Gold World News Flash |

- US Dollar Euphoria and Gold

- The Italian Banking Crisis: No Free Lunch -- or Is There?

- Deutsche Bank Settlement: Seasonal Intraday Charts Provide Evidence for Gold Market Manipulation

- BREAKING: Trump Defeats U.N., Global Government Backs Off After 1 Warning He Sent.

- Here Are The Countries Where Millennials Will Have To Work Until They Die

- TRUMP tells what he will do if Saudi Arabia ever Dare to DissRespect America

- NEW LEAK: Hillary Is in 'BIG Trouble' - Secret About Anti-Trump Electors Just Leaked!

- Federal Reserve Is Not Federal It’s Privately owned

- Irrational Exuberance in US Stock Market Grasps at 20K for Dow

- Proven and Probable interviews GATA Chairman Bill Murphy

- Warning: U.S Financial Crisis and unemploymeent 2017 Explained in a Simplified Way! Please Share

- Hillary is Still Losing Voters –Even After Election Day new Poll Shows!

- Geopolitics, Globalization, And World Order: Part 1

- "A CIA-led Coup Against Trump & US Democracy Unfolding"- Paul Craig Roberts

- COMEX and ICE Gold Vault Reports both Overstate Eligible Gold Inventory

- Anonymous Mainstream Media “War Of Lies” Against President Trump “Outwitted By Truth”

- Stratfor 2017 Annual Forecast

- US needs enemies to justify military spending, wars

- Is Pope Francis A Marxist in Disguise? The WSJ Claims The Pontiff is the Leader of The Globalists

- Gold Seeker Weekly Wrap-Up: Gold and Silver End Slightly Lower on the Week But Miners Gain

- Prepare Your Stock Portfolio For President Trump with Strategic Metals and Minerals

- Sell All Your Bonds

- Time to Sell Everything?

- COT Gold, Silver and US Dollar Index Report - December 23, 2016

- The New “Big Short” — This Is THE Crisis of 2017

- BREAKING: Trump Wants A Nuclear Race with Putin

- China’s Collapse Is Coming, More So Now Than Ever - Gordon Chang

- Dollar Euphoria and Gold

- Anonymous Will Donald Trump gain the White House from the Undead Ones?

- Four Economic Triggers For 2017

- Dollar Euphoria and Gold

- The U.S. Dollar Is Destined To Move Higher

- Deutsche Bank Settlement: Seasonal Intraday Charts Provide Evidence for Market Manipulation

- FORENSIC EVIDENCE: Why Silver Price Manipulation Will End

- Breaking News And Best Of The Web

| Posted: 24 Dec 2016 01:32 AM PST The US dollar has rocketed higher since early November’s US presidential election, rivaling the massive gains seen in the stock markets. With the world’s reserve currency catapulted to extreme secular highs, dollar euphoria has naturally exploded. Traders are overwhelmingly betting the dollar’s strong upside will continue. But this greed-drenched currency looks very toppy and ready to fall, which is very bullish for gold. |

| The Italian Banking Crisis: No Free Lunch -- or Is There? Posted: 24 Dec 2016 01:25 AM PST On December 4, 2016, Italian voters rejected a referendum to amend their constitution to give the government more power, and the Italian prime minister resigned. The resulting chaos has pushed Italy's already-troubled banks into bankruptcy. First on the chopping block is the 500 year old Banca Monte dei Paschi di Siena SpA (BMP), the oldest surviving bank in the world and the third largest bank in Italy. The concern is that its loss could trigger the collapse of other banks and even of the eurozone itself. |

| Deutsche Bank Settlement: Seasonal Intraday Charts Provide Evidence for Gold Market Manipulation Posted: 24 Dec 2016 12:43 AM PST Deutsche Bank trader: "u just said u sold on fix." Answer UBS trader: "yeah, we smashed it good." Deutsche Bank is a defendant in more than 7,000 lawsuits worldwide. In two of them it has recently agreed to settlements and is prepared to pay tens of millions of US dollars in restitution and fines. This includes the settling of lawsuits over gold and silver price manipulation. Associated court proceedings against other financial institutions are still underway. |

| BREAKING: Trump Defeats U.N., Global Government Backs Off After 1 Warning He Sent. Posted: 23 Dec 2016 08:30 PM PST BREAKING: Trump Defeats U.N., Global Gov't Backs Off After 1 Warning He Sent.~~ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Here Are The Countries Where Millennials Will Have To Work Until They Die Posted: 23 Dec 2016 08:30 PM PST It turns out there is a downside to spending 120% of your annual income every year from the time you graduate college until that day you turn 40 and finally realize that you're getting old and have absolutely no liquid assets and no hopes of ever retiring. While the above strategy seemingly makes sense to our elitist, Ivy League-educated central planners at the Fed who have waged a nearly decade-long war on saving (because how can we have economic growth if people aren't willing to lever their income 5x and spend every dollar they make?), the roughly 19% of Americans who are over the age of 65 and are still forced to work are probably wishing they could go back and do things slightly differently. As Bloomberg points out, the percentage of 65 years olds working in the U.S. today is higher than at any point going back to at least 1965.

Unfortunately, this looks to be a record that millennials are destined to beat. As we recently pointed out (see "Most Millennials Have Less Than $1,000 In Savings, Live Paycheck-to-Paycheck"), the majority of millennials are living paycheck to paycheck. A recent survey of millennials by HowMuch.net found that 51.8% of those aged 18-34 have less than $1,000 held between bank accounts and cash savings. As Visual Capitalist's Jeff Desjardins notes, this echoes previous data we've seen – not just on millennials, but Americans in general. For example, we know that 14% of Americans have "negative" wealth. We also know that 62% of Americans don't have emergency savings that could cover a $1,000 hospital visit or a $500 car repair. Taking that into consideration, here's a deeper dive into the more recent millennial data... Courtesy of: Visual Capitalist

Meanwhile, as a testament to their strong work ethic, a study by ManpowerGroup recently found that roughly 30% of millennials envisioned taking an "extended break" from work at some point in their careers to "relax/travel/vacation" while another ~20% said they'd take a break to "pursue a life dream or hobby." Sure, why not? If everything goes horribly wrong then taxpayers will be waiting to payoff your student loans for you...so no worries.

And, unless you thought this was just a phenomenon limited to America's snowflakes, turns out millennials all over the world have very little confidence in their ability to save.

Well, at least we're not alone...misery loves company as they say. |

| TRUMP tells what he will do if Saudi Arabia ever Dare to DissRespect America Posted: 23 Dec 2016 08:00 PM PST Go President Donald Trump! I didn't know that President Obama got 'dissed twice. Even in Cuba? Didn't hear that from the lame stream media. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| NEW LEAK: Hillary Is in 'BIG Trouble' - Secret About Anti-Trump Electors Just Leaked! Posted: 23 Dec 2016 07:30 PM PST Hillary Is in BIG Trouble After Secret About Anti-Trump ElectorsWas Just Leaked! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Federal Reserve Is Not Federal It’s Privately owned Posted: 23 Dec 2016 07:00 PM PST Through the management of currency and interest, the Federal Reserve attempts to keep banks secure -- but some believe it has another purpose. Tune in and learn about the origins of the Fed in this episode. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Irrational Exuberance in US Stock Market Grasps at 20K for Dow Posted: 23 Dec 2016 06:49 PM PST This article by David Haggith was first published on The Great Recession Blog: Since Trump's election, the US stock market has climbed unstoppably along a remarkably steep path to round off at a teetering height. Is this the irrational exuberance that typically marks the last push before a perilous plunge, or is the market reaching escape velocity from the relentless gravity of the Great Recession? This burst of enthusiasm in response to Trump's victory, flew in the face of almost everyone's predictions. That it lifted the market from seven months of languor certainly makes 20K on the Dow look like the elevation marker of a breathtaking summit. While breaking 20k, if it happens, may be as meaningless as one more mile on the odometer when all the numbers roll over, it is psychologically potent for many. Breaking through it, could cause fear as eyes turn down and see how far below the earth now is, or the rarified air up here may bring euphoria that lifts the market to even greater levels on a rising current of hot air. Investors have been buying and selling with as much frenzy as Christmas shoppers. Now there will be much eating and drinking to celebrate this record-setting Santa-Clause rally, even if it doesn't top 20, before Christmas, as investors take a brief rest to enjoy their surprise gains, fat and happy in belief that 2017 will be a prosperous new year. There is almost no evidence of fear amongst all the cheer. According to Gallop, economic confidence has never been higher in the general population. Some are calling it Trumphoria as people seem to be relieved that eight years of Obamanomics are ending, and business is seizing the reins of government, guided by one of the world's richest and most dazzling developers.

A similar CNBC survey indicates this is the greatest breath of fresh air for consumer confidence since Obama was elected in 2008, and it is not just stocks that are soaring. The US dollar has reached its highest peak in fourteen years. TechonoMetrica also says consumer confidence has just hit its highest level since 2006 (just in time for Christmas shopping).

Will this exuberant ride continue in 2017?

Many analysts believe the push through a major milestone, if it happens, confirms a strong new market trend; but what does history say about breaking past such major psychological resistance barriers? When the Dow first broke past the 100 level in 1916, it tumbled below the line immediately and then sputtered along that ceiling for almost ten years. It didn't break through with any continuance again until the mid 20s! When the Dow flirted with the 1,000 mark for the first time in 1966, it tumbled down and again stumbled along near that ceiling for seven years. When it finally passed it at the end of 1972, it did continue a tiny ways higher; but in less than three months the market fell for the next two years, eventually plumbing a depth 44% lower, while the nation sank into recession. The Dow didn't permanently break through 1,000 again until 1982! And, after the Dow broke major, major milestone of 10,000 in 1999, it made it about 10% above that and then fell about 30% from 2001 to 2003 in what became known as the dot-com crash. What if we look at what history has to say about irrational exuberance by using other measures than the Dow? The ratio of stock prices against corporate earnings is one of the most common ways of assessing the relative height of a market peak. Here again, there are only a few times in history that the S&P 500 has climbed to prices that are 27.9 times more than corporate earnings of the last ten years, which is where the S&P stands now. Once was in 1929 just before the Great Depression, then again in an ill-fated boom of the 60's, and only one other time in 2002. The altimeter I'm using here to assess our present peak is called the CAPE (the Cyclically Adjusted Price-Earnings ratio that won Yale's Robert Schiller his Nobel Prize). In market terms, our present mark on the gauge means we're entering the stratosphere! Even in 2007, the market was not this overpriced by the CAPE's measure, and irrational exuberance has always accompanied this level: (Some will argue otherwise, but hang with me a minute.)

Not everyone thinks passing this mark on the CAPE matters. In fact, apparently many don't, or the stock market wouldn't have kept climbing into the CAPE's red zone this month, but according to Valentin Dimitrov of Rutgers University and Prem Jain of Georgetown, the measure has been applied too simplistically by those who disregard it:

It is, however, not just the height of this peak, but the rate of rise that evidences irrational exuberance. This month, the US stock roller coaster ratcheted its way relentlessly up its highest hill one clanky link at a time. If the Dow closes above 20,000 this week, it will be the fastest 1,000-point rise in market history! The previous record rate of rise came in 1999 in the run-up to the dot-com bubble crash. Of course, the higher the market is, the less meaningful a thousand-point rise is.

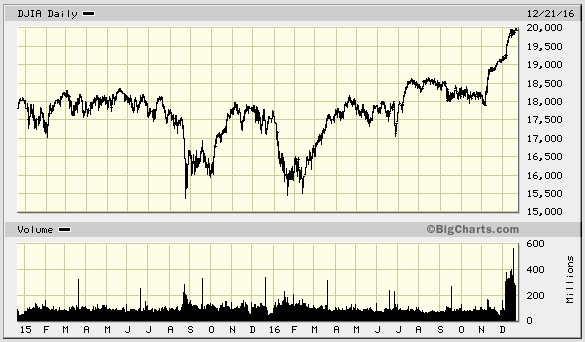

Do these graphs look like irrational exuberance?

Sometimes a visual says more than words:

Fastest, longest rise of the Dow in the past two years. Irrational exuberance?

Notice that it is not just prices that have shot up. Sometimes prices soar while trading volume treads flatly. In other words, there are very few traders, but those that are buying are willing to pay more. This time, trading volume has gone astronomical (lower part of graph) as money floods into stocks. That means it's a flurry of high-stakes trading. The last time we saw this kind of trading volume was …

Is the steepest climb in a decade irrational exuberance, particularly when accompanied by the highest trading volume since the Great Recession began?

Yes, the last time trading volume (lower graph) reached this frenzy was in 2008 and 2009 when we experienced the greatest stock market crash since the Great Depression. And look how long and steep the post-Trump rally (right end of upper graph) looks compared to any other climb during the past decade, including the run-up to the Great Recession. It's almost a straight-up wall!

How irrationally exuberant are investors right now?

Forget about measures for a moment, let's look at forecasts by the revered experts in the industry because if everyone is running with glee in the same direction …

Clearly, Doll sees no top to the hill in sight. Apparently neither do others: in spite of our present nose-bleed heights, Wall Street's gauge of investor fear, the CBOE Volatility Index VIX, rests comfortably at a 16-month low. Seems almost no one sees any reason for concern at all. Lance Roberts writes,

Barron's panel of ten experts (from JPMorgan, Goldman Sachs, Barclays, Citi, Morgan Stanley, BofA, Blackrock and others) were unanimous in their cheer that the US stock market will ascend well beyond its present record heights. But, if everything is so rosy, Wolf Richter asks, why are bank insiders and big industrials selling their own company's stocks faster than ever: (Someone has to be selling for all that buying to happen.)

Have market insiders just lost their appetite for dizzying heights, or do they have reason to believe they are selling into the stock market's last hurrah? Are their banks, perhaps, getting clobbered by the bond crisis that is now developing on the other side of all this trading? Even the Wall Street Journal, notes Richter, saw this high-volume trading as a bullish sign. They couldn't, however, say why it was bullish, but only that it might be profit-taking. Well, why take profits now if you're confident your bank has room to run? Is WSJ's bullish note just more irrational exuberance from all market experts who can smell nothing but roses since Trump's victory?

Bonds are smarter … and far from exuberant

One old adage says that bond traders are the smart money. Money is now fleeing bonds at a record rate of fall that matches the record rate of rise we are seeing in the stock market. Bond money has to go somewhere; so, it could easily be that stocks are going up less because of Trumphoria and more because of bond phobia, triggered by Trump. Fear of what could easily turn into the biggest bond-bubble crash in the history of the world makes stocks look like the safest haven. The global realization that central banks are not so enthusiastic about additional stimulus anymore, has bond investor's realizing that the longest bull market in bond history may finally be waning. At the same time Trump's plan of spending somewhere between half a trillion and one trillion dollars on infrastructure investments (financed on national credit) means interest rates will have to rise in order to attract enough creditors, which they are already doing in anticipation. In many nations, investors' money is trapped in bonds near zero-per |

| Proven and Probable interviews GATA Chairman Bill Murphy Posted: 23 Dec 2016 06:35 PM PST 9:35p ET Friday, December 23, 2016 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy was interviewed this week by Proven and Probable's Maurice Jackson, discussing the prospects for the monetary metals and whether gold or silver have more potential for price appreciation. The interview is 13 minutes long and can be heard at the Proven and Probable internet site here: http://www.provenandprobable.com/blog/bill-murphy-precious-metals-demone... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Market Analyst Fabrice Taylor Expects K92 Shares to Rise Interviewed on Business News Network in Canada, market analyst and financial letter writer Fabrice Taylor said shares of K92 Mining (TSXV:KNT) are likely to rise, even amid declining gold prices, because the company has begun producing gold at its mine in Papua New Guinea: http://www.bnn.ca/video/fabrice-taylor-discusses-k92-mining~1008356 Taylor cited the company's announcement here: http://www.k92mining.com/2016/11/6114/ Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Warning: U.S Financial Crisis and unemploymeent 2017 Explained in a Simplified Way! Please Share Posted: 23 Dec 2016 06:30 PM PST TV NEWS: FINANCIAL CRISIS 2017 has begun! How to protect your money! Important News!! How to survive on 2017 event! Gold Tips! Very important Information! Please take a look and Share... Share... because this video must be shared with max number of people! make your part now, please share it!... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Hillary is Still Losing Voters –Even After Election Day new Poll Shows! Posted: 23 Dec 2016 06:00 PM PST Hillary is Still Losing Voters – Even After Election Day new Poll Shows! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Geopolitics, Globalization, And World Order: Part 1 Posted: 23 Dec 2016 06:00 PM PST Submitted by Federico Pieraccini via Strategic-Culture.org, Understanding the objectives and logic that accompany the expansion of nations or empires is always of paramount importance in helping one draw lessons for the future In this series of four articles I intend to lay a very detailed but easily understandable foundation for describing the mechanisms that drive great powers. To succeed, one must analyze the geopolitical theories that over more than a century have contributed to shaping the relationship between Washington and other world powers. Secondly, it is important to expound on how Washington’s main geopolitical opponents (China, Russia and Iran) have over the years been arranging a way to put a stop to the intrusive and overbearing actions of Washington. Finally, it is important to take note of the possibly significant changes in American foreign policy doctrine that have been occurring over the last twenty years, especially how the new Trump administration intends to change course by redefining priorities and objectives. The first analysis will therefore focus on the international order, globalization, geopolitical theories, their translations into modern concepts, and what controlling a country’s sovereignty means. Before examining geopolitical theories, it is important to understand the effects of globalization and the changing international order it entails, a direct consequence of US strategy that seeks to control every aspect of the economic, political and cultural decisions made by foreign countries, usually applying military means to achieve this objective. Globalization and the International OrderIt is important to first define the international order among nations before and after the collapse of the Berlin wall, especially focusing on the consequences of existing in a globalized world. For the first half of the twentieth century the world found itself fighting two world wars, then, during the Cold War, lasting from 1945 to 1989, the balance of power maintained by the US and USSR held the prospect of a third world war at bay. With the dissolution of the USSR, the United States, the only remaining world superpower, thought it could aspire to absolute domination over the globe, as was famously expressed through the Project for A New American Century. Putting aside for a moment perpetual wars, one of the key strategies towards fulfilling this objective was the so-called experiment of globalization, applied especially in trade, economics and finance, all of course driven by American interests. Having achieved victory in the Cold War over its socialist rival, the world went from a capitalist system to a turbo-charged capitalist system. US corporations, thanks to this model of world globalized economy, have experienced untold riches, such as Apple and other IT corporations generating amounts of cash flow equivalent to that of small countries. Banks and US financial institutions such as Wall Street incrementally increased their already considerable influence over foreign nations thanks to the rise of computer technology, automation and accounting deceptions such as derivatives, just to give one example. The FED implemented policies that took advantage of the role of the dollar in the globalized economy (the dollar is the premier world reserve currency). Over the years this has caused economic crises of all kinds all over the world, defrauding the entire economic system, consisting of schemes such as being able to print money at will, allowing for the financing massive wars, even going so far as lowering interest rates to 0% to keep banks and big corporations from failing – all a repudiation of the most basic rules of capitalism. All this was made possible because the US being the sole world power after 1989, allowing Washington to write the rules of the game in its favor. Since the fall of the Berlin Wall, Wall Street, Big Oil and military corporations, health-care providers, the insurance and agricultural industries slowly replaced national governments, managing to dictate agendas and priorities. A political form of globalization has led to an expropriation of national sovereignty in Europe, with the creation of the Euro and the Lisbon Treaty signed by all EU nations in 2007. Globalization has forced the concept of sovereign states directed by their citizens to be replaced with an international superstructure led by the United States, driving away even more citizens from the decision-making process. The European Union, and in particular the European Commission (not elected, but appointed), is unpopular not only for the decisions it has taken but also for the perception that it is an imposter making important decisions without ever having been elected. Basically, with the end of the USSR, the international order went from a relationship between states made up of citizens to a relationship between international superstructures (NATO, UN, IMF, WTO, World Bank, EU) and citizens, with the weight of the balance of power decisively in favor of the globalists with the economic burden resting on the people. The international order and globalization are therefore to be interpreted according to the logic of Washington, always looking for new ways to dominate the globe, preserving its role of world superpower. It is also for this reason that it is important to understand some geopolitical theories that underlie US strategic decisions in the pursuit of world domination. These theories are some of the most important with which Washington has, over the last 70 years, tried to pursue total domination of the planet. MacKinder + Spykman + Mahan = World Domination

HeartlandThe first geopolitical theory is the so-called Heartland theory, drawn up in 1904 by English geographer Sir Halford Mackinder. The basic principle was the following:

In terms of countries, the Heartland consists mainly of Russia, Kazakhstan, Afghanistan, Mongolia, the Central Asian countries, and parts of Iran, China, Belarus and Ukraine.

RimlandThe second geopolitical theory, another important lodestar for US foreign policy, was developed in the 1930s by the American Nicholas J. Spykman, also a student of geography as well as a scholar of MacKinder’s theory. Spykman, thanks to advancing naval technology, added to the definition of the Heartland theory the Rimland theory. The Rimland is divided into four main areas: Europe, North Africa, Middle East and Asia.

The Rimland essentially consists of Europe (including eastern Europe), Turkey, the Middle East, the Gulf States, India, Pakistan, Southeast Asia (Brunei, Cambodia, Laos, Malaysia, Myanmar, the Philippines*, Thailand, Vietnam) and Japan. As one can see from observing a map, the United States is not physically close to either the Rimland or the Heartland. They are both on the other side of two 6,000-mile oceans. The US is undeniably protected in this way, almost impervious to attack, with an abundance of resources and powerful allies in Europe. These are all characteristics that have favored the rise of the American superpower throughout the twentieth century. But world domination is a different matter and, given the geographical location of the US compared to the Heartland and Rimland, first requires a large capacity to project power. Of course with two oceans in between, it is naval power through which power has been conveyed, especially in the early part of the last century. Mahan and Maritime PowerThe third geopolitical theory is based on the importance given to maritime (or naval) power. The author of this theory, propounded towards the end of 1800, was US Admiral Alfred Thayer Mahan.

As one can easily understand, these three doctrines are central to controlling the whole world. Dominating the Heartland is possible thanks to the control of the Rimland, and in order to conquer the Rimland it is necessary to control shipping routes and dominate the seas, relying upon the Mahan theory of maritime supremacy. In this sense, seas and oceans of great geographic importance are those that encircle the Rimland: The East and South China Seas, the Philippine Sea, the Gulf of Thailand, the Celebes Sea, the Java Sea, the Andaman Sea, the Indian Ocean, the Arabian Sea, the Gulf of Aden, the Red Sea, and finally the Mediterranean. In particular, straits such as Malacca, between Indonesia and Malaysia, or the Suez Canal, are of strategic importance due to their role as a transit route and connection between all the seas adjacent to the so-called Rimland. A bit of history. Route to global dominationIt was Hitler's Germany during World War II that tried to put into practice the theory of geopolitics MacKinder was describing, managing to seize the Heartland but ultimately amounting to nothing with the final victory of the Red Army, who rebuffed and destroyed the Nazis. After the end of World War II, the United States placed the Soviet Union in its crosshairs, with the intention of conquering the Heartland and thereby dominating the world. Alternatively, Plan B was to prevent other nations from teaming together to dominate the Heartland. This explains the historical conflicts between the US and Iran and between Russia and China, the three most important nations composing the Heartland. Russia, since Tsarist times and throughout the Soviet period to today, has always been in the crosshairs of the United States, given its geographical location central to the Heartland. Iran also constitutes a valuable piece of the 'Heart of the World', which was gifted to the Anglo-Americans courtesy the Pahlavi monarchy lending itself to the American plan to conquer the heart of the land. It was only after the 1979 revolution, which ousted the Pahlavi monarchy and installed an Islamic Republic, that Tehran became an enemy of Washington. The reason why Afghanistan was invaded and Ukraine destabilized, and why the Belarusian leadership is hated almost as much as is the Russian one, is the same, namely, the geographical positions of these countries in composing the Heartland compels the US to conquer them as part of its grand strategy to dominate the world through the control of the Heartland. The Republic of China, another constituent part of the Heartland theory, was during the Cold War the great Asian pivot thanks to Kissinger’s policy aimed at curbing the USSR and preventing the birth of a possible alliance between Tehran, Moscow and Beijing that would dominate the Heartland, especially in the late 1980s. The United States, instead of directly attacking China, used it against the Soviet Union. Washington's primary goal, as well as to expand its influence everywhere, was to prevent any kind of alliance that would control the Heartland, specially preventing any alliance or understanding between Moscow and Beijing; but this will be very well explained in my third analysis on how Eurasia reunited to reject the American global empire. Control of a nationHistorically, control of a nation takes place through military power that allows for a variety of impositions. Also, culture is part of the process of conquering a nation. Today, other than militarily, it is mainly economic power that determines the national sovereignty of a nation. In the modern world, especially in the last three decades, if you control the economy of a nation, you control the rulers of that nation. The dollar and neoliberal experiments like globalization are basically the two most powerful and invasive American tools to employ against geopolitical opponents. The application of military force is no longer the sole means of conquering and occupying a country. Obligating the use of a foreign currency for trade or limiting military supplies from a single source, and impeding strategic decisions in the energy sector, are ways the globalist elites are able to dominate a foreign country, taking control over its policies. The European Union and the NATO-member countries are good examples of what artificially independent nations look like, because they are in reality fully dispossessed of strategic choices in the areas mentioned. Washington decides and the vassals obey. It is not always possible to employ military power as in the Middle East, or to stage a color revolution as in Ukraine. Big and significant nations like Russia, India, China and Iran are virtually impossible to control militarily, leaving only the financial option available. In this sense, the role of central banks and the de-dollarization process are a core strategic interest for these countries as a way of maintaining their full sovereignty. In going in this direction, they deliver a dramatic blow to US aspirations for a global empire. The next article will focus on how the United States has tried to implement these strategies, and how these strategies have changed over the last seventy years, especially over the last two decades. |

| "A CIA-led Coup Against Trump & US Democracy Unfolding"- Paul Craig Roberts Posted: 23 Dec 2016 05:30 PM PST "A CIA-led Coup Against President-elect Donald Trump and American Democracy Is Unfolding Before Our Eyes"- Paul Craig Roberts. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| COMEX and ICE Gold Vault Reports both Overstate Eligible Gold Inventory Posted: 23 Dec 2016 05:27 PM PST Bullion Star |

| Anonymous Mainstream Media “War Of Lies” Against President Trump “Outwitted By Truth” Posted: 23 Dec 2016 05:00 PM PST Obama actually succeeded in his quest to cause chaos, terror, and destruction in the world. He is an anti-christ! He has attacked christianity and judaism since the day he skipped into office The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 23 Dec 2016 03:00 PM PST Stratfor Vice President of Global Analysis Reva Goujon highlights the key geopolitical trends for the coming year. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| US needs enemies to justify military spending, wars Posted: 23 Dec 2016 02:30 PM PST The United States has always tried to make up adversaries in order to justify its military spending and wars, says an American author in Chicago. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Is Pope Francis A Marxist in Disguise? The WSJ Claims The Pontiff is the Leader of The Globalists Posted: 23 Dec 2016 01:30 PM PST He is a demon in garb , the devil in disguise The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Gold Seeker Weekly Wrap-Up: Gold and Silver End Slightly Lower on the Week But Miners Gain Posted: 23 Dec 2016 01:16 PM PST Gold rose to as high as $1135.53 in late morning New York trade before it drifted back lower into the close, but it still ended with a gain of 0.28%. Silver slipped to as low as $15.68 and ended with a loss of 0.51%. |

| Prepare Your Stock Portfolio For President Trump with Strategic Metals and Minerals Posted: 23 Dec 2016 01:14 PM PST The markets are pricing in inflation following the Trump US Presidential Election Win. US stocks are soaring to record highs and the Dow is on verge of breaking 20k a major psychological level. Investors should be prepared for volatility as President Trump will counteract a lot of Obama’s moves over the past eight years and this could accelerate moves in many markets. Notice already US bonds are breaking down as capital is flowing to riskier assets most notably stocks and recently copper and energy. This is signaling to me inflation, rising interest rates and major policy changes which is already having dramatic effects on the average portfolio. I am amazed that the US Dollar is still rising despite all bonds crashing. All fiat currencies except the US dollar are crashing. There are some places around the globe experiencing hyperinflation most notably Venezuela and India. Investors are dumping their foreign stocks and paper in favor of US Stocks and US Dollars. This artificially high US dollar could have a dramatic stress on borrowers who are having to pay back loans with expensive dollars. Most notably affected could be our US Federal Government already in record debt.

That is why we still love junior gold miners (GDXJ) and even more so silver miners (SIL) as Trump will not let foreign nations continue devaluing their currency to gain an advantage on the US. I expect Trump will do whatever he can to stimulate spending and growth to make America great again by putting capital into infrastructure. This should benefit the domestic steel, copper and energy sector. In addition, Trump loves nuclear and I expect major investments will be made to update and expand our nuclear fleet of reactors. Investors should look to gain exposure to the Uranium Mining ETF (URA) as Trump may look to build our domestic nuclear sector as we can no longer rely on imports especially when we have millions of pounds of uranium in the Southwest US. There have been a bunch of small uranium miners raising money after the Trump win which may auger a bottom. Continue following the tensions in the South China Seas with the recent stealing of the Chinese of a US military drone. Could China have taken that drone to see what rare earths the US in using to power and guide the advanced drones? All the metals which China has control of should be watched and you should get exposure. Focus on rare earths, graphite and other strategic battery technology metals such as scandium, graphite and cobalt. Trump has put in Peter Navarro as a trade advisor with China and the Chinese are already threatening a trade showdown. Hopefully Trump will move fast to help secure our own supply chain of critical metals as that is how the Chinese can squeeze the West. Take a look at some recent developments in this sector which should be looked at for 2017. Please remember links are to sponsors and shareholdings which I could benefit from if the stock price goes higher. 1)Remember there is no current US production of flake graphite used in high tech batteries. This US junior graphite miner is working on a Preliminary Economic Assessment (PEA) that should be published by the end of January 2017 on the largest graphite deposit in the US. The deposit has 17.95 million metric tons of indicated resources grading 6.3 percent graphitic carbon and 154.36 metric tons of inferred resources at 5.7 percent graphitic carbon identified. The company has a unique spherical graphite which could perform well for batteries. 2)A near term fertilizer producer in North America just raised up to $11.8 million from a NY based asset management firm. This may be signaling smart money wants some exposure to fertilizer stocks as inflation increases. This will allow this junior fertilizer company the ability to advance closer to construction and help fill our supply shortage of sulfate of potash in North America. This junior has two major SOP projects with experienced management that can take projects into production. 3)Keep a close eye on this silver developer in the Golden Triangle in BC as they just raised $3 million CAD and got a new CEO Gary Cope who sold his prior silver company to silver producer Coeur D’alene (CDE) for $350 million. The grade of this silver is some of the top in the world and the new management believes this deposit is expandable. Smart investors should start looking at this situation. I recently participated in the private placement and the company is a sponsor. 4)The Yukon also has some of the highest grade silver in the world. Take a look at this explorer in 2017 as they are just beginning to explore next to silver producer Alexco (AXU) in Keno Hill which recently made a big discovery. The CEO has over 28 years of precious metals exploration experience spending some time as exploration manager at Placer Dome which later became Barrick. Placer Dome produced some of the greatest exploration geologists in the world. They are focusing on high grade silver in the Yukon in Keno Hill adjacent to silver producer Alexco (AXU) who produces silver from some of the highest grade ore in the world. Most silver comes from much riskier jurisdictions like Argentina, Bolivia and Mexico. Recently Kaminak a near term Yukon gold producer was acquired by Goldcorp as they search for production in mining friendly and geopolitically stable jurisdictions. Could some of the other big silver producers look to come into Yukon’s Keno Hill where some of the highest grade silver is found? Disclosure: I own securities in these linked companies and they are website sponsors. This should be considered a conflict of interest as I could benefit from price/volume increase and have been compensated. See full disclaimer and current advertising rates by clicking on the following link: http://goldstocktrades.com/blog/ Section 17(b) provides that: I am biased towards my sponsors (Featured Companies) and get paid in You must do your own due diligence and realize that small cap stocks is an _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

|

| Posted: 23 Dec 2016 01:00 PM PST This post Sell All Your Bonds appeared first on Daily Reckoning. So, Trump has won the election. Of course anything can happen between now and his presumed inauguration on January 20. Maybe the Swamp Creatures will succeed in causing a recount in so-called Purple States that could change the number of electors in Hillary's favor. Maybe they'll somehow influence Trump electors to vote for Hillary. None of this would have been an issue if Baby Bush II, Jeb, had been the Republican nominee, as was supposed to have happened. It all just shows what a transparent (a word these people love to use) fraud "democracy" has become. Let the hoi polloi cast a meaningless vote, so they have the illusion of being in control. Instead of seeing themselves as subjects, they'll think they're "we the people," who actually have some say in what happens. That way they'll pay their taxes willingly, enthusiastically sign on to aggressive wars on the other side of the world against people they know nothing about, and generally do as they're told. Because it's supposed to be patriotic. "Democracy" is a much more effective scam for controlling the plebs than kingship or dictatorship. That said, the Establishment, the Deep State, was genuinely shocked and appalled by Trump's victory. As Baby Bush the First would have said, they misunderestimated how angry the average voter was. That's because the Coastal Democratic Elite are totally out of touch with the common man. But they needn't fret too much. They'll be re-installed, with a vengeance, in four years. That will likely be true for two reasons: The first is simple demographics. The groups that vote Democrat (e.g., blacks, Hispanics, urban dwellers, immigrants, Millennials) are growing in numbers faster than those who vote Republican. Republicans are older people, and the Boomers (born 1946–1966) and the Silent Generation (1926–1946) are dying off. More people are moving to the cities, and that influences them to vote Democratic. More people (still, idiotically) are pursuing higher education, and that also influences them to vote Democrat. The second reason is the Greater Depression. One definition of a depression is a period of time when distortions and misallocations of capital are liquidated. A time when bubbles caused by monetary expansion are popped. A time when unsound businesses fail. I re-emphasize this because the party on whose watch it happens is automatically kicked out. So, the Democrats actually got quite lucky not to be in office when the time bomb goes off. Trump could easily go down as Herbert Hoover II. What could change things? A serious war, much bigger than the sport wars the U.S. is currently engaged in, is the biggest danger. That's much less likely with Trump than Hillary, but these things have a life of their own. My guess for the next president is either a left-wing general (because Americans love and trust their military), or a left-wing populist, like Elizabeth Warren. But that's crystal balling at this point. Let's proceed on the assumption Trump is actually going to be the president for at least the next four years. Although problematical, he's a vast improvement over Hillary. What will it mean for the U.S. and the world? More importantly, what will it mean for your personal finances and freedom? Let's look at the possibilities. Bonds — With bonds, we're at the peak of the biggest financial bubble in world history. This is a very big deal. Interest rates move in very long cycles. They went up from the mid-1940s to the early '80s, when long-term government bonds peaked at close to 16%, and T-Bills at over 16%. I thought they hit bottom years ago, but the cycle overshot. My guess is that they're headed up in earnest now. And Trump, as someone who understands business (even though he doesn't understand economics), will likely (I think…) do what he can to send them higher. Why? He understands the country needs to save, to rebuild capital. And higher rates will encourage saving and discourage debt. The risk is that, with all the debt that's been put on in the last decade, debtors will be hard-pressed to service it. That includes the U.S. government with $20 trillion of on-balance-sheet debt, and a lot more in the way of off-balance-sheet debt, guarantees, and contingent liabilities. Much of it will be activated if higher rates cause a lot of defaults. What should you do? Sell all your bonds. Real Estate — Property, at least in the English-speaking world, floats on a sea of debt. Interest rates go up, real estate prices go down. The economy goes down, so do property prices. Add to that the aging U.S. population, which isn't good for property; as people age, they downsize. Add to that the fact we're in another real estate bubble, similar to what we saw in the mid-oughts. After bonds, property is likely the worst place to be. In fact, I'll go so far as to say the great post–World War II property boom is at an end — but that's a subject for another time. There's not much that Trump can do to fix this. What should you do? Lighten up on property. Make sure any mortgages you keep are at fixed rates. Stocks — If Trump only follows through with his promise to cut taxes, and eliminate two old regulations for every new one, it would be wonderful for the economy. But the economy and the stock market are two different things; they only correlate over the long run. I suppose he'll follow through with his promise to build lots of new infrastructure. Government deficits will soar, and only the Fed will be on hand to buy all that new debt. Infrastructure companies will get a fat slug of the newly printed money. But I find it hard to get enthusiastic for the stock market. In terms of dividends, P/E ratios, or book value, it's already at one of the highest levels ever. Bear in mind that well-selected stocks can still go up, even if the market as a whole goes down. That said, I feel more comfortable with shorts than longs at this point. Gold and Commodities — Frankly, where do you put your money when almost everything is overpriced? Commodities are coming out of a five-year-long bear market. They're about the only thing that's cheap. That's true relative to their cost of production (farmers, ranchers, and miners are breaking even, at best, all over the world). And it's true relative to their history (they're down 50% from the peak of 2011). In other words, commodities are a much safer place for your capital than stocks, bonds, or real estate (excepting agricultural property) for the foreseeable future. The problem is that it's hard to hold a carload of wheat or ten tonnes of sugar. Remember that gold and other commodities aren't "investments." An investment is something that acts to create new wealth. They're simply assets. Sometimes they can be excellent speculations. Gold, however, is money, and will remain so long after the U.S. destroys its currency. I recommend, therefore, that you accumulate gold and silver instead of plunging into conventional investments. Check with the dealers we list in The Gold Book to see who you prefer to work with. [Editor’s note: The Gold Book is exclusive to readers of The Casey Report, which you can sign up for at the end of today’s essay.] But if you don't have a significant position in the metals already, please get going. A final thought. It's usually a mistake to count on any head of state to make things in a country better. It can certainly happen — as with Erhard in Germany after WW2, Pinochet in Chile, Thatcher in Britain, or even Reagan in the U.S. Maybe it will be true of Trump. He's got a much stronger personality than Reagan, for openers. But the bigger and older a State gets, the harder it is to change. It's comparable to trying to stop a fully loaded supertanker. Regards, Doug Casey The post Sell All Your Bonds appeared first on Daily Reckoning. |

| Posted: 23 Dec 2016 01:00 PM PST This post Time to Sell Everything? appeared first on Daily Reckoning. Best-selling author, wine whiz, polo player, bon vivant and citizen du monde… Doug Casey defines the term Renaissance man. Or what the Limeys might call a man of parts. Shake the American dust off your shoes and explore the world, counsels Doug. Take the cold bath and take it bravely. Live. Doug's set foot in over 175 countries and planted himself in 10. He's made fortunes, he's lost fortunes… and made them back again. He's broken bread with heads of state. Rumor whispers he even once tried to take over a country (the coup failed apparently). Doug's central message is simply — but deeply — this: You only have one financial future. Take that future in hand and master it and don't make a wreck of it. But to prepare, you first need an accurate financial weather forecast… 2008 was the leading edge of the hurricane, Doug argues. We've been living in the false peace and calm of the eye these past years. But Doug warns we'll soon be entering the other side of the hurricane wall: There's absolutely no reason from a fundamental point of view for bonds and stocks to be as high as they are right now… Look at it as a hurricane… We went into the leading edge of the hurricane in '07, '08 and '09. They papered it over with all this funny money. Now we're going out to the trailing edge… and it's going to last much longer, be much worse and be much different. How do you make it through the hurricane? Gold and precious metals for starters: The one thing I feel very confident of is we're going to have financial chaos in the years to come and that's going to drive people into gold and, to a lesser degree, into silver. What about interest rates? And bonds?: Interest rates are going to go up… Low interest rates and negative interest rates are actually destructive of capital and civilization because they discourage people from saving… It doesn't matter what these stupid governments do… interest rates are headed up… and I think they're headed way up for a long time at this point… so if you own bonds, sell them. Doug has more to say below. Lots more. About Trump's chances… the coming revenge of the elites… shifting demographics… stocks and real estate. Should you sell everything? Read on. Regards, Brian Maher The post Time to Sell Everything? appeared first on Daily Reckoning. |

| COT Gold, Silver and US Dollar Index Report - December 23, 2016 Posted: 23 Dec 2016 12:30 PM PST COT Gold, Silver and US Dollar Index Report - December 23, 2016 |

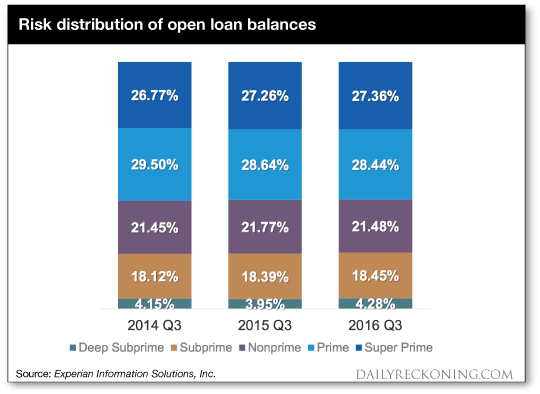

| The New “Big Short” — This Is THE Crisis of 2017 Posted: 23 Dec 2016 12:00 PM PST This post The New "Big Short" — This Is THE Crisis of 2017 appeared first on Daily Reckoning. Subprime auto loans are the new "Big Short." Of course you remember the first "Big Short" — subprime housing loans. Michael Lewis wrote a book about it. In the wake of the subprime housing crisis, millions of Americans lost their homes and jobs. The global financial system nearly collapsed. Thankfully, in the years that followed, the banks found religion. Lenders found their morals. Consumers found responsibility. And Congress beefed up industry oversight. OK, back to reality! Years of ultralow interest rates led to "free money" deals where anyone who could fog a mirror could get a car. Even "better," if those buyers couldn't pay their car off in the standard 48 months, they could extend their loan terms to 72 or even 84 months. Well, those chickens are coming home to roost. From The Wall Street Journal in September this year: "The share of subprime auto loans backing bonds that were at least 60 days behind on payments climbed to 4.86% in August, up from 3.98% a year earlier, according to Fitch Ratings. Annualized net losses reached 8.89%, up from 7.02% a year prior." That's the first layer of bad news. It gets worse. Here's AFP on Nov. 30: "Especially worrisome is the rise in auto loans to borrowers with low credit score, and the accompanying signs of distress among that segment, New York Fed researchers said. Subprime auto loans now account for 33% of total loan balances outstanding…" There are more bad auto loans than ever. And more of them are starting to fail. But according to Experian Automotive's Q3 report, it's even uglier than that.

Experian's risk tracking for the third quarter says 4.28% of all open auto loan balances are "deep subprime." That means FICO scores that are off-the-map low. Thus, 18.45% of all balances are "subprime," or 550 FICO territory. And 21.48% are "nonprime." First, let's agree "nonprime" means exactly that. It's a loan that is not prime and could have an elevated level of default risk. By Experian's own reporting, this means 44.21% of all open auto loan balances in America right now are at least at risk of distress, if not eventual default. That's the really bad news. It's possible 44 cents on every dollar of auto debt is at risk of distress. This risk increases as interest rates continue to rise. And repossessions increase, more leases end and used car prices continue to fall due to inventory gluts. This is all happening right now. Consider that at peak insanity in 2006, there were about $650 billion of subprime mortgages written in the U.S. There's about $1 trillion in total auto debt in America right now. The match to this powder key starts with buy-here-pay-here auto dealers. It spreads to finance companies, including divisions of some major automakers. And it, of course, includes some of the same Wall Street names you remember from the housing crisis. It's true subprime auto is not a subprime housing-sized problem. It is, however, a looming disaster that could cut Detroit's "recovery" off at the knees. It could stop the Trump market rally in its tracks. It could ignite a swift and steep market correction. It could be the opening kickoff of a recession. Here's your takeaway — they did it again. The banks, the unscrupulous lenders, the rating agencies… they used all the same tricks from the mid-2000s and securitized bad debt all over again. And if you own mutual funds, chances are good you're holding part of the bag right now, too. Happy Holidays. Regards, Amanda Stiltner The post The New "Big Short" — This Is THE Crisis of 2017 appeared first on Daily Reckoning. |

| BREAKING: Trump Wants A Nuclear Race with Putin Posted: 23 Dec 2016 11:00 AM PST BREAKING: Armageddon "Trump Says Let It Be A Nuclear Race"President Elect Donald Trump has begun the "Nuclear Arms Race" with Russia as tensions are beginning with Putin The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| China’s Collapse Is Coming, More So Now Than Ever - Gordon Chang Posted: 23 Dec 2016 10:00 AM PST The world's second largest economy is on the brink of collapse, at least that's what best-selling author and Forbes contributor Gordon Chang believes. Author of The Coming Collapse of China, Chang gave his outlook on the country's economy, which remains grim -- more so now than ever. 'Chinese... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 23 Dec 2016 09:01 AM PST Zealllc |

| Anonymous Will Donald Trump gain the White House from the Undead Ones? Posted: 23 Dec 2016 09:00 AM PST It is always the same insted of pointing to the enemies in our own country they point at Russia! Has it not been this way for centuries? This is darkly and dangerously misguided thinking. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://financearmageddon.blogspot.com http://www.figanews.com for full links, other content, and more! ]] |

| Four Economic Triggers For 2017 Posted: 23 Dec 2016 08:56 AM PST This post Four Economic Triggers For 2017 appeared first on Daily Reckoning. If economic patterns are to be any indicator, 2017 is set to be a record year for the global economy with several critical events to watch. All statistical analysis aside, years ending in a 7 have been ground zero for financial disasters. Businessweek summarized, "The biggest one-day stock drop in Wall Street history happened in 1987. The Asian crisis was in 1997. And the worst global meltdown since the Great Depression got rolling in 2007 with the failure of mortgage lenders Northern Rock in the U.K. and New Century Financial in the U.S." While a flawed financial system is the core problem within the global economy, recognizing these economic events will give you an advantage. Understanding the events that can trigger a crisis can leave you better positioned to secure your finances, navigate the storm and read between the lines of financial media. Drawing out an exact time and place for when the market might crash is only a fool's errand. The economic and political events that have been set in motion over the past 12 months have only raised the stakes for financial turmoil. What is increasingly clear is that more perilous events appear to be headed directly for 2017. These events are worth understanding as they escalate severely ahead of an unavoidable economic storm. Here are the four economic triggers for 2017 that are worth monitoring as they add fuel to this dangerous financial climate. 1. ChinaAccording to the Bank for International Settlements China's overall credit-to-GDP gap has hit a phenomenal high of 30.1%. The Basel-based institution reports that the Chinese economy is at the highest risk out of any nation in more than two decades of data collection. Normally, any total from credit-to-GDP that is above 10% is considered to be at an elevated risk for financial banking strain. China has tripled that figure. This could be a very strong indicator that credit growth has hit an excessive amount and that a financial bust could be growing. While credit-to-GDP is one factor ailing China, its currency is another paramount concern. The latest shock to the Chinese system comes as massive currency outflows continue to flee the country at record pace. Goldman Sachs recently reported that $1.1 trillion in capital has left China since August 2015. That amount is more than double what the People's Bank of China, the Chinese central bank, has publicly reported. This flight of money gives particular concern as the yuan is feared by investors to make its largest drop in value in 2017 in over two decades. 2. DebtAccording to NerdWallet, by the end of 2016 the total debt held by Americans is expected to exceed the amount that was owed at the beginning of the financial collapse in 2008. This comes at a time when people are believed to be gaining confidence in the financial system once again. As one nobel prize winning economist told CNBC, “We used to be more into modest living,” said Robert Shiller. “Now people are thinking, that doesn’t work.’ You know? You have to live big-league and you’re on your way.” Although the Dow Jones industrial average continues to circle near 20,000, the unnerving signs around debt cannot go unnoticed. The market might be signaling strength, but the real economy is showing a different story. The continued debt problem in America is even more visible when looking at younger generations. The Wall Street Journal reported that nearly 40% of Americans between the age of 18-34 were living with their parents in 2015. That is the largest percentage on record since 1940. The younger American population is under more debt, student loan obligations and credit card pressures than any other generation prior. As former Reagan budget director David Stockman noted, "there is no chance whatsoever of a clean, immediate fiscal shock to the moribund U.S. economy fantasized by the Wall Street bulls." While the economy might be doing better on the surface, the escalation of debt to levels exceeding the 2008 financial crash can at best be a truncation, and at worst be the gradual trigger for the next crisis. 3. EuropeThe surprise BREXIT vote in June, 2016 has finally sunk into the minds and markets of the world. Now the UK must decide on a way forward. As economist and bestselling author Nomi Prins indicated, "Things for the UK will be rocky as they slowly head toward the Article 50 of exiting the European Union. Theresa May has indicated that all of the strategy and government leadership planning will be made public around March of 2017." The Telegraph did the math and found that the UK would automatically be charged with a massive $62.1 billion bill. The British pound sterling in October hit a modern low in value not seen in over 186 years. If the drops in the pound are any indicator, the repercussions of the Britain-EU split will be significantly felt in 2017. Mainland Europe is the next critical turning point both politically and economically. France, Germany and the Netherlands are all due to hold pivotal elections. In the course of these elections, we could see the continued rise of right leaning leadership. For 2017, German Chancellor Angela Merkel could be ousted as the last remaining G7 leader of the original 2015 vanguard. 4. Escalation of War on CashDuring the course of 2016, cash has become a relic and something that governments from across the world have sought to reduce and eradicate. Starting in May when the European Union axed the 500 euro note, governments were watching around the world with laser focus on how a society could eliminate, overnight, a significant monetary cornerstone.  Image of the now "Specimen" euro currency. This image was taken just last week in the British Museum in London. Cash is already being noted as something criminal and an item of the past. Since then, Indian Prime Minister Narendra Modi declared in a shocking policy move the overall cancellation of two of the nation's highest-denominated notes. This move effectively invalidated 86 percent of all currency in circulation for the country. The move was sought to push the population of more than one billion people further into the financial system, but has since left concerns in society about trust and transparency. Venezuela, not to be outdone, stepped in with a surprise declaration that the 100 bolivar note, the highest denomination banknote in the country, would be axed. By some estimates from the Venezuelan central bank, there are believed to be over 6 billion 100-bolivar notes in active circulation, making up nearly half of all currency notes in the country. Economists from the IMF have indicated that this move will only further escalate inflation in the country to levels that could top 1,600% in 2017. The war on cash could escalate even further in western democratic governments for 2017 and lead to tightening central bank policy, a freeze on credit and a shock to economic confidence that would rock a system that proves to be continuously unstable over the past decade. As Jim Rickards noted nearly six months back when analyzing the next crisis, "In the end, it's not about the snowflakes or neutrons, it's about the initial critical state conditions that allow the possibility of a chain reaction or avalanche. These can be hypothesized and observed at large scale but the exact moment the chain reaction begins cannot be observed. That's because it happens at a minute scale relative to the system." A single snowflake might not be as crucial to the collapse due to the entire system being flawed, but it still is worth monitoring for greater understanding. Being mindful of these economic triggers can allow you to stay out in front of economic turmoil. The International Monetary Fund released its Global Financial Stability Report in October 2016 that focused on Fostering Stability in a Low-Growth, Low-Rate Era. The research report found that "Financial institutions in advanced economies face a number of cyclical and structural challenges and need to adapt to low growth and low interest rates, as well as to an evolving market and regulatory environment." If these structural and cyclical problems are any indicator for what is to come, 2017 could be a year of financial reckoning. Regards, Craig Wilson, @craig_wilson7 The post Four Economic Triggers For 2017 appeared first on Daily Reckoning. |

| Posted: 23 Dec 2016 08:55 AM PST The US dollar has rocketed higher since early November's US presidential election, rivaling the massive gains seen in the stock markets. With the world's reserve currency catapulted to extreme secular highs, dollar euphoria has naturally exploded. Traders are overwhelmingly betting the dollar's strong upside will continue. But this greed-drenched currency looks very toppy and ready to fall, which is very bullish for gold. |

| The U.S. Dollar Is Destined To Move Higher Posted: 23 Dec 2016 08:30 AM PST As counter-intuitive as it may seem to many, I believe the world-wide desirability to own the much, maligned U.S. Dollar is destined to rise. To my mind, the recent upside break-out of the U.S Dollar Index is a major event and confirms my belief. It is driven by conditions existing beyond the borders of the United States that are destined to worsen. The result will be the flight of large sums of foreign capital to the U.S. and the dollar. This will likely be a temporary phenomenon, but its effect will be widely felt. |

| Deutsche Bank Settlement: Seasonal Intraday Charts Provide Evidence for Market Manipulation Posted: 23 Dec 2016 07:15 AM PST Deutsche Bank is a defendant in more than 7,000 lawsuits worldwide. In two of them it has recently agreed to settlements and is prepared to pay tens of millions of US dollars in restitution and fines. This includes the settling of lawsuits over gold and silver price manipulation. Associated court proceedings against other financial institutions are still underway. |

| FORENSIC EVIDENCE: Why Silver Price Manipulation Will End Posted: 23 Dec 2016 07:04 AM PST The one thing silver investors want to know, is when will the manipulation of the silver price finally end. And who can blame then. It becomes extremely frustrating to watch the silver price fade lower and lower, especially as the Dow Jones Index gets ready to surpass the 20,000 level. Furthermore, precious metals sentiment continues to head down the toilet and into the cesspool, while the financial networks like CNBC get ready to pass out "Go 25,000 Dow Jones" baseball caps. However, the broader markets are in serious trouble, pointed out by Wolf Richter's article, What The Heck's Happening To Our Shale Buyback Boom. |

| Breaking News And Best Of The Web Posted: 23 Dec 2016 01:37 AM PST US stocks, interest rates, dollar at recent and/or record highs. Worries about valuation are spreading. US housing starts jump in November, auto sales turn down, numerous factories scaling back. Italian banks restructuring and raising capital as government begins bail-out. Deutsche Bank agrees to big fine for market mortgage fraud. Terrorist attacks in Turkey and Germany. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment