Gold World News Flash |

- Silver Prices for the Year 2017

- Obama's "Farewell To Arms" As War Presidency Ends

- "FAKE NEWS AGENDA:" & the US Govt.'s New Propaganda Factory

- Biggest Challenge of 2017 Directly Ahead for Gold, Stocks

- Mexican Drug Cartels Looting State-Owned Gas Pipelines For Black Market Sales

- The Utter Stupidity Of The New Cold War

- Gold Seeker Closing Report: Gold and Silver Gain While Stocks and Dollar Fall

- Gold Resource Corporation Announces 2016 Preliminary Annual Production Results Exceeding Gold and Achieving Silver Targets

- Biggest challenge of 2017 directly ahead for gold, stocks

- The Curse of Underwater Cars

- 2017 – Spectacular For Gold And Silver But Disaster For Bonds And Stocks

- Real metal will defeat paper gold someday, Hathaway writes contentedly

- Be Prepared for a Violent Fed Reversal

- Gold swaps by BIS exploded in 2016 from nothing to record level

- Gold swaps by BIS exploded in 2016 from nothing to record level

- They Get Away with Murder. You Book Profits…

- Video Commentary - Gold Update

- Why Gold Bulls Should Love Wednesday's Nasty Swoon

- Gold Resource Corporation Substantially Expands Arista Mine With +200 Meter Switchback Step-Out Drill Intercept

- Gold and Silver Market Morning: Jan 12 2017 - The dollar is lower against gold and gold higher against all currencies!

- Gold Rallies To $1,207 After Trump Press Conference Shambles

- Expect the Expected in 2017. For the Rest, Buy Gold

- USD in Decline. SPX and TNX May Follow

- Gold Rallies To $1,207 After Trump Press Conference Shambles

- Breaking News And Best Of The Web

- Is the Appointment of Paul Zink a Game-Changer for Terraco Gold?

- High-Grade Gold Discovery in New Mexico Doubles the Opportunities for Southern Silver Exploration

- Nexus Scores on Gold, Misses on Press Release

- Top Ten Videos — January 12

- Gold Stalls at $1205 as Chinese New Year Approaches

- Biggest Challenge of 2017 Directly Ahead for Gold, Stocks

| Silver Prices for the Year 2017 Posted: 12 Jan 2017 11:01 PM PST How low and how high will the price of silver range on the PAPER markets during 2017? Knowing the influence central bankers, politicians, HFT algos, bullion banks and JPMorgan exercise over... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Obama's "Farewell To Arms" As War Presidency Ends Posted: 12 Jan 2017 11:00 PM PST Submitted by Finian Cunningham via The Strategic Culture Foundation, Eight straight years of warmongering come to an end as US President Barack Obama bows out with his «farewell to the nation» speech this week, as fawning American media dubbed his valediction. In reality, Obama’s outgoing address should have been billed as a «farewell to arms» made by arguably one of the most belligerent presidents to ever have occupied the White House. Only in exceptionally delusional America could such a pernicious paradox be presented as something honorable and sentimental. Obama, the 44th US president, may have been the first black president and winner of a Nobel peace prize during his first year in office in 2009. But apart from those dubious accolades – championed by supposedly liberal Hollywood celebrities and media pundits – his actual record in office is one of blood-soaked disgrace. Instead of ending American overseas wars as he had promised back in 2008, Obama expanded on his predecessor George W Bush’s criminal foreign interventions. At least seven countries – Iraq, Afghanistan, Pakistan, Libya, Syria, Yemen and Somalia – have been routinely bombed under Obama’s watch as the US Commander-in-Chief. That’s one repugnant record. Last year alone, the US military reportedly dropped over 26,000 bombs around the world killing countless thousands of people, the exact number buried under official secrecy and American mainstream media indifference. At that rate, American anti-war campaigner Medea Benjamin estimates that US forces deployed three bombs every hour of every day for the whole of 2016. This death from the skies included Obama’s personal ordering of drone assassinations during his weekly Terror Tuesday briefings from Pentagon chiefs, the use of which increased 10-fold under his command, killing thousands of innocent civilians as «collateral damage». In Yemen, one of the poorest countries on Earth, where Obama fully backs an ongoing Saudi air war, it is reckoned that a child dies every 10 minutes from the American-supplied bombing campaign and blockade. Hardly a word about this US-backed genocide is permitted to intrude into public awareness by the Western corporate-controlled media. Under the supposed Nobel peace laureate, the United States has sold an all-time record of $115 billion-worth of weaponry to Saudi Arabia – one of the most repressive regimes in the world – which has in turn fueled jihadist terrorism across the Middle East, Central Asia, Africa and Europe. In Syria, just one of the countries to be afflicted by Obama’s policy of covert collusion with jihadist terrorism for regime-change machinations, the death toll is estimated to be around 400,000, with millions more displaced by the US-led proxy war that began in March 2011. That war unleashed by the Obama administration to oust President Bashar al-Assad has only been arrested because of Russia’s military intervention at the end of 2015. At every step, Obama and his top diplomat John Kerry have sought to thwart Russia’s efforts to salvage the country from jihadist terror proxies. With warped logic, Obama and his British and French allies – all sponsors of the regime change war in Syria – have tried to paint Russia as a war criminal. In his final year in office, Obama has overseen a massive escalation in US military special operations around the world. These covert forces are now reported to be operating in 138 countries – 70% of the world – a military deployment that represents a 130% increase on that under George W Bush. Self-declared liberal Americans consider Bush to be a warmongering disaster, yet somehow they hail Obama as some kind of progressive «peace president». The Nobel prize awarded to Obama surely stands as an egregious offense to humankind’s intelligence and decency. With his typical rhetorical sophistry, Obama talked about abolishing nuclear weapons during his early days in the White House, only to subsequently commit his nation to a trillion-dollar upgrade of its nuclear arsenal. In stark violation of international obligations under the Non-Proliferation Treaty. Under his watch, the «peace president» has pursued a bellicose collision course with nuclear-armed Russia that threatens a global conflagration. Relations between the US and Russia have sunk to new dangerous depths – never seen since the former Cold War – led largely by the Obama administration’s demonizing of Moscow with a litany of fraudulent charges. Charges amplified by the servile Western mass media of course instead of being debunked as they surely should be. Rather than dialogue and diplomacy, Obama’s presidency has used subterfuge and relentless propaganda to antagonize Russia. From personal insults against Russian President Vladimir Putin being a «Hitler figure» to vilifying Moscow for regional conflicts that the Western powers have actually stoked, Obama has tempted all-out war through reckless sanctions and expansion of NATO forces on Russia’s borders. The last power to have menaced Russia with such flagrant aggression was Nazi Germany. Yet, Putin is caricatured as Hitler, while Obama is lauded in the Western media as a standard-bearer for world peace. This week as Obama gave his self-preening farewell to the nation speech, thousands of new US troops and tanks were dispatched to buttress NATO forces already at unprecedented levels in Germany, Poland and the Baltic states. While his country endures economic austerity and social collapse from poverty, the White House has ordered $3.4 billion in extra military spend in Europe to bolster NATO aggression towards Russian. Part of that warmongering extravagance involves supporting a neo-Nazi junta in Kiev to continue its onslaught against the ethnic Russian people of eastern Ukraine, where the death toll has reached at least 10,000 since 2014. Only in America, the «exceptional nation» as Obama repeatedly proclaims, is a warmongering president feted as a «peace leader». Whereas his successor, Donald Trump who will be inaugurated next week, is pilloried as a traitor because he has dared to call for restoring better relations with Russia. Trump is by no means perfect. His reactionary and at times foul-mouthed populism may be deserving of mockery as it was this week at the Golden Globes film-awards ceremony held in Hollywood. Award-winning actress Meryl Streep won plaudits from the supposed liberal media for her rebuke of Trump over his alleged bigoted and bullying behavior. But where is the appropriate condemnation of Obama for displaying far worse failings – as perhaps the most blood-soaked president to have sat in the «highest office of the nation»? What makes the US the most dangerous nation on Earth to world peace is that so many of its so-called liberal intellectuals, artists and media evidently view Barack Obama as a man of peace and progress. When in reality, the 44th president should be prosecuted for multiple war crimes. Instead of being free to earn millions of dollars in future years giving sonorous speeches on «international relations» to sundry audiences, Obama should be earning time behind bars. (In the ignoble company of other US ex-presidents, it should be added.) |

| "FAKE NEWS AGENDA:" & the US Govt.'s New Propaganda Factory Posted: 12 Jan 2017 10:30 PM PST The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Biggest Challenge of 2017 Directly Ahead for Gold, Stocks Posted: 12 Jan 2017 08:25 PM PST If you thought the pace of the head-spinning political events of the last two months couldn't get any faster, think again. One of the most critical decisions of President-Elect Trump's reign will soon be decided. The final verdict will have a direct impact on the direction of stocks, gold, and the economy in the months to come. The decision in question is the Congressional challenge being made against the Affordable Care Act (ACA), also known as Obamacare. Specifically, the requirement that individual Americans carry health insurance or else pay a stiff financial penalty is being challenged. Earlier this week, Trump directed the Republican-led Congress to begin efforts at repealing and replacing the health care law "very quickly." |

| Mexican Drug Cartels Looting State-Owned Gas Pipelines For Black Market Sales Posted: 12 Jan 2017 08:00 PM PST A couple of weeks ago we highlighted the protests that had engulfed Mexico after the finance ministry announced plans to raise gasoline prices by 20.1% starting January 1st. Amid the chaos, the country's powerful Jalisco New Generation cartel threatened to to burn down gas stations as retribution for taking advantage of "the majority of the people who don't make even a minimum wage."

Alas, after the knee jerk reaction to riot subsided, which would have only resulted in gas prices soaring even higher anyway, Mexico's drug cartels did what any clever black market entrepreneurial organization would do: they decided to steal the gasoline and sell it themselves. With a modest upfront capital investment of $5,000 - $8,000, the cartels have realized they can tap directly into state-owned gas pipelines and withdraw seemingly unlimited supplies of gasoline which they then sell along the highway at a discount to official government prices. It's a win-win situation whereby the drug cartels make 100% profit margins and citizens get "cheap" fuel.

Of course, there are some losers in all of this as Enrique Peña Nieto has basically become the least popular President in Mexico since one-party ruled ended in 2000.

State-owned Pemex is also one of the losers with the company expected to lose about $1 billion to theft this year...but no one really pays taxes anyway so it shouldn't be that big a deal. |

| The Utter Stupidity Of The New Cold War Posted: 12 Jan 2017 07:35 PM PST Submitted by Gary Leupp via The Strategic Culture Foundation, It seems so strange, twenty-seven years after the fall of the Berlin Wall, to be living through a new Cold War with (as it happens, capitalist) Russia. The Russian president is attacked by the U.S. political class and media as they never attacked Soviet leaders; he is personally vilified as a corrupt, venal dictator, who arrests or assassinates political opponents and dissident journalists, and is hell-bent on the restoration of the USSR. (The latter claim rests largely on Vladimir Putin’s comment that the dissolution of the Soviet Union was a “catastrophe” and “tragedy” — which in many respects it was. The press chooses to ignore his comment that “Anyone who does not miss the Soviet Union has no heart, while anyone who wants to restore it has no brain.” It conflicts with the simple talking-point that Putin misses the imperial Russia of the tsars if not the commissars and, burning with resentment over the west’s triumph in the Cold War, plans to exact revenge through wars of aggression and territorial expansion.) The U.S. media following its State Department script depicts Russia as an expansionist power. That it can do so, so successfully, such that even rather progressive people—such as those appalled by Trump’s victory who feel inclined to blame it on an external force—believe it, is testimony to the lingering power and utility of the Cold War mindset. The military brass keep reminding us: We are up against an existential threat! One wants to say that this — obviously — makes no sense! Russia is twice the size of the U.S. with half its population. Its foreign bases can be counted on two hands. The U.S. has 800 or so bases abroad. Russia’s military budget is 14% of the U.S. figure. It does not claim to be the exceptional nation appointed by God to preserve “security” on its terms anywhere on the globe. Since the dissolution of the USSR in 1991, the U.S. has waged war (sometimes creating new client-states) in Bosnia (1994-5), Serbia (1999), Afghanistan (2001- ), Iraq (2003- ), Libya (2011), and Syria (2014- ), while raining down drone strikes from Pakistan to Yemen to North Africa. These wars-based-on-lies have produced hundreds of thousands of civilian deaths, millions of refugees, and general ongoing catastrophe throughout the “Greater Middle East.” There is no understating their evil. The U.S. heads an expanding military alliance formed in 1949 to confront the Soviet Union and global communism in general. Its raison d’être has been dead for many years. Yet it has expanded from 16 to 28 members since 1999, and new members Estonia and Latvia share borders with Russia. (Imagine the Warsaw Pact expanding to include Mexico. But no, the Warsaw Pact of the USSR and six European allies was dissolved 26 years ago in the idealistic expectation that NATO would follow in a new era of cooperation and peace.) And this NATO alliance, in theory designed to defend the North Atlantic, was only first deployed after the long (and peaceful) first Cold War, in what had been neutral Yugoslavia (never a member of either the Warsaw Pact nor NATO), Afghanistan (over 3000 miles from the North Atlantic), and the North African country of Libya. Last summer NATO held its most massive military drills since the collapse of the Soviet Union, involving 31,000 troops in Poland, rehearsing war with Russia. (The German foreign minister Frank-Walter Steinmeier actually criticized this exercise as “warmongering.”) Alliance officials expressed outrage when Russia responded to the warmongering by placing a new S-400 surface-to-air missiles and nuclear-capable Iskander systems on its territory of Kaliningrad between Poland and Lithuania on the Baltic coast. But Russia has in fact been comparatively passive in a military sense during this period. In 1999, as NATO was about to occupy the Serbian province of Kosovo (soon to be proclaimed an independent country, in violation of international law), nearby Russian peacekeepers raced to the airport in Pristina, Kosovo, to secure it an ensure a Russian role in the Serbiam province’s future. It was a bold move that could have provoked a NATO-Russian clash. But the British officer on the ground wisely refused an order from Gen. Wesley Clark to block the Russian move, declaring he would not start World War III for Gen. Clark. This, recall, was after Bill Clinton’s secretary of state, Madeleine Albright (remember, the Hillary shill who said there’s a special place in hell reserved for women who don’t vote for women) presented to the Russian and Serbian negotiators at Rambouillet a plan for NATO occupation of not just Kosovo but all Serbia. It was a ridiculous demand, rejected by the Serbs and Russians, but depicted by unofficial State Department spokesperson and warmonger Christiane Amanpour as the “will of the international community.” As though Russia was not a member of the international community! This Pristina airport operation was largely a symbolic challenge to U.S. hegemony over the former Yugoslavia, a statement of protest that should have been taken seriously at the time. In any case, the new Russian leader Putin was gracious after the 9/11 attacks in 2001, even offering NATO a military transport corridor through Russia to Afghanistan (closed in 2015). He was thanked by George W. Bush with the expansion of NATO by seven more members in 2004. (The U.S. press made light of this extraordinary geopolitical development; it saw and continues to see the expansion of NATO as no more problematic than the expansion of the UN or the European Union.) Then in April 2008 NATO announced that Georgia would be among the next members accepted into the alliance. Soon the crazy Georgian president Mikhail Saakashvili, emboldened by the promise of near-term membership, provoked a war with the breakaway republic of South Ossetia, which had never accepted inclusion of the new Georgian state established upon the dissolution of the Georgian Soviet Socialist Republic in 1991. The Ossetians, fearing resurgent Georgian nationalism, had sought union with the Russian Federation. So had the people of Abkhazia. The two “frozen conflicts,” between the Georgian state and these peoples, had been frozen due to the deployment of Russian and Georgian peacekeepers. Russia had not recognized these regions as independent states nor agreed to their inclusion in the Russian Federation. But when Russian soldiers died in the Georgian attack ion August, Russia responded with a brief punishing invasion. It then recognized of the two new states (six months after the U.S. recognized Kosovo). (Saakashvili, in case you’re interested, was voted out of power, disgraced, accused of economic crimes, and deprived of his Georgian citizenship. After a brief stint at the Fletcher School of International Law and Diplomacy at Tufts University—of which I as a Tufts faculty member feel deeply ashamed—he was appointed as governor of Odessa in Ukraine by the pro-NATO regime empowered by the U.S.-backed coup of February 22, 2014.) Sen. John McCain proclaimed in 2008: “We are all Georgians now,” and advocated U.S. military aid to the Georgian regime. An advocate of war as a rule, McCain then became a big proponent of regime change in Ukraine to allow for that country’s entry into NATO. Neocons in the State Department including most importantly McCain buddy Victoria Nuland, boasted of spending $ 5 billion in support of “the Ukrainian people’s European aspirations” (meaning: the desire of many Ukrainians in the western part of the country to join the European Union — risking, although they perhaps do not realize it, a reduction in their standard of living under a Greek-style austerity program — to be followed by NATO membership, tightening the military noose around Russia). The Ukrainian president opted out in favor of a generous Russian aid package. That decision — to deny these “European aspirations” — was used to justify the coup. But look at it from a Russian point of view. Just look at this map, of the expanding NATO alliance, and imagine it spreading to include that vast country (the largest in Europe, actually) between Russia to the east and Poland to the west, bordering the Black Sea to the south. The NATO countries at present are shown in dark blue, Ukraine and Georgia in green. Imagine those countries’ inclusion. And imagine NATO demanding that Russia vacate its Sevastopol naval facilities, which have been Russian since 1783, turning them over to the (to repeat: anti-Russian) alliance. How can anyone understand the situation in Ukraine without grasping this basic history? The Russians denounced the coup against President Viktor Yanukovych (democratically elected—if it matters—in 2010), which was abetted by neo-fascists and marked from the outset by an ugly Russophobic character encouraged by the U.S. State Department. The majority population in the east of the country, inhabited by Russian-speaking ethnic Russians and not even part of Ukraine until 1917, also denounced the coup and refused to accept the unconstitutional regime that assumed power after Feb. 22. When such people rejected the new government, and declared their autonomy, the Ukrainian army was sent in to repress them but failed, embarrassingly, when the troops confronted by angry babushkas turned back. The regime since has relied on the neo-fascist Azov Battalion to harass secessionists in what has become a new “frozen conflict.” Russia has no doubt assisted the secessionists while refusing to annex Ukrainian territory, urging a federal system for the country to be negotiated by the parties. Russian families straddle the Russian-Ukrainian border. There are many Afghan War veterans in both countries. The Soviet munitions industry integrated Russian and Ukrainian elements. One must assume there are more than enough Russians angry about such atrocities as the May 2014 killing of 42 ethnic Russian government opponents in Odessa to bolster the Donbas volunteers. But there is little evidence (apart from a handful of reports about convoys of dozens of “unmarked military vehicles” from Russia in late 2014) for a Russian “invasion” of Ukraine. And the annexation of Crimea (meaning, its restoration to its 1954 status as Russian territory) following a credible referendum did not require any “invasion” since there were already 38,000 Russian troops stationed there. All they had to do was to secure government buildings, and give Ukrainian soldiers the option of leaving or joining the Russian military. (A lot of Ukrainian soldiers opted to stay and accept Russian citizenship.) Still, these two incidents — the brief 2008 war in Georgia, and Moscow’s (measured) response to the Ukrainian coup since 2014 — have been presented as evidence of a general project to disrupt the world order by military expansion, requiring a firm U.S. response. The entirety of the cable news anchor class embraces this narrative. But they are blind fools. Who has in this young century disrupted world order more than the U.S., wrecking whole countries, slaughtering hundreds of thousands of innocents, provoking more outrage through grotesquely documented torture, generating new terror groups, and flooding Europe with refugees who include some determined to sow chaos and terror in European cities? How can any rational person with any awareness of history since 1991 conclude that Russia is the aggressive party? And yet, this is the conventional wisdom. I doubt you can get a TV anchor job if you question it. The teleprompter will refer routinely to Putin’s aggression and Russian expansion and the need for any mature presidential candidate to respect the time-honored tradition of supporting NATO no matter what. And now the anchor is expected to repeat that all 17 U.S. intelligence services have concluded that Vladimir Putin interfered in the U.S. presidential election. Since there is zero evidence for this, one must conclude that the Democratic losers dipped into the reliable grab bag of scapegoats and posited that Russia and Putin in particular must have hacked the DNC in order to — through the revelation of primary sources of unquestionable validity, revealing the DNC’s determination to make Clinton president, while sabotaging Sanders and promoting (through their media surrogates) Donald Trump as the Republican candidate — undermine Clinton’s legitimacy. All kinds of liberals, including Sanders’ best surrogates like Nina Turner, are totally on board the Putin vilification campaign. It is sad and disturbing that so many progressive people are so willing to jump on the new Cold War bandwagon. It is as though they have learned nothing from history but are positively eager, in their fear and rage, to relive the McCarthy era. But the bottom line is: U.S. Russophobia does not rest on reason, judgment, knowledge of recent history and the ability to make rational comparisons. It rests on religious-like assumptions of “American exceptionalism” and in particular the right of the U.S. to expand militarily at Russia’s expense — as an obvious good in itself, rather than a distinct, obvious evil threatening World War III. The hawks in Congress — bipartisan, amoral, ignorant, knee-jerk Israel apologists, opportunist scum — are determined to dissuade the president-elect (bile rises in my throat as I use that term, but it’s true that he’s that, technically) from any significant rapprochement with Russia. (Heavens, they must be horrified at the possibility that Trump follows Kissinger’s reported advice and recognizes the Russian annexation of Crimea!) They want to so embarrass him with the charge of being (as Hillary accused him of being during the campaign) Putin’s “puppet” that he backs of from his vague promise to “get along” with Russia. They don’t want to get along with Russia. They want more NATO expansion, more confrontation. They are furious with Russian-Syrian victories over U.S-backed, al-Qaeda-led forces in Syria, especially the liberation of Aleppo that the U.S. media (1) does not cover having no reporters on the ground, and little interest since events in Syria so powerfully challenge the State Department’s talking points that shape U.S. reporting, (2) misreports systematically, as the tragic triumph of the evil, Assad’s victory over an imaginary heroic opposition, and (3) sees the strengthening of the position of the Syrian stats as an indication of Russia’s reemergence as a superpower. (This they they cannot accept, as virtually a matter of religious conviction; the U.S. in official doctrine must maintain “full spectrum dominance” over the world and prohibit the emergence of any possible competitor, forever.) * * * The first Cold War was based on the western capitalists’ fear of socialist expansion. It was based on the understanding that the USSR had defeated the Nazis, had extraordinary prestige in the world, and was the center for a time of the expanding global communist movement. It was based on the fear that more and more countries would achieve independence from western imperialism, denying investors their rights to dominate world markets. It had an ideological content. This one does not. Russia and the U.S. are equally committed to capitalism and neoliberal ideology. Their conflict is of the same nature as the U.S. conflict with Germany in the early 20th century. The Kaiser’s Germany was at least as “democratic” as the U.S.; the system was not the issue. It was just jockeying for power, and as it happened, the U.S. intervening in World War I belatedly, after everybody else was exhausted, cleaned up. In World War II in Europe, the U.S. having hesitated to invade the continent despite repeated Soviet appeals to do so, responded to the fall of Berlin to Soviet forces by rushing token forces to the city to claim joint credit. And then it wound up, after the war, establishing its hegemony over most of Europe — much, much more of Europe than became the Soviet-dominated zone, which has since with the Warsaw Pact evaporated. Russia is a truncated, weakened version of its former self. It is not threatening the U.S. in any of the ways the U.S. is threatening itself. It is not expanding a military alliance. It is not holding huge military exercises on the U.S. border. It is not destroying the Middle East through regime-change efforts justified to the American people by sheer misinformation. In September 2015 Putin asked the U.S., at the United Nations: “Do you realize what you’ve done?” Unfortunately the people of this country are not educated, by their schools, press or even their favorite websites to realize what has been done, how truly horrible it is, and how based it all is on lies. Fake news is the order of the day. Up is down, black is white, Russia is the aggressor, the U.S. is the victim. The new president must be a team-player, and for God’s sake, understand that Putin is today’s Hitler, and if Trump wants to get along with him, he will have to become a team-player embracing this most basic of political truths in this particular imperialist country: Russia (with its nukes, which are equally matched with the U.S. stockpile) is the enemy, whose every action must be skewed to inflame anti-Russian feeling, as the normative default sentiment towards this NATO-encircled, sanction-ridden, non-threatening nation, under what seems by comparison a cautious, rational leadership? * * * CNN’s horrible “chief national correspondent” John King (former husband of equally horrid Dana Bash, CNN’s “chief political correspondent”) just posed the question, with an air of aggressive irritation: “Who does Donald Trump respect more, the U.S. intelligence agencies, or the guy who started Wikileaks [Assange]?” It’s a demand for the Trump camp to buy the Russian blame game, or get smeared as a fellow-traveler with international whistle-blowers keen on exposing the multiple crimes of U.S. imperialism. So the real question is: Will Trump play ball, and credit the “intelligence community” that generates “intelligence products” on demand, or brush aside the war hawks’ drive for a showdown with Putin’s Russia? Will the second Cold War peter out coolly, or culminate in the conflagration that “Mutually Assured Destruction” (MAD) was supposed to render impossible? The latter would be utterly stupid. But stupid people — or wise people, cynically exploiting others’ stupidity — are shaping opinion every day, and have been since the first Cold War, based like this one on innumerable lies. |

| Gold Seeker Closing Report: Gold and Silver Gain While Stocks and Dollar Fall Posted: 12 Jan 2017 01:37 PM PST Gold gained $16.02 to $1206.92 in Asia before it drifted back lower in London and New York, but it still ended with a gain of 0.38%. Silver rose to as high as $16.982 and ended with a gain of 0.3%. |

| Posted: 12 Jan 2017 01:25 PM PST Gold Resource Corporation ( NYSE MKT : GORO ) (the "Company") today announced preliminary 2016 year-end and fourth quarter mill production. The Company produced approximately 27,629 gold ounces and 1,857,777 silver ounces for the 2016 year, which exceeded its annual gold production target and achieved its annual silver production target. Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. |

| Biggest challenge of 2017 directly ahead for gold, stocks Posted: 12 Jan 2017 12:57 PM PST If you thought the pace of the head-spinning political events of the last two months couldn't get any faster, think again. One of the most critical decisions of President-Elect Trump's reign will soon be decided. The final verdict will have a direct impact on the direction of stocks, gold, and the economy in the months to come. |

| Posted: 12 Jan 2017 12:42 PM PST This post The Curse of Underwater Cars appeared first on Daily Reckoning. "Listen closely. Hear that?" asks Gerald Celente. "The echoes from the subprime mortgage crisis that kicked off the Panic of '08 are beginning to reverberate again." Today we pick up with the proliferation of auto loans to borrowers with a shaky credit history. "Just as subprime home loan borrowers secured loans with credit scores below 600, high-risk subprime car buyers have flocked to car dealers for years. "And they drive off the lot with shiny new cars. No job? No money in the bank? No problem. Just see your local car dealer. Get a deal you can't refuse." Now all that lending and borrowing is coming home to roost: "Nearly one in five subprime auto loan borrowers are two months or more behind on loan payments," Gerald tells us. "Delinquencies, according to Standard & Poor's, are at highs not seen since 2010. "According to credit tracking agency Experian, the average car loan is 68 months, or more than 5½ years. And many subprime loans offer payback periods of up to eight years, or 96 months. "Those longer payback periods guarantee the money owed outweighs the car's value as the loan matures. Many loans taken out in 2013 or 2014 are guaranteed by an asset worth less than what's due." Yep, there are upside-down auto loans these days — and a lot more of them than you might think. Matter of fact, nearly one-third of vehicles with a lien on them now carry "negative equity," to use the industry term. Little wonder when people trade in a vehicle on which they still owe money… and roll over the outstanding balance into a loan on a new vehicle.

By now, outstanding subprime auto debt is nearly three times the size it was just before the 2007–09 financial crisis. "Oh, boy, doesn't this all sound familiar?" asks Gerald. "That same circumstance fueled the housing market collapse: Mortgage holders couldn't pay. Lenders found themselves with delinquent loans. Balances were more than the home's value." We want to reinforce a point we've been making for more than three years now: Subprime auto loans are a problem, but not enough to wreck the economy as a whole. Nonetheless, "delinquencies are accelerating," Gerald warns. "Bad lenders who aggressively targeted this market sector and hold disproportionate amounts of risky loans will be hit hard. The fallout will be ugly. Some companies that deserve to fail will, in fact, evaporate into thin air." And yet… "The eventual fall of the worst-of-the-worst auto lenders will give fast movers like you a huge profit opportunity, and maybe more than one opportunity, this year." Kind regards, Dave Gonigam The post The Curse of Underwater Cars appeared first on Daily Reckoning. |

| 2017 – Spectacular For Gold And Silver But Disaster For Bonds And Stocks Posted: 12 Jan 2017 09:57 AM PST 2017 – Spectacular For Gold And Silver But Disaster For Bonds And Stocks |

| Real metal will defeat paper gold someday, Hathaway writes contentedly Posted: 12 Jan 2017 09:36 AM PST 12:34p ET Thursday, January 12, 2017 Dear Friend of GATA and Gold: In his market letter this month. Tocqueville Gold Fund manager John Hathaway says the physical gold market will defeat the paper gold market someday, leading to a much higher price for the monetary metal. Can the gold investment industry do anything to hasten the day, or should the industry remain content to collect fees and commissions all the way to the supposed inevitability, even though by then most of its investors may be dead? Hathaway offers no suggestions but does seem content. His letter is posted at the Tocqueville internet site here: http://tocqueville.com/insights/gold-strategy-investor-letter-4Q16 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: Dollar Vigilante Internationalization and Investment Summit Vancouver Resource Investment Conference Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Be Prepared for a Violent Fed Reversal Posted: 12 Jan 2017 09:29 AM PST This post Be Prepared for a Violent Fed Reversal appeared first on Daily Reckoning. The outlook for rates has taken what I call a U-turn. There's very little doubt that the Fed is on track to raise rates. This outlook is not in response to any particular piece of economic data or the overall economic picture. In fact there are plenty of arguments why the Fed should not raise rates based on economic fundamentals. However, they have a separate agenda which is that the Fed has committed, what I think will be viewed in hindsight, as a historical blunder by missing the opportunity to raise rates in 2010, 2011, 2012. That was when the economy was growing, not strongly but those were the early stages of the expansion. The economy was growing well enough then to justify rate increases. If the Fed had normalized rates in 2011-2012, between 2 – 2.5%, they would be in a good position today to cut rates if necessary to fight a recession. Unfortunately they did not do that. They missed an entire cycle while experimenting with Ben Bernanke's quantitative easing, which in hindsight will turn out to be a real mistake by the Fed. Now they're in the position to move rates after the eighth year into the recovery. While this has been a weak recovery, and people are still struggling with part-time employment, or can't launch careers on top of other difficulties, this recovery technically started in June of 2009. This makes for a very long recession by historic standards. More than twice as long as the average expansion since World War II, and comparable to the very long expansions we've had since 1980. We're closer to the end of this cycle than the beginning. The Fed is concerned that if another recession started tomorrow (and I'm not saying it will, but it could) it would have no ability to cut rates. While they currently have rates at 50 basis points, the Fed could only do two cuts until it was back to zero. This would force the decision to begin talking about negative interest rates. The Fed leadership wants to get rates up to 2 or 3% before any potential recession starts, just so they can cut them. The problem is, how do you raise rates to that level? How do you raise rates to 2 or 3% without causing a recession that you're trying to prevent? That's what I call the Fed's conundrum, and that's exactly where the Fed is now. Is this a good time to raise rates? Probably not, but they are going to try to do it anyway. The Fed has said they're on track to raise three times this year. The market doesn't believe it. The market is counting on maybe two rate hikes at most, but not three. My expectation right now is that the Fed will raise rates in March. First, they have a bias towards raising rates. The Fed is not neutral. The threshold is fairly low. They feel that it's "mission accomplished" on the job front; unemployment is 4.7%, we're continuing to create over 100,000 jobs a month. That's not the 2 or 300,000 jobs that we were creating a year to year and a half ago. It is still positive job growth, and with unemployment low and this rate in expansion, that's "good enough." Second, the Fed is concerned about inflation. The Fed believes that monetary policy acts with a lag. This means if you think inflation is coming, and expectations are going up, you need to raise rates now because it takes about a year for increases to have impact. They don't want to get behind the curve. While unemployment is low, together with other factors, the Fed applies what's called a Phillips curve for analysis. While I personally don't put much stock in the Phillips curve, it is worth analyzing to understand what the Fed does in order to forecast policy. If the Fed believes Donald Trump's policies will be stimulative, while unemployment's 4.7%, a standard Phillips curve for analysis would tell them that inflation is going to pick up late this year. This indicates that they should raise rates now to stay ahead. The Fed's got a conventional macroeconomic reason to raise rates, which is based on a Trump stimulus. They also have a bias towards raising rates because they should've raised them five years ago and didn't. For those reasons, I put them on track to raise rates now in March. Now the market doesn't expect this, or at least it is not giving that a lot of weight. The probability based on Fed funds futures is below 50%, so what the Fed will try to do over the next month or so is to steer expectations. The way they do this is leaks to the press, speeches and commentaries. Expect that to play out over the next month or so to try to get expectations up where the rate hike's not a shock. Here's where the U-turn comes in. If the Fed raises rates in March, which I expect right now, the economy is fundamentally weak. Here you've got the Fed trying to lean into stimulus, biased in favor of rate hikes at late stages for the economy. The stimulus might not be that stimulating. You could have a combination of the Fed raising rates, the Trump plan not producing that much stimulus, and the Fed raising into weakness and throwing the economy into recession. If that happens, the stock market will "fall out of bed." This won't tomorrow, by the way; this is something I expected to play out over the course of time. The Fed will have to have to reverse course, which they've done eight times since 2013. This is a recurring pattern. It will talk tough, raises rates, the market will fall out, the Fed will back off, go dovish and then apply forward guidance. You get a U-turn pattern with the stock market, with interest rate markets, etc. My short-term expectation is the Fed will raise rates in March. My intermediate-term expectation is that the market is going to be disappointed with the stimulus, the Fed tightening is going to be at the wrong time, the stock market's going to "fall out of bed," the economy's going to slow down, and the Fed will have to go dovish. At that point you're going to see rallies in bonds, rallies in gold, and a decline in the stock market. Right now we have the opposite of that. Gold has a lot of headwinds, bonds have a lot of headwinds, and the stock market obviously has been booming since the election, but all of that could reverse. We've seen this movie before. Kind regards, Jim Rickards The post Be Prepared for a Violent Fed Reversal appeared first on Daily Reckoning. |

| Gold swaps by BIS exploded in 2016 from nothing to record level Posted: 12 Jan 2017 08:28 AM PST Disclosures in the monthly statements of account published by the Bank for International Settlements since March 2016 indicate that in the last nine months of 2016 the bank increased substantially its use of gold swaps. There is not enough information in the monthly reports to calculate the exact amount of swaps, but based on the information in the BIS' December 2016 statement of account, the bank's gold swaps likely stood in excess of 480 tonnes as of the end of the calendar year. |

| Gold swaps by BIS exploded in 2016 from nothing to record level Posted: 12 Jan 2017 08:11 AM PST By Robert Lambourne Disclosures in the monthly statements of account published by the Bank for International Settlements since March 2016 indicate that in the last nine months of 2016 the bank increased substantially its use of gold swaps. There is not enough information in the monthly reports to calculate the exact amount of swaps, but based on the information in the BIS' December 2016 statement of account, the bank's gold swaps likely stood in excess of 480 tonnes as of the end of the calendar year. This is the BIS' highest level of gold swaps recorded in recent times. The BIS' annual report for its financial year ended March 31, 2010, disclosed that 346 tonnes of gold were acquired through gold swaps from commercial bullion banks. A review of the previous use of gold derivatives by the BIS reveals that the transactions in 2009-10 were far more substantial than anything done by the bank in the years immediately leading up to that. ... Dispatch continues below ... ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ The use of gold swaps by the BIS increased in the financial year ended March 31, 2011, with 409 tonnes of gold swaps reported. As this chart will show, that was the peak amount reported by the bank prior to this year: March 2011: 409 tonnes. As the table shows, the use of gold swaps by the BIS fell considerably up to March 2016, when the use of swaps appeared to have stopped. The BIS offers no explanation for its renewed use of gold swaps in its interim financial statements for the 2016-17 financial year, which were published on November 7, 2016. By contrast, back in 2010 the BIS discussed its gold swaps with the Financial Times in an article published on July 29 that year. BIS General Manager Jaime Caruana said the gold swaps were "regular commercial activities" for the bank: http://www.ft.com/cms/s/0/3e659ed0-9b39-11df-baaf-00144feab49a.html Here are excerpts from the article: "Some analysts speculated that the swap deals were a surreptitious bailout of the European banking system ahead of last week's publication of stress tests. But bankers and officials have described the transactions as 'mutually beneficial.' ... "'The client approached us with the idea of buying some gold with the option to sell it back,' said one European banker, referring to the BIS. "Another banker said: 'From time to time central banks or the BIS want to optimize the return on their currency holdings.'" It is notable that none of these comments in the FT article focused on the gold market itself but implicitly accepted that gold was being used as collateral to support dollar loans to commercial banks. An alternative explanation -- that the swap transactions were initiated by the BIS to place more unallocated gold in the hands of certain central banks -- seemed plausible, since the gold market was tight at the time. Perhaps not conicidentally, the BIS has renewed its use of gold swaps just when many commentators consider gold market conditions to be tight again, as they were in 2010 and 2011. ---- Robert Lambourne is a business executive in the United Kingdom and a GATA consultant. Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

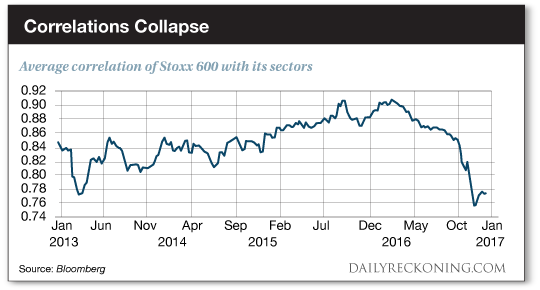

| They Get Away with Murder. You Book Profits… Posted: 12 Jan 2017 07:57 AM PST This post They Get Away with Murder. You Book Profits… appeared first on Daily Reckoning. They're getting away with murder… That's how Trump described the pharmaceutical industry at his Wednesday press conference. Trashing Big Pharma has become a favorite pastime of the political class. And the president-elect showed us that he knows how to play the game. Naturally, the entire health care sector took a hit as soon as Trump went after the drug companies. That has traders worried about additional headline risk as the inauguration draws near. "Going forward, any time Trump is live in a press conference, or speaks about a market-related item, you’ll have this risk," equity trader Michael Antonelli tells the Wall Street Journal. "These events may introduce a new kind of headline risk and we live in a world where these things are instantaneously translated into prices." Pharma stocks weren't the only names dancing during the Trump presser. Gold jumped back to life and the dollar dropped. Then the major averages slipped—only to recover later in the afternoon. Are we concerned about all this political nonsense? No way. Why? Because not that long ago, trading conditions were much worse. Most of 2016 was downright terrible for anyone looking to beat the stock market. By September, the difference between various asset classes' returns hit levels not seen in almost 20 years. Correlations went up. Volatility went down. That didn't bode well for stock pickers. It also didn't create a particularly productive environment for fund managers who are expected to beat the major averages. When every single stock on the market is stuck together like glue, you don't have much of a shot at booking outsized gains. Thankfully, the post-election rally saved the stock pickers from another dreary quarter. Instead of watching paint dry in a highly correlated market, investors have experienced an avalanche of shifting market themes in the weeks since the election. First, money poured out of some of the best performing stocks of the past two years and into the forgotten corners of the market immediately after Trump won. Materials and financial stocks soared. Hedge funds had entered October holding their largest collective position in the technology sector in over ten years. They were caught off guard and underexposed to financials and industrial names, adding fuel to the buying frenzy. Next came a furious small-cap run up. Then an oil spike helped spark an energy stock rally. Add the December rate hike into the mix and you had a recipe for even more market rotation. Real estate, utilities and other dividend payers sank. Precious metals took a hit.

Despite what the fund managers and financial media are telling you, this market is offering plenty of chances to book double-digit gains. You just have to hitch your wagon to the breakout stocks that are bubbling up under the surface of the major averages. That's a far cry from what investors had experienced during the stealth bear markets of the past two years… Remember, the broad market's chop was fueled in part by what MKM Partners chief technician Jonathan Krinsky dubbed "rolling bear markets". "It began with Energy and Materials in late 2014, spilled into Industrials, Financials, and Biotech, and most recently Retail," Krinsky noted last year. "While the SPX has only suffered a 14% drawdown peak-to-trough, 20 of 24 industry groups have seen at least a 15% drawdown." Trump hysteria isn't going away anytime soon. The financial media will continue to play up the "Trump bump" and overplay every single market-related comment. That's fine. We can just tune out this noise. Thanks to collapsing correlations, the market's giving us plenty of opportunities to book consistent gains. Sincerely, Greg Guenthner The post They Get Away with Murder. You Book Profits… appeared first on Daily Reckoning. |

| Video Commentary - Gold Update Posted: 12 Jan 2017 07:08 AM PST There is now little doubt that the yearly cycle low in gold is behind us and we are in the advancing phase of a new intermediate cycle. |

| Why Gold Bulls Should Love Wednesday's Nasty Swoon Posted: 12 Jan 2017 07:00 AM PST Gold's robust rally paused for just long enough on Wednesday to discourage bulls — including your editor, who had advised a long position in GDX with a stop-loss far more generous than is typical for a Rick's Picks trade. Unfortunately, it wasn't generous enough to weather the gratuitous swoon shown in the chart (see inset), although it did leave the 1210.50 rally target we'd been using intact. I've lowered the target slightly, to 1209.80, to conform to a 'one-off' low at 1147.20 that looks likely to produce a more accurate short-term top. |

| Posted: 12 Jan 2017 06:20 AM PST Gold Resource Corporation ( NYSE MKT : GORO ) (the "Company") today announced the most significant expansion of its Switchback vein system to date with a greater than 200 meter step-out drill intercept at the Aguila Project's Arista mine. Gold Resource Corporation is a gold and silver producer, developer and explorer with operations in Oaxaca, Mexico and Nevada, USA. The Company has returned $109 million to shareholders in monthly dividends since commercial production commenced July 1, 2010, and offers shareholders the option to convert their cash dividends into physical gold and silver and take delivery. |

| Posted: 12 Jan 2017 06:17 AM PST Shanghai continues to lead the way for the gold price. And as happened yesterday London and New York rose too. With Shanghai prices continuing to rise we expect London and New York to rise again too. To catch Shanghai up, prices in New York need to rise another $15. London is now in line with yesterday's Shanghai gold price. |

| Gold Rallies To $1,207 After Trump Press Conference Shambles Posted: 12 Jan 2017 06:10 AM PST Gold prices made further gains today amid reduced focus on the Fed and speculation regarding their potential rate hikes and more focus on the next four years of the Trump Presidency. The dollar declined alongside US Treasury bond yields, although U.S. stock indices were supported yesterday and remained buoyant. Declines in Asian and European bourses today have seen U.S. futures decline this morning and the dollar has seen further losses pushing gold higher in all currencies. |

| Expect the Expected in 2017. For the Rest, Buy Gold Posted: 12 Jan 2017 05:47 AM PST Bullion Vault |

| USD in Decline. SPX and TNX May Follow Posted: 12 Jan 2017 05:44 AM PST The USD is in decline, challenging its 50-day Moving Average at 10.99 by declining to 100.70 this morning. The USD has a high correlation to equities and an inverse correlation to treasuries and gold. |

| Gold Rallies To $1,207 After Trump Press Conference Shambles Posted: 12 Jan 2017 04:32 AM PST Gold has rallied to $1,207/oz today as stocks globally have weakened after the first press conference of incoming President Trump turned into a bit of a debacle. |

| Breaking News And Best Of The Web Posted: 12 Jan 2017 01:37 AM PST US stocks fall after Trump press conference. Bitcoin falls from recent high, gold resumes its rise. US jobs growth and wholesale inventories disappoint but wages jump. Global debt continues to soar, especially in China. US retaliates against alleged Russian hacking. Fake news debate rages. Trump holds first press conference since election. Best Of The […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Is the Appointment of Paul Zink a Game-Changer for Terraco Gold? Posted: 12 Jan 2017 12:00 AM PST Terraco Gold rang in 2017 with the announcement that it has appointed Paul Zink as consultant and advisor. |

| High-Grade Gold Discovery in New Mexico Doubles the Opportunities for Southern Silver Exploration Posted: 12 Jan 2017 12:00 AM PST The discovery of a widespread oxide gold system at the Oro deposit in New Mexico creates a second prospect for Southern Silver Exploration. |

| Nexus Scores on Gold, Misses on Press Release Posted: 12 Jan 2017 12:00 AM PST Veteran investor Bob Moriarty provides an update on Nexus Gold's potential home runs in Burkina Faso. |

| Posted: 11 Jan 2017 04:01 PM PST Rick Rule on why gold might tread water for a while before it soars. Donald Trump’s first post-election press conference — see what all the fuss is about. David Morgan, Mike Maloney and more than the usual amount of Max Keiser. The post Top Ten Videos — January 12 appeared first on DollarCollapse.com. |

| Gold Stalls at $1205 as Chinese New Year Approaches Posted: 11 Jan 2017 04:00 PM PST |

| Biggest Challenge of 2017 Directly Ahead for Gold, Stocks Posted: 11 Jan 2017 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment