saveyourassetsfirst3 |

- Former Treasury Official: Dollar Should Be Reduced Already to the Level of Toilet Paper

- COT Report: Gold, Wheat And Corn Markets Are Losing Liquidity

- Dollar Index Revisited

- The Corporate Media’s Gulag of the Mind

- Jimmy Carter Urges Obama To Divide The Land Of Israel At The UN Before Jan 20th

- 2:00PM Water Cooler 12/5/2016

- Turkey Has Declared War On Syria – Is World War 3 About To Erupt In The Middle East?

- A Conversation With SGT Report On The New World Order

- Return of the HEROES

- The Last Time The Fed Hiked Rates in December, Silver Began An $8 Rally

- To Really Make America Great, Trump Could “Reassert 4th Amendment And Roll Back Surveillance State”

- Markets Mega-Movers Impending | Deepcaster

- Relief Rally Coming in Gold and Gold Stocks

- Report: Radioactive Device Stolen In Iran: Officials Warn: “Could Yield A Dirty Bomb”

- Precious Metals in Trump’s 1st Term

- Breaking News And Best Of The Web

- Relief Rally Coming in Gold & Gold Stocks

- Major Royalty Companies All Good Buys Now

- Dang It Gold’s Supposed to Go Up! (Report 4 December, 2016)

- Video Update: Relief Rally Starting

- Global Financial Markets Plunged Into Chaos As Italy Overwhelmingly Votes ‘No’

- Jack Chan: This Past Week in Gold

| Former Treasury Official: Dollar Should Be Reduced Already to the Level of Toilet Paper Posted: 05 Dec 2016 01:00 PM PST “The Federal Reserve's balance sheet has exploded. Anyone who has surplus funds should be holding gold and silver because the dollar should be reduced already to the level of toilet paper…” From Greg Hunter: On holding physical gold and silver, Reagan Treasury Official Dr. Paul Craig Roberts says, "Anyone who has surplus funds should be […] The post Former Treasury Official: Dollar Should Be Reduced Already to the Level of Toilet Paper appeared first on Silver Doctors. |

| COT Report: Gold, Wheat And Corn Markets Are Losing Liquidity Posted: 05 Dec 2016 12:45 PM PST |

| Posted: 05 Dec 2016 12:17 PM PST |

| The Corporate Media’s Gulag of the Mind Posted: 05 Dec 2016 12:00 PM PST Your crime, as it were, need not be substantiated with evidence; the mere fact you publicly revealed your anti-Establishment thought convicted you. From Charles Hugh Smith, Of Two Minds: One of the most remarkable ironies of The Washington Post’s recent evidence-free fabrication of purported “Russian propaganda” websites (including this site) is how closely it […] The post The Corporate Media’s Gulag of the Mind appeared first on Silver Doctors. |

| Jimmy Carter Urges Obama To Divide The Land Of Israel At The UN Before Jan 20th Posted: 05 Dec 2016 11:00 AM PST In an absolutely stunning editorial for the New York Times, former president Jimmy Carter has publicly called for Barack Obama to divide the land of Israel at the United Nations before Inauguration Day. From Michael Snyder: While he was president, Carter negotiated peace between Israel and Egypt, and ever since that time he has […] The post Jimmy Carter Urges Obama To Divide The Land Of Israel At The UN Before Jan 20th appeared first on Silver Doctors. |

| Posted: 05 Dec 2016 11:00 AM PST |

| Turkey Has Declared War On Syria – Is World War 3 About To Erupt In The Middle East? Posted: 05 Dec 2016 10:00 AM PST Is THIS the spark that ignites WW 3? From Michael Snyder, The Economic Collapse Blog: Turkish President Recep Tayyip Erdogan has just announced that the only reason Turkish military forces have entered northern Syria is to "end the rule of the tyrant al-Assad". By publicly proclaiming that Turkey intends to use military force to […] The post Turkey Has Declared War On Syria – Is World War 3 About To Erupt In The Middle East? appeared first on Silver Doctors. |

| A Conversation With SGT Report On The New World Order Posted: 05 Dec 2016 09:00 AM PST Can the NWO Be Stopped? From PM Fund Manager Dave Kranzler: When George H. Bush was president, I was working on Wall Street at the time as a junk bond trader. I vividly recall the rumors circulating that Bush was pedophile. That he had a mistress was a confirmed rumor. As it turns out, […] The post A Conversation With SGT Report On The New World Order appeared first on Silver Doctors. |

| Posted: 05 Dec 2016 08:11 AM PST WAR IS HELL 1 oz Silver Antiqued Proof | Numbered Rim | 500 Minted! The post Return of the HEROES appeared first on Silver Doctors. |

| The Last Time The Fed Hiked Rates in December, Silver Began An $8 Rally Posted: 05 Dec 2016 08:01 AM PST With A Historic Month for the Markets Behind Us, Craig Hemke Joins the Show For In-Depth Analysis, Discussing: Biggest Move in Treasury Market In HISTORY – Implications For Gold and Silver? The TRIGGER? Last Time The Fed Hiked Rates in December, Silver Began An $8 Rally Doc Reveals the REAL Reason For the Elite’s War […] The post The Last Time The Fed Hiked Rates in December, Silver Began An $8 Rally appeared first on Silver Doctors. |

| To Really Make America Great, Trump Could “Reassert 4th Amendment And Roll Back Surveillance State” Posted: 05 Dec 2016 08:00 AM PST During the last eight years, the Obama administration expanded and justified the mass surveillance of American citizens. by Kelli Sladick, Tenth Amendment Center via SHTFPlan: Editor's Comment: The truth of the matter is that presidents come and go, and while some are better than others, it is better that way. What remains, and shall not be […] The post To Really Make America Great, Trump Could "Reassert 4th Amendment And Roll Back Surveillance State" appeared first on Silver Doctors. |

| Markets Mega-Movers Impending | Deepcaster Posted: 05 Dec 2016 07:30 AM PST Equities and other Markets have Rallied Lately on the Prospect (Hope) that a Trump Administration will renew economic growth. But there are Several Major Events and Developments coming in the next few weeks which will drive some Sectors Much Higher and Crash others. Consider: Submitted by Deepcaster: "If you don't do Macro, Macro will […] The post Markets Mega-Movers Impending | Deepcaster appeared first on Silver Doctors. |

| Relief Rally Coming in Gold and Gold Stocks Posted: 05 Dec 2016 07:05 AM PST The Daily Gold |

| Report: Radioactive Device Stolen In Iran: Officials Warn: “Could Yield A Dirty Bomb” Posted: 05 Dec 2016 07:00 AM PST Those who would do us harm will stop at nothing to kill as many men, women and children as possible. A chemical, biological, radiological or nuclear device will be their weapon of choice for such an attack if they can get their hands on it. From Mac Slavo: Conflicting reports from the middle east […] The post Report: Radioactive Device Stolen In Iran: Officials Warn: "Could Yield A Dirty Bomb" appeared first on Silver Doctors. |

| Precious Metals in Trump’s 1st Term Posted: 05 Dec 2016 05:51 AM PST Precious Metals in Trump's 1st TermWhat will happen to precious metals in Trump's First term? Will the Trump Administration have an economic calamity in the bond market because of the heavy global debt load? Precious metals expert David Morgan says, "Yes, something will take place before the four years is over. I can almost guarantee that. The math is just too simple to see, and you are already seeing it in the bond market. I am very confident because of how the bond market is reacting. The amount of paper that has been pushed upon the system has reached a point that the system cannot tolerate any more. Things will unravel in some way, shape or form. . . . I think before that four year time frame (Trump's first term) is over, we are going to see that big thrust into the precious metals." If you have a mutual fund and have your money with a broker the law now allows the broker to refuse to cash out your account. Your money is pledged to the banks to bail their debts out. The way the debt repayment law is structured the derivatives that get repaid first. If the financial bomb blows up the most liquid financial asset will be precious metals. Precious Metals in Trump's 1st Term< won't only be affected by what is happening in the precious metals markets. There will also be geopolitical and global forces that shape what haooens. David discusses with Greg some of the repercussions of Trump election. David believes there will be a honeymoon period. There will be some jobs created. It will feel for a short amount of time like for many America is on the way to being great again. However it won't last because the fundamentals of the debt bomb and increased productivity have not been solved. However the bonds of trust between peoples, businesses, governments and politicians has been lost. Doing what you say you are going to do is one of the foundations that have made America great. David Morgan has just published a new book in which he discusses ome of the opportunities for you to profit:  David Morgan is the author of the new book "Second Chance: How to make and keep big money from the coming of the gold and silver shock-wave." To learn more about the books and services David Morgan offers please visit his web page here David Morgan's Resource Page Listen to the Precious Metals Investing podcast. You can find it on both iTunes and Google Play Music for android users. Precious Metals Investing podcast on iTunes Precious Metals Investing podcast on Google Play Music Greg Hunter interviews David Morgan. Visit Greg's site at USAWatchdog.com: http://usawatchdog.com/record-run-into-gold-and-silver-coming-david-morgan/ The post Precious Metals in Trump's 1st Term appeared first on PreciousMetalsInvesting.com. |

| Breaking News And Best Of The Web Posted: 05 Dec 2016 01:37 AM PST Renzi loses Italian vote, populist parties energized. Euro falls, gold drops and US stocks pop. Austria chooses Green over far-right candidate for president. India’s war on cash may turn into war on gold. Political class still searching for an explanation (see “Best of the Web”). Trump’s cabinet takes shape, with mostly old and a few […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

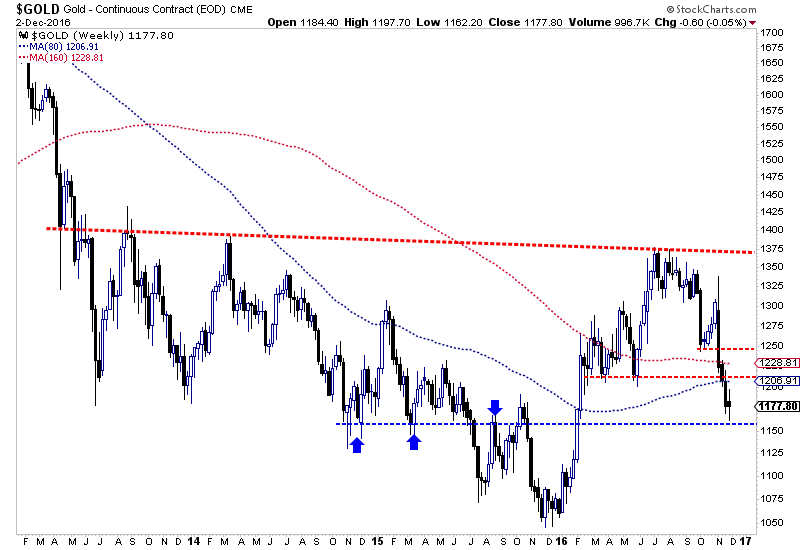

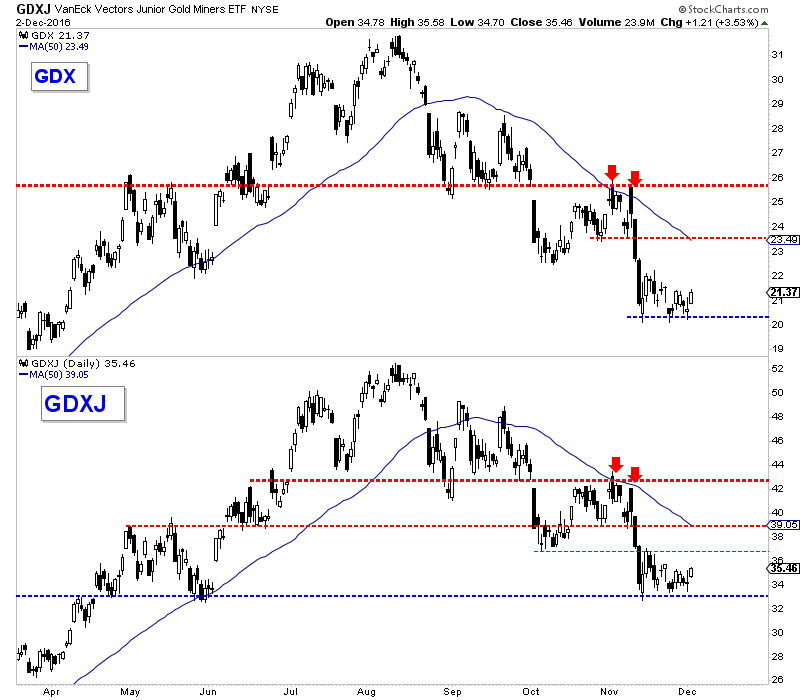

| Relief Rally Coming in Gold & Gold Stocks Posted: 05 Dec 2016 01:27 AM PST Last week we wrote that Gold was broken but noted the oversold condition in the precious metals sector as well as the relative strength in the gold stocks. At one moment last week, the gold stocks were trading above where they were in mid-November when Gold was trading some $60/oz higher. In other words, Gold plummeted $60/oz and made a new low yet the gold stocks did not. It took a bit longer than we expected but Gold and gold mining stocks may have started their rebound at the end of last week. Gold formed a bit of a bullish hammer last week as it managed to close the week well off its low of $1162/oz. Note that Gold managed to rebound from support around $1155-$1160/oz, which is the strongest support between $1080 to $1180/oz. Gold was already oversold when it broke below $1200/oz. The likelihood of a rebound was increasing after Gold lost $1180/oz. Going forward, the rebound targets are $1210/oz, $1230/oz and $1250/oz. We think Gold will test its 40-month moving average at $1230/oz.

As we noted, the gold stocks have held up very well in recent weeks considering Gold's continued decline. Most of the recent daily candles signal accumulation and Friday's gain could be the start of a sustained rebound. The strongest confluence of resistance is at GDX $23.50 and GDXJ $39. These are the conservative, realistic targets. There is also a chance miners could rally a bit farther towards very strong resistance near GDX $26 and GDXJ $42.50. The short and medium term outlook for the precious metals sector is clear. Traders and investors could use the coming strength to de-risk their portfolios and raise cash for a better buying opportunity at the end of winter. Generally speaking, we do not want to think about buying investment positions until we see sub $1080 Gold and an extreme oversold condition coupled with bearish sentiment. The gold stocks have held up very well in recent weeks and we are curious to see if they can continue to outperform Gold beyond the short term. That could affect our medium term outlook. For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017. Jordan Roy-Byrne, CMT, MFTA

The post Relief Rally Coming in Gold & Gold Stocks appeared first on The Daily Gold. |

| Major Royalty Companies All Good Buys Now Posted: 05 Dec 2016 12:00 AM PST |

| Dang It Gold’s Supposed to Go Up! (Report 4 December, 2016) Posted: 04 Dec 2016 09:08 PM PST Monetary Metals |

| Video Update: Relief Rally Starting Posted: 04 Dec 2016 07:47 PM PST Gold and gold stocks have been oversold for weeks. Gold has found support just above key support at $1155-$1160. Meanwhile, gold stocks held up well and did not make new lows even as Gold declined $60/oz. Targets and expectations are discussed. Click Here to Learn More About our Premium Service

The post Video Update: Relief Rally Starting appeared first on The Daily Gold. |

| Global Financial Markets Plunged Into Chaos As Italy Overwhelmingly Votes ‘No’ Posted: 04 Dec 2016 07:10 PM PST

I know that I said a lot in that first paragraph, but it is imperative that people understand how serious this crisis could quickly become. This “no” vote virtually guarantees a major banking crisis for Italy, and many analysts fear that it could trigger a broader financial crisis all across the rest of the continent as well. Just look at what has already happened. All of the votes haven’t even been counted yet, and the euro is absolutely plummeting…

In early 2014, there were times when one euro was trading for almost $1.40. For a very long time I have been warning that the euro was eventually heading for parity with the U.S. dollar, and now we are almost there. Meanwhile, Italian government bonds are going to continue to crash following this election result. This is going to make it even more difficult for the Italian government to borrow money, and that will only aggravate their ongoing financial troubles. But the big problem in Italy is the banks. At this moment there are eight banks in imminent danger of collapsing, and virtually all of the rest of them are in some stage of trouble. The following comes from a Bloomberg article about the crisis that Italian banks are facing right at this moment…

And we may get some news regarding the fate of Banca Monte dei Paschi di Siena as early as Monday morning if what the Sydney Morning Herald is reporting is correct…

If Banca Monte dei Paschi di Siena fails, major banks all over Italy (and all over the rest of Europe) could start going down like dominoes. So what were Italians voting on anyway? Well, the truth is that the constitutional reforms that were proposed actually sound quite boring…

The reason why this vote was ultimately so important is because it became a referendum on Renzi’s administration. The fact that he announced in advance that he would resign if it did not get approved gave a tremendous amount of fuel to the opposition. So now Beppe Grillo’s Five-Star Movement stands poised to come to power, and that could be very bad news for those that are hoping to hold the common currency together. The following is how NPR recently summarized the main goals of the Five-Star Movement…

If Italy chooses to leave the euro, it will probably mean the end of the common currency, and the continued existence of the entire European Union would be called into question. So this vote on Sunday was huge. The Brexit had already done a tremendous amount of damage to the long-term prospects for the European Union, and now the crisis in Italy is sending political and financial shockwaves throughout the entire continent. Over the next few weeks, keep a close eye on the euro and on Italian government bonds. If they both continue to crash, that will be a sign that a major European financial crisis is now upon us. And what happens in Europe definitely does not stay in Europe. If Europe goes down, we are going to go down too. At this point we still have almost a month left in 2016, but 2017 is already shaping up to be a very troubling year. As always, let us hope for the best, but let us also keep preparing for the worst. |

| Jack Chan: This Past Week in Gold Posted: 03 Dec 2016 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment