Gold World News Flash |

- BIG MOVEMENT AHEAD IN THE SILVER MARKET… Serious Trouble In The Paper Markets

- What was the 'strong-dollar policy' except gold leasing and price suppression?

- American Small Businesses Party Like It's 2004

- Trump Honeymoon Ends Before Marriage Begins -- Peter Schiff

- Chinese New Home Prices Soar by 12.4% in December -- Higher by 25% in Tier One Cities

- Democratic Operatives Caught Planing Terror Attack On Inauguration Day

- Trump's options for weakening dollar extend far beyond tweeting

- "Common Sense" - Addressed To The Inhabitants Of 2017 America

- The European Debt Crisis Documentary

- Liberal Preppers Are "Tired Of Being Perceived As Wusses" - Stock Up On Guns, Food As Trumpocalypse Looms

- THE EMPIRE STRIKES BACK: 2017 and THE CIA’S WAR WITH TRUMP

- Ushering In a Totalitarian Police State in Cashless “Smart Cities”

- What was the 'strong-dollar policy' except gold leasing and price suppression?

- Returning Gold Bulls

- Bitcoin and Gold – Outlook and Safe Haven?

- Gold Rallies, Dollar Drops as Trump Says U.S. Currency is ‘Too Strong’

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 2%

- China’s Bogus Currency War Promise

- Momentum Traders Shift To Gold And Silver

- Bitcoin and Gold - Outlook, Volatility and Safe Haven Diversification

- In The News Today

- Peter Schiff on The Trump Economy

- Gold Stocks: Fabulous Rally Accelerates

- Rally in Gold and Gold Stocks Has More Upside

- Trump's comments send dollar reeling

- Trump Takes The Final Currency War Thermonuclear, Puts Gold Cartel On Notice!

- Here’s What Happens to Stocks After the Inauguration…

- Trump Takes The Final Currency War Thermonuclear, Puts Gold Cartel On Notice!

- The Dollar is Headed Down

- Trump will 'restate agenda for American Dream' as key adviser says US economy could cope with stronger dollar

- Damage Inflicted by Precious Metals Manipulation Is in the “Multi Billions†- Keith Neumeyer

- Breaking News And Best Of The Web

- Slivovo Gold Study Points to Further Exploration at Avrupa Minerals' JV

- Joint Venture Decision on Golden Arrow's Chinchillas Project Nears

- Top Ten Videos — January 17

- Trump's Comments Send the Dollar Reeling

- Gold Price Up Through 'Key' $1207 Level as 'Brexit Means UK Out of Single Market'

- Oil Prices Boosted By Struggling US Dollar

| BIG MOVEMENT AHEAD IN THE SILVER MARKET… Serious Trouble In The Paper Markets Posted: 18 Jan 2017 07:07 AM PST The Silver Market will experience a significant trend change in the future due the unraveling of the paper markets. Already we are witnessing a lot of political turmoil and havoc as President-elect Donald Trump gets ready to take over the White House in the next few days. It's also logical to assume the policy changes President-elect Trump wants to make will cause serious ramifications to the highly leveraged debt-based fiat monetary system… whether he realizes it or not. |

| What was the 'strong-dollar policy' except gold leasing and price suppression? Posted: 18 Jan 2017 07:03 AM PST GATA long has maintained that the "strong-dollar policy" was mainly gold price suppression, implemented largely through the gold carry trade devised by President Clinton's treasury secretary, former Goldman Sachs Chairman Robert Rubin, an enterprise in which Western central banks "leased" gold to investment banks at negligible interest rates and encouraged them to sell the metal and invest the proceeds in U.S. government bonds paying closer to 5 percent. |

| American Small Businesses Party Like It's 2004 Posted: 18 Jan 2017 07:01 AM PST That includes gold. As a friend recently reminded me, China's official gold holdings account for only 2 percent of its foreign reserves. Two percent! That's remarkably low, far lower than most large economies. (In the U.S., it's around 75 percent, according to the World Gold Council.) China is obviously interested in supporting its currency, and since it sold off quite a lot of U.S. Treasuries in the past year—Japan is now the top holder of U.S. government debt—it will likely need to substantially build up its gold reserves. |

| Trump Honeymoon Ends Before Marriage Begins -- Peter Schiff Posted: 17 Jan 2017 10:00 PM PST Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar in particular. Peter was one of the first from within the professional investment field to call... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Chinese New Home Prices Soar by 12.4% in December -- Higher by 25% in Tier One Cities Posted: 17 Jan 2017 08:34 PM PST What can go wrong, after all? The Chinese government has already informed us their real estate market, which is being driven by records amount of debt, is NOT in a bubble, so relax, chill and enjoy a large overflowing bowl of wanton soup. Take Larry Hu, for example, economist from Macquarie. He posited, back in October, that the +25% year over year price jumps for Chinese property wasn't indicative of a bubble...because MUH lack of supply. Perfectly normal stuff. Source: BBG

We can revisit a litany of smug remarks by any number of US economists before the US housing market collapsed -- almost mocking those who warned against unchecked gains in property prices. Take, for example, the missives of Jonathan McCarthy and Richard W. Peach -- senior economists at the NY Fed.

Content originally generated at iBankCoin.com |

| Democratic Operatives Caught Planing Terror Attack On Inauguration Day Posted: 17 Jan 2017 08:00 PM PST The left is still unwilling to accept Donald Trump as President and are planning all kinds of dirty tricks to try and derail his inauguration. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Trump's options for weakening dollar extend far beyond tweeting Posted: 17 Jan 2017 07:24 PM PST No mention of gold here. * * * By Andrea Wong https://www.bloomberg.com/news/articles/2017-01-17/president-trump-wants... Donald Trump may have a point: The dollar is indeed strong. Judging from the Federal Reserve's own trade-weighted dollar index, the U.S. currency is now around 7 percent above its four-decade average. A strong dollar isn't necessarily detrimental to the economy, but it may torpedo Trump's vision to revive America's manufacturing sector. Before his comments to the Wall Street Journal that the strong dollar is "killing" the ability of U.S. companies to compete, the 22 percent appreciation since mid-2014 had already worsened the trade deficit, while the full effect hasn't yet percolated into the real economy. ... Dispatch continues below... ADVERTISEMENT Storage and Withdrawal of Gold with Bullion Star in Singapore Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage rates are competitive. For more information, please visit Bullion Star here: What can Trump and his administration do if they want a weaker dollar? Here are five options. 1. Jawboning Talk is cheap, but it has worked for Trump -- so far. If history is any guide, traders stop listening to government officials and central bankers in the absence of concrete policies that target exchange rates. Just look at Japan. When Abenomics lost steam and traders started to bet on a stronger yen, Finance Minister Taro Aso repeatedly warned that the surge had been disorderly and one-sided, hinting that the government could intervene to weaken it. The yen ended up surging as much 22 percent last year. 2. Coordinated Intervention The Treasury Department has worked with central banks worldwide to bring down and drive up the dollar over the past three decades -- most recently in 2011. The problem is coordinated intervention has gone out of vogue in recent years, partly because analysts aren't sure whether it really works when officials are trying to sway a vast market like the dollar, which sees about $5 trillion exchange hands every day. Also, most currency interventions are sterilized, meaning central banks would inject or take out liquidity on the side as part of the transaction to maintain the level of money supply. An argument "common among economists, was that sterilized intervention has no long-lasting effect and unsterilized intervention is just another kind of monetary policy," Jeffrey Frankel, an expert in currency intervention and a professor at Harvard University's Kennedy School of Government, wrote in a paper published December 2015. 3. Unilateral Intervention Going it alone is simply a taller order than having the backing of your allies, in this instance the Group-of Seven-nations. A 2013 communique among G-7 nations denounced unilateral intervention and agreed not to target exchange rates. Yet the statement acknowledged that "excessive volatility and disorderly movements in exchange rates can have adverse implications for economic and financial stability." The Trump administration could spin the same communique to make the case for intervention. While Charles St. Arnaud, a senior economist at Nomura Securities International, doesn't think Trump will unilaterally weaken the dollar, "the U.S. can have a good argument," he said. "The dollar has appreciated a lot in a rapid pace. They can always argue it's difficult for the economy to adjust to such a big, broad-based appreciation." Unilateral intervention poses the risk of turning into a full-blown currency war. If the Treasury decides to break from the pack and starts weakening the dollar, other countries may be justified to do the same. 4. Creation of Sovereign Wealth Fund Nomura also floated a rather left-field option: creating a sovereign wealth fund. Many emerging nations and even developed ones such as Norway have coffers that buy foreign assets from government bonds to real estate, and there's no reason why the U.S. can't follow. 5. Non-Currency Intervention In the end, Trump may just focus on protectionist policies that produced a weaker dollar as a natural consequence. He has vowed to renegotiate trade treaties and impose import tariffs on China and Mexico, moves that may destabilize the dollar and engineer a more favorable exchange rate for America's exporters. Join GATA here: Vancouver Resource Investment Conference Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| "Common Sense" - Addressed To The Inhabitants Of 2017 America Posted: 17 Jan 2017 07:15 PM PST Submitted by Jim Quinn via The Burning Platform blog, “Without the pen of the author of Common Sense, the sword of Washington would have been raised in vain.” – John Adams

Thomas Paine was born in 1737 in Britain. His first thirty seven years of life were pretty much a series of failures and disappointments. Business fiascos, firings, the death of his first wife and child, a failed second marriage, and bankruptcy plagued his early life. He then met Benjamin Franklin in 1774 and was convinced to emigrate to America, arriving in Philadelphia in November 1774. He thus became the Father of the American Revolution with the publication of Common Sense, pamphlets which crystallized opinion for colonial independence in 1776. The first pamphlet was published in Philadelphia on January 10, 1776, and signed anonymously “by an Englishman.” It became an instantaneous sensation, swiftly disseminating 100,000 copies in three months among the two and a half million residents of the 13 colonies. Over 500,000 copies were sold during the course of the American Revolution. Paine published Common Sense after the battle of Lexington and Concord, making the argument the colonists should seek complete independence from Great Britain, rather than merely fighting against unfair levels of taxation. The pamphlets stirred the masses with a fighting spirit, instilling in them the backbone to resist a powerful empire. It was read aloud in taverns, churches and town squares, promoting the notion of republicanism, bolstering fervor for complete separation from Britain, and boosting recruitment for the fledgling Continental Army. He rallied public opinion in favor of revolution among layman, farmers, businessmen and lawmakers. It compelled the colonists to make an immediate choice. It made the case against monarchy, aristocracy, tyranny and unfair taxation, offering Americans a solution – liberty and freedom. It was an important precursor to the Declaration of Independence, which was written six months later by Paine’s fellow revolutionaries. Paine’s contribution to American independence 241 years ago during the first American Fourth Turning cannot be overstated. His clarion call for colonial unity against a tyrannical British monarch played a providential role in convincing farmers, shopkeepers, and tradesmen reconciliation with a hereditary monarchy was impossible, and armed separation was the only common sense option. He made the case breaking away from Britain was inevitable, and the time was now. Armed conflict had already occurred, but support for a full-fledged revolution had not yet coalesced within the thirteen colonies. Paine’s rhetorical style within the pamphlets aroused enough resentment against the British monarchy to rally men to arms, so their children wouldn’t have to fight their battles. “I prefer peace, but if trouble must come, let it be in my time that my children may know peace.” – Thomas Paine Paine did not write Common Sense or The American Crisis pamphlets for his contemporaries like John Adams, Samuel Adams, Jefferson, Madison, or Franklin. These intellectual giants were already convinced of the need to permanently break away from the British Empire and form a new nation. Paine wrote his pamphlets in a style understandable to the common man, rendering complex concepts intelligible for the average citizen. Paine seized this historic moment of crisis to provide the intellectual basis for a republican revolution. To inspire his citizen soldiers, George Washington had Paine’s pamphlets read aloud at their encampments. “These are the times that try men’s souls: The summer soldier and the sunshine patriot will, in this crisis, shrink from the service of their country; but he that stands it now, deserves the love and thanks of man and woman. Tyranny, like Hell, is not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph. What we obtain too cheap, we esteem too lightly: it is dearness only that gives everything its value. Heaven knows how to put a proper price upon its goods; and it would be strange indeed if so celestial an article as freedom should not be highly rated.” – Thomas Paine – The American Crisis The wealthy landowners and firebrands who comprised the Continental Congress leadership were not the audience Paine was trying to sway. They were focused on how a Declaration of Independence would affect the war effort. They were deficient in making their case to the less informed populace. Without public support and volunteers to fight the Redcoats, the revolution would have failed. Paine’s indispensable contribution to our country’s independence was initiating a public debate and disseminating ideas about independence among those who would need to do the fighting and dying if independence was to be achieved. Paine was able to synthesize philosophical enlightenment concepts about human rights into common sense ideas understood by ordinary folks. Paine was not a highly educated intellectual and trusted the common people to make sound assessments regarding major issues, based upon wisdom dispensed in a common sense way. He used common sense to refute the professed entitlements of the British ruling establishment. He used common sense as a weapon to de-legitimize King George’s despotic monarchy, overturning the conventional thinking among the masses. Paine was able to fuse the common cause of the Founding Fathers and the people into a collective revolutionary force. Even though their numbers were small, Paine convinced them they could defeat an empire. “It is not in numbers, but in unity, that our great strength lies; yet our present numbers are sufficient to repel the force of all the world” – Thomas Paine, Common Sense Paine didn’t know he was propelling the American Revolution Fourth Turning towards its successful climax when he wrote those pamphlets. His use of the term Crisis as the title to his second group of pro-revolutionary pamphlets displayed his grasp of the mood in the colonies toward the existing social order. The majority of the 2.5 million people living in the 13 colonies in 1776 were native born. Their loyalty to a distant monarch, treating them with contempt and taxing them to support his far flung empire, had been waning as time progressed. They were ready to shed the cloak of oppression and Paine gave them the rationale for doing so. The American Revolution Crisis was ignited by the fiery Prophet Generation leader Samuel Adams with the provocative Boston Tea Party in 1773. The colonial tinderbox was ignited as Adams’ committees of correspondence rallied resistance against the Crown and formed a political union among the 13 colonies. After the battles of Lexington & Concord, arming of militias and the formation of the Continental Army under command of George Washington, the regeneracy was at hand. Paine, as a Liberty Generation nomad, did what his generation was born to do – be a hands on, pragmatic, get it done leader. His vital contribution to the revolution was rousing the colonists with the toughness, resolution, and backbone to withstand the long difficult trials ahead. He, along with other members of his generation – George Washington, John Adams, and Francis Marion, did the heavy lifting throughout the American Revolution. They knew they would hang if their labors failed, but the struggle for liberty against a tyrannical despot drove them forward against all odds. Paine’s pamphlets, followed shortly thereafter by the Declaration of Independence, marked the regeneracy of the first American Fourth Turning, as solidarity around the cause of liberty inspired by brave words and valiant deeds, propelled history towards its glorious climax at Yorktown. When you’re in the midst of a Fourth Turning it is hard to step back and assess where you are on a daily basis. This Fourth Turning began in September 2008, with the global financial implosion created by the Fed and their Wall Street puppet masters. We have just achieved the long awaited regeneracy as Trump has stepped forth as the Grey Champion to lead a revolution against the corrupt tyrannical establishment. The election of Trump did not mark the end for the Deep State, but just the beginning of the end. Just as Paine’s Common Sense and the Declaration of Independence denoted the beginning of a long string of bloody trials and tribulations, Trump’s ascendency to the presidency has marked the beginning of a battle – with the outcome dependent upon our response to the clashes ahead.

The regeneracy spurred by Thomas Paine and the nation’s Founding Fathers in 1776 was followed by five years of ordeal, misery, misfortune, bloody routs, and numerous junctures where total defeat hung in the balance. Lesser men would have abandoned the cause during the dark bitter winter at Valley Forge in 1778. The shocking victory by Trump has revealed the depth of corruption among the corporate mass media, both political parties, surveillance agencies, and shadowy Deep State moneyed players behind the scenes. The ivory tower D.C. politicians, their entitlement culture, blatant corruption, vile disregard for the Constitution, and complete disregard for the plight of average Americans living outside their bastions of liberal elitism (NYC, L.A., S.F., D.C., Chicago), have shown their true colors since November 8.

Trump utilized the same populist messaging invoked by Paine in his Common Sense pamphlets during his unorthodox presidential campaign. He mobilized the large alienated silent majority who has been left behind as the globalists, corporatists, and militarists reaped the rich rewards of a growing corporate fascist surveillance state. Average Americans in flyover country watched as the fetid swamp creatures in the mainstream media, along with debased political establishment hacks, Hollywood elites, left wing billionaires, and so called social justice warriors coalesced behind a criminal establishment candidate. The out of touch elite have controlled the government for decades, treating the country and its people like a two dollar whore. Just as Paine hit a nerve among the great unwashed masses, Trump united blue collar workers, small business owners, family men, working mothers, guns rights champions, disaffected conservatives, realistic libertarians, disaffected millennials and various anti-establishment types sick and tired of the status quo. He gave voice to the little man with his in your face populist rhetoric against the corrupt dominant elites. His plain spoken, aggressive, no holds barred, pugnacious approach to crushing his enemies rallied millions to his cause. The Make America Great Again revolution has only just begun and the violent, vitriolic pushback from the vested interests are only the opening volleys in this Second American Revolution. The entrenched Deep State establishment will concede nothing. Tyranny will not be defeated without bloodshed. “Power concedes nothing without demand. It never did and it never will. Find out just what people will submit to, and you have found out the exact amount of injustice and wrong which will be imposed upon them; and these will continue until they are resisted with either words or blows or both. The limits of tyrants are prescribed by the endurance of those whom they oppress.” – Thomas Paine The same common sense Paine used to argue against a tyrannical, oppressive hereditary monarchy applies today when judging our corrupt, authoritarian, co-opted government. His themes of society as a blessing, government as evil, and revolution as inevitable are as applicable today as they were 241 years ago. As we approach Trump’s inauguration it has become clear the ruling elite feel threatened and are using their control of the media, intelligence services, military, and financial system to try and undermine his presidency before it begins. As their fake news propaganda falls on the deaf ears of disgusted Americans, their next ploy will be violence, war or assassination. The vested interests have no intention of relinquishing their power and wealth, just as King George and his Parliament had no intention of allowing the colonies to form an independent republic. If you thought voting Trump into the office of the president constituted a victory, you are badly misreading historical precedent and the inevitable paths of Fourth Turnings. The fight is just beginning. The leftist social justice warriors, their wealthy elite puppeteers, the neo-con military industrial complex warmongers, globalists, multi-culturists, and surveillance state apparatchiks have all made it clear they will violently and rhetorically, through their corporate media mouthpieces, resist Trump and his common man revolution. I don’t know if the normal people who supported Trump realize how abnormal, deviant, and despicable their opponents are. Blood will be spilled. Violence will beget violence. The country is already split and the divide will only grow wider. Someone will win and someone will lose. Our choices will matter.

“The seasons of time offer no guarantees. For modern societies, no less than for all forms of life, transformative change is discontinuous. For what seems an eternity, history goes nowhere – and then it suddenly flings us forward across some vast chaos that defies any mortal effort to plan our way there. The Fourth Turning will try our souls – and the saecular rhythm tells us that much will depend on how we face up to that trial. The saeculum does not reveal whether the story will have a happy ending, but it does tell us how and when our choices will make a difference.” – Strauss & Howe – The Fourth Turning In Part Two of this article I will try to show how Paine’s Common Sense, even though written three generations ago, has essential pertinence during these troubled times of our current Fourth Turning. |

| The European Debt Crisis Documentary Posted: 17 Jan 2017 07:00 PM PST The European sovereign debt crisis occurred during a period of time in which several European countries faced the collapse of financial institutions, high government debt and rapidly rising bond yield spreads in government securities. The European sovereign debt crisis started in 2008, with... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 17 Jan 2017 06:25 PM PST Submitted by Shane Dixon Kavanaugh via Vocativ With Trump on the horizon, the survivalist movement — long a pastime of the right — is picking up progressive converts fast. Colin Waugh bought a shotgun four weeks before November's election. An unapologetic liberal, he was no fan of firearms. He had never owned one before. But Waugh, a 31-year-old from Independence, Missouri, couldn't shake his fears of a Donald Trump presidency — and all of the chaos it could bring. He imagined hate crimes and violence waged by extremists emboldened by the Republican nominee's brash, divisive rhetoric. He pictured state-sanctioned roundups of Muslims, gays, and outspoken critics. "I kept asking myself, 'Do I want to live under tyranny?'" said Waugh, who supported Bernie Sanders in the Democratic primary and later backed Hillary Clinton. "The answer was absolutely not." With Trump now days away from assuming the White House, Waugh's preparing for the worst. He's made "bug-out bags" stuffed with ammo, energy bars, and assorted survival gear for his wife and their three cats. He's begun stowing water and browsing real estate listings in Gunnison County, Colorado, which he's determined to be a "liberal safe-haven." Last month, Waugh added a 9mm handgun to his arsenal. His advice to others on the left fearful of the next four years? "Get ready. Pay attention. Keep your wits about you." Waugh's not alone. He is among a new cadre embracing extreme self-reliance in the wake of Trump's surprising victory. Long a calling among conservatives spooked by big government boogymen and calamitous natural disasters, the so-called prepper movement is gaining a decisively liberal following. "We're tired of being perceived as wusses who won't survive when shit hits the fan," said Stacy, a Texas Democrat who recently caught the prepper bug. She spoke with Vocativ on the condition we not publish her last name. "I, for one, don't like to be thought of as some precious snowflake." After years cast as a fringe survival group, preppers entered a kind of golden age during the Obama presidency. A horrific housing crash and the spectacle of Hurricane Sandy helped give rise to reality television shows like Doomsday Preppers and Doomsday Bunker, and fueled a multi-billion dollar survival industry. Branded by some as a foreign-born, gun-grabbing socialist, Obama aroused deep suspicion among the patriot groups, right-wing conservatives, and apocalyptic Christians at the center of the growing movement. Trump's provocative posturing and unpredictability is now inspiring a fresh wave of panic on the left. Those who spoke with Vocativ have envisioned scenarios that could lead to military coups led by loyalists of the president-elect and internment camps packed with political opponents, bloody social unrest and an all-out civil or nuclear war. Sound bonkers? Perhaps. But, for many, so was the prospect of a President Trump. "It's the nature of the political beast," said Kevin O'Brien, a conservative prepper and realtor who specializes in off-the-grid properties in eastern Tennessee. "Obama had many on the right really wound up. Now it's the left's turn."

The signs of change are surely in the air. Groups that cater to gun-toting bleeding hearts — such as the aptly named Liberal Gun Club — say they've seen a surge in paid membership since the election. Candid talk of disaster preparedness among progressives is showing up on social media. Even companies that outfit luxury "safe rooms" — which protect their wealthy owners from bombs, bullets, and chemical attacks — attribute recent boosts in business to the incoming administration. "I don't think we'd have the same level of interest if Hillary had been elected president," Tom Gaffney, whose fortified home shelters at Gaffco Ballistics run as high as $400,000, told Vocativ in an interview. Looking for likeminded folks to weather the Trumpocalypse, Waugh started a private Facebook group called the Liberal Prepper shortly after the election. In nine weeks, it's drummed up more than 750 members, all of whom are individually screened and vetted, Waugh said. Dozens more flock to it daily. Few are wasting precious time. They trade tips on survival swag and solicit recommendations for solar panels, firearms, and raising chickens. There are discussions on homesteading and home safety. Links to news stories about the president-elect or signs of instability around the globe are never in short supply. Occasionally, posts on the Liberal Prepper seem to veer close to parody. One debate thread last week centered around the merits of stocking up on recycled toilet paper rolls versus buying Angel Soft, a brand produced by Koch industries, a notorious climate change foe. And in another discussion, vegetarian and vegan members talked about the best meat- and dairy-free food supplies to have during a sustained crisis. In a smaller Facebook group, Progressive Liberal Preppers, members who blacksmith, bow hunt, and operate ham radios are eager to teach their skills with others, said one the site's administrators, who goes by the name of Blythe Bonnie. "The next thing we're going to do is a class on home brewing and winemaking," said Bonnie, a lifelong Democrat and 70-year-old now living in Arkansas. While most of these liberal preppers say they are readying for any disaster — natural, manmade, or even zombie — a doomsday scenario at the hands of a President Trump continues to be a primary concern. "With the new administration I worry about Nazi-style camps that would include my wife, our twins and myself," said Melissa Letos, who lives with her family on a five-acre spread near Portland, Oregon. In a recent interview, she said she raises chickens, strives to keep a year's supply of canned food, and is able to hold her own with a firearm. She and her family plan to a build a bunker-style basement in the future. Even as Letos and other liberals brace for bedlam, some longtime preppers worry that others in the movement have let their guard down. Michael Snyder, author of The Economic Collapse blog, recently warned against those on the right who seemed overly optimistic about a Trump presidency. "Everyone is feeling so good about things, very few people still seem interested in prepping for hard times ahead," he wrote, raising the specter of financial instability in Europe and a potential trade war with China. "It is almost as if the apocalypse has been canceled and the future history of the U.S. has been rewritten with a much happier ending." For Waugh and his liberal peers, the apocalypse may have just begun. "Fear is an unfortunate catalyst for a lot of folks," he said. "But there are still too many caught up in the idea that the system is infallible and that it will persevere and prevail." |

| THE EMPIRE STRIKES BACK: 2017 and THE CIA’S WAR WITH TRUMP Posted: 17 Jan 2017 05:30 PM PST First off Trump will not fulfill any of his promises second Putin does not control Russia the IMF does and has since the 90s third prepare to be f'd over, if you can buy gold buy it the elite are pushing for war at your door And there are more Soros-descendants: Andrea, Jonathan (CFR!),... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Ushering In a Totalitarian Police State in Cashless “Smart Cities” Posted: 17 Jan 2017 05:00 PM PST It is essential to use cash wherever and whenever you can Total Slavery Tactic:1. Invent $2. Replace Gold and give it to banks3. Take ownership of $4. Make electronic currency5. Make all dependencies work on EC6. Limit cash transactions7. Remove cash from circulation8. Ask for rent on EC... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| What was the 'strong-dollar policy' except gold leasing and price suppression? Posted: 17 Jan 2017 04:48 PM PST 7:55p ET Tuesday, January 17, 2017 Dear Friend of GATA and Gold: Financial news organizations tonight are full of reports about the imminent demise of the U.S. government's longstanding "strong-dollar policy," what with President-elect Trump having declared in an interview with The Wall Street Journal that the dollar is "too strong." The Journal's headline is "Trump Comments Signal Shift in Approach to U.S. Dollar": http://www.wsj.com/articles/trump-comments-signal-shift-in-approach-to-u... The headline in the Financial Times is "Trump Team Shifts Further from Strong-Dollar Policy": https://www.ft.com/content/50376d50-dcaa-11e6-9d7c-be108f1c1dce CNBC says "Trump Just Signaled the Death of Clinton-Era Strong-Dollar Policy": http://www.cnbc.com/2017/01/17/trump-just-signaled-death-of-clinton-era-... And Marketwatch's headline is "Trump Is Waving Adios to the Longstanding 'Strong-Dollar Policy'": http://www.marketwatch.com/story/trump-is-waving-adios-to-the-longstandi... But as always, even now no news organization seems to be explaining exactly how the "strong-dollar policy" was implemented. The policy prevailed through periods of war and peace as well as periods of U.S. government budget restraint and wretched excess. So what did the U.S. government actually do to keep the dollar strong? ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. GATA long has maintained that the "strong-dollar policy" was mainly gold price suppression, implemented largely through the gold carry trade devised by President Clinton's treasury secretary, former Goldman Sachs Chairman Robert Rubin, an enterprise in which Western central banks "leased" gold to investment banks at negligible interest rates and encouraged them to sell the metal and invest the proceeds in U.S. government bonds paying closer to 5 percent. The investment banks thereby collected a spread that was risk-free as long as they had the assurance that, as Federal Reserve Chairman Alan Greenspan told Congress in July 1998, "central banks stand ready to lease gold in increasing quantities should the price rise": https://www.federalreserve.gov/boarddocs/testimony/1998/19980724.htm Gold leasing gave the U.S. government a strong dollar, strong government bond prices, and low interest rates even as the government's debt began to explode under Presidents Bush and Obama. For inflation was safely concealed behind a gold price that was suppressed by artificial and imaginary supply. So if the U.S. government wants a weaker dollar, it probably needs only to curtail gold leases and swaps and take some central bank feet off the gold market, feet that seem to have been stomping on gold pretty hard lately, given the explosion of gold swapping through the Bank for International Settlements over the last year: http://www.gata.org/node/17099 This easing of gold price suppression probably can be done without prompting any suspicion from mainstream Western financial news organizations, which are either brain-dead or as compliant as news organizations in totalitarian countries. Tonight only Marketwatch seems to have come across a hint of what the "strong-dollar policy" was really about. Of the Rubin years at Treasury, Marketwatch writes: "The Clinton administration's tune soon changed once Rubin replaced [Lloyd] Bentsen. Rubin drove home the shift by faithfully repeating that a strong dollar was in America's interest. Some well-timed intervention that burned the fingers of dollar bears also helped." "Intervention"? There's a big story there, but what mainstream financial news organization will ever dare to tell it? CHRIS POWELL, Secretary/Treasurer Join GATA here: Vancouver Resource Investment Conference Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 17 Jan 2017 04:29 PM PST Back in December, I noted that there was not a Gold bull to be found (See post: Not a Gold Bull in Sight) and that the Gold Cycle was on the verge of a significant Cycle turn. Fast forward a month, and 20 days of this Daily Cycle (DC), gold is up almost $100 and has again caught the attention of gold bulls. Since the Cycle turn, this has been a rather interesting first Daily Cycle in gold. Mostly because the rally over the first twenty days has been fairly constant, with the half Cycle Low noticeably absent. Moreover, the move has not seen a surge based on a typical rush to cover short positions normally seen around the turn of any Investor Cycle. |

| Bitcoin and Gold – Outlook and Safe Haven? Posted: 17 Jan 2017 03:41 PM PST gold.ie |

| Gold Rallies, Dollar Drops as Trump Says U.S. Currency is ‘Too Strong’ Posted: 17 Jan 2017 02:55 PM PST Gold Stock Bull |

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 2% Posted: 17 Jan 2017 01:27 PM PST Gold traded mostly modestly higher in holiday thinned trade yesterday and rose to as high as $1218.68 in London today before it chopped back lower at times in New York, but it still ended with a gain of 1.44% from Friday's close. Silver rose to as high as $17.20 and ended with a gain of 2.2%. |

| China’s Bogus Currency War Promise Posted: 17 Jan 2017 01:26 PM PST This post China's Bogus Currency War Promise appeared first on Daily Reckoning. "China is not trying to destroy the old boys' club — they are trying to join it," said Jim Rickards in May of 2015. It was Jim's pithy way of saying Chinese leaders don't want to kick over the table where Western powers make Big Global Decisions. They just want a few more seats at that table, in line with China's status as the world's most populous country and (depending on how you measure it) the world's largest economy. As if we needed any more proof of Jim's proposition the Chinese President was front and center…

It's the first time a Chinese president has dropped in on the global elite's annual shindig in Davos, Switzerland — aka the World Economic Forum. This year's gathering is a hand-wringing affair. The elites are dazed and confused by the ascendance of Trump: "There is a consensus that something huge is going on, global and in many respects unprecedented," says Moises Naim from the Carnegie Endowment for International Peace. "But we don't know what the causes are, nor how to deal with it." And so President Xi Jinping told the assembled worthies all the right things this morning, to wit: "No one will emerge as a winner in a trade war." Ah, but what about a currency war? The yuan weakened nearly 7% against the dollar during 2016 — almost double the pace of 2015. "Mr. Xi also reaffirmed China's long-standing pledge that it won't purposefully devalue its currency to help exports and engage in a currency war with its trading partners," The Wall Street Journal tells us. That's an artful dodge. Without explicitly saying so, Xi is leaving open the possibility of purposefully devaluing the currency for a different reason — to avoid depleting China's foreign exchange reserves. "China is going broke," says Jim Rickards. "It's second-grade math." We return to a chart we shared eight days ago. China's forex reserves have dropped by 25% from their peak in mid-2014. "This was due to capital flight in various forms, legal and illegal, including debt repayment," Jim explains.

Why the capital flight? "Wealthy Chinese," Jim goes on, "are trying to get their money out of China as fast as they can because they fear a new maxi-devaluation is coming" — along the lines of 1994, when Beijing devalued the yuan by a third in one fell swoop. The mainstream would have you believe this chart is no big deal; $3 trillion is still a substantial pile of money, right? Wrong, says Jim: "About $1 trillion of the remaining reserves are illiquid (for example, hedge fund investments made by China Investment Corp., the sovereign wealth fund)." They're not the sort of thing that can be sold off in a hurry. OK, but that still leaves $2 trillion, right? "Another $1 trillion," Jim goes on, "must be held as a precautionary reserve to bail out China's banks, which are facing a wave of bad debts from state-owned enterprises and property speculators." Uh, all right, but that still leaves $1 trillion. That should be plenty to avoid going broke, right? Wrong again, Jim says: "Ongoing capital flight is depleting that remaining $1 trillion at a rate of about $80 billion per month." We'll spare you the trouble of extrapolating the numbers: "This means China will be out of liquid reserves," Jim declares, "and effectively broke as an international trading partner, by the end of 2017." What can China do to avoid going broke? "It can raise interest rates to defend the currency, slap on capital controls or devalue the yuan. "Interest rate hikes will kill the economy and accelerate China's credit crisis. Capital controls will choke off new foreign direct investment and force capital flight into illegal channels without actually stopping it. A maxi-devaluation is the simplest and easiest way out of the box for China. "Why hasn't China devalued already? Part of the reason is to avoid being labeled a 'currency manipulator' by the U.S. This could cause retaliation in the form of tariffs. That is why China has been pursuing a slow, steady devaluation, instead of a maxi-devaluation." But now along comes Trump to upset Beijing's calculus. Trump routinely berates Chinese leaders for suppressing the value of the yuan relative to the dollar. In an interview with The Wall Street Journal last Friday, Trump complained the dollar has gotten "too strong" in part because of China… but he pledged he would not formally label China a currency manipulator as soon as he takes office this Friday. "Certainly, they are manipulators. But I'm not looking to do that." Then again, Trump told the Times of London that he's more or less taking the weekend off and Monday will be what he considers "day one" of his administration — heh. Here's the thing: As long as Trump keeps that threat hanging over Xi and his deputies, they have zero incentive to delay a maxi-devaluation. "The U.S.," Jim says pointedly, "will have taken away China's only motivation to play nice." No reason not to rip the Band-Aid off and get it over with, right? Will they pre-empt Trump and do it on Friday, stealing his inauguration thunder? Or will they wait a couple more weeks or months? They can't wait too long; remember, Jim says China will be out of liquid forex reserves by year-end. Whenever it happens, "the resulting currency and trade war will make the 11% stock market correction of 2015 look like a picnic," Jim says. In fact, Jim believes it could add up to the biggest global currency shock since the British pound was devalued 50 years ago. Best regards, Dave Gonigam The post China's Bogus Currency War Promise appeared first on Daily Reckoning. |

| Momentum Traders Shift To Gold And Silver Posted: 17 Jan 2017 12:09 PM PST On the flip-side of this is gold, which has rallied nearly 6% since late December, and silver, which has rallied 7.8% since its end of December low. The fundamental factors driving gold vs. the dollar would be the continued surge in U.S. Treasury debt issuance; which has doubled in size over the last eight years, contracting economic activity notwithstanding the plethora of fake economic reports; a rapidly expanding Government spending deficit; and a rapidly expanding trade deficit. |

| Bitcoin and Gold - Outlook, Volatility and Safe Haven Diversification Posted: 17 Jan 2017 12:03 PM PST – Recent performance of Bitcoin and Gold – Price outlook – Bitcoin, China and capital flight – Exchanges of value? – Can bitcoin rival gold as a safe haven? – ‘Bitcoin vs Gold’ or ‘bitcoin and gold’? – Importance of diversification – Conclusion: A monetary and financial revolution? |

| Posted: 17 Jan 2017 10:47 AM PST Bill Holter's Commentary Does this sound like a gold adversary or a reflationist? In our opinion we will find out very soon. It seems the previous “official” headwinds may become a tailwind without notice. Mother Nature has a funny way of showing up when needed, we will see man cannot “legislate” against her no matter... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Peter Schiff on The Trump Economy Posted: 17 Jan 2017 10:00 AM PST Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar in particular. Peter was one of the first from within the professional investment field to call... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold Stocks: Fabulous Rally Accelerates Posted: 17 Jan 2017 09:29 AM PST Rate hikes tend to be good for gold, and even better for gold stocks. Since Janet Yellen hiked rates in December, gold has rallied almost $90. That's good news, but the great news is that the US central bank plans more rate hikes this year. Gold has a rough historical tendency to decline ahead of rate hikes, and rally strongly after they happen. |

| Rally in Gold and Gold Stocks Has More Upside Posted: 17 Jan 2017 09:21 AM PST Gold and Gold stocks have rallied as expected and the consolidation in the miners in recent days looks bullish. GDX and GDXJ have digested the recent recovery quite well as Gold is testing resistance around $1200/oz. While the price action portends to more gains so does the breadth in the miners as well as short-term structure in the US$ index and bond yields. |

| Trump's comments send dollar reeling Posted: 17 Jan 2017 08:41 AM PST By Chelsey Dulaney The dollar slid to a one-month low today after President-elect Donald Trump described the currency as "too strong" in an interview with The Wall Street Journal, casting new uncertainty onto the dollar's postelection rally. The WSJ Dollar Index, which measures the U.S. currency against 16 others, fell 1.1 percent to 91.19, its lowest point since the U.S. Federal Reserve raised interest rates on Dec. 14. The dollar was down nearly 1% against the Japanese yen and the Mexican peso. In the interview with the Journal, Mr. Trump said the U.S. dollar was already "too strong," in part because China holds down its currency, the yuan. "Our companies can't compete with them now because our currency is too strong. And it's killing us," he said. Mr. Trump had alluded to the dollar throughout the presidential campaign, threatening to label China a currency manipulator for weakening the yuan. But Mr. Trump's comments were the clearest indication yet that the new administration would prefer a weaker dollar. A stronger dollar can hurt U.S. companies by making their products more expensive overseas. ... ... For the remainder of the report: http://www.wsj.com/articles/trump-comments-send-dollar-reeling-148466671... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference Dollar Vigilante Internationalization and Investment Summit Mining Investment Asia Mines and Money Asia * * * Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Trump Takes The Final Currency War Thermonuclear, Puts Gold Cartel On Notice! Posted: 17 Jan 2017 08:04 AM PST It's the rare day I wake up to see news so powerfully Precious Metal bullish – regarding its short and long-term implications – I can barely contain myself. The last such event was the BrExit – which set into motion the inevitable collapse of the European Union and Euro currency as we know it. Which, seven months later, appears more certain than ever – and perhaps, if this year's Dutch, French, German, Italian, and Catalonian elections and legislative actions trend in the direction I anticipate, imminent. Which I assure you, last night's news will only hasten further. |

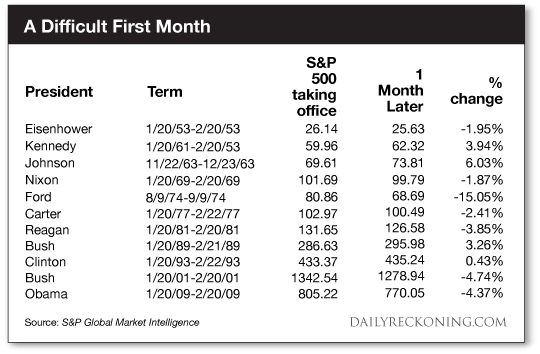

| Here’s What Happens to Stocks After the Inauguration… Posted: 17 Jan 2017 08:00 AM PST This post Here's What Happens to Stocks After the Inauguration… appeared first on Daily Reckoning. In just a few short days, Obama will hit the road. There's a new sheriff in town—and he's looking to make some yuuuuge changes. In the meantime, he's minting market-moving headlines. Donald J. Trump is preparing to take the oath of office on Friday by churning out more business news than you can shake a comb over at… He's put Big Pharma on notice over price increases. He shook down Boeing for going over budget building the new Air Force One. And he took almost every single car company to the woodshed for moving jobs overseas. All told, Trump has targeted 61 separate companies on Twitter over the years, according to Yahoo Finance. And he's giving no indication that he'll let up on the gas. Why? Because his tactics are getting results. General Motors will announce $1 billion in new U.S. investments today including creating or retaining 1,000 jobs at existing facilities, Bloomberg reports. Meanwhile, Walmart claims it’s adding 10,000 new U.S. jobs this year. Big business is already offering plenty of lip service to the new administration. But it's difficult to say whether this political posturing will show up as real economic growth. Trump is already taking credit for the post-election market rally and fact that U.S. small business confidence recently rose to a 12-year high. That's swell. But as inauguration day approaches, Trump must deal with some uncomfortable facts surrounding an incoming president's first 30 days in office. Zor Capital's Joseph Fahmy sees this week's inauguration as a potential sell the news event. And he has some interesting statistics to back up his claim… "The first 30 days of an incoming White House administration tends to be difficult for stocks," Fahmy explains. "It's possible the market could see profit taking while it waits for a clearer agenda from the new administration. In addition, most earnings will be done by February and the market will have fewer catalysts."

From Eisenhower to Obama, the first month for most new presidents has produced some sharp market moves—and most of them aren't positive. We have to go back to Bill Clinton's inauguration to find the most recent S&P first-month gain. We’ve stayed on top of this story since early December. That’s when we told you that the Trump Bump might finally fizzle on Jan. 20. DoubleLine Capital's Jeff Gundlach says the euphoria will probably disappear until just after the inauguration. When a political party reclaims the presidency, Gundlach notes that the post-election rally historically lasts until just after the inauguration in late January. That's when reality starts to creep back into the picture… Remember, history doesn't repeat—but it does rhyme. Using past election cycles are our guide, we can expect the stock market to chill out and drift sideways a bit (or even drop) once Trump takes the oath of office. Does this mean we're headed for a spectacular crash on Friday? It's doubtful. But a short-term pullback could definitely be in the works. Futures are already taking a hit early this morning. Meanwhile, gold is launching to 8-week highs. A small dose of reality is beginning to creep into the picture. We'll have to see where it takes us… Sincerely, Greg Guenthner The post Here's What Happens to Stocks After the Inauguration… appeared first on Daily Reckoning. |

| Trump Takes The Final Currency War Thermonuclear, Puts Gold Cartel On Notice! Posted: 17 Jan 2017 07:38 AM PST Miles Franklin |

| Posted: 17 Jan 2017 07:26 AM PST Everybody is going to be caught on the wrong side of this market ad sentiment is excessively bullish. The dollar is going to be due for a 3 year cycle low sometime in 2017. |

| Posted: 17 Jan 2017 07:21 AM PST This posting includes an audio/video/photo media file: Download Now |

| Damage Inflicted by Precious Metals Manipulation Is in the “Multi Billions†- Keith Neumeyer Posted: 17 Jan 2017 01:59 AM PST Mike Gleason (Money Metals Exchange): It is my privilege now to bring in Keith Neumeyer, founder and CEO of First Majestic Silver Corp, one of the top silver mining companies in the world. Keith has an extensive background in the resource and finance sectors and has also been an outspoken voice about the manipulation that has been occurring in the futures market pricing of silver. It's a real privilege to have him on with us again today. Keith, thanks so much for joining us and welcome back. Mike Gleason: It is my privilege now to bring in Keith Neumeyer, founder and CEO of First Majestic Silver Corp, one of the top silver mining companies in the world. Keith has an extensive background in the resource and finance sectors and has also been an outspoken voice about the manipulation that has been occurring in the futures market pricing of silver. |

| Breaking News And Best Of The Web Posted: 17 Jan 2017 01:37 AM PST US stocks, dollar fall, gold and silver pop. Earnings season starting well for banks and miners. Global debt continues to soar, especially in China. US retaliates against alleged Russian hacking. Fake news debate rages. Trump holds first press conference since election. Best Of The Web Why the stock market has blasted into outerspace – […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Slivovo Gold Study Points to Further Exploration at Avrupa Minerals' JV Posted: 17 Jan 2017 12:00 AM PST The Slivovo Gold Project Study that Avrupa Minerals received from its JV partner recommends further exploration to increase the size of the deposit. |

| Joint Venture Decision on Golden Arrow's Chinchillas Project Nears Posted: 17 Jan 2017 12:00 AM PST Development progresses at Golden Arrow's Chinchillas project as investors await Silver Standard Resources' business combination decision, which is due by March. |

| Posted: 16 Jan 2017 04:01 PM PST Big names saying scary things. David Stockman, Axel Merk, Nomi Prins, Paul Craig Roberts on the risks for investors and hard times ahead for everyone else. Mike Maloney on how gold can help. The post Top Ten Videos — January 17 appeared first on DollarCollapse.com. |

| Trump's Comments Send the Dollar Reeling Posted: 16 Jan 2017 04:00 PM PST |

| Gold Price Up Through 'Key' $1207 Level as 'Brexit Means UK Out of Single Market' Posted: 16 Jan 2017 04:00 PM PST |

| Oil Prices Boosted By Struggling US Dollar Posted: 16 Jan 2017 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment