ending. I don’t have high confidence that I understand how it will play out and what specific events will propel history in the making. I can admit my deficiencies, while people in power with the ability to blow up the world overestimate their understanding of the world and ignore the role of chance in events. “We are prone to overestimate how much we understand about the world and to underestimate the role of chance in events.” – Daniel Kahneman, Thinking, Fast and Slow Knowing what I don’t know about the unknowns, I’ll try and use what I do know to make some prognostications about 2017: Debt ForecastIt is fascinating to me no one seems all that worried about the systematically dangerous levels of global debt supporting essentially bankrupt governments, banks and consumers. Global debt stood at $142 trillion at the end of 2007, just prior to a worldwide financial meltdown, caused by too much bad debt in the financial system. To “fix” this problem, central bankers around the globe ramped up their electronic printing presses to hyper-drive and created another $57 trillion of debt by mid-2014. They haven’t taken their foot off the gas since. Today, global debt most certainly exceeds $225 trillion and has surpassed 300% of global GDP. Rogoff and Reinhart made a pretty strong case that when debt to GDP exceeds 90%, disaster will follow.

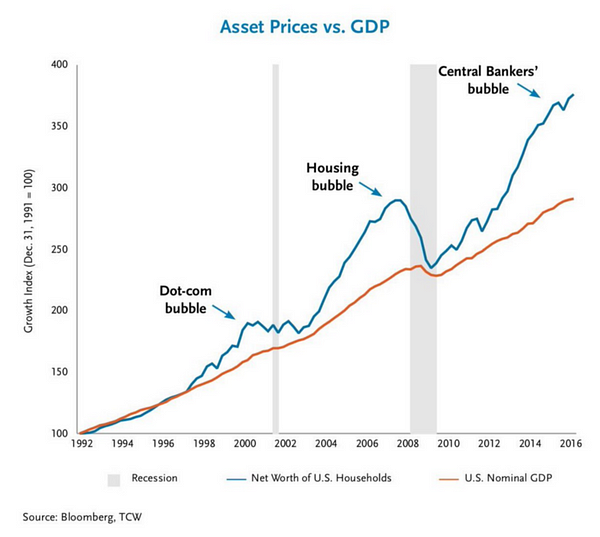

Global debt issuance reached a record $6.6 trillion in 2016, with corporations accounting for $3.6 trillion – most of which was used to buy back their stock at all-time highs. What could possibly go wrong? The level of normalcy bias amongst financial “experts”, the intelligentsia, and the common man is breathtaking to behold. We are in the midst of the mother of all bubbles, never witnessed in the history of mankind, and we pretend everything is normal, with no consequences for our reckless disregard for honesty, rational thinking, or simple math.

The 2000 dot.com bubble and the 2008 housing bubble were one dimensional. This mother of all bubbles required the global coordination and unprecedented irresponsible intervention of the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BOJ), the Bank of England (BOE) and the Swiss National Bank (SNB) to lead the world to the brink of monetary disaster. The highly educated theorists running these central banks have created tens of trillions in unpayable debt while suppressing interest rates to zero or below at the behest of their Deep State masters. The result is simultaneous bubbles in stocks, bonds and real estate. The pin destined to pop all the bubbles is slightly higher interest rates. The 1% increase in the 10 Year Treasury is already causing havoc in the housing market, the bond market and is hammering pension funds. With the hundreds of trillions in globally interconnected derivatives primed to detonate, 2017 could be an explosive year.

Here are a few things I think could happen in 2017 on the economic front:

“The illusion that we understand the past fosters overconfidence in our ability to predict the future.” – Daniel Kahneman, Thinking, Fast and Slow In Part Two of this article I will ponder how much further our civic decay and global disorder will advance in 2017. Over-confidence, hubris and arrogance of our leaders will be the driving factors. |

| Note ban seen shaving a third of India's gold demand in 2017 Posted: 01 Jan 2017 03:48 PM PST By Rejesh Bhayani Demonetization is expected to shave 300 tonnes off India's gold demand, which is unlikely to come back in a hurry. Average monthly gold imports, which have been around 65-70 tonnes for the past few years, halved between February and September this year. In October and November there was a recovery on account of festive buying and the marriage season. However, demonetization is expected to result in a drop in demand. Sudheesh Nambiath, lead analyst for precious metals demand in South Asia and the United Arab Emirates for GFMS-Thomson Reuters, said, "Our estimate is that 300 tonnes of gold demand, which were predominantly cash-based buying, will be shaved off in 2017." Average annual gold demand for the past seven years has been 875 tonnes, and around 85-90 percent of this gold has been imported. Analysts said around 20 percent of the demand was met through smuggled gold. ... ... For the remainder of the report: http://www.business-standard.com/article/economy-policy/demonetisation-t... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Clif High-2017 Predictions on Everything Posted: 01 Jan 2017 03:30 PM PST Internet data mining expert Clif High uses calls what he does "Predictive Linguistics," to mine the Internet and collects billions of data points to produce forecasts of the future. High has predictions on Trump, gold, silver, housing, stocks, bonds, the dollar, interest rates and even new... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: WIKILEAKS Just PROVED OBAMA IS LYING ABOUT RUSSIA & Trying To SABOTAGE TRUMP’s PRESIDENCY! Posted: 01 Jan 2017 12:30 PM PST Once more...Obama is stacking TREASONOUS ACTIONS one on top of another like fire wood. They will become HIS FUNERAL PYRE...and Trump is standing there ready to strike the match on Jan.21,2017 ! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Alan Watts ~ The Freedom To Make Mistakes Posted: 01 Jan 2017 11:30 AM PST Alan Watts explains how is it that through mistakes is that we learn from life ,interested in the lectures from Alan Watts . Follow the links below .alanwatts.org The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold: Getting There A Little At A Time Posted: 01 Jan 2017 10:59 AM PST One of life's hardest-to-learn but most necessary lessons is that things usually take a lot longer to work out than you'd like them to. That's where the sayings "Being too early is the same thing as being wrong" and "The market can stay irrational longer than you can stay solvent" come from. A current case […] The post Gold: Getting There A Little At A Time appeared first on DollarCollapse.com. |

| The Stock Market Has Topped. Next Up the US Dollar Driven Bloodbath Posted: 01 Jan 2017 10:31 AM PST The momentum driven post election rally has ended. Next up is the US Dollar driven collapse in the markets. Copper called this weeks ago as we noted before. No one listed. It’s now down nearly 10% from its peak and clinging to support for dear life. |

| Is China About to Demand the US Dollar Lose Reserve Currency Status? Posted: 01 Jan 2017 10:27 AM PST The biggest issue in the financial system… the issue that CNBC is completely avoiding… and 99% of professionals are ignoring is the US DOLLAR. The US Dollar has ripped to 103. |

| Posted: 01 Jan 2017 10:14 AM PST Stef it's hard for you to talk about redpills and blue pills when you still haven't taken the ultimate redpill we all know what I am talking about a certain race with special immunities that rhymes with Stew. Delicious beef stew. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold And Silver 2017 – The Golden Lye Posted: 01 Jan 2017 10:08 AM PST Lye – [noun] a strongly alkaline solution, esp. of potassium hydroxide, used for washing or cleansing. There has indeed been an ongoing cleansing in the precious metals market since the spike highs five years ago. Remember, there have been calls for a massive turnaround in prices for both gold and silver since 2013…2014…again, even more so in 2015. 2016 has just freshly passed, and both metals continue to flirt with their lows from a year ago. A few years ago, all the rage was for the man and woman on the street to be buying gold and silver coins, long lines, especially in China, forming for blocks to make purchases for the inevitable rally “sure” to soon follow. |

| Breaking News And Best Of The Web Posted: 01 Jan 2017 01:37 AM PST Stocks, gold, dollar fall in last trading day of 2016. US home sales decline, London real estate boom fading. Italian bank bail-out not going well. China money markets in turmoil. US retaliates against alleged Russian hacking. Fake news debate rages. Best Of The Web As we enter 2017, keep the big picture in mind […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment