saveyourassetsfirst3 |

- Silver Wheaton - Exceptional Business Plan On Cornerstone Assets

- Gold & Gold Stocks Setup for Post-Fed Rally

- Gold’s Brutal Beatdown Ending?

- Alasdair Macleod’s Market Report: Gold Steadies

- Gold Investors Can Profit from This Key Contrarian Indicator

- Breaking News And Best Of The Web

- Gold BOMBED Again! – Harvey Organ

- CASE CLOSED: The Fact of Bullion Bank Gold and Silver Price Manipulation - Craig Hemke

- Trumphoria: Americans Are More Optimistic About The Economy Than They Have Been Since Obama’s Win In 2008

- The Lost Gold Mine of Venezuela

| Silver Wheaton - Exceptional Business Plan On Cornerstone Assets Posted: 11 Dec 2016 12:36 PM PST |

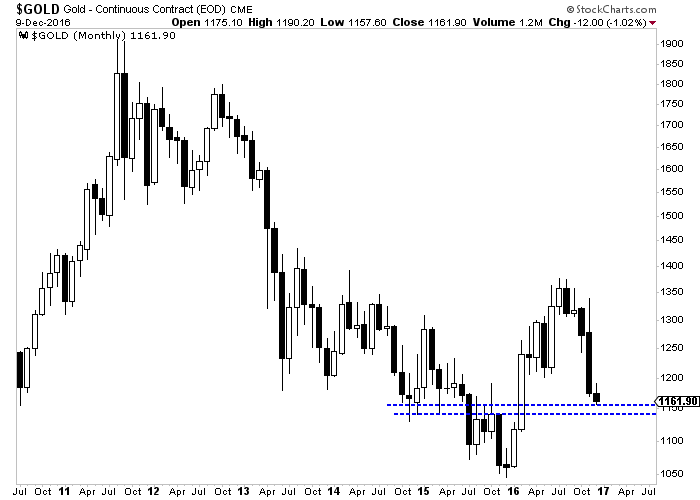

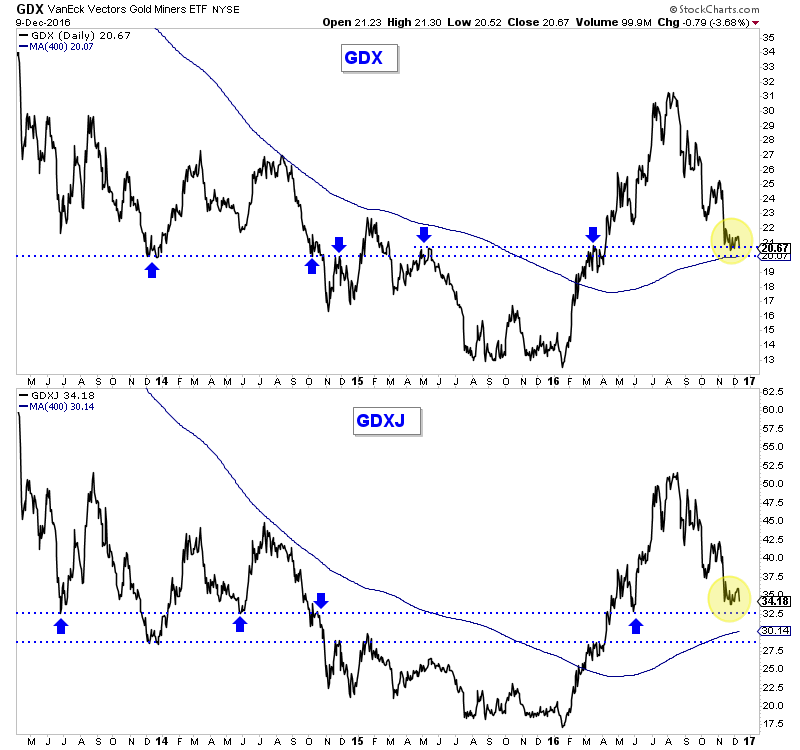

| Gold & Gold Stocks Setup for Post-Fed Rally Posted: 11 Dec 2016 12:18 PM PST Gold and gold mining stocks have been very oversold but have struggled to rally. The sector looked to be starting a rebound until Friday's decline which pushed Gold to a new low. However, positive divergences remain in place as gold stocks and Silver remain above their recent lows. While the Federal Reserve could say something hawkish next week, the setup continues to favor a rebound in the precious metals sector rather than an immediate decline to new lows. The monthly chart of Gold is shown below. Gold closed last week at $1162/oz after trading as low as $1157/oz. The weekly chart (not shown) shows key support (and closes) at $1158-$1165/oz while the monthly chart shows support from $1142 to $1157/oz. That range marked key support or resistance from the end of 2014 through most of 2015. It is highly unlikely that Gold does not hold this level in its current oversold state. However, that does mean Gold could test as low as $1142/oz before rebounding.  Gold Monthly Chart The gold stocks are in a similar position in that they could drop a tiny bit more before the start of a rebound. The daily line chart below shows the strong support in GDX at $20, which includes the 400-day moving average. GDX closed Friday at $20.67. Also, the 62% retracement is 1% below $20, at $19.80. GDXJ has been stronger as it remains a good distance above its 400-day moving average and 62% retracement. However, the chart below shows key support at $32.50, which is 5% below Friday's close.  GDX, & GDXJ Daily Line The technicals argue that both Gold and gold mining stocks could drop a tiny bit more before starting a rebound. It would not surprise me if the sector is soft into or even immediately after the coming Federal Reserve rate hike. Once that passes, the sector could be in position to rally as expected. The coming strength would be an opportunity for traders and investors to de-risk their portfolios and raise cash for a better buying opportunity early next year. Generally speaking, we do not want to buy investment positions until we see sub $1100 Gold and an extreme oversold condition coupled with bearish sentiment. For professional guidance in riding the bull market in Gold, consider learning more about our premium service including our favorite junior miners for 2017. Jordan Roy-Byrne, CMT, MFTA Jordan@TheDailyGold.com The post Gold & Gold Stocks Setup for Post-Fed Rally appeared first on The Daily Gold. |

| Gold’s Brutal Beatdown Ending? Posted: 11 Dec 2016 11:00 AM PST Gold has suffered brutal, withering selling pressure in the month following the US presidential election. The stock markets' surprise surge after Trump's surprise win has led speculators and investors alike to rush for the gold exits. As usual the former group's extreme selling came largely through gold futures. But this gold-futures dumping has been so […] The post Gold’s Brutal Beatdown Ending? appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: Gold Steadies Posted: 11 Dec 2016 08:55 AM PST Gold and silver are showing signs of support this week, with silver notably recovering its poise, as the chart above shows. From Alasdair Macleod: Gold and silver are showing signs of support this week, with silver notably recovering its poise, as the chart above shows. Today gold is unchanged from last Friday's close at […] The post Alasdair Macleod’s Market Report: Gold Steadies appeared first on Silver Doctors. |

| Gold Investors Can Profit from This Key Contrarian Indicator Posted: 11 Dec 2016 07:59 AM PST  The price of gold has been trounced the past few weeks, and most of the bulls have left the building. The price of gold has slid $175 since election night, but this pales in comparison to the amount of bulls heading for the exits. According to the Daily Sentiment Index, bullish sentiment on gold has […] The price of gold has been trounced the past few weeks, and most of the bulls have left the building. The price of gold has slid $175 since election night, but this pales in comparison to the amount of bulls heading for the exits. According to the Daily Sentiment Index, bullish sentiment on gold has […] |

| Breaking News And Best Of The Web Posted: 11 Dec 2016 01:37 AM PST US stocks hit new record, Treasury bond yields jump again. European Central Bank maintains QE, the euro plunges, euro-bond yields rise. Italian government forced to “bail in” major bank. Gold falls further; Friday’s COT report shows modestly bullish changes. The “fake news” debate intensifies. Best Of The Web The march of the billionaires: on […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Gold BOMBED Again! – Harvey Organ Posted: 10 Dec 2016 09:56 PM PST GOLD BOMBED AGAIN! GOLD BOMBED AGAIN ON FRIDAYS, DOWN $10.40/SILVER DOWN 12 CENTS/MORE ON THE EVIDENCE FILED IN SILVER RIGGING CASE/HUGE SPREAD OF 28 DOLLARS ON THE SHANGHAI FIX VS NY PRICING/THE ECB REJECTS GIVING MONTE DE PASCHI MORE TIME/GERMANY'S BUBA CHIEF TOTALLY AGAINST ECB DECISION OF MORE QE Gold at (1:30 am […] The post Gold BOMBED Again! – Harvey Organ appeared first on Silver Doctors. |

| CASE CLOSED: The Fact of Bullion Bank Gold and Silver Price Manipulation - Craig Hemke Posted: 10 Dec 2016 07:33 PM PST Sprott Money |

| Posted: 10 Dec 2016 05:17 PM PST

It is funny how our political perspectives so greatly shape our view of the future. Because Trump won, Democrats now have an extremely dismal opinion of where the economy is heading, while Republicans suddenly believe that happy days are here again. Of course the truth is that the president has far less power to influence the economy than the Federal Reserve does, and so most Americans greatly overestimate what a president can do to alter our economic trajectory. But for now most Americans (excluding Democrats) are feeling really good about where things are headed. In fact, we just learned that the University of Michigan consumer confidence survey has soared to the highest level that we have seen since 2005. And of course the financial markets continued to roll onward and upward on Friday. The Dow was up another 142 points, and it is now less than 250 points away from the magic number of 20,000. I never thought that we would actually get to 20,000, but thanks to “Trumphoria” we may actually get there before the wheels start coming off. This post-election run has really been unprecedented. The following comes from CNBC…

Wouldn’t it be great if every month during Trump’s presidency was like the last 30 days? Trump promised that we would start winning so much that we would actually start getting tired of winning, and so far we are off to a tremendous start. As I discussed yesterday, some of the biggest winners from “Trumphoria” have been the big banks…

But is this momentum in the financial markets sustainable? Of course not. There are signs of emerging economic trouble all around us. For instance, Sears just announced that it lost 748 million dollars last quarter and that it plans to liquidate even more stores. How in the world do you lose three-quarters of a billion dollars in a single quarter? If you had employees in every store literally flushing dollar bills down the toilet all day I don’t think you could lose money that quickly. And the moment that Trump takes office, he may immediately be faced with a major financial crisis in Europe which has been sparked by the meltdown of large Italian banks. The following comes from a Forbes article entitled “Italy’s Banking Crisis Is Nearly Upon Us“…

Unfortunately, it looks like things are about to get very real for Italian banking giant Monte dei Paschi di Siena. According to Reuters, the European Central Bank has turned down their request for more time to raise needed capital…

But most Americans have no idea what is unfolding in Europe right now. As Americans, we tend to be largely oblivious to what is going on in the rest of the world, and at this moment “Trumphoria” has gripped our nation. It is certainly not wrong to celebrate the fact that we are getting Donald Trump instead of Hillary Clinton, but let us also not lose sight of the fact that we are likely to be facing some tremendous challenges very early in 2017. |

| The Lost Gold Mine of Venezuela Posted: 10 Dec 2016 04:00 PM PST New York Times |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment